Aorto-Iliac Occlusive Disease Treatment Market Size, Share & Trends Analysis Report Device Type (Endovascular Devices, Surgical Devices), By Procedure (Endovascular Procedures, Hybrid Procedures, Open Surgical Procedures), By End Use (Hospitals, Outpatient Facilities, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Aorto-Iliac Occlusive Disease Treatment Market Overview

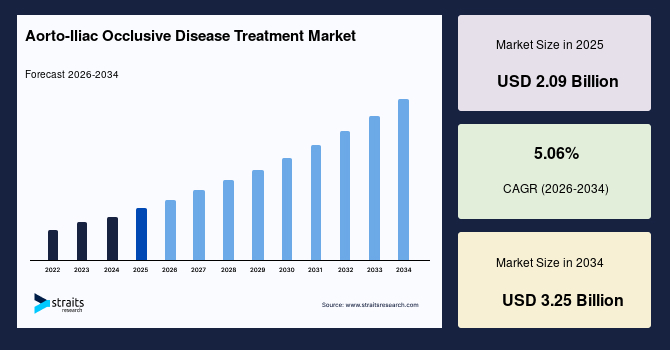

The global aorto-iliac occlusive disease treatment market size is valued at USD 2.09 billion in 2025 and is estimated to reach USD 3.25 billion by 2034, growing at a CAGR of 5.06% during the forecast period. The consistent growth of the market is augmented by the increasing clinical emphasis on early intervention for peripheral arterial disease and rising utilization of minimally invasive revascularization procedures across vascular care settings.

Key Market Trends & Insights

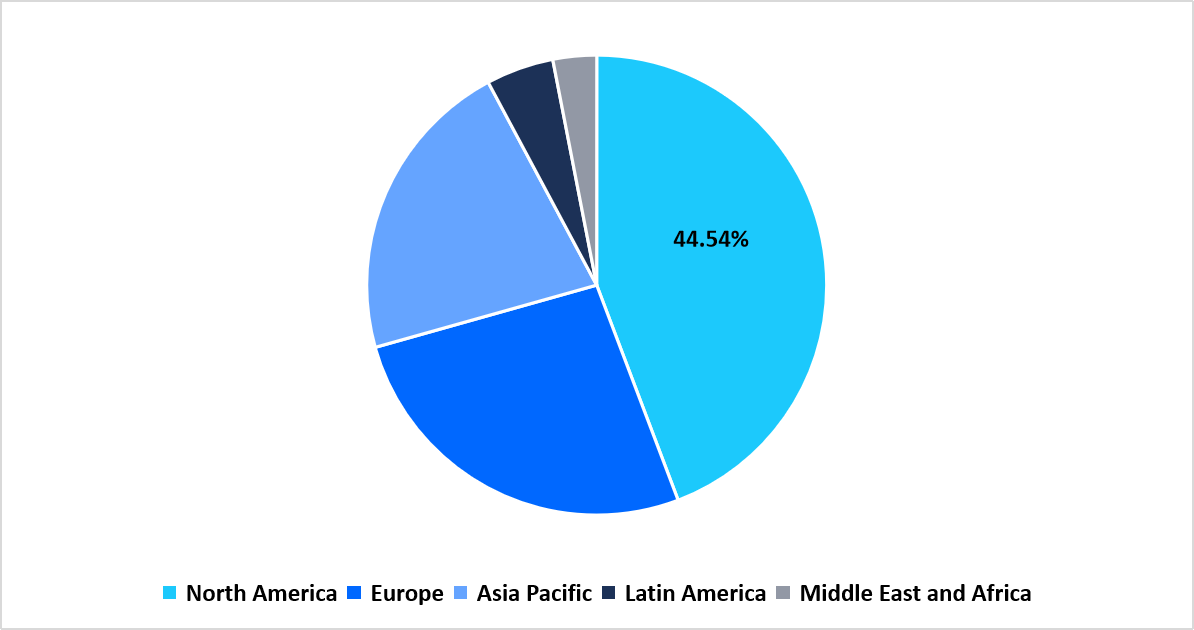

- North America held a dominant share of the global market, accounting for 54% in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 7.06% during the forecast period.

- Based on Device Type, surgical devices are anticipated to register the fastest growth of 6.12% during the forecast period.

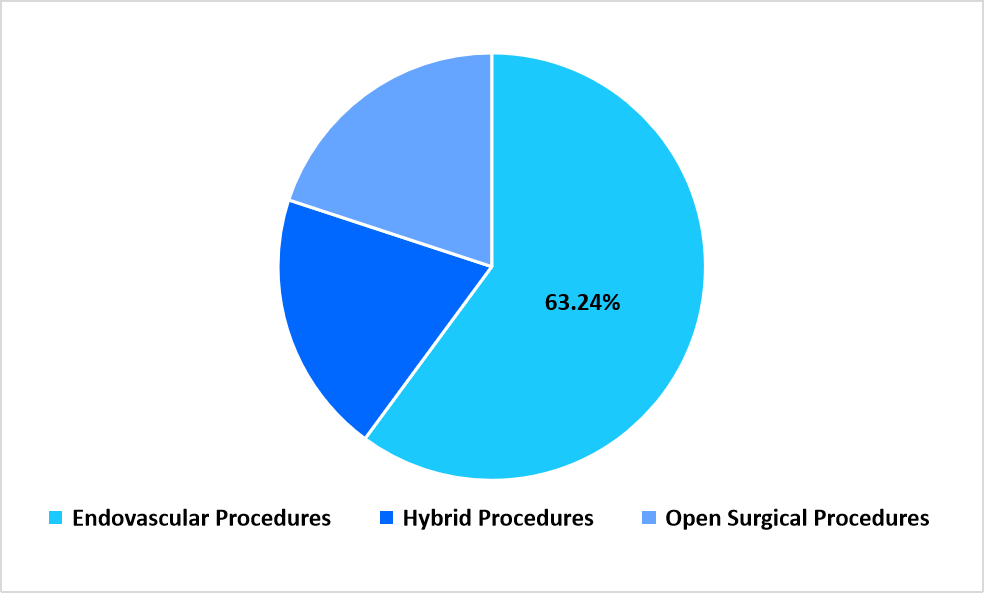

- Based on Procedure, the endovascular procedures segment dominated the market with a revenue share of 63.24%.

- Based on End Use, the hospital segment dominated the market with a revenue share of 50.23%.

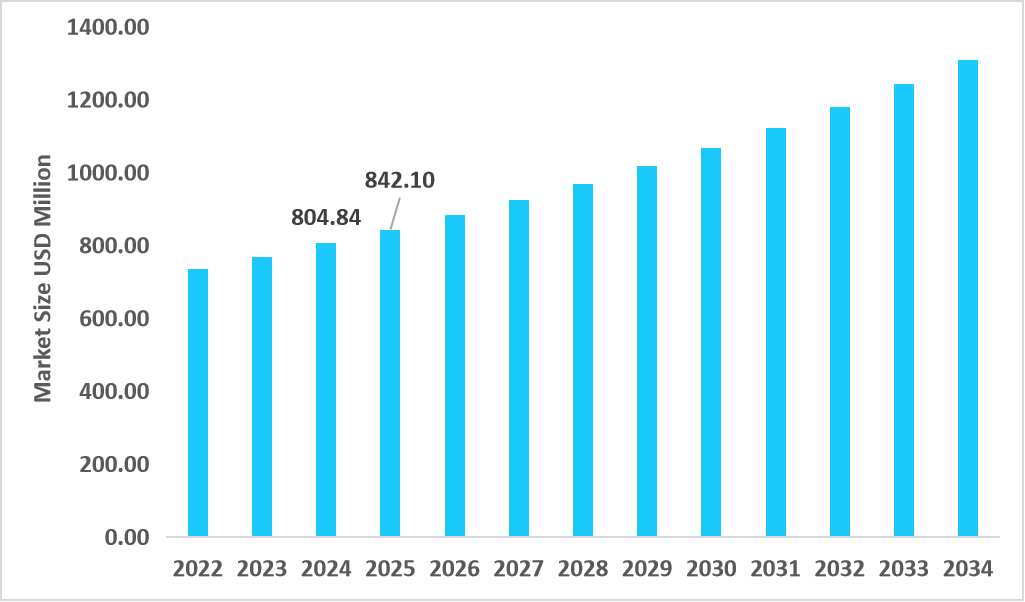

- The U.S. dominates the market, valued at USD 804.84 million in 2024 and reaching USD 842.10 million in 2025.

Table: U.S. Aorto-iliac Occlusive Disease Treatment Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.09 billion

- 2034 Projected Market Size: USD 3.25 billion

- CAGR (2026-2034): 5.06%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The aorto-iliac occlusive disease treatment market encompasses medical devices, procedures, and care settings focused on the management of obstructive atherosclerotic disease affecting the distal abdominal aorta and iliac arteries. This market includes endovascular devices such as balloon angioplasty systems, atherectomy platforms, and a broad range of stents, including self-expanding stents, balloon expandable stents, covered stent grafts, and bifurcated aortic stent grafts designed to restore arterial patency and improve lower limb perfusion. Surgical devices used in open reconstruction procedures also form part of the market for patients requiring direct arterial repair. Treatment approaches are categorized into endovascular procedures, including balloon angioplasty, primary stenting, kissing stent techniques, covered stent graft placement, and endovascular aortic repair, as well as hybrid procedures that combine open and endovascular methods and conventional open surgical procedures. End-use settings include hospitals, outpatient facilities, and other specialized vascular care centers that deliver diagnostic evaluation, interventional therapy, and post-procedure management for aorto-iliac occlusive disease.

Latest Market Trends

Shift from standalone iliac stents to lesion-specific endovascular systems

A distinct trend in the aorto-iliac occlusive disease treatment market is the shift from generic iliac stent usage toward lesion-specific endovascular systems designed for calcified bifurcations, chronic total occlusions, and ostial disease. Treatment strategies increasingly prioritize device selection based on vessel geometry and plaque morphology, leading to wider clinical use of covered stent grafts, bifurcated aortic stents, and dedicated iliac platforms. This shift reflects growing procedural planning precision and deeper alignment between device architecture and complex aorto-iliac anatomy.

Shift from single-stage interventions to staged and image-guided revascularization planning

The emerging trend is the shift from single-stage procedural decision-making to staged treatment pathways supported by intravascular imaging and advanced pre-procedural planning tools. Clinicians increasingly adopt stepwise revascularization approaches that combine diagnostic imaging runs lesion preparation, and definitive stenting in sequenced workflows. This evolution supports procedural predictability and optimized resource utilization within vascular catheterization laboratories.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.09 Billion |

| Estimated 2026 Value | USD 2.19 Billion |

| Projected 2034 Value | USD 3.25 Billion |

| CAGR (2026-2034) | 5.06% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Medtronic plc, L. Gore & Associates, Inc., Boston Scientific Corporation, Abbott Laboratories, Cook Medical LLC |

to learn more about this report Download Free Sample Report

Aorto-Iliac Occlusive Disease Treatment Market Driver

Rising burden of peripheral arterial disease involving aorto-iliac segments

The market is driven by the increasing prevalence of peripheral arterial disease affecting the proximal iliac and aortic bifurcation regions, particularly among aging populations with diabetes and smoking history. Progressive symptom burden, such as claudication and critical limb ischemia, drives clinical intervention, sustaining demand for revascularization procedures across vascular surgery and interventional cardiology practices.

Market Restraint

Complex reimbursement alignment for multilevel iliac interventions

A key restraint is variability in reimbursement structures for multilevel aorto-iliac interventions, particularly procedures involving combined stenting, atherectomy, and adjunct imaging. Inconsistent coding clarity across healthcare systems creates administrative complexity and influences procedural planning decisions, affecting the adoption of advanced treatment strategies in cost-sensitive care settings.

Market Opportunity

Development of dedicated aorto-iliac training and procedural support programs

A notable opportunity exists in the expansion of structured physician training and procedural support programs focused exclusively on aorto-iliac disease management. Device manufacturers offering simulation-based training proctorship models and standardized treatment algorithms are positioned to support wider adoption of complex iliac interventions. As procedural expertise deepens across regional vascular centers, demand for advanced aorto-iliac treatment solutions is expected to expand.

Regional Analysis

North America Market Insights

North America held the leading share of 44.54% in the aorto iliac occlusive disease treatment market in 2025, supported by high utilization of peripheral revascularization procedures across tertiary vascular centers. Strong penetration of catheter-based interventions and structured referral pathways from primary care to vascular specialists support steady procedural volumes.

The U.S. market is driven by widespread use of ankle brachial index screening and advanced vascular imaging in patients with peripheral arterial disease, supporting timely adoption of stent placement and surgical bypass procedures across hospital networks.

Asia Pacific Market Insights

Asia Pacific is projected to record a rapid expansion of 7.06% during the forecast period due to rising diagnoses of peripheral arterial disease and increasing availability of vascular surgery services in metropolitan hospitals. Growth is supported by the expansion of interventional cardiology departments and rising clinician preference for minimally invasive limb revascularization approaches.

China's market growth is driven by increasing use of locally manufactured vascular stents within public hospitals, combined with growing procedural expertise in high volume urban medical centers.

Regional Market share (%) in 2025

Source: Straits Research

Europe Aorto Market Insights

Europe demonstrates steady growth supported by established treatment algorithms for peripheral arterial disease and strong coordination between vascular surgeons and interventional radiologists. Reimbursement coverage for endovascular and open procedures supports consistent adoption across public healthcare systems.

German market is driven by routine vascular risk assessment in aging populations, leading to sustained demand for iliac artery stents and surgical reconstruction procedures.

Latin America Market Insights

Latin America is witnessing a gradual expansion supported by the growing availability of vascular specialty services within private hospitals. Increasing investment in angiography suites and trained specialists supports the adoption of endovascular interventions in major cities.

Brazil market growth is driven by rising referrals to tertiary hospitals for advanced peripheral artery disease management, supporting uptake of iliac stenting procedures.

Middle East and Africa Aorto Market Insights

The Middle East and Africa market is developing steadily as healthcare systems expand advanced vascular treatment capacity. Adoption remains concentrated within referral hospitals managing complex peripheral arterial disease cases.

Saudi Arabia market is driven by public investment in specialized cardiovascular centers, enabling broader access to endovascular and surgical treatment options for aorto iliac occlusive disease.

Device Type Insights

The endovascular devices segment dominated the market in 2025 due to the broad utilization of balloon angioplasty devices, atherectomy systems, and stents in iliac artery revascularization procedures. High procedural preference for self-expanding stents, balloon expandable stents, covered stent grafts, and bifurcated aortic stent grafts supports the dominance of this segment, as these devices align with minimally invasive treatment strategies for complex iliac lesions.

The surgical devices segment is anticipated to register the fastest growth during the forecast period, accounting for a growth rate of 6.12%. Growth is driven by the continued clinical relevance of open surgical reconstruction in patients with advanced occlusive disease unsuitable for endovascular intervention.

Procedure Insights

The endovascular procedures segment dominated the market in 2025, representing a revenue share of 63.24%. Dominance is supported by widespread adoption of balloon angioplasty, primary stenting, kissing stent techniques, covered stent graft placement, and endovascular aortic repair for aorto iliac disease management. Preference for reduced recovery time and lower perioperative burden supports sustained procedural volumes.

The hybrid procedures segment is expected to witness the fastest growth with a growth rate of 6.34%. Expansion is supported by increasing use of combined open and endovascular approaches to address complex multilevel occlusive disease.

By Procedure Market Share (%), 2025

Source: Straits Research

End Use Insights

The hospitals segment dominated the market in 2025 with a revenue share of 50.23%. Availability of advanced imaging systems, specialized vascular teams, and the capacity to manage high complexity cases support hospital-based treatment dominance.

The outpatient facilities segment is anticipated to grow at the fastest rate, accounting for a growth rate of 6.78%. Growth is supported by the gradual transition of selected endovascular interventions toward outpatient settings that emphasize procedural efficiency and shorter recovery duration.

Competitive Landscape

The global aorto-iliac occlusive disease treatment market is moderately fragmented, with established cardiovascular device manufacturers and specialized peripheral vascular solution providers competing across hospital-based vascular surgery and interventional cardiology settings. Market participants focus on portfolio depth across stents, catheters, and surgical grafts, alongside clinician training and procedural support initiatives.

Medtronic plc: An emerging market player

Medtronic holds a strong position in the aorto-iliac occlusive disease treatment market through its broad range of peripheral vascular stents, balloons, and access systems. The company emphasizes device versatility to address complex lesion morphology and calcified vessels. Its strategy centers on expanding clinical adoption through long-term physician engagement, evidence generation, and alignment with evolving peripheral artery disease treatment protocols. Continuous refinement of delivery platforms and integration across endovascular workflows support Medtronic’s competitive positioning across global vascular care markets.

List of Key and Emerging Players in Aorto-Iliac Occlusive Disease Treatment Market

- Medtronic plc

- L. Gore & Associates, Inc.

- Boston Scientific Corporation

- Abbott Laboratories

- Cook Medical LLC

- Terumo Corporation

- Cordis Corporation

- Braun Melsungen AG

- BD

- LeMaitre Vascular, Inc.

- Endologix, Inc.

- Inari Medical, Inc.

- Merit Medical Systems, Inc.

- Biotronik SE & Co. KG

- Meril Life Sciences Pvt. Ltd.

- Others

Strategic Initiatives

- May 2025: The Saudi Food and Drug Authority (SFDA) initiated digital awareness campaigns to inform the public about the safe and proper use of medical devices, which are crucial for managing conditions like PAD.

- March 2025: The Washington Healthcare Authority noted that balloon angioplasty remained a central treatment for lower extremity PAD, especially in femoro-popliteal and infra-popliteal segments. The report emphasized its use for improving blood flow and limb preservation, pointing to growing adoption of drug-coated balloon technologies.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.09 Billion |

| Market Size in 2026 | USD 2.19 Billion |

| Market Size in 2034 | USD 3.25 Billion |

| CAGR | 5.06% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | Device Type, By Procedure, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Aorto-Iliac Occlusive Disease Treatment Market Segments

Device Type

-

Endovascular Devices

- Balloon Angioplasty Devices

- Atherectomy Systems

-

Stents

- Self-Expanding Stent

- Balloon-Expandable Stents

- Covered Stent Grafts

- Bifurcated Aortic Stent Grafts

- Surgical Devices

By Procedure

-

Endovascular Procedures

- Balloon Angioplasty

- Primary Stenting

- Kissing Stents

- Covered Stent Grafts

- Endovascular Aortic Repair (EVAR)

- Hybrid Procedures

- Open Surgical Procedures

By End Use

- Hospitals

- Outpatient Facilities

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.