Bunion Correction Systems Market Size, Share & Trends Analysis Report By Type (Osteotomy, Arthrodesis, Lapidus, Exostectomy), By Product Type (Correction Systems, Implants & Accessories, Wearables), By End-User (Hospitals, Ambulatory Surgery Centers, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Bunion Correction Systems Market Size

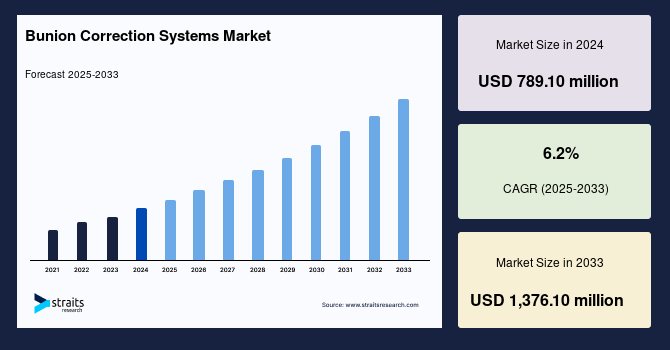

The global bunion correction systems market size was valued at USD 789.10 million in 2024 and is projected to grow from USD 847.80 million in 2025 to reach USD 1,376.10 million by 2033, exhibiting a CAGR of 6.2% during the forecast period (2025-2033).

Bunion correction systems are medical devices or surgical techniques designed to treat bunions, which are painful, bony bumps that form at the base of the big toe. These systems can include orthotics, braces, or surgical procedures aimed at realigning the big toe and restoring proper foot function. Non-invasive systems often provide relief by cushioning the bunion and gradually correcting its position, while surgical correction may involve realigning the bones or removing the bump.

Bunion correction systems are typically recommended for individuals who experience persistent pain or difficulty walking due to the condition. The global bunion correction systems market is witnessing substantial growth, driven by a combination of factors such as advancements in surgical techniques, increasing awareness of foot health, and a growing demand for minimally invasive procedures. The market is further fueled by the increasing prevalence of bunions, particularly among older adults and those with genetic predispositions or lifestyle-related factors.

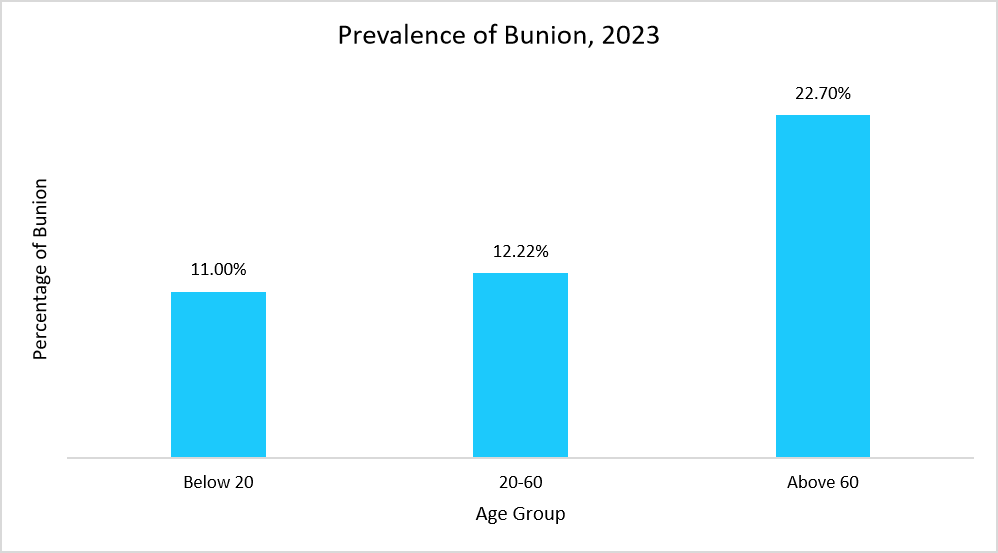

The below graph shows the rising prevalence of bunions in 2023

Source: Straits Research, National Library of Medicine

According to the above-mentioned data, the rising prevalence of bunions is particularly notable in individuals aged 60 and above, with an incidence of 22.70%. In contrast, the prevalence in those under 20 and between 20-60 is significantly lower, at 11.00% and 12.22%, respectively. This increased prevalence is largely driven by factors such as genetic predisposition, improper footwear, and arthritis, which contribute to the development of Hallux valgus. As awareness of these contributing factors grows, there is a noticeable shift toward minimally invasive surgery, which has become the preferred treatment option due to its reduced recovery times, less pain, and fewer complications compared to traditional open surgeries.

Latest Market Key Trends

Rising Demand for Minimally Invasive Bunion Correction Surgeries

The rising demand for minimally invasive bunion correction surgeries is reshaping the market, driven by the clear advantages these procedures offer. Patients and surgeons alike are increasingly favoring minimally invasive techniques due to their ability to reduce pain, speed up recovery, minimize scarring, and lower the risk of complications. These modern approaches, which use shorter incisions, are proving to deliver superior outcomes compared to traditional open surgeries, making them the go-to choice for bunion correction.

- For example, in December 2022, Arthrex launched the Arthrex Minimally Invasive Bunionectomy System, providing a cutting-edge alternative to conventional bunion surgery. This all-inclusive system is designed to facilitate precise, minimally invasive procedures that not only deliver clinically proven outcomes but also match or exceed the effectiveness of open surgeries.

Such innovations in minimally invasive surgery offer patients faster recovery and improved outcomes, which are boosting the market growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 789.10 Million |

| Estimated 2025 Value | USD 847.80 Million |

| Projected 2033 Value | USD 1,376.10 Million |

| CAGR (2025-2033) | 6.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Stryker Corporation, Arthrex, Inc., Zimmer Biomet Holdings, Inc., Wright Medical Technology, Inc., Extremity Medical, LLC. |

to learn more about this report Download Free Sample Report

Bunion Correction Systems Market Driving Factors

Rising Prevalence of Bunion Conditions

The rising prevalence of bunion conditions is a major driver for the growth of the global market. As bunions become more common, particularly with age, there is a growing demand for both surgical and non-surgical treatment options. This increasing prevalence is fostering innovation and pushing the market toward more effective and accessible solutions.

- For instance, according to a study by the National Library of Medicine in August 2023, hallux valgus (bunion deformity) affects approximately 23% of adults aged 18 to 65 years, with the incidence rising to 36% among individuals over 65 years.

As the condition affects a larger portion of the population, the need for effective bunion correction treatments continues to drive market growth.

Advancements in Surgical Techniques

Advancements in surgical techniques are also playing a significant role in boosting market growth. Innovations like minimally invasive surgery, 3D-planning, and robot-assisted surgery are improving surgical precision, reducing recovery time, and minimizing complications. These technologies allow surgeons to perform highly accurate procedures, resulting in better patient outcomes. As new, more effective procedures emerge, they create opportunities for further growth in the bunion correction systems market.

- For instance, in October 2023, the Panorama Orthopedic & Spine Center introduced the Lapiplasty 3D Bunion Correction system, offering a groundbreaking approach to bunion treatment. Lapiplasty targets the root cause of the condition by correcting the 3D deformity with advanced titanium plating technology, providing greater stability and faster recovery. Patients can walk within days of surgery, significantly reducing recovery times compared to traditional methods.

These advancements in surgical techniques are driving the growth of the bunion correction systems market by offering more efficient, effective treatments with faster recovery and improved outcomes.

Market Restraining Factors

Post-Operative Complications

Post-operative complications remain a significant restraint in the global market. Common issues such as infections, prolonged recovery times, nerve injuries, and residual pain can deter patients from opting for surgery. These complications can extend the recovery period, sometimes requiring additional interventions, thereby increasing both the cost and treatment burden.

Even with advancements in surgical techniques and technologies, the risk of post-surgical issues may lead patients to reconsider undergoing bunion correction procedures. As these complications can negatively impact patient outcomes and satisfaction, they represent a critical challenge in encouraging wider adoption of bunion correction systems.

Market Opportunity

Integration of Ai in Bunion Surgery

The integration of AI in bunion surgery presents a significant opportunity for the market for global bunion correction systems. AI-based technologies are improving the precision and personalization of procedures, making surgery more effective and accessible. Using AI-driven software, patient-specific 3D models are created from CT scans, allowing surgeons to plan and rehearse procedures in advance. This level of precision not only enhances surgical outcomes but also reduces the risk of complications and accelerates recovery. AI also supports real-time corrections during surgery, further optimizing the procedure.

- For example, in July 2022, Redpoint Medical 3D received FDA clearance for its patient-specific bone-cutting guides, which use AI to transform CT scan data into 3D models. This system enables surgeons to plan and execute highly precise bunion corrections with customized guides, particularly addressing complex deformities.

As AI continues to transform surgical practices, the demand for advanced solutions is expected to grow, creating substantial market opportunities for manufacturers, healthcare providers, and patients alike.

Regional Insights

North America holds a dominant position in the bunion correction systems market with 39.12% market share, driven by the widespread adoption of innovative surgical technologies and heightened awareness about foot health. The region benefits from a well-established healthcare infrastructure and a large pool of specialized orthopedic professionals, ensuring high-quality care and accessibility.

Moreover, ongoing research and development efforts focused on improving bunion correction techniques are expected to further propel market growth. The increasing popularity of minimally invasive procedures, combined with advancements in surgical tools, reinforces North America's leadership in this sector.

U.s. Bunion Correction Systems Market Trends

- U.S.- The U.S. leads the bunion correction systems industry due to substantial investment in research and development and the introduction of cutting-edge systems by leading companies. For instance, Treace Medical Concepts launched an AI-powered, patient-specific bunion surgery system in December 2024, combining IntelliGuide PSI technology with the Adductoplasty system. This innovation offers personalized CT-based correction tailored to each patient’s unique foot deformities, further solidifying the U.S. as a global leader in the field.

Asia-Pacific Bunion Correction Systems Market Trends

Asia-Pacific is emerging as the fastest-growing market, with the highest projected CAGR during the forecast period. This growth can be attributed to the rising prevalence of foot deformities in the region, coupled with significant investments in healthcare infrastructure. As medical technology continues to evolve, Asia-Pacific nations are increasingly adopting advanced surgical techniques, further boosting the market. The demand for minimally invasive bunion surgeries is particularly strong as patients seek quicker recovery times and reduced post-surgery. discomfort.

- India– India is witnessing rapid growth in the market for bunion correction systems, driven by the expansion of healthcare infrastructure and the increasing adoption of advanced medical technologies. In March 2022, SRV Hospitals, in collaboration with Lokmanya Hospital, launched the SRV LHPL Centre of Excellence in Robotic Orthopedics. Equipped with the CORI Robotics Surgical System, the center promotes robotic-assisted surgeries, offering greater precision, reduced recovery time, and driving market demand for innovative bunion correction procedures.

- China– China’s bunion correction systems market is propelled by extensive research and development activities aimed at enhancing surgical outcomes. In December 2024, the University of Science and Technology of China developed a cobalt-infused titanium-based bone implant using plasma immersion ion implantation technology. This advancement improves recovery times and reduces post-surgical complications by providing a more efficient, stable implant material, thus advancing the potential of orthopedic treatments, including bunion correction surgeries.

Europe Bunion Correction Systems Market Trends

- UK- The UK’s bunion correction systems market is driven by the expansion of new healthcare facilities and state-of-the-art surgical centers. For example, the James Paget Orthopaedic Centre (JPOC), opened in January 2025, aims to improve orthopedic care access. By enhancing patient care efficiency and providing advanced surgical infrastructure, this expansion is expected to streamline treatment pathways, improve patient outcomes, and foster the growth of bunion correction procedures.

Type Insights

The osteotomy segment leads the market due to its effectiveness in realigning the toe by cutting and repositioning the bone. This method is preferred for moderate to severe bunions and is increasingly performed with minimally invasive techniques, which offer faster recovery times, reduced pain, and fewer complications compared to traditional open surgeries. As these techniques become more refined, osteotomy remains the preferred choice for both patients and surgeons, ensuring its dominant position in the market.

Product Type Insights

The implants and accessories segment holds the largest market share, driven by the rising demand for corrective bunion surgeries. Customized implants, including screws, plates, and pins, play a critical role in stabilizing bones during the healing process, ensuring long-term success and minimizing complications. As technological advancements continue to evolve, the need for more precise and durable implants has grown, contributing to the segment’s dominance. The increasing focus on improving surgical outcomes solidifies implants and accessories as a vital component of bunion correction.

End-User Insights

Hospitals hold the largest market share among end-users in the market for bunion correction systems due to their capacity to provide comprehensive care, advanced surgical technologies, and specialized post-operative services. Hospitals are the preferred choice for complex bunion correction surgeries, offering a controlled environment with access to skilled surgeons and state-of-the-art equipment. As the demand for specialized surgical interventions continues to rise, hospitals remain central to the successful implementation of bunion correction systems, further strengthening their leading position in the market.

Company Market Share

Key players in the market are increasingly focusing on adopting key business strategies, including strategic collaborations, product approvals, acquisitions, and product launches, to solidify their market presence. By partnering with leading healthcare providers and research institutions, companies are enhancing their product offerings and expanding their geographical reach.

Treache Medical Concepts, Inc.: An Emerging Player in the Global Bunion Correction Systems Market

Treace Medical Concepts, Inc. is a leading medical technology company focused on pioneering solutions for bunion and midfoot deformities. The company’s flagship product, the Lapiplasty 3D Bunion Correction System, is renowned for its minimally invasive, three-dimensional approach to bunion correction. With its innovative technology and commitment to improving surgical outcomes, Treace Medical Concepts is poised to become a dominant player in the bunion correction market, shaping the future of foot and ankle care.

Recent developments at Treache Medical Concepts, Inc:

- In December 2024, Treace Medical Concepts, Inc. announced the successful completion of the first cases combining its IntelliGuide PSI technology with the Adductoplasty System. This innovative approach offers a CT-based, patient-specific correction tailored to the patient's unique midfoot deformity. This advancement integrates Treace's cutting-edge technology with its flagship Adductoplasty System to deliver highly precise, personalized treatments for bunion and midfoot deformities, enhancing surgical outcomes and patient care.

List of Key and Emerging Players in Bunion Correction Systems Market

- Stryker Corporation

- Arthrex, Inc.

- Zimmer Biomet Holdings, Inc.

- Wright Medical Technology, Inc.

- Extremity Medical, LLC.

- Acumed, LLC.

- De Puy Synthes

- Biomet, Inc.

- CrossRoads Extremity Systems

- BioPro, Inc.

- Orthofix Holdings Inc.

- OrthoHelix Surgical Designs

- Treace Medical Concepts, Inc

- Medartis AG

- Redpoint Global Inc.

to learn more about this report Download Market Share

Recent Developments

- August 2024 – Johnson & Johnson MedTech announced the launch of its TriLEAP Lower Extremity Anatomic Plating System by DePuy Synthes, designed to support foot and ankle surgeons in performing reconstructive and trauma procedures. This system features low-profile, procedure-specific titanium plates for the fixation and fusion of bones and bone fragments, covering a wide range of forefoot and midfoot surgeries, including those relevant for bunion correction and related conditions in adults and adolescents.

Analyst Opinion

As per our analysts, the global bunion correction systems market is poised for substantial growth, driven by rapid advancements in surgical technologies, increased awareness of foot health, and the rising demand for minimally invasive procedures. Innovations such as 3D-guided planning, AI-assisted surgical tools, and patient-specific instrumentation are enhancing surgical precision, improving patient outcomes, and accelerating market growth.

Despite these positive trends, the market does face challenges. High costs associated with advanced surgical technologies and the limited availability of specialized healthcare professionals in certain regions can impede growth. Additionally, patients’ hesitance toward surgery, driven by concerns over recovery time and surgical risks, remains a barrier.

However, the expanding healthcare infrastructure in emerging regions like Asia-Pacific, coupled with the growing adoption of advanced orthopedic technologies, presents significant growth opportunities. As these challenges are addressed, the market is expected to continue expanding, with a particular focus on improving patient access to innovative treatment solutions and enhancing overall care delivery.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 789.10 Million |

| Market Size in 2025 | USD 847.80 Million |

| Market Size in 2033 | USD 1,376.10 Million |

| CAGR | 6.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Product Type, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Bunion Correction Systems Market Segments

By Type

- Osteotomy

- Arthrodesis

- Lapidus

- Exostectomy

By Product Type

- Correction Systems

- Implants & Accessories

- Wearables

By End-User

- Hospitals

- Ambulatory Surgery Centers

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.