EHR EMR Market Size, Share & Trends Analysis Report By Component (Software, Hardware, Services), By End Use (Hospital and Clinics, Ambulatory Care, Diagnostic Centers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

EHR EMR Market Size

The EHR EMR market size was valued at USD 29.8 billion in 2025 and is projected to reach USD 50 billion by 2034, growing at a CAGR of 6.3% during the forecast period (2026-2034). Electronic Health Record (EHR) and Electronic Medical Record (EMR) systems are digital platforms that are used to collect, store and share patient health information in electronic formats. EHR and EMR systems are adopted by large hospitals, academic medical centers, outpatient clinics, long-term care centers, telehealth platforms, and public health/research settings.

Key Market Insights

- North America dominated the market with the largest share of 45% in 2025.

- The Asia Pacific is expected to be the fastest-growing region in the market during the forecast period at a CAGR of 6.2%.

- By component, the software component accounted for the largest share of 65% in 2025.

- By end use, the ambulatory care centers and clinics segment is anticipated to register the fastest CAGR of 8% during the forecast period.

- The US EHR EMR market size was valued at USD 15 billion in 2025 and is projected to reach USD 170 billion in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 29.8 billion |

| Estimated 2026 Value | USD 31.8 Billion |

| Projected 2034 Value | USD 50 billion |

| CAGR (2026-2034) | 6.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Epic Systems, Oracle Health (Cerner), MEDITECH, eClinicalWorks, athenahealth |

to learn more about this report Download Free Sample Report

EHR EMR Market Trends

Shift toward centralized operating platforms by physicians

Separate tools for clinical documentation, scheduling, billing, claims, and patient communication result in duplicate work, errors, and delays. EHR EMR systems eliminate fragmentation by being central platforms for physicians who often face staff shortages and clinician burnout amid rising administrative costs. A centralized EHR system automates documentation, orders, billing, and follow-ups. This directly improves productivity and saves time. There is a shift toward value-based care, which requires longitudinal patient data and population health analytics. A unified EHR platform enables real-time insights, quality reporting, and coordinated care, making it essential for reimbursement and compliance. AI tools require structured clinical data and patient records.

Increasing adoption of cloud-first and remote-ready systems

Healthcare is no longer restricted to hospitals since telehealth visits, home healthcare, and remote patient monitoring have now become standard norms. Cloud-based EHRs allow clinicians to securely access records anytime, anywhere, which was not possible with traditional systems. These systems require heavy infrastructure investment, data centers, and IT teams. Cloud EHR EMRs use subscription (SaaS) models, thereby reducing expenditure for cost-pressured providers. Healthcare regulations, billing codes, and workflows change constantly. Traditional on-premises systems update slowly, while cloud systems are updated automatically. This avoids any form of operational disruption. Healthcare systems are expanding through network growth and multi-location clinics. Thus, cloud platforms scale instantly, which makes it easier to onboard new sites, users, and services. Natural disasters, cyber incidents, and outages are increasing day by day. In such situations, cloud systems offer built-in backups and faster recovery times, providing effective crisis management. Leading cloud providers also invest heavily in encryption and continuous monitoring, offering higher security standards than on-premise systems. Hence, cloud platforms are being increasingly adopted in healthcare systems.

EHR EMR Market Drivers

Rising healthcare data volume drives market

Healthcare data is no longer restricted to doctor notes and lab results. It now includes imaging (CT, MRI, X-ray), wearables & remote monitoring devices, and patient-generated health data. EHR EMR systems help in storing and managing this volume of diverse data in one place. Raw healthcare data is often unstructured and inconsistent. EHR platforms convert data into standardized formats and enable coding, tagging, and classification. This is essential for clinical decisions, analytics, and reporting. AI and advanced analytics require large, clean datasets and structured records. Thus, with rising volumes EHR EMR platforms have become the foundation for AI. Doctors regularly need access to historical patient records and cross-specialty inputs. EHRs provide a unified patient view, which is impossible with paper records. Growing data volumes increase the need for quality reporting and traceability. EHR EMR systems help in reducing errors and simplifying reporting. Paper records and traditional systems cannot survive high data loads and reduce clinical workflows. EHR EMRs help in tackling these issues effectively.

Favorable government regulations and incentives boost market

Governments require electronic clinical documentation and standardized health data exchange. Hence, healthcare providers need to adopt certified EHR EMR systems to remain compliant and avoid penalties. In many countries (especially the US), governments provide incentive payments and bonus programs, which in turn makes adoption of EHR EMR systems financially attractive. Similarly, providers without compliant EHR EMR systems may face lower quality scores and payment penalties. Regulations promote standardized clinical coding and documentation. EHR EMR platforms enforce standardization across providers, improving care coordination and system efficiency. These factors drive the market growth.

Market Restraints

Resistance to change among healthcare staff hinders market growth

Doctors, nurses, and admin staff are used to traditional routines. New EHR systems force changes in documentation, ordering, and communication thus creating frustration and non-compliance. Many clinicians feel EHRs increase data entry requirements and increase screen time. This perception leads to reluctance and underutilization. Older or less tech-comfortable staff may struggle more since these systems can be complex. This makes organizations hesitant to implement these systems. Since healthcare staff are already burnt out, and adapting to new systems is an additional work for them. This limits their willingness to engage with new technology. If EHR benefits (time savings, decision support) are not immediately visible, clinicians see systems as administrative tools instead of supportive tools.

Market Opportunities

Need for specialty-specific and customizable systems present lucrative opportunities

A cardiology clinic, oncology center, and behavioral health practice work very differently, comprising different documentation needs and different billing and coding requirements. Specialty-specific EHRs improve efficiency and accuracy in these cases. Tailored templates and dashboards reduce clicks and manual entry along with lowering training time. This leads to better user acceptance and retention. Specialty-aligned EHRs enable correct procedure and diagnosis codes, fewer claim denials and faster reimbursements. This is especially valuable in complex specialties such as oncology, orthopedics, and cardiology. Since healthcare is shifting toward outpatient and specialty-focused care, these systems are boosting the growth of ambulatory & specialty care. For instance, eClinicalWorks is an ambulatory-focused EHR platform, which focuses on cost-effective digitization, telehealth integration, and patient engagement for small and mid-sized practices. Providers are also willing to pay a premium for systems that save time and reduce errors. Since clinicians work faster, get paid correctly, and deliver better care, specialty-specific and customizable EHR & EMRs present attractive opportunities.

Technological Landscape

- Epic Systems (EpicCare) is an integrated EHR platform that focuses on unifying clinical, administrative, and financial workflows into a single operating system for large hospitals and health systems.

- Oracle Health (Cerner Millennium) is an enterprise-grade EHR platform that focuses on interoperable data exchange and population health management across complex care networks.

- eClinicalWorks is an ambulatory-focused EHR platform that focuses on cost-effective digitization, telehealth integration, and patient engagement for small and mid-sized practices.

Regional Analysis

North America dominated the EHR EMR market with the largest share of 45% in 2025 due to a combination of early technology adoption, strong regulatory support and advanced healthcare infrastructure. There is a presence of leading EHR vendors (Epic, Oracle Health/Cerner, Athenahealth, and MEDITECH) and a strong health IT innovation ecosystem, which maintains the technological leadership of the region. High healthcare expenditure and strong payer participation enable providers to invest in premium, enterprise-scale EHR solutions. These factors position North America as the dominant and most technologically advanced EHR EMR market globally.

The US leads the North American region because it combines strong vendor dominance and continuous innovation at scale. The US implemented incentive programs. For instance, the HITECH Act and Meaningful Use programs accelerated EHR adoption across hospitals and physician practices by offering financial incentives and enforcing compliance deadlines. The country has the largest healthcare IT spending base supported by high healthcare expenditure and complex reimbursement systems. Together, these factors make the US not only the largest market but also the global technology and innovation leader in this region.

Asia Pacific

The Asia Pacific region is expected to be the fastest-growing region in the market during the forecast period at a CAGR of 6.2%. The region is experiencing rapid growth in healthcare infrastructure and patient volumes, fueled by population growth, urbanization, aging demographics, and rising prevalence of chronic diseases. Since hospitals and clinics are shifting from paper-based systems to digital systems, market growth is rising rapidly compared to other markets. The widespread use of smartphones, improving internet connectivity, and availability of local and regional EHR vendors have further propelled the growth of the APAC market.

China is leading the Asia Pacific market due to its scale of healthcare demand, strong government-driven digitization and growing health IT ecosystem. Its enormous population and hospital volumes have created heightened demand for digital health records. EHR EMR systems have thus become essential for workflow efficiency to manage these high volumes of outpatient and inpatient loads in large hospitals. China is rapidly advancing toward smart hospitals by integrating EHRs with AI, clinical decision support, imaging systems, pharmacy automation, and hospital information systems (HIS). This integration is therefore driving higher spending by the payers and providers within China.

Europe

The Europe EHR EMR market is growing steadily due to policy-driven digital transformation and cross-border interoperability initiatives. Strong government support and EU-wide digital health strategies are accelerating the growth of the market. For instance, the European Health Data Space (EHDS) is a European Union initiative designed to create a secure and standardized framework for sharing health data across EU member states. Increasing emphasis on data protection, cybersecurity, and regulatory compliance under frameworks like GDPR (General Data Protection Regulation) is boosting investments in EHR platforms.

Germany is leading the EHR EMR market in Europe because of its high healthcare spending and large hospital base. Germany has implemented one of Europe’s most aggressive healthcare digitization frameworks. The Hospital Future Act (Krankenhauszukunftsgesetz—KHZG) has accelerated digital transformation initiatives in the country. Germany is a leader in interoperability and digital health standards, driven by initiatives such as gematik, which is the national digital health agency. The presence of established health IT vendors and growing adoption of cloud-enabled solutions further strengthens Germany’s leadership.

Latin America

The Latin America EHR EMR market is growing due to expanding private healthcare and rising demand for efficient care delivery. Growth of private healthcare providers and medical tourism in Brazil, Mexico, Colombia, and Chile is driving adoption of modern EHR systems. Cloud-based and cost-effective EHR solutions are gaining traction across the region. SaaS models reduce capital expenditure and are well-suited to small hospitals and physician practices.

Brazil leads the regional market because it has one of the largest healthcare systems in Latin America, with a vast public network (SUS) and a rapidly expanding private healthcare sector. Government initiatives promoting digital health are gaining popularity. For instance, the National Digital Health Strategy (Estratégia de Saúde Digital – ESD) is Brazil’s government-led framework to modernize and integrate the country’s healthcare system through digital technologies.

Middle East and Africa

The Middle East & Africa market is growing steadily due to government-led healthcare transformation and rapid infrastructure development. Rising population growth, urbanization, and chronic disease prevalence, particularly diabetes and cardiovascular conditions, are increasing the need for longitudinal patient records and coordinated care. EHR EMR systems have become essential for healthcare providers to effectively manage these high volumes of patients. Hence, increasing emphasis on healthcare quality, accreditation standards, medical tourism, and private sector participation are driving providers to adopt advanced EHR platforms.

Saudi Arabia is leading the Middle East & Africa market owing to the strong participation of private healthcare providers and international health IT vendors, coupled with strict regulatory oversight and data security requirements. Saudi Arabia has developed centralized national health platforms. For instance, NPHIES (National Platform for Health and Insurance Exchange Services) and SeHE (Saudi Health Exchange) require providers to use interoperable, standardized EHR systems. These factors position Saudi Arabia as the largest market in the Middle East & Africa region.

Component Insights

The software segment dominates the market due to its essential role in enabling end-to-end digital healthcare operations. This segment comprises core EHR EMR platforms, clinical applications, and specialty modules that manage patient records, appointments, and billing. The growing role of EHR & EMRs as the central operating platform in healthcare and the need for regulatory compliance are further propelling the growth of this segment.

The services segment of the EHR EMR market is the fastest growing at a CAGR of 6% during the forecast period. This growth is fueled by the increasing demand for training, customization, integration, data migration, cybersecurity, and ongoing support services. Small and mid-sized practices are increasing demand for managed services and subscription-based support models, since they reduce operational burden while ensuring system performance and security.

End Use Insights

The hospitals segment dominated the market with a share of 59% in 2025, as they require comprehensive platforms to manage high patient volumes. These organizations require EHR EMR systems that can manage inpatient, outpatient, emergency, ICU, pharmacy, laboratory, radiology, and billing functions within a single centralized system. Hospitals are also the largest revenue-generating end-use segment with higher spending due to data security requirements, which require regular software updates.

The ambulatory care centers and clinics segment is anticipated to register a CAGR of 8% during the forecast period, owing to the rapid digitization among small and mid-sized practices and the shift toward outpatient and value-based care models. Smaller clinics are rapidly adopting cloud-based and SaaS EHRs, which offer lower upfront costs, faster deployment and mobile access. Growth of this segment is also fueled by rising telehealth utilization, increased focus on preventive and chronic disease management, and demand for specialty-specific EHR solutions.

| SEGMENT | INCLUSION | DOMINANT SEGMENT | SHARE OF DOMINANT SEGMENT, 2025 |

|---|---|---|---|

|

COMPONENT |

|

Software |

XX% |

|

END USE |

|

Hospitals |

59% |

|

REGION |

|

North America |

45% |

Regulatory Bodies Governing EHR EMR Market

| REGULATORY BODY | COUNTRY/REGION |

|---|---|

|

Centers for Medicare & Medicaid Services (CMS) |

US |

|

European Commission (EC) |

Europe |

|

Ministry of Health under ABDM |

India |

|

China’s National Health Commission) |

China |

|

SeHE (Saudi Health Exchange) |

Saudi Arabia |

Competitive Landscape

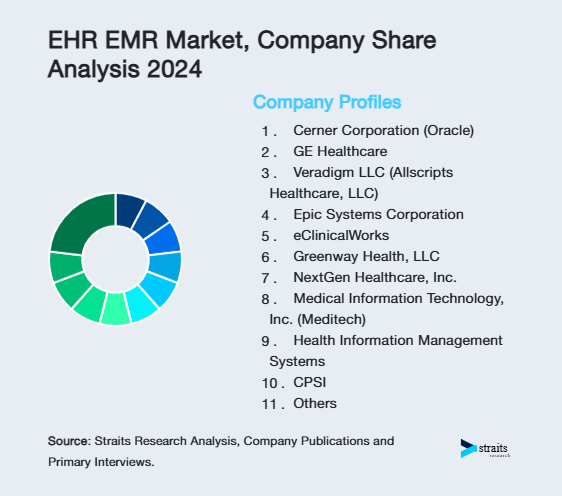

The EHR EMR market is highly fragmented, with a mix of established global health IT vendors, large enterprise-grade platform providers, mid-tier and regional software companies, specialty-focused EHR developers, cloud-native SaaS providers, emerging AI, and interoperability-driven innovators. Competition varies significantly across hospital size, end-use segment, and geography, preventing market consolidation into a single dominant platform. Emerging trends in the market include mobile-first & flexible user interfaces, remote care & telehealth integration, and EHR as the central operating platform.

List of Key and Emerging Players in EHR EMR Market

- Epic Systems

- Oracle Health (Cerner)

- MEDITECH

- eClinicalWorks

- athenahealth

- NextGen Healthcare

- Veradigm (Allscripts)

- Practice Fusion

- ModMed

- TruBridge

- Athenahealth

- BD (Becton, Dickinson and Company)

- Truveta

- OpenMRS

- Carasent (Webdoc)

- Medley, Inc.

- Carepatron

- WebPT

- AdvancedMD

- CureMD Healthcare

- EverCommerce (EHR solutions)

- Conifer Health

to learn more about this report Download Market Share

Latest News on Key and Emerging Players

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

|

January 2026 |

Epic Systems Corporation |

Epic Systems secured strategic investment to enhance its cloud-based EHR solutions and interoperability features. The funding supports AI-driven clinical decision support, telehealth integration, and patient data analytics. |

|

December 2025 |

Conifer Health |

Conifer Health announced a new multi-year revenue cycle partnership with Northeast Alabama Regional Medical Center. |

|

December 2025 |

Athenahealth |

Athenahealth announced a partnership to embed Microsoft Dragon Copilot as an ambient notes option in its athenaOne platform, enhancing AI-assisted documentation for ambulatory clinicians. |

|

November 2025 |

BD |

The company rolled out its Alaris EMR interoperability with MEDITECH’s EHR at Duncan Regional Hospital, US. |

|

August 2025 |

Oracle Health |

Oracle unveiled a new AI-driven electronic health records system, positioning its modern EHR for ambulatory providers with contextual and conversational AI features. |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 29.8 billion |

| Market Size in 2026 | USD 31.8 Billion |

| Market Size in 2034 | USD 50 billion |

| CAGR | 6.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

EHR EMR Market Segments

By Component

- Software

- Hardware

- Services

By End Use

- Hospital and Clinics

- Ambulatory Care

- Diagnostic Centers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.