Drug Reference Apps Market Size, Share & Trends Analysis Report By Type (Android, iOS), By Pricing Model (Freemium (Free), Paid (Subscription)), By Application (Drug Information/Drug Data Base, Drug Interactions, Dosage Calculators, Pill/Drug Identification, Others), By End Use (Healthcare Professionals, Patients, Pharmacists, Researchers and Educators, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Drug Reference Apps Market Overview

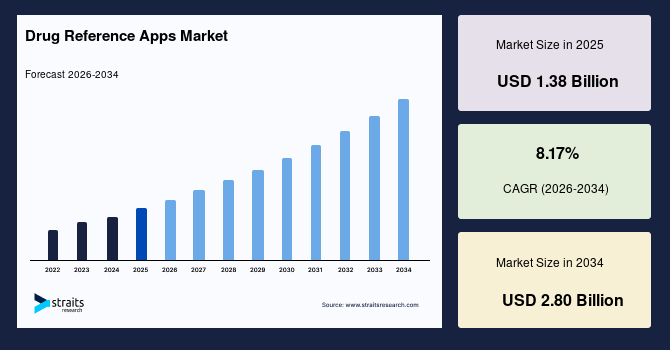

The global drug reference apps market size is estimated at USD 1.38 billion in 2025 and is projected to reach USD 2.80 billion in 2034, growing at a CAGR of 8.17% during the forecast period. Remarkable growth of the market is propelled by the expanding adoption of real-time digital pharmacology tools in clinical workflows, the increasing reliance on evidence-based mobile resources for continuing medical education, and the integration of AI-powered contextual search within drug information systems.

Key Market Trends & Insights

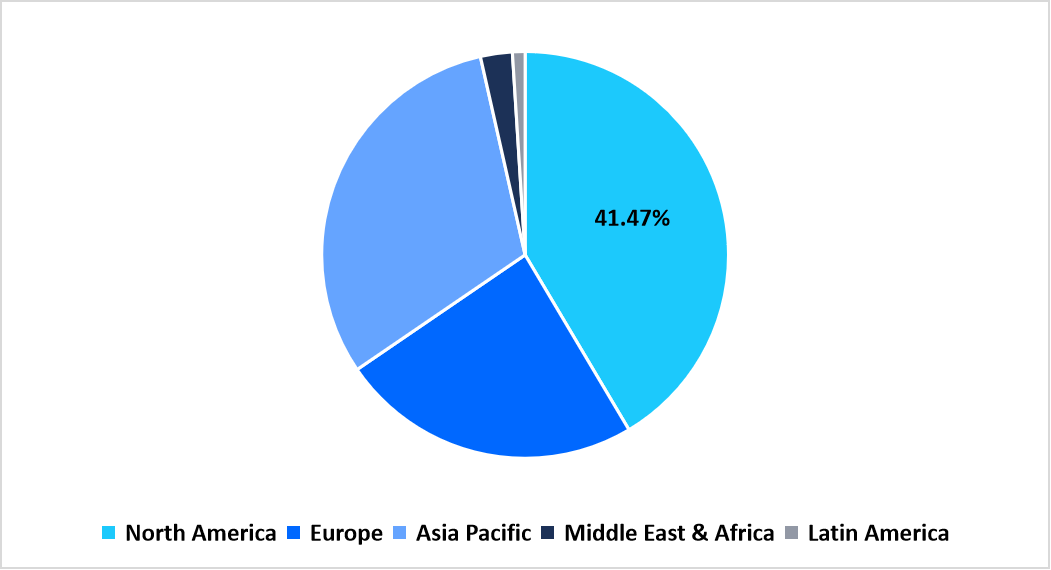

- North America held a dominant share of the global market, accounting for 41.47% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 10.32%.

- Based on Type, the iOS segment is expected to register the fastest CAGR of 9.47% during the forecast period.

- Based on the Pricing Model, the paid (subscription) segment is anticipated to grow at the fastest CAGR of 9.32% during the forecast period.

- Based on Application, the drug information/drug database segment dominated the market in 2025, accounting for a revenue share of 37.47%.

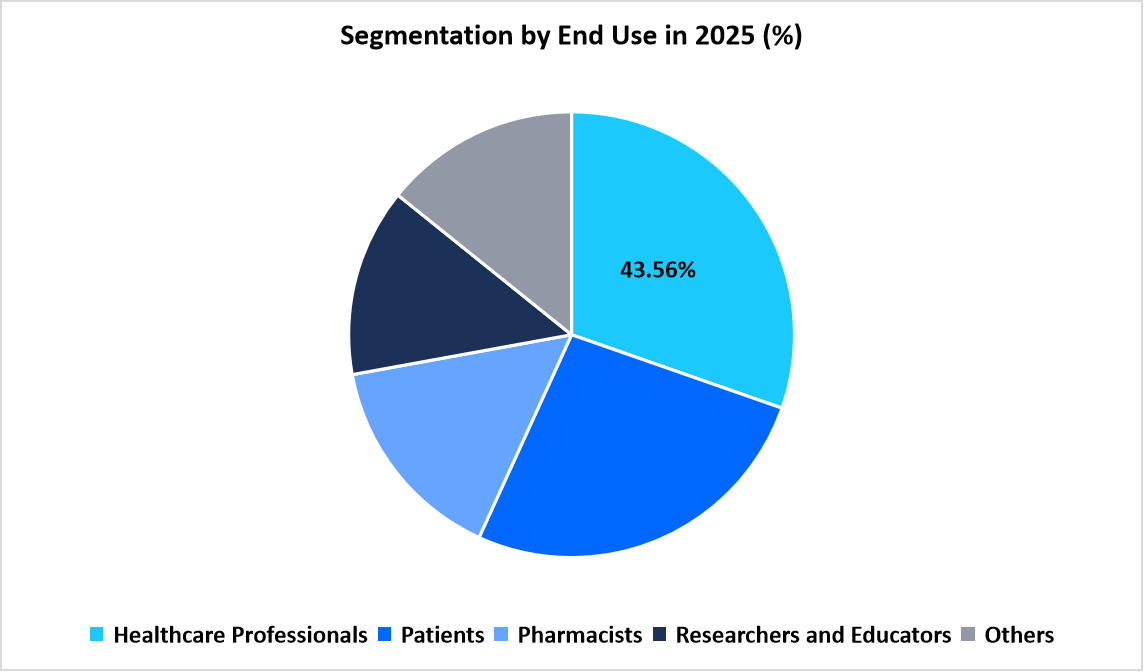

- Based on End-Use, the healthcare professionals segment dominated the market in 2025 with a revenue share of 43.56%.

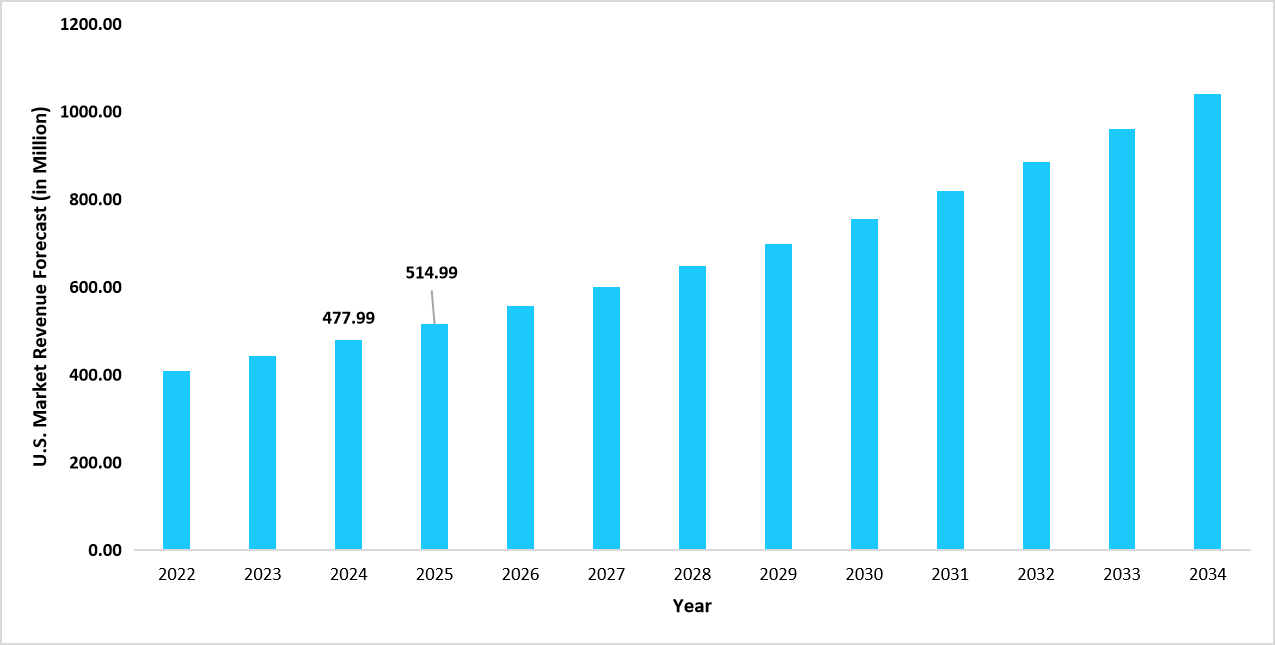

- The U.S. dominates the global drug reference apps market, valued at USD 477.99 million in 2024 and reaching USD 514.99 million in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1.38 billion

- 2034 Projected Market Size: USD 2.80 billion

- CAGR (2025 to 2034): 8.17%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The drug reference apps market comprises digital platforms and mobile applications that provide accurate, evidence-based information on medications, supporting healthcare professionals, pharmacists, patients, and researchers in clinical decision-making and medication management. These applications offer comprehensive functionalities such as drug monographs, dosage guidelines, interaction checkers, pill identification, and pharmacological data, aimed at improving prescribing accuracy and enhancing patient safety.

The market is segmented by type into Android and iOS, reflecting the two major mobile ecosystems; by pricing model into freemium (free) and paid (subscription), catering to both general and professional users; by application into drug information/databases, drug interactions, dosage calculators, pill/drug identification, and others, covering diverse clinical and educational demands; and by end use into healthcare professionals, patients, pharmacists, researchers and educators, and others. Collectively, these segments illustrate the market’s broad scope within digital healthcare, where mobile-based reference tools are becoming essential for ensuring safe, informed, and efficient medication practices.

Latest Market Trends

Integration of Artificial Intelligence and Predictive Analytics in Clinical Decision Support

A growing trend in the drug reference apps market is the integration of artificial intelligence (AI) and predictive analytics to enhance clinical decision-making. These technologies are enabling drug reference platforms to suggest personalized medication options, flag potential prescribing errors, and provide adaptive drug recommendations based on patient-specific parameters. Several AI-integrated drug information apps introduced context-aware search features that interpreted clinical queries to deliver faster, evidence-based results. This advancement is improving the speed and precision of drug referencing in hospitals and clinical settings, reducing data overload, and supporting more informed prescribing practices.

Rising Adoption of Cloud-Based and Interoperable Reference Systems

The growing adoption of cloud-based and interoperable platforms is transforming the way healthcare institutions access, manage, and share drug information. Hospitals, pharmacies, and educational institutions are shifting toward cloud-hosted databases that allow real-time updates, synchronization across devices, and secure collaboration between multidisciplinary teams. Cloud integration enables seamless connectivity with electronic health record (EHR) systems, allowing clinicians to retrieve updated drug data within prescribing workflows. This trend promotes consistent medication guidance, reduces manual referencing errors, and enhances workflow efficiency across healthcare systems.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.38 Billion |

| Estimated 2026 Value | USD 1.49 Billion |

| Projected 2034 Value | USD 2.80 Billion |

| CAGR (2026-2034) | 8.17% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Glooko, Inc., Wolters Kluwer N.V., Lattice Solutions, VisualDx, EBSCO Industries, Inc. |

to learn more about this report Download Free Sample Report

Market Drivers

Growing Focus on Medication Safety and Pharmacovigilance

The increasing emphasis on medication safety and adverse drug event prevention is driving the adoption of drug reference apps across hospitals and healthcare networks. Rising cases of prescription-related errors have pushed healthcare organizations to implement evidence-based drug information systems that provide real-time alerts, dosage limits, and interaction warnings. Regulatory initiatives by agencies such as the U.S. FDA and EMA, which mandate stricter pharmacovigilance practices, are further strengthening the use of mobile and digital drug referencing tools to improve patient safety.

Market Restraint

Limited Data Integration with Legacy Healthcare Systems

The major challenges in the drug reference apps market are the limited compatibility of new mobile and AI-powered platforms with older healthcare information systems. Several hospitals still operate on outdated EHR architectures that do not support seamless integration of external databases or real-time updates. This fragmentation results in data silos, inconsistent medication records, and delays in accessing updated drug information, especially in multi-department setups. As a result, healthcare facilities face hurdles in adopting comprehensive reference applications across all clinical functions.

Market Opportunity

Expansion of Multilingual and Region-Specific Drug Databases

The development of multilingual and region-specific drug reference applications presents a strong growth opportunity. As global healthcare networks expand and cross-border telemedicine rises, demand is increasing for localized drug compendiums that include country-specific formulations, brand equivalents, and regional regulatory information. Expanding these databases allows app developers to reach diverse clinical audiences, including non-English-speaking practitioners and pharmacists. This opportunity not only enhances global accessibility but also supports safer prescribing in multicultural and multi-regional healthcare environments.

Regional Analysis

The North America region dominated the drug reference apps market with a revenue share of 41.47% in 2025. Growth is driven by the strong integration of clinical decision-support systems in hospital networks, widespread adoption of mobile health platforms, and rising emphasis on medication safety compliance. The region benefits from digital health legislation that supports interoperability and data-sharing standards across healthcare providers.

The U.S. drug reference apps market is primarily influenced by the Centers for Medicare & Medicaid Services (CMS) focus on reducing adverse drug events through electronic prescribing mandates and the FDA’s Digital Health Innovation Action Plan. The growing collaboration between app developers and EHR vendors enables clinicians to access real-time drug monographs, interactions, and formulary data directly within electronic workflows, improving prescribing accuracy and reducing preventable medication errors.

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing market with a CAGR of 10.32% during the forecast period, fueled by rising mobile health literacy, expanding smartphone penetration among healthcare professionals, and a surge in clinical digitization across hospitals. The regional focus on medical education and continuing professional development is also encouraging healthcare providers to adopt digital reference tools for evidence-based learning.

The Indian drug reference apps market is evolving due to the government’s efforts to strengthen digital healthcare infrastructure under the Ayushman Bharat Digital Mission (ABDM). The growing use of app-based drug compendiums and formulary databases by physicians, along with partnerships between health-tech startups and academic medical institutions, is driving market penetration. The availability of locally curated drug databases addressing generic variations further supports adoption among clinicians and pharmacists.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

The European market is expanding due to the growing digital transformation of healthcare and strong regulatory support for mobile clinical tools that enhance pharmacovigilance and e-prescription practices. The European Medicines Agency (EMA) encourages digital platforms that offer validated, evidence-based drug information to healthcare professionals.

Germany’s market is expanding due to the implementation of the Digital Healthcare Act (DVG), which allows physicians to prescribe approved digital health applications, including drug information apps, to patients. Increasing usage of such apps by pharmacists and general practitioners for medication reconciliation and dosage verification is enhancing the adoption of drug reference tools across the country.

Middle East and Africa Market Insights

The Middle East and Africa region is witnessing expansion driven by the adoption of mobile health solutions in tertiary care centers and growing investments in health IT modernization. The increasing reliance on drug reference apps in telemedicine programs and pharmacy networks supports safer prescription practices and improves clinical efficiency.

The UAE market is advancing due to the Ministry of Health and Prevention’s (MOHAP) initiatives promoting digital tools for medication management and e-prescriptions. Hospitals and clinics are integrating multilingual drug reference apps into their patient management systems to support clinicians from diverse backgrounds, ensuring accurate drug utilization and improved treatment outcomes.

Latin America Market Insights

The Latin American market is expanding as healthcare professionals increasingly rely on digital reference tools for updated pharmaceutical information and drug interaction checks. Growing awareness of medication safety, combined with the rise of mobile health education programs, is fueling adoption across hospitals and pharmacies.

Brazil’s market is developing due to the national e-health strategy, which emphasizes digital literacy and clinical decision support adoption in both public and private sectors. The increasing collaboration between pharmaceutical associations and app developers to offer Portuguese-language drug compendiums enables broader accessibility for local clinicians and pharmacists.

Type Insights

The Android segment dominated the market in 2025, driven by the high penetration of Android-based smartphones among healthcare professionals and medical students in both developed and developing regions. The flexibility of Android app development and the availability of cost-efficient devices have encouraged widespread adoption for clinical referencing.

The iOS segment is expected to register the fastest CAGR of 9.47% during the forecast period. iOS-based drug reference apps are increasingly preferred by healthcare professionals in developed markets due to stronger data privacy compliance, seamless integration with hospital systems, and optimized performance across clinical-grade devices. The demand for premium subscription models available exclusively on iOS platforms further enhances segment growth.

Pricing Model Insights

The freemium (free) segment dominated the market in 2025 due to wide accessibility among medical students, general practitioners, and small-scale healthcare centers. Freemium versions offering essential features such as drug search, dosage information, and side-effect alerts have encouraged early adoption across emerging economies. The availability of ad-supported models has also expanded user reach and sustained retention rates among entry-level users.

The paid (subscription) segment is anticipated to grow at the fastest CAGR of 9.32% during the forecast period. Subscription-based platforms offering advanced features like offline access, institutional integration, and evidence-based updates are increasingly adopted by hospitals and research centers. These platforms cater to clinicians seeking verified and regularly updated medical information, improving decision-making efficiency across critical care and pharmacy operations.

Application Insights

The drug information/drug database segment dominated the market in 2025, accounting for a revenue share of 37.47%. This segment’s growth is supported by the continuous demand for comprehensive and updated drug information systems that provide clinicians with details on dosage, contraindications, and pharmacokinetics. The inclusion of regulatory updates, clinical evidence, and formulary data in mobile databases allows healthcare professionals to make data-driven prescribing decisions with improved accuracy.

The drug interactions segment is projected to record the fastest CAGR of 9.11% during the forecast period. The rising adoption of polypharmacy and the increasing prevalence of chronic illnesses have heightened the importance of real-time interaction checking. Drug reference apps offering automatic interaction alerts and risk-level classifications are gaining adoption across hospital pharmacies and specialty clinics.

End Use Insights

The healthcare professionals segment dominated the market in 2025 with a revenue share of 43.56%. The segment’s leadership is attributed to the growing integration of digital drug reference solutions in clinical workflows to improve medication safety and prescribing accuracy. Physicians, nurses, and pharmacists rely on these apps for instant access to updated treatment protocols, dosage calculations, and drug compatibility data, supporting efficient patient management.

The patient’s segment is projected to expand at the fastest CAGR of 9.10% during the forecast period. The rising awareness of self-care and medication literacy is driving patient adoption of drug reference apps to monitor side effects, verify prescriptions, and understand dosage instructions. Increasing availability of consumer-oriented drug information tools integrated with telehealth and wearable ecosystems further strengthens this segment’s growth.

Source: Straits Research

Competitive Landscape

The global drug reference apps market is highly fragmented, with the presence of several established healthcare information providers and emerging digital health platforms. These companies are focusing on enhancing clinical decision support, improving mobile accessibility, and integrating AI tools to provide evidence-based drug information for healthcare professionals and consumers.

Spectrum Mobile Health Inc: An emerging market player

Spectrum Mobile Health Inc. is an emerging player in the drug reference and antimicrobial stewardship apps market, offering clinical decision support tools that guide clinicians on optimal drug selection, resistance patterns, and treatment protocols.

In April 2024, Spectrum Mobile Health Inc. expanded its infectious-disease and medication-guidance platform through new global health system partnerships to support real-time antimicrobial prescribing and drug-guideline access at the point of care. This update enhanced clinician workflows and improved therapy accuracy by delivering expert-reviewed prescribing recommendations through its mobile app.

List of Key and Emerging Players in Drug Reference Apps Market

- Glooko, Inc.

- Wolters Kluwer N.V.

- Lattice Solutions

- VisualDx

- EBSCO Industries, Inc.

- PEPID, LLC.

- Skyscape

- WebMD LLC

- athenahealth

- Medical Integration Co., Ltd.

- Pharma Software Solutions

- IBM Corporation

- GrepMed

- Cosmas Health, Inc.

- Indigo Med

- Velvetech, LLC.

- smartpatient GmbH

- Medisafe

- MDCalc

- PillPack

- Others

Strategic Initiatives

- September 2025: Glooko, Inc. expanded its diabetes management portfolio into hospital settings through the acquisition of Monarch Medical Technologies and its EndoTool software, a system designed to optimize inpatient insulin therapy. The initiative addressed the demands of the estimated 30–40% of hospitalized patients who required insulin to regulate glucose levels and minimize complications during treatment.

- March 2025: Wolters Kluwer N.V. strengthened clinical decision support by integrating its UpToDate drug and clinical information into Suki’s AI-powered assistant platform, providing healthcare professionals with seamless access to evidence-based content.

- December 2024: Researchers at the National Centre for Clinical Research on Emerging Drugs (NCCRED) introduced the S-Check app which is a self-guided mobile tool developed from the Stimulant Check-Up service model at St Vincent’s Hospital, Sydney to support individuals who use methamphetamine track their usage patterns and assess their health and wellbeing, particularly targeting those who have not previously engaged with conventional treatment services.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.38 Billion |

| Market Size in 2026 | USD 1.49 Billion |

| Market Size in 2034 | USD 2.80 Billion |

| CAGR | 8.17% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Pricing Model, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Drug Reference Apps Market Segments

By Type

- Android

- iOS

By Pricing Model

- Freemium (Free)

- Paid (Subscription)

By Application

- Drug Information/Drug Data Base

- Drug Interactions

- Dosage Calculators

- Pill/Drug Identification

- Others

By End Use

- Healthcare Professionals

- Patients

- Pharmacists

- Researchers and Educators

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.