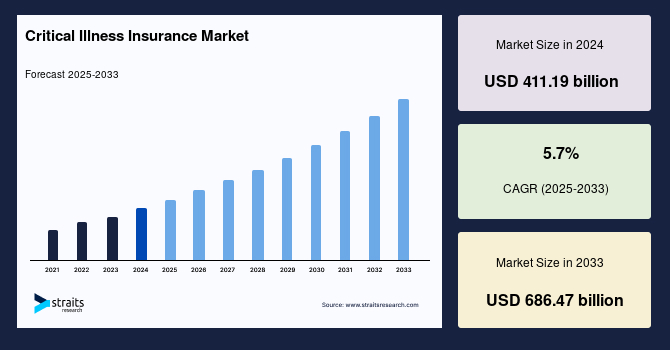

Critical Illness Insurance Market Size, Share & Trends Analysis Report By Premium Type (Monthly, Quarterly, Half Yearly, Yearly), By Disease (Cancer, Heart Attack, Stroke, Organ Transplant, Others), By Type (Individual Insurance, Family Insurance) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Critical Illness Insurance Market Size

The global critical illness insurance market size was valued at USD 411.19 billion in 2024 and is projected to grow from USD 441.78 billion in 2025 to reach USD 686.47 billion by 2033, exhibiting a CAGR of 5.7% during the forecast period (2025-2033).

The global market is experiencing rapid growth, driven by the rising prevalence of chronic diseases, increasing healthcare expenditures, and a growing awareness of financial risk management. Critical illness insurance provides a lump-sum payment upon the diagnosis of serious illnesses such as cancer, heart attack, stroke, or organ failure. This payout helps policyholders cover medical treatments, lost income, or other expenses during recovery.

The rise in lifestyle-related diseases, fueled by high-stress living, lack of physical activity, and unhealthy eating habits, has contributed to an increasing number of cases of heart disease, cancer, and stroke. As healthcare costs continue to rise, individuals are seeking protection beyond standard health insurance. Moreover, more employers are integrating serious disease insurance into their compensation packages, further driving market growth.

- For example, in October 2023, Premier Choice Group introduced value-driven critical illness insurance for its workforce, offering a tax-free lump sum upon diagnosis of designated illnesses. This initiative not only enhances employee retention and job satisfaction but also strengthens benefits packages as a whole.

The growing need for financial protection against major medical events, combined with the increasing adoption of serious disease insurance by employers, is expected to drive continued expansion in this market.

Critical Illness Insurance Market Trends

Rising Demand for Employer-Sponsored Critical Illness Insurance

Employer-sponsored critical illness insurance is becoming popular as firms see the necessity of offering economic protection to employees with serious medical conditions. Most firms today offer serious disease insurance as part of compensation packages to promote worker well-being, retention, and job satisfaction.

- For instance, in March 2024, MetLife figured in their 22nd Annual U.S. Employee Benefit Trends Study that employees absorbing the worth of their benefits and using them are almost 88% more likely to feel as though they are valued, which showcases the requirement for improved employer-sponsored benefits.

The increasing workplace stress and financial insecurity among employees have further driven the adoption of critical illness insurance as a key benefit, reinforcing its role in the overall market growth.

Integration of Telemedicine in Medical Insurance Plans

The incorporation of telemedicine into medical insurance is reshaping the critical illness insurance landscape. Telemedicine enables remote consultations, mental health support, preventive check-ups, and chronic disease management, making healthcare more accessible and proactive for policyholders.

- In October 2024, Care Health Insurance issued a comprehensive telemedicine health insurance guide outlining the addition of telemedicine services to health insurance policies. The action is reflective of the growing trend where telemedicine is being added by insurers to enhance convenience and accessibility for policyholders.

The integration of telemedicine not only strengthens the value proposition of serious disease insurance but also aligns with the increasing demand for digitalized healthcare services.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 411.19 Billion |

| Estimated 2025 Value | USD 441.78 Billion |

| Projected 2033 Value | USD 686.47 Billion |

| CAGR (2025-2033) | 5.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Allianz, China Life Insurance Company Limited, Aflac Incorporated, Prudential, American International Group, Inc. |

to learn more about this report Download Free Sample Report

Critical Illness Insurance Market Driving Factors

Increasing Prevalence of Critical Illnesses

The rising incidence of critical illnesses is driven by an aging population, a growing prevalence of chronic diseases such as cardiovascular conditions, cancer, and diabetes, and improved survival rates from acute illnesses. As more individuals live longer with serious health conditions, the demand for financial protection through serious disease insurance continues to rise.

- For instance, in September 2023, a population study published in the European Journal of Medical Research examined the burden of critical illnesses in Sweden's Sörmland County. The study reported a prevalence rate of 19.4 per 100,000 adults, with 10.5% of hospitalized patients classified as critically ill.

As the prevalence of life-threatening diseases continues to grow, so do healthcare expenditures, extended hospital stays, and financial burdens on patients. This, in turn, fuels the demand for critical illness insurance, driving market expansion.

Rising Demand for Multi-Claim Critical Illness Coverage

Multi-claim critical illness insurance policies allow policyholders to file multiple claims for different illnesses or recurring conditions within the same policy term. This feature provides long-term financial security and ensures continuous protection against severe health issues.

- In October 2024, Allianz Life Insurance Malaysia launched the Complimentary Multi-Claim Critical Illness (CI) Coverage, allowing policyholders to make multiple claims for various or recurring critical illnesses. The policy offers up to 320% of the insured value in cumulative claims, providing extended financial support.

Thus, the increasing prevalence of repeated severe illnesses and growing demand for longer-term coverage boost growth in the serious disease insurance sector by rendering policies broader and attractive to buyers.

Market Restraining Factors

High Premium Cost of Critical Illness Insurance

The high cost of critical illness insurance premiums makes it less accessible, particularly for middle- and low-income individuals. Compared to standard health insurance, serious disease coverage demands higher payments due to its lump-sum payout structure. Factors such as age, pre-existing conditions, and rising medical costs further drive up premiums, making it difficult for older adults to obtain coverage.

In developing markets, affordability remains a major challenge, leading consumers to opt for basic health insurance instead. Moreover, insurers must balance claim payouts and profitability, resulting in high premiums, lower market penetration, increased policy lapses, and a shift toward alternative coverage options.

Market Opportunity

Awareness towards Critical Illness Insurance

Awareness of critical illness insurance refers to the level of understanding individuals have regarding its coverage, benefits, and role in financial planning. As healthcare costs continue to rise, educating consumers about the importance of serious disease insurance presents a significant market opportunity for insurers.

- For instance, in November 2024, a study revealed that 71% of individuals now consider health insurance a necessity, a substantial shift influenced by the pandemic. This growing awareness creates an opportunity for insurers to emphasize the unique benefits of critical illness insurance, such as hospital-free lump-sum payouts that provide immediate financial relief during medical crises.

Thus, increasing awareness among policyholders about the necessity of serious disease insurance not only enhances consumer confidence but also fuels the overall market growth, offering insurers a valuable opportunity to expand their reach and influence.

Regional Insights

North America holds a dominant position in the global critical illness insurance market with 40.6% market share, driven by high healthcare spending, increasing prevalence of chronic diseases, and strong insurance penetration. The region benefits from a well-established medical infrastructure, heightened awareness of financial protection, and widespread employer-sponsored serious disease coverage. Moreover, the aging population and lifestyle-related health risks, such as heart disease and diabetes, are further fueling demand for serious disease insurance. The presence of major insurance providers and a supportive regulatory environment strengthens North America's leadership in the market, ensuring continued expansion.

U.s. Critical Illness Insurance Market Trends

- U.S.- The U.S. critical illness insurance market is leading, driven by high healthcare costs and rising chronic disease rates. In January 2023, the American Cancer Society projected 1.9 million new cancer diagnoses in the country. With increasing cancer mortality and associated medical expenses, financial protection is crucial, fueling demand for serious disease insurance. As healthcare costs continue to rise, more individuals seek coverage to safeguard their finances, significantly driving market expansion in the U.S.

Asia Pacific Critical Illness Insurance Market Trends

Asia-Pacific is expected to register the fastest CAGR due to several factors, including economic growth, rising healthcare awareness, and an increasing prevalence of critical illnesses such as cancer, stroke, and cardiovascular diseases. Urbanization and changing lifestyles have further escalated health risks, driving demand for serious disease coverage. Moreover, government initiatives supporting healthcare access, improvements in medical infrastructure, and greater insurance penetration are accelerating market growth.

- India– India’s critical illness insurance market is growing rapidly, fueled by an expanding healthcare system and government-led initiatives. According to the Ministry of Health and Family Welfare, 12.8% of the population is covered under state-sponsored insurance schemes, improving access to financial protection. With rising healthcare costs and increasing awareness of insurance benefits, more individuals are seeking coverage. These factors are collectively propelling India’s market, making it a key emerging player.

- China- China’s market is driven by its vast population, rising prevalence of critical diseases, and regulatory initiatives. For instance, in 2023, 11.56 million urban and rural dwellers in China benefited from critical illness insurance, saving them an average of CNY 7,924 ($1,117) per individual, as reported by the National Healthcare Security Administration. This indicates China's growing major disease insurance coverage, further propelling the market growth for serious disease insurance in the country.

Europe Critical Illness Insurance Market Trends

- Germany- Germany boasts one of Europe’s largest critical illness insurance markets, supported by extensive healthcare access and government policies. Its universal health coverage system insures 86% of residents under statutory health insurance (SHI), ensuring broad protection. This structured yet adaptable system enhances the need for supplementary coverage, boosting demand for serious disease insurance. With a well-established medical framework and increasing awareness of financial security, Germany continues to see significant market growth in this sector.

- France- France’s market for critical illness insurance is strengthened by its advanced healthcare system and a strong private insurance sector. The nation’s health insurance system covered 68.7 million people, with €185 billion in reimbursements. Around 35% of the population received coverage for critical illnesses or chronic conditions, with annual healthcare spending averaging €4,680/ person. This coverage framework significantly boosts demand for serious disease insurance, reinforcing market growth.

Premium Type Insights

The monthly premium segment holds the largest share in the market due to its affordability and flexibility. Many consumers, especially middle-income earners and young policyholders, prefer manageable monthly payments over a large upfront sum. This structure allows them to maintain financial stability while securing essential coverage. Moreover, insurers benefit from a steady revenue stream, while policyholders find monthly payments more accessible, ultimately driving market growth and expanding insurance adoption across diverse demographics.

Disease Insights

Cancer dominates the global market as it remains one of the most prevalent and costly diseases worldwide. Cancer treatment involves prolonged care, expensive therapies, and extended recovery periods, making insurance coverage essential to managing financial burdens. A 2024 report by the International Agency for Research on Cancer (IARC) and the American Cancer Society (ACS) revealed that global cancer cases surged to nearly 20 million in 2022, with a projected 77% rise by 2050. This escalating burden fuels the demand for serious disease insurance.

Type Insights

Individual critical illness insurance leads the market due to its personalized coverage, affordability, and flexibility. Unlike family policies, individual plans cater to specific health risks, allowing policyholders to tailor their coverage based on medical history and financial capacity. Increasing healthcare costs and growing awareness of personalized healthcare needs further drive demand for these policies. As more consumers prioritize financial security and specialized coverage, individual serious disease insurance continues to gain traction, reinforcing its dominance in the market.

Company Market Share

Key players in the critical illness insurance industry are actively adopting strategic business approaches to strengthen their market presence. These include forming strategic collaborations, securing product approvals, acquiring competitors, and launching innovative products. Companies are also investing in R&D to enhance their offerings, expanding their global reach through partnerships, and leveraging digital transformation to improve customer engagement.

Bajaj Allianz General Insurance: An Emerging Player in the Global Market

Bajaj Allianz General Insurance, a leading private insurance provider in India, is a joint venture between Bajaj Finserv Limited and Allianz SE. The company is known for its innovative policies, flexible and customizable insurance plans, and robust digital services. It offers seamless online policy management, AI-driven claim processing, and 24/7 customer support to enhance the user experience.

Recent developments by Bajaj Allianz General Insurance:

- Bajaj Allianz General Insurance launched Criti-Care (critical illness policy) that covers 43 afflictions in 5 specialized plans- Cancer Care, Cardiovascular Care, Kidney & Transplant Care, Neuro Care, and Sensory Organ Replacement. The policy offers sum insured options from 1 lakh to 50 lakh with a max coverage of 20 lakh.

List of Key and Emerging Players in Critical Illness Insurance Market

- Allianz

- China Life Insurance Company Limited

- Aflac Incorporated

- Prudential

- American International Group, Inc.

- American Fidelity Assurance Company

- Aviva India

- United HealthCare Services, Inc

- Aegon

- Bajaj Allianz Life Insurance Co. Ltd.

- Nassau Financial Group

- TATA AIG General Insurance Company Limited

- Sun Life Assurance Company of Canada

- Generali China Life Insurance Co., Ltd.

- AXA Hong Kong

to learn more about this report Download Market Share

Recent Developments

- February 2025 – Securian Financial launched accident and critical illness insurance products tailored for affinity organizations, including financial institutions and associations. These products provide lump-sum benefits to cover expenses not included in major health insurance, offering financial relief for accidents and serious illnesses like cancer, heart attacks, and strokes. The plans feature flexible underwriting and customizable options, helping organizations meet specific customer needs.

- August 2024 – Sun Life U.S. expanded its critical illness insurance coverage to include family planning services, behavioral health support, and broader health conditions. This enhancement aims to provide more comprehensive financial protection for policyholders, addressing evolving healthcare needs. The expansion reflects Sun Life’s commitment to adapting its insurance offerings to support individuals facing significant medical expenses.

Analyst Opinion

As per our analysts, the market is poised for steady growth, driven by rising healthcare costs, increasing cases of chronic diseases, and growing awareness of financial security. Emerging markets like India and China are witnessing higher adoption due to government initiatives and improving economic conditions.

Product innovations, such as personalized coverage and seamless online policy issuance, further enhance accessibility. Despite these opportunities, the global critical illness insurance market faces challenges, including high premium costs, regulatory complexities, and consumer skepticism about claim settlements.

However, insurers are addressing these issues through technology-driven solutions, policy flexibility, and enhanced transparency. As companies focus on product customization and digital advancements, the market is expected to expand significantly, meeting evolving consumer needs and reinforcing long-term growth.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 411.19 Billion |

| Market Size in 2025 | USD 441.78 Billion |

| Market Size in 2033 | USD 686.47 Billion |

| CAGR | 5.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Premium Type, By Disease, By Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Critical Illness Insurance Market Segments

By Premium Type

- Monthly

- Quarterly

- Half Yearly

- Yearly

By Disease

- Cancer

- Heart Attack

- Stroke

- Organ Transplant

- Others

By Type

- Individual Insurance

- Family Insurance

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.