Contraband Detector Market Size, Share & Trends Analysis Report By Type (Intrusive Methods, Non-Intrusive Techniques, X-ray Scanners, Metal Detectors, Body Scanners, Thermal Imaging Cameras, Chemical Detection Systems, Electronic Noses, Radiation Detectors), By Deployment Mode (Fixed Systems, Mobile Systems), By Application (Airports and Transportation Hubs, Customs and Border Security, Prisons and Correctional Facilities, Law Enforcement and Defense, Public Venues and Events, Commercial and Industrial Premises) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Contraband Detector Market Overview

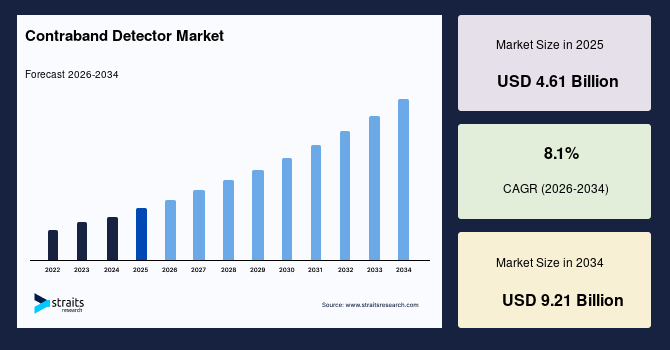

The global contraband detector market size is valued at USD 4.61 billion in 2025 and is estimated to reach USD 9.21 billion by 2034, growing at a CAGR of 8.1% during the forecast period. Consistent growth of the market is supported by the increasing adoption of advanced contraband detection technologies, which allow rapid and accurate identification of prohibited items, enhance security efficiency, and encourage governments and enterprises to invest proactively in modern surveillance solutions.

Key Market Trends & Insights

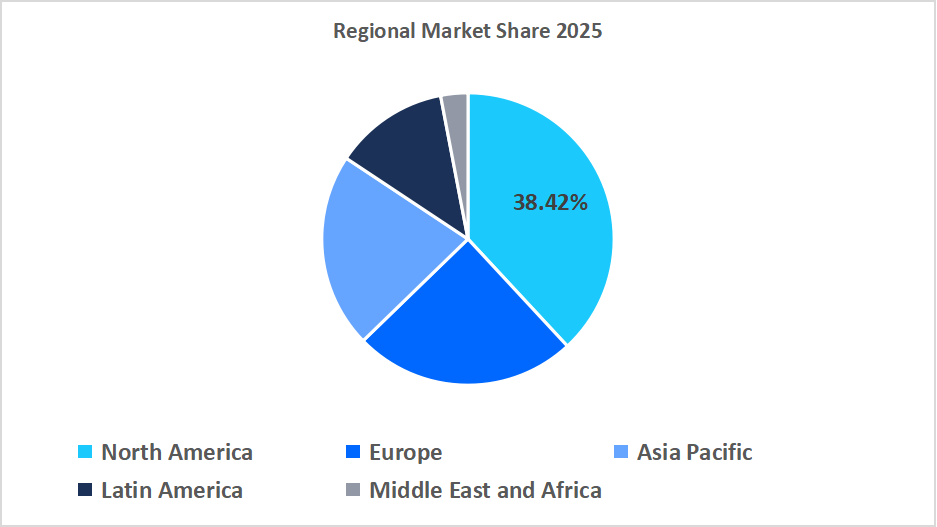

- North America dominated the market with a revenue share of 38.42% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 9.05% during the forecast period.

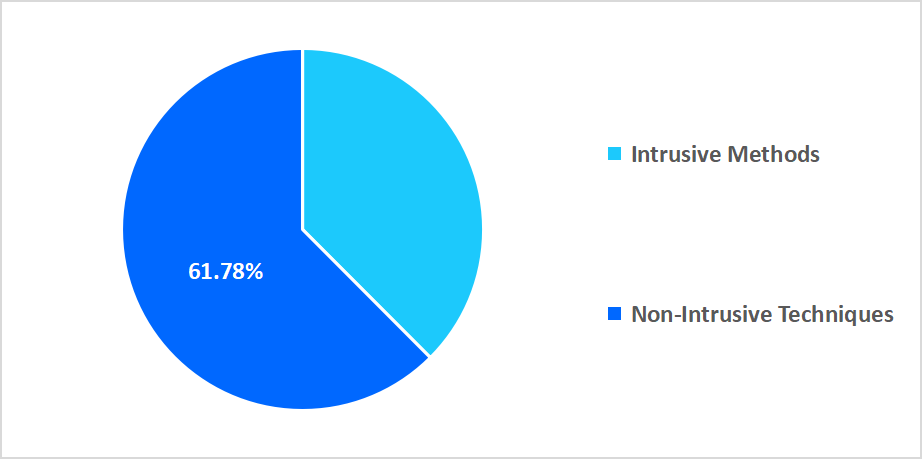

- Based on type, the non-intrusive techniques segment held the highest market share of 61.78% in 2025.

- By deployment mode, the mobile systems segment is estimated to register the fastest CAGR growth of 9.72%.

- Based on application, the airports and transportation hubs segment dominated the market in 2025.

- Based on the type of non-intrusive technique, the X-ray scanners segment is projected to register the fastest CAGR during the forecast period.

- US dominates the contraband detector market, valued at USD 1.75 billion in 2024 and reaching USD 1.88 billion in 2025.

Table: U.S Contraband Detector Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 4.61 billion

- 2034 Projected Market Size: USD 9.21 billion

- CAGR (2026-2034): 8.1%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market encompasses a wide range of security screening solutions, including X-ray scanners, metal detectors, body scanners, thermal imaging cameras, chemical detection systems, electronic noses, and radiation detectors. These systems are deployed through various modes such as fixed installations and portable/mobile units. Furthermore, contraband detection solutions are provided by diverse organizations, including government security agencies, private security companies, commercial enterprises, airports, and transportation hubs, addressing the safety and security requirements of public and private venues through integrated, technology-driven solutions across global markets.

Latest Market Trends

Implementation of AI-Augmented Screening Systems

The contraband detector market is experiencing a rapid shift toward AI-driven screening systems that allow for automated threat scanning and predictive analysis. The next-generation systems scan advanced patterns of X-ray and chemical sensor inputs, allowing security authorities to focus on high-risk offenders and reduce false alarms. Government agencies such as the U.S. Transportation Security Administration (TSA) and the European Union Aviation Safety Agency (EASA) have also introduced AI-based protocols for strengthening security at airports and borders. Introducing such applications has highlighted operational efficiency, reduced inspection time, and increased detection rates.

Ongoing software upgrades and machine learning are accelerating adaptive threat detection, which gets better as it upgrades with continuous operation data. Use of AI-based technology is on the rise in ports, rail systems, and public spaces to facilitate quicker processing with the guarantee of strict national security standards compliance. Quantitative system throughput and accuracy analysis are employed in procurement and deployment. The trend forms part of a larger move toward increasingly technology-enabled intelligent security infrastructure.

Public-Private Security Partnerships Expanding

Public-private partnership contraband detection is growing around the world based on a shared aim to enhance international security as well as maximize investment in costly detection equipment. Governments are contracting with private security and technology firms to introduce advanced screening technology into airports, seaports, prisons, and large public event venues. Regulatory agencies, the U.S. Department of Homeland Security (DHS) ,and the Ministry of Home Affairs, India, are facilitating collaborative efforts with grants, subsidies, and equipment certification specifications. Cooperative efforts enable the swift deployment of state-of-the-art sensors, in-service orientation, and command-center surveillance. Operational data of joint programs indicate improved detection and lower operational costs with potential for scalability. Standardized procurement mechanisms and shared analytics platforms enable coordination of public security goals with commercial techno capability. The trend indicates increased cooperation between government agencies and private industry to provide security coverage effectively.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.61 Billion |

| Estimated 2026 Value | USD 4.98 Billion |

| Projected 2034 Value | USD 9.21 Billion |

| CAGR (2026-2034) | 8.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Smiths Detection Group Ltd, Rapiscan Systems, L3Harris Technologies, Leidos Holdings, Analogic Corporation |

to learn more about this report Download Free Sample Report

Contraband Detector Market Driver

Increased Investments in National Border Security Infrastructure

Modernization of border security programs is becoming a strong driver of growth in the global market. Governments are focusing on the use of cutting-edge detection systems to counter growing smuggling operations involving weapons, narcotics, and counterfeit products. North American, European, and Asian-Pacific countries are boosting budget spends on border control initiatives. In accordance with the U.S. Customs and Border Protection, federal expenditures for security infrastructure enhancements were well over USD 25 billion in 2024, many of which were invested in new inspection systems and non-intrusive detection technologies.

The European Border and Coast Guard Agency also initiated similar efforts to improve real-time cargo scanning and passenger screening. Such an increasing investment scenario is facilitating the acquisition of next-gen detectors with automated scanning, high-resolution imaging, and multi-threat analysis capabilities. Increasing border security infrastructures are directly influencing the need for scalable and interoperable contraband detection systems across the world.

Market Restraint

Strict Regulatory Approval and Lengthy Certification Times

The key restraint in the global market is the very strict regulatory clearance process before deployment, which retards technology growth and adoption. Enhanced detection systems must adhere to numerous national and international standards for radiation safety, data protection, and security processes. In ICAO, certification cycles for new screening gear can exceed 18 months, involving rigorous technical verification and multi-stage field tests. Delays are then compounded across different countries by disparate regional needs, requiring separate clearances from disparate agencies.

The World Customs Organization (WCO) has reported that incoherent border regulatory regimes are still a major impediment to the quick installation of security screening technology. This incoherent regulatory regime inhibits market penetration, deters small vendors from engaging in the business, and induces procurement backlogs for public security institutions. Therefore, regulatory impediments still constrain the rapid expansion of illicit goods detection technologies worldwide.

Market Opportunity

Maritime Security Frameworks Enhanced

The heightened focus on improving maritime security is creating new opportunities for growth in the global market. Coastal and port agencies are using more advanced detection systems to suppress illicit trade, human smuggling, and unauthorized carriage of cargo. Australia's Border Force (ABF) has strengthened its maritime surveillance programs with investment in high-scanning and detection capability systems at major ports and shipping lanes. These initiatives aim to increase cargo screening capability with a focus on maintaining global maritime safety standards.

The agency screened over 20,000 high-risk shipments of cargo in 2024, which reflects increased enforcement capability, according to ABF reports This strategic focus on port security upgrading is creating new prospects for technology vendors to partner with government entities and logistics players. Improved maritime structures will be anticipated to fuel long-term demand for adaptable, interoperable contraband detection platforms designed specifically for coastal and offshore applications.

Regional Analysis

North America was at the forefront in 2025 with a market share of 38.42%. This is attributed to well-developed security infrastructure, open regulatory systems, and high government expenditure on sophisticated screening technology. The U.S. Transportation Security Administration (TSA) and the Canadian Air Transport Security Authority (CATSA) impose strict demands on airports, seaports, and borders, mandating the installation of the most modern contraband screening devices. Collaborative pilot programs and research studies comparing next-generation scanning and chem detection technology pushed forward implementation, and compliant performance and reporting standards provide stakeholders with assurance of operation. These drivers stimulate each other's large-scale deployment of contraband detection technology throughout North America.

Increased priority on aviation and border modernization drives growth in the US. contraband detector market. More than 20,000 risk-shipped shipments were screened in 2024 by the United States Customs and Border Protection (CBP) using state-of-the-art X-ray, radiation, and chemical detection technologies to significantly improve threat interception rates. The U.S. Department of Homeland Security (DHS) is still making substantial investments in major technology upgrades in major airports and ports of entry along the borders, supporting national security and operational efficiency. These strong regulatory mandates and government-backed initiatives are driving adoption, and they have made the U.S. the largest North American regional market.

Asia Pacific Market Insights

Asia Pacific is becoming the region that is growing at the fastest rate with a CAGR of 9.05% during 2026–2034, powered by growing cross-border trade, expansion of air transport networks, and investment in public security infrastructure. China, India, Japan, and South Korea are all heavily investing in non-intrusive screening solutions and portable detection systems to enhance airports, seaports, and correctional facilities. Government policies initiating national security modernization, as well as the expansion in the presence of private sector security technology providers, are propelling market adoption throughout the region.

The India contraband detector market is growing swiftly through government programs and wide-scale deployment of security solutions across airports, railways, and public places. The Bureau of Civil Aviation Security (BCAS) has enforced rigorous inspection requirements, requiring advanced scanning systems in all international airports. Projects encompassing mobile detection units for festivals and public events are also fueling demand. Moreover, partnerships with private technology suppliers and overseas agencies are allowing greater access to advanced contraband detection systems, making India a vital growth center in the Asia Pacific.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is experiencing consistent expansion in contraband detector market demand as a result of heightened border security requirements, more sophisticated screening procedures, and growing investments in next-generation surveillance technologies. Frontex, the European Border and Coast Guard Agency, continues to support improved performance through the use of non-intrusive inspection technology coupled with more sophisticated detection systems at major checkpoints to enable faster screening without disrupting trade and passenger traffic. Second, collaboration between security agencies within the nation and the European Commission is raising interoperability levels and data exchange as well as driving the roll-out of contraband detection technology in the region at a higher rate.

The growth in the U.K. contraband detector market is fueled by the strict enforcement of customs measures and persistent security infrastructure upgradation at airports, ports, and prisons. As per Her Majesty's Revenue and Customs (HMRC), major investments are being placed in high-resolution X-ray scanners and chemical trace detection units to enhance the detection of contraband, drugs, and dangerous chemicals. The Home Office has also provided more funds for portable detection units for supporting quick response operations. These government-funded programs and security upgradation initiatives are boosting national border protection and catalyzing the growth of the market throughout the U.K.

Latin America Market Insights

Latin America's contraband detector market is growing steadily, boosted by tougher customs controls and increased deployment of inspection systems at key high-traffic border crossings. Brazil, Mexico, and Argentina are among nations focusing on security modernization through non-intrusive cargo screening and radiation detection technology to reduce smuggling activity and improve public security. Regional customs authorities' joint programs with international security agencies are boosting adoption, especially in trade and transportation centers.

The Brazil contraband detector market is increasing on account of government sponsored programs to upgrade the security level in ports and airports. High-technology scanners have been installed by RFB in major maritime ports to boost the pace of screening cargo. Mobile X-ray and trace detection units are also utilized by national security agencies to support operations in rural areas, increasing the overall inspection rate and maintaining steady growth in the market.

Middle East and Africa Market Insights

The Middle East and Africa contraband detector market is growing as governments increase anti smuggling drives and invest in advanced detection capabilities in order to secure national borders and strategic assets. Spending on security within airports and seaports, as well as evolving regulatory regimes, is driving penetration across the region.

Egypt Market: Egypt's contraband detector market is growing significantly with government-sparked programs of modernization. Egyptian Customs has installed computerized scanning and surveillance systems at key points of entry and shipping terminals to improve the effectiveness of illegal commodity and contraband detection. Additionally, international cooperation programs are providing technical support and funding for institution development, thus supplementing Egypt's inspection capabilities and supporting sustainable market growth.

Type Insights

The non-intrusive methods segment dominated the market with a 61.78% revenue share in 2025. The growth is contributed primarily by the increased use of advanced security screening technology at airports, seaports, and high-risk checkpoints. Non-intrusive technologies such as X-ray scanners, body scanners, and chemical detection units enable rapid and accurate identification of hidden contraband without direct contact, enhancing the efficiency of operations and customer satisfaction. The trend towards less invasive but highly precise detection products continues to solidify this segment's market leadership.

The X-ray scanners market is anticipated to share the highest growth, with a projected CAGR of around 9.84% during the forecast period. The strong growth is induced by heightened government spending on aviation and border security enhancement, coupled with stricter regulatory requirements for enhanced inspection solutions. X-ray scanners offer high-resolution images and fast throughput rates, which make them the best solution for bulk security operations across transportation terminals, defense establishments, and border crossing checkpoints.

By Type Market Share (%), 2025

Source: Straits Research

Deployment Mode Insights

The mobile systems segment is anticipated to have the highest CAGR growth of 9.72% throughout the forecasting period. This growth comes as a result of augmented use of mobile security checkpoints in major public events, transportation nodes, and border regions. Portable detectors are highly flexible with quick setup and efficient coverage in places where it is not possible to install fixed infrastructure. Their capacity to augment emergency response operations and transient security arrangements is driving their uptake globally, thus facilitating segment growth.

The fixed systems segment accounted for the dominating market share of 58.34% in 2025, owing to their extensive integration within essential infrastructures like airports, seaports, prisons, and customs crossing points. These systems offer continuous, high-throughput screening capabilities with sophisticated imaging and detection precision. Being permanently installed facilitates unobstructed monitoring, reduced maintenance downtime, and tighter conformity with global security standards, supporting their leading market position.

Application Insights

The airports and transportation segment will have the highest CAGR of 9.05% during the forecast period, driven by international passenger traffic growth and improved global aviation security standards. With drug trafficking and smuggling becoming ever-growing concerns for governments, airports are spending on advanced non-intrusive contraband detection systems to beef up checkpoint security. Along with this, increasing global trade and tourism are forcing airport authorities to expand scanning capacity and operational effectiveness, thereby fueling demand for advanced detection technologies in this sector.

Competitive Landscape

The global market is fragmented with various well-established security technology vendors and niche detection solution firms. A limited number of major players enjoy high market shares by having extensive product portfolios, sophisticated screening technologies, and collaborative partnerships with government organizations.

The key players in the market are Smiths Detection Group Ltd, Leidos Holdings, Rapiscan System,s and others. These entities are vying aggressively to enhance their position in the market through product innovation, strategic alliances, and acquisitions, with an objective of increasing their international presence and building up their technical prowess.

ScanTech AI Systems: An emerging market player

ScanTech AI Systems, a US security technology company, is making inroads in the contraband detector market with its next-generation fixed-gantry CT scanners and AI-based detection software.

- In February 2025, ScanTech collaborated with the Virginia Department of Corrections (VADOC) to pilot its Sentinel CT scanner for mail screening within corrections facilities, allowing for automated contraband detection in prisoner mail.

As such, ScanTech became a significant contraband detector market player through the use of domain-specific product releases and government pilot take-up to establish legitimacy and increase its global footprint.

List of Key and Emerging Players in Contraband Detector Market

- Smiths Detection Group Ltd

- Rapiscan Systems

- L3Harris Technologies

- Leidos Holdings

- Analogic Corporation

- Thermo Fisher Scientific

- Nuctech Company Limited

- Astrophysics Inc.

- CEIA S.p.A.

- Morpho Detection (OT-Morpho)

- SGS S.A.

- OSI Systems, Inc.

- Honeywell International

- Daon Global

- Garrett Metal Detectors

- Serco Group plc

- Rohde & Schwarz GmbH & Co. KG

- ZKTECO

- Evolv Technology

- Dynascan Technology

Strategic Initiatives

- May 2025: Smiths Detection delivered and installed four HCVM™ XL mobile scanners to the Customs and Excise Division (CED) of Trinidad & Tobago to bolster border screening capabilities.

- January 2025: CEIA introduced its HI-PE Plus upgrade series, a new generation of walk-through metal detectors designed to detect concealed contraband

- January 2025: Leidos secured a multi-year contract from the Transportation Security Administration (TSA) to supply and support its next-generation CT scanners for enhanced threat detection at U.S. airport checkpoints.

- July 2024: Liberty Defense won a contract from the Texas Department of Criminal Justice for the deployment of 20 HEXWAVE units at correctional facility entrances to enhance contraband screening.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.61 Billion |

| Market Size in 2026 | USD 4.98 Billion |

| Market Size in 2034 | USD 9.21 Billion |

| CAGR | 8.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Deployment Mode, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Contraband Detector Market Segments

By Type

- Intrusive Methods

- Non-Intrusive Techniques

- X-ray Scanners

- Metal Detectors

- Body Scanners

- Thermal Imaging Cameras

- Chemical Detection Systems

- Electronic Noses

- Radiation Detectors

By Deployment Mode

- Fixed Systems

- Mobile Systems

By Application

- Airports and Transportation Hubs

- Customs and Border Security

- Prisons and Correctional Facilities

- Law Enforcement and Defense

- Public Venues and Events

- Commercial and Industrial Premises

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.