Data Center Power System Market Size, Share & Trends Analysis Report By Type (UPS, Generators, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Data Center Power System Market Size

The global data center power system market size was valued at USD 9,672.82 million in 2024 and is projected to grow from USD 10,385.49 million in 2025 to USD 17509.7 million by 2033, exhibiting a CAGR of 7.7% during the forecast period (2025-2033).

The growing demand for cloud storage has given rise to data centers to expand globally, leading to increased use of energy. As there is an increase in demand for modular data center solutions efforts are being made to combine the advanced equipment to lower power usage in the light of environmental impact. The data center power infrastructure assists in supplying and controlling power in the data center. The infrastructure includes power distribution units, UPS, and Generators. Numerous industries including IT and Telecom, BFSI, retail, and Government use these power solutions. Strong data center infrastructure is more crucial than ever to enable absolute remote operations due to this shift in work culture which is also driving the industry innovation and market expansion.

Hyperscale data centers are an important driver of growth, which requires large-scale backup power solutions, cooling, and stabilized technologies to manage the high workloads. Major cloud providers such as Amazon Web Services (AWS), Azure, and Google Cloud are increasing their investments in advanced power distribution architectures to improve the energy usage. Another element influencing the market is edge computing as companies build smaller and broadcast data centers to improve the security in remote areas. This is increasing demand for microgrids, modular power solutions and AI-driven power monitoring systems.

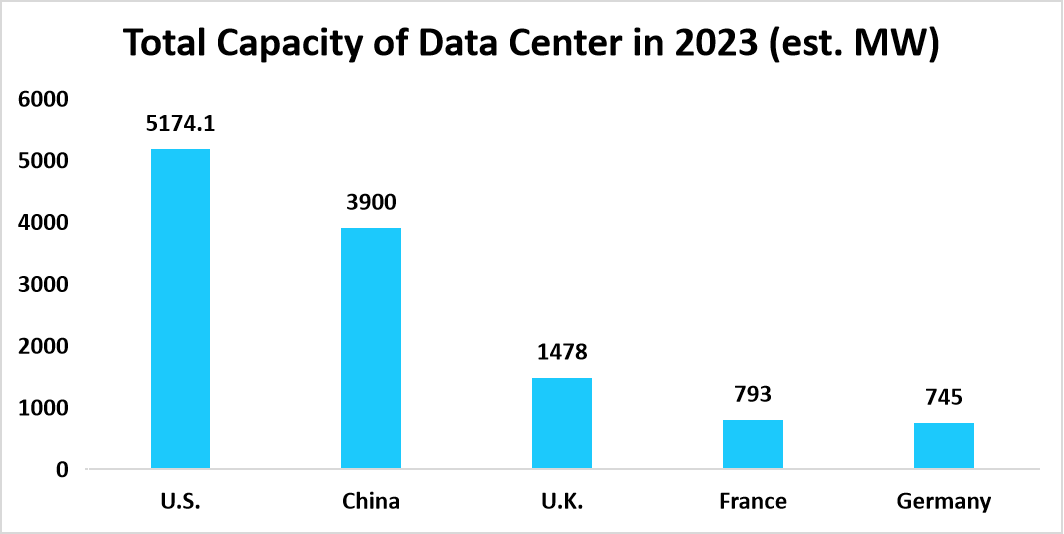

The below graph shows the estimated total data center capacity (in MW) for major countries in 2023, highlighting the U.S., China, the U.K., France, and Germany.

Source: Straits Research

According to industry estimates, the U.S. led global data center capacity in 2023 with approximately 5,174.1 MW, followed by China at 3,900 MW. The significant capacity in these regions reflects the expansion of hyperscale data centers driven by cloud adoption, AI workloads, and digital transformation. In Europe, the U.K. (1,478 MW), France (793 MW), and Germany (745 MW) are among the leading markets, supported by growing colocation services and regulatory pushes for sustainable data center operations.

Latest Market Trends

Rising Adoption of Modular Power Systems in Data Centers

The data center market is turning to modular power systems because of the requirement for fast scalability, cost savings, and space utilization. Modular designs enable operators to add or take away power elements based on demand without the delays of large-scale infrastructure build-outs. Modular power units are pre-engineered, unlike traditional configurations, saving installation time. Data centers, particularly colocation and hyperscale centers, favor modular systems since they enhance power reliability without over-allocating resources. Edge data centers are also fueling the trend, as rapid deployment is essential there.

- For instance, in July 2024, Vertiv has introduced a high-density prefabricated modular data center solution designed to support the rapid global deployment of AI computing. The solution integrates power protection and distribution, including busway and switchgear, along with the high-efficiency Vertiv Trinergy UPS and Vertiv PowerNexus system. This setup minimizes power system footprint by closely coupling the UPS and switchgear, enhancing scalability for AI-driven workloads.

Increasing Focus on Renewable Energy Integration

Power usage in data centers is increasing, forcing operators to adopt sustainable alternatives. Renewable energy is gaining traction due to its ability to assist businesses in achieving carbon neutrality and weaning themselves from fossil fuels. Governments and enterprises are introducing regulations that can decrease emissions, which drives the transition faster. Cloud and colocation operators are pledging 100% renewable energy, with it becoming an industry priority. The application of solar, wind, and future technologies such as small nuclear reactors is becoming popular.

- For instance, The U.S. Department of Energy estimated that data centers used around 4.4% of the U.S. total electricity in 2023. The share is projected to rise to between 6.7% and 12% by 2028, increasing the need for renewable power solutions. The growing energy needs of data centers are driving investments in clean energy sources to end the dependence on conventional power grids.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 9,672.82 Million |

| Estimated 2025 Value | USD 10,385.49 Million |

| Projected 2033 Value | USD 17509.7 Million |

| CAGR (2025-2033) | 7.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | ABB, Schneider Electric, Vertiv Group Corp, Eaton, Siemens |

to learn more about this report Download Free Sample Report

Data Center Power System Market Growth Factors

Growing Demand for Hyperscale Data Centers Worldwide

Hyperscale data centers are growing because of the expanding demand for huge data storage and processing. Companies are producing more data through cloud computing, AI, and IoT, necessitating large data centers to manage workload effectively. The data centers provide greater operational efficiency and cost advantages, thus being the go-to option for cloud providers. With increasing workloads in AI, hyperscale facilities are engineered to increase power and cooling demands to support high-performance computing.

- For instance, Equinix announced a USD 15 billion joint venture between GIC and Canada Pension Plan Investment Board (CPP Investments) to grow hyperscale data centers in the US. The investment will be used to finance new xScale facilities of more than 100 MW, adding more than 1.5 GW of new capacity for hyperscale customers.

Expansion of Cloud Service Providers Driving Power Infrastructure Investments

Cloud growth is creating a higher demand for increased power infrastructure at data centers. Cloud providers have to ensure high availability and dependability, rising investments in power backup technology, energy efficiency, and grid stability. Enterprise migration of workloads to the cloud means that hyperscale data centers need constant power to avert service failures. The drive towards AI and edge computing enhances the demand for scalable power technology even more.

- For instance, The French digital sector recorded a 6.5% industry-wide growth in 2023, driven by increased investments in cloud services (+17.5%), big data (+18%), and cybersecurity (+10.2%). The rapid expansion of cloud services is fueling the demand for advanced power infrastructure in data centers to support scalable and secure operations.

Market Restraint

High Initial Investment Cost for Advanced Power Systems

Implementation of high-tech power infrastructure within data centers demands a lot of capital. High-efficiency power equipment, including lithium-ion UPS, modular power units, and renewable integrations, entails high initial investments versus conventional power configurations. Such a financial obstacle restricts small businesses from embracing latest power solutions, hindering market penetration. Even though the long-term cost benefits exist, most businesses hold back because of financial constraints.

- For instance, The cost of uninterruptible power supply (UPS) systems in data centers varies based on capacity and technology. For small to mid-sized facilities, three-phase UPS systems (10-50 kVA) range from USD 10,000 to USD 50,000, while large-scale data centers requiring 100-500 kVA or more can face costs between USD 50,000 and USD 250,000+. The high initial investment in advanced power infrastructure remains a financial challenge for many operators.

Market Opportunity

Development of Energy-Efficient Power Solutions for Sustainable Operations

The growing focus on sustainability presents a window of opportunity for energy-efficient power solutions to data centers. As power prices rise, the operators are looking for ways to reduce power consumption and carbon footprints. Liquid cooling, direct current (DC) power distribution, and artificial intelligence (AI)-based energy management are the technologies that bring efficiency benefits. Governments and companies driving green IT are investing in such technologies, thereby creating a growing market for energy-efficient power systems.

- For instance, in December 2024, Meta announced a USD 10 billion data center project in Richland Parish, Louisiana, designed to run on clean energy. This development is expected to drive demand for advanced power solutions, including power distribution units, and backup supply infrastructure, supporting sustainable data center operations.

Regional Insights

North America experiences robust demand for data center power infrastructure. Hyperscale and colocation data centers are growing, requiring reliable and efficient backup power. Cloud services and AI workloads are expanding, driving the demand for power infrastructure. The U.S. market is influenced by grid modernization and investments in power-efficient systems. Data centers also consider modular configurations that maximize space and cost. Regulations are encouraging operators to implement improved power management, so efficiency becomes a priority.

United States Data Center Market Trends

The United States boasts the most data centers globally, with Virginia (250 sites) and California (208 sites) processing over 10% of the world's data storage. Such scale requires strong and efficient power systems, such as UPS, backup generators, and power distribution units. AI and cloud computing growth is making power reliability increasingly important.

Canada: Data center investments are on the rise, with the Macquarie Group investing USD 5 billion in data-focused initiatives. Industry giants such as Nvidia, Apple, Alphabet, and Meta are establishing facilities, thus the need for power systems rises. As growth takes place in cities such as Toronto and Montreal, the companies seek power solutions which are scalable and energy-efficient to enable long-term operations.

Asia Pacific Market Trends

Asia-Pacific is experiencing fast expansion in data center power demand. Countries like China, India, and Singapore are increasing investments in new facilities. More internet use, cloud adoption, and AI computing drive this growth. Power backup systems are crucial as data centers scale operations. Governments are encouraging renewable energy adoption, pushing for sustainable power solutions. Edge computing and 5G growth also mean more power infrastructure is needed across emerging markets.

Chinese Market Insights

China's data centers used 237 billion kWh of power in 2021, roughly 3% of the nation's overall power consumption. AI, 5G, and cloud demand are prompting data centers to improve power infrastructure. Power-saving UPS systems and high-capacity generators are assuming a central position. Sustainability too is a high priority, and operators are ensuring emissions reduction alongside a stable supply of power.

India: With 751.5 million internet users and 52.4% penetration, India's data center market is expanding rapidly. Mobile internet, online banking, and cloud growth are driving power demand. Government policies and hyperscale initiatives are driving investment in power backup infrastructure.

Singapore: The PDPA and Cybersecurity Act are strict laws that mandate data centers to operate stably, necessitating the use of UPS systems and redundant power configurations. Space is constrained, and hence high-efficiency, space-saving power systems are being employed.

Germany's Market Growth Factors

Colocation data centers added USD 11.27 billion to the GDP of Germany in 2023 and remain a robust sector in the economy. Frankfurt, Berlin, and Munich host major-sized facilities needing high-efficiency power systems. There is growing movement towards clean energy, modular UPS, and intelligent backup technologies.

U.K.– London has one of the largest data center hubs in the world, with 40% of Europe's Tier 1 capacity. Data centers have been listed by the UK government as critical infrastructure, which translates to not being able to fail on power. This is causing demand for more efficient UPS systems, battery storage, and backup power supplies.

France- France's digital industry is growing rapidly. Cloud computing is up 17.5%, big data by 18%, and cybersecurity is increasing at 10.2%. Data centers are also upgrading their power infrastructure to keep pace. Lithium-ion battery UPS, power distribution units that are efficient, and backup power solutions are becoming a priority as businesses seek more reliable and sustainable infrastructure.

Type Analysis

By type, the market is divided into UPS, Generators, and others. UPS dominates as it ensures an uninterrupted power supply and safeguards crucial equipment from fluctuations and outages. Data centers need stable and efficient power backup, and UPS systems ensure immediate response during power outages to avoid downtime. In contrast to generators, UPS systems ensure instantaneous switching without lag, which is critical for undisturbed operation. The move toward high-density computing and AI-based workloads contributes further to the demand for sophisticated UPS solutions with better efficiency and lower losses. Modular designs of UPS systems also facilitate scaling, in response to the increasing demand for agile power infrastructure.

- For instance, on December 12, 2024 – Vertiv introduced the PowerUPS 9000, a high-power-density, space-efficient UPS for large-scale data centers and mission-critical IT applications. Rated between 250 kW and 1250 kW per unit, it has up to 97.5% efficiency in double-conversion mode. The product has a space-efficient design, cable-entry flexibility, and integrated safety features, making it easy to deploy in international markets.

Company Market Share

Key players in the industry are focus on adopting key business strategies, such as strategic collaborations, product approvals, acquisitions, and product launches, to gain a strong foothold in the market.

Generac Power Systems, Inc.: An Emerging Player in the Data Center Power System Market

Generac Power Systems, Inc. is an emerging player in backup power solutions, offering generators and energy storage systems that support data centers, industrial facilities, and critical infrastructure with reliable power backup.

Recent developments by Generac Power Systems, Inc.:

- In February 2025, Generac announced intentions to launch large-scale diesel-powered generators specifically designed for hyper-scale data centers in the United States. The new 2.25 to 3.25 MW generators are designed to satisfy the growing need for dependable backup power in large data center installations.

List of Key and Emerging Players in Data Center Power System Market

- ABB

- Schneider Electric

- Vertiv Group Corp

- Eaton

- Siemens

- Generac Power Systems, Inc.

- Aksa power generation

- CK Power

- nVent

- Kehua Data Co., Ltd

- Delta Electronics, Inc

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric

- Toshiba Corporation

- Fuji Electric Co., Ltd

Recent Developments

- In March 2025, ABB purchased a minority position in DG Matrix to aid in the commercialization of solid-state power electronics for generative AI data centers and sustainable microgrids a business based in North Carolina. With its Power Router platform, the business offers a comprehensive solution that is up to five times smaller and has the best-in-class energy efficiency of 98 percent, replacing traditional systems.

- In March 2025, Schneider Electric developed digital twin technology for AI data centers in collaboration with NVIDIA and ETAP. Through this partnership data centers may be virtually replicated allowing for better performance and energy efficiency through optimal design and operation.

Analyst Opinion

The data center power system market is evolving with rising energy demands, AI-driven workloads, and cloud expansion. As data centers scale up, the need for efficient, resilient, and modular power infrastructure is increasing. Sustainability is becoming a priority, with operators integrating renewable energy sources and energy-efficient power backup systems to reduce carbon footprints. UPS and generators remain critical, but advancements in battery storage and grid modernization are shaping future investments. Regulations and cost pressures are pushing data centers to optimize power usage while ensuring uptime. Growth is strongest in North America and Asia-Pacific, driven by hyperscale data center investments and edge computing expansion. The market is shifting toward scalable, intelligent power management solutions, aligning with digital transformation needs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 9,672.82 Million |

| Market Size in 2025 | USD 10,385.49 Million |

| Market Size in 2033 | USD 17509.7 Million |

| CAGR | 7.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Data Center Power System Market Segments

By Type

- UPS

- Generators

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.