Cosmetic Packaging Market Size, Share & Trends Analysis Report By Material Type (Plastic, Metal, Glass, Paper, Others), By Cosmetic Type (Skincare, Haircare, Nailcare, Make-up), By Packaging Type (Tubes, Bottles, Pumps & Dispensers, Jars & Containers, Sachets & Stick Packs, Aerosol Cans, Blisters, Folding Cartons, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Cosmetic Packaging Market Size

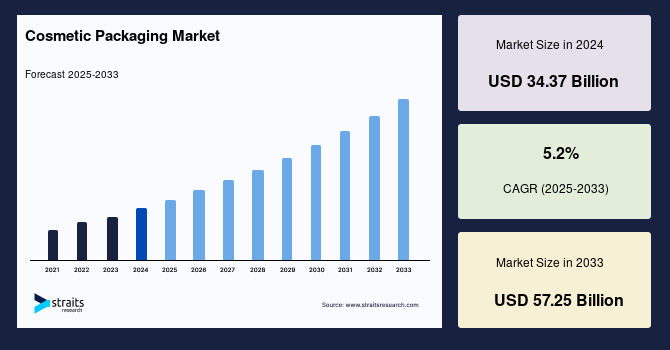

The global cosmetic packaging market size was valued at USD 34.37 billion in 2024 and is projected to grow from USD 38.0 billion in 2025 to USD 57.25 billion in 2033, exhibiting a CAGR of 5.2% during the forecast period (2025-2033).

The global market involves developing and distributing containers, dispensers, and materials used for beauty and personal care products. This includes bottles, jars, tubes, pumps, and compacts for skincare, haircare, fragrance, and makeup. Market growth is driven by increasing demand for premium, eco-friendly, and innovative packaging solutions that enhance product appeal and sustainability. Key trends include the rise of refillable and recyclable materials, digital printing, and minimalist aesthetics.

The global market is driven by increasing demand among rising youth populations and changing grooming behaviors among men and women. With the advent and emerging penetration of improved Internet connectivity, borderlines have been broken through e-commerce, which suffered growth towards a more significant demand for feasible packaging systems. It has also been a factor in the rate at which one will be expanding the markets - changing perceptions and awareness toward the environment now that people consider eco-friendly or sustainable packaging. Emerging economies with improved living standards and changing lifestyles also open doors toward more growth opportunities.

Current Market Trends

Rise of Eco-Friendly and Sustainable Packaging

Environmental awareness among consumers has compelled cosmetic brands to implement environment-friendly and sustainable packaging solutions. Using recyclable, reusable, and biodegradable materials like paper, bamboo, glass, and bioplastics replaces conventional plastic packaging. Regulatory pressures from governments worldwide are intensifying, pushing companies to accelerate their transition toward green packaging. Brand commitments to sustainability goals, like carbon neutrality and zero-waste initiatives, further accelerate this trend.

-

For instance, in January 2025, L’Oréal announced the expansion of its "Eco-Design Packaging Lab" to fast-track sustainable packaging across its brands. Garnier introduced fully recyclable shampoo pouches under this initiative in select European markets.

-

Similarly, Estée Lauder, as of late 2024, reported that 56% of its packaging is now recyclable, reusable, or refillable, and plans to launch a refillable fragrance station pilot program in North America by mid-2025.

Companies are investing in innovative packaging design that utilizes sustainable materials and maintains high aesthetic appeal, ensuring brand loyalty, differentiation, and alignment with evolving consumer values.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 34.37 Billion |

| Estimated 2025 Value | USD 38.0 Billion |

| Projected 2033 Value | USD 57.25 Billion |

| CAGR (2025-2033) | 5.2% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | AptarGroup Inc., Amcor Group GmbH, Albea SA, Altium Packaging Loews Corporation, HCP Packaging Co. Ltd |

to learn more about this report Download Free Sample Report

Cosmetic Packaging Market Growth Factors

Growing E-Commerce and Online Retailing

The explosive growth of e-commerce and online beauty retail has significantly impacted the cosmetic packaging market. Packaging becomes consumers' first tangible interaction with a product in the digital space, elevating its importance. Durable yet visually appealing packaging that protects products during long-distance shipping is critical. Furthermore, unboxing videos, influencer marketing, and social sharing have turned packaging into a content tool, prompting companies to create Instagram-worthy and photogenic designs.

-

For example, in August 2024, Glossier revamped its packaging with reusable pouches and introduced “low-impact” shipping kits with reduced carbon footprints, resonating with digital-first consumers.

As online beauty sales rise, particularly among Gen Z and Millennial consumers, packaging innovation becomes essential in influencing click-to-cart behavior and reducing product returns.

Restraining Factors

Regulatory Restrictions on Plastic Packaging

The increasing stringency of global regulations concerning plastic use is a significant restraint in the cosmetic packaging industry. Governments across Europe, North America, and Asia are implementing strict legislation to reduce single-use plastics and mandating extended producer responsibility (EPR). Such rules force companies to redesign packaging strategies to meet compliance, often involving higher production costs and longer R&D cycles. These shifts can be particularly challenging for small and mid-sized cosmetic firms with the budget to adapt to regulatory changes rapidly.

For example, the EU’s Single-Use Plastics Directive and similar bans in India, Canada, and parts of the U.S. have already compelled cosmetic companies to phase out specific plastic components. The shift requires investment in alternative materials and the re-evaluation of supply chain logistics, often slowing down the speed to market and raising cost barriers.

Market Opportunity

Emerging Markets with Growing Disposable Incomes

Emerging markets across Asia-Pacific, Latin America, Africa, and the Middle East present significant growth potential for cosmetic packaging companies. With rising urbanization, improved standards of living, and increased awareness of personal grooming, consumers in these regions are adopting sophisticated beauty regimens. This, in turn, drives demand for mass-market and premium cosmetic packaging. Local customization, such as packaging suited to hot climates or culturally preferred designs, also unlocks further opportunities.

-

For instance, in November 2024, Elf Beauty announced a collaboration with Dollar General to expand into rural areas, aiming to reach lower-income customers and broaden their market presence.

India and China are witnessing a boom in e-commerce beauty sales, encouraging companies to localize their packaging strategies to cater to regional tastes. Similarly, Latin American countries are seeing a surge in men’s grooming and personal care, opening new avenues for gender-neutral and male-specific packaging formats that reflect shifting cultural norms.

Regional Insights

Asia-Pacific: Dominant Region with 43.2% Market Share

Asia-Pacific emerged as the largest regional market in 2024, commanding a 43.2% global cosmetic packaging market share. Rapid urbanization, rising disposable incomes, growing beauty consciousness, and expanding domestic and international cosmetic brands have fueled this growth. Countries like China, Japan, South Korea, and India are the key growth engines. China is leading the charge due to its advanced manufacturing infrastructure, consumer demand, and technological innovation in smart packaging and refillable solutions.

Consumers in this region increasingly gravitate toward skincare and beauty routines, influenced by K-beauty and J-beauty trends, which emphasize multi-step regimens and functional packaging. Refillable pouches, airless bottles, and hybrid cosmetic-packaging innovations are highly favored. Moreover, the shift toward sustainable and eco-conscious products particularly among younger consumers is driving the adoption of biodegradable plastics, glass, and paper-based packaging formats.

Europe: Fastest-Growing Region with the Highest Market Cagr

Europe is experiencing rapid growth in the cosmetic packaging sector, with the highest forecasted CAGR among all regions. The region is characterized by a strong demand for natural, organic, and ethically sourced beauty products trends directly influencing packaging innovations. European consumers are discerning, demanding packaging that combines luxury, functionality, and sustainability. Countries like Germany, France, and the UK lead packaging design, incorporating glass, aluminum, and compostable materials into high-end product lines.

Regulations such as the EU Plastics Strategy and Single-Use Plastics Directive push brands to adopt recyclable, reusable, and minimalistic packaging formats. The UK's booming e-commerce and subscription box culture has created a demand for customized, lightweight, and eco-friendly cosmetic packaging. As innovation continues to rise, Europe stands poised to be a leader in next-generation cosmetic packaging.

Country Insights

Emerging markets, particularly in Asia-Pacific and Latin America, are significantly contributing to the growth of the cosmetic packaging industry. Countries like China, India, and Brazil are witnessing a surge in demand for cosmetics, propelled by rising disposable incomes, increasing urbanization, and the growing influence of global beauty trends. These markets are moving toward premiumization and sustainability, presenting immense opportunities for innovative and eco-conscious packaging manufacturers.

- United States: The U.S. remains a global leader, with a mature beauty industry and high consumer demand for premium, functional, and sustainable packaging. Major brands are adopting recyclable, refillable, and minimalist designs to align with consumer values. Innovations such as airless pumps and biodegradable containers are reshaping packaging standards.

- Canada: Driven by green consumerism and regulatory pressures, Canada’s cosmetic packaging industry is expanding steadily. Brands increasingly turn to plant-based plastics, paper-based materials, and zero-waste packaging models to meet environmental goals and consumer expectations.

- Japan: Japan’s packaging market reflects a unique blend of aesthetics, compactness, and functionality. The cultural appreciation for elegant design drives demand for minimalist yet high-end packaging. The popularity of luxury skincare is spurring innovation in refined, premium materials, including glass and ceramic containers.

- India: India’s fast-growing middle class is fueling demand for affordable yet visually appealing packaging. Brands are responding with vibrant, travel-friendly, and eco-friendly packaging solutions. As sustainability awareness grows, biodegradable and refillable packaging is gaining popularity, especially among urban youth.

- China: China’s cosmetic packaging market is surging due to a booming e-commerce sector and increasing demand for visually striking and high-performance packaging. The rising influence of sustainability has led brands to introduce recyclable plastics, refill pods, and smart packaging technologies, especially for skincare and color cosmetics.

- United Kingdom: The UK market is highly influenced by eco-conscious consumers and government initiatives targeting single-use plastics. This has accelerated the shift toward biodegradable, compostable, and reusable packaging. The trend of “naked” packaging and refill stations in retail is growing among ethical beauty brands.

- Germany: Germany stands out for its commitment to green innovation in packaging. With stringent environmental regulations and a strong consumer base that values sustainability, the market favors recyclable glass, aluminum, and bio-based polymers. German consumers also appreciate functional, clean designs that reflect efficiency and quality.

- Brazil: Brazil’s vibrant beauty market embraces sustainable packaging, especially eco-conscious designs that reflect the country’s biodiversity. With increasing concern for environmental protection, brands are using natural materials, refillable bottles, and locally sourced packaging to appeal to green-minded consumers.

Cosmetic Packaging Market Segmentation Analysis

By Material Type

Plastic continues to dominate the cosmetic packaging market, contributing to 61.2% of the total revenue share in 2024. Its dominance is attributed to its flexibility, lightweight, cost-effectiveness, and adaptability across various packaging formats such as bottles, tubes, jars, and dispensers. Plastic materials allow for mass-market and premium branding because they can easily be molded into custom shapes, textures, and finishes. Furthermore, the industry is actively transitioning towards more eco-conscious plastic alternatives, including bioplastics, post-consumer recycled (PCR) plastics, and compostable variants.

By Cosmetic Type

The skincare segment commands the highest market share in the cosmetic packaging industry, driven by consumers’ increasing prioritization of skin health, anti-aging treatments, hydration solutions, and sun protection. The growing trend toward preventive skincare, daily routines, and wellness-centric beauty has increased demand for functional and premium packaging that ensures product integrity and enhances user experience. Moreover, the demand for sustainable skincare packaging is surging, with brands offering recyclable, refillable, and biodegradable options to align with conscious consumerism.

By Packaging Type

Bottles have emerged as the most preferred packaging format in the cosmetic industry due to their durability, versatility, and suitability for liquid and semi-liquid formulations. From cleansers and serums to lotions and hair oils, bottles offer a secure and hygienic dispensing method that consumers trust. They are available in various materials, including glass, PET, HDPE, and increasingly sustainable options like biodegradable plastics and refillable glass. Their customizable shapes and surface treatments matte finishes, embossed logos, and frosted glass help brands create a unique shelf presence and convey luxury or natural brand identities.

Company Market Share

Cosmetic packaging has become much more competitive, with its leading brands claiming a massive market share. Some of the biggest brands monopolize the industry because of wider portfolios with broader distribution and, most importantly, a strong focus on sustainability. They invest heavily in innovations to build up ecologically appealing and eye-catching packaging to fulfill the ever-changing interests of consumers in the modern-day world.

EcoPack Solutions: An emerging player in the market

EcoPack Solutions promotes the cause for sustainable packaging to various advertising companies. EcoPack Solutions works with biodegradable plastics and glass-like alternatives, propelling the green benefits of the products while continuing to deliver their integrity. Such innovations become attractive to eco-conscious brands from the beauty industry.

List of Key and Emerging Players in Cosmetic Packaging Market

- AptarGroup Inc.

- Amcor Group GmbH

- Albea SA

- Altium Packaging Loews Corporation

- HCP Packaging Co. Ltd

- RPC Group PLC

- Berry Global Group

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Libo Cosmetics Company Ltd

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corporation

- Gerresheimer AG

- Raepak Ltd

- Ball Corporation

- Verescence France

- SKS Bottle & Packaging Inc.

to learn more about this report Download Market Share

Recent Developments

- November 2024- Amcor plc and Berry Global Group, Inc. (“Berry”) announced they entered a definitive merger agreement, under which Amcor and Berry will combine in an all-stock transaction.

- May 2024- Cosmopak, a prominent manufacturer in the beauty industry, introduced its new "Waves of Beauty" collection. This collection incorporates creative and eco-friendly packaging options and accessories. Cosmopak aims to captivate and inspire its clientele through this latest offering, highlighting the latest trends and the breadth of its manufacturing capabilities.

Analyst Opinion

As per our analyst, the global cosmetic packaging market is transforming profoundly and is shaped by shifting consumer preferences and environmental imperatives. A major driver is the increasing demand for sustainable and premium packaging, with brands striving to reduce their ecological footprint through recyclable, biodegradable, and refillable solutions. Emerging markets such as India, China, and Brazil are witnessing exponential growth due to rising disposable incomes, urbanization, and a growing appetite for personal care products.

Meanwhile, mature markets like the U.S., Germany, and the UK are prioritizing sustainability and innovation, catalyzed by both government regulations and consumer activism. The rise of e-commerce and social media influence has further accelerated the need for attractive, functional packaging that enhances brand identity and product experience. Packaging is no longer just a container but a strategic tool for differentiation, sustainability, and consumer engagement, making it a critical focus area for cosmetic brands worldwide.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 34.37 Billion |

| Market Size in 2025 | USD 38.0 Billion |

| Market Size in 2033 | USD 57.25 Billion |

| CAGR | 5.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material Type, By Cosmetic Type, By Packaging Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cosmetic Packaging Market Segments

By Material Type

- Plastic

- Metal

- Glass

- Paper

- Others

By Cosmetic Type

- Skincare

- Haircare

- Nailcare

- Make-up

By Packaging Type

- Tubes

- Bottles

- Pumps & Dispensers

- Jars & Containers

- Sachets & Stick Packs

- Aerosol Cans

- Blisters

- Folding Cartons

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.