De-Oiled Lecithin Market Size, Share & Trends Analysis Report By Form (Powder, Granules), By Source (Soybean, Sunflower, Rapeseed & Canola, Egg, Others), By Method of Extractions (Acetone Extraction, Carbon Dioxide Extraction, Ultrafiltration Process), By Applications (Food & Beverages, Bakery Products, Convenience Food, Confectioneries, Beverages, Dairy & Non-Dairy Products, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

De-Oiled Lecithin Market Size

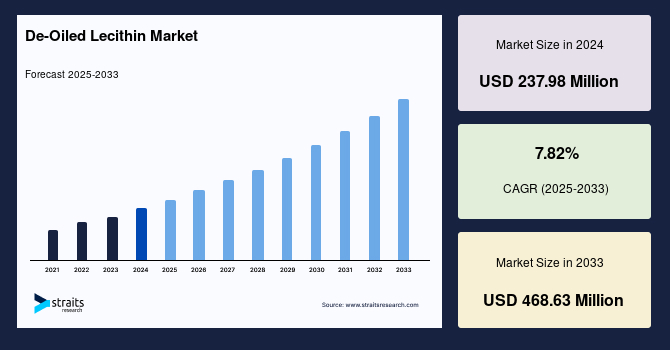

The global de-oiled lecithin market size was valued at USD 237.98 million in 2024 and is estimated to grow from USD 256.59 million in 2025 to reach USD 468.63 million by 2033, growing at a CAGR of 7.82% during the forecast period (2025–2033).

De-oiled lecithin is a highly concentrated form of lecithin that has had its oil content removed, resulting in a powdered or granular substance rich in phospholipids. Unlike regular liquid lecithin, de-oiled lecithin offers better stability, easier handling, and a longer shelf life, making it ideal for use in food, pharmaceuticals, cosmetics, and animal feed. It acts as a natural emulsifier, helping blend ingredients like oil and water, and is valued for its health benefits, including support for brain, liver, and cell membrane functions.

One of the key drivers propelling the global de-oiled lecithin market is the rising demand for natural emulsifiers in animal nutrition. De-oiled lecithin, especially in powder form, is increasingly used in poultry, swine, and cattle feed to improve nutrient absorption, enhance digestive efficiency, and support overall animal health. Its high phospholipid content and non-toxic nature make it a preferred additive in feed formulations. Moreover, the growth of the global livestock industry, especially in emerging economies, is fueling the need for high-quality, cost-effective feed ingredients, thereby driving the demand for de-oiled lecithin.

Recent Market Trends

Shift towards Non-Gmo and Allergen-Free Food Ingredients

One of the prominent trends shaping the global market is the shift towards non-GMO and allergen-free food ingredients. As consumers increasingly seek transparency and health-conscious choices, food manufacturers are reformulating products to eliminate common allergens and genetically modified components.

- For instance, in November 2022, Novastell introduced two lecithin granule products tailored for the food and beverage industry: Soycithin G97 IP and Suncithin G96. Soycithin G97 IP is a traditional soy lecithin that is fully traceable and non-GMO, while Suncithin G96 is derived from sunflower lecithin, offering an allergen-free and non-GMO alternative. Both products cater to the growing demand for clean-label ingredients, providing flexibility in food formulations.

This growing emphasis on natural, safe, and transparent ingredients continues to fuel innovation in the de-oiled lecithin market worldwide.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 237.98 Million |

| Estimated 2025 Value | USD 256.59 Million |

| Projected 2033 Value | USD 468.63 Million |

| CAGR (2025-2033) | 7.82% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Cargill, Incorporated, ADM, Stern-Wywiol Gruppe, IMCD Group B.V., Bunge Limited |

to learn more about this report Download Free Sample Report

De-Oiled Lecithin Market Growth Factors

Increasing Demand from the Food & Beverage Industry

One of the key drivers propelling the global market is the growing demand from the food and beverage industry for clean-label, non-GMO, and allergen-free ingredients. De-oiled lecithin is widely appreciated for its superior emulsifying and dispersing capabilities, making it an essential component in various food products such as baked goods, chocolates, dairy, and ready-to-eat meals.

- For instance, in August 2024, Bunge expanded its lecithin product portfolio by launching deoiled soybean lecithin in both powdered and granulated formats. This innovation is designed to meet the rising demand for clean-label ingredients, offering a neutral taste and light color ideal for food and beverage formulations. The new formats cater to manufacturers seeking enhanced functionality, improved solubility, and better consistency in applications such as bakery, confectionery, and instant products.

As health-conscious consumers push for natural and transparent ingredient lists, demand for de-oiled lecithin continues to rise globally.

Restraining Factors

Supply Chain Volatility Due to Dependency on Soybean and Sunflower Crops

One of the major restraints in the global market is the supply chain volatility caused by heavy dependence on soybean and sunflower crops. These crops are vulnerable to fluctuating weather conditions, geopolitical tensions, and agricultural uncertainties, which can lead to inconsistent raw material availability and pricing.

Moreover, regional imbalances in crop production and trade restrictions can disrupt the steady flow of inputs needed for lecithin extraction. Such volatility makes it difficult for companies to maintain stable production and pricing, posing a challenge for long-term contracts and planning, especially for industries that rely on consistent ingredient supply.

Market Opportunities

Expanding Application in Pharmaceuticals and Cosmetics

The global market is seeing significant opportunities in the pharmaceuticals and cosmetics sectors. In pharmaceuticals, de-oiled lecithin is increasingly used as a carrier in drug formulations due to its excellent emulsifying properties and ability to improve bioavailability. For example, companies like Cargill are utilizing lecithin in the production of lipid-based drug delivery systems, enhancing the effectiveness of oral medications.

In cosmetics, de-oiled lecithin acts as an effective moisturizer and emulsifier, helping to stabilize formulations while improving skin hydration. Brands such as L'Oréal have incorporated it into skincare products to create smoother, more effective creams and lotions. As consumer demand for natural ingredients rises, these industries are expected to further embrace de-oiled lecithin for its versatility and safety.

Regional Insights

Asia-Pacific: Dominant Region

Asia-Pacific leads the global market, driven by rapid industrialization and increasing demand from sectors like food, cosmetics, and pharmaceuticals. Countries such as China, India, and Japan are major consumers of de-oiled lecithin due to their large food processing industries. For example, in China, the rise in processed food consumption boosts the demand for lecithin as an emulsifier. Moreover, the growing awareness of its health benefits in functional foods and the region’s expanding cosmetic industry further drive market growth. The abundant availability of raw materials like soybeans and sunflower in the region also strengthens its dominance.

Europe: A Significantly Growing Region

Europe is experiencing significant growth in the global market, driven by increasing demand for plant-based and clean-label products. The rise in health-conscious consumers and their preference for natural ingredients fuels lecithin usage, particularly in the food and beverage sectors. Countries like Germany and France are leading the way, with growing demand for lecithin as a natural emulsifier in dairy products and bakery items. The region’s stringent regulations on food additives and growing trend toward sustainable sourcing also support lecithin’s market expansion.

Country Analysis

- United Kingdom: The UK has seen a growing demand for de-oiled lecithin, driven by the booming health and wellness sector. This is reflected in the increasing popularity of plant-based diets and functional foods. Companies like Cargill are focusing on expanding lecithin production to cater to the growing vegan and organic food markets. Moreover, with a strong emphasis on sustainable food ingredients, the UK is investing in eco-friendly lecithin extraction processes, boosting demand in both the food and pharmaceutical industries.

- United States: The US is a key market for de-oiled lecithin, with high usage in the food, nutraceutical, and pharmaceutical sectors. The rise of health-conscious consumers and the demand for natural ingredients in functional foods drive lecithin consumption. Companies like Bunge are expanding their lecithin production facilities, capitalizing on the growth of plant-based and non-GMO product trends. With regulations favoring transparency in food ingredients, lecithin is increasingly used in natural and organic formulations, making it a staple in clean-label products.

- China: China’s rapidly expanding F&B sector, along with rising awareness of health and wellness, has increased the demand for de-oiled lecithin. As a major manufacturing hub, China is focusing on expanding its lecithin production capabilities, led by companies like Shandong Shenglin and Lecithin Foods Co. Lecithin is widely used in processed foods, dietary supplements, and cosmetics, reflecting the country’s ongoing growth in the consumption of functional food ingredients. Moreover, China’s demand for lecithin in animal feed is also rising.

- Germany: Germany is a leader in the European market for de-oiled lecithin, owing to its robust food and pharmaceutical industries. Companies such as Lipoid are making significant strides in producing high-quality lecithin for food, cosmetics, and pharmaceuticals. The increasing demand for plant-based and clean-label products fuels the market’s growth. Germany’s emphasis on sustainability and eco-friendly ingredients further boosts lecithin's role in food formulations, with its applications expanding across baking, confectionery, and dietary supplements.

- Japan: Japan's strong inclination toward functional foods and nutraceuticals has driven up the demand for de-oiled lecithin. Japanese companies, such as Kao Corporation, utilize lecithin in both food products and cosmetics. As consumer demand for high-quality, health-enhancing ingredients grows, lecithin is increasingly used in various applications, including energy drinks, supplements, and skincare products. Moreover, Japan’s advanced technological infrastructure ensures the production of lecithin through efficient and sustainable processes, positioning it as a critical player.

- India: India's de-oiled lecithin market is growing, particularly in the food and beverage, nutraceutical, and cosmetic sectors. The rise in health-consciousness, alongside the growing adoption of vegetarian and plant-based diets, is spurring demand for lecithin as an emulsifier and functional ingredient. Companies like Lecithin India are tapping into the expanding market by offering high-quality lecithin to meet increasing consumer demand for natural and organic products. India's booming nutraceutical sector further enhances lecithin's application in dietary supplements and health products.

De-Oiled Lecithin Market Segmentation Analysis

By Form

The powder form of de-oiled lecithin dominates the market due to its versatility and ease of integration in various industries. It is widely used in food and beverages for its emulsifying properties, enhancing texture and stability. Moreover, powder lecithin finds extensive applications in animal feed, pharmaceuticals, and health care products. The powder form is highly preferred because it is easier to store, transport, and mix into dry products, ensuring consistency and quality in formulations across multiple sectors.

By Source

Soybean-derived de-oiled lecithin is the dominant segment due to its availability, cost-effectiveness, and nutritional benefits. It is extensively used in the food and beverage industry, including bakery products, beverages, and dairy. Moreover, it is preferred in health care and feed applications for its high-quality phospholipids. Soy lecithin's global accessibility and established supply chains make it a reliable source, making it the most widely used variant in the lecithin market, especially as consumers demand cleaner and plant-based ingredients.

By Method of Extractions

Acetone extraction leads the de-oiled lecithin market due to its high efficiency in separating lecithin from oil. This method is widely preferred for its cost-effectiveness and ability to produce high-quality lecithin. It is especially common in the food and beverage sector, where lecithin must meet stringent purity standards. Acetone extraction is also widely used in health care products and feed applications, where the focus is on maintaining the lecithin’s functionality for emulsification and stabilization, making it the preferred method.

By Applications

The food and beverages segment is the dominant application for de-oiled lecithin, accounting for a significant market share. Lecithin’s ability to act as an emulsifier, stabilizer, and dispersing agent makes it highly sought after in various food products like bakery goods, confectioneries, dairy, and beverages. Its use ensures smoother textures, improved shelf life, and enhanced quality. As consumer preferences for healthier, plant-based products grow, the demand for lecithin in food and beverages continues to rise, solidifying its position.

Company Market Share

Many key market players are investing in research and development to improve the emulsifying, stabilizing, and moisturizing properties of de-oiled lecithin, making it more suitable for applications in pharmaceuticals, cosmetics, and food processing. Companies are also prioritizing sustainable sourcing and production methods to meet consumer preferences for natural, eco-friendly ingredients.

List of Key and Emerging Players in De-Oiled Lecithin Market

- Cargill, Incorporated

- ADM

- Stern-Wywiol Gruppe

- IMCD Group B.V.

- Bunge Limited

- Sonic Biochem

- American Lecithin Company

- Lecico GmBH

- Lecital

- Austrade Inc.

- Lipoid GmbH

- Clarkson Specialty Lecithins

- Amitex Agro Product Pvt. Ltd.

- VAV Life Sciences Pvt. Ltd.

- DowDupont Inc.

to learn more about this report Download Market Share

Recent Developments

- September 2023 – The Louis Dreyfus Company (LDC), in partnership with Donlink and HAID Group, completed the first phase of a major food industrial park in Guangzhou, China. This facility includes a lecithin production line, highlighting its role in producing plant-based ingredients such as de-oiled lecithin. This development strengthens supply chains and supports China's rising demand for sustainable, high-quality, and allergen-free ingredients.

Analyst Opinion

As per our analyst, the market is poised for steady growth driven by rising demand across feed, industrial, and health care applications. The growing awareness of lecithin’s functional benefits, like emulsification, dispersion, and stabilization, is encouraging its use beyond traditional F&B segments. Moreover, emerging markets are showing increased adoption, particularly in animal feed and nutraceuticals, further boosting growth prospects.

Despite these positive trends, the global de-oiled lecithin faces challenges such as fluctuating raw material prices and the complexity of lecithin extraction methods. Moreover, regulatory variations across regions may impact product approvals and market entry strategies. However, our analysts believe that continuous advancements in extraction technologies and the shift towards clean-label, plant-based ingredients will help companies overcome these hurdles.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 237.98 Million |

| Market Size in 2025 | USD 256.59 Million |

| Market Size in 2033 | USD 468.63 Million |

| CAGR | 7.82% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Form, By Source, By Method of Extractions, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

De-Oiled Lecithin Market Segments

By Form

- Powder

- Granules

By Source

- Soybean

- Sunflower

- Rapeseed & Canola

- Egg

- Others

By Method of Extractions

- Acetone Extraction

- Carbon Dioxide Extraction

- Ultrafiltration Process

By Applications

- Food & Beverages

- Bakery Products

- Convenience Food

- Confectioneries

- Beverages

- Dairy & Non-Dairy Products

-

Others

- Feed

- Industrial

- Health Care Products

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.