Battery Manufacturing Equipment Market Size, Share & Trends Analysis Report By Equipment Stage (Electrode Manufacturing, Cell Assembly, Formation, Ageing & Testing, Pack/Module Assembly & Others), By Battery Chemistry (Lithium-ion (NMC, NCA, LFP), Solid-State, Sodium-Ion, Lead-Acid, Nickel-Based (NiMH, NiCd)), By Automation Level (Manual, Semi-Automatic, Fully Automated, Lights-Out/Hyper-automation), By End Use (Automotive & EV, Energy Storage Systems (Utility & C&I), Consumer Electronics, Industrial & Power Tools, Aerospace & Defence) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Battery Manufacturing Equipment Market Overview

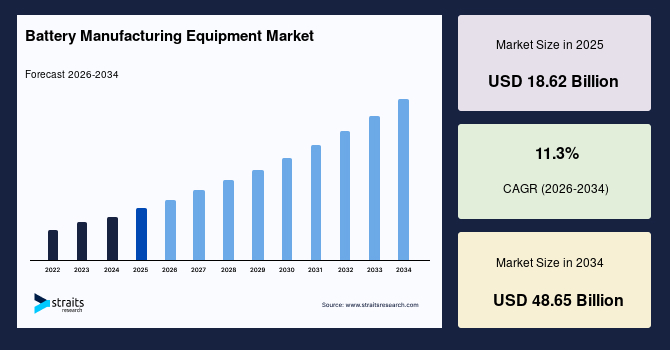

According to the Straits Research, the global battery manufacturing equipment market size was valued at USD 18.62 billion in 2025 and is forecast to reach USD 48.65 billion by 2034, expanding at a CAGR of 11.3% from 2026 to 2034. The market’s growth has been supported by large-scale gigafactory expansions and policy-led capex in North America and Europe, alongside strong capacity additions in the Asia Pacific. A resilient EV demand trajectory, accelerated energy storage deployments, and ongoing improvements in electrode processing technologies collectively reinforced equipment orders. In 2025, vendors benefited from elevated order backlogs for cell assembly and formation systems as manufacturers standardised next-generation cell formats and retooled for higher throughput and yield.

The battery manufacturing equipment market demonstrated resilient expansion in 2025, underpinned by a firm pipeline of greenfield and brownfield cell capacity across key regions. Strong EV penetration, peak order intake for 4680/cylindrical and high-nickel prismatic lines, and growing requirements for pack assembly and end-of-line testing equipment supported demand. Vendors benefited from multi-year framework agreements with automakers, energy storage developers, and integrated cell manufacturers. Meanwhile, governments implemented generous incentives, which catalysed domestic equipment localisation efforts and spurred adjacent investments in ancillary systems such as dry-room HVAC, solvent recovery, and inline metrology.

From 2026 onward, the market is expected to sustain high-single to low-double-digit gains as purchasers prioritise throughput, yield, and cost-per-kWh reductions. Equipment buyers are standardising on modular platforms to reduce commissioning times, while adopting data-rich process controls to shrink scrap rates and enable rapid chemistry transitions. The competitive landscape will continue to evolve as global players scale turnkey offerings and local champions expand internationally, with an emphasis on solid-state pilot lines, sodium-ion upscale projects, and AI-enabled quality assurance. Supply chain rationalisation, improved delivery reliability, and service-led differentiation will remain decisive factors for capturing market share across the forecast period.

Key Market Trends & Insights

- Dominant region and growth leader: Asia Pacific held a 59% share in 2025; North America will post the fastest CAGR at 12.8% through 2034.

- By Equipment Stage: Electrode Manufacturing led in 2025 with a 34% share; Formation & Ageing Systems will be the fastest-growing subsegment at a 12.9% CAGR.

- By Battery Chemistry: Lithium-ion (Li-ion) dominated with an 84% share in 2025; Solid-state equipment will grow the fastest at a 34.5% CAGR.

- By Automation Level: Fully Automated lines led with a 62% share in 2025; Lights-out/Hyper-automation will record a 16.1% CAGR.

- By End Use: Automotive & EV led with a 68% share in 2025; Utility-scale Energy Storage Systems will grow at a 14.2% CAGR.

- Dominant country: China’s battery manufacturing equipment market was valued at USD 7.3 billion in 2024 and is expected to reach USD 8.2 billion in 2025.

Latest Industry Trends

Shift to Dry-Electrode and Solvent-Free Coating

Manufacturers increasingly adopted dry-electrode and solvent-free coating approaches in 2025 to lower energy consumption, reduce NMP usage, and shrink factory footprints. Over 2026-2034, this trend will reshape capital expenditure (CAPEX) priorities, driving demand for high-precision calendaring, powder handling, and advanced binderless process controls, as producers target faster ramp schedules and consistent thickness uniformity at scale.

Digital Twins and Inline Metrology

Deployment of digital twins, machine vision, and inline X-ray and laser metrology accelerated in 2025 to stabilise yields. Through 2034, equipment buyers will integrate advanced analytics, edge computing, and closed-loop control to monitor slurry rheology, coating defects, electrode porosity, and tab alignment. The result will be fewer line stoppages, faster root-cause analysis, and measurable improvements in cost per cell.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 18.62 Billion |

| Estimated 2026 Value | USD 20.72 Billion |

| Projected 2034 Value | USD 48.65 Billion |

| CAGR (2026-2034) | 11.3% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Wuxi Lead Intelligent Equipment Co., Ltd., Shenzhen Yinghe Technology Co., Ltd., Manz AG, Hitachi High-Tech Corporation, Dürr Group (Teamtechnik) |

to learn more about this report Download Free Sample Report

Battery Manufacturing Equipment Market Drivers

Demand Surge from EV and Stationary Storage

Global EV sales and grid-scale storage additions expanded in 2024, anchoring cell capacity announcements. From 2025 onward, multiyear procurement programs by automakers and utilities will sustain orders for electrode, assembly, formation, and pack equipment. Vendors that deliver higher throughput and flexible chemistry changeovers will capture a disproportionate share.

Policy Incentives and Localisation

Incentives under the Inflation Reduction Act and the EU’s Net-Zero Industry framework supported localised manufacturing in 2024. Through 2033, tax credits, grants, and local-content rules will influence sourcing strategies, prompting investment in regional supply chains and spurring orders for turnkey lines, training, and aftermarket services across North America and Europe.

Market Restraints

Capital Cyclicality and Component Bottlenecks

The market faced episodic delays in 2025 due to long lead times for precision mechatronics, dry-room systems, and power electronics. Over the forecast, capex timing variability and integration complexity will temper growth in select quarters, requiring vendors to maintain flexible production planning and execute projects agilely.

Market Opportunities

Solid-State Pilot-to-Production Scale-Up

Prototype and pilot orders for solid-state equipment gained traction in 2025. From 2025 onward, scale-up programs will unlock demand for novel deposition, lamination, and stack-press systems, as well as dry room upgrades and specialised formation protocols. Vendors with expertise in materials and the ability to develop collaborative processes will gain early-mover advantages.

Sodium-Ion and LFP Redeployment

Interest in sodium-ion and cost-optimised LFP lines expanded in 2025, particularly for entry-level EVs and stationary storage. Over 2026–2034, equipment compatible with low-cost cathodes and aqueous processing will see rising orders, supported by mining diversification and regionalisation initiatives that target resilient, affordable supply chains.

Regional Analysis

North America accounted for 16% of the battery manufacturing equipment market in 2025 and will register a CAGR of 12.8% from 2026 to 2034. Strong policy incentives, off-take agreements with automakers, and upgrades to power infrastructure will support sustained investments in equipment. The region will emphasise fully automated, modular platforms to reduce commissioning timelines and meet domestic content requirements.

The U.S. dominated the region, supported by multibillion-dollar gigafactory pipelines and comprehensive supplier parks co-located with cell plants. Access to IRA tax credits, rapid qualification cycles with OEMs, and tight partnerships with robotics and automation vendors will underpin growth.

Europe Market Insights

Europe held a 20% share in 2025 and will grow at a 10.3% CAGR through 2033. Despite near-term demand normalisation in select EV segments, strategic funding and sovereignty goals will keep equipment orders steady. European purchasers will prioritise dry coating, solvent recovery, and digital quality controls that align with sustainability mandates.

Germany led the regional market, backed by high-end engineering capabilities, robust R&D for solid-state cells, and a deep automotive ecosystem. Cross-border collaborations with Nordic and Eastern European projects will further stimulate orders for formation, pack assembly, and end-of-line test systems.

Asia Pacific Market Insights

The Asia Pacific captured 59% of the battery manufacturing equipment market in 2025 and is expected to expand at a 11.1% CAGR from 2026 to 2034. The region will benefit from established supply chains, competitive cost structures, and the continuous buildout of high-volume cell and component plants. Equipment vendors will emphasise throughput, uptime, and flexible production suited to frequent chemistry iteration.

China dominated the region due to scale advantages, vertically integrated ecosystem participants, and a robust network of local equipment champions. Competitive pricing, rapid engineering iterations, and adjacent strengths in electronics manufacturing will sustain China’s leadership in both domestic and export markets.

Middle East & Africa Market Insights

The Middle East & Africa represented 2% of the market in 2025 and is expected to post an 8.9% CAGR over 2026–2034. Emerging industrialisation agendas, renewable energy deployments, and mineral-to-market strategies will support the gradual adoption of equipment. Investments will prioritise pack assembly, BESS integration, and training-led pilot lines ahead of broader cell manufacturing.

Saudi Arabia stood out, propelled by national industrial diversification plans, strategic partnerships, and commitments to localise parts of the EV value chain. The presence of sovereign-backed funds and special economic zones will help anchor early-stage projects.

Latin America Market Insights

Latin America accounted for 3% of the battery manufacturing equipment market in 2025 and will grow at a 9.6% CAGR through 2034. The region will leverage critical mineral resources and nearshoring opportunities to attract selected cell and pack investments. Orders will concentrate on mid-scale lines, refurbishment, and assembly equipment linked to domestic mobility and storage needs.

Mexico led the region, supported by its proximity to U.S. OEMs, trade agreements, and the rising localisation of EV components. The expansion of automotive clusters and the advantages of cross-border logistics will drive demand for automated assembly and end-of-line testing systems.

Equipment Stage Insights

Dominant Subsegment: Electrode Manufacturing – Electrode manufacturing equipment, including slurry mixing, coating and drying, and calendaring, held a 34% share in 2025. This subsegment benefited from standardisation on high-throughput coating lines and process improvements, which reduced solvent consumption and energy intensity. Vendors that offered integrated coating, drying, and solvent recovery solutions captured larger orders tied to new gigafactory phases.

Fastest-Growing Subsegment: Formation & Ageing Systems – Formation and ageing systems will post a 12.9% CAGR through 2034, supported by increasing cell capacities, tighter quality thresholds, and the need for scalable, energy-efficient formation protocols. Adoption of high-power cyclers, thermal management integration, and analytics for early defect detection will drive procurement.

Battery Chemistry Insights

Dominant Subsegment: Lithium-ion – Li-ion infrastructure held an 84% share in 2025 across NMC, NCA, and LFP chemistries. Established process recipes, supply continuity, and robust downstream demand in EVs and stationary storage reinforced the dominance of Li-ion equipment, particularly for high-nickel prismatic and 4680 cylindrical formats.

Fastest-Growing Subsegment: Solid-State – Solid-state battery equipment will record a 34.5% CAGR through 2034, moving from pilot to initial production. Demand will focus on specialised deposition, lamination, and dry-room upgrades, as well as precision stacking and press systems tailored to solid electrolytes and hybrid cell architectures.

Automation Level Insights

Dominant Subsegment: Fully Automated – Fully automated lines held a 62% share in 2025 as manufacturers prioritised high OEE, safe material handling, and traceability. Integration of robotics, MES, and inline inspection systems reduced labour intensity and improved yield consistency, particularly for complex cell assembly steps.

Fastest-Growing Subsegment: Lights-Out/Hyper-automation – Lights-out and hyper-automated configurations will grow at a 16.1% CAGR through 2034. These systems will leverage autonomous material movement, AI-driven process control, and predictive maintenance, enabling 24/7 operations with minimal human intervention and lower per-unit costs.

End Use Insights

Dominant Subsegment: Automotive & EV – Automotive and EV applications commanded a 68% share in 2025. Automakers and tier suppliers invested in co-located lines, pack-to-vehicle integration, and end-of-line testing to accelerate model launches and secure their supply chains. This subsegment benefited from high-volume cell formats and standardised module architectures.

Fastest-Growing Subsegment: Energy Storage Systems (ESS) – Utility-scale ESS equipment will expand at a 14.2% CAGR during 2026–2034, propelled by grid resiliency goals, renewables integration, and utility procurement frameworks. Purchasers will emphasise LFP and sodium-ion compatibility, long-duration cycling, and safety-focused pack designs.

Competitive Landscape

The battery manufacturing equipment market featured a concentrated set of turnkey providers and specialists. Wuxi Lead Intelligent Equipment Co., Ltd. led with a broad portfolio spanning electrode, assembly, and formation lines. Shenzhen Yinghe Technology, Manz AG, Hitachi High-Tech Corporation, and Dürr Group (Teamtechnik) rounded out the top tier. In January 2025, Wuxi Lead launched an integrated dry-electrode coating platform with inline porosity control, aiming to achieve cost reductions and faster ramp-up for next-generation lines.

List of Key and Emerging Players in Battery Manufacturing Equipment Market

- Wuxi Lead Intelligent Equipment Co., Ltd.

- Shenzhen Yinghe Technology Co., Ltd.

- Manz AG

- Hitachi High-Tech Corporation

- Dürr Group (Teamtechnik)

- Toray Engineering Co., Ltd.

- Zhejiang Hangke Technology Co., Ltd. (Hangke)

- Chroma ATE Inc.

- ATS Corporation

- Comau S.p.A.

- CKD Corporation

- Bühler Group

- NAURA Technology Group Co., Ltd.

- Maccor, Inc.

- Bitrode Corporation

- ABB Robotics

- KUKA AG

- Schuler Group GmbH

- Nordson Corporation

- Atlas Copco (Industrial Assembly Solutions)

Strategic Initiatives

- Nov 2024 – Manz AG: Signed a multi-year partnership with a European cell maker to co-develop solvent-free electrode coating and calendaring packages for solid-state pilot lines.

- Dec 2024 – Shenzhen Yinghe Technology: Secured a turnkey order for two high-speed 4680 cylindrical lines with integrated formation and end-of-line test for a North American gigafactory.

- Jan 2025 – Wuxi Lead Intelligent: Launched an integrated dry-electrode coating platform with closed-loop porosity and thickness control, aimed at reducing energy usage by 30%.

- Feb 2025 – Hitachi High-Tech: Acquired a niche inline X-ray/CT inspection startup to enhance defect detection and traceability across cell assembly lines.

- Mar 2025 – Dürr Group (Teamtechnik): Opened a battery process technology centre in Michigan to localise commissioning, training, and after-sales service for U.S.-based projects.

- Apr 2025 – ATS Corporation: Announced a CAD 180 million contract for a modular pack assembly and EOL testing solution for a Canadian ESS integrator.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 18.62 Billion |

| Market Size in 2026 | USD 20.72 Billion |

| Market Size in 2034 | USD 48.65 Billion |

| CAGR | 11.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Equipment Stage, By Battery Chemistry, By Automation Level, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Battery Manufacturing Equipment Market Segments

By Equipment Stage

-

Electrode Manufacturing

- Slurry Mixing

- Coating & Drying

- Calendaring

- Solvent Recovery/NMP Systems

-

Cell Assembly

- Stacking/Winding

- Electrolyte Filling

- Sealing & Tab Welding

- Inline Inspection & Metrology

-

Formation, Ageing & Testing

- Formation Cyclers

- Aging Racks & Thermal Chambers

- Electrical & Safety Testing

-

Pack/Module Assembly & Others

- Module Assembly

- Pack Assembly & EOL Test

- Dry-Room/HVAC & Environmental Controls

- Process Utilities & Solvent Handling

By Battery Chemistry

- Lithium-ion (NMC, NCA, LFP)

- Solid-State

- Sodium-Ion

- Lead-Acid

- Nickel-Based (NiMH, NiCd)

By Automation Level

- Manual

- Semi-Automatic

- Fully Automated

- Lights-Out/Hyper-automation

By End Use

- Automotive & EV

- Energy Storage Systems (Utility & C&I)

- Consumer Electronics

- Industrial & Power Tools

- Aerospace & Defence

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.