Engineering Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premises), By Applications (Design Automation, Product Design & Testing, Plant Design, Drafting & 3D Modeling, Others), By End-User (Automotive, Aerospace & Defense, Electronics, Architecture, Engineering, and Construction (AEC), Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Engineering Software Market Size

The global engineering software market size was valued at USD 25.5 billion in 2024 and is projected to grow from USD 30.7 billion in 2025 to reach USD 65.5 billion by 2033, growing at a CAGR of 9.3% during the forecast period (2025-2033).

Engineering software refers to specialized tools that aid in the automation, simulation, design, and analysis of engineering processes, enabling the development of innovative solutions. These tools are widely adopted across various industries to boost efficiency, reduce costs, and accelerate product development cycles.

The integration of advanced technologies such as cloud computing, artificial intelligence (AI), and machine learning (ML) is transforming engineering software, enhancing its capabilities and scope. The rising demand for complex designs and simulations, coupled with the rapid automation of industries such as automotive and aerospace, is driving the growth of the global market.

By streamlining workflows and enabling precision in design and analysis, these tools play a pivotal role in shaping modern engineering processes.

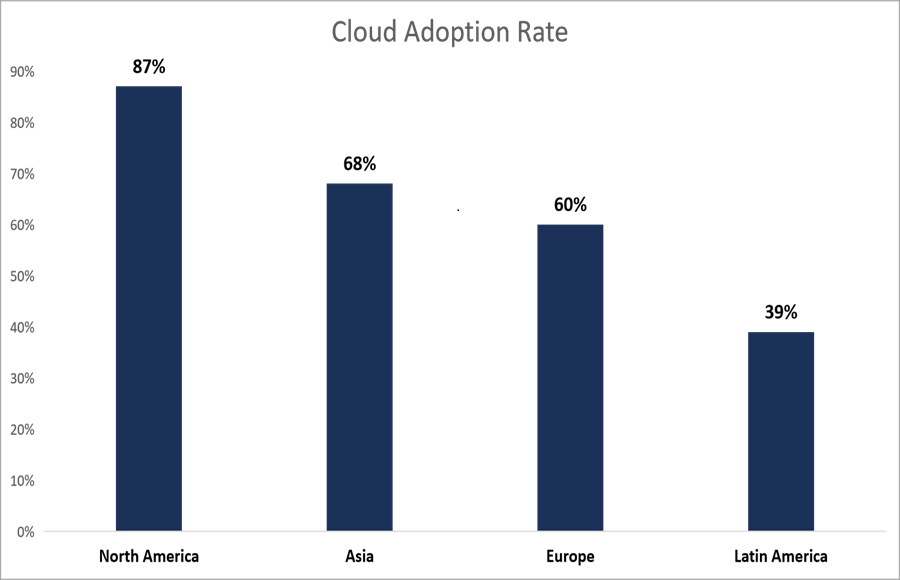

The below graph shows the cloud adoption rate in different regions:

Engineering Software Market Trends

Cloud-Based Solutions

Cloud-based solutions have gained significant popularity due to their scalability, cost-efficiency, and accessibility. These tools enable organizations to share files in real-time, access large datasets remotely, and eliminate the need for expensive on-premises infrastructure. They are particularly appealing to small and medium enterprises (SMEs) seeking efficient and budget-friendly solutions.

- For example, Autodesk, a leading design software provider, has witnessed a surge in cloud-based subscriptions. These subscriptions empower users to access design tools remotely, fostering seamless collaboration among teams worldwide.

Increasing Use of Ai and Automation

The integration of artificial intelligence (AI) and automation into engineering software is revolutionizing the industry. AI-powered algorithms enhance design processes, predict product performance, and perform complex calculations, significantly reducing reliance on manual tasks and improving efficiency. This transformative technology is reshaping industries by delivering greater precision and faster project completion.

- For instance, Siemens' digital twin technology allows engineers to simulate real-world conditions, predict potential failures, and optimize designs, proving invaluable in sectors like manufacturing and automotive.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 25.5 Billion |

| Estimated 2025 Value | USD 30.7 Billion |

| Projected 2033 Value | USD 65.5 Billion |

| CAGR (2025-2033) | 9.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Autodesk, Dassault Systèmes, Siemens PLM Software, PTC, Ansys |

to learn more about this report Download Free Sample Report

Engineering Software Market Growth Factors

Demand for Automation and Simulation Tools

A key driver in the engineering software market is the rising demand for automation and simulation tools as industries increasingly automate their processes. This software enables the automation of design, testing, and manufacturing workflows, reducing human error, accelerating production, and maximizing efficiency. This allows businesses to optimize operations while meeting the growing need for precision and timely project delivery.

- For example, Dassault Systèmes’ CATIA software integrates automation and simulation features, enabling industries like aerospace and automotive to streamline their design-to-production pipelines and achieve greater operational efficiency.

The growing emphasis on automation in engineering processes continues to propel the expansion of the global market.

Increasing Complexity of Designs

The growing complexity of product designs is a significant driver for the global market. As industries innovate, the demand for tools capable of managing intricate calculations, simulations, and optimizations across multiple disciplines increases. Multidisciplinary workflows require seamless integration and real-time collaboration among various teams, often involving the handling of large datasets throughout the development process.

- For instance, ANSYS, a leading provider of simulation software, offers solutions that enable engineers to perform detailed multiphysics simulations, such as fluid-structure interactions in the aerospace and automotive sectors.

By providing advanced tools to meet these challenges, this software plays a pivotal role in modern innovation, driving efficiency and accuracy in industries that rely on complex designs. This rising complexity continues to push the boundaries of what engineering software can achieve, fostering market growth.

Restraining Factors

Complexity of Integration

The complexity and time involved in integrating new software into existing systems present a significant challenge for the global engineering software market. Companies often struggle to ensure compatibility with legacy systems, which slows down the adoption of modern tools. Seamless integration demands substantial resources, including time, skilled personnel, and financial investment, further increasing project costs and delays.

For instance, industries using older manufacturing infrastructure may face difficulties in implementing advanced automation or simulation tools, resulting in operational disruptions. These challenges deter businesses from upgrading their systems, impacting the overall growth potential of the global market.

Addressing these integration hurdles remains crucial for fostering wider adoption of advanced engineering solutions.

Market Opportunity

Integration of Augmented Reality and Virtual Reality

The integration of augmented reality (AR) and virtual reality (VR) is unlocking transformative opportunities in product design, prototyping, and visualization. These immersive technologies enable real-time feedback, dynamic collaboration, and early issue identification, enhancing efficiency and innovation.

- For example, PTC’s integration of AR into its CAD software allows engineers to visualize 3D designs in real-world environments, improving collaboration and minimizing errors.

By streamlining the development cycle, AR and VR technologies drive more efficient and innovative engineering processes, creating significant growth opportunities for the market.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America led the global market in 2023, fueled by its advanced industrial ecosystem and the presence of major players like Altair Engineering, Inc., ANSYS, Inc., Autodesk, Inc., and Bentley Systems, Inc. The region’s strong focus on R&D and innovation has created a demand for cutting-edge solutions in design, simulation, and analysis, particularly in the aerospace, automotive, and electronics sectors. With its mature industrial landscape and established technological infrastructure, North America continues to drive growth in engineering solutions and maintains a significant market share.

Asia-Pacific: Rapidly Growing Region

Asia-Pacific is poised to achieve the highest CAGR during the forecast period, driven by rapid industrialization and urbanization in countries such as China and India. Growing investments in infrastructure projects, including energy, transportation, and construction, amplify the need for engineering solutions. Moreover, the region's increasing focus on technological advancements and digital transformation in industries like aerospace and automotive boosts the adoption of CAD, CAM, and CAE software. This dynamic environment positions Asia-Pacific as a critical growth driver for the regional market.

Countries Insights

- United States: The United States remains the global leader in the engineering software industry, hosting key players such as Autodesk, Dassault Systèmes, and PTC. The aerospace, automotive, and manufacturing sectors rely heavily on advanced engineering software for product design, simulation, and testing, placing the country at a significant advantage.

Digital transformation and automation advancements, particularly in cloud-based solutions, further fuel market growth, positioning the U.S. as a key player in the engineering software landscape.

- Germany: Germany is one of Europe’s largest markets for engineering software, driven by its robust automotive, aerospace, and industrial manufacturing sectors. Siemens, SAP, and Dassault Systèmes provide cutting-edge solutions for product design, simulation, and manufacturing.

With the nation focusing on Industry 4.0 and other advanced manufacturing technologies, the demand for sophisticated engineering software continues to rise, ensuring Germany's ongoing leadership in the industry.

- China: China’s market is experiencing rapid growth, particularly due to its status as the world’s largest manufacturing hub. The country’s swift industrialization and emphasis on high-tech industries such as aerospace, automotive, and electronics are driving significant demand for CAD, CAM, and CAE software.

Major players like Huawei and Lenovo are integrating these engineering tools into their product development processes, contributing to the expanding market.

- Japan: Japan has a well-established engineering software market, largely fueled by the dominance of its automotive, robotics, and electronics industries. Leading manufacturers such as Mitsubishi Electric, Hitachi, and Toyota heavily rely on engineering software for product lifecycle management and CAD/CAE development and design.

The nation’s advanced technological infrastructure and engineering capabilities continue to drive growth in the sector, particularly in automotive design and industrial automation.

- South Korea: South Korea’s market is propelled by rapid advancements in its semiconductor, automotive, and electronics sectors. Global giants like Samsung, Hyundai, and LG rely on engineering software for product design, simulation, and testing, further boosting demand for CAD and CAE tools. The country's focus on smart manufacturing, AI, and IoT also drives the adoption of advanced engineering solutions, fostering continued market growth.

- India: India's market is rapidly growing and is driven by the automotive, aerospace, and construction industries. With more engineering companies and manufacturers embracing CAD, CAM, and CAE tools, production and design efficiency have significantly improved.

The "Make in India" initiative, along with a growing focus on digitalization in the manufacturing sector, accelerates the country’s adoption of engineering software, propelling it toward faster growth.

- United Kingdom: The United Kingdom remains a key market for engineering software, with strong demand from the automotive, aerospace, and manufacturing industries. Companies like Rolls-Royce, BAE Systems, and major engineering firms rely on advanced software for product design, simulation, and testing. The UK’s long-standing industrial base, combined with a focus on technological innovation, continues to drive the adoption and development of engineering software solutions.

- France: France boasts a large engineering software market fueled by the aerospace, automotive, and energy sectors. Major companies like Airbus and Renault extensively use engineering software for product design, simulation, and testing. The country’s efforts to digitalize manufacturing processes and improve energy efficiency further elevate the demand for advanced software solutions, particularly those aimed at enhancing sustainability and operational efficiency.

Segmentation Analysis

By Component

Software Segment Dominates the Market with the Largest Market Revenue

The software segment dominates the market due to its critical role in design, simulation, testing, and analysis, enabling end-to-end product lifecycle management. With industries increasingly requiring solutions to manage complex products, especially in automotive, aerospace, and electronics, integrated software tools have become indispensable. Their ability to streamline workflows, enhance precision, and reduce time-to-market drives their adoption. As industries innovate, the demand for software tools capable of handling intricate processes continues to grow, cementing the segment's leadership in the market.

By Deployment Mode

Cloud-Based Engineering Software Solutions Lead the Market

The cloud segment is the dominant deployment mode due to its unmatched flexibility, scalability, and cost-efficiency. Cloud-based software facilitates real-time collaboration across geographically dispersed teams, optimizing design workflows and reducing operational costs. Its adoption is accelerating as businesses prioritize adaptability and seamless integration. With the increasing need for efficient, remotely accessible tools, the cloud segment is poised to maintain its dominance, driving innovation in industries like automotive, aerospace, and manufacturing.

By Application

Product Design & Testing dominates with the highest market share

Product design and testing lead the application segment due to the rising demand for faster time-to-market and improved operational efficiency. Engineering software specializing in Product Lifecycle Management (PLM) and design automation has become essential, particularly in automotive, aerospace, and electronics. These tools enable precise simulations, rapid prototyping, and efficient design iterations, aligning with industry demands for innovation. This dominance is set to grow as companies increasingly focus on streamlined processes and optimal product design.

By End-User

Automotive Segment Leads the Market

The automotive industry stands out as the leading end-user of engineering software, driven by its need for cutting-edge design, simulation, and testing tools. Advanced software enables automakers to innovate in vehicle performance, safety, and efficiency, catering to evolving consumer demands. The segment’s reliance on this software for tasks such as aerodynamics testing and electric vehicle design underscores its market leadership. As the automotive industry advances, its dependency on such tools ensures sustained dominance.

Company Market Share

Key market players are making significant investments in advanced engineering software technologies to strengthen their competitive edge. These companies are pursuing strategies such as mergers and acquisitions to expand their market presence, diversify their product offerings, and gain access to new technologies.

Moreover, continuous product innovations, including the development of cloud-based solutions, AI-powered tools, and enhanced simulation capabilities, are driving growth and meeting the evolving needs of industries like aerospace, automotive, and manufacturing.

Onshape: An Emerging Player

Onshape provides cloud-based CAD software that allows multiple users to work on the same design simultaneously, offering real-time collaboration features. With its subscription model and focus on the cloud, Onshape is disrupting traditional CAD solutions by offering a fully cloud-native, collaborative design environment. It is especially appealing to startups and small to medium-sized enterprises (SMEs) looking for flexible and cost-effective solutions.

Recent Developments:

- In September 2024, PTC entered into a Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to accelerate the growth of its Onshape cloud-native CAD and product data management (PDM) solution. The collaboration will focus on enhancing Onshape's features, driving customer adoption, and advancing AI initiatives to help product designers and engineers develop high-quality products more quickly and efficiently.

List of Key and Emerging Players in Engineering Software Market

- Autodesk

- Dassault Systèmes

- Siemens PLM Software

- PTC

- Ansys

- Altair Engineering

- Bentley Systems

- Dassault Systèmes SOLIDWORKS

- Hexagon AB

- Others

Recent Developments:

- November 2024 - L&T Technology Services Limited (LTTS) announced a definitive agreement to acquire Silicon Valley-based Intelliswift. This acquisition aims to strengthen LTTS's capabilities in Software Product Development, Platform Engineering, Digital Integration, and Data & AI. The deal aligns with LTTS's strategy to enhance its service offerings and expand its footprint in the digital transformation space.

- October 2024 - Esri and Autodesk strengthened their strategic alliance by integrating Esri's geospatial reference data into Autodesk Forma. This collaboration aims to enhance the early design and planning stages for professionals in the architecture, engineering, construction, and operations (AECO) industry, leveraging Esri's authoritative GIS technology to improve location intelligence and decision-making.

Analyst Opinion

As per our analyst, the industry is set for substantial growth, fueled by the rapid adoption of cloud-based solutions, AI integration, and immersive technologies such as AR and VR. These advancements are transforming collaboration, streamlining product development, and significantly enhancing efficiency in design processes. Companies that prioritize innovation, scalability, and user-friendly solutions are well-positioned to gain a competitive edge.

With these transformative shifts, the industry is poised to unlock vast opportunities for improving design, prototyping, and product lifecycle management, paving the way for future advancements and market expansion.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 25.5 Billion |

| Market Size in 2025 | USD 30.7 Billion |

| Market Size in 2033 | USD 65.5 Billion |

| CAGR | 9.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment, By Applications, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Engineering Software Market Segments

By Component

- Software

- Services

By Deployment

- Cloud

- On-premises

By Applications

- Design Automation

- Product Design & Testing

- Plant Design

- Drafting & 3D Modeling

- Others

By End-User

- Automotive

- Aerospace & Defense

- Electronics

- Architecture, Engineering, and Construction (AEC)

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.