Dimethyl Ether Market Size, Share & Trends Analysis Report By Raw Material (Methanol, Bio-Based Feedstock, Coal, Natural Gas), By Application (Aerosol Propellant, LPG Blending, Transportation Fuel, Power Plant Fuel, Chemical Feedstock) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Dimethyl Ether Market Size

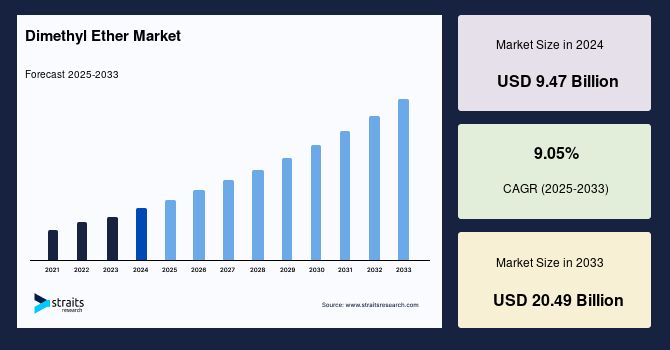

The global dimethyl ether market size was valued at USD 9.47 billion in 2024 and is projected to grow from USD 10.24 billion in 2025 to USD 20.49 billion by 2033, exhibiting a CAGR of 9.05% during the forecast period (2025-2033).

Dimethyl ether (DME), a colorless gas, is the simplest aliphatic ether. Also called methyl ether, it is currently produced by dehydrating methanol. Dimethyl ether is a synthetically produced alternative to diesel for use in specially designed compression ignition diesel engines. Diethyl ether produces rubber, plastics, paints, coatings, perfumes, and cosmetics. It is a solvent or extractant for fats, waxes, oils, resins, dyes, and alkaloids. It makes other small molecules, such as acetic acid or dimethyl sulfate. It is also a spray-can propellant and a refrigerant to replace chlorofluorocarbons. It has been proposed as a cleaner-burning fuel than hydrocarbons.

The global market is expanding due to its growing adoption as an alternative fuel in LPG blending, transportation, and power generation. The rising demand for clean-burning fuels, driven by stricter environmental regulations and sustainability goals, is a key growth driver. Governments worldwide are encouraging the shift toward low-emission energy sources, boosting market penetration. Technological advancements in production processes, particularly from renewable sources such as biomass and waste, present significant growth opportunities. The increasing application of Dimethyl ether in the aerosol propellant and chemical feedstock sectors also supports market expansion. Asia-Pacific, led by China and India, dominates the market due to high LPG consumption and strong governmental support for DME as a fuel alternative. Investments in research and development for cost-effective production and improved distribution networks can unlock new opportunities for market players.

Current Market Trends

Dimethyl Ether Emerges as A Promising Diesel Fuel Alternative

The demand for cleaner and more efficient fuels is rising globally, and dimethyl ether is increasingly recognized as a viable alternative to diesel. With a high cetane number (above 55) and clean-burning characteristics, Dimethyl ether provides advantages over traditional diesel, such as significantly lower emissions of particulate matter (PM), nitrogen oxides (NOx), and carbon monoxide (CO). Unlike fossil-based diesel, DME contains no sulfur, making it a suitable option for reducing urban air pollution.

Additionally, dimethyl ether can be produced from multiple feedstocks, including natural gas, coal, and biomass, making it a versatile energy carrier with the potential to be a renewable fuel. Government policies encouraging low-carbon transportation and shifting toward alternative fuels in heavy-duty vehicles are expected to boost DME adoption in the coming years.

- For example, in March 2023, DCC plc and Oberon Fuels announced a partnership to build renewable dimethyl ether (rDME) production plants in Europe. This collaboration aims to increase the availability of sustainable fuel alternatives and contribute to decarbonization goals.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 9.47 Billion |

| Estimated 2025 Value | USD 10.24 Billion |

| Projected 2033 Value | USD 20.49 Billion |

| CAGR (2025-2033) | 9.05% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Akzo Nobel N.V., China Energy Limited, Ferrostal GmbH, Grillo-Werke AG, Jiutai Energy Group |

to learn more about this report Download Free Sample Report

Dimethyl Ether Market Growth Factors

Increasing Demand for Blended Dme and Its Suitability as An Lpg Replacement

The global dimethyl ether market is poised for significant expansion due to its rising adoption as a blended fuel and potential as a direct substitute for liquefied petroleum gas (LPG). DME's ability to be mixed with LPG (up to 20%) without significant modifications makes it an attractive solution for countries seeking to reduce dependence on fossil fuels and lower emissions from domestic and industrial usage.

- For instance, China's LPG production increased to 4.43 million metric tons in December 2023, up from 4.15 million metric tons in November 2023 (National Bureau of Statistics of China).

Countries like India, China, and Indonesia are promoting DME blending mandates to curb pollution and improve fuel efficiency in residential and commercial applications. Major oil and energy firms are investing in DME production facilities to meet the growing demand for clean fuel alternatives.

Moreover, consumer awareness regarding environmental sustainability and carbon emissions is increasing, leading to greater demand for low-emission fuels like dimethyl ether. Due to its smokeless combustion and absence of sulfur compounds, Dimethyl ether offers improved air quality benefits compared to diesel, LPG, and gasoline.

Market Restraints

High Production Costs and Infrastructure Limitations

The commercialization of dimethyl ether is hampered by high production costs, particularly for rDME. The capital-intensive nature of dimethyl ether synthesis plants and the limited availability of large-scale production facilities have slowed adoption rates. Infrastructure modifications, including storage tanks and fuel injection systems, require substantial investments, making the transition less attractive for fleet operators.

- For instance, DME’s cost per gallon is higher than conventional diesel due to expensive methanol conversion and purification processes.

Despite strong demand in Asia-Pacific and Europe, DME lacks universal fuel standards, creating uncertainty among producers and buyers. Countries have varying regulations regarding fuel blending limits and emissions benchmarks, complicating international trade. While China mandates dimethyl ether blending in LPG, the European Union fuel policies focus more on biofuels rather than synthetic fuels like DME, affecting its adoption in European markets.

While DME can be produced from natural gas, coal, and biomass, most production still relies on fossil fuels, limiting its environmental benefits. Expanding the production of renewable DME (rDME) is essential to align with global decarbonization goals, but it requires policy incentives, carbon pricing mechanisms, and infrastructure investments.

Market Opportunity

Use of Dme as An Alternative Fuel in the Power and Transportation Sector

Dimethyl ether presents a massive power generation and transportation opportunity as a low-carbon alternative to conventional fuels. DME can be used in the power generation of gas turbines and fuel cells due to its high combustion efficiency and low environmental impact. Dimethyl ether can replace diesel for heavy-duty trucks, buses, and marine vessels. It can also be blended with propane to create low-carbon fuel options for vehicle fleets.

- For instance, Oberon Fuels and SHV Energy are collaborating to scale up rDME production, aiming to introduce a 20% rDME blend that reduces propane’s carbon intensity significantly. Oberon has secured over USD 30 million in private funding and a USD 2.9 million grant from California’s energy initiatives to scale production to 1.6 million gallons annually.

Countries with stringent emission reduction goals, like Germany, the United States, China, and Japan, are exploring DME-fueled transport solutions to meet Net Zero targets by 2050.

Regional Insights

Asia Pacific: Dominant Region

Asia-Pacific dominates the global market. This is primarily due to the region's large population, increasing energy demands, and growing awareness of cleaner fuel alternatives. Countries like China and India are major consumers of DME, particularly in the household sector, where it is blended with LPG for cooking and heating. Additionally, the presence of key dimethyl ether producers and the region's focus on sustainable energy solutions contribute to its market dominance.

- According to the Petroleum Planning and Analysis Cell, as of October 2023, PSU OMCs (IOCL, BPCL, and HPCL) together have 31.54 crore (USD 3.78 million) active LPG customers in the domestic category whom 25,425 LPG distributors are serving.

North America: Fastest-Growing Market

North America's dimethyl ether market is expanding due to its focus on transportation decarbonization. Stringent environmental regulations, like California's low-carbon fuel standards and initiatives such as the Renewable Fuel Standard, create a demand for cleaner alternatives to traditional diesel. DME is gaining traction with its potential to reduce greenhouse gas emissions in heavy-duty vehicles. Furthermore, DME's compatibility with propane blending, a standard fuel in North America, provides another avenue for market growth. These factors, combined with increasing investments in DME infrastructure, position North America as a key growth market.

- The US Department of Energy's Vehicle Technologies Office (VTO) invested over USD 4 million in 2021 to explore various dimethyl ether (DME) applications as a low-carbon fuel alternative. Furthermore, in 2022, the US government committed to infrastructure, technology, and manufacturing investments to achieve a 50–52% reduction in greenhouse gas emissions by 2030.

Countries Insights

- United States: The United States is emerging as a key player in the renewable dimethyl ether market, driven by government initiatives, technological advancements, and increasing investments in low-carbon fuel alternatives. In May 2024, Lummus Technology launched CDDMESM, a new catalytic distillation-enhanced DME technology designed to improve renewable DME production efficiency. This innovation is expected to reduce production costs and make rDME a more competitive alternative to conventional fuels.

- Ireland: Ireland is positioning itself as a hub for renewable DME production in Europe, with significant energy companies investing in sustainable fuel alternatives. In March 2023, DCC plc and Oberon Fuels partnered to advance the development of European renewable DME production facilities. Their initial feasibility study confirmed significant market potential for a sustainable LPG replacement.

- Canada: Canada’s Clean Fuel Regulations (2023) aim to reduce transportation fuel emissions by 13% by 2030, increasing demand for low-carbon alternatives like DME and biofuels. Canadian companies are partnering with U.S. firms to develop DME-based sustainable fuel infrastructure.

- China: China remains the largest producer and consumer of dimethyl ether, primarily using it as a blending agent in LPG for residential and industrial applications. China is the first country to commercialize DME-blended LPG, with nearly 20% of LPG products blended with DME. This widespread adoption has lowered household fuel costs and reduced reliance on fossil-based LPG.

- Japan: Japan has been actively exploring DME as an alternative fuel, particularly in the residential and industrial heating sector. According to the Ministry of Economy, Trade, and Industry (METI), Japan's liquefied petroleum gas (LPG) production reached 3.07 million metric tons in 2022. Japanese energy companies are working on integrating DME into LPG distribution networks to improve energy security and lower carbon emissions. The Japanese market is driven by investments in DME Research for LPG replacement. According to Japan’s METI, LPG production reached 3.07 million metric tons in 2022, prompting research into DME as a substitute. Japanese energy firms are testing DME-powered generators to enhance disaster resilience.

- India: India’s growing energy demand and rising LPG imports drive the adoption of DME as a cooking and industrial fuel alternative. India’s ethanol blending targets (20% by 2025) indicate that a similar approach could be taken for DME-LPG blends. Government initiatives supporting bio-DME from biomass waste are expanding local production capabilities.

Dimethyl Ether Market segmentation Analysis

By Raw Material

Natural gas offers a high purity level, minimizing the need for extensive pre-treatment before conversion. Furthermore, converting natural gas to dimethyl ether is relatively straightforward compared to other feedstocks, making it a more economically viable and efficient option. These factors contribute to natural gas being the preferred choice for large-scale DME production, thus driving its dominance in the market.

By Application

The largest market share belonged to the LPG blending segment due to the widespread use of LPG in households. LPG is widely used for cooking and heating in homes globally, and blending dimethyl ether offers several advantages. DME's clean-burning properties can improve the overall combustion efficiency and reduce emissions of LPG. Additionally, DME can be produced from various sources, including some renewable ones, adding a potentially sustainable element to LPG use. This widespread household application of LPG blended with dimethyl ether is the primary driver behind its substantial market share.

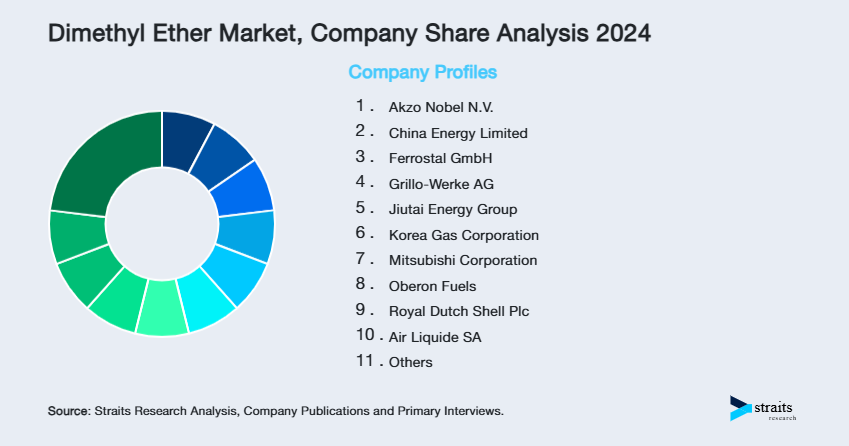

Company Market Share

The global market is moderately fragmented, with key companies focusing on expanding production capacity and developing innovative applications to capitalize on the growing demand for cleaner fuels. In the fuel sector, companies invest in DME production from various feedstocks, including natural gas, coal, and biomass, to meet the rising demand for LPG blending and diesel fuel alternatives. Furthermore, collaborations and partnerships are prioritized to advance renewable dimethyl ether production and infrastructure development. These efforts and increasing research and development in DME-powered vehicles and power generation technologies drive competition across a moderately fragmented global market.

Oberon Fuels: A rising star in the renewable dimethyl ether market

Oberon Fuels, a renewable dimethyl ether (DME) transportation fuel producer, is emerging as a significant player in the global DME market. The company has made strides in developing and commercializing its renewable DME production technology, utilizing a variety of feedstocks, including waste, biomass, and biogas. This approach aligns with the growing demand for cleaner, more sustainable fuel alternatives. Oberon Fuels' commitment to innovation and its focus on renewable DME production position it as a key contributor to the market's growth and a potential leader in the transition towards cleaner energy sources. The company's recent expansion and construction of the first renewable DME production facility further solidified its position as a rising star in the market.

List of Key and Emerging Players in Dimethyl Ether Market

- Akzo Nobel N.V.

- China Energy Limited

- Ferrostal GmbH

- Grillo-Werke AG

- Jiutai Energy Group

- Korea Gas Corporation

- Mitsubishi Corporation

- Oberon Fuels

- Royal Dutch Shell Plc

- Air Liquide SA

- I. du Pont de Nemours & Co (DuPont)

- Haldor Topsoe

- Merck KGaA

- Nouryon Chemicals Holding BV

- Sigma-Aldrich

- Toyo Engineering Corporation

- Zagros Petrochemical Company

- Fuel DME Production Co

- Guangdong JOVO Group Co.

- The Chemours Company

to learn more about this report Download Market Share

recent Developments

- May 2024- Lummus Technology introduced CDDMESM, an innovative renewable DME production technology enhanced by catalytic distillation. This advancement aims to bolster the U.S. DME market by providing a sustainable alternative to traditional fuels.

Analyst Opinion

The global market is experiencing significant growth, fueled by rising demand for cleaner fuels and their versatile applications. A growing emphasis on sustainability and stricter environmental regulations are driving the adoption of DME as a clean-burning alternative to diesel and LPG, creating opportunities for innovation. However, challenges related to infrastructure development and cost competitiveness present obstacles.

Asia-Pacific currently leads the market due to high LPG demand and a large population base. North America is emerging as a fast-growing market, driven by transportation decarbonization efforts and supportive policies. Key players prioritize partnerships and investments in renewable DME production to capitalize on this expanding market. R&D investments in dimethyl ether applications, particularly fuel blending, power generation, and transportation, indicate substantial potential for future innovation and market penetration.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 9.47 Billion |

| Market Size in 2025 | USD 10.24 Billion |

| Market Size in 2033 | USD 20.49 Billion |

| CAGR | 9.05% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Raw Material, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Dimethyl Ether Market Segments

By Raw Material

- Methanol

- Bio-Based Feedstock

- Coal

- Natural Gas

By Application

- Aerosol Propellant

- LPG Blending

- Transportation Fuel

- Power Plant Fuel

- Chemical Feedstock

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.