Barite Market Size, Share & Trends Analysis Report By Applications (Oil & Gas, Fillers, Chemical, Others), By Grade (Grade 3.9, Grade 4.1, Grade 4.2, Grade 4.3, Above) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Barite Market Overview

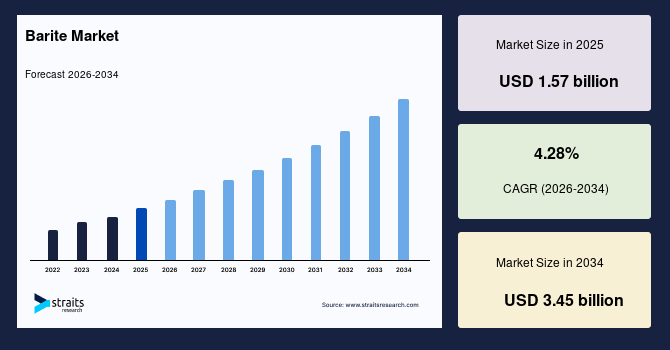

The global barite market size is estimated at USD 1.57 billion in 2025 and is projected to reach USD 3.45 billion by 2034, growing at a CAGR of 4.28% during the forecast period. Market growth is primarily driven by its rising utilization in the oil & gas industry, where barite is primarily used as a weighing agent in drilling fluids and muds in order to control formation pressures, prevent blowouts during production and exploration activities, and stabilize boreholes.

Key Market Trends & Insights

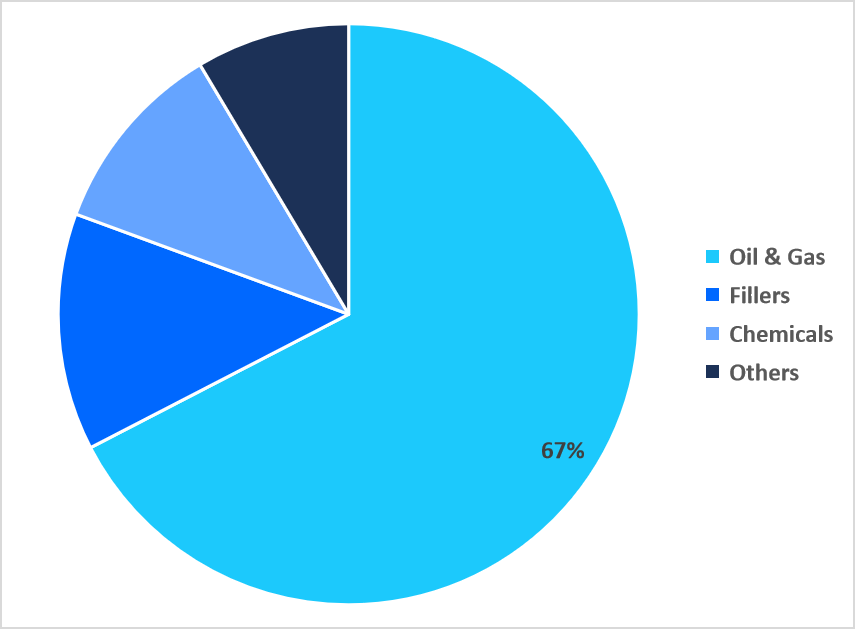

- The oil and gas drilling segment dominated the barite market, accounting for the largest revenue share of 67.41% in 2025.

- Grade 4.3 emerged as the fastest-growing segment with a CAGR of 4.9% from 2026–2034.

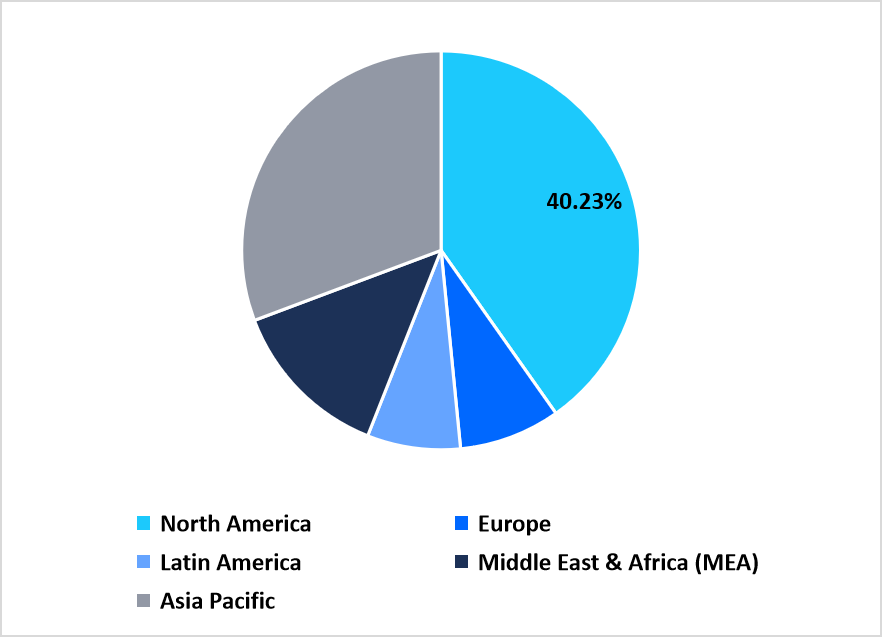

- North America dominated the barite market, accounting for over 40% of global revenue in 2025.

- Asia Pacific emerged as the fastest-growing region with a CAGR of 5.2% from 2026-2034.

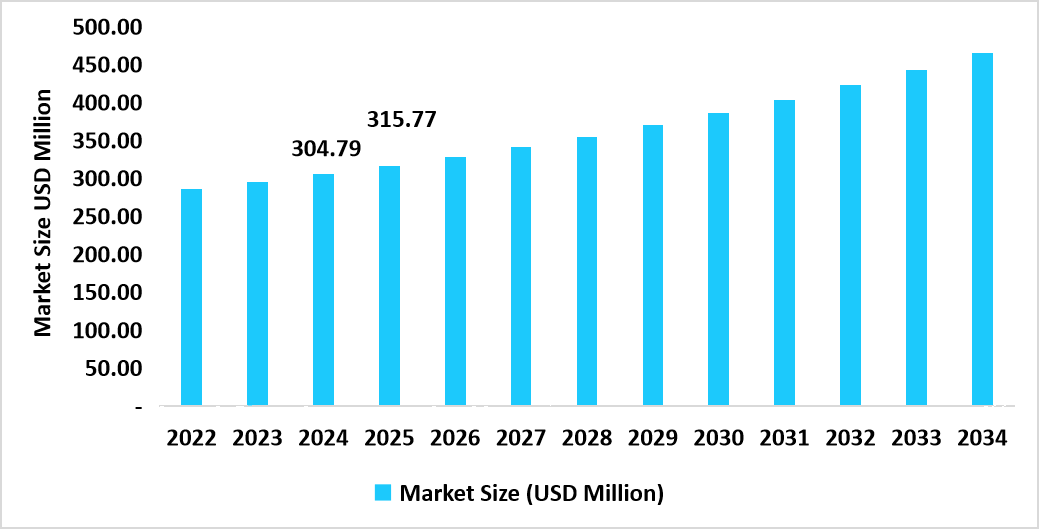

- U.S. dominated the regional market with a revenue of USD 315.77 million in 2025.

Figure: U.S. Barite Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1.57 billion

- 2034 Projected Market Size: USD 3.45 billion

- CAGR (2026-2034): 4.28%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

Barite is typically white or grey in appearance, but may vary from yellow, brown, red, or black due to impurities. Its Mohs hardness ranges from 3.0 to 3.5, classifying it as a relatively soft mineral. Chemically inert and insoluble, Barite’s high density and stability make it suitable for applications across the oil & gas, chemicals, fillers, and paints & coatings sectors.

Latest Market Trends

Strategic Reserves and Localisation of Barite Supply Chains

Governments worldwide are increasingly recognising Barite as a critical mineral due to its indispensable contribution to energy security and drilling operations. To mitigate risks associated with import dependence, countries such as the U.S. and India are actively pursuing strategic reserve development and local mining initiatives. Simultaneously, oilfield service companies are entering into long-term agreements with local producers, thereby establishing geographically diversified supply chains and reducing exposure to geopolitical risks and price volatility.

- For instance, on 7th February 2025, the Government of India notified barytes (Barite) as a major mineral instead of a minor mineral under an official gazette notification. This policy action demonstrates India’s commitment to strengthening regulatory oversight and ensuring strategic availability of Barite for domestic industries, particularly the oil and gas drilling sector.

Sustainable Mining Practices and Shifting Global Supply Dynamics

Companies are adopting low-impact extraction techniques to minimize environmental concerns. This includes water recycling, automated processing, and energy-efficient operations. This trend is expected to enhance the adoption of sustainable mining methods. Countries such as India, Morocco, and Nigeria are scaling up Barite production to reduce dependence on China, which remains the world’s largest producer and a dominant player in the global market.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.57 billion |

| Estimated 2026 Value | USD 1.78 billion |

| Projected 2034 Value | USD 3.45 billion |

| CAGR (2026-2034) | 4.28% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Anglo Pacific Minerals Ltd., CIMBAR Performance Minerals, Demeter O&G Supplies Sdn Bhd, International Earth Products LLC (IEP), P&S Barite Mining Co., Ltd |

to learn more about this report Download Free Sample Report

Market Growth Factor

Growing Oil & Gas Industry Brings a Shift in Barite Demand

Barite is extensively utilised in oil and gas production, primarily as a weighting agent in drilling fluids. Saudi Aramco, the state-owned petroleum and natural gas company of Saudi Arabia, with majority ownership held by the Saudi government and its investment fund, announced a capital expenditure target of USD 50 billion this year to support an increase in oil production to 13 million barrels per day by 2027. The expansion of the oil & gas sector is projected to drive Barite demand throughout the forecast period.

Restraining Factor for Barite

Impact of U.S. Regulatory Framework on Barite Market Growth

The U.S. has established stringent rules and regulations for Barite, depending on its intended application. For drilling purposes, the API (American Petroleum Institute) Specification 13A mandates a minimum specific gravity of 4.2 and a precise particle size distribution (97% passing 200-mesh, 30% passing 6 μm). These regulatory requirements are expected to act as a restraining factor for the Barite market growth in the region.

Opportunity

Expanding Chemical Industry Driving Barite Consumption

Barite serves as a primary raw material for the production of various barium compounds, such as barium carbonate, which are essential in the manufacturing of glass, ceramics, and other specialty chemicals. As per the National Bureau of Statistics of China, the country’s chemical raw materials and chemical product manufacturing industry grew by 9.5% in the first eleven months of 2024. The expansion of the chemical industry is projected to enhance barite demand in the near future.

Regional Analysis

North America dominated the barite market, accounting for over 40% of global revenue in 2025. The region remains prominent in oil and gas production. According to the U.S. Energy Information Administration, oil production reached a record 13.3 million barrels per day (Mbd) in December 2024.

The U.S. is a leading country in the paints and coatings industry. According to the Government of the U.S., the Paints and Coatings industry is estimated to achieve a 2.3% increase in volume and a 5.3% increase in value in 2025, thereby contributing to Barite demand.

Asia Pacific Market Insights

Asia Pacific emerged as the fastest-growing region with a CAGR of 5.2% from 2026-2034. The China National Coatings Industry Association reported in May 2025 that the coatings sector produced 7.576 million tons in Q1, representing a modest year-on-year increase of 0.14%. Despite limited volume growth, total revenue climbed to 88.59 billion yuan, marking a 4.2% increase, while industry-wide profits surged by 26.5%.

Barite is utilized in the paints and coatings industry as a high-density filler to enhance the opacity, durability, and weathering resistance of coatings. It improves performance by providing scratch resistance, corrosion protection, and water resistance, while acting as a cost-effective filler to reduce production costs without compromising quality.

According to Akzo Nobel India, one of the leading paint manufacturers, India’s paints and coatings industry is projected to reach USD 12.22 billion over the next five years. The company stated in its most recent annual report that the industry is currently valued at approximately USD 7.57 billion. The anticipated growth in the paints and coatings sector presents significant opportunities for Barite demand in India.

Regional Market share (%) in 2025

Source: Straits Research

Latin America Barite Market Insights

Latin America is steadily increasing its presence in the global Barite market, supported by oil & gas exploration and rising industrial consumption. Growing investments in drilling projects across offshore basins, particularly in Brazil, are boosting demand for Barite as a weighting agent. Additionally, the construction and paints & coatings sectors in the region are witnessing robust growth, further enhancing Barite applications.

Brazil’s National Petroleum Agency (ANP) reported that oil production reached an average of 3.7 million barrels per day in June 2025, a record level for the country. Higher drilling activities in Brazil are driving Barite demand as a weighting agent in oil well drilling muds.

Brazil’s construction industry expanded by 6.4% in 2024, according to the Brazilian Chamber of Construction Industry, which has fuelled paints and coatings consumption. Rising demand for paints and coatings directly increases Barite consumption as a key filler material.

Europe Market Insights

Europe remains a mature yet resilient market for Barite, driven by stable demand in oilfield services and advanced manufacturing industries. The region also maintains a strong position in paints, coatings, and chemicals, which are major application areas for Barite. Germany, with its large industrial base and consistent drilling activities, leads regional demand and serves as a major consumer hub.

According to the German Paint and Printing Ink Association (VdL), Germany’s paints and coatings output in 2025 is forecasted to reach 2.08 million tons, representing a 2.1% increase from 2024. Growth in coatings demand strengthens the utilisation of Barite as a filler and extender pigment.

The German Federal Institute for Geosciences and Natural Resources (BGR) highlighted that exploration activities in Germany’s oil and gas sector remained resilient, with investment in new wells increasing by 5% in 2024. Expanded exploration boosts Barite consumption in drilling muds.

Middle East & Africa (MEA) Market Insights

The MEA region is among the most prominent consumers of Barite globally due to extensive oil & gas drilling activities. Ongoing exploration and production expansions are supported by government-led investments to strengthen energy capacity. In addition to oilfield services, demand from the paints and coatings industry is increasing as infrastructure and industrial projects expand. Saudi Arabia dominates the regional market as the largest oil producer and Barite consumer.

According to Saudi Aramco’s annual report (2025), drilling activity increased as part of its plan to sustain a production capacity of 13 million barrels per day by 2027. Expanded drilling operations directly elevate Barite demand for well-drilling fluids. The Saudi Ministry of Industry and Mineral Resources recently announced that non-oil industrial production grew by 6.1%, with paints and coatings among the key contributors. Rising industrial coatings demand ensures consistent Barite usage as a filler and extender.

Application Insights

The oil and gas drilling segment dominated the Barite market, accounting for the largest revenue share of 67.41% in 2025. This dominance is attributed to the extensive use of barite as a weighting agent in drilling fluids, which helps maintain wellbore stability and control formation pressures. Countries with large-scale exploration projects, such as the United States, Saudi Arabia, and India, contributed significantly to this segment’s revenue. Sustained demand for oil and gas exploration across both onshore and offshore reserves further underscores the strategic importance of Barite in the energy sector.

Chemicals emerged as the fastest-growing application with a CAGR of 5.0% from 2026-2032. The growth is attributed to barite’s use as a key raw material in the production of barium chemicals, including barium carbonate, barium chloride, barium sulfate, barium hydroxide, and nitrate, among others.

Application Market Share (%), 2025

Source: Straits Research

Grade Insights

Grade 2 dominated the barite market with a revenue share of 28.5% in 2025, owing to its API standards. The U.S., Saudi Arabia, and India have experienced growth in regional oilfield ventures, alongside rising demand from industrial and specialty chemical sectors, which is propelling the application of high-purity barite type like grade 4.2.

Grade 4.3 emerged as the fastest-growing grade with a CAGR of 4.9% from 2026–2034. Its growth is primarily driven by applications in high-pressure drilling operations, medical imaging, and specialty chemical use, where chemical stability, high purity, and high specific gravity are required. The segment’s expansion is further supported by increasing offshore and deepwater drilling operations, which necessitate high-quality Barite to stabilize the wellbore and create accurate drilling fluids.

Competitive Landscape

The global market is moderately consolidated, with key players such as Anglo Pacific Minerals Limited, CIMBAR Performance Minerals, Demeter O&G Supplies Sdn Bhd, International Earth Products LLC (IEP), PVS Chemicals, and SLB dominating the market. These companies aim to expand their market share through strategic initiatives, including mergers and acquisitions, new product development, and partnerships. While the market remains moderately consolidated, the presence of numerous smaller producers creates opportunities for competition and innovation, particularly in sustainable Barite production techniques.

Excalibar- An emerging player in the barite industry

Excalibar Minerals LLC operates as a manufacturer and processor of industrial minerals. The company offers Barite and calcium carbonate for use in oil and gas exploration, marine coatings, paints, brake pads, acoustical compounds, plastics, and other industrial applications. By utilizing advanced manufacturing technologies, Excalibar processes refined materials for diverse applications, including industrial adhesives and sealants.

List of Key and Emerging Players in Barite Market

- Anglo Pacific Minerals Ltd.

- CIMBAR Performance Minerals

- Demeter O&G Supplies Sdn Bhd

- International Earth Products LLC (IEP)

- P&S Barite Mining Co., Ltd

- PVS Chemicals

- SLB

- Guizhou Tianhong Mining Co., Ltd

- Halliburton Energy Services Inc

- Baribright Co. Ltd

- Excalibar Minerals LLC

- Baker Hughes Company

- China National Minerals & Metals Group

- Ma’aden Mining Company

- Al Maktoum Minerals

- Felsbarite Mining Co.

- Jindal Mineral Industries

- Tata Chemicals Ltd.

- Henan Barite Co., Ltd

- India Mineral & Chemicals Ltd.

- Others

Strategic Initiatives

- 23rdSeptember 2025: Fastmarkets introduced a new price assessment for Barite, specifically for drilling-grade unground lump with a specific gravity of 4.30, free on board (FOB) Vietnam. This initiative is intended to enhance transparency and standardization in barite pricing, reflecting the increasing importance of Southeast Asia in the global barite supply chain.

- August 2025: Sojitz Corporation undertook a restructuring initiative to optimize its chemical trading operations, including those related to barite. This strategic measure is expected to improve operational efficiency and strengthen the company’s position in the global market.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.57 billion |

| Market Size in 2026 | USD 1.78 billion |

| Market Size in 2034 | USD 3.45 billion |

| CAGR | 4.28% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Applications, By Grade |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Barite Market Segments

By Applications

- Oil & Gas

- Fillers

- Chemical

- Others

By Grade

- Grade 3.9

- Grade 4.1

- Grade 4.2

- Grade 4.3

- Above

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.