Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional, Observational, Expanded access), By Indication (Autoimmune/Inflammation, Pain management, Oncology, CNS condition, Diabetes, Obesity, Cardiovascular, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Clinical Trials Market Size

The global clinical trials market size was valued at USD 76.70 billion in 2024 and is projected to grow from USD 80.71 billion in 2025 to reach USD 132.05 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period (2025-2033).

Clinical trials are carefully designed research studies that test how well medical interventions, such as new drugs, therapies, or medical devices, work in humans. They are essential for determining the safety and effectiveness of treatments before they are widely used.

These trials are conducted in phases, each serving a unique purpose:

-

Phase 1: Focuses on safety, testing a new treatment on a small group to evaluate side effects and dosage.

-

Phase 2: Assesses the treatment’s effectiveness while continuing to monitor safety.

-

Phase 3: Compares the new treatment to existing options in a larger group of participants.

-

Phase 4: Conducted after the treatment is approved, it monitors long-term effects and safety.

Clinical trials follow strict protocols and are overseen by regulatory bodies to ensure participant safety and scientific accuracy. These studies rely on the voluntary participation of individuals who meet specific eligibility criteria, often giving participants access to cutting-edge treatments. The major factors propelling the expansion of the global clinical trials market are the surge in global healthcare needs, especially for chronic and complex diseases, and the growing focus on personalized and precision medicine.

Clinical Trials Market Trends

Adoption of Decentralized Clinical Trials (dcts)

DCTs involve conducting trials outside traditional clinical settings, using technologies like telemedicine, wearable devices, mobile apps, and eConsent. This enables remote patient participation, improving access, enhancing recruitment, reducing dropout rates, and speeding up trial timelines.

-

For example, Pfizer's fully virtual trial for Atopic Dermatitis used mobile technology to enable remote patient monitoring and virtual consultations, aligning with the DCT approach to improve accessibility and efficiency.

Thus, DCTs enhance accessibility, streamline processes, and improve patient retention, making clinical research more efficient and inclusive.

Shifting Focus to Patient-Centric Trial Designs

Patient-centric trial designs focus on improving the overall experience for participants, ensuring their needs, preferences, and well-being are central to the trial process. This approach includes flexible protocols, personalized care, and the use of technology to enhance communication and reduce participant burden.

-

For example, Janssen's "Patient Voice in Clinical Trials" program actively involves patients in the trial design process, gathering their input to improve trial protocols, enhance patient engagement, and ensure the trials better align with their needs and preferences.

Thus, patient-centric trial designs enhance participant experience, drive better engagement, and improve clinical trial outcomes.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 76.70 Billion |

| Estimated 2025 Value | USD 80.71 Billion |

| Projected 2033 Value | USD 132.05 Billion |

| CAGR (2025-2033) | 6.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.), ICON plc, Charles River Laboratories International, Inc., IQVIA, SYNEOS HEALTH |

to learn more about this report Download Free Sample Report

Clinical Trials Market Growth Factors

Surge in the Number of Clinical Trials

The increasing number of clinical trials is a key driver in the market, reflecting the growing demand for new therapies and treatments across diverse therapeutic areas. Pharmaceutical and biotech companies are expanding their research pipelines to address unmet medical needs, leading to a surge in clinical trial activities.

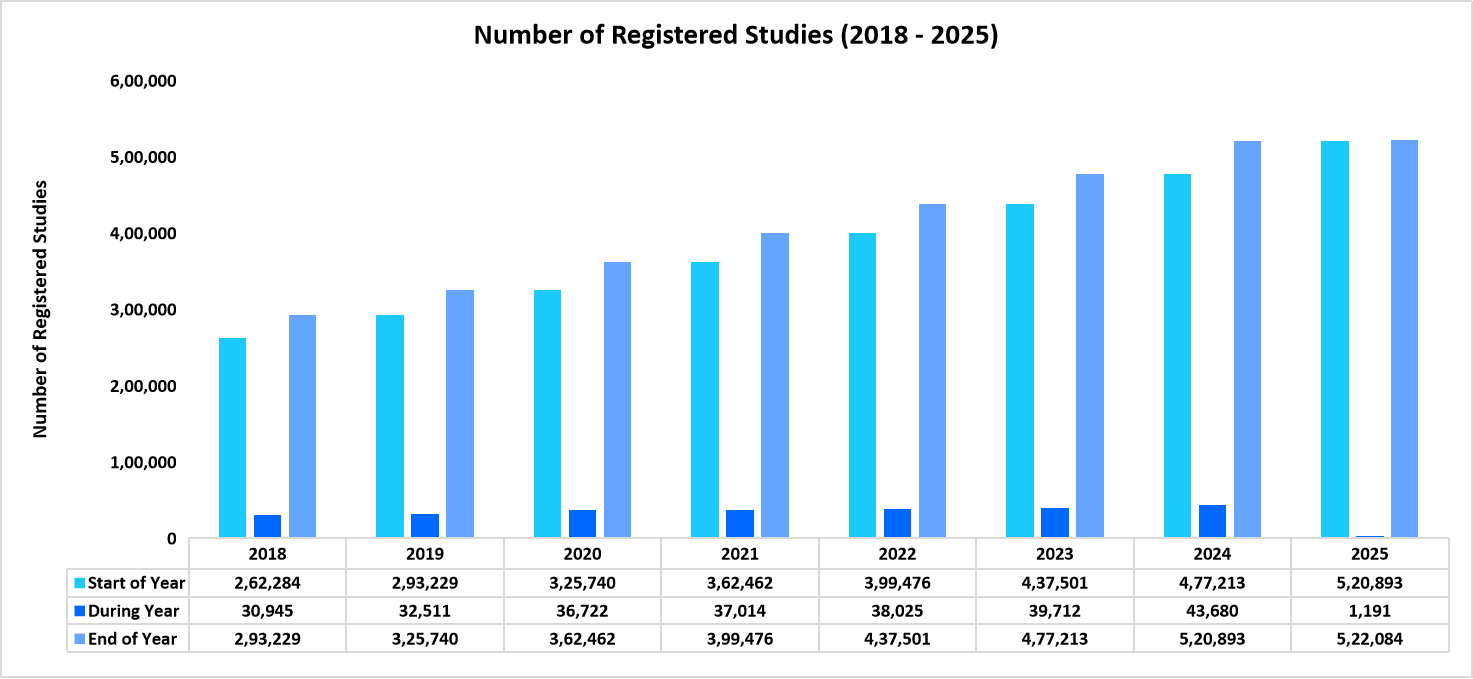

The number of registered clinical studies from 2018 to 2025 depicting a growth of 8.18% from 2019 to 2025 (to date)

Source: ClinicalTrials.gov

Thus, the upward trend highlights the increasing demand for clinical trials driven by the need for novel therapies, advancing technologies, and expanding research initiatives across various therapeutic areas, ultimately contributing to the growth of the clinical trials market.

Globalization of Clinical Trials

The globalization of clinical trials propels market expansion by enabling access to diverse patient populations, reducing recruitment challenges, and lowering costs. It accelerates study timelines and fosters multinational collaborations, leading to faster regulatory approvals and broader market access for new therapies.

-

As per the data published by the WHO in June 2024, the number of trials registered in the Western Pacific (23,250) was around 14 times higher than that in Africa (845). This disparity is largely due to the substantial number of trial registrations in China, driven by the increasing number of Chinese journals, government funding agencies, universities, and hospitals that require trial registration.

Thus, the globalization of clinical trials accelerates market growth by expanding patient access, reducing costs, and fostering international collaboration for faster drug development.

Market Restraining Factor

Patient Recruitment and Retention Issues

Patient recruitment and retention remain critical challenges in the clinical trial industry, significantly hindering the speed and success of drug development. A shortage of participants or high dropout rates disrupt trial timelines, compromise data integrity, and increase costs.

-

According to a whitepaper by the Emmes Company, LLC (September 2023), over 85% of clinical trials fail to retain sufficient participants until study completion.

-

Similarly, an article by Md Group (October 2020) reported that approximately 30% of patients drop out before completing trials due to financial strain, time conflicts, lack of understanding or engagement, long-distance travel, stress, anxiety, and family commitments.

These dropouts result in delays, loss of critical data, and the financial burden of recruiting replacements. As highlighted by MJH Life Sciences (April 2023), the average cost to replace one lost participant is $19,533, further straining the recruitment process.

Addressing these challenges is vital to enhancing the efficiency, cost-effectiveness, and success rates of clinical trials. Improved patient engagement strategies, financial support, and flexible scheduling can help mitigate these issues.

Market Opportunities

Expansion of Contract Research Organizations (cros)

The growing presence of Contract Research Organizations (CROs) offers a transformative opportunity for the clinical trials industry by streamlining operations, reducing costs, and accelerating drug development timelines. CROs bring specialized expertise in regulatory compliance, patient recruitment, data management, and trial execution, allowing pharmaceutical companies to focus on research and innovation.

- Thermo Fisher Scientific Inc. (July 2023) reported that a European biotech firm collaborated with a CRO employing a Functional Service Provider (FSP) model. This partnership streamlined resources across functions such as regulatory affairs, medical writing, and data management. As a result, the time-to-offer was reduced from over 50 days to just 36 days, enabling faster scaling and efficient resource allocation.

By leveraging CROs' global reach, pharmaceutical companies can enhance patient access, improve trial efficiency, and foster innovation. This collaboration accelerates the entry of new therapies into the market, creating a win-win scenario for all stakeholders.

Regional Insights

North America holds the largest revenue share in the global market for clinical trials, with 37.60% market share, driven by its advanced healthcare infrastructure, substantial investments in research and development, and the presence of major pharmaceutical and biotechnology companies. The region benefits from supportive regulatory frameworks, a diverse patient pool, and the widespread adoption of cutting-edge technologies for trial management. These factors establish North America as a global hub for innovative clinical research and accelerated drug development.

U.s. Clinical Trials Market Trends

- U.S. – The U.S. leads the market, supported by its robust healthcare infrastructure, high R&D investments, and numerous top pharmaceutical companies. With a large concentration of CROs offering trial management, regulatory support, and data analytics, the U.S. attracts domestic and global pharmaceutical firms. This well-established ecosystem streamlines clinical trial processes, enabling innovative drug development and maintaining the U.S.’s dominant position.

Asia-Pacific Clinical Trials Market Trends

The Asia-Pacific region is expected to exhibit the fastest CAGR during the forecast period, fueled by a burgeoning healthcare sector, increased investments in clinical research, and a growing patient population. Countries like China, Japan, and India play a pivotal role in improving regulatory environments and cost-effective operations, attracting global trials. Enhanced infrastructure and rising demand for innovative treatments further position Asia-Pacific as a key growth driver in the clinical trials industry.

- Japan: Japan’s clinical trials industry is witnessing rapid growth, driven by its aging population, advanced healthcare infrastructure, and strong focus on cutting-edge medical research. The country’s well-regulated clinical trial environment, combined with its extensive network of academic institutions and hospitals, makes it a leader in Asia for clinical research. Japan’s emphasis on oncology, regenerative medicine, and personalized treatments further enhances its role in the global market.

- China: China has emerged as a key player in the global market due to its large and diverse patient population, increasing demand for new therapies, and improving regulatory environment. The rapid expansion of healthcare infrastructure, along with government incentives to boost clinical research, has made China an appealing destination for clinical trials, particularly in oncology, cardiovascular diseases, and infectious diseases.

- India: India is one of the fastest-growing clinical trials market, driven by its diverse population, increasing healthcare awareness, and cost-effective trial execution. The country’s well-established medical infrastructure, with numerous hospitals and research institutions, supports the expansion of clinical trials. Government initiatives to simplify regulations and growing foreign investments in clinical research reinforce India’s role as an emerging market leader, despite challenges in regulatory processes.

- Australia: Australia’s clinical trials industry is characterized by its strong regulatory framework, high-quality healthcare system, and world-class research institutions. The country’s participation in global clinical trials, particularly in oncology, neurology, and immunology, is supported by its diverse patient population and access to advanced medical technology. Australia’s government offers significant incentives for research and clinical trials, further driving market growth.

Europe Clinical Trials Market Trends

- UK: The UK’s strong healthcare infrastructure, experienced research organizations, and robust regulatory frameworks drive its market. The National Health Service (NHS) offers a diverse patient pool, while government support for healthcare innovation and streamlined regulations enhance growth. Collaborations among academia, biotechnology, and pharmaceutical companies strengthen the UK’s position as a key player in developing cutting-edge treatments and therapies.

- Germany: Germany stands out in Europe’s market for clinical trials, supported by its advanced healthcare system, well-regulated research environment, and strong pharmaceutical industry. Its extensive network of hospitals and research centers facilitates trials in oncology, neurology, and cardiology. A highly skilled workforce and government focus on promoting innovation further bolsters Germany’s reputation as a prime destination for clinical research.

- France: France’s market thrives on its focus on oncology, immunology, and rare diseases. A strong healthcare system, diverse patient demographics, and numerous clinical trial centers drive growth. The country’s well-established regulatory framework and active participation in multinational research initiatives enhance its global standing. Moreover, government efforts to support R&D and streamline processes make France a key player in clinical research.

Phase Insights

The Phase III segment leads the global market, driven by its large-scale patient participation and pivotal role in confirming the safety and efficacy of new treatments. This phase generates comprehensive data required for regulatory approvals, making it critical for the success of drug development. The high costs and resources associated with Phase III trials further highlight their importance in ensuring therapeutic reliability and addressing public health needs effectively.

Therapeutic Area Insights

The oncology segment dominates the global clinical trials market, fueled by the increasing prevalence of cancer and the urgent need for innovative treatments. Significant investments in cancer research and drug development, coupled with advancements in targeted therapies and immuno-oncology, have accelerated clinical trials in this area. The high demand for effective cancer solutions reinforces the segment's dominance, highlighting its critical role in addressing a pressing global health challenge.

Study of Design Insights

The interventional segment leads the market due to its widespread adoption in evaluating treatment efficacy and safety under controlled conditions. These trials are essential for generating robust data required for regulatory approvals. Interventional studies’ structured approach ensures consistency, enabling researchers to assess the therapeutic impact more accurately. As a cornerstone of drug development, this segment drives innovation and enhances the credibility of new medical interventions.

Service Type Insights

Clinical trial data management services dominate the market, given their critical role in ensuring the accuracy, integrity, and security of clinical data. With trials becoming increasingly complex, effective data management streamlines operations, ensures compliance with regulatory standards, and provides real-time insights. By enabling efficient handling of vast datasets, these services support faster decision-making and enhance trial outcomes, making them indispensable in modern clinical research.

Company Market Share

Key players in the market are actively pursuing strategic collaborations, acquisitions, and partnerships to enhance their service offerings, expand their geographic presence, and strengthen their competitive position. Companies are leveraging partnerships with CROs, academic institutions, and biotechnology firms to streamline operations and accelerate drug development timelines.

Clinipace (caidya): An Emerging Provider in the Global Clinical Trials Market

Clinipace, now rebranded as Caidya, is an emerging leader in the clinical trials industry, recognized for its innovative approach to advancing next-generation therapies. The company is particularly known for its cutting-edge LAG-3 immunotherapies, targeting a novel checkpoint pathway to enhance immune response against cancer. This breakthrough positions Caidya as a key contributor to oncology research, especially in the rapidly evolving field of immuno-oncology.

List of Key and Emerging Players in Clinical Trials Market

- Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.)

- ICON plc

- Charles River Laboratories International, Inc.

- IQVIA

- SYNEOS HEALTH

- SGS SA

- PAREXEL International Corporation

- Wuxi AppTec, Inc

- Chiltern International Ltd (Laboratory Corporation of America)

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Clinipace (Caidya)

- Medpace

- Frontage Labs

Recent Developments

- January 2025 – The University of Chicago Medicine initiated a Phase 2 clinical trial to investigate the use of CAR T-cell therapy for autoimmune diseases, including systemic lupus erythematosus, inflammatory myositis, and systemic sclerosis. Initially approved by the FDA in 2017 for certain blood cancers, CAR T-cell therapy is now being explored for its potential in treating these chronic conditions.

Analyst Opinion

As per our analyst, the global market is witnessing strong growth, fueled by the increasing prevalence of chronic diseases, advancements in biotechnology, and the rising demand for personalized medicine and innovative therapies. The expansion of healthcare infrastructure in emerging markets, coupled with regulatory reforms designed to streamline trial processes, is further accelerating market development.

Moreover, the adoption of advanced technologies like AI and big data analytics is transforming the industry, boosting trial efficiency, cutting costs, and making clinical trials more scalable across the globe. However, challenges remain, particularly in patient recruitment and retention, with high dropout rates and limited access to diverse patient populations impacting trial timelines and increasing costs.

Regulatory differences across regions also pose significant hurdles, requiring companies to navigate complex compliance landscapes. Overcoming these challenges is essential to sustain the market’s growth and success.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 76.70 Billion |

| Market Size in 2025 | USD 80.71 Billion |

| Market Size in 2033 | USD 132.05 Billion |

| CAGR | 6.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Phase, By Therapeutic Area, By Study of Design, By Service Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Clinical Trials Market Segments

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Area

- Infectious Diseases

- Pain Management

- Oncology

- CNS Condition

- Metabolic

- Cardiovascular

- Others

By Study of Design

- Interventional

- Observational

- Expanded Access

By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Clinical Trial Data Management Services

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.