Cruise Missile Market Size, Share & Trends Analysis Report By Missile Type (Land-Attack Cruise Missiles (LACM), Anti-Ship Cruise Missiles (ASCM), Air-Launched Cruise Missiles (ALCM)), By Component (Guidance Systems, Propulsion Systems, Warheads, Missile Airframe, Sensors & Seekers, Communication Systems), By Missile Speed (Subsonic (Below Mach 1), Supersonic (Mach 1 - 5), Hypersonic (Above Mach 5)), By Launch Platform (Airborne, Ground-Launched, Naval), By Missile Range (Short Range (Below 1000 km), Medium range (1000-3000 km), Long Range (Above 3000 km)), By Guidance Technologies (Autonomous, Real-Time Tracking, Swarm Intelligence), By Operational Mode (Pre-Programmed Targets, Dynamic Targeting/In-Flight Retargeting, Loitering /Patrolling (Time-Sensitive Strike)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Cruise Missile Market Overview

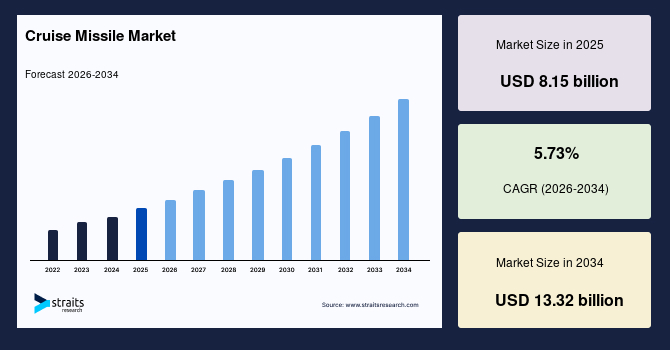

The global cruise missile market size was valued at USD 8.15 billion in 2025 and is estimated to reach USD 13.32 billion by 2034, growing at a CAGR of 5.73% during the forecast period (2026–2034). The global market is driven by rising defense budgets, modernization of military arsenals, and increasing demand for long-range precision strike capabilities. Advanced guidance systems, stealth technology, and multi-platform adaptability further accelerate market growth worldwide.

Key Market Trends & Insights

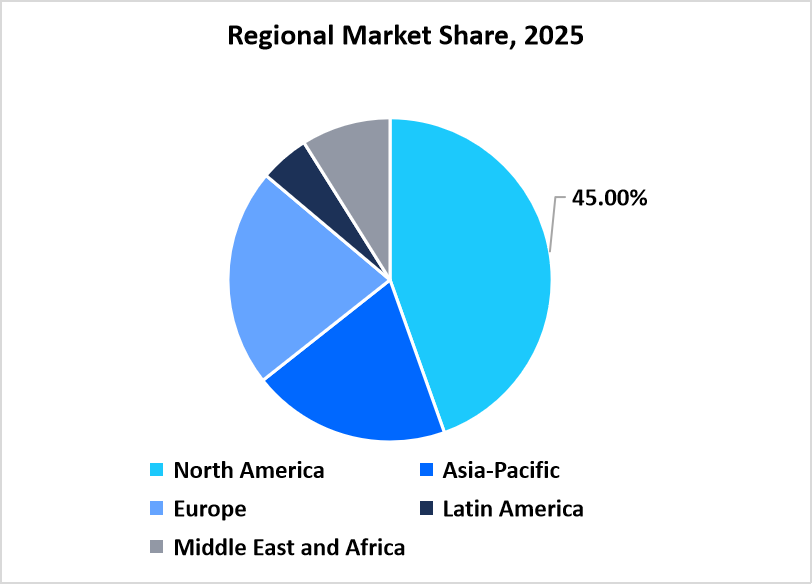

- North America held the largest market share, over 45% of the global market.

- Asia-Pacific is the fastest-growing region, with a CAGR of 6.83%,

- By Missile Type, the Air-Launched Cruise Missiles (ALCM) segment held the highest market share of over 45%.

- By Component, the sensors and seekers segmentis expected to witness the fastest CAGR of 6.34%.

- By Missile Speed, the subsonic cruise missiles segment held the highest market share of over 50%.

- ByLaunch Platform, the naval-launched cruise missiles segment is expected to witness the fastest CAGR of 6.5%.

- By Missile Range, the medium-range missiles (1000–3000 km) segment held the highest market share of over 40%.

- ByGuidance Technologies, the Swarm intelligence guidance segment is expected to witness the fastest CAGR of 6.34%.

- By Operational Mode, the Pre-programmed target missiles segment held the highest market share of over 45%.

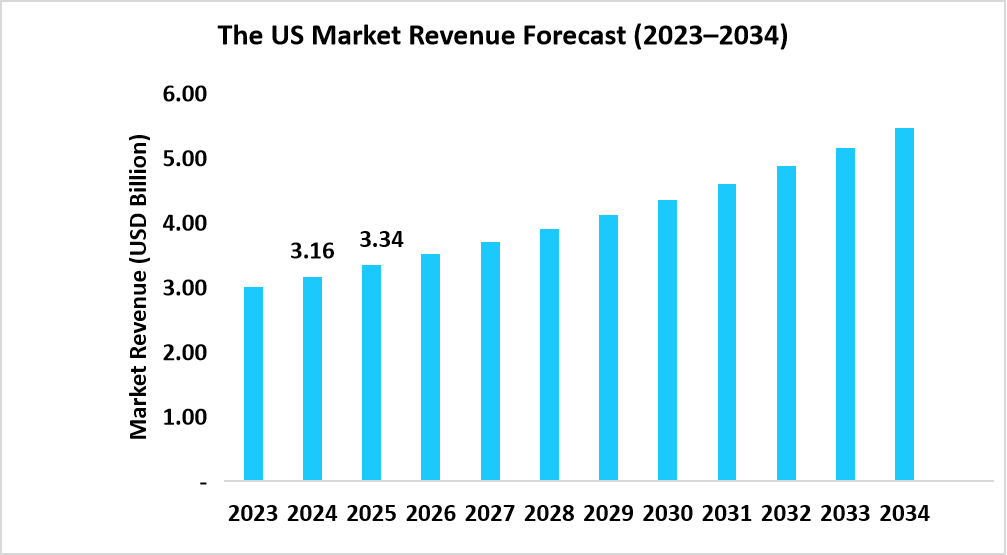

- The U.S. cruise missile market was valued at USD 3.16 billion in 2024 and reached USD 3.34 billion in 2025.

Graph: The U.S. Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 8.15 billion

- 2034 Projected Market Size: USD 13.32 billion

- CAGR (2026-2034): 73%

- North America: Largest market

- Asia-Pacific: Fastest growing

A cruise missile is a guided, long-range weapon designed to deliver conventional or nuclear warheads with high precision. Unlike ballistic missiles, it flies at low altitudes, following terrain contours to evade detection. Cruise missiles can be launched from land, sea, or air platforms and are used for strategic strikes, anti-ship missions, and tactical battlefield support. Their accuracy, stealth features, and adaptability make them essential for modern militaries seeking rapid, precise, and flexible engagement capabilities in contested environments.

The market is propelled by increasing demand for advanced, cost-effective strike solutions and flexible deployment across multiple platforms. Opportunities arise from the development of modular missile designs, enhanced survivability in contested zones, and integration of multi-mode seekers for superior targeting. Rising investments in research and testing of supersonic and hypersonic variants, along with expanding defense collaborations and export potential, further strengthen growth prospects, positioning cruise missiles as a critical component of modern defense strategies worldwide.

Latest Market Trends

Integration of AI and autonomous guidance systems

The integration of Artificial Intelligence (AI) and autonomous guidance systems is revolutionizing the cruise missile landscape. Modern missiles are now capable of analyzing terrain data, adjusting flight paths, and identifying targets with minimal human intervention. This advancement enhances operational accuracy and mission adaptability across complex and evolving battlefields.

As nations invest in next-generation defense technologies, AI-enabled cruise missiles offer greater precision, reduced response time, and improved strike efficiency. These systems allow seamless coordination with other networked defense assets, supporting faster decision-making. The trend signifies a strategic shift toward intelligent, self-learning weapon systems designed for future warfare scenarios.

Increased focus on sea-launched and air-launched cruise missiles

The increasing focus on sea-launched and air-launched cruise missiles reflects the global shift toward flexible and survivable strike capabilities. These platforms offer extended range, rapid deployment, and stealth features, enabling nations to respond quickly to threats without relying on fixed land-based infrastructure or vulnerable ground assets.

As per Straits Research, the demand for multi-platform launch systems continues to grow as defense forces seek enhanced mobility and precision. Air and naval forces are investing heavily in adaptable launch technologies that allow missiles to engage targets across various terrains and conditions, strengthening deterrence and strategic response capabilities worldwide.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 8.15 billion |

| Estimated 2026 Value | USD 8.58 billion |

| Projected 2034 Value | USD 13.32 billion |

| CAGR (2026-2034) | 5.73% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Lockheed Martin Corporation, Raytheon Technologies Corporation, Boeing Company, Northrop Grumman Corporation, BAE Systems plc |

to learn more about this report Download Free Sample Report

Market Growth Factor

Growing military modernization and increased defense spending

The growing wave of military modernization and rising defense budgets across the globe are major factors driving the growth of the cruise missile market. Nations are increasingly focusing on upgrading their long-range precision strike capabilities to enhance deterrence and ensure combat readiness in modern warfare.

- For instance, in March 2025, Germany awarded Saab a $159 million contract to modernize and maintain its TAURUS KEPD 350 cruise missiles until 2035, ensuring operational readiness through 2045.

- Similarly, in August 2025, India’s Ministry of Defence approved procurement deals worth ₹67,000 crore, including over 110 air-launched BrahMos supersonic cruise missiles, as part of its modernization strategy.

Such large-scale investments highlight the emphasis on sustaining technologically advanced missile systems, strengthening national security, and maintaining strategic superiority amid evolving global threats.

Market Restraint

High development and production costs

The integration of advanced technologies such as AI-based navigation, stealth coatings, and high-performance propulsion systems significantly increases manufacturing expenses. Developing nations often struggle to allocate sufficient budgets for such complex systems, limiting large-scale adoption. Moreover, continuous upgrades and testing requirements further add to the financial burden. These high costs slow procurement and create dependency on international collaborations or defense imports to access cutting-edge missile technologies.

Market Opportunity

Advancements in navigation, propulsion, and guidance systems

The global cruise missile market presents significant opportunities driven by advancements in navigation, propulsion, and guidance systems. Modern militaries are increasingly investing in next-generation cruise missiles to enhance long-range precision strike capabilities while reducing operational costs. Innovations in modular designs, multi-mode seekers, and stealth technology are enabling more flexible deployment across diverse platforms.

- For instance, in October 2025, Kratos unveiled its “Ragnarök” low-cost cruise missile, featuring a modular structure, advanced propulsion, and enhanced guidance suited for both manned and unmanned platforms — a vivid demonstration of how innovation lowers costs and increases flexibility.

- Similarly, at DSEI UK 2025, MBDA revealed its STRATUS series, comprising STRATUS-LO (stealthy subsonic) and STRATUS-RS (ramjet-powered supersonic) missiles, leveraging new aerodynamic designs and multi-mode RF seekers to boost performance in contested environments.

These technological strides highlight a shift toward intelligent, efficient, and adaptive missile systems, positioning defense industries to capitalize on the rising demand for high-precision and multi-role cruise missile solutions worldwide.

Regional Analysis

North America’s cruise missile market is dominant with a market share of over 45%, driven by extensive defense budgets, technological advancements, and strategic modernization of missile systems. Investments in precision-guided, long-range, and stealth cruise missiles strengthen military readiness and enhance deterrence capabilities. The focus on autonomous guidance, advanced propulsion, and integration with multi-platform launch systems supports operational flexibility. Moreover, collaborative efforts between government agencies and defense contractors, combined with continuous R&D, ensure innovation in materials, navigation, and targeting systems, solidifying North America’s leading position.

The United States cruise missile market is growing, with companies such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman developing next-generation precision-guided and stealth missiles. Strategic partnerships with the Department of Defense enhance testing, production, and deployment, while R&D investments continue to optimize range, accuracy, and survivability.

Canada’s cruise missile market is evolving with firms like Magellan Aerospace and Rheinmetall Canada focusing on missile integration, guidance systems, and defense technology collaborations. Investments target modernization of existing missile platforms, precision guidance improvements, and enhanced interoperability with allied systems.

Asia-Pacific: Significantly Growing Region

The Asia-Pacific cruise missile market is the fastest-growing, with a CAGR of 6.83%, supported by increasing defense expenditures, geopolitical tensions, and strategic military modernization. Governments are investing in indigenous missile programs, advanced guidance systems, and flexible launch platforms. The growing naval and air defense sectors drive demand for both subsonic and supersonic cruise missiles. As per Straits Research, focus on stealth technology, autonomous navigation, and precision targeting strengthens regional capabilities. Collaborations with international contractors and expansions in local R&D infrastructure further accelerate the adoption of advanced cruise missile systems.

China’s market is expanding with companies like CASC (China Aerospace Science and Technology Corporation) and China Aerospace Science and Industry Corporation (CASIC) developing long-range, hypersonic, and stealthy cruise missiles. Key focus areas include AI-enhanced guidance, multi-platform launch capabilities, and propulsion system innovations.

India’s cruise missile market is growing with organizations like DRDO and Bharat Dynamics Limited (BDL) spearheading programs for long-range, precision-guided, and surface-to-surface missiles. Collaborations with private defense manufacturers improve production efficiency, while extensive trials and integration with naval and aerial platforms strengthen operational readiness and regional deterrence capabilities.

Source: Straits Research

Europe Market Trends

Europe’s cruise missile market is witnessing steady growth due to defense modernization programs, rising security concerns, and emphasis on joint military capabilities. Governments are investing in advanced precision-guided, long-range, and low-observable missile systems. European defense contractors focus on autonomous guidance, propulsion efficiency, and modular designs to enhance flexibility across naval, land, and air platforms. Moreover, collaborations with NATO allies, investment in R&D, and upgrades to existing missile fleets drive the adoption of next-generation systems.

- Germany’s cruise missile marketis expanding with firms such as MBDA Germany and Diehl Defence focusing on long-range, subsonic, and hypersonic missile development. Efforts include propulsion optimization, digital guidance systems, and retrofitting older platforms with modern technology.

Latin America Market Trends

The Latin America cruise missile market is gradually growing due to rising defense modernization programs, regional security challenges, and naval fleet expansions. Governments are focusing on acquiring precision-guided and cost-efficient missile systems. Moreover, partnerships with international defense contractors support technology transfer and local integration, while R&D initiatives aim at developing indigenous solutions. Expansion of infrastructure, testing facilities, and training programs strengthens operational capabilities.

- Brazil’s cruise missile market isevolving with companies like Avibras Aeroespacial and Mectron focusing on indigenous missile development, precision targeting, and naval integration. Investments are directed toward testing, guidance systems, and production capabilities to strengthen local defense self-reliance.

Middle East and Africa Market Trends

The Middle East and Africa cruise missile market is witnessing steady growth, driven by rising geopolitical tensions, naval modernization programs, and investments in advanced defense technology. Countries are acquiring long-range, precision-guided, and stealth missile systems for deterrence and strategic defense. Moreover, increasing focus on autonomous guidance, propulsion efficiency, and integration across air, land, and sea platforms is strengthening operational capabilities and enhancing the region’s overall military readiness.

- Saudi Arabia’s cruise missile marketis growing with defense entities like Saudi Arabian Military Industries and international partners supplying long-range, stealth, and precision-guided missile systems. Investments focus on local manufacturing, training, and technology transfer to enhance strategic self-sufficiency.

Missile Type Insights

Air-Launched Cruise Missiles (ALCM) dominate the market with over 45% share, favored for their rapid deployment, strategic flexibility, and precision targeting capabilities. Widely used by modern air forces, ALCMs enable standoff engagement and enhanced survivability during operations. Their compatibility with multiple aircraft platforms and integration with advanced guidance systems reinforce their dominant position, sustaining continuous procurement and technological upgrades across global defense programs.

Anti-Ship Cruise Missiles (ASCM) are expanding at a CAGR of 6.12%, driven by rising naval modernization and maritime security requirements. ASCMs are increasingly adopted for precision engagement of enemy vessels, offering long-range strike capabilities. Growth is strongest in Asia-Pacific and North America, where coastal defense and blue-water navies are prioritizing advanced anti-ship systems. Rising demand for high-speed, maneuverable missiles is steadily boosting the ASCM market share globally.

Source: Straits Research

Component Insights

Guidance systems hold dominance with over 40% market share, critical for ensuring accuracy and reliability in modern cruise missiles. Integration of GPS, INS, and terrain-matching technologies enhances strike precision across varying operational environments. Continued investment in guidance innovations and system upgrades strengthens performance and reliability, making them the most essential component for military forces worldwide and securing sustained procurement across multiple cruise missile platforms.

Sensors and seekers are the fastest-growing segment, growing at a CAGR of 6.34%. Advanced electro-optical, infrared, and radar seekers enable target acquisition under complex conditions, increasing mission success rates. Rising focus on intelligent and autonomous strike capabilities drives innovation in sensor technology. Growth is particularly strong in Europe and North America, where precision strike modernization programs are increasing market share for sensor-equipped cruise missiles.

Missile Speed Insights

Subsonic cruise missiles dominate with over 50% market share, valued for cost efficiency, reliable propulsion, and long operational range. Their adaptability to various platforms, combined with stealthy flight profiles, ensures consistent operational effectiveness. Widespread integration into national defense programs and proven combat performance reinforce their position. Subsonic missiles remain the primary choice for most military fleets, balancing affordability, precision, and survivability across diverse scenarios globally.

Hypersonic missiles are the fastest-growing speed segment, expanding at a CAGR of 6.25%. Capable of exceeding Mach 5, they provide unmatched speed, maneuverability, and rapid strike potential, challenging conventional defense systems. Strategic programs in North America, Europe, and Asia-Pacific focus on hypersonic development, driving adoption. Increasing investment in materials, propulsion, and guidance technologies ensures hypersonic missiles steadily capture a higher market share in cutting-edge military operations worldwide.

Launch Platform Insights

Airborne launch platforms dominate with over 45% market share, offering flexibility, rapid deployment, and strategic standoff advantages. Aircraft-launched missiles provide enhanced survivability, range, and target precision, ensuring consistent operational utility. Strong adoption by modern air forces worldwide and compatibility with multiple fighter and bomber platforms reinforce this dominance, sustaining procurement pipelines and consolidating the airborne segment as a critical pillar of cruise missile operations globally.

Naval-launched cruise missiles are growing fastest at a CAGR of 6.50%, driven by expanding maritime security and coastal defense requirements. Deployed from surface combatants and submarines, these missiles provide extended reach and precision strike capabilities against naval and land targets. Moreover, growth is strongest in Asia-Pacific and Europe, where modern naval fleets prioritize long-range deterrence, steadily increasing the share of naval missile systems in defense portfolios worldwide.

Missile Range Insights

Medium-range missiles (1000–3000 km) dominate with over 40% market share, offering an optimal balance of reach, payload, and operational flexibility. They are widely deployed in strategic deterrence and conventional strike missions, ensuring versatility across multiple theaters. Continued investment in propulsion and guidance improvements reinforces performance. Medium-range missiles remain the most relied-upon option for military forces seeking precision engagement without the complexity and cost of long-range systems.

Long-range cruise missiles are the fastest-growing segment, expanding at a CAGR of 6.38%. Capable of striking targets beyond 3000 km, they provide strategic reach and deterrence, enabling global operational coverage. Development programs in North America, Europe, and Asia-Pacific focus on enhanced range, stealth, and accuracy. Rising investment in long-range missile technology is steadily increasing market share, reflecting demand for extended-reach precision strike capabilities across modern defense strategies.

Guidance Technologies Insights

Real-time tracking guidance dominates with over 40% market share, allowing continuous in-flight monitoring and precise engagement of moving targets. Its integration with advanced sensors and satellite-based systems ensures higher accuracy, reducing collateral damage. Widely adopted in modern missile programs, this technology strengthens operational reliability. Real-time tracking remains a core feature in cruise missile development, sustaining dominance across national defense and strategic deployment programs globally.

Swarm intelligence guidance is the fastest-growing segment, growing at a CAGR of 6.43%. Utilizing coordinated, autonomous behavior among multiple missiles, it improves target saturation, evasion, and effectiveness against advanced defenses. Growth is driven by investment in AI-enabled missile systems in North America and the Asia-Pacific. The rising focus on networked, intelligent munitions ensures this segment steadily gains market share in next-generation cruise missile technology globally.

Operational Mode Insights

Pre-programmed target missiles dominate with over 45% market share, offering reliability and simplicity for fixed strategic strikes. Widely used in established military operations, they enable precise engagement of predetermined targets with minimal in-flight adjustments. Integration with advanced navigation systems enhances accuracy, ensuring mission success. This operational mode remains essential for military planners, sustaining dominance across diverse global defense programs and standard cruise missile inventories.

Loitering or patrolling cruise missiles are the fastest-growing operational mode, with a CAGR of 6.24%. Capable of extended flight while searching for time-sensitive targets, they enhance tactical flexibility and situational responsiveness. Growth is strongest in Asia-Pacific and Europe, where defense programs prioritize adaptive engagement in dynamic conflict zones. Rising adoption reflects increasing demand for versatile, intelligence-driven strike capabilities, steadily expanding market share for loitering missile systems worldwide.

Company Market Share

Leading players hold significant shares by focusing on advanced propulsion systems, stealth technology, and precision guidance solutions. Companies are increasingly investing in modular designs, supersonic and hypersonic capabilities, and multi-platform adaptability to meet modern defense requirements. Research is also emphasizing AI-assisted targeting, improved survivability in contested environments, and cost-effective production methods, ensuring sustained growth and competitiveness across both manned and unmanned missile platforms.

Lockheed Martin Corporation

Lockheed Martin Corporation, established in 1995 through the merger of Lockheed Corporation and Martin Marietta, is headquartered in Bethesda, Maryland, USA. As a global aerospace and defense leader, it specializes in advanced technology systems, including missile development, aircraft, and space solutions. The company focuses on innovation, integrating cutting-edge propulsion, guidance, and stealth technologies for modern defense applications.

- September 2025 - Lockheed Martin's Skunk Works® introduced the Vectis™, a Group 5 survivable and lethal collaborative combat aircraft (CCA) designed to advance air dominance for American and allied militaries

List of Key and Emerging Players in Cruise Missile Market

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Boeing Company

- Northrop Grumman Corporation

- BAE Systems plc

- MBDA Missile Systems

- Saab AB

- Rafael Advanced Defense Systems

- Kratos Defense & Security Solutions

- Denel SOC Ltd

- Almaz-Antey

- NPO Mashinostroyeniya

- Bharat Dynamics Limited (BDL)

- China Aerospace Science and Technology Corporation (CASC)

- Hyundai Rotem

- LIG Nex1

- Taiwan Aerospace Corporation

- Kongsberg Defence & Aerospace

- Textron Inc.

- MBDA Italia

Recent Development

- October 2025 - Ukraine has unveiled the "Flamingo," a domestically developed cruise missile with a range of approximately 3,000 km. Designed to fly at altitudes under 50 meters, it aims to outmaneuver advanced air defense systems. Currently in limited production, the Flamingo enhances Ukraine's strategic strike capabilities.

- April 2025 - India’s Defence Research & Development Laboratory (DRDL), part of DRDO in Hyderabad, achieved a breakthrough in hypersonic weapon technology. The lab successfully conducted long-duration ground testing of an actively cooled scramjet subscale combustor for over 1,000 seconds, demonstrating significant progress in high-speed propulsion and hypersonic flight capabilities.

- June 2025 - German defense giant Rheinmetall partnered with U.S.-based Anduril Industries to co-develop advanced cruise missiles, combat drones, and solid-fuel rocket motors for the European market. The collaboration highlights Anduril’s Barracuda low-cost cruise missiles and the YFQ-44 jet-powered combat drone, targeting cost-effective yet high-performance solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 8.15 billion |

| Market Size in 2026 | USD 8.58 billion |

| Market Size in 2034 | USD 13.32 billion |

| CAGR | 5.73% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Missile Type, By Component, By Missile Speed, By Launch Platform, By Missile Range, By Guidance Technologies, By Operational Mode |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cruise Missile Market Segments

By Missile Type

- Land-Attack Cruise Missiles (LACM)

- Anti-Ship Cruise Missiles (ASCM)

- Air-Launched Cruise Missiles (ALCM)

By Component

- Guidance Systems

- Propulsion Systems

- Warheads

- Missile Airframe

- Sensors & Seekers

- Communication Systems

By Missile Speed

- Subsonic (Below Mach 1)

- Supersonic (Mach 1 - 5)

- Hypersonic (Above Mach 5)

By Launch Platform

- Airborne

- Ground-Launched

- Naval

By Missile Range

- Short Range (Below 1000 km)

- Medium range (1000-3000 km)

- Long Range (Above 3000 km)

By Guidance Technologies

- Autonomous

- Real-Time Tracking

- Swarm Intelligence

By Operational Mode

- Pre-Programmed Targets

- Dynamic Targeting/In-Flight Retargeting

- Loitering /Patrolling (Time-Sensitive Strike)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.