Charcoal Briquette Market Size, Share & Trends Analysis Report By Type (Wood Charcoal Briquettes, Coconut Shell Charcoal Briquettes, Others), By Raw Material (Hardwood, Softwood, Agricultural Waste, Coconut Shell, Bamboo, Others), By Shape (Pillow-shaped Briquettes, Hexagonal Briquettes, Round Briquettes, Square Briquettes, Custom/Extruded Shapes), By Application (Household, Cooking (indoor/outdoor), Heating, Commercial, Restaurants and Hotels, BBQ/Catering Services, Industrial, Metallurgy, Smelting and Foundries, Power Generation), By Distribution Channel (Online, Offline) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Charcoal Briquette Market Size

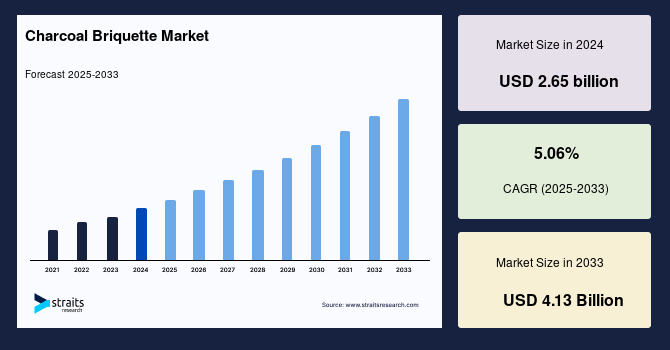

The global charcoal briquette market size was valued at USD 2.65 billion in 2024 and is anticipated to grow from USD 2.78 billion in 2025 to reach USD 4.13 billion by 2033, growing at a CAGR of 5.06% during the forecast period (2025–2033).

A charcoal briquette is a compact block made from combustible materials such as charcoal dust, sawdust, wood chips, and other biomass. These materials are compressed together with a binding agent like starch to form uniform shapes, often used as fuel for grilling, heating, and cooking. Charcoal briquettes burn longer and more evenly than regular wood, making them a popular choice for barbecue and industrial applications. They are environmentally friendly when produced from renewable resources and offer a cleaner, more efficient alternative to traditional fuels like firewood or coal.

The global market is primarily driven by the surging demand for clean and sustainable fuel alternatives, especially in regions facing severe deforestation and indoor air pollution challenges. Additionally, the abundant availability of raw biomass materials such as sawdust, coconut shells, and agricultural residues in developing regions, particularly in Asia-Pacific and Africa, supports large-scale briquette production. Furthermore, rising urbanization and increased consumer preference for convenient and smokeless cooking fuels propel market growth. Moreover, the increasing awareness regarding the harmful effects of indoor smoke from conventional fuels encourages households to switch to charcoal briquettes, boosting demand across both residential and commercial sectors.

Latest Market Trends

Adoption of Mechanized and Clean Production Technologies

One of the key trends shaping the global charcoal briquette market is the growing adoption of mechanized and clean production technologies. Traditional methods of charcoal briquette production often involve inefficient processes and contribute to environmental degradation. However, companies are now shifting towards cleaner, automated systems to enhance efficiency and reduce emissions.

- For instance, in February 2024, Reduction Technologies Pvt. Ltd., a subsidiary of EKI Energy Services Ltd., inaugurated a state-of-the-art biomass briquette manufacturing plant in Nashik, Maharashtra. The facility produces biocoal from agricultural residues such as sugarcane trash, corn cobs, soya husk, and tamarind waste. These briquettes serve as a renewable substitute for coal in industrial applications, like boilers and furnaces.

Such developments not only reduce reliance on conventional fossil fuels but also help curb open-field biomass burning, contributing to cleaner air and more sustainable energy practices.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2.65 Billion |

| Estimated 2025 Value | USD 2.78 Billion |

| Projected 2033 Value | USD 4.13 Billion |

| CAGR (2025-2033) | 5.06% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Kingsford Products Company, Royal Oak Enterprises LLC, Duraflame Inc., Weber-Stephen Products LLC, Gryfskand Sp. z o.o. |

to learn more about this report Download Free Sample Report

Charcoal Briquette Market Growth Factor

Expansion of the Hospitality and Tourism Sectors

The expansion of the hospitality and tourism sectors significantly drives the global charcoal briquette market. With increasing travel and leisure activities, outdoor cooking and heating applications in hotels, resorts, and restaurants have seen growing demand. Charcoal briquettes are favored for their ease of use, consistent heat, and cleaner combustion compared to traditional fuels. This trend is particularly prominent in regions promoting outdoor dining and eco-tourism experiences.

- According to the UN Tourism Data Dashboard, in 2024, the global tourism industry experienced a remarkable resurgence, effectively rebounding to pre-pandemic levels. An estimated 1.4 billion international tourists traveled worldwide, marking a 99% recovery compared to 2019 and an 11% increase over 2023, with 140 million more international arrivals.

This surge in tourist activities further fuels the demand for charcoal briquettes in outdoor cooking and heating across the hospitality industry.

Market Restraint

Environmental Concerns Related to Traditional Charcoal Production

Environmental concerns surrounding traditional charcoal production pose a significant restraint in the global market. Conventional methods often involve inefficient kilns and uncontrolled combustion, leading to high carbon emissions and contributing to deforestation, particularly in developing regions. The extensive use of hardwood as a raw material further accelerates forest degradation, threatening biodiversity and ecosystem stability.

Additionally, the release of particulate matter and volatile organic compounds during the production process affects air quality and public health. Growing international pressure to reduce carbon footprints and implement sustainable practices is prompting regulatory bodies to impose restrictions on unsustainable charcoal production. These environmental issues hinder market growth, particularly in regions where strict environmental standards and sustainability targets are being increasingly enforced.

Market Opportunity

Government Subsidies and Incentives

Government subsidies and incentives are playing a crucial role in accelerating the growth of the global charcoal briquette market. Various national programs aimed at minimizing carbon emissions and promoting the use of renewable energy have created favorable conditions for briquette producers. These financial incentives help reduce capital investment burdens and improve the economic viability of briquette manufacturing.

- For instance, in India, the Ministry of New and Renewable Energy's National Bioenergy Programme offers substantial Central Financial Assistance (CFA) to briquette manufacturers. As of July 2024, non-torrefied pellet plants can receive ₹21 lakh per metric ton per hour (MTPH) of capacity, up to ₹105 lakh per project, while torrefied plants are eligible for ₹42 lakh/MTPH, capped at ₹210 lakh or 30% of capital costs.

Such initiatives are likely to stimulate market entry, capacity expansion, and innovation in the briquette industry.

Regional Analysis

Asia Pacific is the dominant region in this market and is witnessing significant growth due to the abundant availability of raw materials from biomass and rising energy needs in both urban and rural areas. Increasing awareness of sustainable fuel alternatives and government initiatives supporting clean energy boosts the market. Charcoal briquettes are widely used for cooking and heating, especially in areas where traditional fuels pose environmental and health risks. Rapid urbanization, expanding hospitality industries, and rising disposable incomes further drive demand. Emerging e-commerce channels improve product reach, fueling regional market expansion.

- Indonesia's charcoal briquette industry thrives on strong global demand for coconut shell briquettes, especially for export to the Middle East and Europe for shisha and barbecue use. SMEs in Central Java and Sulawesi are major producers. The government's support for renewable energy and the availability of coconut waste have enabled large-scale production. For example, PT Coco Charcoal Indonesia exports premium briquettes to Germany and the UAE.

- India's market is expanding due to rising demand for clean cooking fuels and industrial heating. The use of briquettes made from agricultural waste, like sawdust and rice husk, is promoted by government schemes such as Ujjwala Yojana. For instance, rural enterprises in Maharashtra and Tamil Nadu are adopting biomass briquettes as a sustainable alternative to firewood in food processing and textile industries.

North America Market Trends

The North American market is driven by growing consumer preference for eco-friendly and convenient cooking fuels, especially for outdoor grilling and barbecuing. Increasing health awareness encourages the use of smokeless, odorless briquettes. Expansion of retail and e-commerce channels improves product availability. Additionally, the surging adoption of sustainable practices in hospitality and recreational sectors fuels demand. Government regulations promoting clean energy and reducing emissions also support market growth. Urban populations focusing on cleaner fuel alternatives further accelerate charcoal briquette consumption in this region.

- The United States market is driven by high demand for grilling and barbecuing, especially during the summer. Brands like Kingsford dominate retail shelves, catering to backyard cooking enthusiasts. Increased awareness of eco-friendly fuels is encouraging the adoption of natural briquettes. The market also benefits from online retail expansion, with platforms like Amazon offering coconut and hardwood briquettes targeting health- and environment-conscious consumers.

- The Canadian market is witnessing growth due to rising interest in sustainable outdoor cooking solutions. Products made from compressed biomass, such as sawdust or agricultural waste, are gaining popularity. Companies like Maple Leaf Charcoal offer clean-burning alternatives suited for campgrounds and cottage usage. The government's focus on clean energy and forest management indirectly supports biomass-based briquette adoption in both residential and commercial barbecue applications.

Europe Market Trends

Europe’s market benefits from increasing environmental regulations and a strong focus on reducing carbon footprints. Rising interest in sustainable and renewable energy solutions among households and commercial users propels demand. The region’s growing outdoor leisure culture, including grilling and camping activities, enhances product usage. Additionally, advancements in briquette technology yield cleaner and efficient fuel options that attract consumers. Strong government support for biomass fuels and eco-friendly products further bolsters market expansion. Distribution through modern retail and online platforms aids accessibility.

- Germany's charcoal briquette market is driven by eco-conscious consumers and strict environmental regulations. Demand is strong for sustainably sourced, smokeless briquettes, especially in urban grilling culture. For instance, brands like Grill Profi offer coconut shell briquettes that comply with emission norms. Rising popularity of outdoor barbecuing and the government's support for renewable biomass fuels further boost market potential in Germany’s retail and hospitality sectors.

- The UK market is expanding due to increasing preference for premium, clean-burning fuels for barbecues and garden use. Retailers such as Big K Products and The Green Olive Firewood Company offer FSC-certified briquettes that appeal to sustainability-minded consumers. With summer BBQ culture growing and public awareness around carbon emissions rising, the market sees strong demand for natural, low-smoke briquettes across households and restaurants.

Type Insights

Wood charcoal briquettes dominate the market due to their high calorific value, easy availability, and versatility in applications. Produced from compressed wood waste or sawdust, these briquettes offer steady combustion, low ash content, and minimal smoke, making them suitable for both domestic and industrial use. Their popularity is bolstered by the perception of being a natural and eco-friendly fuel source. Consumers prefer wood-based briquettes for grilling, heating, and cooking due to their balanced performance and relatively low emissions. Widespread use across Asia-Pacific, Africa, and Latin America further enhances the growth prospects of the wood charcoal briquettes segment.

Raw Material Insights

Softwood-based charcoal briquettes are gaining traction due to their ease of ignition and relatively lower cost. Derived from pine, spruce, and fir trees, these briquettes burn quickly and are suitable for short-duration cooking or heating needs. While they produce less heat and burn faster than hardwood briquettes, they remain a preferred option for users seeking budget-friendly and readily available fuel alternatives. The softwood segment is particularly popular in regions with abundant coniferous forests and is used for both domestic and light commercial applications. Their lighter composition also makes them ideal for easy transport and storage, further driving market adoption.

Shape Insights

Pillow-shaped charcoal briquettes are widely favored due to their uniform shape, ease of stacking, and efficient burning properties. Commonly used in grilling and barbecuing, their compact form ensures consistent heat distribution and longer burn times compared to irregularly shaped alternatives. These briquettes are also easier to handle and package, making them a staple in retail and commercial sectors. Manufacturers prefer this shape for its high production efficiency during compression molding. Popular across North America and Europe, pillow-shaped briquettes cater to household, restaurant, and outdoor cooking markets, reinforcing their dominance in the charcoal briquette industry.

Application Insights

The household segment represents a key end-user of charcoal briquettes, driven by growing demand for clean, efficient, and easy-to-use solid fuels. Briquettes are extensively used for cooking and heating purposes, particularly in rural and semi-urban households where access to electricity or gas is limited. Their smokeless and odorless characteristics make them a healthier alternative to traditional wood or coal. Increasing awareness about indoor air pollution and rising urban BBQ culture also fuel demand in urban homes. Furthermore, the affordability and easy availability of charcoal briquettes through local retailers and e-commerce support strong growth in the household application segment.

Distribution Channel Insights

The offline distribution channel holds a substantial share in the charcoal briquette market due to its accessibility and consumer trust. Supermarkets, hypermarkets, and local retail outlets remain popular for purchasing briquettes, especially in regions with limited internet penetration. Customers often prefer in-store purchases to examine product quality, packaging, and quantity before buying. Additionally, bulk purchases for commercial and household use are frequently made through offline channels. The segment benefits from seasonal promotions, BBQ festivals, and direct manufacturer-supplier partnerships. Rural and semi-urban areas, where traditional fuel alternatives are dominant, also rely heavily on offline stores for briquette availability.

Company Market Share

Companies in the charcoal briquette market are focusing on expanding their production capacities, adopting eco-friendly raw materials, and improving briquette quality to meet diverse consumer needs. They are also investing in advanced carbonization technologies and exploring sustainable sourcing methods. Additionally, players are strengthening distribution networks, especially through e-commerce, and engaging in promotional campaigns to boost brand visibility. Strategic collaborations and innovations in product offerings are key approaches to enhance their market share.

List of Key and Emerging Players in Charcoal Briquette Market

- Kingsford Products Company

- Royal Oak Enterprises LLC

- Duraflame Inc.

- Weber-Stephen Products LLC

- Gryfskand Sp. z o.o.

- Dancoal Sp. z o.o.

- The Clorox Company

- Timber Charcoal Company LLC

- Namchar Pty Ltd.

- BRICAPAR SA

Recent Developments

- November 2024 – The Kwara State Government, in collaboration with the Agro-Climatic Resilience in Semi-Arid Landscapes (ACReSAL) and the Abral Development Initiative (ADI), has introduced an eco-friendly briquette made entirely from organic materials. This new product offers a sustainable and cleaner substitute for traditional charcoal, which is usually produced through deforestation.

Analyst Opinion

As per our analyst, the global market is poised for steady growth, driven by increasing demand for sustainable and affordable fuel alternatives across residential, commercial, and industrial sectors. The rising trend of outdoor cooking, especially in urban and developed regions, along with the push for eco-friendly fuels, supports long-term market expansion.

However, challenges such as inconsistent quality standards, environmental concerns surrounding traditional charcoal production, and limited awareness in rural areas may hinder adoption. In addition, the market remains fragmented in developing regions, affecting scalability and product consistency.

Despite these hurdles, the market is witnessing significant opportunities in product innovation, government-backed clean energy initiatives, and the growing availability of renewable raw materials like sawdust and coconut shells. These factors, combined with increasing urbanization and rising energy costs, are expected to fuel demand and support the overall growth trajectory of the market.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2.65 Billion |

| Market Size in 2025 | USD 2.78 Billion |

| Market Size in 2033 | USD 4.13 Billion |

| CAGR | 5.06% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Raw Material, By Shape, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Charcoal Briquette Market Segments

By Type

- Wood Charcoal Briquettes

- Coconut Shell Charcoal Briquettes

- Others

By Raw Material

- Hardwood

- Softwood

- Agricultural Waste

- Coconut Shell

- Bamboo

- Others

By Shape

- Pillow-shaped Briquettes

- Hexagonal Briquettes

- Round Briquettes

- Square Briquettes

- Custom/Extruded Shapes

By Application

- Household

- Cooking (indoor/outdoor)

- Heating

- Commercial

- Restaurants and Hotels

- BBQ/Catering Services

- Industrial

- Metallurgy

- Smelting and Foundries

- Power Generation

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.