Cardiovascular Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic & Monitoring Devices, Surgical Devices), By Application (Coronary Artery Disease, Arrhythmia & Conduction Disorders, Heart Failure & Cardiomyopathy, Structural & Congenital Heart Defects, Peripheral Vascular Disease), By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Cardiology Clinics, Homecare Settings) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Cardiovascular Devices Market Overview

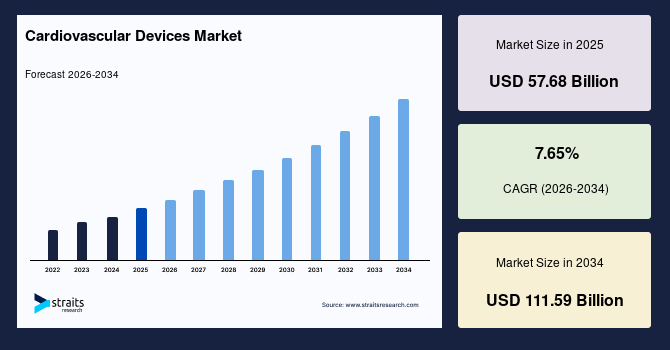

The global cardiovascular devices market size is valued at USD 57.68 billion in 2025 and is estimated to reach USD 111.59 billion by 2034, growing at a CAGR of 7.65% during the forecast period. The accelerated growth of the cardiovascular devices market is fueled by the continuous adoption of biodegradable and drug-eluting stents, enhancing patient outcomes and reducing reintervention rates.

Key Market Trends & Insights

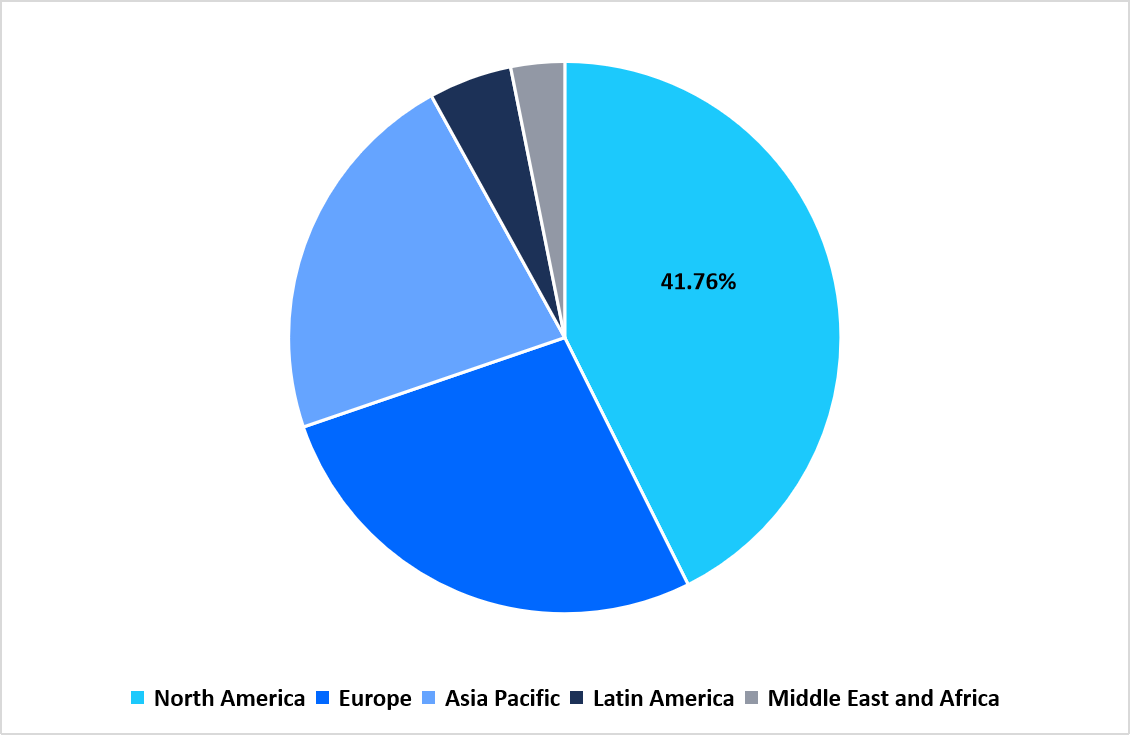

- North America dominated the global market, accounting for 41.76% share in 2025.

- The Asia Pacific region is projected to grow at the fastest pace, with a CAGR of 9.04% during the forecast period.

- By product, the surgical devices segment dominated the market in 2025.

- By application, the structural & congenital heart defects segment is expected to register the fastest CAGR growth of 8.49%

- Based on the end user, the hospitals & clinics segment dominated the market with a revenue share of 48.36% in 2025.

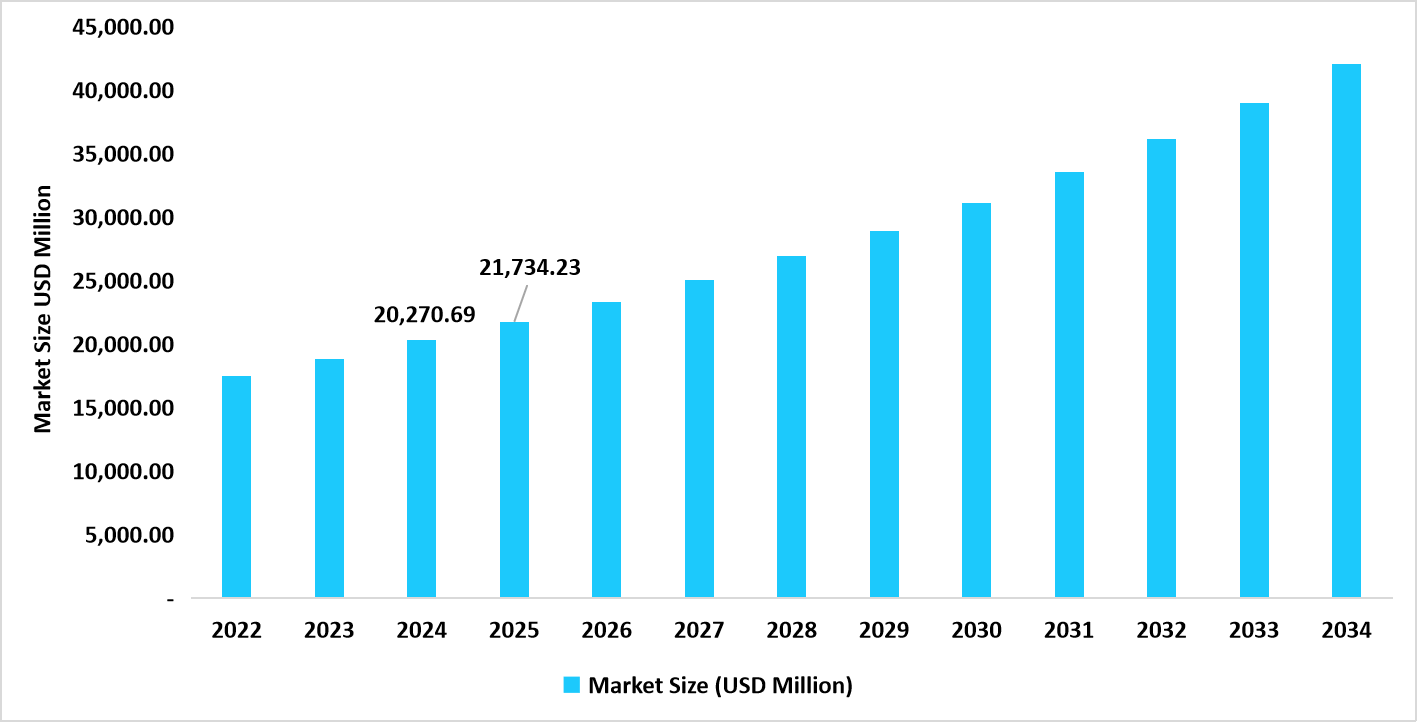

- The U.S. dominated the cardiovascular devices market, valued at USD 20.27 billion in 2024 and reaching USD 21.73 billion in 2025.

Table: U.S. Cardiovascular Devices Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 57.68 billion

- 2034 Projected Market Size: USD 111.59 billion

- CAGR (2026-2034): 7.65%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The cardiovascular devices market comprises a wide spectrum of technologies designed for diagnosing, monitoring, and treating cardiac and vascular conditions. It includes diagnostic and monitoring systems such as implantable cardiac monitors, ECG, cardiac CT, echocardiography/ultrasound, and others, along with surgical and therapeutic devices including pacemakers, implantable defibrillators, coronary stents, catheters, heart valves, and ventricular assist devices, and others. These solutions support applications ranging from coronary artery disease, arrhythmia & conduction disorders, heart failure & cardiomyopathy, structural & congenital heart defects, and peripheral vascular disease, and are utilized across hospitals, ambulatory centers, cardiology clinics, and homecare settings.

Latest Market Trends

Shift Toward Minimally Invasive and Image-Guided Cardiac Interventions

A major trend in the cardiovascular devices market is the rapid shift toward minimally invasive and image-guided cardiac interventions. Traditional open-heart procedures are increasingly replaced by catheter-based techniques, supported by advancements in transcatheter heart valves, drug-eluting stents, and electrophysiology systems. These innovations reduce surgical risks, shorten recovery times, and improve long-term outcomes. As clinical success rates rise, minimally invasive cardiovascular solutions are becoming the preferred approach for both patients and clinicians, reshaping modern cardiac care.

Growing Adoption Of Wearable And Remote Cardiac Monitoring Technologies

The growing adoption of wearable and remote cardiac monitoring technologies enable continuous, non-invasive tracking of heart rhythms outside clinical settings, is a key trend for market growth. These solutions enhance early detection of arrhythmias and improve disease management. For instance, the introduction of novel patch-based cardiac monitors by leading manufacturers expanded real-time monitoring capabilities, offering greater comfort and diagnostic accuracy. This shift toward connected, patient-centric monitoring is transforming how cardiovascular conditions are managed globally.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 57.68 Billion |

| Estimated 2026 Value | USD 61.88 Billion |

| Projected 2034 Value | USD 111.59 Billion |

| CAGR (2026-2034) | 7.65% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Abbott, Argon Medical Devices, Inc., Braun SE, BIOTRONIK SE & Co. KG, Boston Scientific Corporation |

to learn more about this report Download Free Sample Report

Market Driver

High Burden Of Cardiovascular Diseases

The rising global burden of cardiovascular diseases is accelerating the adoption of advanced minimally invasive interventions, marking a major trend in the cardiovascular devices market. As heart failure, coronary artery disease, and structural heart disorders continue to increase, demand for safer and more efficient treatment options is growing rapidly. For instance, the expanding use of transcatheter aortic valve replacement (TAVR), supported by devices such as the Edwards SAPIEN 3 Ultra, reflects the strong clinical shift toward less invasive cardiac therapies.

Market Restraint

High Cost of Advanced Cardiac Implants

A major restraint in the cardiovascular devices market is the high cost of advanced cardiac implants and minimally invasive intervention systems, which limit accessibility in underserved regions. Premium technologies such as transcatheter heart valves and ventricular assist devices require substantial investment in both equipment and specialized surgical expertise. For example, TAVR procedures in the U.S. exceed USD 50,000, making them financially challenging for many patients and healthcare facilities.

Consequently, high treatment expenses continue to restrict the broader adoption of cutting-edge cardiovascular devices.

Market Opportunity

Expanding use of Advanced Echocardiography and Ultrasound Systems

The expanding use of advanced echocardiography and ultrasound systems for early and real-time cardiac assessment. Growing demand for portable and handheld ultrasound devices is enabling quicker diagnosis across hospitals, emergency settings, and remote care environments. For instance, the adoption of point-of-care ultrasound (POCUS) systems increased notably, allowing clinicians to evaluate cardiac function immediately at the bedside. As image quality, AI-assisted analysis, and portability continue to improve, echocardiography is poised to become an even more essential tool in modern cardiovascular care.

Regional Analysis

North America dominated the cardiovascular devices market in 2025, accounting for 41.76% market share. This leadership is driven by widespread implementation of value-based care initiatives that incentivize hospitals and clinics to adopt advanced, outcome-focused cardiovascular technologies. These programs encourage investment in innovative devices, remote monitoring systems, and minimally invasive solutions, enhancing patient outcomes and reinforcing the region’s market leadership.

The U.S. market is growing due to Medtronic’s strategic expansion of its minimally invasive valve and stent portfolio, which increased procedure accessibility and adoption across leading hospitals. The company’s continuous innovation, robust clinical trials, and strong partnerships with healthcare providers are driving the uptake of advanced cardiovascular therapies nationwide.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 9.04% from 2026-2034, owing to MicroPort Scientific Corporation’s targeted expansion in China and Southeast Asia, which includes introducing innovative stents and cardiac rhythm management devices. Their localized manufacturing and strategic partnerships are enhancing device accessibility, fueling rapid market growth across the region.

Japan’s cardiovascular devices market is supported by government-supported initiatives promoting advanced cardiac care in regional and remote areas, including funding for telecardiology and portable diagnostic devices. These programs improve access to high-quality cardiovascular diagnostics and interventions, drive adoption of innovative devices, and strengthen the overall growth of the market across the country.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is witnessing strong growth in the cardiovascular devices market due to the region’s increasing adoption of EU-wide regulatory incentives for innovative medical devices, such as the Medical Device Regulation (MDR) fast-track approvals. These frameworks encourage manufacturers to launch advanced cardiac technologies, boosting device availability, clinical adoption, and market expansion across European countries.

Germany’s market is benefiting from its strong network of certified heart centers and specialized cardiac care programs, which promote the adoption of cutting-edge devices such as minimally invasive valves and advanced pacemakers. This well-structured healthcare infrastructure supports high procedure volumes, driving demand and accelerating market growth within the country.

Latin America Market Insights

The Latin American cardiovascular devices market is expanding due to growing medical tourism for advanced cardiac procedures, especially in countries like Argentina, Brazil, and Colombia. Patients from neighboring regions seek cost-effective, high-quality interventions, boosting demand for cardiovascular devices and encouraging hospitals to adopt innovative diagnostic and therapeutic technologies.

Brazil's market is being driven by the adoption of public-private partnerships (PPPs) in healthcare, which fund the procurement of advanced cardiac devices and support specialized cardiac centers. These collaborations enhance access to innovative stents, pacemakers, and imaging technologies, driving both procedural volumes and overall market expansion in the country.

Middle East and Africa Market Insights

The Middle East and Africa cardiovascular devices market is growing due to the strong establishment of specialized heart institutes and centers of excellence in countries like the UAE and South Africa, which focus on advanced interventional cardiology and complex cardiac surgeries. These centers drive demand for innovative devices and support regional market expansion.

Saudi Arabia's market is supported by the country’s Vision 2030 healthcare modernization initiatives, which prioritize upgrading cardiac care infrastructure and adopting advanced interventional and diagnostic devices. Government-led investments in smart hospitals and specialized cardiac centers are enhancing procedural capabilities, increasing device adoption, and driving robust market growth across the nation.

Product Insights

The surgical devices segment dominated the market in 2025. This growth is attributed to the rising adoption of robot-assisted cardiac surgeries, which offer superior precision, smaller incisions, and reduced postoperative complications. Growing integration of robotic platforms in complex procedures such as mitral valve repair notably accelerated demand for advanced surgical cardiovascular devices.

The diagnostic & monitoring devices segment is projected to register the fastest CAGR of 8.94% during the forecast period. This growth is augmented by the integration of AI-driven cardiac imaging analytics, which enhances the detection of subtle structural abnormalities. These advanced algorithms improve diagnostic speed and accuracy, driving accelerated adoption of cardiovascular monitoring technologies across clinical settings.

Application Insights

Coronary artery disease segment dominated the market with a revenue share of 43.76% in 2025, due to the increasing use of intravascular imaging technologies, such as IVUS and OCT, which enable highly precise assessment of plaque composition and vessel morphology. These tools optimize stent placement and procedural outcomes, substantially increasing the clinical reliance on advanced CAD treatment solutions.

The structural & congenital heart defects segment is expected to register the fastest CAGR growth of 8.49% during the forecast period. This growth is driven by the rising adoption of 3D echo-guided transcatheter repair systems, which enable highly precise visualization of complex cardiac anatomies. These advanced imaging-supported interventions improve procedural accuracy and broaden treatment eligibility for patients previously unsuitable for surgery.

By Application Market Share (%), 2025

Source: Straits Research

End User Insights

The hospitals & clinics segment dominated the market in 2025, accounting for 56.83%. This growth is stimulated by increasing adoption of hybrid cardiac operating rooms, which combine advanced imaging technologies with surgical capabilities. These integrated environments enable complex procedures such as TAVR and hybrid revascularization to be performed with greater precision, thereby boosting demand for comprehensive cardiovascular device installations.

The cardiology clinics segment is expected to register the fastest CAGR during the forecast period, owing to the rising adoption of specialized outpatient cardiac diagnostics, particularly advanced stress echo and ambulatory rhythm monitoring services. These focused capabilities enable faster evaluations, reduce patient wait times, and streamline management of high-risk individuals, driving greater reliance on dedicated cardiology clinics for routine and complex cardiovascular assessments.

Competitive Landscape

Eurocor Tech GmbH: An Emerging Market Player

Eurocor Tech GmbH is an emerging player in the cardiovascular devices market, gaining recognition for its innovative drug coated balloon and stent technologies aimed at improving vascular intervention outcomes. The company is strengthening its position through continuous product development and expanding clinical evidence supporting its devices for peripheral and coronary artery diseases. With a growing global footprint and targeted R&D efforts, Eurocor is steadily establishing itself as a competitive developer in the cardiovascular space.

List of Key and Emerging Players in Cardiovascular Devices Market

- Abbott

- Argon Medical Devices, Inc.

- Braun SE

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Canon

- Cardinal Health, Inc.

- Edwards Lifesciences Corporation

- Eurocor Tech GmbH

- GE HealthCare

- Getinge AB

- Johnson & Johnson Services Inc.

- Lepu Medical Technology

- Medtronic plc

- Merit Medical Systems, Inc.

- MicroPort Scientific Corporation

- Siemens Healthineers

- Terumo Corporation

- L. Gore & Associates, Inc.

- Others

Strategic Initiatives

- October 2025: MedAxiom partnered with Kestra Medical Technologies, a medical device and digital technology company, to connect the MedAxiom community with Kestra’s innovative Cardiac Recovery System platform, offering clinicians new tools to support patients at risk for sudden cardiac arrest.

- July 2025: AliveCor, a leading developer of AI-powered cardiology solutions, launched its Kardia 12L ECG system in India. It is the world's first AI-powered, handheld 12-lead electrocardiogram (ECG) system.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 57.68 Billion |

| Market Size in 2026 | USD 61.88 Billion |

| Market Size in 2034 | USD 111.59 Billion |

| CAGR | 7.65% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cardiovascular Devices Market Segments

By Product

-

Diagnostic & Monitoring Devices

- Implantable Cardiac Monitors

- ECG

- Cardiac CT

- Echocardiography/ Ultrasound

- Others

-

Surgical Devices

- Implantable Cardioverter Defibrillators

- Cardiac Resynchronization Therapy

- Pacemakers

- Coronary Stents

- Catheters

- Ventricular Assist Devices

- Cannula

- Heart Valves

- Others

By Application

- Coronary Artery Disease

- Arrhythmia & Conduction Disorders

- Heart Failure & Cardiomyopathy

- Structural & Congenital Heart Defects

- Peripheral Vascular Disease

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Cardiology Clinics

- Homecare Settings

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.