5G From Space Market Size, Share & Trends Analysis Report By Service Category (Direct to Device (D2D) 5G Connectivity, Backhaul and Trunking Services, Massive IoT and mMTC Connectivity, Mission Critical and Emergency Communications), By Satellite Orbit Type (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO)), By Spectrum Band (L-Band, S-Band, Ku-Band, Ka-Band), By End Use Industry (Defense and Government, Maritime, Aviation, Energy and Utilities, Mining and Remote Industries, Agriculture, Disaster Management, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

5G From Space Market Overview

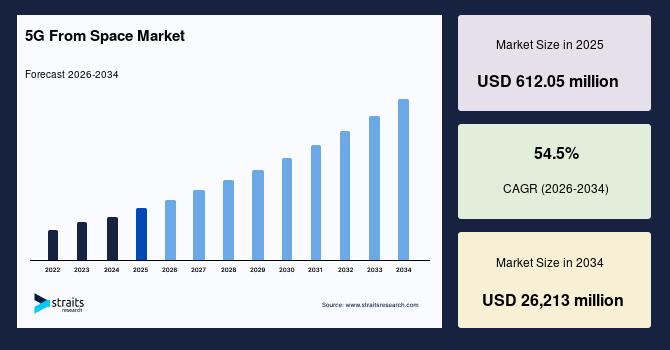

The global 5G from space market size is valued at USD 612.05 million in 2025 and is estimated to reach USD 26,213 million by 2034, growing at a CAGR of 54.5% during the forecast period. Consistent growth of the market is supported by the rapid advancement of non-terrestrial network (NTN) technologies, increasing demand for direct-to-device connectivity, and the need for seamless 5G coverage in remote and underserved regions, enabling telecom operators, governments, and enterprises to extend high-speed, low-latency communication beyond terrestrial network limitations.

Key Market Trends & Insights

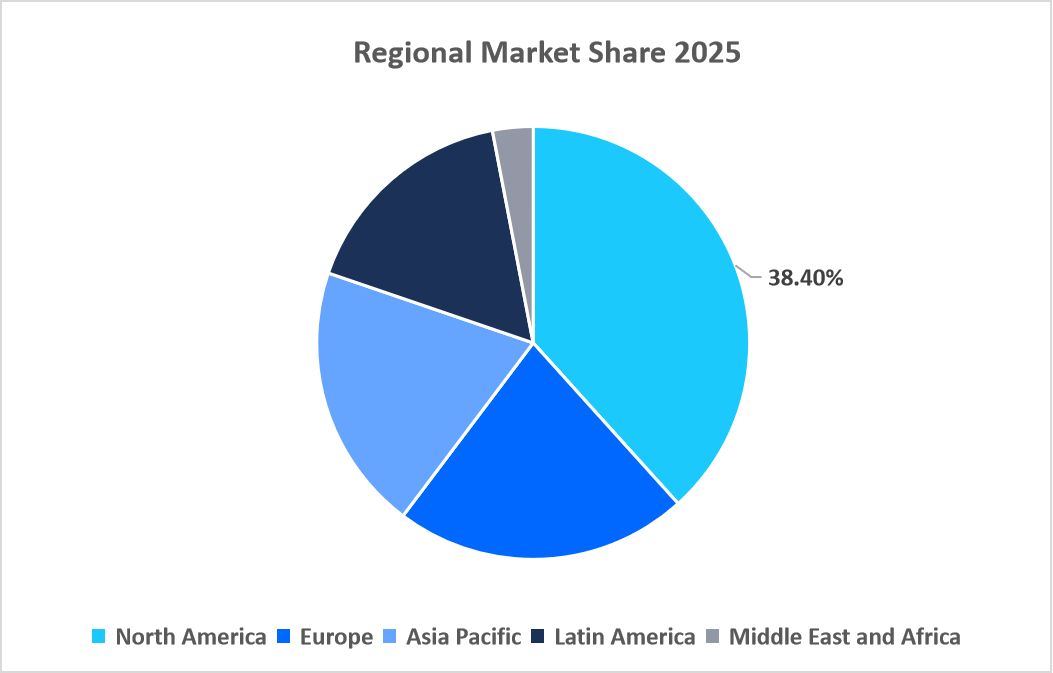

- North America dominated the market with a revenue share of 38.4% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 56.8% during the forecast period.

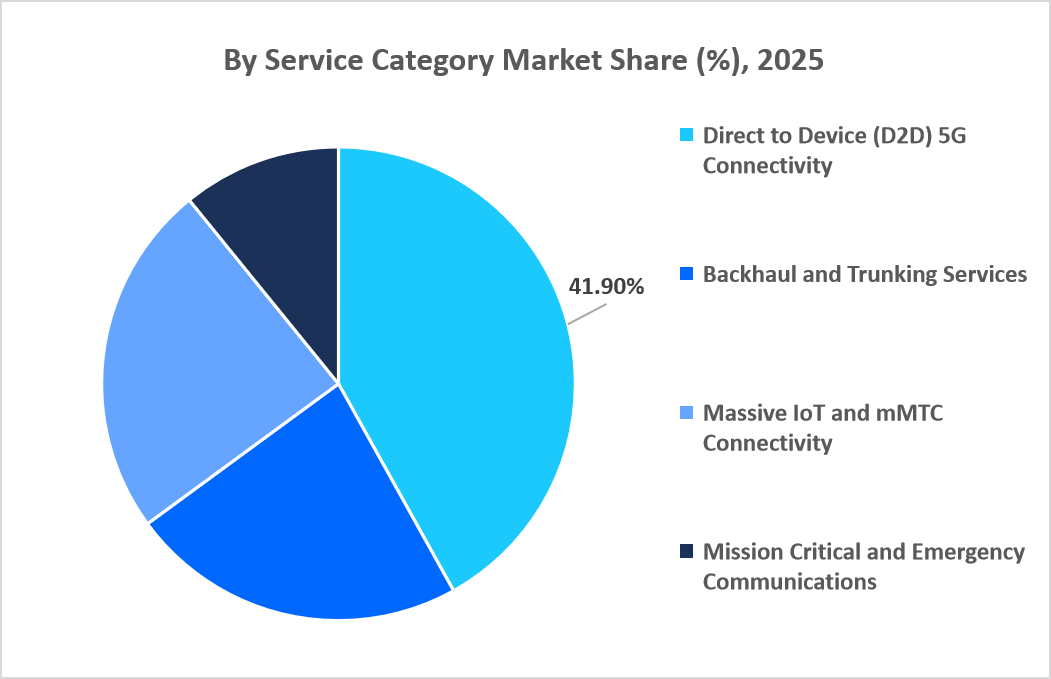

- Based on Service Category, the Direct to Device (D2D) 5G Connectivity segment held the highest market share of 41.9% in 2025.

- By Satellite Orbit Type, the Low Earth Orbit (LEO) segment is estimated to register the fastest CAGR growth of 58.4%.

- By Spectrum Band, the Ka-Band segment dominated the market in 2025, accounting for a market share of 36.8%.

- Based on End Use Industry, the Defense and Government segment is anticipated to grow at a CAGR of 52.6% during the forecast period.

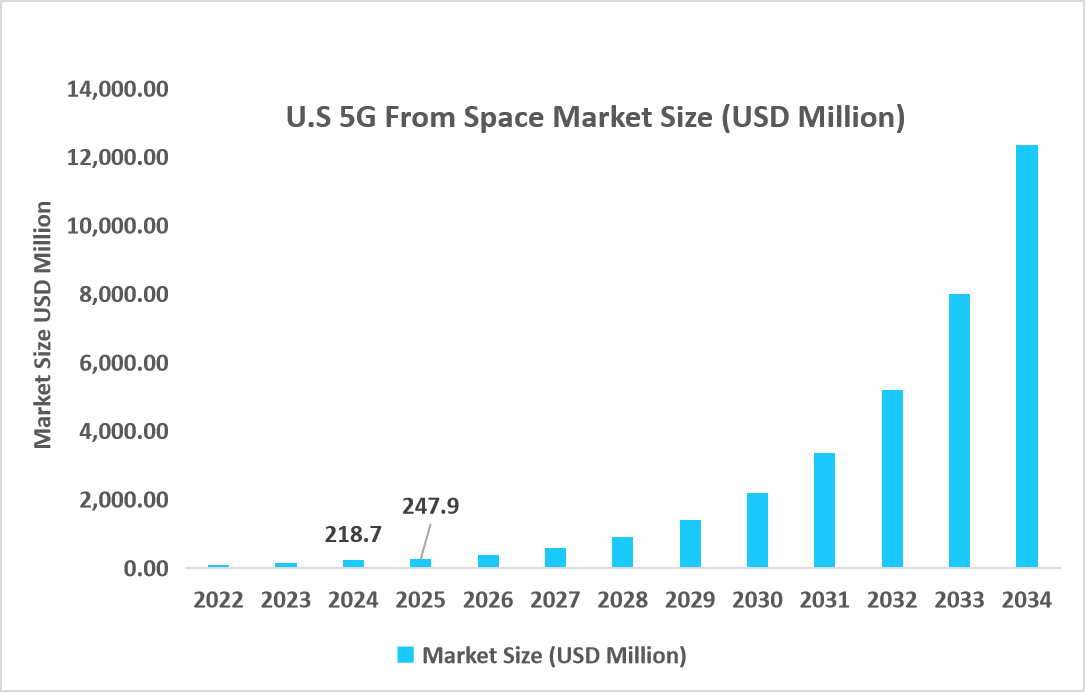

- The U.S. dominates the 5G from space market, valued at USD 218.7 million in 2024 and reaching USD 247.9 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 612.05 million

- 2034 Projected Market Size: USD 26,213 million

- CAGR (2026-2034): 54.5%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global 5G from space market comprises various satellite-based 5G connectivity offerings such as direct device communication, backhaul and trunk communication, massive IoT and mMTC connectivity, and critical and emergency communication. The different satellite orbit systems that are offered to provide continuous connectivity on a global scale include low Earth orbit, medium Earth orbit, and geostationary Earth orbit. The 5G from space industry offerings function on various bands of the frequency spectrum, such as L-band, S-band, Ku-band, and Ka-band. The various industries that are relying on the global market include defense and government organizations, maritime industry, aviation industry, energy and utility industries, mining and remote industries, agriculture and farm industries, and disaster relief industries.

Market Trends

Transition From Terrestrial-Dependent Networks To Integrated Non-Terrestrial 5 G Connectivity

The trend in the provision of 5G connections is undergoing a paradigm shift from the traditional territorial networks to a comprehensive satellite and terrestrial network solution. At present, coverage of mobile networks consists of tower networks and fiber connections. However, the development of 5G from space means that satellite constellations can actually be directly integrated into the core networks of the 5G connectivity solution, ensuring seamless coverage not supported by the tower networks. Hence, the continuity, robustness, and universality of the networks have undergone a revolutionary transformation in the provision of the next-generation mobile connections.

Acceleration of Direct-To-Device Satellite Connectivity Adoption

One of the most significant trends in the 5G from Space market today is the use of direct-to-device connectivity. Direct-to-device refers to the use of the average smartphone or IoT device to communicate directly with a satellite without the aid of a specialized device. This was not possible in the initial use of satellite communication, which could only be done by a satellite terminal or a ground station. However, technological advancements in chipset technology, spectrum management, and beamforming have made it possible for a satellite to communicate directly to an average device. This increases the addressable market by enabling the provision of messaging, voice, or data services in areas where there are no ground connections. Advances in direct-to-device services are changing the demand for always-connected services among consumers.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 612.05 million |

| Estimated 2026 Value | USD 945.6 million |

| Projected 2034 Value | USD 26,213 million |

| CAGR (2026-2034) | 54.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | SpaceX, OneWeb, Amazon, Eutelsat Group, SES S.A. |

to learn more about this report Download Free Sample Report

Market Driver

Government-Mandated Expansion of Universal Connectivity Through Non-Terrestrial Networks

National administrations grow in their efforts to institutionalize satellite-based 5G technology as a fundamental component within universal connectivity agenda initiatives, thereby inculcating a robust market driving force for 5G From Space Market demand. National regulatory initiatives such as integrating Non-Terrestrial Networks within 5G technologies, nation-based space communications regulations, and public funding initiatives for rural coverage in remote areas accelerate 5G technology launches. Some national administrations have come up with regulatory initiatives, such as allocating spectral regulatory provisions for satellite providers for interoperable 5G network connectivity, which initiatives lower regulatory barriers for satellite technology to readily connect to 5G technology in national administrations. Public sector demand for national 5G coverage in national border areas, islands, and remote areas drives national 5G technology demands.

Market Restraint

Fragmented Spectrum Authorization And Cross-Border Licensing Complexity

The most important factors restraining the 5G from space market are the lack of standardization in the authorization of use of satellite communication frequencies across country borders. Although satellite communication provides coverage across vast geographical areas, standardization in the use of satellite frequencies is left to national regulatory bodies, leading to disparities in authorization, deployment schedules, and continuity across national borders. In some countries, standardization is further hindered by the coordination process between civil aviation bodies, defense bodies, and national telecommunication regulatory bodies, further slowing down deployment. Thus, standardization continues to be a restraining factor in widespread acceptance across countries for 5G communication services from space.

Market Opportunity

Commercialization of Satellite-Enabled 5G Connectivity For Global Aviation And Maritime Corridors

The integration of satellite-enabled 5G networks in global aviation and maritime routes is unlocking new avenues of growth in the 5G From space market. The need for continuous high-speed connectivity among air transport and maritime transport is rising, enabling airlines and maritime transport providers to offer digital functions in a real-time setting, apart from their land and sea communication networks that cover coastal regions only. Satellite communication, available through previous technology, is not sufficient in providing high-capacity, low-latency Communication networks, thus hindering their communication functions in high-data processing, such as weather analysis, predictive maintenance, or optimizing daily functions in a digital setting. The emergence of 5G from Space is providing a new dimension, facilitating high-capacity communication in a low-latency network setting while unlocking new business opportunities through long-term contracts with airline, cargo, and maritime transport providers, categorizing air and maritime communication in a high-potential business segment to enter for growth in markets.

Regional Analysis

North America dominated the market share in 2025, with 38.4%. This dominance is driven by the early commercialization of non-terrestrial 5G services across the region, strong integration between satellite operators and telecom providers, and high demand coming from the defense, aviation, and maritime sectors. The region has mature satellite launch capabilities, advanced deployments of 5G core networks, and early adoption trials in direct-to-device connectivity, supporting a collective scaling and monetization of 5G-from-space services at a faster rate for commercial and government use cases.

Large-scale deployment of low-earth orbit satellite constellations and expanding commercial partnerships between satellite operators and mobile network providers contribute toward the growth of the 5G from space market in the U.S. The country has turned out to be one of the main testing sites for direct-to-device communication, emergency connectivity, and remote broadband services across rural and underserved areas. In addition, strong demand at the enterprise level for resilient connectivity across defense, logistics, and critical infrastructure verticals continues to strengthen the position of the U.S. as the largest national market in North America.

Asia Pacific 5G From Space Market Insights

It is expected that the CAGR will be seen as 56.8% during the forecast period due to rapid digital inclusion initiatives, large underserved populations, and expanding satellite manufacturing and launch ecosystems in the Asia Pacific. To extend connectivity to remote islands, mountainous regions, and rural communities, countries across this region are accelerating their adoption of satellite-enabled 5G. Regional telecom operators increasingly participate, whereas demand from key segments such as agriculture, disaster management, and maritime further strengthens market momentum.

The 5G-from-space market of India is growing at a good pace as space-based connectivity is increasingly utilized to fill the coverage gap in rural and geographically challenging areas. The adoption of satellite-enabled 5G services in response to disasters, for remote education, monitoring agriculture, and communication in border areas, is on the rise in the country. With increased collaboration between domestic operators and satellite services providers, accompanied by a strong focus on pan-India digital inclusion, India is all set to emerge as a high-potential growth market in the APAC region.

Source: Straits Analysis

Europe Market Insights

The Europe market is experiencing a growing trend in the 5G From Space industry, led by the rising need for uninterrupted connectivity in distant areas and across transport corridors. The priority on digital sovereignty and robust communication networks in the European market contributes to the adoption of satellite-based connectivity in 5G technology. Furthermore, the collaboration among telecom companies and satellite service firms in the industry is driving the adoption of trials and initial commercial launches.

The market for 5G from space in Germany is on the rise due to the growing requirement for seamless connectivity to support the automation of industry, logistics, and connected mobility. The focus on Industry 4.0 and smart manufacturing in the country has increased the demand for the use of satellite-based 5G connectivity for seamless communication beyond the boundaries of industrial floors as well as the city. The increased utilization of satellite connectivity for rail communications, autonomous test fields, and distant industrial locations has further boosted the position of Germany in the EU market.

Latin America Market Insights

The 5G from Space Market in Latin America is being fueled by the requirement to fill the connectivity divide in rural areas, densely forested regions, and mountainous regions. A number of countries in Latin America are embracing satellite-based 5G solutions. The increasing adoption of satellite connectivity services in agricultural monitoring, energy operations, and marine operations will further fuel the growth of the market in Latin America.

Brazil’s 5G from space industry is growing at a rapid pace due to the increasing use of satellite connectivity solutions in supporting agriculture, mining activities, and environmental surveillance in vast regions. A major population of Brazilian citizens living in rural areas and the country’s coastline is also fueling the demand for a satisfactory solution for connecting vast regions. Use of 5G from space services in agriculture, tracking, and emergency communication in Brazil is also propelling the Latin American market.

Middle East and Africa Market Insights

The Middle East and Africa region is experiencing growing momentum, thanks to satellite-based 5G networks, which tackle infrastructure gaps in deserts, offshore oil & gas discoveries, and remote areas where population density is sparse. Rising requirements for secure communication, smart city development, and reliable network connectivity for critical infrastructure are also boosting adoption in both public and commercial segments in ME&A. Satellite-based 5G networks are thus being viewed as a key solution for providing uninterrupted network connectivity in challenging environments.

The 5G space market in the United Arab Emirates is developing at a rapid pace owing to widespread adoption of satellite-based connectivity solutions related to smart city projects, air transport, and sea activities. The UAE’s emphasis on developing advanced digital and mobility infrastructure is fueling the demand for seamless 5G connectivity. The growing adoption of satellite-based 5G connectivity solutions related to autonomous systems, logistic nodes, and offshore activities is solidifying the UAE’s position as a key market in the Middle East and Africa region.

Service Category Insights

The Direct to Device (D2D) 5G Connectivity segment was the largest in 2025, with a revenue share of 41.9%. The major factor responsible for this trend is the requirement for seamless mobile connectivity in remote areas, with no need for any physical infrastructure.

The Massive IoT & mMTC Connectivity segment is expected to grow at the fastest rate, registering a CAGR of 55% during the forecast period. A number of factors, including growth in covered sensors, tracking solutions for assets, and monitoring devices in remote industrial, agricultural, and logistics environments, contribute to their widespread growth.

Source: Straits Research

Satellite Orbit Type Insights

The Geostationary Earth Orbit (GEO) segment dominated the market with a revenue share of 33.6% in 2025. The significant share of this segment is attributed to GEO satellites, which have traditionally been deployed for wide-area coverage and continuous signal availability, finding extensive usage in broadcast, maritime, and government communication services.

The LEO segment is expected to grow at the highest rate during the forecast period, at a CAGR of 58.4%. This growth is triggered by the large-scale deployment of LEO constellations, offering low latency and higher data throughput, which would be more compatible with 5G non-terrestrial network architectures.

Spectrum Band Insights

Ka-Band recorded the highest market share in 2025, with a share of 36.8%, as this spectrum allows for high-capacity data communication, which is required for broadband 5G satellite services.

The Ku-Band portion of the satellite service market is expected to register the highest growth rate during the forecast period. The key factor contributing to the growth of the Ku-band satellite service market is its compatibility and widespread adoption.

End Use Industry Insights

The Defense and Government industry is expected to register the fastest growth at a CAGR of 52.6% over the forecast period. This is due to the increasing requirement for reliable and infrastructure-agnostic communication networks. Also, as defense organizations and government bodies focus on having uninterrupted communication capabilities in remote and disaster-prone areas, satellite-based 5G networks are gaining adoption in order to support uninterrupted command and control capabilities.

Competitive Landscape

The market for 5G From Space globally is moderately concentrated, with a few large satellite operators with extensive constellation coverage. The key players in this market hold an appreciable share in this market due to their control over the satellite resources, launch services, and relationships with wireless operators, thereby enabling them to commercialize the services at a rapid pace.

The key competitors in this market include SpaceX, OneWeb, and Amazon, among others that are currently emerging in the satellite communication industry. The competitors in this industry are vying to position themselves in this industry by launching massive satellite constellations, partnerships with telecommunication companies, and enhancing their existing products, which include direct-to-device and backhaul satellite communication connections, among others.

AST SpaceMobile: An emerging market player

AST SpaceMobile, a U.S.-based satellite communications company that is building a space-based 5G broadband network to connect directly to standard mobile devices, is emerging as a notable player in the 5G From Space Market by advancing its next-generation product offerings.

- In December 2025, the company is slated to launch its BlueBird 6 satellite, which is 3.5 times larger than its predecessors and expected to support up to 10 times its data capacity, significantly enhancing its space-to-cellular broadband capabilities and marking a key product milestone toward commercial service readiness.

Thus, AST SpaceMobile emerged as one of the big names in the global market, scaling its direct-to-device 5G connectivity solutions by leveraging the upcoming launch of the product, BlueBird 6, to accelerate commercial deployment.

List of Key and Emerging Players in 5G From Space Market

- SpaceX

- OneWeb

- Amazon

- Eutelsat Group

- SES S.A.

- Viasat Inc.

- Iridium Communications

- AST SpaceMobile

- Lynk Global

- Telesat

- Thales Group

- Airbus Defence and Space

- Lockheed Martin

- Nokia

- Ericsson

- Samsung Electronics

- Qualcomm

- Rakuten Symphony

- Hughes Network Systems

- Intelsat

- Others

Strategic Initiatives

- August 2025: OQ Technology launched its flagship 5NETSAT mission, supported by a European Innovation Council (EIC) grant, marking Europe’s first direct-to-mobile 5G satellite service demonstration that enables satellite messaging and emergency alerts to standard smartphones without hardware changes.

- May 2025: Sateliot, a European 5G satellite IoT connectivity operator, officially entered the Australian market by launching a pilot program to connect over 300,000 IoT devices, generating more than AUD 15 million in recurring annual revenues through 5G standard-based satellite connectivity for industrial and remote applications.

- April 2025: Amazon Leo launched its first operational batch of satellites. Amazon successfully launched its first 27 Amazon Leo (formerly Project Kuiper) satellites into low Earth orbit from Cape Canaveral, marking the beginning of its large satellite broadband network deployment to support global internet and potential 5G-from-space services.

- February 2025: Eutelsat Group, MediaTek, and Airbus Defence and Space conducted the world’s first successful 5G Non-Terrestrial Network (NTN) trial over OneWeb low Earth orbit (LEO) satellites, demonstrating 3GPP-based 5G connectivity via satellite and paving the way for future integrated terrestrial and satellite services.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 612.05 million |

| Market Size in 2026 | USD 945.6 million |

| Market Size in 2034 | USD 26,213 million |

| CAGR | 54.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Category, By Satellite Orbit Type, By Spectrum Band, By End Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

5G From Space Market Segments

By Service Category

- Direct to Device (D2D) 5G Connectivity

- Backhaul and Trunking Services

- Massive IoT and mMTC Connectivity

- Mission Critical and Emergency Communications

By Satellite Orbit Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

By Spectrum Band

- L-Band

- S-Band

- Ku-Band

- Ka-Band

By End Use Industry

- Defense and Government

- Maritime

- Aviation

- Energy and Utilities

- Mining and Remote Industries

- Agriculture

- Disaster Management

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.