Dental Impression System Market Size, Share & Trends Analysis Report By Product (Impression Materials, Intraoral Scanners, Impression Trays, Others), By Application (Restorative & Prosthodontics Dentistry, Orthodontics, Others), By End Use (Dental Hospital & Clinics, Dental Laboratories, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Dental Impression System Market Overview

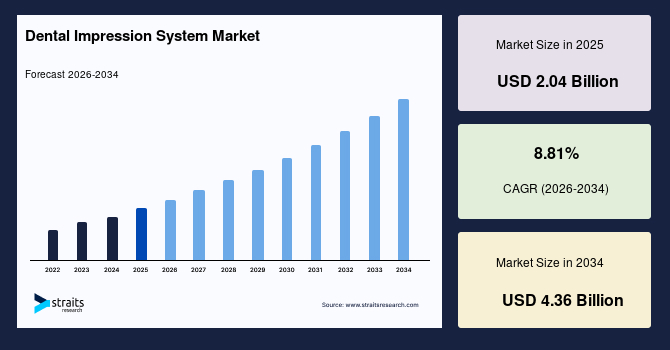

The global dental impression system market size is valued at USD 2.04 billion in 2025 and is estimated to reach USD 4.36 billion by 2034, growing at a CAGR of 8.81% during 2026-2034. The global market observed impressive growth stimulated by increasing demand for hybrid impression workflows combining digital scanning with 3D printed prosthetics.

Key Market Trends & Insights

- Europe held a dominant share of the global market, accounting for 38.84% in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 54%.

- Based on product, the saline Dental Impression System segment is projected to register the fastest CAGR of 10.13%.

- Based on the application, the restorative & prosthodontic dentistry segment dominated the market in 2025, accounting for 41.23% revenue share.

- On the basis of end use, the dental hospital & clinics segment dominated the market in 2025.

- Germany dominates the dental impression system market, valued at USD 241.33 million in 2024 and reaching USD 261.56 million in 2025.

Table: Germany Dental Impression System Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.04 billion

- 2034 Projected Market Size: USD 4.36 billion

- CAGR (2026-2034): 8.81%

- Dominating Region: Europe

- Fastest Growing Region: Asia Pacific

The market includes a broad range of products such as impression materials, intraoral scanners, impression trays, and others. These systems support applications in restorative and prosthodontic dentistry, orthodontics, and other diagnostic requirements. Dental impressions are essential for creating crowns, bridges, aligners, and dentures, and are widely utilized across dental hospitals, clinics, and laboratories, and other healthcare facilities.

Latest Market Trends

Shift Toward Digital Intraoral Scanning and Fully Integrated Cad/Cam Workflows

A major trend in the dental impression system market is the rapid shift from traditional impression materials to digital intraoral scanning technologies, driven by the demand for higher precision, faster workflows, and improved patient comfort. Digital impressions reduce errors, enable seamless CAD/CAM integration, and support same-day restorations. This transition is accelerating innovation in scanner accuracy and software capabilities, while reinforcing clinician confidence in adopting fully digital workflows for restorative and orthodontic procedures.

Expansion of 3d Printing Integrated Impression Workflows

The increasing integration of 3D printing with digital impression workflows is a key trend for market growth. In 2024, dental clinics and laboratories adopted direct-to-print models using scans from intraoral scanners to produce highly accurate crowns, aligners, and surgical guides. This shift reduces production time, enhances customization, and lowers laboratory costs. As 3D printing becomes more accessible, its combination with digital impressions is rapidly transforming restorative and orthodontic practices.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.04 Billion |

| Estimated 2026 Value | USD 2.22 Billion |

| Projected 2034 Value | USD 4.36 Billion |

| CAGR (2026-2034) | 8.81% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | 3M Company, Align Technology, Inc., Danaher, Dentsply Sirona, DMG |

to learn more about this report Download Free Sample Report

Market Driver

Growing Demand For Advanced Restorative and Prosthodontic Procedures

The rising global burden of tooth loss, aging populations, and increasing adoption of dental implants and crowns are major drivers of the dental impression system market. As restorative procedures continue to surge, clinicians require highly accurate impressions to ensure optimal treatment outcomes. In 2024, for example, Heartland Dental, one of the largest U.S. dental networks, expanded its deployment of digital scanners across multiple locations to support faster restorative workflows.

Thus, the growing demand for prosthodontic procedures is a key driver supporting market growth.

Market Restraints

High Cost And Limited Accessibility Of Digital Impression Systems

A major restraint in the dental impression system market is the high upfront and operational cost of digital impression technologies, including intraoral scanners, software upgrades, and technician training. Smaller dental clinics and facilities in developing regions struggle to afford these investments, slowing the shift from traditional materials to digital workflows. Additionally, maintenance requirements and integration challenges add to the burden.

As a result, these cost-related barriers continue to limit adoption and restrain overall market growth.

Market Opportunity

Growing Adoption Of Digital Dentistry In Emerging Markets

A key opportunity in the dental impression system market lies in the rapid expansion of digital dentistry across developing regions, supported by rising patient awareness and growing investments in dental infrastructure. Countries such as India, Brazil, and Indonesia are witnessing increased installation of digital scanners and CAD/CAM systems in clinics and laboratories. For example, in 2024, Laxmi Dental deployed its proprietary iScanPro intraoral scanner in 759 clinics, enabling dentists to send digital impressions directly to labs, reducing turnaround times and remake rates by 50%. This expanding digital penetration is expected to create strong, sustained market growth.

Regional Analysis

Europe dominated the dental impression system market in 2025, accounting for 38.84% market share. This growth is driven by the early adoption of fully integrated digital dental workflows, where clinics and laboratories widely utilize intraoral scanners, CAD/CAM systems, and 3D-printed restorations. This advanced technological infrastructure supports precise, efficient treatments, driving strong regional demand and market growth.

A major factor driving the market in Germany is the partial reimbursement of CAD/CAM-based dental restorations by statutory health insurance. This reduces the financial burden on clinics, encouraging widespread adoption of intraoral scanners and digital workflows, while Germany’s advanced dental infrastructure further supports growth and strengthens market demand.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 10.13% from 2026-2034. The growth is driven by the rapid modernization of dental clinics in China, supported by initiatives like Volume-Based Procurement. In 2024–25, Straumann reported increased adoption of its SIRIOS intraoral scanners, reflecting growing demand for digital solutions and strengthening regional market growth.

A major factor driving the dental impression system market in China is the growth of dental tourism and international clinic investments. In 2024, various private chains partnered with global dental technology providers to offer advanced CAD/CAM and digital impression services, expanding access to high-quality restorative care and boosting market adoption.

Regional Market share (%) in 2025

![]()

Source: Straits Research

North America Market Insights

A major factor driving the North America dental impression system market is the widespread digital transformation led by Dental Service Organizations (DSOs). Many DSOs adopted advanced intraoral scanners, such as Straumann’s SIRIOS, to enhance workflow efficiency, improve restorative precision, and deliver scalable, high-quality dental care, fueling regional market growth.

A key factor driving the U.S. market is the extensive adoption of Align Technology’s iTero scanners. By 2024, over 100,000 devices deployed across U.S. dental practices, enabling fully digital restorative and orthodontic workflows, improving precision, and enhancing efficiency, thereby strengthening market growth.

Latin America Market Insights

In Latin America, the dental impression system market growth is propelled by the introduction of government-backed programs promoting digital dentistry adoption. In 2024, initiatives in Brazil and Mexico encouraged clinics to implement intraoral scanners and digital workflows, improving treatment accuracy, expanding access to modern restorative care, and stimulating overall regional market growth.

A key factor driving Argentina’s market is the rising uptake of chair-side CAD/CAM systems in major cities like Buenos Aires, Córdoba, and Rosario. Local practices increasingly install intraoral scanners to support same-day restorations, shorten patient visits, and modernize workflows.

Middle East and Africa Market Insights

In the Middle East, the market is expanding due to the surge in government and private investments in dental infrastructure across Gulf countries. In 2024, the UAE’s “Make It in the Emirates” initiative enabled reduced import costs and faster approvals for digital dental devices, accelerating intraoral scanner adoption in state-of-the-art clinics.

A key factor driving Egypt’s market is the increasing demand for cosmetic and esthetic dentistry procedures in urban areas like Cairo and Alexandria. In 2024, many private clinics invested in digital impression systems to provide precise crowns, veneers, and aligners, enhancing patient outcomes and accelerating the adoption of advanced dental technologies.

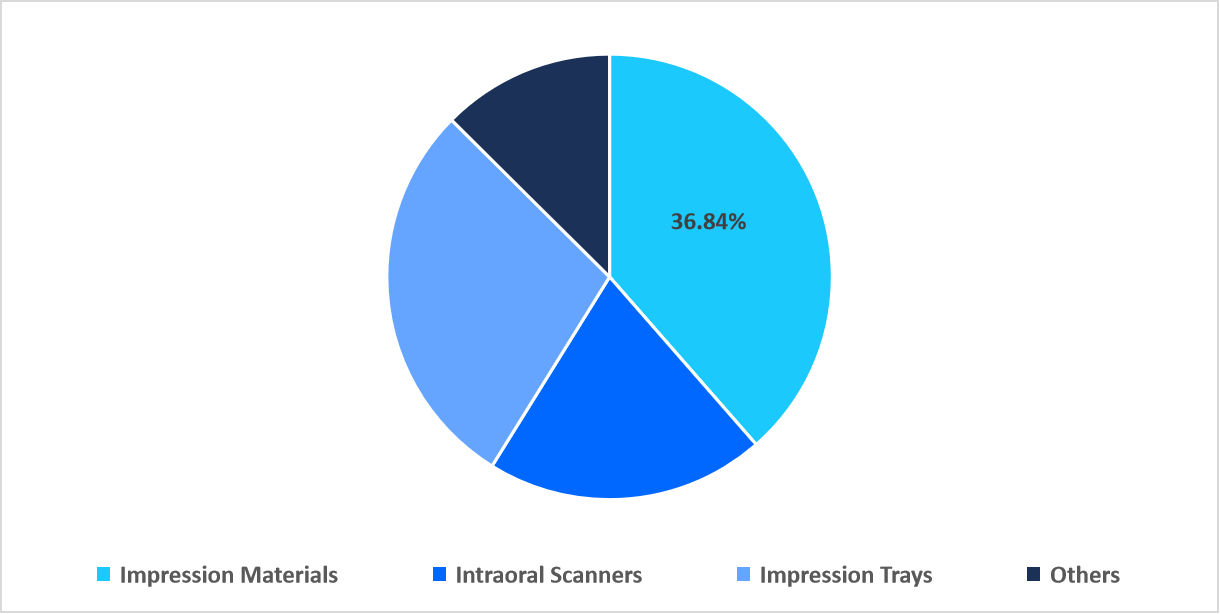

Product Insights

The impression materials segment dominated the market in 2025, accounting for 36.84% revenue share. This growth is driven by the growing use of hydrophilic VPS formulations, which deliver superior moisture tolerance and detail reproduction. In 2025, many clinics adopted these advanced materials to reduce remake rates in complex restorative cases, strengthening demand across high-precision workflows.

The intraoral scanners segment is projected to witness the fastest CAGR of 9.49% during the forecast timeframe. This growth is augmented by the integration of AI-powered margin detection and error correction in models, enabling dentists to capture more precise digital impressions, reduce chair time, and improve overall restorative accuracy.

By Product Market Share (%), 2025

Source: Straits Research

Application Insights

The restorative & prosthodontic dentistry segment dominated the market in 2025 with a revenue share of 41.23%, owing to increasing use of digital bite registration technologies, which improve occlusal accuracy in crowns and bridges, reduce adjustment time, and enhance the predictability of complex prosthodontic treatments.

The orthodontics segment is expected to register the fastest CAGR growth of 9.24% during the forecast period. This growth is supported by the growing use of clear aligners combined with digital impression systems, enabling accurate treatment planning, enhanced patient comfort, and seamless collaboration with dental laboratories for highly personalized and efficient orthodontic solutions.

End Use Insights

The dental hospital & clinics segment dominated the market in 2025, because of high patient footfall and increasing preference for advanced, in-house restorative and prosthodontic treatments. Additionally, hospitals and large clinics are equipped with modern digital impression systems, intraoral scanners, and CAD/CAM workflows.

The dental laboratories segment is estimated to grow at a CAGR of 9.45% during the forecast period, due to increasing adoption of cloud-based digital impression sharing, which allows laboratories to receive high precision scans from clinics instantly, streamline prosthetic fabrication, and improve turnaround times for customized restorations.

Competitive Landscape

The global dental impression system market is moderately competitive, with various established companies holding notable market share. Continuous advancements in digital impression technologies, intraoral scanners, and high-precision materials are intensifying competition among key players. Major companies in the market include Dentsply Sirona, 3M, Align Technology, Ivoclar Vivadent, Planmeca, GC Corporation, and others. These companies are actively pursuing product innovations, strategic partnerships, and digital workflow expansion to strengthen their global presence and maintain a competitive advantage.

Kettenbach GmbH & Co. KG: An emerging market player

Kettenbach GmbH & Co. KG is a rising firm in the global market, specializing in high-quality VPS and alginate replacement materials like Identium, Panasil, and Futar. With a growing international footprint, the company supports digital CAD/CAM workflows through innovative impression solutions. Its commitment to R&D and clinician-focused design positions Kettenbach as a nimble, fast-growing challenger in precision-driven restorative dentistry.

List of Key and Emerging Players in Dental Impression System Market

- 3M Company

- Align Technology, Inc.

- Danaher

- Dentsply Sirona

- DMG

- GC Corporation

- Henry Schein, Inc.

- Ivoclar Vivadent AG

- Kettenbach GmbH & Co. KG

- Keystone Industries

- Parkell, Inc.

- Planmeca Oy

- Septodont Holding

- Ultradent Products Inc.

- Voco GmbH

- Zest Dental Solutions

- Zhermack Spa

- Envista

- Others

Strategic Initiatives:

- March 2025: Planmeca launched its first handheld intraoral X-ray device, Planmeca ProX GO, for accurate diagnostics and informed decision-making.

- March 2025: OMNIVISION and Biotech Dental partnered to involve Biotech Dental’s use of multiple medical-grade camera modules from OMNIVISION in the design of its new Scan4All 3D intraoral scanners, Iris by Starck.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.04 Billion |

| Market Size in 2026 | USD 2.22 Billion |

| Market Size in 2034 | USD 4.36 Billion |

| CAGR | 8.81% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application , By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Dental Impression System Market Segments

By Product

- Impression Materials

- Intraoral Scanners

- Impression Trays

- Others

By Application

- Restorative & Prosthodontics Dentistry

- Orthodontics

- Others

By End Use

- Dental Hospital & Clinics

- Dental Laboratories

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.