Enterprise LLM Market Size, Share & Trends Analysis Report By Type (Proprietary Enterprise LLMs, Open-Source Enterprise LLMs, Composite Enterprise LLMs, LLM-as-a-Service (LaaS) Platforms), By Technology (Retrieval Augmented Generation (RAG) LLMs, Instruction Tuned LLMs, Multimodal LLMs, Domain Fine-Tuned LLMs), By Deployment Model (Cloud-Based Deployment, On-Premise Deployment, Hybrid Deployment), By Application (Customer Support, Content Generation, Data Analysis, Code Generation, Compliance Management), By End Use Industry (BFSI, Healthcare, Retail, IT & Telecom, Manufacturing, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Enterprise LLM Market Overview

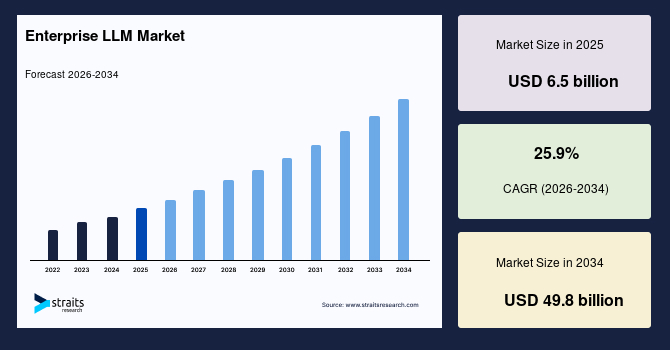

The global enterprise LLM market size is valued at USD 6.5 billion in 2025 and is projected to reach USD 49.8 billion by 2034, growing at a CAGR of 25.9% during the forecast period. Strong market expansion is driven by the rapid enterprise adoption of large language models for automation, data-driven decision-making, and secure knowledge management, along with advancements in RAG architectures, domain-tuned models, and compliance-centric AI frameworks that enable organizations to deploy LLMs safely at scale.

Key Market Trends And Insights

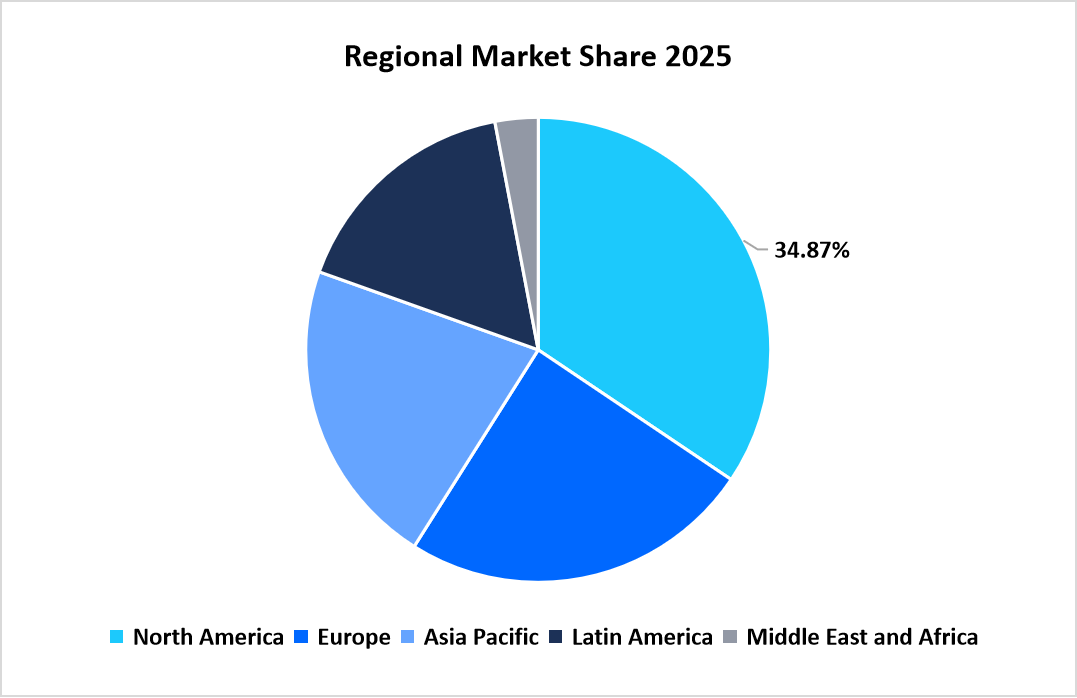

- North America dominated the market with a revenue share of 34.87% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 27.45% during the forecast period.

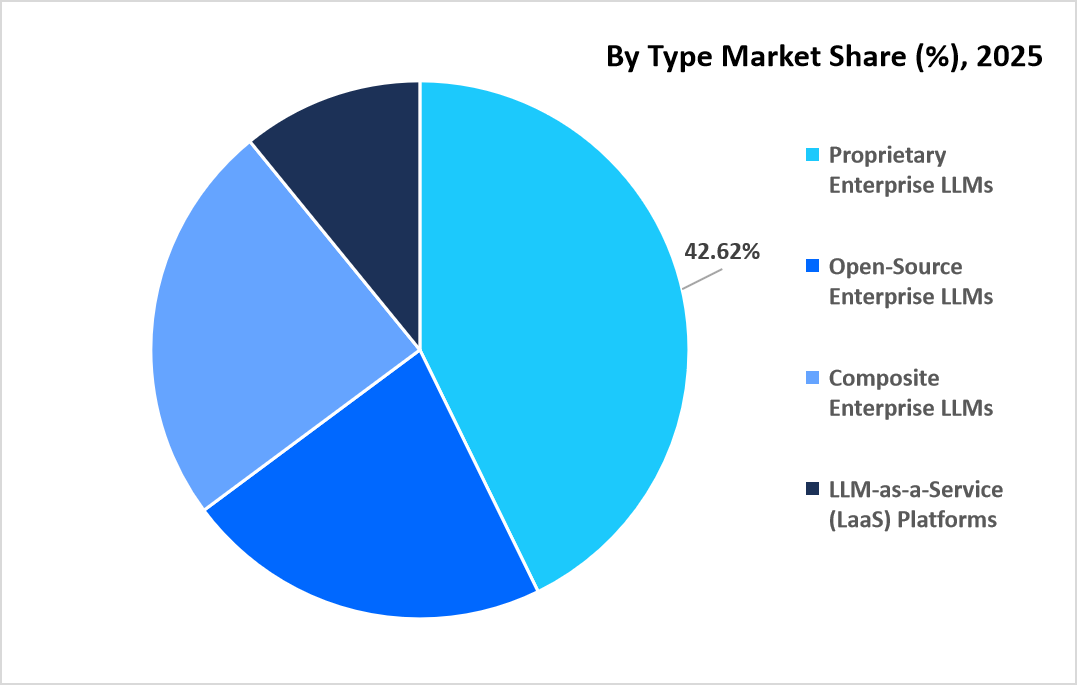

- Based on type, the Proprietary Enterprise LLMs segment held the highest market share of 42.62% in 2025.

- By technology, the Retrieval Augmented Generation (RAG) LLMs segment is estimated to register the fastest CAGR growth of 29.34%.

- Based on the deployment model, the Cloud-Based Deployment segment dominated the market in 2025 with a revenue share of 41.74%.

- Based on application, the Customer Support segment dominated the market with a revenue share of 32.48% in 2025.

- By end-use industry, the Healthcare segment is anticipated to grow at the fastest rate of 12%.

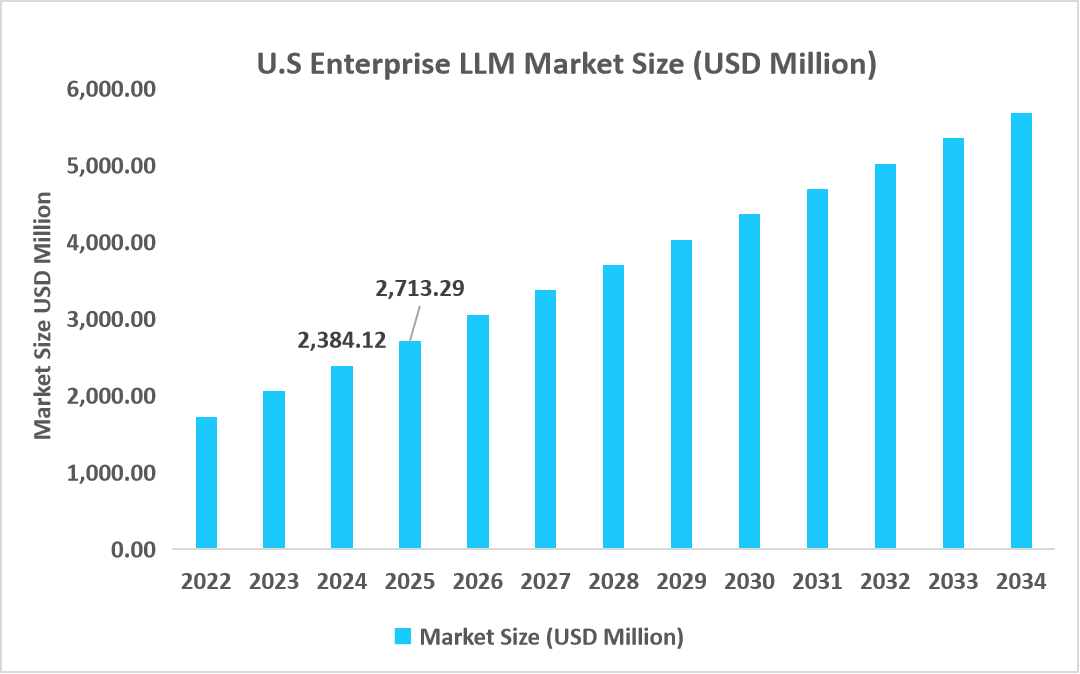

- The U.S. dominates the global market, valued at USD 2.38 billion in 2024 and reaching USD 2.71 billion in 2025.

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 6.5 billion

- 2034 Projected Market Size: USD 8 billion

- CAGR (2026-2034): 25.9%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global enterprise LLM market has a broad range of advanced, large language model solutions specifically designed for organizational use. It ranges from proprietary enterprise-grade LLMs to open-source models adapted for secure operations, composite architectures integrating multiple models, and LLM-as-a-Service platforms. These solutions function on key technologies such as Retrieval-Augmented Generation (RAG), instruction-tuned models, multimodal systems, and domain-fine-tuned architectures for industry-specific workflows.

Enterprise LLMs are deployed on cloud-based environments, on-premise infrastructures, and hybrid models that support a variety of applications, including customer support automation, content generation, data analysis, code development, and compliance management. The market serves a wide set of industries that comprises BFSI, healthcare, retail, IT and telecom, manufacturing, and other enterprise sectors with secure, scalable, and governance-driven AI capabilities to improve operational efficiency, quicken decision-making, and enable transformative intelligent automation for enterprises across global markets.

Market Trends

Shift from Standalone AI Tools to Fully Integrated Enterprise Intelligence Systems

The use of enterprise LLMs is extending beyond isolated deployments to comprehensive, organization-wide intelligence ecosystems that knit together internal sources of information, workflows, and decision-support systems. Whereas formerly an array of fragmented analytics dashboards, rule-based automation, and departmental tools maintained operational silos and inconsistent outputs, today's architectures integrate seamlessly with CRMs, ERPs, knowledge bases, and collaboration suites to provide the enabling capabilities for continuous reasoning, contextual retrieval, and automated workflow execution.

Companies that have deployed integrated LLM ecosystems are reporting major improvements in speed of operations, consistency of insights, and cross-department alignment. This transition reflects the basic shift from deploying LLMs as productivity enhancers to making them an integral part of core infrastructure for enterprise-wide decision-making and knowledge automation.

Acceleration of Compliance-Ready AI Frameworks In Regulated Industries

A key trend that shapes the market is rapid development and publication of compliance-focused LLM frameworks for meeting governance, audit, and risk requirements in highly regulated verticals such as BFSI, healthcare, and manufacturing. Traditional AI deployments often compromise on data privacy, traceability, and adherence to policies and regulations, making enterprise-scale adoption difficult. A modern set of enterprise LLM systems includes policy reasoning, automatic redaction, lineage tracking, and controlled retrieval to allow organizations to deploy generative AI with regulatory integrity. Early adopters have demonstrated significant reductions in compliance review time, audit readiness, and transparency into automated decision paths. This rapidly accelerates industry acceptance, with this feature set becoming table stakes rather than a nice-to-have capability.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.5 billion |

| Estimated 2026 Value | USD 8.19 billion |

| Projected 2034 Value | USD 49.8 billion |

| CAGR (2026-2034) | 25.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | OpenAI, Microsoft, Google, Meta AI, Anthropic |

to learn more about this report Download Free Sample Report

Market Driver

Government Acceleration of National AI Infrastructure Programs

The rapid growth of government-led AI infrastructure projects is a strong driver that enables organizations to deploy large-scale language technologies at breakneck speeds. Governments in the Asia Pacific, North America, and Europe are investing heavily in the development of native cloud frameworks, national compute grids, and regulated data exchange infrastructures that can support enterprise-class AI workloads.

For instance, various national digital strategy programs launched between 2023 and 2025 introduced secure data-sharing hubs, public-sector AI sandboxes, and tax incentives for enterprises deploying compliant language-model solutions. These programs brought down the adoption barrier significantly for industries like banking, health care, and manufacturing, for which regulatory restrictions earlier impeded AI integration. As enterprises get access to secure compute and standardized governance models, demand has surged for deployable LLM systems, with government-backed AI infrastructure being one of the most powerful catalysts driving global market growth.

Market Restraint

Regulatory Uncertainty Around Enterprise AI Governance is Slowing Down Adoption

The major restraints being witnessed in the enterprise LLM market are the increasing complexity and ambiguity with respect to national and cross-border AI governance frameworks. Over the last couple of years, various governments of the EU, Canada, Singapore, and the U.S. have proposed draft regulations and compliance requirements on high-impact AI systems, forcing enterprises to ensure that models demonstrate a high level of transparency and auditability, and are properly risk-classified and have proper data provenance. For example, the current and developing AI regulatory framework from the EU designates certain types of enterprise AI applications as "high-risk," thereby compelling compulsory conformity assessment and ongoing monitoring obligations.

While these rules propose an ambitious objective to drive greater safety and accountability, the absence of harmonized global standards has driven operational uncertainty for large, multinational enterprises. Organizations are reportedly deferring large-scale LLM deployments out of concern for regulatory exposure, ambiguous liability boundaries, and the need to internally redesign governance structures. This dynamic, uneven regulatory environment constrains rapid enterprise adoption and is one of the most influential restraints on the global enterprise LLM industry.

Market Opportunity

Rapid Expansion of Enterprise Data Modernization Programs is Unlocking New LLM Deployment Potential

A key opportunity unfolding in the Enterprise LLM Market involves the increasing trend of organizations towards large-scale data modernization efforts that ready legacy information systems for AI-driven automation. In the last couple of years, enterprises in sectors such as BFSI, healthcare, retail, and manufacturing started restructuring internal datasets-converting unstructured documents into machine-readable formats, consolidating fragmented repositories, and establishing unified knowledge layers. This is creating ideal conditions for LLM deployments, as enterprises now have access to cleaner, better-organized, and context-rich data assets that considerably improve model accuracy and performance. Early adopters implementing structured knowledge hubs have claimed substantial improvements in process automation outcomes and decision-making reliability. With more enterprises worldwide undergoing digital data restructuring, demand for LLM solutions capable of leveraging these newly accessible information ecosystems is expected to spiral upwards, thereby opening up a large and sustained opportunity for market growth.

Regional Analysis

North America dominated the market in 2025, accounting for 34.87% of global revenue, due to robust enterprise digital transformation programs and early adoption of AI-governance frameworks that ensure safer LLM deployments across regulated industries. The mature cloud ecosystems, high enterprise spending on automation, and broad availability of structured corporate data in the region drive the quicker integration of LLMs into customer operations, compliance workflows, and internal knowledge systems. Increasing innovation in enterprise software platforms and rising use of LLM-embedded productivity tools reinforce the dominant position held by North America within the global market.

The U.S. Enterprise LLM market is growing rapidly due to extensive organizational investment in AI-driven operational redesign. Enterprises from BFSI, healthcare, retail, and manufacturing are gradually leveraging LLM-powered systems for secure knowledge retrieval, automated documentation, and advanced workflows for decision support. Increasing corporate demand for scalable inference infrastructure and proliferation of enterprise app ecosystems with integral LLM capabilities are strengthening the growth in the U.S. market. The emphasis on responsible AI deployment and internal model governance frameworks within the country further bolsters trust and enterprise-scale adoption.

Asia Pacific Enterprise LLM Market Insights

By 2026–2034, the CAGR is projected to reach 27.45%, and the Asia Pacific will emerge as the fastest-growing region. Large-scale enterprise digitalization programs across major economies, strong cloud adoption across developing economies, and rapid private-sector AI ecosystem expansion are driving high growth in the region. Most countries across the region have started integrating domain-tuned LLMs into sectors such as telecom, financial services, and retail to enhance service automation and operational resilience. Growing corporate investment in multilingual AI capabilities and accelerated modernization of enterprise data infrastructure further contribute to regional market growth.

India's Enterprise LLM industry is growing quickly, supported by large domestic enterprises modernizing legacy systems and adopting LLMs for document automation, customer service improvement, and data-driven decision workflows. The rise of native AI solution providers offering customizable, domain-specific LLM deployments opens greater market accessibility for mid-sized organizations. Also, the integration of LLMs into enterprise SaaS platforms-especially those belonging to IT services, telecom, and financial institutions-drives further adoption. These factors make India one of the most dynamic and fast-scaling markets across the Asia Pacific.

Source: Straits Research

Europe Market Insights

Europe continues to see unprecedented expansion in enterprise LLM adoption, with secure AI deployment, multilingual model performance, and structured governance frameworks for enterprise-wide automation becoming key priorities among organizations. Cross-industry data standardization initiatives see increased investment, while rapid modernization of enterprise knowledge repositories drives adoption within financial services, government operations, retail, and advanced manufacturing. The region's emphasis on transparent workflows in AI and responsible deployment practices accelerates demand for LLM-powered platforms that drive accuracy, traceability, and compliance across internal processes.

Growth in the market of Enterprise LLMs in Germany is driven by rapid digitization across manufacturing, automotive, and industrial engineering sectors. Enterprises are deploying LLM-driven systems to modernize maintenance documentation, streamline supplier communication, and automate technical support workflows. Large industrial firms are adopting domain-tuned LLM models to interpret complex engineering data, enabling faster troubleshooting and improved production continuity. The strong enterprise digitalization momentum and focus on high-precision automation in Germany are well-positioning the country to be one of the leading adopters of LLM technologies in Europe.

Latin America Market Insights

The growth in digital transformation, along with the adoption of secure AI solutions to automate business processes across organizations in Brazil, Mexico, and Chile, is driving the Latin America enterprise LLM market. There is increasing enterprise interest in multilingual LLM capabilities to support customer service, automation of documentation, and internal knowledge management across diverse linguistic markets. The increasing integration of AI-enabled enterprise SaaS platforms is enabling companies to modernize their operations without heavy infrastructure investments, thus helping in the steady rise of LLM implementation across Latin America.

The Brazil market for enterprise LLM is observing rapid growth as large-scale enterprises leverage AI-powered automation to manage customer interactions, optimize workflows related to back-office operations, and modernize financial and retail service operations. The local technology providers are partnering with large enterprises to build domain-adapted LLM applications targeting compliance monitoring, conversational banking, and supply-chain intelligence. Increased corporate investment in digital workflow optimization and scalable cloud ecosystems enhances the reach of LLM solutions in Brazilian enterprises, strengthening the country's role as a key market within Latin America.

Middle East and Africa Market Insights

Adoption of enterprise LLM solutions is on the rise in the Middle East and Africa, as organizations demand advanced automation aligned with regional business practices and data-security expectations. Enterprises operating in industries such as banking, aviation, logistics, and energy use LLMs to enhance internal documentation, accelerate customer response systems, and provide better visibility into operations. Growth in enterprise innovation hubs and rapid expansion of cloud infrastructure across major economies support broader LLM deployment across the region.

The UAE Enterprise LLM market has been growing rapidly as companies adopt AI-driven knowledge automation to raise the quality of services, operational efficiency, and multilingual communication. Enterprises from telecom, hospitality, and financial services have started deploying LLM-based platforms to unify the internal knowledge resources and reduce manual processing workloads. The strong corporate focus on digital innovation, along with rapid investments by enterprises in scalable AI systems within the country, is hence offering a dynamic environment for LLM adoption and positioning the UAE as the leading market within the Middle East and Africa region.

Type Insights

The Proprietary Enterprise LLMs dominated the market, accounting for 42.62% of the revenue share in 2025, driven by strong demand for secure, compliance-ready, and centrally governed AI systems deployable across regulated industries. Enterprises increasingly favor proprietary models since they provide enhanced data protection controls, robust performance benchmarks, and dedicated vendor support, together, ensuring higher reliability and continuity in mission-critical workflows.

The segment of Composite Enterprise LLMs is expected to see the fastest growth, with a projected CAGR of 29.84% during the forecast period. This is driven by the surge in enterprise adoption of composite architectures that bring together multiple best-of-breed models for different functions, such as RAG engines, domain-tuned LLMs, and multimodal systems, together for higher accuracy and agility.

Source: Straits Research

Technology Insights

The segment of Retrieval Augmented Generation (RAG) LLMs dominated the market, with a revenue share of 38.41% in 2025, driven by increasing enterprise demand for accuracy, auditability, and context-aware responses in knowledge-intensive workflows. As more organizations centralize their unstructured data into repositories that can be searched, RAG-based architectures are preferred since they minimize hallucinations, ensure traceable outputs, and provide real-time insights from proprietary data.

The fastest-growing segment during the forecast period would be Multimodal LLMs, estimated at a CAGR of 29.34%. High growth is driven by surging demand for unified AI systems that can process text, images, documents, charts, and audio in a single workflow. Multimodal capabilities unleash richer automation scenarios-visual interpretation of documents, contextual code reviews, and multimedia customer-service interactions-that drive significant operational efficiencies.

Deployment Model Insights

The Cloud-Based Deployment segment dominated the market in 2025, with a revenue share of 41.74%, driven by the increasing reliance of enterprises on scalable AI infrastructure, elastic compute availability, and rapid deployment cycles to support organization-wide LLM adoption. Cloud ecosystems enable firms to integrate LLMs with enterprise data platforms, collaboration tools, and security frameworks without delays associated with on-premise provisioning.

The segment of Hybrid Deployment is expected to grow the fastest with a CAGR of 26.7%, during the forecast period. This growth is due to the high demand for deployment models that offer a balance between performance, data privacy, and regulatory compliance for sectors like BFSI, healthcare, and government services that deal with highly sensitive information.

Application Insights

The Customer Support segment dominated the market with a revenue share of 32.48% in 2025. This growth is driven by the rapid shift of enterprises toward AI-powered assistance to manage rising volumes of customer interactions. As organizations prioritize faster resolution times, multilingual service capabilities, and personalized support experiences, LLM-driven customer service platforms have become the preferred solution.

The Content Generation segment is anticipated to witness the fastest growth during the forecast timeframe. High growth is fueled by increasing enterprise demand for automated creation of marketing content, technical documentation, internal communication drafts, and product descriptions.

End Use Industry Insights

The Healthcare segment is anticipated to grow at the fastest rate of 28.12%, driven by the rising demand for AI-enabled clinical documentation, medical coding assistance, and intelligent decision-support systems. As healthcare providers increasingly manage large volumes of unstructured medical records, LLM-powered solutions are being adopted to improve accuracy, reduce administrative burden, and streamline patient data workflows.

Competitive Landscape

The global Enterprise LLM Market follows a moderately concentrated market structure, with a mix of established AI developers and large technology providers setting the tone for competitiveness. A few leading players hold a significant share of the market due to their extensive model portfolios, strong cloud ecosystems, and enterprise-focused AI deployment capabilities. These firms reinforce their positions in the market through upgrades of models, strategic partnerships, and the scaling up of enterprise-grade AI platforms.

Major players in the market include OpenAI, Microsoft, and Google, along with several emerging vendors offering specialized LLM solutions. These leading companies are vying to increase enterprise adoption through secure deployment architectures, domain-tuned capabilities, and integrated workflow automation tools. Strategic initiatives-such as cross-industry collaborations, enterprise platform integrations, and large-scale ecosystem expansion-enable these companies to further strengthen their presence and drive innovation across the market.

Thinking Machines Lab: An emerging market player

Thinking Machines Lab, a US-based AI startup, has just entered the Enterprise LLM space with a strong enterprise-first focus.

- In October 2025, it launched its first product, Tinker, a Python-based API that makes large language model fine-tuning scalable and enterprise-ready for companies to use.

Thus, Thinking Machines Lab is a notable recent entrant into the market for enterprise LLM that applies recent product innovation and enterprise-grade architecture to the current need for differentiated and scalable LLM services among organizations.

List of Key and Emerging Players in Enterprise LLM Market

- OpenAI

- Microsoft

- Meta AI

- Anthropic

- Cohere

- AI21 Labs

- IBM Watson

- Hugging Face

- Oracle

- Amazon Web Services

- Salesforce (Einstein)

- Baidu

- Alibaba Cloud

- NVIDIA

- SAP

- Infosys Nia

- DataRobot

- SemaText

- Stability AI

- Others

Strategic Initiatives

- June 2025: NTT DATA partnered with Google Cloud to accelerate “agentic AI” and cloud-native modernization for enterprises globally, enabling industry-specific LLM and AI solutions across sectors such as BFSI, retail, manufacturing, and healthcare.

- June 2025: IBM expanded its Granite LLM family by launching Granite 3.2, a suite of multi-modal and reasoning-capable enterprise LLMs designed for document understanding, vision-language tasks, and efficient inference, catering to real-world enterprise workloads with a balance of performance, size, and safety.

- March 2025: AI launched Enterprise LLM Studio, a “Fine-Tuning-as-a-Service” offering on private infrastructure tailored for enterprises needing custom, domain-specific LLMs on their own data.

- February 2025: Fujitsu introduced the Fujitsu Cloud Service Generative AI Platform in Japan, a secure enterprise-grade generative AI service combining data confidentiality with cloud scalability, aimed at corporate customers requiring privacy and compliance.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.5 billion |

| Market Size in 2026 | USD 8.19 billion |

| Market Size in 2034 | USD 49.8 billion |

| CAGR | 25.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Deployment Model, By Application, By End Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Enterprise LLM Market Segments

By Type

- Proprietary Enterprise LLMs

- Open-Source Enterprise LLMs

- Composite Enterprise LLMs

- LLM-as-a-Service (LaaS) Platforms

By Technology

- Retrieval Augmented Generation (RAG) LLMs

- Instruction Tuned LLMs

- Multimodal LLMs

- Domain Fine-Tuned LLMs

By Deployment Model

- Cloud-Based Deployment

- On-Premise Deployment

- Hybrid Deployment

By Application

- Customer Support

- Content Generation

- Data Analysis

- Code Generation

- Compliance Management

By End Use Industry

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Manufacturing

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.