Epichlorohydrin Market Size, Share & Trends Analysis Report By Product Type (Oil-Based Epichlorohydrin, Bio-Based Epichlorohydrin), By End Use (Chemical, Electronic, Automotive, Aerospace, Construction, Textile, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Epichlorohydrin Market Overview

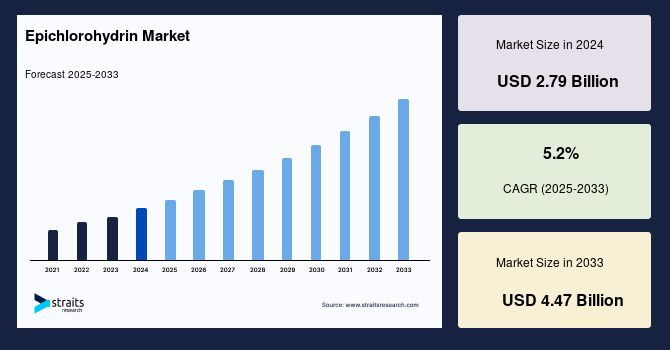

The global epichlorohydrin market size was valued at USD 2.79 billion in 2024 and is projected to reach from USD 2.94 billion in 2025 to USD 4.47 billion by 2033, growing at a CAGR of 5.2% during the forecast period (2025-2033). The global epichlorohydrin market is propelled by its growing penetration in the chemical manufacturing industry, rising trade activities for the product, and investments by industry players for global expansion.

Key Market Indicators

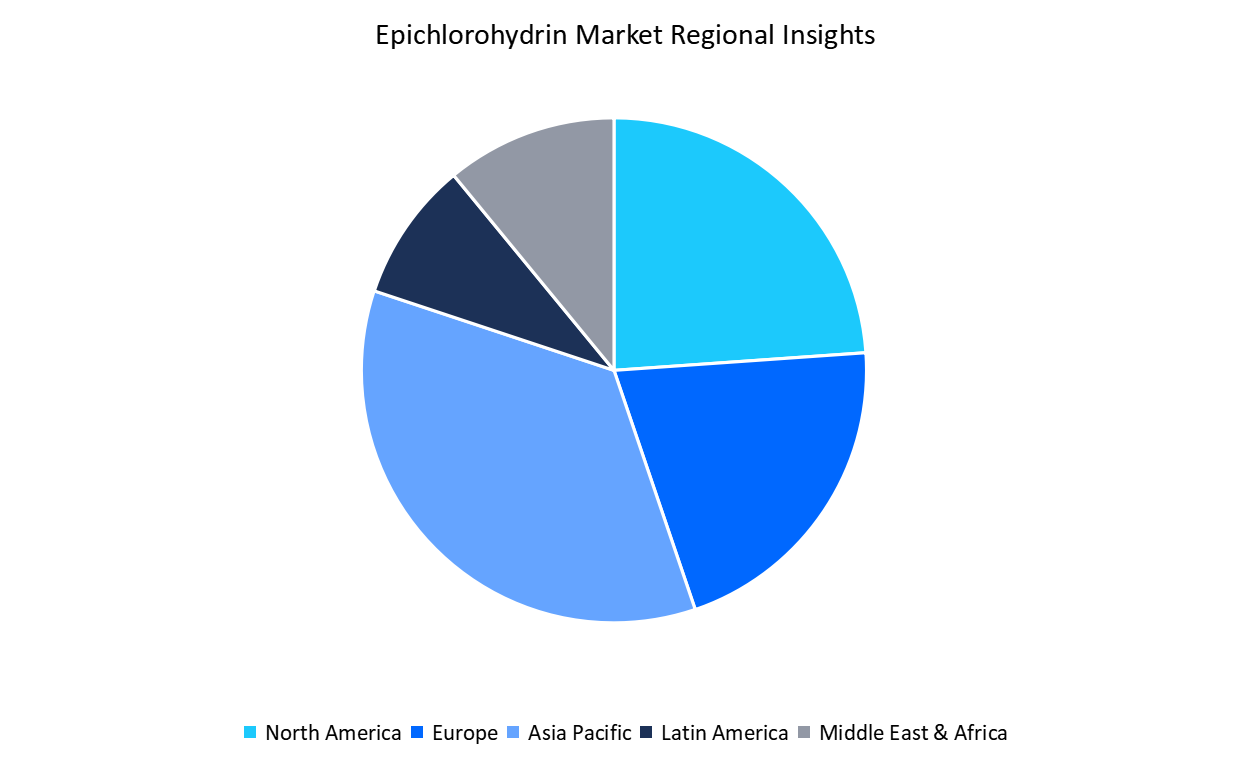

- Asia Pacific, is the dominant market in the global epichlorohydrin industry with a market share of 48.34% in 2024.

- Based on product type, oil-based epichlorohydrin dominated the industry in 2024 with a market share of 61.83%.

- Based on end use, the construction segment led the market in 2024 with a market share of 22.79%.

Market Size & Forecast

- 2024 Market Size: USD 2.79 Billion

- 2033 Projected Market Size: USD 4.47 Billion

- CAGR (2025–2033): 5.2%

- Largest market in 2024 : Asia Pacific

- Fastest-growing regions : North America

As epichlorohydrin is the major component in the manufacturing of epoxy resins, the demand for epichlorohydrin rises with the demand for epoxy resins. Epoxy resins are widely applicable across multiple industries such as construction, electronics, automotive, textile, and others. This wide industry reach of epoxy resins signifies the demand for epichlorohydrin. Hence, the trade of epichlorohydrin plays a crucial role in market growth.

Epichlorohydrin Global Export Data, 2023 & 2024 (Tons)

|

Country |

Export Quantity (Tons), 2023 |

Export Quantity (Tons), 2024 |

|

Thailand |

110,752 |

107,892 |

|

China |

57,860 |

84,353 |

|

South Korea |

39,979 |

54,979 |

|

Germany |

44,500 |

37,072 |

|

Japan |

22,652 |

31,325 |

|

U.S. |

15,607 |

24,558 |

|

France |

8,997 |

22,523 |

Source: International Trade Centre

These top 7 epichlorohydrin exporting countries underscore the demand for epichlorohydrin in the market.

Epichlorohydrin is a clear, volatile organic liquid that is frequently used in chemical industries as an intermediate during the manufacturing of other chemicals. Majorly, it is used in the manufacturing of epoxy resins that are widely applicable for key functionalities across various industries such as automotive, construction, electronics, and textiles. Epoxy resins enhance the durability and resistance of coatings and adhesives, promoting their role in different industries. This high demand for epoxy resins subsequently boosts the demand for epichlorohydrin.

Market Trends

Epoxy Resins Combined with Innovative Hardener: A Strong Barrier for Environmental Factors

The applications of epoxy resins are diversifying across multiple industries. So, the manufacturers are incorporating innovative components with epoxy resins to increase their durability.

- For instance, in March 2025, BASF and Sika launched an epoxy hardener for construction applications, specifically for the flooring part.

- In February 2025, Olin developed a hardener, D.E.H.828EU, to provide anti-corrosion coating for vehicles and industrial coating.

Modern Era of Wet Strength Paper: First Polyamide-Epichlorohydrin Resin Chemistry in Market

Wet-strength papers are widely used in the food and packaging industry for frozen food packaging, labels, and disposable tableware, as they do not lose their strength when they come in contact with water. As a global wet strength resin leader, Solenis launched innovative resin chemistry in the market.

- In 2024, Solenis invented Kymene 557 wet-strength resin, the first polyamide-epichlorohydrin resin chemistry. The product functions in neutral as well as alkaline pH.

This extensive application directs its successful commercialization, enhancing the demand for epichlorohydrin.

These innovative incorporations signify the role of epoxy resins, thereby propelling the demand for epichlorohydrin.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2.79 Billion |

| Estimated 2025 Value | USD 2.94 Billion |

| Projected 2033 Value | USD 4.47 Billion |

| CAGR (2025-2033) | 5.2% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Solvay, Sumitomo Chemical Co., Ltd., Olin Corporation, DCM SHRIRAM CHEMICALS, AGC Vinythai |

to learn more about this report Download Free Sample Report

Epichlorohydrin Market Drivers

Rise in Trade of Epichlorohydrin

A year-on-year rise in trade of epichlorohydrin highlights its demand across multiple industries across the globe.

- For example, the increase in export of epichlorohydrin from the U.S. signifies it as one of the major exporters of epichlorohydrin.

.png)

Source: International Trade Centre

This year-on-year increase in export of epichlorohydrin across multiple countries drives the market growth, thereby highlighting the rise in demand.

Automotive Industry Expansion Driving the Demand for Epichlorohydrin

Rising demand and production of the automobile industry are significantly increasing the demand for epichlorohydrin. Epoxy resins are consistently used in the automotive industry to reduce the weight of vehicles, coatings to provide mechanical strength, adhesion to metals, and heat resistance. These multiple applications make epoxy resin a crucial component in automotive manufacturing.

- For example, India’s rising automobile production propels demand for epoxy resins and hence for epichlorohydrin. The graph below indicates the number of vehicles manufactured in India.

.png)

Source: India Brand Equity Foundation

This continuously increasing production of automotives drives the demand for epoxy resins, thereby reflecting in market growth.

Market Restraining Factor

Epichlorohydrin & Serious Health Complications

Epichlorohydrin is prominently used for the production of epoxy resins that are applicable across multiple industries. So, the demand for epichlorohydrin surges in parallel. However, the people working with epichlorohydrin face a high exposure and need to face various health complications.

- For example, epichlorohydrin mainly targets the respiratory system, causing pulmonary oedema on exposure to a concentration of more than 20 ppm for 12 hours. Additionally, it irritates the eyes, causes nausea, vomiting, cough, and skin irritation as well

These multiple complications may lead to serious health issues. So, the manufacturers can prefer alternatives over epichlorohydrin for the manufacturing of epoxy resins, thereby impacting the market growth.

Market Opportunity

Market Expansion by Key Players: A Significant Opportunity

Epoxy resins are being adopted with their unique properties across key industries. Accordingly, the major manufacturing companies are expanding their business to new global locations, presenting opportunities for market growth.

- For instance, in June 2024, Aditya Birla Group invested USD 50 million in a manufacturing and R&D center in Texas. The company has a well-established business in India, Thailand, and Europe.

This expansion of the epoxy resin business by Aditya Birla Group marks the demand for epichlorohydrin in the region of North America.

Regional Analysis

The Asia Pacific region dominated the market with a revenue share of 48.34% in 2024. The growth is attributed to major factors such as increasing demand for epichlorohydrin in the chemical industry for manufacturing of epoxy resins that are applicable in key industries such as electronics, automotives, and chemicals. As these industries are prominently growing in the Asia Pacific, they carry the demand for epichlorohydrin subsequently.

China holds the major share of electronic products, where the requirement of epoxy resins is a must for insulation purposes. China is expanding its market reach across the globe. For example, in 2024, China started manufacturing electronics in Mexico and exported them to the U.S. as per the tariff requirements for Mexico. This strategic planning of China in the electronics sector marks the demand for epoxy resins and hence up-scales the epichlorohydrin market.

India has experienced a robust growth in the textile industry in the last 5 years. As epoxy resins are the necessary components in textiles to modify fabric properties and create high-strength composite materials, the demand for epichlorohydrin surges accordingly. For instance, according to the India Brand Equity Foundation, India had apparel and textile exports of 30 billion in 2021, and it has reached USD 37 billion in 2025. This remarkable growth underscores the demand for epichlorohydrin.

Source: Straits Research Analysis

U.S.- Growing investments by key manufacturers in aerospace manufacturing in the U.S. direct the demand for epoxy resins and hence for epichlorohydrin. For example, in March 2025, GE Aerospace invested USD 1 billion in U.S. manufacturing to strengthen manufacturing and increase the use of innovative parts and materials needed for better product development.

Germany is Europe’s leading construction sector, and it is growing continuously. As the constructionindustry is facing challenges with respect to external infrastructure sustainability due to environmental factors, epichlorohydrin’s major role in preventing the degradation influences the market demand.

South Africa is the key chemical manufacturing country in the African region. Being the largest chemical industry, South Africa is home to investments in chemical manufacturing. As epichlorohydrin is used in chemical manufacturing as an intermediate for high-performance materials and chemical synthesis, the dominant chemical industry of South Africa propels the market growth.

Brazil’s rising focus towards digitalization promotes the demand for epoxy resins and hence epichlorohydrin. For example, in September 2024, Brazil invested USD 35.12 billion in digital transformation in key areas such as semiconductors, industrial robotics, and others. This huge investment is expected to be reflected in demand for epichlorohydrin via epoxy resins.

Product Type Insights

The oil-based epichlorohydrin segment dominated the market with a revenue share of 61.83% in 2024. The growth is attributed to its rising demand in the construction, automotive, and electronics industries due to its enhanced mechanical properties for coating and adhesive formulations, high water solubility, and excellent resistance to moisture and UV degradation.

End Use Insights

The construction segment dominated the market with a revenue share of 22.79% in 2024. The growth is attributed to the rising demand for epoxy resins for the purpose of limiting the degradation of coatings and adhesives by moisture and UV radiation. This rising demand for epoxy resins simultaneously increases the demand for epichlorohydrin, which is a major raw material for manufacturing.

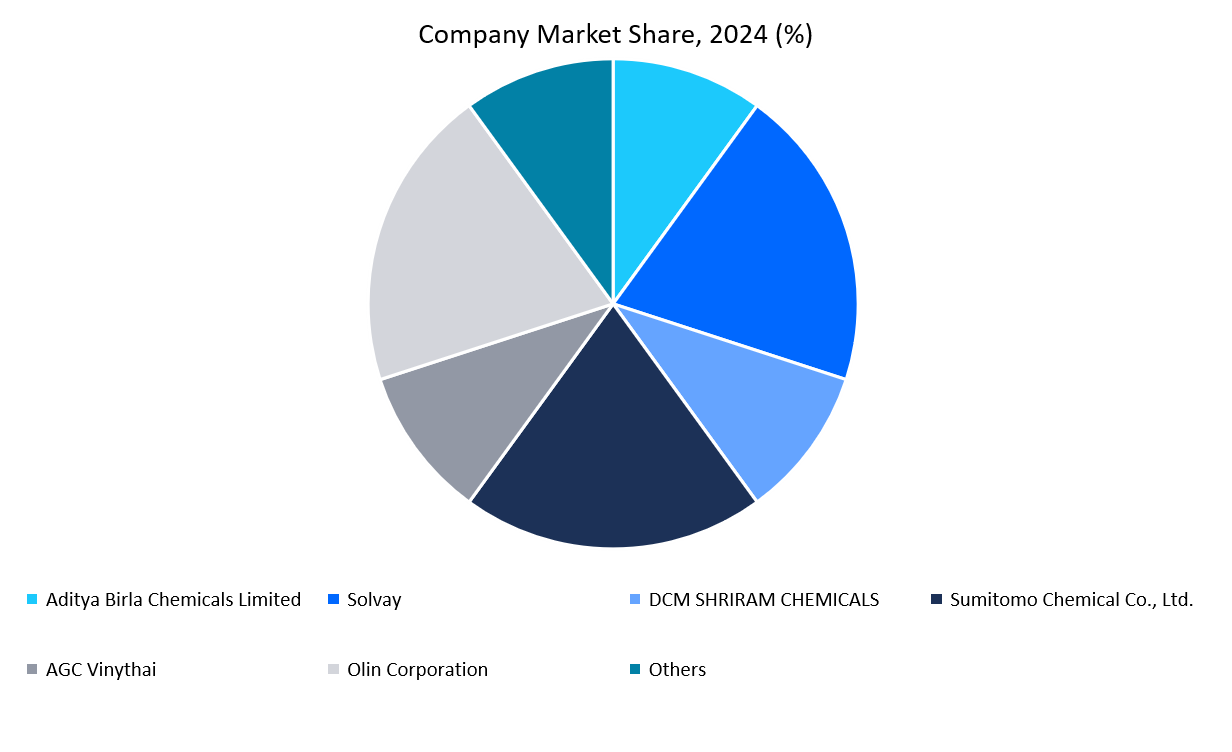

Company Market Share

The global epichlorohydrin market is consolidated in nature, owing to collaborations, mergers and acquisitions, and new innovative product development. The top players in the industry are Solvay, Sumitomo Chemical Co., Ltd., Olin Corporation, DCM SHRIRAM CHEMICALS, AGC Vinythai, and Aditya Birla Chemicals Limited.

Source: Straits Research Analysis

Ennoreindia Chemical: An emerging player in the epichlorohydrin market

Ennoreindia Chemical is an India-based company dealing with chemical manufacturing, specifically the marine chemicals. The company manufactures high-quality epichlorohydrin applicable across multiple industries such as chemicals, automotives, construction, and others. In just 12 years, the company has established its business on a global level with more than 15 international business partners. With a wide portfolio of chemicals, Ennoreindia continues to grow.

List of Key and Emerging Players in Epichlorohydrin Market

- Solvay

- Sumitomo Chemical Co., Ltd.

- Olin Corporation

- DCM SHRIRAM CHEMICALS

- AGC Vinythai

- TechnipFMC plc

- Epigral (Meghmani Organics Ltd.)

- Befar Group Co., Ltd.

- Huaqiang Chemical Group Stock Co., Ltd.

- ECO ORGANICS

- DHALOP CHEMICALS

- Shandong River Chemical Co., Ltd

- Central Drug House

- Hangzhou Leap Chem Co., Ltd.

- Aggarwwal Exports

- Aditya Birla Chemicals Limited

- Ennoreindia Chemical

- Others

Recent Developments

- In June 2025 : Nanshan Group Co., Ltd. announced a plan to invest USD 259.28 million to build a project with an annual production capacity of 165,000 tons of epichlorohydrin in Indonesia.

- In February 2025 : AGC Vinythai, a leading manufacturer of Epichlorohydrin, signed a cooperation agreement with BIG to supply low-carbon nitrogen and low-carbon oxygen through a pipeline network.

Analyst Opinion

The global market of epichlorohydrin is growing in both ways, one as direct and indirect utilization. Epichlorohydrin is directly utilized as an intermediate in chemical manufacturing and indirectly through the utilization of manufactured chemicals. It is mainly used for the manufacturing of epoxy resins, and they have a wide range of applications in construction, automotive, textile, and electronics industries. Rising demand for epoxy resins in these industries significantly boosts the demand for epichlorohydrin for the manufacturing of epoxy resins. Specific countries dominant for specific industries, such as China for electronics, impose a high demand for epoxy resins and hence epichlorohydrin, driving the market growth.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2.79 Billion |

| Market Size in 2025 | USD 2.94 Billion |

| Market Size in 2033 | USD 4.47 Billion |

| CAGR | 5.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Epichlorohydrin Market Segments

By Product Type

- Oil-Based Epichlorohydrin

- Bio-Based Epichlorohydrin

By End Use

- Chemical

- Electronic

- Automotive

- Aerospace

- Construction

- Textile

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.