Apparel Market Size, Share & Trends Analysis Report By Product (Clothing, Footwear, Accessories), By Distribution Channel (Offline Channels, Online Channels), By Gender (Men, Women, Children), By Fabric (Natural Fibers, Synthetic Fibers), By Price Range (Luxury Apparel, Premium Apparel, Mid-Range Apparel, Economy Apparel), By Sustainability (Conventional Apparel, Sustainable/Eco-Friendly Apparel) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Apparel Market Size

The global apparel market size was valued at USD 1.67 trillion in 2024 and is projected to reach from USD 1.80 trillion by 2025 to USD 2.97 trillion by 2033, exhibiting a CAGR of 8.02% during the forecast period (2025-2033).

The global apparel market is a dynamic and multifaceted sector encompassing a wide range of clothing products, including casual wear, formal attire, sportswear, and luxury items. According to the World Trade Organization (WTO), this market is characterized by the influence of various factors, such as rising disposable incomes, population growth, and the increasing impact of fashion trends. The industry operates through a complex supply chain involving raw material suppliers, manufacturers, distributors, and retailers, all of which play crucial roles in delivering products to consumers.

In recent years, sustainability has emerged as a key focus within the apparel industry, with many companies committing to environmentally friendly practices. The United Nations Industrial Development Organization (UNIDO) highlights that many manufacturers are adopting circular economy principles, which emphasize recycling and reducing waste. This shift toward sustainable production methods is driven by consumer demand for ethical and environmentally friendly products, pushing brands to innovate in their materials and supply chain processes.

Trade policies and regulations significantly influence the global apparel market. The International Trade Centre (ITC) reports that trade agreements play a crucial role in shaping market dynamics, enabling manufacturers to access new markets and consumers to enjoy a broader selection of products. Countries with strong textile and apparel industries, such as China, India, and Bangladesh, benefit from favorable trade terms, which facilitate export growth and increase their competitive positioning in the global market.

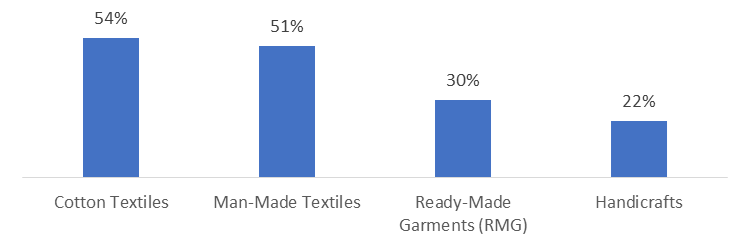

Textiles and Apparel Exports Growth, 2021-22 (%)

Source: Trade portal, a unit of the Ministry of Commerce and Industry

The data on textiles and apparel exports for the period of 2021-22, sourced from the Trade Portal, a unit of the Ministry of Commerce and Industry, shows significant growth across various product categories within the global apparel market. Cotton textiles lead this trend with a yearly growth rate of 54%, indicating an increase in demand for natural fibers.

This rise can largely be attributed to shifting consumer preferences toward sustainable and eco-friendly products, reflecting a broader industry trend favoring environmentally conscious choices. Moreover, the 51% growth in man-made textiles highlights the continued importance of synthetic materials, which provide versatility and adaptability to current fashion trends.

The steady growth observed in ready-made garments (RMG) at 30% and handicrafts at 22% further emphasizes the resilience and diversity of the global apparel sector. The demand for RMG aligns with the fast fashion movement, where consumers seek immediate access to trendy clothing options. Meanwhile, the growth in handicrafts demonstrates an increasing appreciation for artisanal craftsmanship, as consumers prefer unique and culturally rich products.

Overall, the data highlights a dynamic and evolving global apparel market characterized by a blend of sustainability, innovation, and a strong response to changing consumer demands, as reported by the Trade Portal.

Apparel Market Trends

Rise of E-Commerce and Digital Shopping in Fashion Retail

The rise of e-commerce and digital shopping has significantly transformed the fashion retail landscape, reshaping how consumers engage with brands and purchase apparel. Accelerated by technological advancements and changing consumer behaviors, online shopping has become a preferred channel for many consumers, offering convenience, a wider range of products, and the ability to shop from anywhere at any time.

- According to the U.S. Census Bureau, e-commerce sales in the apparel sector surged during the COVID-19 pandemic, prompting traditional retailers to increase their online presence and adapt to the digital marketplace. As a result, fashion brands are increasingly investing in user-friendly websites and mobile applications to facilitate seamless shopping experiences and cater to the growing demand for online retail.

To engage customers, retailers are leveraging social media, influencer marketing, and personalized recommendations to drive traffic and boost sales. Data analytics helps brands understand consumer preferences, enabling tailored marketing and inventory strategies. The incorporation of augmented reality (AR) and virtual fitting rooms further enhances the digital shopping experience, allowing consumers to visualize how garments will fit before purchasing. As e-commerce continues to evolve, digital shopping is set to remain a dominant force in the fashion retail market.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.67 trillion |

| Estimated 2025 Value | USD 1.80 trillion |

| Projected 2033 Value | USD 2.97 trillion |

| CAGR (2025-2033) | 8.02% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Nike, Inc., Adidas AG, H&M Group, Inditex (Zara), Uniqlo (Fast Retailing Co., Ltd.) |

to learn more about this report Download Free Sample Report

Apparel Market Growth Factors

Rising Affluence in Growing Economies Accelerates Apparel Consumption

The growing consumer demand for sustainable and ethical fashion is reshaping the global apparel industry as more individuals prioritize environmental and social responsibility in their purchasing decisions. This shift is driven by increasing awareness of the negative impacts of fast fashion, including excessive waste, pollution, and poor labor practices. Consumers are now seeking brands that embrace sustainable practices, such as using eco-friendly materials, reducing carbon emissions, and promoting fair labor conditions.

- According to the United Nations Industrial Development Organization (UNIDO), this demand has prompted many fashion companies to integrate sustainability into their business models, focusing on ethical sourcing, transparent supply chains, and environmentally conscious production methods.

In response, fashion brands are aligning themselves with sustainability goals to meet consumer expectations and maintain competitiveness. As consumers continue to demand more from fashion in terms of sustainability and ethics, brands that prioritize these values are gaining loyalty, setting the stage for a long-term shift in the apparel industry towards more responsible production and consumption.

Expansion of Online Retail and Digital Innovations in Apparel Shopping

The expansion of online retail and digital innovations in apparel shopping has revolutionized the way consumers engage with fashion brands and purchase clothing. E-commerce has rapidly grown, fuelled by the convenience, variety, and accessibility it offers to shoppers. Traditional brick-and-mortar stores have increasingly shifted to digital platforms, developing sophisticated websites and mobile apps to accommodate this changing consumer behavior.

- According to the U.S. Census Bureau, online sales in the apparel industry have seen significant growth, particularly during and after the COVID-19 pandemic. This surge has prompted retailers to increase their digital infrastructure, offering personalized shopping experiences, streamlined payment systems, and faster delivery options to meet the growing demand.

Digital innovations have further transformed the online apparel shopping experience, making it more interactive and engaging. Technologies such as augmented reality (AR) and virtual fitting rooms allow consumers to visualize how clothing will look and fit before purchasing, addressing one of the main challenges of online shopping.

Social media platforms, influencer marketing, and live-stream shopping events are also increasingly integrated into e-commerce strategies, creating new ways for brands to connect with consumers. As digital innovations continue to evolve, they are likely to shape the future of apparel shopping, making it more efficient, personalized, and immersive.

Apparel Market Restraining Factors

Rising Production Costs and Supply Chain Disruptions

Rising production costs and supply chain disruptions have become significant restraints in the global apparel market, challenging the profitability and operational efficiency of fashion brands. The increasing cost of raw materials, such as cotton, wool, and synthetic fibers, has driven up manufacturing expenses, while labor costs in key production regions like Asia have also been on the rise. Moreover, growing compliance with environmental regulations, which requires investments in sustainable materials and cleaner production processes, further adds to these costs. These pressures are forcing brands to either raise prices or absorb higher costs, affecting their margins and competitive positioning in the market.

Apparel Market Opportunities

Sustainability and Eco-Friendly Practices in Apparel Production

The growing demand for sustainable and eco-friendly practices represents a significant opportunity in the global apparel market, as consumers increasingly value transparency and responsible sourcing. Brands are shifting to sustainable practices, such as using organic and recycled materials, to meet this demand and address environmental issues like climate change and pollution.

- For instance, Patagonia, a leader in eco-conscious fashion, uses recycled polyester and organic cotton in its products while implementing strict standards for water and energy conservation in its supply chain.

Industry collaboration and regulatory frameworks further support this shift. The Sustainable Apparel Coalition (SAC), through tools like the Higg Index, enables brands to assess their environmental impact and encourages partnerships among apparel companies, manufacturers, and retailers. Governments worldwide also enforce stricter regulations around waste management and resource use, urging companies to adopt eco-friendly practices.

- For example, the European Union’s Circular Economy Action Plan emphasizes sustainable product design and extended producer responsibility, prompting brands to integrate sustainable processes into their business models.

As sustainability becomes a core value in the apparel industry, companies that prioritize eco-friendly practices and align with regulatory standards stand to enhance brand loyalty and secure long-term growth.

Regional Insights

Asia Pacific: Dominant Region with the Highest Market Share

Regionally, Asia-Pacific is expected to continue dominating the global apparel market, driven by its large population, growing disposable incomes, and significant manufacturing capacity. According to the World Trade Organization (WTO), Asia-Pacific is home to key production hubs such as China, India, Bangladesh, and Vietnam, which together produce a substantial portion of the world’s apparel exports.

Moreover, the Apparel Export Promotion Council of India (AEPC) highlights that India and China are not only major producers but also increasingly important consumer markets due to rising domestic demand. Manufacturers' reports, such as those from Adidas and Nike, consistently emphasize the strategic importance of the Asia-Pacific region in both manufacturing and market growth.

Europe: the Second-Largest Regional Player in the Global Apparel Market

Europe is the second-largest regional player in the global apparel market. According to reports from the European Apparel and Textile Confederation (Euratex), Europe has a well-established fashion industry driven by leading fashion hubs like Italy, France, Germany, and Spain. The region is renowned for its high-quality apparel production, luxury fashion houses, and strong consumer demand.

European brands such as LVMH, Kering, and Inditex (Zara) hold significant influence in both the regional and global markets. Moreover, Europe is a key player in sustainable and eco-friendly apparel, with stringent regulations promoting environmentally responsible practices in fashion production.

Countries Insights

- The U.S. is one of the largest apparel markets globally, characterized by a strong consumer base that values both fast fashion and premium brands. The e-commerce sector has seen significant growth, with consumers increasingly favoring online shopping for apparel.

- As the largest apparel market in the world, China is a major manufacturing hub and a growing consumer market. The demand for both domestic and international brands is on the rise, particularly in urban areas, with a strong inclination towards premium and luxury fashion.

- India’s apparel market is expanding rapidly, driven by a burgeoning middle class and increasing disposable incomes. The demand for ethnic wear, along with Western styles, showcases the country’s diverse consumer preferences, with a significant shift towards online retail.

- Germany is the largest apparel market in Europe, known for its preference for quality and sustainability. German consumers are increasingly seeking eco-friendly products, influencing local and international brands to adopt sustainable practices in their collections.

- Japan’s apparel market is marked by unique fashion trends and a strong inclination towards quality and craftsmanship. The country has a diverse consumer base, with a growing interest in both domestic designers and international brands, particularly in urban centers like Tokyo.

- Brazil is the largest apparel market in South America, with a youthful population that drives demand for trendy and affordable fashion. The market is witnessing a surge in e-commerce, and local brands are increasingly competing with international players.

- The UK apparel market is characterized by a mix of high-street and luxury brands. British consumers are increasingly focused on sustainability and ethical sourcing, prompting brands to implement eco-friendly practices and transparency in their supply chains.

Segmentation Analysis

By Product

Clothing is expected to maintain its leadership position, driven by strong demand across various demographic groups. According to reports from the International Apparel Federation (IAF), clothing remains the largest category in the apparel sector, accounting for the majority of consumer purchases across formal wear, casual wear, and activewear. The demand for clothing is bolstered by the fast fashion industry, which continuously introduces new styles and trends, encouraging frequent purchases.

By Fabric

For fabric, synthetic fibers are expected to dominate due to their cost-effectiveness and versatility. According to the International Textile Manufacturers Federation (ITMF), synthetic fibers such as polyester and nylon are widely used in the production of a broad range of apparel, from sportswear to casual wear. The United Nations Industrial Development Organization (UNIDO) notes that synthetic fibers are favored for their durability, lower production costs, and adaptability to modern fashion trends.

By Gender

In the gender segment, women's apparel is anticipated to maintain the highest market share, fuelled by a greater variety of product offerings and higher spending on fashion. Reports from the European Apparel and Textile Confederation (Euratex) highlight that women’s clothing continues to generate more revenue compared to men's and children's apparel. Leading manufacturers like Inditex and VF Corporation emphasize in their annual reports the critical importance of women’s fashion collections, noting that women’s apparel often sees higher turnover due to fashion trends and seasonal variations.

By Distribution Channel

Offline channels continue to dominate, although the rise of e-commerce is reshaping the landscape. Data from the U.S. Census Bureau and the International Trade Centre (ITC) indicate that while online retail is growing, physical stores still account for a significant portion of apparel sales. Many consumers, particularly in regions like Europe and Asia-Pacific, prefer to shop in person, as they can physically inspect and try on clothing before making a purchase. According to the National Retail Federation (NRF), large retailers such as Uniqlo, H&M, and department stores remain highly competitive in the offline market due to their established customer bases and wide product assortments.

By Price Range

In the price range segment, mid-range apparel is projected to lead the market, as it caters to the largest consumer base globally. According to the World Bank, the growth of the middle class, particularly in emerging markets like China and India, has fuelled demand for affordable yet stylish clothing. Manufacturers such as H&M, Zara, and Uniqlo dominate this category, providing fashionable, high-quality apparel at accessible price points. The mid-range segment is particularly popular among middle-income consumers, who seek value without compromising on style or quality.

By Sustainability

In the sustainability segment, while conventional apparel still holds the majority share, sustainable/eco-friendly apparel is experiencing significant growth. Data from the United Nations Environment Programme (UNEP) and Euratex suggest that the global shift toward sustainability is reshaping consumer preferences. Many fashion brands are increasingly investing in sustainable practices, with companies such as Patagonia and Levi Strauss & Co. leading the charge by adopting organic materials and water-saving technologies.

Company Market Share

Key apparel market players are investing in advanced diagnostic technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to increase their products and expand their market presence.

Nike, Inc.: An established player in the apparel market

Nike, Inc., headquartered in Beaverton, Oregon, is a leading multinational corporation engaged in the design, development, and marketing of athletic footwear, apparel, equipment, and accessories. Established in 1964 as Blue Ribbon Sports and rebranded to Nike, Inc. in 1971, the company derives its name from the Greek goddess of victory, reflecting its focus on athletic performance.

Nike operates through several segments, including footwear, apparel, and equipment, with well-known brands such as Nike, Jordan, and Converse under its umbrella. The company has established a significant share in the global sportswear market, leveraging a diverse distribution network that includes retail stores, e-commerce platforms, and partnerships with various retailers worldwide.

Recent Developments

- In April 2023, Nike announced its commitment to increasing the use of sustainable materials in its apparel lines as part of its broader sustainability strategy. The company aims to incorporate at least 50% recycled content in select apparel by 2025. This initiative aligns with Nike's long-term goal of reducing its environmental footprint and promoting circularity in its product offerings.

List of Key and Emerging Players in Apparel Market

- Nike, Inc.

- Adidas AG

- H&M Group

- Inditex (Zara)

- Uniqlo (Fast Retailing Co., Ltd.)

- L Brands (Victoria's Secret and Bath & Body Works)

- PVH Corp.

- GAP Inc.

- American Eagle Outfitters, Inc.

- Li & Fung Limited

- Hanesbrands Inc.

- Burlington Stores, Inc.

- Mango

- Esprit Holdings Limited

- Superdry

Recent Developments

- January 2024 - Adidas announced a new initiative focused on circularity in its production processes. The company plans to launch a line of fully recyclable footwear and apparel, aiming to minimize waste and extend the life cycle of its products. This initiative aligns with Adidas's broader sustainability goals and commitment to reducing its carbon footprint.

- April 2024 -Under Armour launched a new line of performance apparel that incorporates smart fabric technology designed to regulate body temperature and moisture levels during workouts. This innovative approach aims to increase athletic performance and represents Under Armour's focus on combining technology with activewear.

- February 2024 - PVH Corp., the parent company of brands like Calvin Klein and Tommy Hilfiger, announced a new sustainability strategy focusing on reducing water usage and emissions in its production processes. The initiative aims to achieve significant reductions by 2025 and reflects the company's dedication to integrating sustainability into its business model.

- January 2024 - Lululemon introduced its first-ever line of running shoes, expanding its product offerings beyond athletic apparel. This launch marks a significant strategic move for Lululemon as it aims to capture a larger share of the growing footwear market, increasing its brand presence in the athletic segment.

Analyst Opinion

As per our analyst, the apparel industry is transforming rapidly, driven by trends such as sustainability, e-commerce growth, and digital advancements. Major brands are adopting sustainable practices like recycled materials and circular production to meet the rising demand for eco-friendly products. Digital innovations, including AI-driven personalization and enhanced online shopping, are reshaping retail strategies and boosting customer engagement. This shift toward sustainable, tech-integrated products is fostering responsible consumption, intensifying competition, and emphasizing ethical manufacturing. These trends are expected to create a resilient apparel market focused on environmental stewardship and social responsibility, ultimately influencing consumer behavior and industry standards.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.67 trillion |

| Market Size in 2025 | USD 1.80 trillion |

| Market Size in 2033 | USD 2.97 trillion |

| CAGR | 8.02% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Distribution Channel, By Gender, By Fabric, By Price Range, By Sustainability |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Apparel Market Segments

By Product

- Clothing

- Footwear

- Accessories

By Distribution Channel

- Offline Channels

- Online Channels

By Gender

- Men

- Women

- Children

By Fabric

- Natural Fibers

- Synthetic Fibers

By Price Range

- Luxury Apparel

- Premium Apparel

- Mid-Range Apparel

- Economy Apparel

By Sustainability

- Conventional Apparel

- Sustainable/Eco-Friendly Apparel

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.