Burner Management System Market Size, Share & Trends Analysis Report By Type (Gas Burner Management Systems, Oil Burner Management Systems, Dual Fuel Burner Management Systems, Other Burner Management Systems), By Technology (PLC-Based Burner Management Systems, Microcontroller-Based Burner Management Systems, DCS Integrated Burner Management Systems, Software-Based Monitoring Systems), By Integration Level (OEM Integrated BMS, Aftermarket/Retrofit BMS), By End Use Sector (Power Generation, Oil & Gas, Chemicals, Food Processing, Pulp & Paper, Other Industrial Applications) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Burner Management System Market Overview

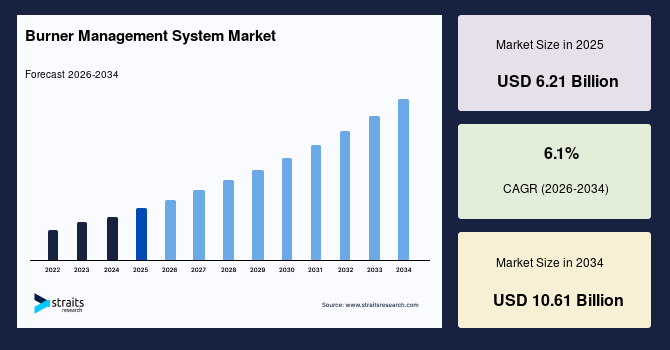

The global burner management system market size is estimated at USD 6.21 billion in 2025 and is projected to reach USD 10.61 billion by 2034, growing at a CAGR of 6.1% during the forecast period. Consistent growth of the market is supported by the increasing adoption of industrial automation and safety control systems, which enhance operational efficiency, ensure compliance with safety regulations, and encourage industries to implement advanced burner management solutions proactively.

Key Market Trends & Insights

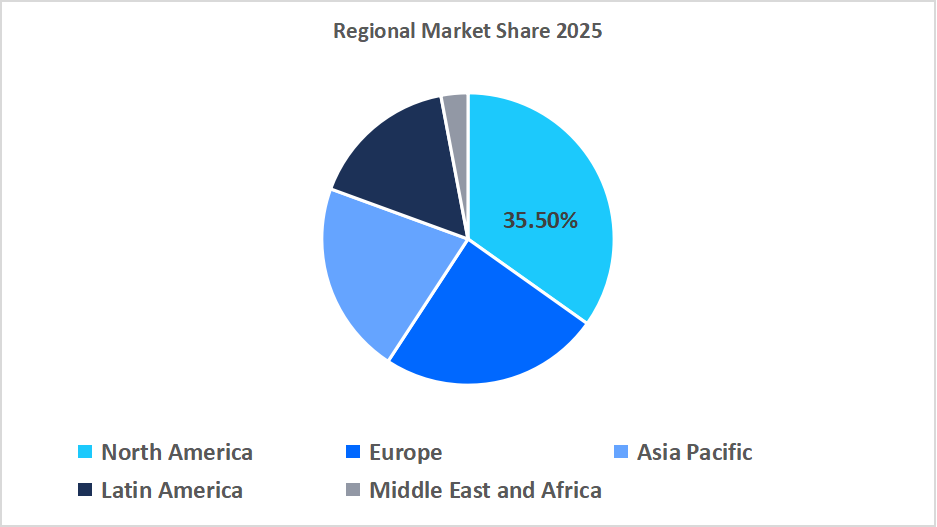

- North America dominated the market with a revenue share of 35.5% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 6.9% during the forecast period.

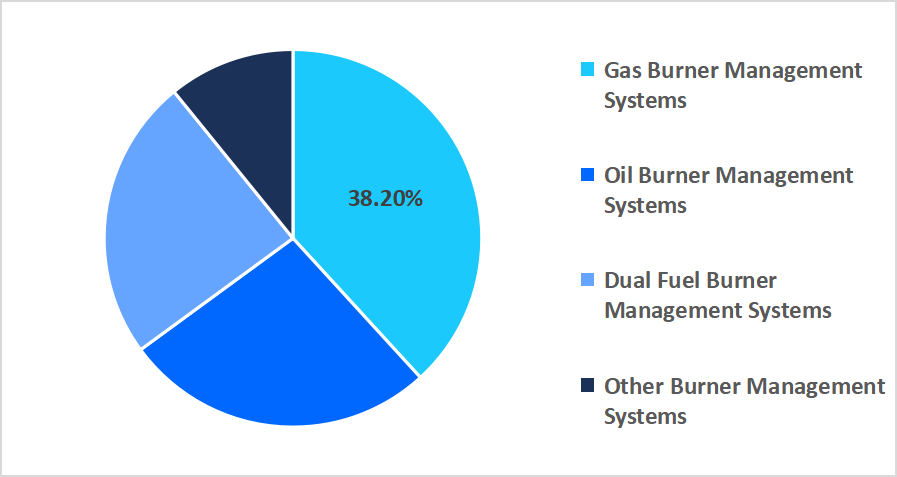

- Based on type, the gas burner management systems segment held the highest market share of 38.2% in 2025.

- By technology, the PLC-based burner management systems segment is estimated to register the fastest CAGR growth of 6.5%.

- Based on the integration level, the OEM integrated BMS segment dominated the market in 2025.

- Based on end-use sector, the power generation segment is projected to register the fastest CAGR during the forecast period.

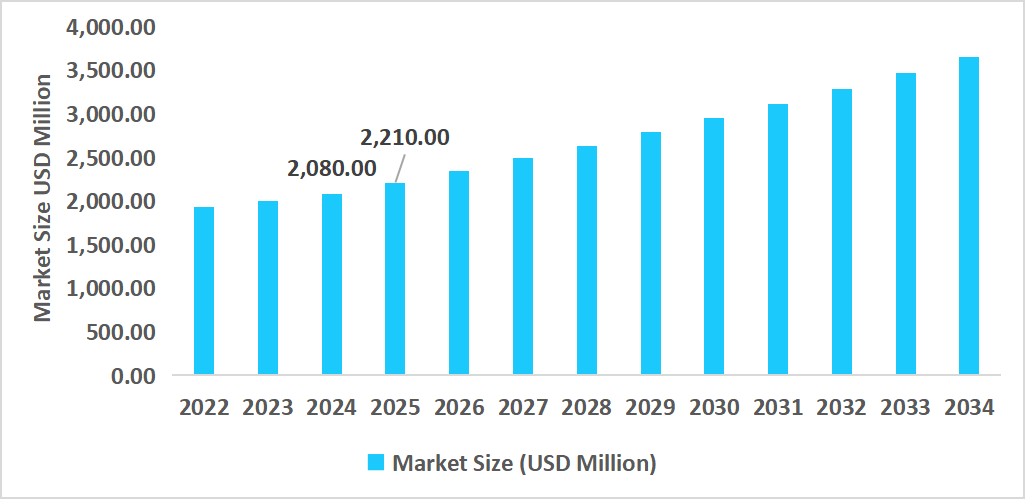

- US. dominates the burner management system market, valued at USD 2.08 billion in 2024 and reaching USD 2.21 billion in 2025.

Table: U.S Burner Management System Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 6.21billion

- 2034 Projected Market Size: USD 10.61 billion

- CAGR (2026-2034): 6.1%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market encompasses a broad range of industrial safety and control solutions such as oil burner management systems, dual fuel burner management systems, and other burner control systems . These are developed and deployed using different models of technology like PLC-based systems, microcontroller-based systems, DCS-integrated systems, and software-based monitoring platforms. In addition, burner management systems are installed on varied integration levels, such as OEM-integrated systems and aftermarket/retrofit installations, and operate in various end-use industries like power generation, oil & gas, chemicals, food processing, pulp & paper, and other industrial uses, delivering complete, technology-based safety and operational efficiency solutions to worldwide markets.

Latest Market Trends

Shift from Legacy Burner Controls to Integrated Industrial Automation Platforms

The burner management system market is moving from stand-alone burner control configurations to industrial automation platforms with integrated real-time monitoring, predictive analytics, and centralized control. Historically, operators utilized manual monitoring and independent safety controls that increased the possibility of operation inefficiencies and non-compliance.

Emerging platforms integrate sensors, remote diagnostic services, and cloud monitoring without any gaps, enabling operators to manage multiple burners and processes in a single interface. U.S. Department of Energy (DOE) and the Occupational Safety and Health Administration (OSHA) noted that plants that utilize integrated burner management platforms experience measurable reductions in operational downtime and safety incidents. The integrated solution improves process efficiency, imposes regulatory compliance, and enables data-based maintenance planning. Government incentives and energy efficiency regulations are also driving adoption of this market.

Government Regulations are Driving the Adoption of BMS.

According to Straits Research, stricter emission standards and energy efficiency requirements for industrial furnaces and boilers have been established by the United States Environmental Protection Agency (EPA) and the European Union's Industrial Emissions Directive (IED). Meeting these regulations causes industries to adopt burner management systems that track combustion efficiency, minimize fuel consumption, and lower dangerous emissions. According to the U.S. Department of Energy, buildings with BMS installations certified can achieve up to 15–20% savings of their energy consumption while being compliant to safety standards, illustrating the double benefit of operation efficiency and regulatory compliance.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.21 Billion |

| Estimated 2026 Value | USD 6.59 Billion |

| Projected 2034 Value | USD 10.61 Billion |

| CAGR (2026-2034) | 6.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Honeywell International Inc., Siemens AG, ABB Ltd., Schneider Electric SE, Emerson Electric Co. |

to learn more about this report Download Free Sample Report

Burner Management System Market Drivers

Industrial Safety Regulations and Compliance Requirements Expansion

Compliance requirements and stringent industrial safety regulations are becoming a key growth driver for the burner management system market. The U.S., Germany, Japan, and South Korea are all adopting stricter norms on industrial boiler operation, hazardous material management, and emission control. The U.S. Occupational Safety and Health Administration (OSHA) indicated that certified burner management system-installed facilities reduced fire and explosion accidents by 30% and recognized the importance of implementation of BMS in addressing regulatory compliance.

Likewise, the European Union's Industrial Emissions Directive (IED) requires constant industrial combustion system monitoring and control, which drives adoption of next-generation BMS solutions. This legislative stimulus is joined by government incentives for industry to invest in cutting-edge safety control technologies, in the form of tax credits and energy efficiency grants through initiatives like the U.S. Department of Energy's Industrial Assessment Centers (IAC).

The mounting demand for compliance audits and safety certifications for industrial operations is motivating operators to apply burner management systems on a proactive basis. This high focus on safety and regulatory compliance is driving the adoption of BMS, significantly contributing towards overall market growth.

Market Restraints

Limited Talent Pool for Effective BMS Operation and Maintenance

The main restraint in the burner management system market is the limited number of trained specialists who know how to install, operate, and maintain complex BMS solutions. The U.S. Department of Labor's Bureau of Labor Statistics (BLS) asserts that industrial control technicians and automation engineers with special skills are scarce, and by 2028, the rate of employment growth will exceed available talent by a considerable margin.

This shortage poses challenges for factory plants looking to deploy or replace burner management systems, especially in developing economies where technical training programs are under development. Inadequate operation or maintenance due to lack of competence can result in safety hazards, regulatory non-compliance, and inefficiency of operations.

Consequently, industries experience delays in BMS deployment and restricted use of advanced features, holding back market growth even with regulatory and safety-oriented demand.

Market Opportunities

Increase in Industrial Safety Training and Certification Programs

The increase in government-initiated industrial safety training and certification programs is generating new opportunities for the burner management system market. Taking cognisance of the opportunistic nature of this market, Singapore's Workplace Safety and Health (WSH) Council has launched specialized courses of certification for industrial process safety and burner operation to improve workforce competency in high-hazard industrial settings.

These programs allow facilities to educate operators and maintenance staff in best practices for BMS installation, guaranteeing safe, compliant, and effective industrial burner operation. The prevalence of certified training programs not only minimizes workplace accidents but also promotes industries to invest in more sophisticated burner management solutions.

Consequently, skill development and certification programs sponsored by the government are propelling market growth by raising the confidence levels of industrial operators in adopting BMS solutions, thereby providing high growth prospects in emerging markets as well as developed ones.

Regional Analysis

North America dominated the market in 2025 with a 35.5% market share. This is because of rigorous industrial safety regulations, high adoption of automated industrial processes, and stringent regulatory compliance monitoring. Institutions such as OSHA (Occupational Safety and Health Administration) and the U.S. Environmental Protection Agency (EPA) have rigorous boiler and burner operating guidelines that urge industries to employ reliable burner management systems. These have all contributed in total to the top-level installation of BMS solutions in power plants, chemical plants, and oil & gas facilities.

In the US, BMS market growth is fueled by compliance with regulations and safety improvement programs. For example, as per OSHA, plants that implemented certified burner management systems had fewer industrial fire and explosion accidents by up to 30% in 2024. The U.S. Department of Energy's Industrial Assessment Centers (IAC) also offers technical assistance and recommendations for retrofitting aging industrial boilers with state-of-the-art BMS technology. Such state-supported schemes, in conjunction with high industrial automation take-up, continue to fortify the U.S. market.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing region with a CAGR of 6.9% during 2026–2034 due to industrial modernization in nations like China, India, Japan, and South Korea. The quick growth of power plants, oil & gas plants, and chemical industries along with more stringent regulatory measures on emissions and operational safety, are fueling the adoption of burner management systems. Regional industrial safety-promoting policies, energy efficiency norms, and government-backed modernization initiatives are additionally fueling BMS adoption in the Asia Pacific.

India Market: India's BMS market is growing very fast with the help of government incentives and modernization initiatives. Energy efficiency and safety of industrial boilers are emphasized by the Bureau of Energy Efficiency (BEE) and urged industries to adopt burner management solutions. Some private industrial companies are adopting OEM and retrofit BMS solutions to meet emissions standards and enhance operational reliability. These efforts are making India a leading growth hub for burner management systems in the country.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe, is experiencing consistent growth in the use of burner management systems owing to increasing industrial safety regulations and energy efficiency standards in Germany, France, Italy, and the U.K. Regulators such as the German Federal Ministry for Economic Affairs and Climate Action (BMWK) and the European Union's Industrial Emissions Directive are imposing higher emissions and operation safety standards that require companies to adopt next-generation BMS solutions.

In the U.K.,energy-saving schemes and industrial safety legislation, such as U.K. Department for Business, Energy & Industrial Strategy (BEIS) and Health and Safety Executive (HSE) schemes, are fueling the growth of the U.K. BMS market. These schemes encourage replacement retrofitting of old boilers with advanced burner management systems to improve safety, reduce emissions, and save fuel. Government and industry-sponsored industrial modernization programs are fueling widespread use of BMS in the power generation, chemical, and oil & gas industries.

Latin America Market Insights

Latin America's BMS market is spurred on by Brazil, Mexico, and Argentina, where industrial expansion and improved emission regulations are driving take-up. Public policies regarding boiler safety and energy efficiency, together with updating industrial equipment, are generating demand for dependable burner management systems. Cross-border industrial partnerships and technical training initiatives are also improving operation standards, facilitating market growth.

Brazil's burner management system market is growing with industrial operators replacing ageing furnaces and boilers to comply with safety and environmental regulations. Top industrial plants are implementing OEM and retrofit BMS solutions to optimize operating performance and maintain compliance with Brazilian Environmental Agency (IBAMA) emission limits. This is fuelling increased adoption of sophisticated BMS solutions throughout the region.

Middle East and Africa Market Insights

Middle East and Africa BMS market is expanding as nations like the UAE, Saudi Arabia, and South Africa adopt industrial safety standards and energy efficiency projects. BMS solutions are being employed increasingly by industrial plants to ensure compliance with government-certified safety procedures, track emissions, and improve operational dependability.

Egypt Market: Egypt's BMS market is growing as government initiatives encourage industry modernization and energy efficiency. Public facilities are increasingly retrofitting old boilers with certified burner management systems through technical support from such regulatory agencies as the Egyptian Environmental Affairs Agency (EEAA). These efforts enhance operational safety and conformance, driving wider industrial sector adoption of BMS.

Type Insights

The gas burner management systems market led with 38.2% revenue share in 2025. It is fueled by the extensive application of gas-fired industrial boilers in power generation, oil & gas, and chemical sectors, where gas burners enable cleaner combustion and better operational control. Gas BMS solutions are favored due to their capability to promote safety, regulatory compliance, and optimal fuel utilization in high-demand industrial processes.

The dual fuel burner management systems segment is expected to see the highest growth with a projected CAGR of approximately 6.7% through the forecast period. Industries' need to be flexible to switch between gas and oil fuels due to energy price volatility, supply chain constraints, or emission standards is driving high growth. This flexibility, along with improved interlocks for safety and automated monitoring, is driving greater adoption of dual fuel BMS solutions across the world.

By Type Market Share (%), 2025

Source: Straits Research

Technology Insights

The PLC-based burner management systems segment is expected to record the highest CAGR growth of 6.5% through the forecast period. This is due to industries moving towards PLC-based solutions due to their reliability, ease of integration into existing automation systems, and solid safety interlocks. Plants using PLC-based BMS are able to monitor multiple burners in real-time, optimize fuel consumption, and meet strict safety regulations, and hence it is a popular choice for new installations and retrofits.

The burner management systems with DCS integration captured the highest market share of 34.8% in 2025 due to its facility to seamlessly integrate with distributed control systems within large industrial plants. Its use is also complemented by the means to centralize monitoring, automate intricate burner sequences, and offer advanced diagnostics, guaranteeing higher operational efficiency, minimized downtime, and improved safety in power generation, chemical, and oil & gas plants.

Integration Level Insights

By integration level, the OEM integrated BMS category dominated the market in 2025 with a revenue share of 32%, as original equipment manufacturers provide fully tested, factory-integrated burner management systems along with their boilers and industrial furnaces. This integrated model ensures optimal compatibility, compliance with safety standards, and minimal installation complexity, thereby supporting segmental growth.

The aftermarket/retrofit BMS segment is expected to witness the highest growth during the forecast period. This is fueled by increasing modernization initiatives in old industrial plants, where operators retrofit old burners with advanced BMS solutions to meet today's safety regulations as well as improve operational efficiency. Government programs, such as the U.S. Industrial Assessment Centers (IAC) of the Department of Energy, provide retrofit programs with technical support and energy efficiency incentives, pushing adoption and segmental growth.

End Use Sector Insights

The power generation segment is expected to increase at the highest rate of 6.8% due to the growing demand for more secure and efficient operations within thermal and biomass power plants. With increasing regulatory pressures and plants trying to minimize downtime, power generation plants are proactively installing sophisticated burner management systems to maximize combustion efficiency, guarantee compliance with emissions regulations, and maximize operational reliability, driving demand for dedicated BMS solutions in this space.

Competitive Landscape

The global Burner Management System (BMS) market is moderately fragmented, with the availability of established industrial automation companies and specialized BMS providers. Few players account for the major market share through their extensive product portfolio and integrated safety and control solutions.

The major players in the market include Siemens, GE Vernova, Honeywell International Inc, ABB and others. These industry players are competing with each other to gain a strong market foothold through the launch of new solutions, strategic partnerships, and mergers & acquisitions strategies.

ClearSign Technologies Corporation: An emerging market player

ClearSign Technologies Corporation is a US company that specializes in providing sophisticated combustion and burner management technologies. The company stands out on the basis of its proprietary technologies that maximize flame stability and produce low emissions.

- In January 2025, ClearSign Technologies announced a large order of engineering services from one of the world supermajor refiners to design and implement a 32-burner burner management system to be installed at a facility in California over 15-18 months, commenting on its entry into major industrial refining applications.

In this manner, ClearSign Technologies became an important force in the global market by leveraging its sole emission control technologies and securing contracts with large energy players.

List of Key and Emerging Players in Burner Management System Market

- Honeywell International Inc.

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Emerson Electric Co.

- General Electric (GE)

- Yokogawa Electric Corporation

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- Larsen & Toubro Limited (L&T)

- Endress+Hauser AG

- Omron Corporation

- B&R Industrial Automation

- Fuji Electric Co., Ltd.

- Wood Group (John Wood Group PLC)

- Eaton Corporation

- Azbil Corporation

- Rotork plc

- ClearSign Technologies Corporation

- Control Dynamics, Inc.

Strategic Initiatives

- September 2025: Siemens underscored its sustainability focus by its five levers driving its green future strategy. These involve speeding up decarbonization and making sustainable practices part of its operations, in sync with the increasing need for energy-efficient and eco-friendly BMS solutions.

- July 2025: Honeywell has plans to break into three publicly traded companies by the end of 2026 with a focus on core automation markets. This move involves considering options for alternatives for its Productivity Solutions and Services (PSS) and Warehouse and Workflow Solutions (WWS) businesses, with a view to simplifying operations and increasing concentration on automation technology.

- February 2025: Rockwell Automation released a new PlantPAx-based BMS library. It offers pre-engineered, modular code to streamline and expedite the installation of safety-rated burner management on their ControlLogix platforms aimed at the food processing and chemical industries.

- August 2024: Yokogawa Electric Corporation introduced its OpreX™ Burner Management System Safety Package, a pre-configured and certified solution that minimizes engineering time and costs for validation in brownfield modernizations in the chemical and pharmaceutical industries.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.21 Billion |

| Market Size in 2026 | USD 6.59 Billion |

| Market Size in 2034 | USD 10.61 Billion |

| CAGR | 6.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Integration Level, By End Use Sector |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Burner Management System Market Segments

By Type

- Gas Burner Management Systems

- Oil Burner Management Systems

- Dual Fuel Burner Management Systems

- Other Burner Management Systems

By Technology

- PLC-Based Burner Management Systems

- Microcontroller-Based Burner Management Systems

- DCS Integrated Burner Management Systems

- Software-Based Monitoring Systems

By Integration Level

- OEM Integrated BMS

- Aftermarket/Retrofit BMS

By End Use Sector

- Power Generation

- Oil & Gas

- Chemicals

- Food Processing

- Pulp & Paper

- Other Industrial Applications

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.