Air Charter Services Market Size, Share & Trends Analysis Report By Service Type (Passenger Charter Services, Private Charter Services, Business Charter Services, Group Charter Services, Cargo Charter Services, Medical Charter Services, Government & Defense Charter Services), By Aircraft Type (Light Jets, Mid-size Jets, Large Jets, Turboprop Aircraft, Helicopters, Cargo Aircraft), By Application (Business Travel, Leisure Travel, Emergency & Medical Evacuations, Cargo & Freight Transport, Sports & Entertainment Industry, Government & Military Operations), By Ownership Model (On-Demand Charter, Fractional Ownership, Membership Programs, Jet Card Programs), By End-User (Individuals, Corporations, Sports Teams & Celebrities, Government & Military Agencies, Freight & Logistics Companies, Medical & Emergency Services) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Air Charter Services Market Size

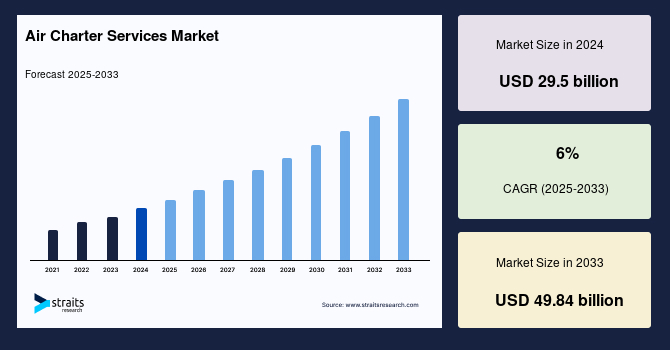

The global air charter services market size was worth USD 29.5 billion in 2024 and is estimated to reach an expected value of USD 31.27 billion in 2025 to USD 49.84 billion by 2033, growing at a CAGR of 6% during the forecast period (2025-2033).

Air charter services provide private aircraft rentals for individuals, businesses, or cargo transport, offering flexible and customized flight solutions. Unlike commercial airlines, charter flights operate on demand, allowing clients to select departure times, routes, and aircraft types based on their needs. These services cater to executives, VIPs, emergency medical evacuations, and freight transport. Air charter services ensure privacy, convenience, and efficiency, often accessing airports that commercial airlines cannot. They include private jets, helicopters, and cargo planes, enhancing mobility without scheduled flight limitations. Businesses and individuals use charter flights to save time, avoid crowded airports, and reach remote destinations quickly, making them a valuable option for those prioritizing speed and exclusivity.

The global market growth is driven by increasing demand for on-demand air travel, expanding business aviation, and the need for urgent cargo transportation. Technological advancements are increasingly improving aircraft efficiency and digital booking platforms, shortening lead times. At the same time, economic growth continues to provide a growing community of ultra-high-net-worth individuals to spur market expansion. Also, the changing regulations and changing sustainability programs are significant factors influencing the market, particularly the government's push towards fuel-efficient aircraft adoption and carbon offset programs. As global connectivity and premium demand for travel pick up, the market is savage competition and innovation, making it a dynamic space in the aviation landscape.

The following graph represent the number of authorized aircraft and certified holders for air charter services as they are Part 135 certified by the "Federal Aviation Administration (FAA)", this allows this aircraft to operate as a non-scheduled air charter carrier, encompassing regulations for on-demand jet charters.

.png)

Source: Straits Research

Latest Market Trends

Digitalization and Ai-Powered Booking Platforms

The growing acceptance of AI-powered platforms and digital booking systems has completely transformed the market. AI-driven solutions enhance flight optimization, pricing accuracy, and customer service, making private air travel more accessible and efficient. Automated booking systems streamline the reservation process, reducing human errors and providing real-time flight availability updates. Additionally, AI helps in predictive maintenance, reducing aircraft downtime and increasing operational efficiency.

- According to a report by the U.S. Federal Aviation Administration (FAA), digitalization has brought about a 20% improvement in flight efficiency over the last five years, significantly reducing delays and optimizing route planning. The integration of AI in air charter services has also led to dynamic pricing models, allowing operators to adjust fares based on demand patterns, fuel prices, and customer preferences.

As technology advances, blockchain-based verification systems are being tested to enhance security, transparency, and data integrity in digital bookings, further revolutionizing the industry.

Sustainable Aviation and Carbon Offset Programs

With rising regulatory pressure and growing consumer preference for eco-friendly travel, air charter companies increasingly invest in sustainable aviation fuels (SAFs) and carbon offset programs. SAFs, derived from renewable sources like biofuels and synthetic fuels, significantly reduce greenhouse gas emissions compared to traditional jet fuel. Additionally, carbon offset initiatives allow companies to compensate for their emissions by investing in environmental projects such as reforestation and renewable energy.

- Under the European Union's Fit for 55 policy, aviation emissions must be reduced by 55% by 2030, compelling the industry to accelerate sustainability efforts. Leading companies like NetJets have committed over USD 1 billion to sustainable aviation initiatives, including investments in SAF production and hybrid-electric propulsion technologies.

Airlines and charter service providers are also exploring electric and hydrogen-powered aircraft to achieve long-term sustainability goals. With growing pressure from regulators and environmentally conscious consumers, sustainable aviation will be a key differentiator in the market.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 29.5 Billion |

| Estimated 2025 Value | USD 31.27 Billion |

| Projected 2033 Value | USD 49.84 Billion |

| CAGR (2025-2033) | 6% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | NetJets, VistaJet, Flexjet, Wheels Up, Jet Aviation |

to learn more about this report Download Free Sample Report

Global Air Charter Services Market Growth Factors

Rise in Business and Luxury Travel

The increasing number of ultra-high-net-worth individuals (UHNWIs) and corporate executives drives demand for private air travel. With time-sensitive schedules and the need for convenience, business leaders and high-net-worth travelers prefer chartered flights over commercial airlines. Private aviation offers greater flexibility, privacy, and direct routes to smaller airports that commercial airlines do not serve, making it a desirable option.

- According to Knight Frank's Wealth Report, the global UHNWI population grew by 9.3% in 2023, significantly boosting demand for luxury air charter services. The expansion of international business hubs, global events, and luxury tourism further amplifies the need for premium charter flights.

Additionally, fractional jet ownership and jet card programs are gaining traction, offering frequent travelers a cost-effective alternative to outright aircraft ownership. With business globalization and rising disposable incomes, the market for private air travel is expected to continue its upward trajectory.

Increasing Demand for Urgent Cargo Transport

The demand for air charter services for high-priority cargo shipments has risen significantly, fueled by the rapid expansion of e-commerce and the need for expedited logistics. Industries such as pharmaceuticals, electronics, and luxury goods rely on air charter solutions for time-sensitive deliveries, ensuring efficiency and reliability in their supply chains. The COVID-19 pandemic further underscored the importance of air cargo, as vaccines and medical supplies needed to be transported rapidly across borders.

Furthermore, global supply chain disruptions have intensified the need for flexible and dependable transport solutions, making air cargo charters a crucial component of modern logistics. According to the International Air Transport Association (IATA), air cargo charter bookings increased by 15% in 2023, with a significant portion driven by the transportation of pharmaceuticals, perishable goods, and high-value shipments requiring specialized handling. Additionally, geopolitical tensions and trade uncertainties have further elevated the demand for customized cargo solutions, allowing businesses to mitigate risks and maintain continuity in their supply chains.

Market Restraint

High Operational Costs and Regulatory Compliance

One of the biggest challenges air charter service providers face, particularly smaller operators, is the high cost of maintaining and operating aircraft. Expenses related to fuel, maintenance, pilot salaries, insurance, and airport fees contribute to the significant financial burden of running a charter service. Furthermore, the industry is subject to stringent regulatory requirements, including safety inspections, crew training, and emissions compliance, which add to operational costs.

- According to FAA forecasts, tighter carbon emission standards and sustainability mandates are expected to increase operating costs by approximately 12% for small- and mid-sized charter operators. Transitioning to sustainable aviation fuels (SAFs) and advanced aircraft technologies will require significant capital investment, further straining financial resources.

Additionally, global economic fluctuations, fuel price volatility, and geopolitical uncertainties can impact profitability, making cost management a critical challenge for charter service providers. Many operators are exploring partnerships, fleet optimization strategies, and innovative pricing models to mitigate these challenges and remain competitive in the evolving market landscape.

Market Opportunity

Expansion into Emerging Markets

The rapid economic growth of emerging markets, particularly in the Asia-Pacific and Middle East, presents a lucrative opportunity for air charter service providers. Rising affluence, increasing foreign investments, and a growing luxury travel appetite drive demand for private aviation solutions. In nations such as China, India, and the United Arab Emirates, business aviation is gaining traction as executives seek efficient and exclusive travel options.

- According to the Civil Aviation Administration of China (CAAC), business aviation is expected to grow by 30% by 2026, reflecting strong demand for chartered flights in the region. Similarly, the Middle East has witnessed a surge in private aviation fueled by ultra-high-net-worth individuals, government officials, and VIP travelers. The development of luxury tourism destinations, mega-events like the FIFA World Cup, and corporate expansions further propel demand.

Charter service providers are capitalizing on this trend by expanding their fleets, establishing regional hubs, and forming strategic alliances with local aviation authorities. Introducing on-demand jet services, fractional ownership models, and tailored travel packages further enhances accessibility for affluent travelers in these markets. With continued economic growth and infrastructure development, emerging markets are poised to be key drivers of the air charter industry in the coming years.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America holds more than 40 percent of the global air charter services market, with demand for business aviation being extremely robust due to quality aviation infrastructure and a large ultra-high-net-worth individual (UHNWI) population. This region benefits from well-established regulatory frameworks, strategic airport networks, and a culture that values private air travel for its efficiency, privacy, and flexibility. Over three million private charter flights were recorded by the Federal Aviation Administration (FAA) in 2023, solidifying North America’s dominance in the sector.

Additionally, major corporate hubs, financial centers such as New York and Silicon Valley, and a thriving entertainment industry drive frequent use of private charter services. Sports teams, celebrities, and business executives rely heavily on air charter services, fueling continuous market expansion. The ongoing advancements in aircraft technology, including hybrid-electric and sustainable aviation fuel (SAF)-powered jets, further bolstered the region’s charter industry.

Moreover, North America's well-developed fractional ownership programs, jet card memberships, and on-demand charter platforms ensure continuous service accessibility. The region’s extensive fleet availability, regulatory flexibility, and increasing corporate travel demand make it the epicenter of air charter services globally.

Asia-Pacific: Rapidly Growing Region

Asia-Pacific is the fastest-growing global air charter services market region, driven by rapid wealth accumulation, corporate globalization, and a rising preference for private aviation. According to the Civil Aviation Administration of China (CAAC), business aviation grew by 18% in 2023, reflecting the increasing appetite for charter solutions. The region’s economic expansion, large-scale infrastructure development, and the rising number of high-net-worth individuals (HNWIs) fuel the demand for private air travel.

Business leaders and affluent travelers increasingly opt for charter flights to bypass congested commercial airports and access remote destinations in China, India, and Southeast Asia. Expanding free trade zones and multinational business activities in cities like Singapore, Hong Kong, and Tokyo further drive demand for corporate jet charters. Governments across the region are also modernizing aviation regulations to attract foreign investment in private aviation, easing restrictions on charter operations.

With a growing middle-class population and increased demand for premium travel experiences, private aviation companies are expanding their fleets and regional networks to capitalize on this surge. Leading air charter service providers are forming strategic partnerships with luxury travel agencies and concierge services to cater to Asia’s elite clientele. Integrating AI-powered booking platforms and tailored membership programs also improves customer accessibility to private aviation solutions, reinforcing the region’s rapid growth in the air charter sector.

Countries Insights

- U.S.: In 2023, the Federal Aviation Administration (FAA) is providing USD 563.3 million to modernize digital air traffic control systems, thus enhancing charter flight operations throughout the United States. This investment aims to improve real-time data management by minimizing congestion in the sectors and optimizing flight paths, which leads to a smoother operational framework for private aviation operators. Thus, the U.S. air charter services market has grown and become competitive.

- Canada: By January 2025, the Canadian government invested USD 11 million to advance sustainable aviation fuel (SAF) undertakings in the aviation sector. This funding is intended to enhance the industry's low-carbon approach, fostering green innovations for environmental sustainability. Focusing on cleaner fuels and technological advancements, Canada's air charter services segment will emerge competitively and widen operational opportunities across various markets.

- Germany: To improve the efficiency of charter operations, Germany's Federal Aviation Authority has appropriated USD 200 million for artificial intelligence-driven air traffic management improvements. This investment focuses on predictive data analysis, automated decision support, and integrated internal screening tools to reduce delays and promote safety. In this way, Germany's air charter services market will surely enjoy high operational efficiency and meaningful competitiveness.

- UAE: This first-of-its-kind aviation authority disclosed the launch of a USD 1.2 billion program for aviation sustainability aimed to lessen carbon footprints and promote clean-energy solutions. This program targets fuel efficiency, waste disposal, and other renewable technologies to meet global compliance emission standards. Therefore, the demand for green charter services is expected to soar, significantly changing the UAE's private aviation market.

- China: Diverging USD 750 million from the Civil Aviation Administration towards the upgrading of the private jet infrastructure to respond to the increasing business aviation demands in that country, including the building of hangars, the growth of terminals, and the easing of flight permission to improve their operational efficiency, signed the expansion of the charter services market in China to respond adequately to such demand in the region.

- The UK: The British government announced tax incentives to encourage the private jet industry to adopt sustainable aviation fuel. Other objectives include lowering the carbon footprint of air transport, contributing to cleaner propulsion, and fulfilling international emissions standards. As a result, greener operations shall develop an upper hand in the UK air charter services market and establish its reputation as a global leader in environmental luxury aviation.

- Australia: Australia is spending USD 300 million to build alternate private aviation networks across regional airports to enhance remote area access and infrastructure. This includes runway upgrades, state-of-the-art communication systems, and enhanced safety measures to stimulate tourism and economic development. Thus, the charter services market in Australia now stands to gain favorable momentum to narrow down the gaps in accessibility among several geographical locations.

- India: With USD 500 million, the new hubs for business aviation development in India would be able to widen the connecting of charter flights to economic corridors. The funds would cover modernizing airport infrastructure, optimizing security protocols, and creating dedicated private terminals to meet the rising corporate demand. Thus, India is set to grow the charter services market, addressing the impending demands in business aviation.

Segmentation Analysis

By Service Type

Passenger charter services hold the largest share in the global air charter services market at around 60%, according to the IATA, 2023. This is mainly a result of the strong demand from corporate travelers and VIP clientele who favor privacy and flexibility. Passenger charter services worldwide are also expected to grow because of the convenience of on-demand flights.

By Aircraft Type

Light jets segment dominated the market with the largest market revenue. Light jets are taking hold in the market due to their cost-efficient operations, lesser runway requirement, and simplified operations. The Phenom 300 of Embraer continues to attract market participation, accounting for about 25% of charter fleet deliveries worldwide. These smaller aircraft are used for A to B point services catering to time-sensitive travel, providing flexibility while keeping down operating costs in a mode of travel with a growing demand for its private sector.

By Application

Business travel segment dominated the market with the largest market share. Business travel accounts for 55% of the demand for air charter services. Rapid growth in corporate organizations, collaborations across borders, and time-sensitive travel are expected to accelerate this segment's growth. Travel executives choose a private flight for commercial or corporate travel because it ensures direct routes, offers privacy, and prefers faster processing time through the airport. Air charter services provide a competitive edge by minimizing transit-down time, thus accommodating quick decision-making and scheduling on the global landscape.

By Ownership Model

Fractional ownership segment dominated the market with the largest market revenue. Fractional ownership models are growing globally by providing cost-effective solutions for clients after part ownership in an aircraft. NetJets is currently the market leader in this segment, with its 65% market share owing to a notable fleet of airplanes and flexible utilization plans. Fractional ownership attracts business travelers and individuals alike due to its affordability on the upfront and ease of asset management; thus, it creates conflict-free opportunities.

By End-User

Individuals segment dominated the market with the largest market share. The top management and high-net-worth individuals engaging in 70% of worldwide charter reservations drive the market. Private aviation has become a natural choice in travel plans for this clientele, which seeks privacy, personalized itineraries, and time efficiency. Demand arises after mergers, acquisitions, and expansions, while on-demand flights help expedite decision-making. Their focus on exclusivity and convenience cements their dominant place in charter usage.

Company Market Share

Key market players are investing in advanced Global Air Charter Services technologies and pursuing collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Wheel Up: An Emerging Player in the Global Air Charter Services Market

Wheels Up, founded in 2013, has rapidly emerged as a significant Global Air Charter Services market player. The company offers a membership-based private aviation service, providing flexible and accessible flight solutions. Wheels Up has expanded its fleet and service offerings through strategic acquisitions, including Delta Private Jets and Gama Aviation Signature, positioning itself as a prominent competitor.

Recent Developments:

- In November 2024, Wheels Up secured a USD 332 million revolving equipment notes facility with Bank of America. This financing enabled the acquisition of GrandView Aviation's fleet, comprising 17 Embraer Phenom 300 and 300E aircraft. The deal also included associated maintenance assets and customer programs, significantly enhancing Wheels Up's operational capabilities and service portfolio.

List of Key and Emerging Players in Air Charter Services Market

- NetJets

- VistaJet

- Flexjet

- Wheels Up

- Jet Aviation

- XO Global

- FlyVictor

- GlobeAir

- Luxaviation

- Jet Linx Aviation

- Others

Recent Developments

- February 2025- Hera Flight, a private air charter provider based in Clearwater, Florida, announced that it has received approval from the Federal Aviation Administration (FAA) to conduct worldwide Class II operations. This certification allows the company to operate flights over remote and oceanic airspace using advanced navigation and communication technologies, expanding its global reach and service offerings.

- November 2024- Sirius India Airlines, an air charter services operator based in Gurugram, India, announced plans to raise USD 100 million through debt and other instruments to expand its fleet and services. Founder and promoter Arun Kashyap stated that the funds are expected to be secured by March 2025, with implementation beginning in the fiscal year 2026.

Analyst Opinion

As per our analyst, the global air charter services market is poised for steady growth as digital transformation, AI-powered booking systems, and sustainable aviation initiatives converge to enhance operational efficiency and user experience. The increasing demand from UHNWIs and corporate travelers combined with urgent cargo and medical evacuation needs has driven significant investments in innovative service models, including jet sharing, on-demand charters, and fractional ownership.

Despite challenges such as high operational costs and strict regulatory compliance, the market continues to expand due to increasing globalization and demand for personalized, time-efficient travel solutions. Emerging markets in Asia-Pacific and the Middle East are projected to drive substantial industry growth as infrastructure modernization and regulatory reforms make private aviation more accessible. Additionally, with the increased adoption of SAFs and electric aircraft technologies, the push toward sustainability is set to reshape the future of air charter services.

Moreover, the integration of blockchain for secure transactions, AI-driven pricing models, and real-time aircraft tracking is improving efficiency and transparency in charter services. As the sector embraces technological innovation and sustainability efforts, the market is projected to expand at a CAGR of 6% through 2033, ensuring steady growth in developed and emerging regions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 29.5 Billion |

| Market Size in 2025 | USD 31.27 Billion |

| Market Size in 2033 | USD 49.84 Billion |

| CAGR | 6% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Type, By Aircraft Type, By Application, By Ownership Model, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Air Charter Services Market Segments

By Service Type

- Passenger Charter Services

- Private Charter Services

- Business Charter Services

- Group Charter Services

- Cargo Charter Services

- Medical Charter Services

- Government & Defense Charter Services

By Aircraft Type

- Light Jets

- Mid-size Jets

- Large Jets

- Turboprop Aircraft

- Helicopters

- Cargo Aircraft

By Application

- Business Travel

- Leisure Travel

- Emergency & Medical Evacuations

- Cargo & Freight Transport

- Sports & Entertainment Industry

- Government & Military Operations

By Ownership Model

- On-Demand Charter

- Fractional Ownership

- Membership Programs

- Jet Card Programs

By End-User

- Individuals

- Corporations

- Sports Teams & Celebrities

- Government & Military Agencies

- Freight & Logistics Companies

- Medical & Emergency Services

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.