Electronic Fluoride Liquid Market Size, Share & Trends Analysis Report By Type (Metal Hydrofluoroether, Perfluoropolyether, Others), By Applications (Semiconductor, Data Center, Electronics, Automotive, Aerospace, Machinery Manufacturing, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Electronic Fluoride Liquid Market Overview

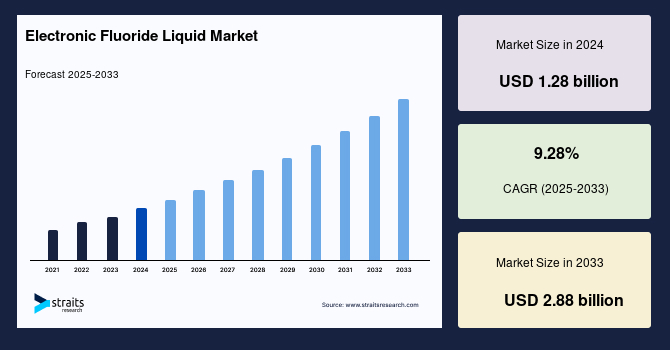

The global electronic fluoride liquid market size was valued at USD 1.28 billion in 2024 and is estimated to grow from USD 1.39 billion in 2025 to reach USD 2.88 billion by 2033, growing at a CAGR of 9.28% during the forecast period (2025–2033). The market is propelled by continuous innovation in electronics and nanotechnology. Increasing demand for miniaturized, high-speed devices, coupled with advancements in AI and cloud computing infrastructure, drives the need for specialized cooling and insulating solutions. Regulatory pressure for energy-efficient operations, combined with a shift toward environmentally safer, non-toxic chemical alternatives, also supports market growth.

Key Market Insights

- North America held a dominant share of more than 35% of the global market.

- Based on type, the perfluoropolyether segment is projected to grow at the fastest rate with a CAGR of 8.93%.

- Based on application, the data center segment held the largest market share of more than 40% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.28 billion

- 2033 Projected Market Size: USD 2.88 billion

- CAGR (2025-2033): 9.58%

- Largest market in 2024: North America

Electronic fluoride liquids are specialty chemical compounds used primarily in advanced electronics and precision manufacturing. Known for their high thermal stability, chemical inertness, and non-conductive properties, they play a critical role in cooling, etching, and insulating sensitive electronic components. These liquids are essential in applications such as data centers, high-performance computing systems, OLED displays, and quantum devices. Their purity and performance standards make them indispensable for industries seeking to enhance the efficiency, reliability, and longevity of electronic equipment.

Market Trend

Growing Adoption in Semiconductor Manufacturing and Wafer Etching

The global electronic fluoride liquid market is witnessing significant growth, primarily driven by its expanding use in semiconductor manufacturing and wafer etching. As electronic devices become increasingly compact and sophisticated, manufacturers require high-purity fluoride liquids for precise etching and cleaning processes. These chemicals ensure better accuracy in creating microelectronic components, enhancing device performance and reliability.

Moreover, the rise of advanced electronics, including smartphones, wearables, and IoT devices, is boosting demand for these specialized chemicals. The trend toward miniaturization, combined with the need for high-quality semiconductor fabrication, continues to reinforce the market’s growth trajectory globally.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.28 billion |

| Estimated 2025 Value | USD 1.39 billion |

| Projected 2033 Value | USD 2.88 billion |

| CAGR (2025-2033) | 9.28% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | 3M Company, Solvay S.A., Honeywell International Inc., Daikin Industries, Ltd., AGC Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Rising Global Demand for Efficient Cooling Solutions

The global electronic fluoride liquid market is being significantly driven by the rising global demand for efficient cooling solutions, particularly in high-performance computing, data centers, and next-generation electronics. As devices and servers generate increasingly high heat loads, traditional air-cooling methods are no longer sufficient, leading manufacturers to adopt advanced liquid cooling technologies.

- For instance, in August 2025, Chemours' Opteon™ two-phase immersion cooling fluid was successfully qualified by Samsung Electronics for use with its Generation 4 Solid State Drives (SSDs). This approval highlights the fluid's effectiveness in meeting the cooling requirements of AI and next-generation chips. Moreover, in June 2025, Shell launched a Direct Liquid Cooling (DLC) fluid targeting high-heat components in dense server racks, ensuring efficient heat management.

Such innovations are boosting the adoption of electronic fluoride liquids across the electronics and data center industries.

Market Restraint

High Production and Operational Costs for Specialty Fluoride Liquids

A key restraint for the global electronic fluoride liquid market is the high production and operational costs associated with specialty fluoride liquids. Manufacturing these high-purity chemicals requires advanced processes, stringent quality controls, and expensive raw materials, which significantly increase overall costs.

Moreover, handling, storage, and transportation of fluoride liquids demand specialized equipment and safety measures, further raising operational expenses. These high costs can limit adoption, especially among small- and medium-sized electronics manufacturers who may find alternative cooling or etching solutions more economical.

Market Opportunity

Expansion in Emerging Markets

The global electronic fluoride liquid market presents significant opportunities for expansion, particularly in emerging markets where demand for high-performance electronics and semiconductors is growing rapidly. Companies are increasingly targeting regions with developing semiconductor industries to establish a strong foothold and capitalize on rising consumption.

- For instance, in May 2025, Merck KGaA acquired a Chinese startup specializing in high-purity electronic fluoride liquids, aiming to strengthen its semiconductor material supply chain and expand its presence in the fast-growing Asian market. Similarly, in February 2025, ElectroChem launched an advanced electronic fluoride liquid with enhanced purity, specifically designed for lithium-ion batteries and semiconductor manufacturing.

These strategic initiatives highlight the market’s potential for growth through innovation and regional expansion.

Regional Analysis

North America captured over 35% of the global market, reinforcing its dominant position, due to advanced industrial infrastructure, strong R&D capabilities, and high adoption of innovative cooling solutions in electronics manufacturing. The region benefits from a robust network of semiconductor and electronics manufacturers, driving consistent demand for high-performance specialty liquids. For example, several leading tech firms have recently increased production capacities for high-precision electronics, further boosting the consumption of electronic fluoride liquids across multiple sectors, from consumer electronics to aerospace components.

The United States market is driven by the presence of major semiconductor and electronics manufacturers, creating a steady demand for high-purity cooling solutions. Industries are increasingly investing in advanced production technologies, enhancing efficiency and reducing thermal risks in sensitive components. For instance, leading electronics firms have adopted new fluoride liquid formulations to optimize heat dissipation in microchips and other high-performance devices, supporting growth in both commercial and defense applications.

Canada’s electronic fluoride liquid market is witnessing steady growth due to the expansion of the electronics and semiconductor manufacturing sectors. Companies are focusing on integrating high-efficiency cooling solutions into their production lines to improve product reliability and performance. For example, Canadian tech manufacturers have begun deploying specialized fluoride liquids for precision electronics, especially in research and development facilities, boosting both domestic demand and export potential for these advanced cooling materials.

Asia-Pacific Market Trends

The Asia-Pacific region is experiencing significant growth in the electronic fluoride liquid market, fueled by rapid industrialization, increasing electronics production, and growing investments in advanced manufacturing technologies. Rising demand from consumer electronics, automotive electronics, and renewable energy sectors is a key driver. For instance, multiple electronics manufacturing hubs in the region have expanded production lines using state-of-the-art fluoride liquids to ensure thermal stability and efficiency, highlighting the region’s potential to surpass other markets in terms of both production volume and technological innovation in the coming years.

China’s market is expanding rapidly due to its extensive electronics manufacturing base and adoption of advanced thermal management solutions. Local companies are increasingly using high-performance fluoride liquids to enhance heat dissipation in semiconductors and other precision electronics. For example, leading electronics manufacturers in the region have integrated innovative fluoride-based cooling solutions in large-scale production facilities, driving market demand and supporting technological competitiveness.

India’s electronic fluoride liquid industry is witnessing accelerated growth driven by expanding electronics manufacturing and growing adoption of high-efficiency cooling technologies. Companies are increasingly implementing fluoride liquids in production processes to improve device reliability and manage thermal loads. For instance, Indian electronics firms producing consumer and industrial electronics have begun integrating specialized fluoride liquids into microchip and circuit manufacturing, boosting demand while promoting innovation in thermal management solutions.

Type Insights

Perfluoropolyether (PFP) dominates the global market due to its exceptional chemical stability, low viscosity, and high thermal conductivity. These properties make PFP ideal for advanced cooling and lubrication in sensitive electronics and semiconductor equipment. For instance, in semiconductor manufacturing, PFP-based liquids are widely used for precision cleaning and thermal management in high-performance chips, helping manufacturers achieve higher yields while maintaining equipment longevity and reliability in increasingly miniaturized and complex devices.

Applications Insights

The data center segment dominated the market in 2024, holding the largest share of more than 40%, as the demand for efficient thermal management grows with increasing cloud computing, AI, and high-performance computing workloads. Electronic fluoride liquids, particularly perfluoropolyether-based coolants, are extensively employed in immersion cooling and direct-contact cooling systems for servers. Companies like Green Revolution Cooling and Submer are implementing PFP-based fluids to maintain optimal temperatures, reduce energy consumption, and enhance the lifespan of critical IT infrastructure, making data centers the largest application segment globally.

Company Market Share

Leading players are focusing on enhancing product purity, developing high-performance specialty formulations, and expanding production capacities to meet rising semiconductor industry demand. Companies are investing in advanced R&D to innovate next-generation fluoride liquids suitable for emerging applications like AI chips and 5G devices. Strategic collaborations and regional expansion are also common, allowing firms to strengthen supply chains and distribution networks. These efforts collectively shape competitive market shares without emphasizing specific company identities.

The Chemours Company, established in 2015 as a spin-off from a major chemical conglomerate, specializes in producing advanced chemical solutions, including high-purity electronic fluoride liquids, titanium technologies, and performance chemicals. The company focuses on innovation in specialty materials for electronics, automotive, and industrial applications, emphasizing sustainability and efficiency.

- In July 2025, The Chemours Company signed a strategic partnership with Navin Fluorine International Limited to produce its Opteon two-phase immersion cooling fluid. This was to deal with the emerging issues of heat, energy, and water distribution in high-concentration data centers and AI equipment that was being provided through the Chemours Liquid Cooling Venture.

List of Key and Emerging Players in Electronic Fluoride Liquid Market

- 3M Company

- Solvay S.A.

- Honeywell International Inc.

- Daikin Industries, Ltd.

- AGC Inc.

- Gujarat Fluorochemicals Limited

- Dongyue Group Limited

- Picosun Oy

- Fluorez Technology

- Meiqi New Materials

- Zhejiang Noah Fluorochemical

- Sikang Technology

- Win in both (WinBoth Technology)

- Dongguan Meide New Material Co.

- Fluorsid S.p.A. (fluorine derivatives)

- Sunlit Chemical (specializes in fluoride chemicals)

- Air Products and Chemicals, Inc.

- Mitsubishi Chemical Corporation

- The Chemours Company

to learn more about this report Download Market Share

Recent Development:

- February 2025 - Bharat Petroleum Corporation Limited (BPCL) and Refroid Technologies have unveiled India's first indigenous liquid coolant tailored for AI-driven and sovereign data centers. This innovative coolant enhances cooling efficiency, reduces Power Usage Effectiveness (PUE), and minimizes carbon emissions, aligning with India's sustainability objectives.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.28 billion |

| Market Size in 2025 | USD 1.39 billion |

| Market Size in 2033 | USD 2.88 billion |

| CAGR | 9.28% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Electronic Fluoride Liquid Market Segments

By Type

- Metal Hydrofluoroether

- Perfluoropolyether

- Others

By Applications

- Semiconductor

- Data Center

- Electronics

- Automotive

- Aerospace

- Machinery Manufacturing

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.