Bubble Wrap Packaging Market Size, Share & Trends Analysis Report By Material (LDPE / LLDPE air-bubble film, Anti-static / ESD bubble film (electronics grade), PCR-content / recycled-LDPE bubble films (high recycled content blends), Paper-bubble / paper-formed cushioning (paper alternatives), Pre-formed cushions and pillows (air pillows, inflatable cushions), Hybrid systems (paper + minimal film, laminated solutions)), By Format (Rolls (small consumer rolls, industrial roll stock), Sheets and mailers (self-adhesive sheets, envelopes), Pre-formed pillows and inserts (machine-inflated pouches), Automated dispensing systems and machine-ready formats), By Application (E-commerce/parcel and direct-to-consumer fulfilment, Electronics and high-value goods (ESD, anti-static), Furniture/appliance transit protection, Industrial and B2B packaging (manufacturing outbound), Fragile goods (glass, ceramics, artworks)), By Channel (OEM / industrial direct supply, Retail / DIY consumer rolls, 3PL and fulfilment / automated warehouse systems) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Bubble Wrap Packaging Market Overview

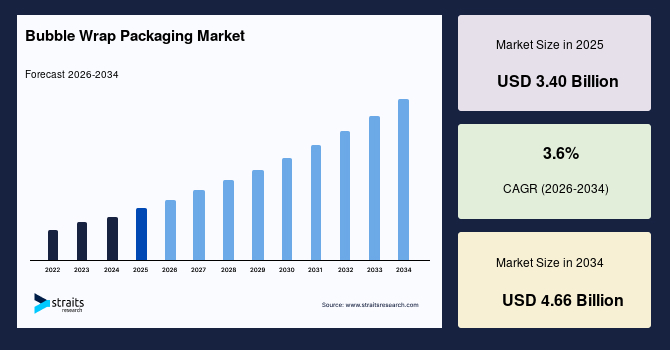

The global bubble wrap packaging market size was projected at USD 3.40 billion in 2025 and is anticipated to grow from USD 3.51 billion in 2026 to USD 4.66 billion by 2034, growing at a CAGR of 3.6% from 2026-2034. The market is witnessing strong growth fueled by e-commerce expansion, direct-to-consumer logistics, and increasing industrial applications such as electronics, home appliances, fragile glassware, and bulk B2B shipments.

Key Market Indicators

- Asia Pacific held a dominant share of the global bubble wrap packaging industry with a market share of 43% in 2025.

- The North America region is growing at the fastest pace, with a CAGR of 4.2% in 2025.

- Based on material, the LDPE/LLDPE air-bubble film is estimated to grow at a CAGR of 3.4%.

- Based on application, E-commerce and direct-to-consumer fulfillment led the market share of 54% in 2025.

- China dominates the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.40 billion

- 2034 Projected Market Size: USD 4.66 billion

- CAGR (2026-2034): 3.6%

- Largest market in 2025: Asia Pacific

- Fastest-growing region: North America

The global market for bubble wrap packaging supplies protective, cushioning film and sheet materials, most commonly air-filled polyethylene bubble films and a growing set of paper alternatives, used to protect goods during storage and transport. Manufacturers supply product families like standard bubble rolls, anti-static bubbles for electronics, peel-and-stick sheets, and sustainable paper bubble alternatives, and increasingly offer automated packaging systems.

Market Trends

E-commerce and Fulfillment Automation

E-commerce remains the main driver for bubble wrap demand. Parcel volumes are consistently high, fueling the need for protective packaging. Bubble films are a top choice due to their low weight, which reduces transport costs, and their effectiveness in preventing damage. Fulfillment centers are also increasingly investing in automated systems to speed up packing.

- For instance, Sealed Air emphasized its automated packaging systems in 2024, which require standardized, machine-ready bubble products to streamline operations and meet the growing demand for e-commerce solutions

Overall, rising parcel counts and warehouse automation continue to sustain a strong, multi-year demand for bubble cushioning.

Paper Bubble and Hybrid Cushions for Regulated and Premium Segments

Paper-based cushioning and hybrid cushioning systems are a new trend for companies to appeal to brands focused on sustainability and recyclability. Several startups and suppliers are launching and commercializing paper bubble products and are beginning trials with e-commerce and subscription brands. This material is ideal for goods that don't require moisture protection, like books and clothing. By offering a diverse portfolio that includes both plastic and paper options, manufacturers can cater to a wider range of customers. Overall, Paper Bubble is gaining traction in key markets like the U.S. and Europe, making it a viable growth vector for the future.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 3.40 Billion |

| Estimated 2026 Value | USD 3.51 Billion |

| Projected 2034 Value | USD 4.66 Billion |

| CAGR (2026-2034) | 3.6% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Sealed Air, Amcor, Berry Global, Amcor, Pregis |

to learn more about this report Download Free Sample Report

Market Drivers

Material Substitution and Paper Bubble Innovation

There's a strong and accelerating trend toward sustainable alternatives like paper bubble wrap, which mimics the cushioning of plastic but is recyclable. Startups and specialist suppliers launched and scaled paper bubble products that mimic the cushioning geometry of plastic bubble wrap while offering curbside recyclability and reduced plastic content. Companies like BubblePaper and PapairWrap are scaling their products to reduce plastic use.

- For example, in November 2024, Amcor plc agreed with Kolon Industries to co-develop and commercialize more sustainable polyester materials for Amcor's flexible packaging business.

While paper-based options are not yet a complete replacement for plastic due to cost and performance differences, they are gaining significant traction in the consumer goods sector.

Cost-Effective Damage Reduction and Logistics Economics

The low cost and weight of bubble wrap make it an attractive option for businesses looking to minimize damage-related expenses. For retailers, the small price of protective material is often less than the cost of a returned or replaced item. For logistics companies, lighter cushioning reduces fuel costs compared to heavier alternatives. This is particularly important for fragile goods like consumer electronics and specialty cosmetics. Since bubble wrap can be dispensed quickly, it also helps maintain high throughput in just-in-time operations, keeping the total cost of ownership low.

Market Restraint

Tightening Regulations and Producer Responsibility

Regulatory pressure on plastic packaging, especially in the EU with the Packaging and Packaging Waste Regulation (PPWR) and national Extended Producer Responsibility rules, creates a structural restraint on traditional single-use plastic bubble films. This pressure forces retailers to reduce their use of non-recyclable plastics, leading to a shift away from conventional bubble films. For manufacturers, these regulations increase costs for new formulations and certifications, which can squeeze profit margins as they adapt. This regulatory environment lowers the growth for traditional plastic bubble categories in key markets.

Market Opportunity

Recycled-Content, PCR Film Blends, and Closed-Loop Services

The demand for sustainability has created a significant opportunity for bubble wrap manufacturers to develop products with higher post-consumer recycled (PCR) content. Major firms like Amcor and Sealed Air are investing heavily in these capabilities to meet the demands of large retailers.

- For example, in November 2024, Amcor acquired Berry Global for USD 8.43 billion and reported investments to expand Post-Consumer Recycled (PCR) material capacity, a strategic move to increase the supply of recycled content in packaging.

Additionally, offering take-back and recycling services creates a "closed-loop" model, which not only provides a new revenue stream but also helps build customer loyalty.

Regional Analysis

Asia Pacific is the dominant region for bubble wrap packaging market, driven by massive parcel volumes, the biggest manufacturing base for electronics and consumer goods, and rapidly expanding fulfilment infrastructure. China alone processed approximately 174.5 billion parcels in 2024, as per the State Post Bureau, making it the world's largest express delivery market. India's e-commerce market is also growing rapidly, fueling demand. Furthermore, the region's logistics infrastructure, with major players investing in automated packing lines, standardizes the use of machine-ready roll stock, which keeps local demand for bubble products consistently high.

China is the largest national bubble wrap packaging market by volume due to its massive parcel throughput and electronics manufacturing. The country's express delivery system handled approximately 174.5 billion parcels in 2024, driving an immense need for protective packaging, according to the State Council Information Office. Local converters supply vast quantities of low-cost, machine-ready bubble film to the automated fulfillment networks of domestic platforms and 3PLs. While the government is implementing some recycling policies, the sheer scale of e-commerce growth ensures that demand for traditional polyethylene bubble wrap remains extremely high.

India's bubble cushioning market is experiencing rapid growth as e-commerce expands into smaller cities. This surge in parcel volumes is driving investment in warehousing and logistics, which in turn fuels demand for roll stock and pre-formed cushions. The market is highly price-sensitive, making lightweight LDPE bubble film the dominant material. Local converting capabilities and logistics support are crucial for suppliers to win contracts in this fast-growing market.

North America Market Trends

North America is the fastest-growing region. The growth is attributed to resilient parcel demand, heavy investment in fulfilment automation, and a strong focus on sustainability. The US domestic parcel volume hit record levels in 2024, driven by a strong e-commerce market. Large retailers and marketplaces continue to expand private logistics and 3PL capacity, and major carriers like USPS, Amazon Logistics, UPS, and FedEx together sustain high baseline parcel flows that maintain steady demand for protective packaging. At the same time, regulatory pressures are pushing demand for films with high recycled content, creating a profitable opportunity for manufacturers who can supply PCR blends and provide closed-loop recycling services.

The U.S. is a large and mature market anchored by strong e-commerce and extensive logistics infrastructure. The continued investment in fulfillment automation, such as automated dispensing and pre-formed cushion systems, favors the use of industrial roll stock and machine-ready air pillows. This creates a steady demand for both materials and system contracts with major suppliers like Sealed Air and Pregis. Additionally, sustainability goals are accelerating the demand for PCR-content films and recyclable alternatives, pushing converters to invest in new processing and take-back schemes.

Canada's bubble wrap packaging market is similar to the U.S., with demand driven by e-commerce and industrial packaging. Federal actions on plastics reporting and the new Federal Plastics Registry beginning in 2025 are increasing compliance requirements, which encourage the use of recycled content and recycling partnerships. The long transport distances in Canada also make local supply and inventory crucial for timely delivery. Suppliers that can provide local conversion, access to recycled materials, and system support are favored by major retailers.

Germany Market Trends

Germany's demand for bubble wrap packaging market is steady and technically driven. Its strong manufacturing sectors, including automotive and electronics, and high export volumes require specialized, high-spec cushioning like ESD-grade bubble film. The country also has rigorous sustainability goals that encourage the use of recycled films and paper-based alternatives. Additionally, government investments in industrial projects create an indirect demand for robust cushioning to transport large components and sensitive equipment.

Material Insights

LDPE/LLDPE air-bubble film is the leading subsegment. The growth is primarily driven by its low cost, lightweight nature, and effectiveness in protecting a wide range of goods. The booming e-commerce sector relies on this material for high-volume parcel shipments because it's both economical and highly efficient at damage reduction, which helps minimize costly returns and replacements. Additionally, its compatibility with automated packaging systems makes it the top choice for large fulfillment centers that need high-throughput solutions.

Format Insights

Rolls (industrial roll stock) are the dominant format type. This subsegment’s growth is fueled by the demand for continuous, high-volume protective packaging in industrial and e-commerce settings. Industrial roll stock is compatible with automated dispensing systems, which are essential for high-speed, cost-effective packaging lines in fulfillment and distribution centers. Its versatility allows it to be cut to size for various products, making it a flexible and essential solution for businesses that require consistent and scalable protective packaging.

Application Insights

The e-commerce and direct-to-consumer fulfillment segment leads the market. This segment is the largest driver of the bubble wrap packaging market due to the sustained, rapid growth of online shopping. The need to protect a wide variety of goods, from electronics to fragile items, during transit has created a massive demand for lightweight and effective cushioning. The focus on reducing product damage and minimizing return costs makes bubble wrap an indispensable material for companies shipping directly to consumers.

Channel Insights

3PL and fulfillment or automated warehouse systems are the largest channel in the market. The growth of this subsegment is a direct result of the high demand for outsourced logistics services from e-commerce companies. These professional logistics providers require efficient, high-volume packaging solutions to manage their vast number of parcels. The integration of automated systems in these warehouses drives demand for standardized bubble wrap products that can be dispensed quickly and reliably, supporting a scalable and cost-effective operation.

Competitive Landscape

The bubble wrap packaging market is highly fragmented, featuring two primary types of players. First, there are large, integrated global suppliers who offer a full range of film production, converting, and automated dispensing systems. They are heavily invested in scaling up production of films with recycled content. Second, some specialist innovators focus on sustainable paper-based cushioning and high-spec products like ESD bubble film. Many companies are shifting from selling just film to providing full-service contracts that include equipment and maintenance.

Sealed Air is a market leader known for its BUBBLE WRAP brand. The company's Protective segment provides materials and automated systems to e-commerce, industrial, and electronics customers, creating a consistent revenue stream from large fulfillment centers. The company’s strategy emphasizes system sales and sustainable content to maintain its market share.

Latest News

- In February 2025, Sealed Air reported Q4 and full-year 2024 results and provided a 2025 outlook that emphasised its Protective business and investments in systems and sustainability. The results underline Sealed Air’s scale in protective packaging and its strategic emphasis on automation and sustainable materials for fulfillment customers.

List of Key and Emerging Players in Bubble Wrap Packaging Market

- Sealed Air

- Amcor

- Berry Global

- Amcor

- Pregis

- Storopack

- Ranpak

- Novolex

- Mondi

- DS Smith

- Smurfit Kappa

- Huhtamaki

- International Paper

- Sonoco; Sigma Plastics

- Intertape Polymer Group (IPG)

- Boxed and Co converters

- BubblePaper

- EcoCushion / PapairWrap

Recent Developments

- In August 2025, Ranpak expanded its partnership with Walmart, which will see the installation of numerous AutoFill™ systems across five of Walmart's next-generation fulfillment centers. This aims to increase fulfillment speed and reduce packaging waste.

- In April 2025, Amcor completed its acquisition of Berry Global, creating a much larger multi-substrate packaging group with enhanced R&D and scale for PCR and sustainable packaging.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 3.40 Billion |

| Market Size in 2026 | USD 3.51 Billion |

| Market Size in 2034 | USD 4.66 Billion |

| CAGR | 3.6% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material, By Format, By Application, By Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Bubble Wrap Packaging Market Segments

By Material

- LDPE / LLDPE air-bubble film

- Anti-static / ESD bubble film (electronics grade)

- PCR-content / recycled-LDPE bubble films (high recycled content blends)

- Paper-bubble / paper-formed cushioning (paper alternatives)

- Pre-formed cushions and pillows (air pillows, inflatable cushions)

- Hybrid systems (paper + minimal film, laminated solutions)

By Format

- Rolls (small consumer rolls, industrial roll stock)

- Sheets and mailers (self-adhesive sheets, envelopes)

- Pre-formed pillows and inserts (machine-inflated pouches)

- Automated dispensing systems and machine-ready formats

By Application

- E-commerce/parcel and direct-to-consumer fulfilment

- Electronics and high-value goods (ESD, anti-static)

- Furniture/appliance transit protection

- Industrial and B2B packaging (manufacturing outbound)

- Fragile goods (glass, ceramics, artworks)

By Channel

- OEM / industrial direct supply

- Retail / DIY consumer rolls

- 3PL and fulfilment / automated warehouse systems

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.