Electronic Manufacturing Services Market Size, Share & Trends Analysis Report By Services (Electronics manufacturing services, Engineering services, Test & development implementation, Logistics services, Others), By Industry (Consumer electronics, Automotive, Heavy industrial manufacturing, Aerospace and Defense, Healthcare, IT and telecom, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Electronic Manufacturing Services Market Overview

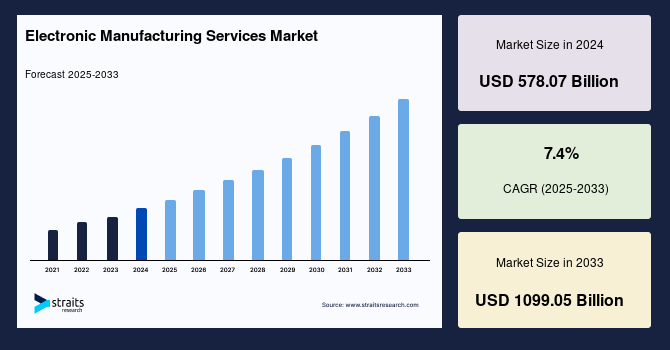

The global electronic manufacturing services market size was valued at USD 578.07 billion in 2024 and is expected to grow from USD 620.85 billion in 2025 to reach USD 1099.05 billion by 2033, growing at a CAGR of 7.4% during the forecast period (2025-2033). Growing demand for consumer electronics is fueling the EMS market through high-volume, cost-efficient, and innovative manufacturing solutions. At the same time, the expansion of 5G and IoT networks is boosting the need for advanced telecom components and cutting-edge EMS technologies.

Key Market Indicators

- Asia-Pacific dominated the electronic manufacturing services industry and accounted for a 45.2% share in 2024.

- Based on industry, the consumer electronics segment held the largest share of approximately 24.26% in 2024.

- Based on services, the electronics manufacturing services (EMS) sector is witnessing the most significant growth because its comprehensive design-to-distribution capabilities and global efficiency in meeting rising electronic demand across industries.

Market Size & Forecast

- 2024 Market Size : USD 578.07 billion

- 2033 Projected Market Size : USD 1099.05 billion

- CAGR (2025–2033) : 7.4%

- Largest market in 2024 : Asia-Pacific

- Fastest-growing region : North America

Electronic Manufacturing Services (EMS) design, manufacture, test, and distribute electronic components and devices for original equipment manufacturers (OEMs). EMS providers offer end-to-end solutions, including printed circuit board assembly (PCBA), prototyping, supply chain management, and after-sales support. These services enable companies to scale production efficiently while minimizing costs and capital investment in manufacturing infrastructure.

EMS providers cater to consumer electronics, telecommunications, healthcare, automotive, and industrial automation industries. They leverage advanced production technologies, automation, and quality control processes to ensure high-precision manufacturing. With the growing demand for smart devices, IoT, and wearable technology, EMS is crucial in accelerating innovation and time-to-market for electronic products.

The global electronic manufacturing services market is expanding due to rising consumer electronics demand, swift 5G technology advancement, and heightened manufacturing automation adoption. Industries propelled by digital transformation experience an escalating demand for high-performance connected devices. Smart fabrication and IoT-integrated automation systems once more accelerate market expansion. Within this ecosystem, the primary entities consist of electronics manufacturers who operate under the Electronics Manufacturing Services (EMS) model to deliver cost-effective solutions while maintaining design expertise and robust supply chain management. Also, Original Equipment Manufacturers (OEMs) in diverse sectors benefit from these solutions to simplify production processes while boosting operational effectiveness and reducing market entry time. As a result, the increasing intricacy of electronic components combined with global supply networks makes EMS providers essential collaborators for achieving both innovation and operational superiority.

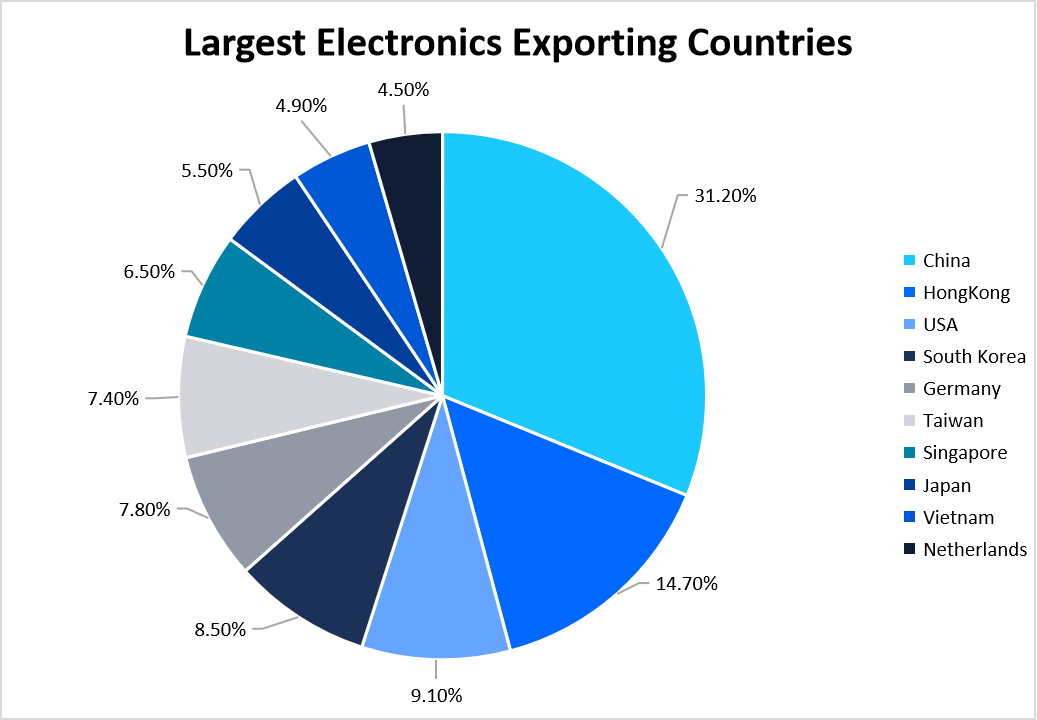

Source: International Trade Centre

Market Trends

Surge in Adoption of Advanced Robotics and Automation

The Electronics Manufacturing Services (EMS) industry has an influence on automation and robotics to boost output and accuracy. Firms now use AI-powered robot systems to smooth out assembly lines, reduce human mistakes, and increase productivity. Smart factories highly focus on IoT AI and cloud tech for EMS works. These factories allow for live tracking, upkeep before things break, and choices based on data. As tech grows, EMS providers use automation to spark new ideas and stay ahead.

- For instance, in 2023, Foxconn unveiled intentions to implement a robotic workforce exceeding 1 million units to streamline production processes across Chinese factories while cutting labor expenses.

Growth of Sustainable Manufacturing Practices

With the increase in eco-friendly awareness around the globe, EMS providers have also begun introducing green practices into their operations to reduce their environmental footprint. The providers now employ power-saving manufacturing practices, generate less waste, and ensure e-waste recycling. The sector is making every possible effort to implement RoHS (Restriction of Hazardous Substances) guidelines and employ nontoxic material that does not harm the planet. By introducing green manufacturing solutions, EMS providers are not only complying with the regulations they must abide by but also making a better world for the earth and a more environmentally responsible world.

- For instance, In 2024, Flex Ltd. launched a sustainable packaging program, decreasing plastic consumption and using closed-loop recycling schemes throughout its manufacturing facilities to promote greater environmental responsibility.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 578.07 Billion |

| Estimated 2025 Value | USD 620.85 Billion |

| Projected 2033 Value | USD 1099.05 Billion |

| CAGR (2025-2033) | 7.4% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Foxconn Technology Group, Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation |

to learn more about this report Download Free Sample Report

Electronic Manufacturing Services Market Drivers

Rising Demand for Consumer Electronics

The surge in smartphone, wearables, and smart home gadget consumption is pushing growth in the Electronics Manufacturing Services (EMS) sector to a large extent. EMS providers ' high-volume manufacturing, affordable production, and efficient supply chain solutions rely on more valuable and sustainable consumer electronics manufacturers. As consumers continually look for enhanced, connected gadgets, EMS operators ensure efficiency, scalability, and innovation in a rapidly changing consumer electronics landscape.

Advanced manufacturing techniques such as automation, robotics, and AI-driven production enable EMS companies to meet growing consumer demands efficiently. Furthermore, the push for sustainability and energy-efficient devices is prompting EMS providers to adopt eco-friendly production and material sourcing practices. The rise of connected devices and smart home ecosystems also increases the need for high-quality components and advanced circuit board assembly.

- For instance, Apple collaborated with Pegatron and Foxconn to mass-produce iPhones, ensuring rapid market supply and cost optimization. Similarly, Samsung and Xiaomi work with EMS partners to meet rising consumer demand while focusing on reducing time-to-market and production costs.

Expansion of 5g and Iot Networks

The rapid deployment of 5G and IoT networks is compelling higher demand for sophisticated telecom infrastructure, compelling EMS providers to supply key components. These include RF modules, board-level circuit boards, and fiber-optic solutions, which support high-speed connections and network durability. As operators extend their telecom networks, EMS providers rely on advanced manufacturing technologies to accommodate industry needs and deliver efficient, scalable, high-performance telecommunication solutions. The need for low-latency, ultra-fast connectivity is driving EMS companies to invest in cutting-edge fabrication techniques, miniaturization, and high-density interconnect PCBs. Additionally, the emergence of smart cities, AI-powered automation, and industrial IoT further increases the need for complex electronic components manufactured at scale.

- For instance, 64% of respondents expect 5G to go mainstream within three years, while 59% see new telecom opportunities. Over half are exploring Open RAN to cut costs. Additionally, major telecom players such as Ericsson and Nokia are working with EMS firms to ramp up the production of next-generation network equipment.

Market Restraint

Supply Chain Disruptions and Component Shortages

The global electronic manufacturing services market faces serious challenges due to semiconductor shortages and geopolitical tensions. These factors have resulted in manufacturing setbacks, higher expenses, and unstable supply chains. The disruptions, primarily caused by trade restrictions, raw material shortages, and fluctuating transportation costs, have significantly impacted production timelines and order fulfillment. EMS providers are overcoming these challenges by diversifying suppliers, investing in localized production, and leveraging smart supply chain management practices.

Additionally, businesses adopt AI-powered forecasting and blockchain technology to enhance supply chain transparency and mitigate risks. Industry participants strive to achieve longer-term solutions, such as securing alternative component sources and investing in in-house chip fabrication, to be resilient and efficient as electronic component demand keeps growing. Governments and private enterprises are collaborating to develop domestic semiconductor manufacturing hubs to reduce dependency on foreign suppliers and avoid future crises.

Market Opportunity

Growing Demand for Electric Vehicles (evs)

The shift toward electric vehicles (EVs) is opening avenues for Electronics Manufacturing Services (EMS) suppliers to develop high-performing electronic equipment. As automobile manufacturers accelerate EV penetration, EMS companies make critical components such as battery management systems, inverters, and power electronics. These technologies are instrumental in driving vehicle efficiency, safety, and performance. The increasing focus on sustainability and reducing carbon emissions pushes the automotive sector to transition rapidly towards EV adoption, further increasing the need for specialized electronic components.

Additionally, innovations in energy storage, fast-charging solutions, and vehicle-to-grid (V2G) technology require advanced electronic manufacturing capabilities. EMS providers are actively investing in research and development to optimize automotive electronics performance, miniaturization, and durability. As demand for more environmentally friendly mobility increases worldwide, EMS providers are positioned at the helm of assisting in reforming the evolving automotive industry through technological innovation and high-precision production.

- For instance, BYD entered an MoU with Ayvens to promote sustainable mobility in Europe, offering new energy vehicles and customized electric fleet solutions for businesses, SMEs, and retail consumers. Similarly, Tesla and Rivian are expanding partnerships with EMS providers to enhance supply chain efficiency and accelerate EV production capabilities.

Regional Insights

In 2024, Asia-Pacific led the electronic manufacturing services industry with a 45.2% market share. Asia-Pacific continues to lead the market due to solid manufacturing hubs in China, Taiwan, and South Korea. The heavy presence of major EMS players, cost-effective labor, and government incentives for electronics production have driven their dominance. These initiatives include the hundreds of billions of USD worth of investment EMS providers are pulling into China with “Made in China 2025” to strengthen local manufacturing. Governments across the region are heavily investing in technology parks, infrastructure, and R&D hubs to attract global EMS firms.

Further, Asia-Pacific has been a key enabler of innovation in consumer electronics and advanced technologies, supporting large-scale EMS production to meet growing demand. Countries like Vietnam and India are also emerging as attractive alternatives for EMS investments due to lower operational costs and favorable regulatory policies.

- For instance, India’s “Make in India” initiative has encouraged global companies like Foxconn and Pegatron to set up new EMS facilities.

Additionally, South Korea’s government-backed semiconductor push is drawing foreign investment into the region.

China has a robust supply base and cost structure as a manufacturing powerhouse to be the leader in global EMS. China is the world's most significant hardware manufacturing country, and it is highly focused on electronic manufacturing services for consumers to use effectively. Statements of Vision like "Made in China'25 are created systematically to increase China's manufacturing industry, hence bringing various EMS investments from around the globe to China as their hub for electronics manufacturing.

India As a prospective international EMS hub, backed by policies such as "Make in India," which simplifies local manufacturing and helps attract city-level foreign investments, Skilled workers, and an inexpensive market combine for an attractive market for EMS players that want to expand from offshore sites.

North America Market Trends

North America has tremendous growth prospects in the global electronic manufacturing services market due to reshoring strategies, rising semiconductor component demand, and government-backed interventions. The U.S. CHIPS Act ($50B in 2024 for domestic semiconductor manufacturing) is fueling further industry growth, supporting EMS players like Jabil, Celestica, and others. When supply chain resilience becomes a key priority, North America will fortify its stronghold in advanced electronics manufacturing. Additionally, the rise of AI-powered automation and Industry 4.0 initiatives is enhancing manufacturing capabilities in the region. Companies are investing in smart factories, AI-driven quality control, and digital twin technology to improve efficiency and reduce costs.

- For instance, Intel’s plans to build multiple semiconductor fabrication plants in Arizona and Ohio reflect the growing emphasis on strengthening the domestic supply chain for EMS production.

Canada's EMS market is growing to include an extensive workforce and an innovation-driven landscape. Research and development reports show that government grants to technology industries have targeted EMS investments, particularly in the aerospace, defense, and medical device sectors.

The U.S. government fueled $50 billion of money through the CHIPS Act to bolster local semiconductor capacity to decrease reliance on offshore suppliers and enhance national security. That massive spending will probably help players like Jabil and Celestica as EMS providers, enabling them to ramp up additional capacity to meet the growing demand for components.

Germany Market Trends

Germany is looking at high-end automotive continuous-length EMS solutions via its excellent automotive industry and engineering potential. The country's focus on high-accuracy and high-quality manufacturing has made it the destination for leading global manufacturing of vehicle components, such as electric and self-driving cars.

South Korea, the world leader in semiconductor and display panel making (Samsungs/LGs), dominating high-tech manufacturing again, as shown above. Home's advantageous technology base and permanent innovation effort keep the U.S. strong in EMS, especially with high-tech components.

Mexico geographical proximity to the U.S. has placed Mexico at the forefront as a recipient of nearshoring strategies due to firms looking to move manufacturing closer to final markets. This phenomenon has caused higher investments in Mexico's EMS industry, thus augmenting its position in the global supply chain of electronics.

Service Insights

The Electronics Manufacturing Services (EMS) sector possesses the largest market share, owing to its complete offerings of design, assembly, and testing of electronic components. EMS vendors cater to various industries with an extensive portfolio of electronic products that contribute to their dominant position in the market. With an international presence, they achieve high-efficiency manufacturing and distribution with smooth operations over several geographic areas. As the demand for electronics increases, EMS vendors grow their capacities even further, sustaining their position in the leadership rank.

Industry Insights

In 2024, the consumer electronics segment emerged as the largest in the electronic manufacturing services market with a 24.26% share, driven by the constant demand for newer, feature-rich devices. The frequent product releases, quick tech developments, and shifting consumer preferences constantly fuel the segment. EMS providers are centrally involved in fulfilling the demand by offering quality manufacturing options for smartphones, wearables, smart home products, and many more. With every technological advancement, the consumer electronics sector remains the growth driver for the market.

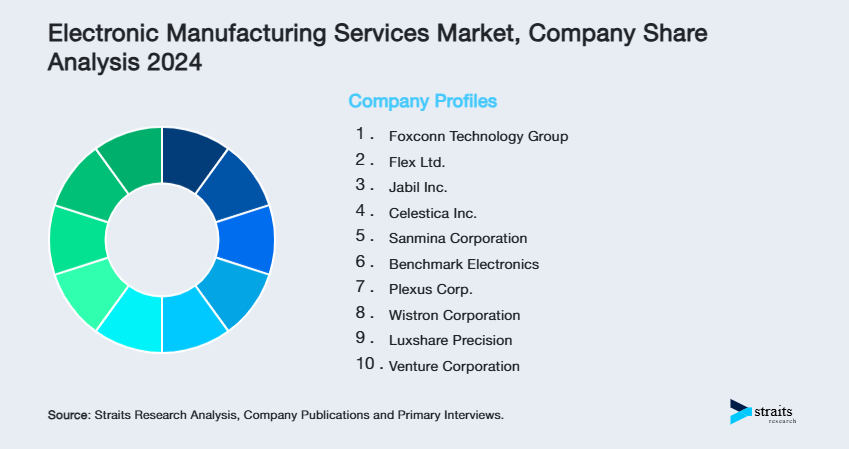

Company Market Share

Key market players are investing in advanced Global Electronic Manufacturing Services technologies and pursuing collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Luxshare: An Emerging Player in the Market

Luxshare Precision Industry Co., Ltd., established in 2004, is a Chinese company that produces electronic components in connectors and cables for computing, communications, consumer electronics, automotive, and medical industries.

Recent Developments

- In October 2024, Luxshare Precision announced its plans to increase Huawei smartwatch manufacturing by expanding new Southeast Asian facilities to develop Huawei's wearable technology further.

List of Key and Emerging Players in Electronic Manufacturing Services Market

- Foxconn Technology Group

- Flex Ltd.

- Jabil Inc.

- Celestica Inc.

- Sanmina Corporation

- Benchmark Electronics

- Plexus Corp.

- Wistron Corporation

- Luxshare Precision

- Venture Corporation

to learn more about this report Download Market Share

Recent Developments

- In September 2025 : Kaynes Technology, an EMS and design firm based in Mysuru, announced plans to launch its outsourced semiconductor assembly and test (OSAT) plant in Sanand by December 2025. This development marks a significant milestone for the company’s expansion into semiconductor manufacturing and testing, positioning it as a important player in India's growing semiconductor ecosystem.

- In August 2025 : Amphenol announced its acquisition of CommScope’s connectivity and cable solutions business for $10.5 billion in an all-cash deal. This acquisition marks Amphenol’s largest to date and is intended to expand its broadband portfolio and strengthen its position in the growing 5G and broadband markets. The deal is anticipated to close in the first half of 2026.

- In February 2025 : TE Connectivity announced plans to acquire Richards Manufacturing for approximately $2.3 billion in cash. This acquisition aims to enhance TE Connectivity's presence in the electrical utilities market, responding to the increasing demand for power driven by artificial intelligence and the need for more resilient infrastructure.

- In February 2025 : Murata Manufacturing's CEO announced plans for significant mergers and acquisitions, with deals exceeding $665 million. The company is targeting expansion in inductors and sensors, considering both domestic and overseas opportunities to boost market presence.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 578.07 Billion |

| Market Size in 2025 | USD 620.85 Billion |

| Market Size in 2033 | USD 1099.05 Billion |

| CAGR | 7.4% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Services, By Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Electronic Manufacturing Services Market Segments

By Services

- Electronics manufacturing services

- Engineering services

- Test & development implementation

- Logistics services

- Others

By Industry

- Consumer electronics

- Automotive

- Heavy industrial manufacturing

- Aerospace and Defense

- Healthcare

- IT and telecom

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.