AI Data Center Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Data Center Type (Hyperscale Data Centers, Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, Modular & Portable Data Centers), By Deployment Outlook (On-Premises, Cloud-Based, Hybrid), By AI Application (AI Model Training, AI Model Inference, Big Data Analytics, Computer Vision Processing, Natural Language Processing (NLP), Autonomous Systems & Robotics, Cybersecurity & Fraud Detection), By End User Industry (IT & Telecom, Cloud Service Providers, Healthcare, BFSI, Industrial Automation, Research Institutes, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

AI Data Center Market Overview

The global AI Data Center Market size is valued at USD 17.33 billion in 2025 and is estimated to reach USD 147.58 billion by 2034, growing at a CAGR of 28.5% during the forecast period. Consistent growth of the market is driven by the increasing adoption of AI-driven workloads and advanced computing infrastructure, which enables efficient training and inference of complex models, accelerates digital transformation across industries, and drives demand for scalable, high-performance data center solutions globally.

Key Market Trends & Insights

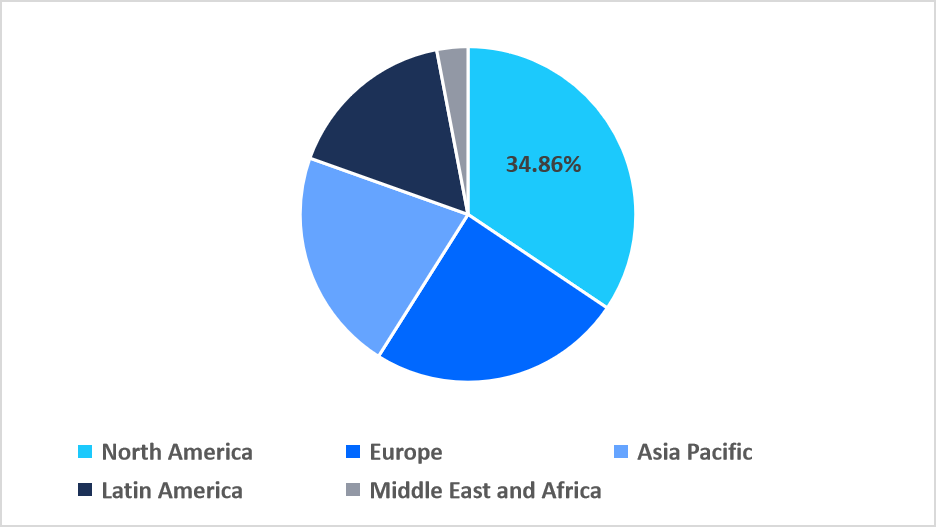

- North America dominated the market with a revenue share of 34.86% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 31.27% during the forecast period.

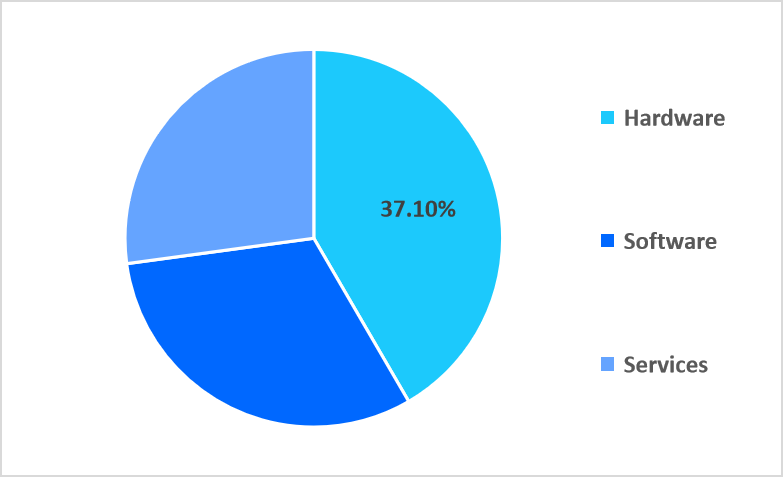

- Based on component, the Hardware segment held the highest market share of 52.41% in 2025.

- By data center type, the Hyperscale Data Centers segment is estimated to register the fastest CAGR growth of 30.15%.

- Based on deployment outlook, the Cloud-Based segment held the highest market share of 48.26% in 2025.

- By AI application outlook, AI model training led the market in 2025, with a revenue of 38.64%

- Based on end-user industry, the Cloud Service Providers segment is projected to grow at a CAGR of 31.26%.

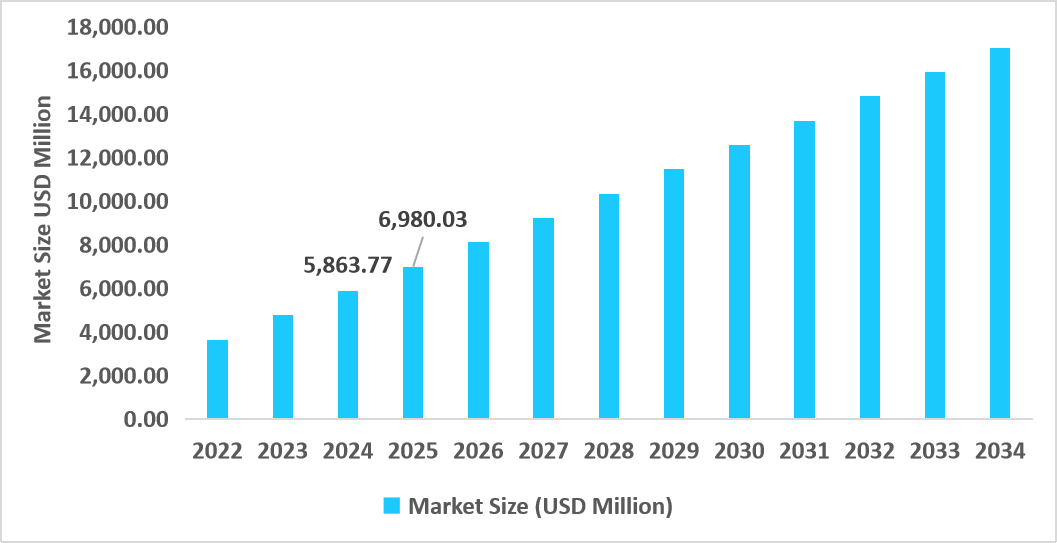

- The U.S. dominates the market, valued at USD 5.86 billion in 2024 and reaching USD 6.98 billion in 2025.

Table: U.S AI Data Center Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 17.33 billion

- 2034 Projected Market Size: USD 147.58 billion

- CAGR (2026-2034): 28.5%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market for AI data centers covers a broad set of infrastructure and service solutions that support sophisticated AI workloads such as AI model training, model inference, big data analytics, computer vision, natural language processing (NLP), autonomous systems, and cybersecurity applications. These workloads are delivered through varied data center architectures like hyperscale, enterprise, colocation, edge, and modular facilities, installed in on-premises, cloud-based, and hybrid environments. In addition, AI data center solutions are provided in the form of a connected ecosystem of hardware, software, and services that provide scalable and high-performance computing functionality. Major end users comprise IT and telecom firms, cloud service providers, healthcare organizations, BFSI organizations, manufacturing plants, and research centers, spearheading global digital transformation using AI-driven, high-efficiency infrastructure.

Latest Market Trends

Transition from Legacy Data Centers to AI-Tuned, Cloud-Connected Infrastructure

The market for AI data centers is experiencing a dramatic transformation from traditional, isolated data centers to highly interconnected, AI-optimized data centers that combine high-performance computing, cloud-based orchestration, and edge computing capabilities. Moreover, businesses have used suboptimal on-premises data centers with minimal scalability, making operations expensive, associated with latency, and involving inefficiencies in handling AI workloads. Today, contemporary AI data centers deliver real-time processing of data, smooth migration of workloads, and AI-managed resources, which allow businesses to scale efficiently and minimize downtime. Cloud and hyperscale leaders have shown that the convergence of AI accelerators, next-generation storage offerings, and smart networking can dramatically improve computational efficiency, throughput, and energy optimization, ushering in a new era of highly responsive, AI-oriented infrastructure.

Accelerated Deployment of AI Workloads Across Sectors

The use of AI workloads such as model training, inference, computer vision, NLP, autonomous systems, and cybersecurity has expanded manifold across verticals. Be it IT and telecom or healthcare, BFSI, and industrial automation, the business is embracing AI data centers more and more to manage big data analytics and machine learning functions. In the last decade, the need for dedicated AI compute capabilities has grown dramatically, with companies moving from commodity cloud servers to AI-hyper-scale data centers that can provide low-latency, high-throughput processing. This shift has made AI data centers a foundational pillar for digital transformation around the world, allowing businesses to deploy real-time analytics, predictive simulation, and intelligent automation at scale.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 17.33 Billion |

| Estimated 2026 Value | USD 22.27 Billion |

| Projected 2034 Value | USD 147.58 Billion |

| CAGR (2026-2034) | 28.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Advanced Micro Devices, Inc. (AMD), Amazon Web Services, Inc. (AWS), Arista Networks, Inc., Cisco Systems, Inc., CoreWeave |

to learn more about this report Download Free Sample Report

AI Data Center Market Drivers

Government Programs that Push for AI and High-Performance Computing Adoption

Government initiatives and national AI plans promoting these are coming into play as a key driver of the growth of the market. Nations such as the United States, China, and the European Union have launched significant programs to develop AI-ready facilities, specifically energy-efficient data centers, AI innovation, and cloud computing strength. The U.S. National Science Foundation made multi-billion-dollar commitments to AI research and utilization of cutting-edge computer capacity to drive AI innovation. The European Commission's Digital Europe Program also provides grants of specific amounts to create AI infrastructure and high-performance computing centers. These steps prompt organizations to embrace AI workloads, form public-private partnerships, and hasten the development of hyperscale and edge AI data centers that contribute hugely to market growth in established as well as emerging economies.

Market Restraints

Limited Availability of High-End AI-capable Infrastructure in Emerging Markets

The restraints in the AI data center market is the unequal availability of cutting-edge, AI-optimized infrastructure, especially in emerging economies. Most geographies do not have adequate high-capacity power supply, reliable cooling systems, and strong networking facilities to handle large-scale AI workloads. The U.S. Department of Energy reports that close to 40% of emerging-market data centers struggle to maintain consistent uptime due to poor electrical and cooling infrastructure. This confines hyperscale and edge AI data center deployment beyond developed economies, hindering adoption by companies that need real-time AI processing. Regulatory inconsistencies and permitting holdups for large data center projects in a number of countries also decelerate market growth, posing an impediment to AI data center solutions worldwide.

Market Opportunities

Integration of Sovereign and Green Data Center Policies

The growing convergence of national data sovereignty legislation with sustainability efforts is providing a major opportunity for the AI data center market. Governments worldwide are making the creation of sovereign AI data centers that adhere to regional data protection requirements a priority while enabling energy-efficient operations. For instance, the European Union's Green Deal and Digital Sovereignty Strategy together incentivize AI data centers fueled by renewable energy sources and locally controlled cloud platforms.

Similarly, nations like India and Japan are initiating countrywide AI computing initiatives that integrate carbon-neutral infrastructure objectives with localized data control. These policy synergies pave the way for public-private partnerships and mass investment in AI-ready, environmentally friendly, and regulation-friendly data centers, situating the market for long-term growth and international competitiveness.

Regional Analysis

North America led the AI data center market during 2025 with 34.86% market share. This is because of enormous hyperscale build-outs, early adoption of AI infrastructure, and robust government policies in favor of sovereign data capacity. The region enjoys gigantic investments in GPU facilities and sophisticated liquid cooling infrastructure that maximize energy efficiency for AI workloads. In addition, tight coordination among technology vendors, data center providers, and AI chip makers sped up the rollout of next-generation computing clusters throughout the U.S. and Canada. All these advances collectively reinforce North America's dominance in AI-enabled computational infrastructure.

Expansion of the market in the U.S. is fueled by the nation's focus on growing domestic AI compute capacity and ensuring energy-efficient data operation. For example, the U.S. Department of Energy and National Science Foundation jointly sponsored projects in 2024 to enable large-scale AI supercomputer facilities for accelerating climate modeling, biomedical discovery, and defense analysis. The increased use of AI-optimized servers combined with the growth of data center highways in Texas, Virginia, and Oregon is reshaping the U.S. as the world center for high-density AI data processing. Therefore, strong policy support and infrastructure extensibility are the foremost drivers driving the U.S. market.

Asia Pacific Market Insights

Asia Pacific is proving to be the fastest-growing region in the future, expected to register a CAGR of 31.27% during 2026–2034. The region is led by high-speed cloud uptake, huge data localization requirements, and sizeable investments from local hyperscalers. States like China, India, Singapore, and South Korea are ramping up AI-ready data center capacities to fuel national digital transformation plans. Additionally, AI-centric energy optimization initiatives and edge data center integration alongside urban AI computing hotspots are driving operational efficiency. These developments are propelling the creation of sustainable, high-performance AI data center infrastructures across the region.

India's AI data center space is growing at a fast pace, spurred by the country's government-led strategic initiative under its "National AI Mission" and investment incentives for AI infrastructure. The development of AI-ready hyperscale campuses in Hyderabad, Mumbai, and Chennai is further bolstering the country's position as a regional data hub. Furthermore, local players are collaborating with international chipmakers to create GPU-driven compute zones that host generative AI and analytics workloads. This blending of policy initiatives, technology partnerships, and domestic AI cloud services demand is putting India as a prominent growth driver in the Asia Pacific AI data center market.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is experiencing strong growth in the AI data center market due to robust regulatory emphasis on digital sovereignty, eco-friendly energy consumption, and secure AI infrastructure. The EU's "Green Data Strategy" and local AI governance policies are compelling operators to create carbon-free and ethically regulated AI computing environments. Moreover, increasing implementation of AI-optimized chips and liquid cooling technology in data centers of nations such as Germany, France, and the Netherlands is improving performance efficiency. Creation of AI innovation clusters and cross-border digital corridors under the EU's Digital Europe Programme is also speeding up the deployment of scalable, environmentally friendly AI data centers across the region.

Germany's market expansion is driven by increasing enterprise use of AI-fueled automation, cloud-native computing, and national investment in edge computing infrastructure. The nation is expanding quickly its AI data capacity through joint ventures between local utilities, industrial technology vendors, and hyperscale developers to provide sustainable power supply for compute-intensive AI loads. In 2024, Germany initiated country-wide programs to increase AI compute infrastructure for automotive AI, industrial robots, and energy management systems. These initiatives, together with increased deployment of modular AI data centers as well as server farms powered by renewable sources, are making Germany a dominant force in sustainable and high-performance AI computing infrastructure in Europe.

Latin America Market Insights

The Latin America AI data center market is expanding steadily, bolstered by growing digital infrastructure and increased uptake of cloud-based AI services in nations like Brazil, Mexico, and Chile. Growing government interest in digital transformation and new submarine cable initiatives are enhancing connectivity and reducing latency for AI model deployment. The region is also witnessing an increase in AI-integrated colocation facilities, allowing companies to scale data-intensive workloads with greater efficiency. Additionally, local telecom-strategic alliances with worldwide AI cloud providers are driving the development of energy-efficient and regionally dispersed AI data centers.

The Brazilian market is growing as businesses from the banking, e-commerce, and manufacturing industries spend on AI-powered analytics and automation. The national digital transformation blueprint of the government, along with initiatives from the private sector, has accelerated the construction of new hyperscale and modular AI data centers in Rio de Janeiro and São Paulo. Regional providers are investing in renewable-powered operations and integration with smart grids to lower carbon footprints. The investments are making Brazil a leading AI infrastructure hub for Latin America that can host both local innovation and cross-border cloud services.

Middle East and Africa Market Insights

The Middle East and Africa AI data center market is witnessing fast growth, underpinned by the digital economy diversification plans and national AI plans. The UAE, Saudi Arabia, and South Africa are taking a leadership role in infrastructure growth through collaborations with international hyperscalers and local telecom leaders to create AI-ready cloud regions. Governments are also focusing on green data center initiatives and AI-based smart city use cases, creating sustainable and secure computational environments.

Saudi Arabia's market is expanding rapidly as part of its overall digital transformation and Vision 2030 programs. The nation is also heavily investing in AI computing infrastructure to enable national programs in autonomous mobility, predictive analytics, and smart industrial systems. Multiple large-scale AI data centers are being developed in the NEOM region and other technology corridors with renewable energy and high-efficiency cooling systems. This synergy of infrastructure investments, renewable energy emphasis, and national AI policy backing is making Saudi Arabia a strategic AI data center location throughout the Middle East and Africa.

Component Insights

The hardware component led the market for AI data centers in 2025 with a revenue contribution of 52.41%. The leadership is attributed to the rising deployment of high-performance graphics processing units and AI accelerators needed for heavy model training workloads.

The services segment is expected to see the fastest growth, showing a CAGR of approximately 31.25% over the forecast period. This growth is driven by the proliferation of demand for managed AI infrastructure, data orchestration, and system integration services.

By Component Market Share (%), 2025

Source: Straits Research

Data Center Type Insights

The edge data center led the AI data center market with 41.28% revenue share in 2025. This sudden growth is pushed by the spread of IoT devices, real-time AI inference use cases, and 5G network deployments requiring low-latency data processing near the user.

The hyperscale data center market is expected to exhibit the highest growth, with a predicted CAGR of approximately 33.47% over the forecast period. This is because of the explosive growth in large-scale training of AI models and enterprise cloud use, demanding tremendous computational power as well as scalable infrastructure.

Deployment Outlook Insights

The cloud segment led the AI data center market in 2025 with a revenue share of 48.26% due to the growing movement of businesses toward scalable and on-demand AI infrastructure. Cloud vendors are providing GPU-accelerated compute environments tailored to machine learning, big data analytics, and generative AI workloads, substantially curtailing the necessity for in-house infrastructure investment.

The segment of hybrid deployment is expected to experience the maximum growth over the forecast period with a CAGR of approximately 31.26%. The growth in this segment is largely driven by the increasing adoption of hybrid architectures that leverage the security of on-premises systems along with the scalability of cloud infrastructure.

AI Application Insights

The segment of AI model training led the market in 2025 with a revenue of 38.64%, fueled by the exponential rise in need for large-scale model development and model fine-tuning across various sectors.

The natural language processing (NLP) segment is expected to see the most rapid growth over the forecast period, achieving a CAGR of nearly 32.48%. The quick uptake of AI-powered conversational solutions, smart document processing, and generative language systems has tremendously grown data processing workloads in NLP data centers.

End User Industry Insights

The cloud service providers segment is expected to grow at the highest rate of 31.26% based on the increasing need for scalable, high-performance infrastructure to host AI workloads and generative model deployment. As the global hyperscalers like AWS, Microsoft Azure, and Google Cloud build out their AI-optimized data center networks, the segment remains under rapid acceleration.

Competitive Landscape

The global AI data center market is moderately fragmented, with dominant presence by large technology providers, hyperscale cloud operators, and AI infrastructure specialists. The market is led by a few prominent players with large product portfolios, massive GPU deployments, and sophisticated AI workload management solutions.

Front-runner companies like Advanced Micro Devices, Inc. (AMD), Amazon Web Services, Inc. (AWS), and Arista Networks, Inc. are at the forefront of driving the competitive environment through providing high-performance computing solutions, scalable cloud infrastructure, and cognizant networking systems optimized for AI environments. These companies are directing their efforts toward strategic partnerships, AI hardware optimization, and localized data center expansion to maximize computational efficiency and reach.

CoreWeave: An emerging market player

CoreWeave, a cloud computing and AI infrastructure company based in the U.S., is quickly emerging as a major contender in the global market.

- In July 2025, the firm disclosed a US$6 billion investment to construct a new AI data center campus in Pennsylvania with a planned opening capacity of 100 megawatts and a future expansion to 300 megawatts.

The move underscores CoreWeave's vision to scale AI-optimized infrastructure at hyperscale, meeting the accelerating demand for large-format GPU clusters and high-performance computer environments.

List of Key and Emerging Players in AI Data Center Market

- Advanced Micro Devices, Inc. (AMD)

- Amazon Web Services, Inc. (AWS)

- Arista Networks, Inc.

- Cisco Systems, Inc.

- CoreWeave

- Dell Technologies

- Google LLC

- Hewlett Packard Enterprise Development LP (HPE)

- Hitachi Vantara LLC

- Humain

- Intel Corporation

- International Business Machines Corporation (IBM)

- Juniper Networks, Inc.

- Microsoft Corporation

- Meta Platforms, Inc.

- NVIDIA Corporation

- Neysa

- Oracle Corporation

- Super Micro Computer, Inc.

- io

- Others

Strategic Initiatives

- September 2025: Microsoft announced the completion of its AI data center in Mount Pleasant, Wisconsin, marking it as the world's most powerful AI datacenter.

- September 2025: OpenAI and NVIDIA announced a strategic partnership to deploy at least 10 gigawatts of AI data centers, with NVIDIA systems representing millions of GPUs. NVIDIA plans to invest up to $100 billion in OpenAI progressively as each gigawatt is deployed.

- July 2025: CoreWeave launched RTX PRO 6000 Blackwell instances, delivering advanced AI, graphics, and large language model performance on its cloud infrastructure. This move enhances their offerings for AI developers and enterprises.

- May 2025: NVIDIA introduced the 800 VDC (volts direct current) architecture at COMPUTEX 2025, aimed at powering next-generation AI data centers. This innovation is expected to improve energy efficiency and performance in AI infrastructure.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 17.33 Billion |

| Market Size in 2026 | USD 22.27 Billion |

| Market Size in 2034 | USD 147.58 Billion |

| CAGR | 28.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Data Center Type, By Deployment Outlook, By AI Application, By End User Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

AI Data Center Market Segments

By Component

- Hardware

- Software

- Services

By Data Center Type

- Hyperscale Data Centers

- Enterprise Data Centers

- Colocation Data Centers

- Edge Data Centers

- Modular & Portable Data Centers

By Deployment Outlook

- On-Premises

- Cloud-Based

- Hybrid

By AI Application

- AI Model Training

- AI Model Inference

- Big Data Analytics

- Computer Vision Processing

- Natural Language Processing (NLP)

- Autonomous Systems & Robotics

- Cybersecurity & Fraud Detection

By End User Industry

- IT & Telecom

- Cloud Service Providers

- Healthcare

- BFSI

- Industrial Automation

- Research Institutes

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.