Automotive Suspension System Market Size, Share & Trends Analysis Report By Type (Passive Suspension Systems, Semi Active Suspension Systems, Active Suspension Systems), By Component (Shock Absorbers & Dampers, Springs, Control Arms, Anti-Roll Bars, Bushings, Sensors), By Technology (Hydraulic Suspension Systems, Pneumatic (Air) Suspension Systems, Electromagnetic Suspension Systems), By Application (On Road Vehicles, Off Road Vehicles) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Automotive Suspension System Market Size

The automotive suspension system market size was valued at USD 142.14 billion in 2025 and is projected to grow from USD 150.55 billion in 2026 to USD 238.65 billion by 2034, at a CAGR of 5.9% during the forecast period, as per Straits Research Analysis. The automotive suspension system functions as a mechanical and electronic system that connects the vehicle's wheels to its chassis. The system provides vehicle support while managing upward and downward movement, dampening road impacts and surface vibrations, and preserving proper contact between tires and road. The system provides maximum tire grip during acceleration, braking, and cornering while ensuring ride comfort and vehicle stability, and maintains predictable handling in all driving conditions.

Key Market Insights

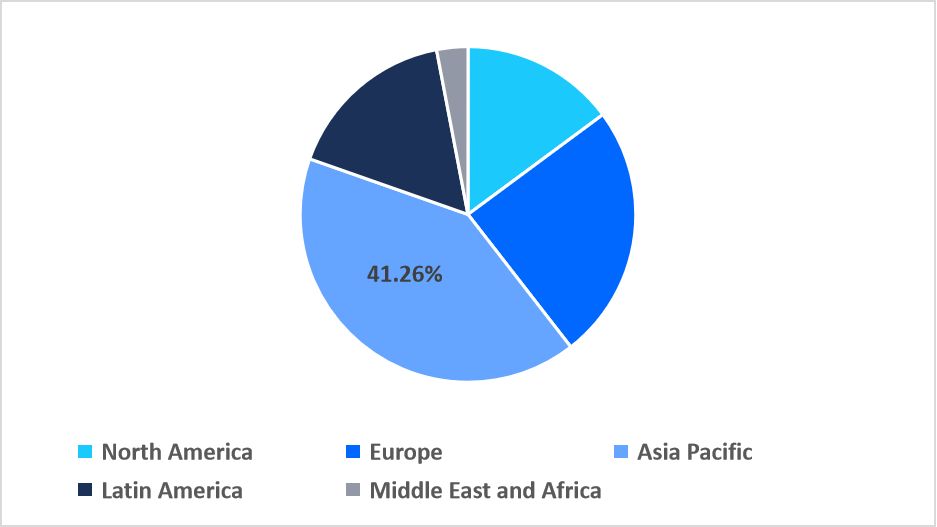

- Asia Pacific dominated the automotive suspension system market with a revenue share of 41.26% in 2025.

- North America is anticipated to grow at the fastest CAGR of 6.7% during the forecast period.

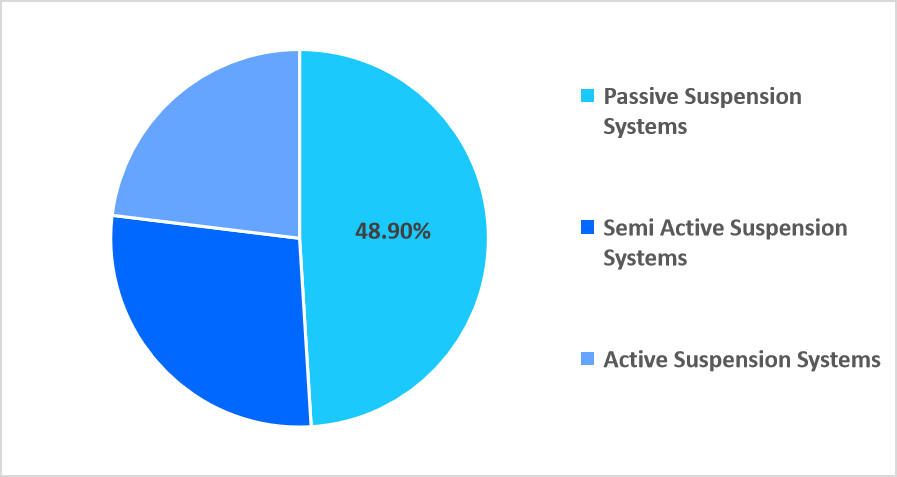

- Based on suspension system type, the passive suspension systems segment held the highest market share of 48.9% in 2025.

- Based on component, the shock absorbers & dampers segment is estimated to register a CAGR growth of 6.2% during the forecast period.

- By technology, hydraulic suspension systems held the market share of 43.6% in 2025

- Based on application, the on-road vehicles segment dominated the market in 2025.

- The US automotive suspension system market size was valued at USD 22.10 billion in 2025 and is expected to reach USD 24.43 billion in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 142.14 Billion |

| Estimated 2026 Value | USD 150.55 Billion |

| Projected 2034 Value | USD 238.65 Billion |

| CAGR (2026-2034) | 5.9% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ZF Friedrichshafen AG, Tenneco Inc., Volkswagen, KYB Corporation, Continental AG |

to learn more about this report Download Free Sample Report

Automotive Suspension System Market Trends

Growing trend of adaptive ride-height control across premium models and EVs

Height-adjustable suspension systems have become standard design elements in premium passenger cars, electric vehicles, and SUVs because they support the growing trend of adaptive ride-height control across different vehicle platforms. The systems are undergoing highway operation testing because they need to perform at their best both for off-road driving and comfort needs. Suspension systems have evolved to their current state because the industry now accepts active ride height control systems as standard equipment for vehicle dynamics management and energy efficiency improvements. Adaptive suspensions have evolved from their previous role as comfort features to become essential components that enhance vehicle performance and create unique characteristics for different platforms.

Shift toward wider-track suspension geometry for vehicle stability

Suspension systems are utilizing track widths that extend beyond traditional limits, together with load distribution systems that achieve optimal performance to provide improved stability for vehicles during their on-road operations. This design shift shows its strongest impact on sports utility vehicles, pickup trucks, and commercial vehicles, which use new suspension designs to handle their elevated center-of-gravity needs. Manufacturers are focusing on mechanical stability through suspension layout optimization instead of depending exclusively on electronic stability systems. The current trend shows a general industry shift toward suspension systems that use built-in rollover protection to establish their fundamental design structure.

Automotive Suspension System Market Drivers

Growing emphasis on braking stability and tire-road contact performance drives market

Suspension systems that keep tires in contact with the road during emergency braking and turning need to become the main focus of automotive manufacturers. The need for suspension control systems to function properly requires equal distribution of wheel load across all wheels because uneven distribution leads to braking system failures. The automotive industry now finds itself compelled to develop advanced suspension systems that enable better vehicle safety performance because vehicle braking stability and crash prevention capabilities have become essential requirements.

Neef for lightweight suspension and efficiency-focused design strategies boosts market growth

The rising need of car manufacturers to minimize the weight of their vehicles to achieve fleet-wide emissions and fuel economy targets makes suspension systems a critical area for weight reduction. Items such as control arms, springs, and subframes are currently being engineered with new materials and geometries to achieve significant weight reduction. The current focus on suspension weight reduction is driving the need for advanced suspension systems, and weight-efficient suspension systems are thus a key enabler of vehicle compliance and fuel economy strategies.

Market Restraints

Corrosion and long-term durability limits adoption of magnesium and aluminum suspensions

The automotive industry restricts the use of magnesium and aluminum suspension components because these materials present long-term durability and corrosion problems. Suspension systems face constant vibration while facing extended dampness and road salt and contaminant exposure, which results in material deterioration throughout the vehicle's operational period. The performance restrictions of existing steel components prevent manufacturers from adopting lightweight suspension systems, which leads to reduced market innovation in material development.

Market Opportunities

Adoption of comfort-optimized suspension solutions for shared mobility and ride-hailing fleets offers growth opportunities

Ride-hailing and shared mobility services focus on passenger comfort because it helps them achieve better service ratings and customer retention, which creates a need for suspension systems that provide urban driving performance. Shared mobility vehicles operate at higher usage rates while their drivers spend more time driving at low speeds, which makes advanced damping and vibration control systems essential for their operations. The current situation allows suspension manufacturers to create suspension systems that deliver maximum comfort and meet the specific needs of fleet customers instead of individual customers.

Technological Landscape

- Monroe Intelligent Suspension CVSAe is an electronically controlled semi-active damping technology that continuously senses road and driving conditions, adjusting damping levels in real-time for optimal comfort, handling, and stability across varying situations.

- ZF OptiRide ECAS provides electronically controlled air suspension with integrated smart pneumatic actuators, enabling automatic height adjustment, load-dependent stability, and functions like kneeling for enhanced ride quality and efficiency in buses and trucks.

- Monroe CVSA2/Kinetic H2 offers semi-active suspension with dual-valve control and kinetic roll control, eliminating traditional sway bars to reduce vehicle weight while delivering adaptive damping for superior body control and comfort in SUVs and electric vehicles.

Regional Analysis

The Asia Pacific automotive suspension system market had a share of 41.26% in 2025. The region has robust car production facilities, high passenger car volume, and well-built supply chains for automotive components. Large-scale localization of suspension component products, along with the rapid development of OEM assembly plants, has boosted the adoption of suspension systems in mass-market and mid-line passenger vehicles. Increased private car penetration and a shifting trend for sports utility vehicles are also boosting regional growth.

The China automotive suspension system market is growing due to a large automotive production base and periodic model upgrades. The market emphasizes quality and dynamics in automotive products to cater to customer needs and expectations, which has encouraged OEMs to absorb more dynamic suspension systems. In addition, the presence of a well-developed aftermarket market and advancements in automotive technologies make China a major regional player.

North America

The North America automotive suspension system market is expected to register a CAGR of 6.7% during the forecast period. This can be attributed to the rising demand for performance-focused vehicles, pickup trucks, and SUVs. The region is experiencing an increased integration of advanced suspension systems that cater to the fast-growing demand for improved vehicle performance standards and the expanding demand for premium and electric vehicles.

The US automotive suspension system market is growing at a considerable rate, owing to the high usage rates and demand for comfort and performance-oriented upgrades. A rising trend of owning larger vehicles, such as SUVs and light trucks, has increased the demand for heavier-duty suspension systems that can handle the heavy load and varying road conditions. Moreover, the developed aftermarket and the increased focus on vehicle maintenance and upgrades are contributing to the growth of the US market.

Regional Market Share (%) in 2025

Source: Straits Research

Europe

The European market for automotive suspension systems is growing because of strict EU emissions and safety regulations, increasing electric vehicle (EV) demand, and the need for better ride comfort and handling in high-end automotive markets. Adoption of semi-active, active, and air suspension technologies has accelerated in passenger cars, SUVs, and commercial vehicles across airport-adjacent logistics, high-speed rail networks, and urban mobility projects. European countries have increased their demand for intelligent, lightweight adaptive suspension systems because of their sustainable mobility initiatives and connected autonomous vehicle development projects.

The Germany automotive suspension system market is backed by high-tech automotive engineering and vehicle manufacturing. OEMs in the country develop suspension systems that provide accurate vehicle control with stable ride performance and complete chassis balance. The German market has established itself with the presence of major automotive manufacturers and an extensive Tier-1 supplier network, which facilitates the swift implementation of advanced suspension technologies in new vehicle designs.

Latin America

The Latin American automotive suspension system market is driven by increasing vehicle ownership and automotive production activities in Brazil, Mexico, and Argentina. Car manufacturers in the region demand durable suspension systems that can operate on uneven surfaces and sustain heavy traffic because of its existing road conditions. The rising demand for light commercial vehicles and pickup trucks is driving the need for suspension components that can handle both urban and rural driving situations.

The growth of the Brazil automotive suspension system market is driven by the diverse road systems, which make suspension systems more critical to withstand various weight loads. This also creates ongoing demand for replacement parts in the aftermarket. The logistics and agricultural sectors of Brazil continue to grow, which drives demand for suspension systems that can handle heavy loads and extended usage, making the country a leading market in the Latin America region.

Middle East and Africa

The Middle East and Africa automotive suspension system market is developing due to increasing adoption of high-tech systems in vehicles to withstand extreme weather and rough driving conditions. Drivers need suspension systems that provide better durability and stability because they operate their vehicles in high-temperature environments and across rough terrain during extended travel. The region is experiencing continuous growth of suspension components due to the expanding commercial transportation network.

The UAE is adopting hydraulic and adaptive automotive suspension systems to maintain heat resistance and resist abrasion from sand penetration. The country also boasts of tourist hotspots that bank on off-road terrain experiences for leisure, such as dunes and gravel rides. This drives the demand for semi-automatic and electronically controlled suspension systems.

Type Insights

Passive suspension systems held the leading share of 48.9% in the automotive suspension market, by type, in 2025. This can be attributed to their widespread adoption in a large number of mass-production vehicles due to cost-effectiveness and mechanical simplicity. In addition, their proven durability and ease of integration across multiple vehicle platforms continue to support high-volume OEM adoption.

The semi-active suspension systems segment is expected to register a CAGR of about 6.8% during the forecast period. This is driven by the rising focus of OEMs on ride and dynamic performance by means of electronically controlled damping systems, especially in the case of SUVs, electric vehicles, and passenger cars in the mid- to premium segments.

By Type Market Share (%), 2025

Source: Straits Research

Component Insights

The shock absorbers & dampers segment accounted for a share of 34.6% in 2025. They are used in critical aspects such as controlling vehicle motion, improving ride comfort, and ensuring tire contact with the road surface under variant driving conditions. With the increasing volume of EVs that stresses suspension systems with heavier weight and instant torque, the adoption of high-performance dampers is expected to increase to manage suspension lifecycle.

The sensors segment is expected to grow at a CAGR of about 6.2% during the forecast period. Sensors are increasingly used in electronically controlled and adaptive suspension system mechanisms that depend on real-time data about road and vehicle conditions. A shift toward intelligent systems such as ride-height sensors, wheel speed sensors, body acceleration sensors, and steering angle sensors is also expected to boost demand in this segment.

Technology Insights

The technology segment was led by hydraulic suspension systems in 2025, with a revenue share of 43.6%. Hydraulic suspension systems have been widely adopted in the passenger car and commercial vehicle market because of their load-bearing capacity and cost-effectiveness. An increase in infrastructure projects globally, agriculture mechanization, and booming mining activities are driving the need for high articulation, load leveling, and terrain adaptability technology. Hydraulic systems provide better towing and loading capabilities, which are expected to drive segment growth.

The pneumatic (air) suspension systems segment is projected to have considerable growth in the automotive suspension market. The key drivers for the same are the increasing adoption in the case of luxury passenger cars, electric cars, and sport utility vehicles. The advantages of adaptive ride height, comfort, and load leveling are considered crucial in these vehicles, which drives the adoption of pneumatic (air) suspension systems.

Application Insights

On-road vehicles accounted for a dominant market sharein 2025, supported by high global production of passenger cars and light commercial vehicles, along with increasing daily vehicle utilization. Rising demand for improved ride comfort, stability, and handling performance in urban and highway driving conditions is further reinforcing segment dominance.

The off-road vehicles segment is expected to register a CAGR of 6.1% during the forecast period, driven by demand from construction, agriculture, mining, and specialty mobility applications that require enhanced suspension durability. The need for higher load-bearing capacity, ground clearance, and vibration resistance in harsh operating environments continues to support suspension system adoption in this segment.

| SEGMENT | INCLUSION | DOMINANT SEGMENT | SHARE OF DOMINANT SEGMENT, 2025 |

|---|---|---|---|

|

TYPE |

|

Passive Suspension Systems |

48.9% |

|

COMPONENT |

|

Shock Absorbers & Dampers |

34.6% |

|

TECHNOLOGY |

|

Hydraulic Suspension Systems |

43.6% |

|

APPLICATION |

|

On Road Vehicles |

XX% |

|

REGION |

|

Asia Pacific |

41.26% |

Regulatory Bodies Governing Automotive Suspension System Market

| REGULATORY BODY | COUNTRY/REGION |

|---|---|

|

National Highway Traffic Safety Administration (NHTSA) |

US |

|

European Commission – Directorate-General for Mobility and Transport (DG MOVE) |

Europe |

|

Ministry of Land, Infrastructure, Transport and Tourism (MLIT) |

Japan |

|

Gulf Standards Organization (GSO) |

Middle East |

|

National Institute of Metrology, Quality and Technology (INMETRO) |

Brazil |

Competitive Landscape

The automotive suspension system market is moderately fragmented, with a mix of international Tier-1 automotive suppliers competing with dedicated suspension manufacturers, local component manufacturers, and aftermarket companies. Multinational suppliers use platform integration and permanent OEM contracts and their worldwide production capabilities to compete. Regional manufacturers focus on minimizing expenses and producing goods for local markets and quickly meeting domestic OEM demands. Market competitiveness arises from suspension tuning expertise, durability performance, platform compatibility, and the capability to support extensive vehicle production. New competitive forces in the market arise from suspension system platform modularization, the increased need for durability testing on various road surfaces, the growth of aftermarket products for older vehicle fleets, and the need for OEMs to support multiple vehicle platform systems.

List of Key and Emerging Players in Automotive Suspension System Market

- ZF Friedrichshafen AG

- Tenneco Inc.

- Volkswagen

- KYB Corporation

- Continental AG

- Robert Bosch GmbH

- Schaeffler AG

- Magna International Inc.

- BWI Group

- Astemo

- Mando Corporation

- Showa Corporation

- Thyssenkrupp AG

- BENTELER International

- Multimatic Inc.

- Sogefi Group

- NHK Spring Co. Ltd.

- Endurance Technologies

- Marelli

- Hutchinson SA

- ZF Lifetec

Latest News on Key and Emerging Players

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

|

October 2025 |

Tenneco Inc. |

Tenneco Inc. launched the Monroe Air Suspension range as a premium aftermarket replacement solution for commercial & passenger vehicles, engineered for durability, precise handling, and reduced noise/vibration. |

|

October 2025 |

BENTELER International |

BENTELER International opened a new module plant in Beijing (joint venture with BHAP) and started production of chassis suspension modules for Beijing Benz, focusing on intelligent chassis systems and structural components for new energy vehicles (EVs). |

|

October 2025 |

Astemo |

Astemo launched next-generation suspension systems and ADAS for motorcycle safety and comfort. |

|

September 2025 |

KYB Corporation |

KYB Corporation partnered with Siam Motors Parts to create a new joint venture in Thailand aimed at expanding the distribution of KYB suspension products in the Thai automotive aftermarket segment. |

|

August 2025 |

Volkswagen |

Volkswagen announced the production of its VW Amarok third generation model at the Volkswagen do Brasil plant, which features automotive suspension systems at the front and rear. |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 142.14 Billion |

| Market Size in 2026 | USD 150.55 Billion |

| Market Size in 2034 | USD 238.65 Billion |

| CAGR | 5.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Component, By Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automotive Suspension System Market Segments

By Type

- Passive Suspension Systems

- Semi Active Suspension Systems

- Active Suspension Systems

By Component

- Shock Absorbers & Dampers

- Springs

- Control Arms

- Anti-Roll Bars

- Bushings

- Sensors

By Technology

- Hydraulic Suspension Systems

- Pneumatic (Air) Suspension Systems

- Electromagnetic Suspension Systems

By Application

- On Road Vehicles

- Off Road Vehicles

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.