Aromatic Solvents Market Size, Share & Trends Analysis Report By Product Type (Toluene, Xylene (mixed, ortho, meta, para), Ethylbenzene, High-boiling aromatic solvents (C9–C11 and heavy aromatics)), By Application (Paints and Coatings, Adhesives and Sealants, Printing Inks, Rubber and Tire Manufacturing, Agrochemicals, Pharmaceuticals and Others), By End-Use Industry (Construction, Automotive, Industrial Manufacturing, Packaging and Printing, Chemicals and Pharmaceuticals) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Aromatic Solvents Market Overview

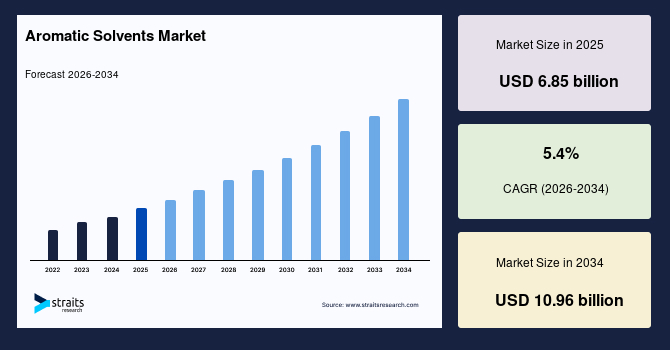

The global aromatic solvents market size is valued at USD 6.85 billion in 2025 and is estimated to reach USD 10.96 billion by 2034, growing at a CAGR of 5.4% during the forecast period. The market is driven by steady growth in paints and coatings, adhesives, inks, and chemical intermediates, alongside ongoing industrialisation, infrastructure development, and the need for high-performance solvents that offer strong solvency and formulation stability.

Key Market Trends & Insights

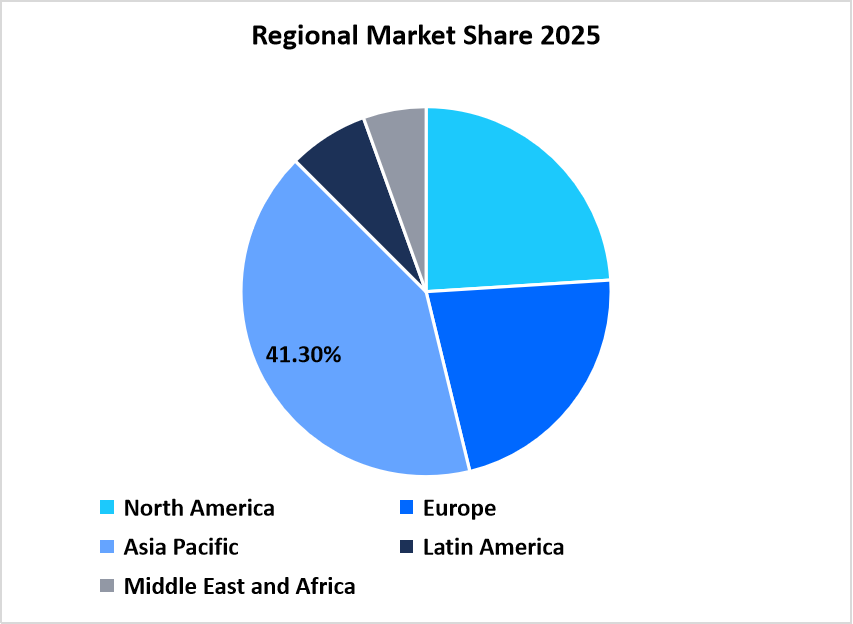

- Asia Pacific dominated the market with a revenue share of 41.3% in 2025.

- North America is anticipated to grow at the fastest CAGR of 5.8% during the forecast period.

- Based on Product Type, the Xylene segment held the highest market share of 38% in 2025.

- By Application, the Adhesives and sealants segment is estimated to register the fastest CAGR growth of 6.6%.

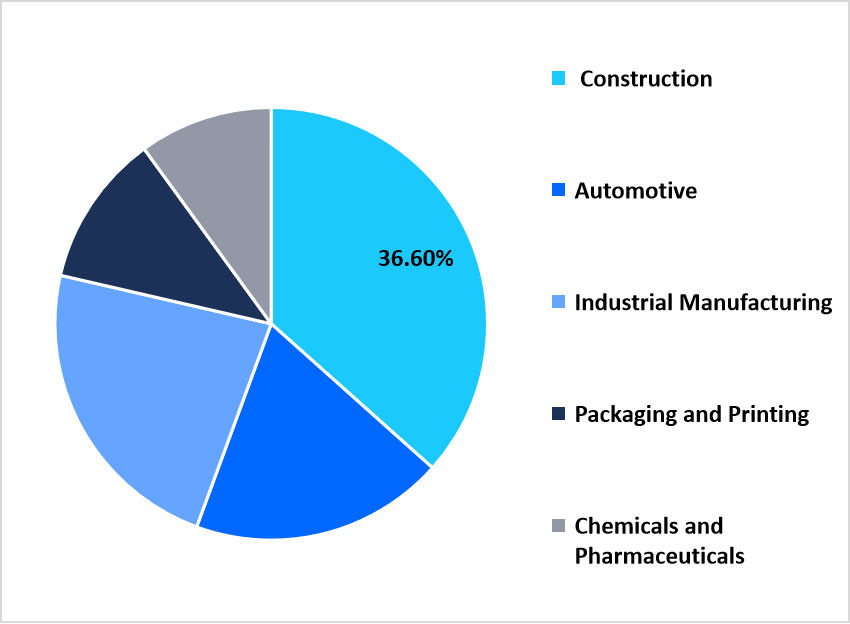

- Based on End-Use Industry,the construction industry dominated the market in 2025 with a revenue share of 36.6%.

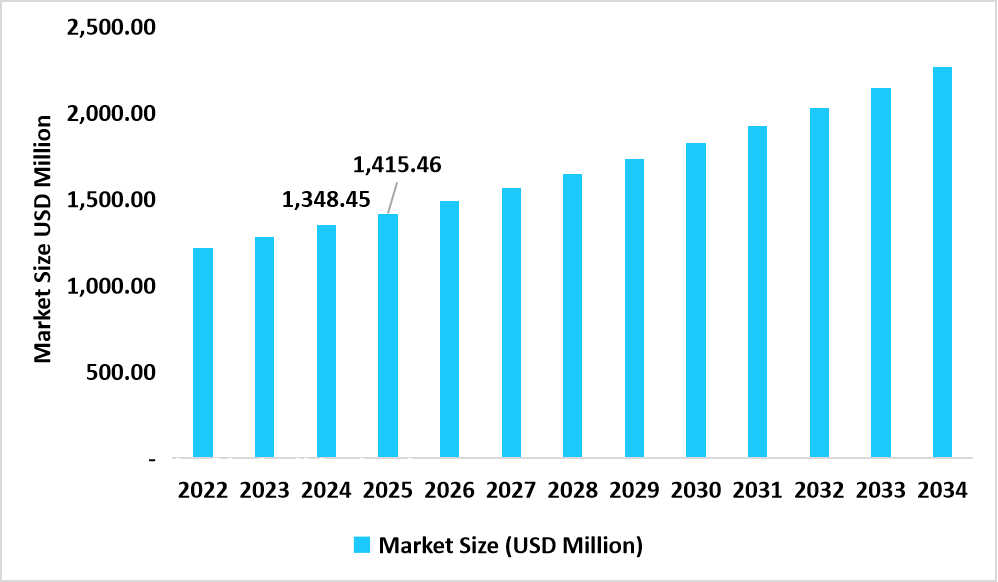

- China dominates the market, valued at USD 1,348.45 million in 2024 and reaching USD 1,415.46 million in 2025.

China Aromatic Solvents Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 6.85 billion

- 2034 Projected Market Size: USD 10.96 billion

- CAGR (2026-2034): 5.4%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

The global aromatic solvents market covers products derived primarily from petroleum-based aromatics, including toluene, xylene, ethylbenzene, and high-boiling aromatic hydrocarbons. These solvents are widely used in paints and coatings, printing inks, adhesives, rubber processing, agrochemicals, pharmaceuticals, and industrial cleaning applications to dissolve resins, improve viscosity control, enhance drying properties, and ensure consistent performance in industrial formulations. Market growth is supported by expanding construction activity, automotive production, industrial manufacturing, and continuous product optimisation to meet evolving regulatory and performance requirements.

Latest Market Trends

Shift Toward High-Performance Industrial Formulations

The aromatic solvents market is increasingly driven by demand for high-performance industrial formulations that require strong solvency, chemical stability, and compatibility with complex materials. Industries such as automotive coatings, industrial paints, and advanced adhesives rely on aromatic solvents to dissolve resins effectively and improve film formation. Rising performance expectations in end-use sectors necessitate that coatings and adhesives deliver durability, corrosion resistance, and consistent application under harsh conditions. Aromatic solvents remain essential in heavy-duty, marine, and infrastructure coatings where alternative solvents often fail to match performance, pushing the market further.

Gradual Reformulation Toward Lower-Emission Aromatic Grades

A key trend in the aromatic solvents market is the gradual reformulation of solvent grades toward lower-emission and more refined products. Increasing regulatory focus on volatile organic compound emissions has encouraged manufacturers to improve solvent purity, optimise boiling ranges, and refine blending techniques. Instead of full replacement, many industries adopt improved aromatic formulations that reduce environmental impact while maintaining performance. This trend enables the market to adapt to regulatory requirements while keeping the functional advantages that aromatic solvents offer in industrial applications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.85 billion |

| Estimated 2026 Value | USD 7.20 billion |

| Projected 2034 Value | USD 10.96 billion |

| CAGR (2026-2034) | 5.4% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ExxonMobil Chemical, Shell Chemicals, BASF SE, TotalEnergies, Chevron Phillips Chemical |

to learn more about this report Download Free Sample Report

Market Driver

Growth in Construction, Infrastructure, and Coatings Demand

Expansion in construction and infrastructure activity is a major driver of the aromatic solvents market. These solvents are widely used in architectural, protective, and industrial coatings applied to buildings, bridges, pipelines, and industrial facilities. Urbanisation, public infrastructure development, and renovation projects increase demand for durable solvent-based coatings, particularly in regions where water-based alternatives are less effective due to climate or performance needs. Aromatic solvents, such as xylene and toluene, are valued for their ability to achieve strong adhesion, durability, and uniform application. This driver anchors long-term demand by linking aromatic solvents to essential construction and maintenance activities.

Market Restraint

Environmental and Health Regulations

Environmental and health regulations pose a significant restraint on the aromatic solvents market. Aromatic solvents are associated with VOC emissions and potential health risks, leading to stricter rules on their use, storage, and disposal. Regulatory frameworks increasingly favour low-VOC or alternative solvent systems, especially in developed markets. Compliance costs, additional safety requirements, and monitoring obligations can limit expansion, particularly for smaller manufacturers. These regulatory pressures constrain market growth and encourage gradual substitution in applications where performance requirements are less demanding.

Market Opportunity

Growth in Emerging Economies and Industrialisation

Emerging economies present strong growth opportunities for the aromatic solvents market due to ongoing industrialisation, urban development, and expansion of manufacturing capacity. In many developing regions, solvent-based systems remain widely used because of their cost efficiency, proven performance, and relatively flexible regulatory environments. The growing demand for paints, coatings, adhesives, rubber products, and industrial chemicals supports the consumption of aromatic solvents. Expansion of local production facilities further improves supply availability and affordability. This opportunity promotes long-term market growth by expanding geographic demand and balancing slower growth in more mature market.

Regional Analysis

Asia Pacific dominated the market in 2025, accounting for 41.3% market share, supported by rapid industrialisation, large-scale construction activity, and strong growth in automotive and manufacturing sectors. The region benefits from extensive chemical production capacity, cost-efficient manufacturing, and widespread use of solvent-based systems in paints, coatings, adhesives, and rubber processing. The expansion of urban infrastructure and rising demand for industrial and protective coatings further support consumption.

- China is the leading country in the Asia Pacific due to its dominant position in construction, automotive manufacturing, and chemical processing. Aromatic solvents are widely used in industrial coatings, printing inks, and adhesives, supporting infrastructure and export-oriented manufacturing. Strong domestic production of aromatics ensures supply stability, while ongoing urban development and industrial upgrades continue to sustain high consumption levels across multiple end-use industries.

North America Market Insights

North America is emerging as the fastest-growing region with a CAGR of 5.8% from 2026-2034, characterised by stable demand from industrial manufacturing, automotive refinishing, and infrastructure maintenance. The area benefits from advanced production facilities, consistent demand for high-performance coatings, and a strong aftermarket for industrial and automotive applications. While environmental regulations are relatively stringent, aromatic solvents remain essential in heavy-duty and speciality applications where performance requirements outweigh the potential for substitution.

- The U.S. is the largest market in North America, primarily due to its extensive construction, automotive, and industrial sectors. Aromatic solvents are widely used in protective coatings, adhesives, and maintenance products. Continued investment in infrastructure renewal and industrial production supports stable consumption. Domestic production capacity and technological advancements further reinforce the country’s strong position in the regional market.

Source: Straits Research

Europe Market Insights

Europe's market share is driven by a mature industrial base and strong demand from automotive, coatings, and speciality chemical industries. The region places significant emphasis on regulatory compliance, which has encouraged gradual reformulation toward refined and lower-emission aromatic solvent grades rather than complete substitution. Demand remains strong in industrial coatings, marine applications, and infrastructure maintenance, where stringent performance requirements prevail.

- Germany leads the European aromatic solvents market owing to its advanced automotive and industrial manufacturing sectors. Aromatic solvents are essential in high-performance coatings, adhesives, and industrial maintenance products. The country’s focus on quality, efficiency, and export-oriented manufacturing sustains consistent demand despite increasing regulatory scrutiny.

Latin America Aromatic Solvents Market Insights

Latin America is supported by growing construction activity, urbanisation, and expanding manufacturing sectors. Aromatic solvents are widely used in paints, coatings, and adhesives due to their cost-effectiveness and functional reliability. The region benefits from local availability of petrochemical feedstocks and increasing investment in industrial capacity. Latin America is expected to grow, driven by infrastructure development, housing demand, and the gradual modernisation of industrial processes.

- Brazil is the largest aromatic solvents market in Latin America due to its sizable construction sector and diversified manufacturing base. Architectural and industrial coatings, automotive refinishing, and packaging applications drive demand. Expanding urban centres and steady industrial output support consistent solvent consumption across the country.

Middle East and Africa Market Insights

The Middle East and Africa accounted for a smaller but strategically important market. Growth is supported by infrastructure development, oil and gas-related construction, and rising demand for industrial coatings and adhesives. Gulf countries rely heavily on solvent-based coatings due to harsh environmental conditions, while parts of Africa exhibit gradual growth linked to urbanisation and basic manufacturing expansion.

- Saudi Arabia is the leading market in the MEA region due to large-scale infrastructure projects, industrial expansion, and strong demand for protective coatings. Aromatic solvents are widely used in construction, energy-related facilities, and industrial maintenance. Government-led development programs and ongoing investment in manufacturing support steady growth in solvent consumption.

Product Type Analysis

Xylene dominated the market with a revenue share of 38% in 2025. Its dominance is driven by extensive use in paints, coatings, and inks due to excellent solvency, moderate evaporation rate, and compatibility with a wide range of resins. Xylene is widely used in construction, automotive coatings, and industrial maintenance, where performance reliability is critical. Its cost-effectiveness and availability further support strong demand across both developed and emerging markets.

High-boiling aromatic solvents represent the fastest-growing product segment, projected to grow at a CAGR of 6.4%. These solvents are increasingly preferred in applications requiring slower evaporation rates, improved levelling, and enhanced film integrity. Their ability to reduce defects, such as blistering and cracking, under harsh conditions supports their adoption in demanding environments. As industries prioritise coating durability and performance over rapid drying, high-boiling aromatic solvents continue to gain traction in specialised and premium applications.

Application Analysis

Paints and coatings accounted for the largest application share of approximately 44% in 2025. Aromatic solvents play a crucial role in dissolving resins, controlling viscosity, and ensuring the smooth formation of films in architectural, industrial, and protective coatings. Strong construction activity, infrastructure development, and refurbishment projects globally continue to support high solvent consumption. Their proven performance in harsh environments maintains their preference over alternative solvent systems in demanding applications.

Adhesives and sealants are the fastest-growing application segment, with an expected CAGR of 6.6%, driven by increasing use of solvent-based adhesives in automotive assembly, packaging, footwear manufacturing, furniture, and industrial bonding applications. Aromatic solvents provide excellent solvency for polymers, enabling strong adhesion, controlled drying, and long-term durability. The expansion of manufacturing industries and the demand for high-performance bonding solutions continue to accelerate solvent consumption in this segment.

By End-Use Industry Market Share (%), 2025

Source: Straits Research

End-Use Industry Analysis

The construction industry dominated the aromatic solvents market with an estimated market share of 36.6% in 2025. Aromatic solvents are extensively used in construction-related coatings, waterproofing compounds, sealants, and surface treatments. Rapid urbanisation, public infrastructure investment, and industrial facility expansion continue to drive demand. Their ability to deliver long-lasting protection and consistent application performance supports continued usage in large-scale construction projects.

Automotive is the fastest-growing end-use industry, projected to expand at a CAGR of 6.2%, driven by increased vehicle production, demand for high-quality automotive coatings, refinishing products, and rubber components. Aromatic solvents are essential in achieving smooth finishes, strong adhesion, and durable protective layers in both OEM manufacturing and aftermarket refinishing. They also play a crucial role in rubber processing and the production of interior components.

Competitive Landscape

The Aromatic Solvents Market is moderately consolidated, characterised by a mix of large integrated petrochemical producers, established speciality chemical manufacturers, and a limited number of regional suppliers. Global leaders dominate through upstream integration, large-scale refining capacity, and long-term supply contracts with coatings, adhesives, and industrial manufacturers. Mid-tier and regional players primarily compete on pricing, localised supply, and application-specific customisation, particularly in emerging markets.

SK Innovation: An Integrated Petrochemical Producer

SK Innovation is a major participant in the aromatic solvents market, leveraging its integrated refining and petrochemical operations to supply toluene, xylene, and related aromatic products for industrial applications. The company benefits from strong access to feedstock, advanced refining infrastructure, and long-standing relationships with downstream customers in the coatings, automotive, and manufacturing sectors. Its aromatic solvents portfolio is positioned toward high-volume industrial users that prioritise supply reliability and consistent quality.

List of Key and Emerging Players in Aromatic Solvents Market

- ExxonMobil Chemical

- Shell Chemicals

- BASF SE

- TotalEnergies

- Chevron Phillips Chemical

- LyondellBasell Industries

- SK Innovation

- Reliance Industries Limited

- Sinopec

- PetroChina

- INEOS

- LG Chem

- Mitsubishi Chemical Group

- Idemitsu Kosan

- Formosa Plastics Corporation

- PTT Global Chemical

- Hanwha Solutions

- Repsol

- Braskem

- Eastman Chemical Company

- Sasol

- Petronas Chemicals Group

- JXTG Nippon Oil & Energy

- Thai Oil

- Bharat Petroleum Corporation Limited

Strategic Initiatives

- November 2025 - Aramco and Sinopec signed a Venture Framework Agreement (VFA) to expand the Yasref refinery in Yanbu, Saudi Arabia. The project includes the construction of a massive 1.5 million tons per year aromatics complex, marking one of the largest capacity expansions in the sector this decade.

- May 2025 - Haltermann Carless (Germany) initiated a new hydrogenation unit at its Speyer site. This unit specifically focuses on increasing the production of high-purity speciality aromatic solvents, which are used in sensitive applications such as agrochemicals and pharmaceuticals.

- April 2025 - BASF launched its first "reduced Product Carbon Footprint" (rPCF) aroma and solvent ingredients. Using a mass balance approach, these products offer a 10–15% reduction in CO2 footprint without requiring customers to reformulate their products.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.85 billion |

| Market Size in 2026 | USD 7.20 billion |

| Market Size in 2034 | USD 10.96 billion |

| CAGR | 5.4% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Aromatic Solvents Market Segments

By Product Type

- Toluene

- Xylene (mixed, ortho, meta, para)

- Ethylbenzene

- High-boiling aromatic solvents (C9–C11 and heavy aromatics)

By Application

- Paints and Coatings

- Adhesives and Sealants

- Printing Inks

- Rubber and Tire Manufacturing

- Agrochemicals

- Pharmaceuticals and Others

By End-Use Industry

- Construction

- Automotive

- Industrial Manufacturing

- Packaging and Printing

- Chemicals and Pharmaceuticals

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.