Saudi Arabia Carbon Capture and Storage Market Size, Share & Trends Analysis Report By Technology (Pre-combustion capture, Oxy-fuel combustion capture, Post-combustion capture), By Service (Capture, Transportation, Storage, Utilization), By Utilization Technology (Uptake, Catalytic conversion, Mineralization), By End-User (Power Generation, Oil and Gas, Metal Production, Others) and Forecasts, 2025-2033

Saudi Arabia Carbon Capture and Storage Market Size

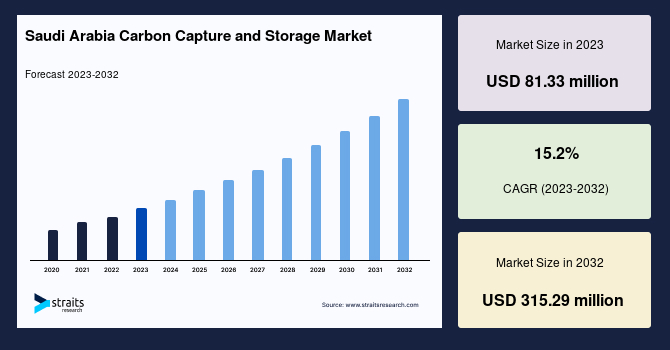

The Saudi Arabia carbon capture and storage (CCS) market was valued at USD 93.69 million in 2024 and is projected to reach from USD 107.93 million in 2025 to reach USD 334.79 million by 2033, with a CAGR of 15.2% during the forecast period (2025–2033). This market growth is driven by government policies, global pressure to reduce emissions, and the nation’s desire to diversify its energy mix.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 93.69 Million |

| Estimated 2025 Value | USD 107.93 Million |

| Projected 2033 Value | USD 334.79 Million |

| CAGR (2025-2033) | 15.2% |

| Key Market Players | Aker Solutions, Air Liquide, Baker Hughes, Dakota Gasification Company, Exxon Mobil Corporation |

to learn more about this report Download Free Sample Report

Saudi Arabia Carbon Capture and Storage Market Growth Factors

Vision 2030 and National Climate Goals

Saudi Arabia’s Vision 2030 and Net-Zero by 2060 commitments have led to increased investment in carbon capture technologies. As part of its diversification away from oil dependency, the government has integrated CCS as a key part of its climate strategy. The country has committed to investing in clean energy technologies, including hydrogen production, CCS, and renewables, with the Saudi Green Initiative (SGI) paving the way for accelerated deployment of CCS technologies. The Saudi Aramco initiative, such as the Uthmaniyah CCS project, exemplifies the nation's commitment, aiming to capture and store 800,000 tons of CO₂ annually. These efforts aim to decarbonize the oil and gas industry while helping to fulfill international climate commitments.

Market Restraint

High Infrastructure Costs and Technological Barriers

Despite robust policies, the high initial capital investment and technological challenges associated with deploying CCS infrastructure are significant restraints in the CCS market. Establishing and maintaining large-scale CCS operations from CO₂ capture to storage requires substantial investments in pipeline infrastructure, transportation, and monitoring systems. Additionally, there are concerns over the geological suitability for safe and long-term CO₂ storage in Saudi Arabia. The National Industrial Development and Logistics Program (NIDLP) has highlighted the necessity to overcome these obstacles, particularly in regions where the geology may not be conducive to large-scale CO₂ sequestration, which could result in increased costs and delays.

Market Opportunity

Synergies with Hydrogen Economy and Enhanced Oil Recovery (eor)

An exciting opportunity for CCS in Saudi Arabia lies in its synergies with hydrogen production and enhanced oil recovery (EOR). The combination of blue hydrogen production (which utilizes CCS) and the country’s large-scale oil infrastructure creates a sustainable business model for CCS. Projects like the Jazan Energy and Development Company’s hydrogen project could significantly boost the demand for CCS technologies. Additionally, EOR, which involves injecting CO₂ into aging oil fields to increase production, is already an essential practice in Saudi Arabia. This provides an opportunity to reuse captured CO₂ and create a sustainable, closed-loop carbon system, ensuring continued investment and expansion of CCS infrastructure.

Country Insights

The market is characterized by diverse CCS applications across Saudi Arabia’s critical industrial, power, and oil sectors.As one of the world’s largest oil producers and exporters, Saudi Arabia has increasingly recognized the importance of CCS technologies in meeting its Vision 2030 goals and net-zero emissions target by 2060. The country has actively invested in CCS infrastructure, with initiatives like the Uthmaniyah CO₂ Injection Project spearheaded by Saudi Aramco and supported by international players like Air Products.

Riyadh, as the capital city and a central industrial hub, is seeing growing investments in CCS infrastructure. Saudi Aramco has implemented CCS projects in Riyadh, especially refining and chemical manufacturing. Riyadh’s position as the economic and political center of the kingdom ensures continuous support for CCS technologies, mainly as the government aims to reduce emissions in line with Vision 2030.

Jeddah is one of Saudi Arabia’s leading cities in energy production, particularly in the natural gas and petrochemical industries. The Jeddah South Thermal Power Plant is expected to incorporate CCS technologies to help meet emission targets. Additionally, Jeddah’s proximity to the Red Sea makes it a viable location for CO₂ sequestration projects.

Dhahran is home to Saudi Aramco’s headquarters, which leads many of the nation’s CCS initiatives. The city is pivotal in exploring EOR technologies, where CO₂ is injected into oil fields to increase production. These processes align with the national strategy for using CCS to enhance oil recovery while reducing overall emissions.

Dammam is a major industrial city with significant oil and gas infrastructure. SABIC operates large chemical plants here, many of which have begun integrating CCS technologies. Dammam’s industrial base makes it a key market for capture by service and catalytic conversion technologies, where CO₂ emissions can be reduced while producing valuable products.

Mecca is evolving into a green energy hub focusing on sustainability, especially for its large-scale infrastructure and tourism sectors. As part of its efforts to diversify energy sources, Mecca is exploring the integration of CCS with new solar energy projects, which could play a role in the city's efforts to meet its environmental goals.

Technology Insights

Pre-combustion capture dominates the technology segment and is expected to grow at a CAGR of 14.7% over the forecast period. Pre-combustion capture remains a critical technology for Saudi Arabia’s power and industrial sectors. It allows CO₂ to be captured before combustion during fuel production or processing, making it ideal for oil refining and natural gas processing industries. This is particularly relevant as Saudi Arabia continues to rely on fossil fuels for energy, and Saudi Aramco’s gas processing plants are ideal candidates for deploying pre-combustion technologies to reduce their carbon emissions and align with national climate goals.

Services Insights

Capture services dominate the service segment and are expected to grow at a CAGR of 14.7% during the forecast period. Capture services include all technologies that help remove CO₂ from industrial processes. Saudi Arabia’s industrial sector, particularly in petrochemicals and cement, presents a growing opportunity for such services. As the National Industrial Development and Logistics Program (NIDLP) continues prioritizing sustainable industries, the demand for efficient CCS capture services is expected to rise. Saudi Aramco has already incorporated CCS services at its Hawiyah CO₂ Injection Facility, and expanding these services across the industrial sector is a critical component of Saudi Arabia’s emissions-reduction strategy.

Utilization Technology Insights

Catalytic conversion dominates the utilization technology and is expected to grow at a CAGR of 15.6% over the forecast period. This technology converts captured CO₂ into valuable products such as methanol, synthetic fuels, and plastics. Saudi Basic Industries Corporation (SABIC), one of the world’s largest petrochemical manufacturers, has explored CO₂ conversion technologies in its SABIC Innovation Center, where captured CO₂ produces industrial chemicals. These innovative applications are driving the demand for catalytic conversion technologies, offering a path for economic value while addressing environmental concerns.

End Users Insights

Oil and gas dominate the end-user segment and is expected to grow at a CAGR of 16.0% during the forecast period. As the country continues to rely heavily on fossil fuels for electricity generation, particularly natural gas, CCS is essential to reduce the emissions from power plants. The Riyadh Power Plant and the Jeddah South Thermal Power Plant are prime candidates for CCS retrofits, aiming to capture CO₂ and reduce the carbon footprint of power generation. Additionally, the government’s focus on increasing the share of renewable energy will further enhance the need for hybrid systems incorporating CCS to meet the country’s emission targets.

List of Key and Emerging Players in Saudi Arabia Carbon Capture and Storage Market

- Aker Solutions

- Air Liquide

- Baker Hughes

- Dakota Gasification Company

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric

Analyst’s Perspective

As per our analyst, the Saudi Arabia carbon capture and storage market is poised for rapid expansion in the coming years. This growth is primarily driven by Saudi Arabia’s ambitious climate goals and the need to reduce emissions from the oil and gas sector, where CCS technologies have a significant role to play. The country’s large-scale CCS projects, particularly in oil fields and industrial facilities, are expected to scale up over the next decade, with government investments supporting technological development. Integrating blue hydrogen production with CCS and the increasing use of EOR will further accelerate growth. While high infrastructure costs and technological barriers present challenges, the growing synergy between CCS, hydrogen, and EOR positions Saudi Arabia as a regional leader in carbon capture technology.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 93.69 Million |

| Market Size in 2025 | USD 107.93 Million |

| Market Size in 2033 | USD 334.79 Million |

| CAGR | 15.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology, By End-User Industry |

to learn more about this report Download Free Sample Report

Saudi Arabia Carbon Capture and Storage Market Segments

By Technology

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

- Post-combustion Capture

By End-User Industry

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.