Anti-Money Laundering Solution Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment Type (Cloud, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Application (Compliance Management, Currency Transaction Reporting, Customer Identity Management, Transaction Monitoring, Fraud & AML Integrated Suites, Others), By End Use (Banking, Financial Services & Insurance (BFSI), Government, IT & Telecom, Healthcare, Energy & Utilities, Retail, Gaming & Gambling, Real Estate, Transportation & Logistics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Anti-Money Laundering Solution Market Overview

The global anti-money laundering (AML) solution market size is valued at USD 3.92 billion in 2025 and is estimated to reach USD 17.63 billion by 2034, growing at a CAGR of 18.1% during the forecast period. Growth of the market is supported by increasing regulatory compliance requirements, the rising adoption of AI and machine learning for fraud detection, and the expansion of digital financial transactions, which allow early identification of suspicious activities, enhance risk management, and encourage financial institutions to implement advanced AML solutions proactively.

Key Market Trends & Insights

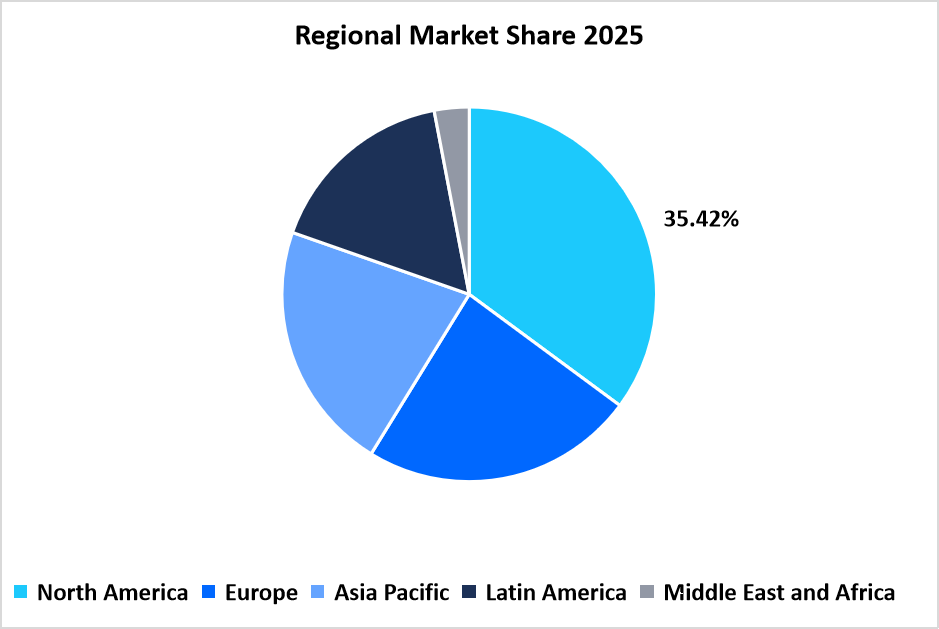

- North America dominated the market with a revenue share of 35.42% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 21.3% during the forecast period.

- Based on component, the solution segment held the highest market share of 61.5% in 2025.

- By deployment type, the cloud-based segment is estimated to register the fastest CAGR growth of 23.1%.

- Based on enterprise size, the large enterprises segment dominated the market in 2025, accounting for 56% market share.

- Based on application, the transaction monitoring segment is projected to register the fastest CAGR growth of 22.8% during the forecast period.

- Based on end use, the Banking, Financial Services & Insurance (BFSI) segment held the highest market share of 46.7% in 2025

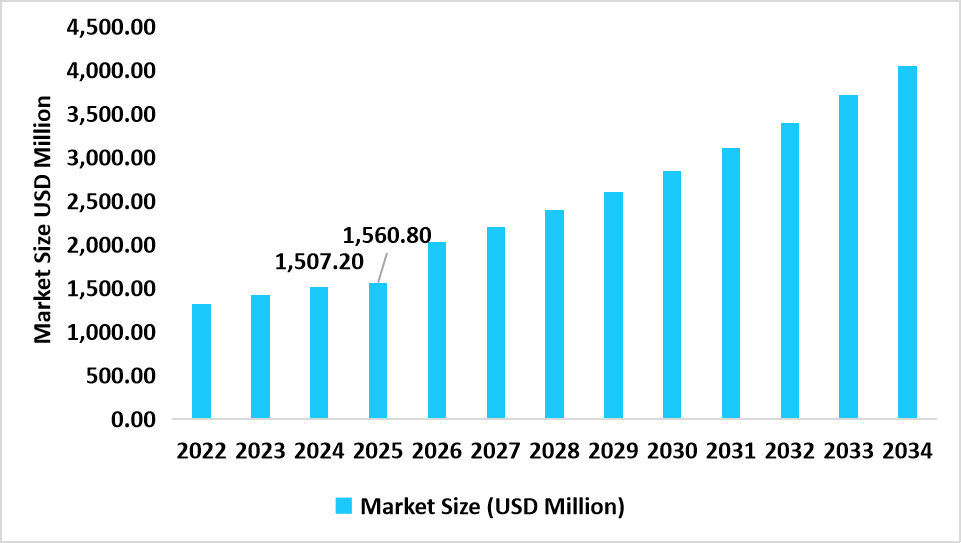

- The U.S. dominates the AML solution market, valued at USD 1.50 billion in 2024 and reaching USD 1.56 billion in 2025.

Table: U.S Anti-Money Laundering Solution Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 3.92 billion

- 2034 Projected Market Size: USD 17.63 billion

- CAGR (2026-2034): 18.1%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

Anti-Money Laundering (AML) solutions that assist in detecting report transactions that seem suspicious. They are used in many different industries as software and services. The Banking, Financial Services, and Insurance (BFSI) sector represents one of the fastest-growing industries in the market. AML solutions are widely used in this sector to keep operations honest by monitoring transactions, managing compliance, and verifying customer identities. Additionally, companies are putting a lot of effort into reducing risk, which shows how important AML solutions are.

Latest Market Trends

Transition from compliance verifications to comprehensive monitoring ecosystems

AML solution deployment is shifting away from disparate, stand-alone compliance scanning towards unified monitoring environments that leverage transaction monitoring, customer identity management, and regulatory reporting. Financial institutions used to suffer from disparate systems, manual reviews, and late reporting, which resulted in constraint of efficiency and heightened exposure to risk. Today, AML platforms provide centralized dashboards, cross-channel transaction monitoring, and real-time notifications, making continuous monitoring possible across the entire organization. Systems like those combining Fiserv's AML monitoring with NICE Actimize's risk management proved how synchronized monitoring and integrated reporting enhanced accuracy, operational efficiency, and regulatory compliance. This integrated solution experienced quantifiable decreases in suspicious activity backlog and false positives. Industry reports also provided evidence that such centralized AML environments enhanced risk governance and enabled timely intervention, representing a significant change towards more effective organization-wide compliance management.

Exponential growth in global AML adoption

AML adoption is undergoing explosive growth, and it is a prime trend in the market. During the early 2000s, AML solutions were put in place primarily by big banks within advanced regions for few types of transactions. But since 2010, adoption has risen sharply till 2025. According to industry analytics, over 8,500 global financial institutions had implemented formal AML programs by 2024, indicating widespread regulatory enforcement and increasing demand for compliance solutions. Such growth indicates how AML solutions have transitioned from being niche regulatory solutions to become core elements of risk management strategies, fueling market growth across BFSI, government, and fintech industries worldwide.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 3.92 billion |

| Estimated 2026 Value | USD 4.8 billion |

| Projected 2034 Value | USD 17.63 Billion |

| CAGR (2026-2034) | 18.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | NICE Actimize, Tata Consultancy Services Limited, Cognizant Technology Solutions Corporation, ACI Worldwide, Inc., SAS Institute, Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Increased adoption of cross-border financial compliance programs

AML solutions are gaining traction to facilitate cross-border financial transactions as a principal growth driver for the AML solution market. North America, Europe, Asia-Pacific, and the Middle East are emerging as critical locations due to strict regulatory environments, global banking standards, and increased interbank connectivity. The Financial Action Task Force (FATF) has indicated that more than 200 countries and jurisdictions had adopted AML and counter-terrorist financing laws by 2024, with multilateral banks actively utilizing packaged AML programs to meet cross-border regulatory requirements. This stringent application of cross-border compliance standards is compelling global embracement of AML solutions and increasing the size of the market, with financial institutions scrambling to assure transparency, reduce risk, and uphold operational credibility beyond borders.

Market Restraint

Fragmented regulatory frameworks limit seamless compliance

Most significant restrictions in the AML solution space is regulatory framework variations across regions, making uniform implementation difficult. According to the FATF, although there are over 200 countries and jurisdictions with AML laws, enforcement intensity, reporting standards, and regulatory requirements differ significantly across countries.

Accordingly, multinational banks and financial institutions also grapple with ensuring consistent compliance across borders. The fragmented regulatory landscape, in turn, continues to make it difficult to adopt and integrate AML solutions globally with ease, raising operational complexity and compliance risk.

Market Opportunity

Increased focus on transparency of regulations and anti-counterfeiting initiatives

Increased focus from governments and regulators on financial transparency and anti-fraud activities is creating significant opportunity for AML solution vendors. The U.S. Financial Crimes Enforcement Network (FinCEN), European Banking Authority (EBA), and Monetary Authority of Singapore (MAS) are establishing stringently upgraded reporting rules and heightened due diligence on cross-border payments.

Such initiatives not only enhance financial crime detection and prevention but also promote financial institutions to implement complete AML solutions. Such a trend offers AML vendors a greater market for enhanced monitoring, reporting, and compliance solutions that allow institutions to fulfill regulatory requirements effectively and limit exposure to financial and reputational risks.

Regional Analysis

North America dominated the market in 2025 with a market share of 38.41%. This leadership is a result of stringent anti-money laundering (AML) regulations and highly aggressive enforcement policies that have encouraged widespread usage of advanced AML platforms. Regime frameworks such as the Financial Crimes Enforcement Network (FinCEN) rules and the Office of Foreign Assets Control (OFAC) sanctions screening regulations have compelled banks to adopt automated transaction monitoring, Know Your Customer (KYC), and suspicious activity reporting systems. Furthermore, the greater focus on real-time data analysis and artificial intelligence-based risk scoring models is enabling U.S. financial institutions to strengthen compliance infrastructures, minimize fraud risks, and enhance business efficiency. These factors, in turn, serve to contribute to the strong take-up of AML solutions in the region.

The U.S. AML solutions market is witnessing strong growth owing to mounting regulatory pressure and a growing network of electronic financial transactions. For example, under the Financial Crimes Enforcement Network's modernization effort, the introduction of beneficial ownership report of rules and stronger transaction monitoring programs are compelling financial institutions to enhance their AML infrastructures. Large U.S. banks and fintech organizations are investing heavily in AI-based transaction analysis software and behavioral analysis to identify unusual activity in real-time, lowering compliance expenses and enhancing reporting accuracy. The nation's robust legal system combined with swift digital payment growth is still making the U.S. one of the largest and most developed AML solution markets in the world.

Asia Pacific Market Insights

Asia Pacific is becoming the fastest-growing region, expected to have a CAGR of 21.7% from 2026–2034. This rapid growth is fueled by fintech acceptance at a quick pace, expansion in cross-border payments, and regulatory transformation in major countries including India, Singapore, and Australia. The regional governments and central banks are proactively setting AML compliance frameworks, promoting the implementation of cloud-based monitoring systems and AI-enabled compliance systems. Increased investment in cybersecurity and the creation of public–private partnerships to fight financial crime are also boosting market growth in this region.

India AML solutions market is growing fast with heightened financial digitization, higher Unified Payments Interface (UPI) volumes, and increasing enforcement under the Financial Intelligence Unit – India. Top banks and payment aggregators are embracing next-generation risk monitoring tools to meet real-time reporting and flagging suspicious transactions requirements. Besides this, fintech companies are providing low-cost, API-based AML compliance modules for small and mid-sized banks, enhancing accessibility and regulatory fit. These trends, coupled with fast digitalization and tightening regulations, are making India one of the fastest-growing AML solution markets in Asia Pacific.

Source: Straits Research

Europe Market Insights

Europe too is witnessing strong growth in the anti-money laundering (AML) market on account of strong regulatory requirements such as the EU's 6th Anti-Money Laundering Directive (AMLD6) and the increasing financial crimes in the region. Financial institutions in Europe too are adopting advanced AML solutions driven by AI, machine learning, and big data analytics for real-time transaction surveillance and compliance management. Increased digitalization of finance and banking has also increased demand in the major countries of Germany, France, and the UK. Moreover, managed compliance and AML expert consulting services are also increasing as institutions outsource complex regulatory efforts to reduce business risk.

Germany is leading AML markets in the European region with revenue of approximately USD 96.8 million in 2024 and is anticipated to grow to USD 247.3 million by 2030 at a CAGR of 17.1%. The market is supported by expanded applications of sophisticated AML software, especially transaction monitoring and compliance management, and the fusion of AML solutions with broader financial crime prevention strategies. Alignment with EU AMLD6 and emphasis on real-time data analytics are fueling investments. Strategic government and private partnerships are developing AML technologies to protect the country's financial system from money laundering threats.

Latin America Market Insights

The Latin America Anti-Money Laundering Market driven by nations like Brazil, Mexico, and Argentina; where strengthening of regulatory environments and increased transparency in financial transactions are becoming the order of the day. Fintech growth and higher usage of digital payment systems are driving demand for AML products and services with capabilities suited to address regional-specific risks. Telemonitoring and cloud-based AML solutions are addressing geographic and infrastructure-related issues, enabling improved coverage of remote and unpenetrated areas and cross-border compliance.

Brazil AML market is increasingly growing, with revenues of around USD 58.1 million in 2024 and projected to grow to USD 141.2 million by 2030 with a CAGR of 16.1%. The market growth is fueled by stricter regulatory requirements and investments by top banks such as Bradesco to implement real-time fraud and compliance solutions. Employer-sponsored compliance programs and corporate wellness are driving adoption of AML solutions, thus fostering transparency, and curtailing illicit financial flows across the country.

Middle East and Africa Market Insights

The MEA region is experiencing growth in AML adoption at a high rate, driven by expanding regulatory pressures and rising financial crimes. Countries such as UAE, Saudi Arabia, and South Africa are adopting AI-driven AML solutions for enhanced compliance and monitoring effectiveness. Government initiatives aimed at harmonizing local regulations with international standards, for instance, FATF recommendations, are encouraging robust AML frameworks.

Egypt AML sector is changing with collaborative efforts on the part of financial institutions and the regulatory environment. The government prefers low-cost implementation of AML technology as part of larger financial transparency initiatives. Electronic identity verification, AI-based transaction monitoring, and risk-based compliance models are implemented more extensively in order to improve detection and prevention of money laundering. Egypt is aligning its AML/KYC regimes to international norms, supported by infrastructure investment and regulatory reforms designed to enhance trust and security within the financial system.

Component Insights

The solution segment dominated the AML solution industry in 2025. The growth is driven by increasing demand for comprehensive monitoring and reporting solutions across large banks and BFSI companies. With banks and fintech companies increasingly seeking centralized platforms to track transactions, manage customer identities, and report compliance, AML solutions gain traction as they have the capability to enable regulatory compliance and minimize risk exposure.

Service segment is anticipated to witness the highest growth during the forecast period. The growth is driven by increased adoption of outsourced anti-money laundering monitoring services, consulting services, and compliance services by small and mid-sized businesses due to regulatory needs and requirements for expert capabilities in meeting anti-money laundering duties.

Deployment Type Insights

The on-premise segment led the AML solution market in 2025. On-premise deployment is fueled by the demand from large businesses and financial institutions to deploy in-house for increased control over sensitive financial information, regulatory compliance, and integration with existing IT infrastructure. On-premise solutions are preferred where organizations need complete control over monitoring systems and safe processing of sensitive transaction information.

The cloud segment is expected to record the highest growth over the forecast period. The AML service is fueled by the growing use of elastic, subscription-based AML services among small and medium businesses and fintech companies, buoyed by the demand for flexible, real-time monitoring and reporting across various channels without huge initial infrastructure outlay.

Enterprise Size Insights

The AML solution market was led by the large enterprises sector with a revenue hold of 56% in 2025. This is fueled by the rising deployment of AML solutions among major banks, multinational financial institutions, and large corporations that need effective compliance systems to track high-volume transactions, regulatory reporting, and combat financial crime risks.

The small & medium enterprises (SMEs) segment is expected to see the highest growth, with a forecasted CAGR of 20.4% over the forecast period. The high growth is fueled by the increasing number of SMEs and fintech players embracing outsourced AML solutions and cloud-based services to ensure regulatory requirements cost-effectively, bolstered by government support for institutionalized compliance standards among smaller financial institutions.

Application Insights

By application, the compliance management segment led the AML solution market in 2025 with a revenue share of around 38%, as government agencies and financial institutions implement end-to-end solutions to address regulatory reporting, risk assessment, and policy compliance. An integrated approach minimizes compliance gaps and maximizes operational efficiency, hence driving segmental growth.

The Fraud & AML Integrated Suites is anticipated to exhibit the highest cagr 19.3% over the forecast period. Growth is being accelerated by growing acceptance of real-time transaction monitoring, suspicious activity recognition, and cross-channel monitoring among banks, fintech, and large corporations. Increasing regulatory mandates and the necessity for early detection of prospective money laundering activities are driving these solutions' deployment, leading to swift adoption over financial networks and hence segmental growth.

End Use Insights

The Banking, Financial Services & Insurance (BFSI) segment is anticipated to grow at the fastest rate of 19.8%, driven by the increasing volume of digital transactions and stringent regulatory oversight. As more banks and financial institutions expand their operations globally, they are actively adopting AML solutions to monitor cross-border transactions, prevent financial crimes, and ensure regulatory compliance, increasing demand for specialized AML services across the sector.

Competitive Landscape

The global anti-money laundering (AML) solution market is moderately fragmented, having a wide variety of established technology providers and service firms vying to offer end-to-end AML tools and platforms. Some players have substantial market share by offering an extensive variety of solutions from transaction monitoring, customer due diligence, sanctions screening, and case management. These companies are stepping up to enhance their competencies by advancing in AI and machine learning and strategies like new product development, strategic partnerships, and acquisitions to build their market presence.

The major players in the AML solution market include NICE Actimize, Tata Consultancy Services Limited, Cognizant Technology Solutions Corporation, and many others. These players continuously compete to offer scalable, AI-driven, and cloud-compatible AML compliance suites that meet stringent regulatory requirements globally.

NICE Actimize: Emerging Market Player

NICE Actimize was named a leader in anti-money laundering solutions in 2025. NICE Actimize has considerably enhanced its position in the global market by leveraging its highly developed AI-based risk detection and scalable compliance platforms.

- In April 2025, NICE Actimize achieved the maximum scores in all ten criteria in the Forrester Wave™: Anti-Money Laundering Solutions, such as for AI/ML risk scoring, data integration, watchlist management, case management, and reporting.The company also reported serving over 1,000 organizations worldwide across more than 70 countries.

Therefore, NICE Actimize is surfacing even more powerfully as a best-practice vendor in the AML space, riding its known strengths, expansive functional competencies, and leadership position to extend further within large financial institutions and compliance procurers.

List of Key and Emerging Players in Anti-Money Laundering Solution Market

- NICE Actimize

- Tata Consultancy Services Limited

- Cognizant Technology Solutions Corporation

- ACI Worldwide, Inc.

- SAS Institute, Inc.

- Fiserv, Inc.

- Oracle Corporation

- BAE Systems

- Accenture

- Open Text Corporation

- Experian Information Solutions, Inc.

- ComplyAdvantage

- Tookitaki

- Alessa

- Sanction Scanner

- Napier AI

- Quantexa

- LexisNexis Risk Solutions

- Verafin (Nasdaq)

- Quantifind

- Others

Strategic initiatives

- July 2025: Tata Consultancy Services introduced a comprehensive AI and machine learning-based AML solution integrated with blockchain analytics, aiming to reduce financial crime investigation time by 30% for banking clients.

- June 2025: Comply Advantage launched an AI-driven transaction monitoring update that processes over 110 million transactions yearly, reducing false positives by 19% and enabling clients to detect new laundering typologies effectively.

- June 2025, SEON Technologies, a U.S.-based fraud prevention and AML compliance company, introduced an AI-powered AML compliance suite to enhance detection capabilities and reduce false positives.

- May 2025, Oracle introduced the Financial Crime and Compliance Management (FCCM) Cloud Service, a comprehensive, AI-driven SaaS platform that automates scenario calibration for AML transaction monitoring.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 3.92 billion |

| Market Size in 2026 | USD 4.8 billion |

| Market Size in 2034 | USD 17.63 Billion |

| CAGR | 18.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment Type, By Enterprise Size, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Anti-Money Laundering Solution Market Segments

By Component

- Solution

- Service

By Deployment Type

- Cloud

- On-Premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

- Fraud & AML Integrated Suites

- Others

By End Use

- Banking, Financial Services & Insurance (BFSI)

- Government

- IT & Telecom

- Healthcare

- Energy & Utilities

- Retail

- Gaming & Gambling

- Real Estate

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.