Ethane Market Size, Share & Trends Analysis Report By Applications (Ethylene Synthesis, Acetic Acid Synthesis, Refrigerant), By End Users (Packaging, Automotive & Transportation, Construction, Electricals & Electronics, Healthcare, Power) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Ethane Market Size

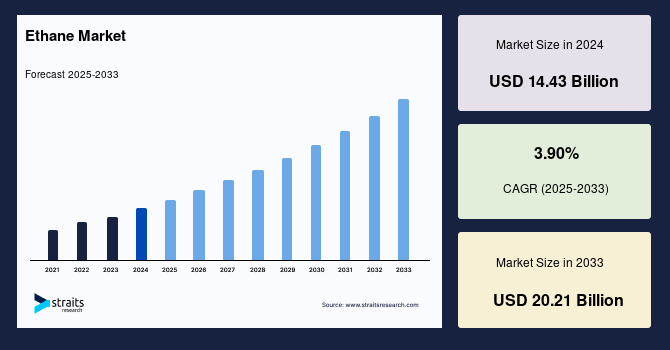

The global ethane market size was valued at USD 14.43 billion in 2024 and is expected to reach from USD 14.88 billion in 2025 to USD 20.21 billion in 2033, growing at a CAGR of 3.90% over the forecast period (2025-33).

Ethane is a colorless, odorless, gaseous hydrocarbon, it is a combination of hydrogen and carbon that is a member of the paraffin series. It is the most structurally straightforward hydrocarbon with a single carbon-carbon link. Ethane is primarily used as the raw material for ethylene production, which is used for further production of plastics, fruit ripening, and detergent making. It is the second most significant component of natural gas. It may also be found dissolved in petroleum oils and as a byproduct of coal carbonization and oil refinery activities. Ethane's industrial significance stems from its ease of pyrolysis, or cracking when heated in tubes, which produces ethylene and hydrogen. It is a key raw ingredient for the massive ethylene petrochemical industry, which makes crucial products like polyethylene plastic, ethylene glycol, and ethyl alcohol.

The global market is growing due to rising demand for ethylene, a key raw material in producing plastics, packaging, and construction materials. The expansion of the petrochemical industry, particularly in Asia-Pacific and North America, is a primary driver, supported by the abundant availability of shale gas reserves, especially in the U.S. Increasing investments in ethane crackers and ethylene production facilities in China, India, and the Middle East further boost market growth. The shift toward lightweight and cost-effective materials in automotive, consumer goods, and industrial applications enhances consumption.

Furthermore, the development of greener ethane processing technologies, advancements in ethane-to-ethylene conversion, and increased trade of liquefied ethane to regions with limited production capacity. Expanding downstream applications and rising petrochemical investments in developing economies also support future market expansion.

Latest Market Trends

Growing Demand from the Petrochemical Industry

The petrochemical industry is the primary driver of demand, particularly for ethylene production, a key component in plastics, chemicals, and synthetic materials. Ethane, propylene, and benzene play a crucial role in the electrification and energy storage industries, where petrochemicals are essential for manufacturing batteries, capacitors, and renewable energy storage systems. The rapid expansion of electric vehicle (EV) production, wind and solar power storage, and industrial-scale energy storage solutions further intensifies the demand for ethane-derived products. The increasing investments in downstream petrochemical plants, particularly in North America and Asia-Pacific, highlight ethane’s importance in meeting the rising global need for energy-efficient materials.

- The U.S. has emerged as a significant ethane supplier, with wholesale gas prices averaging about one-third of those in most other industrial nations.

- U.S. industrial electricity prices are 30-50% lower than other leading exporters, giving American ethane-based petrochemical products a cost advantage in global markets.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 14.43 Billion |

| Estimated 2025 Value | USD 14.88 Billion |

| Projected 2033 Value | USD 20.21 Billion |

| CAGR (2025-2033) | 3.90% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

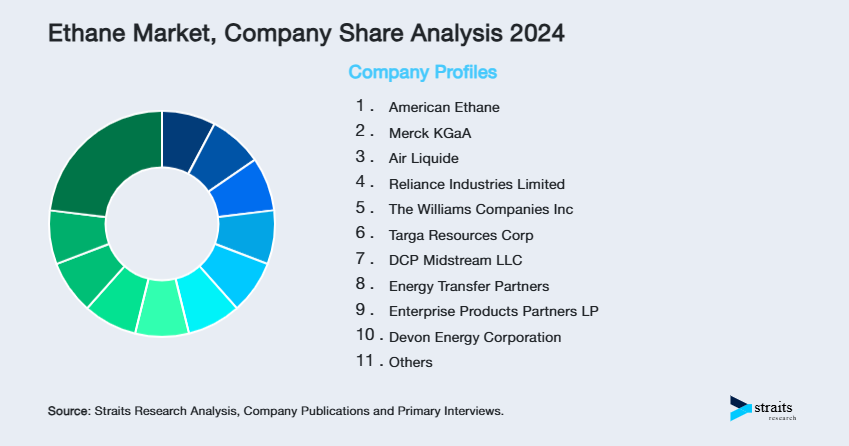

| Key Market Players | American Ethane, Merck KGaA, Air Liquide, Reliance Industries Limited, The Williams Companies Inc |

to learn more about this report Download Free Sample Report

Ethane Market Growth Factors

Ethane Demand Growth Amidst Long-Term Sustainability

Global consumer preferences have shifted the plastics industry's focus to include investments in sophisticated recycling technologies, waste reduction, biodegradable or reusable packaging, and expanding the circular economy. Governments, such as California and members of the European Union States, have implemented measures to lessen the need for raw materials in the plastics sector, which could impact the demand in the long run.

- The production of plastic is predicted to quadruple by 2040 and expand by 2.5 times by 2050, according to figures released by ISO in March 2022. The government's efforts to recycle and reuse plastic also contribute to the future expansion of the market.

Improvements in ethane-fed steam crackers offer a short-term chance to move toward lowering emissions in the petrochemical sector, both locally and globally. They could lead to increased demand in the market.

Restraining Factors

Environmental Concerns

Ethane extraction and processing have significant environmental implications. It is separated from natural gas and transported in liquid form to ethane crackers, where high temperatures break its molecules into ethylene. This process emits sulfur dioxide, nitrogen oxides, carcinogenic benzene, and volatile organic compounds, contributing to air pollution and climate change. As a result, governments and regulatory agencies are imposing stricter environmental standards on petrochemical production.

- The U.S. currently accounts for approximately 40% of global ethane-based petrochemical production and is the largest exporter, primarily supplying China, India, Norway, and the U.K.

Moreover, heightened environmental scrutiny may increase compliance costs and stricter regulations, affecting long-term market growth.

Market Opportunity

Rising Global Ethane Exports and Infrastructure Growth in Petrochemicals

The global ethane export volumes have surged due to its high ethylene yield and cost advantages over naphtha in ethylene production since 2014. Many petrochemical facilities have the flexibility to switch between ethane and naphtha, but ethane cracking has historically provided higher profit margins, particularly in the U.S., compared to Asia and Europe. New ethane infrastructure projects, including expanding ethane pipelines and export terminals in the U.S., are expected to support global market growth. Emerging economies in Africa and Latin America are exploring ethane import possibilities to establish their petrochemical production hubs.

Consequently, petrochemical companies invest in new ethane crackers and infrastructure to capitalize on cost-effective feedstock. The U.S. is expanding its pipeline infrastructure and export terminals to cater to rising international demand. China and India are building new petrochemical plants to integrate ethane-based production into their industrial supply chains.

Regional Insights

North America: Dominant Region with Robust Market Growth

North America holds the largest revenue share of the global market. This area's market revenue increase has been attributed to rising domestic consumer demand. Ethane output hit a new monthly record of 2.7 billion barrels per day, while consumption grew by 9%, according to the US Energy Information Administration (EIA). Another critical factor in increasing ethane production capacity in the region is the rise in natural gas output.

- Alberta's petrochemical industry is Canada's primary source of ethane demand. The Energy Information Administration (EIA) estimates that Canada produces 2.6 billion barrels of ethane per day on average, and by 2024, those figures will have risen from the previous year.

Asia Pacific: Rapid Expansion Fueled by Emerging Markets

The Asia Pacific market is anticipated to develop quickly during the projected period. One of the main factors propelling the Asia Pacific market's revenue growth is the expanding capacity for ethylene glycol production. The Asia-Pacific region's significant nations are investing in manufacturing growth to boost output capacity.

- For example, in March 2023, Yulong Petrochemical of China signed memorandums of understanding agreements with BP and Chevron to build the refinery and a 1.5-billion-tonne-per-year ethylene complex in Shandong province and approved USD 20 billion projects. Additionally, China National Offshore Oil and Shell inked a deal for a USD 7.6 billion investment in the third phase of an ethylene project in China's Guangdong region.

Countries Insights

- United States: The U.S. is the largest producer and exporter of ethane, with increased production due to rising natural gas output. According to the U.S. Energy Information Administration, ethanol production hit a record 3.0 million barrels per day (b/d) in May 2024, with the first half of 2024 averaging 2.8 million b/d. The surge in production supports domestic ethane-fed petrochemical plants and exports to key markets such as China, India, and Europe. In 2023, U.S. ethane and ethane-based petrochemical exports reached a record 21.6 billion metric tons, up 134% from 2014 and 17% from 2022.

- China: China is the largest importer of U.S. ethane, accounting for 45% of total U.S. exports in 2023. China’s demand for ethane, naphtha, and liquefied petroleum gas (LPG) for petrochemical feedstocks has grown significantly, averaging 1.7 million barrels per day in 2023, exceeding 2019. The country is expanding its import infrastructure and petrochemical capacity to support its growing plastics and chemicals industries.

- Mexico: The Texas Inland and New Mexico refining districts span the Permian Basin and accounted for 61% of total U.S. ethane production in 2023. Mexico, a growing consumer of ethane-based petrochemical products, is increasing its imports to meet rising industrial and manufacturing demand.

- India: India is rapidly expanding its petrochemical sector, producing approximately 8.9 billion metric tons of ethylene in 2020. Ethane imports from the U.S. and the Middle East fuel India’s growing demand for ethylene-based products. Government initiatives to enhance domestic petrochemical capacity and integrate sustainable plastic production will shape the future of India’s ethane market.

- Germany: Germany is a key player in the European market, focusing on transitioning towards lower-emission petrochemical production. The country primarily sources ethane from the U.S. to supply its chemical industry. In 2023, INEOS expanded its ethane-based cracker capacity in Cologne, marking one of Europe's largest ethylene production investments. While ethane remains a vital petrochemical input, companies like BASF and Covestro are exploring carbon capture and greener alternatives alongside ethane to comply with EU emissions targets.

- United Kingdom: The UK is a major importer, with INEOS’ Grangemouth facility in Scotland serving as the largest ethane-processing plant in Europe. To ensure long-term supply stability, INEOS invested in expanding ethane storage and import facilities at its Grangemouth plant.

- Canada: Canada plays a significant role in ethane production, mainly through its natural gas industry. Alberta, in particular, has seen increased ethane extraction due to rising shale gas output. Canada’s Clean Fuel Regulations (2023) aim to reduce carbon intensity, encouraging investments in more efficient ethane cracking technology and sustainable alternatives.

- Saudi Arabia: Saudi Arabia is a leading producer of ethane, primarily through its massive natural gas processing facilities. The Saudi Vision 2030 plan includes significant investments in petrochemical expansion, with Saudi Aramco and SABIC leading ethane-based projects. The Kingdom is also exploring alternative feedstocks like hydrogen while maintaining ethane as a crucial industrial input.

Ethane Market segmentation Analysis

By Applications

The ethylene synthesis application category dominated the market revenue. Metals' performance has been improved by the expanding food, building and construction, and manufacturing industries in developed and emerging nations. Much ethylene is used in the production of metal. Ethylene is also utilized as an oxy-fuel gas in high-velocity thermal spraying, welding, and metal cutting. This is expected to be one of the main factors propelling the ethylene synthesis segment's expansion inside the expanding metal fabrication industry.

By End Users

The packaging segment accounted for the most significant market revenue. Several factors contribute to the packaging industry's current high growth phase, including the rapidly expanding e-commerce sector, which has raised demand for packaging materials. Online retailers need specialized packaging solutions to safeguard their goods during storage and transportation. Ethane is widely utilized as a key element in plastic packaging, and it has seen growth due to the expanding population and increased use of plastic in daily life. The government's efforts to recycle and reuse plastic also contribute to the future expansion of the market.

Company Market Share

The global market is moderately fragmented, with key companies focusing on new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. The most prominent market players are investing in research and development to expand their product lines, which will help the global market grow even more. To develop and survive in a market that is becoming more competitive and growing, competitors in the ethane industry must provide cost-effective products.

American Ethane: An emerging player

American Ethane is a U.S. energy corporation based in Houston developing a cutting-edge export facility on the US Gulf Coast. American Ethane, which is run by a group of forward-thinking experts in the energy sector, is aware of and prepared to take advantage of ethane's enormous potential as a cheap, clean-burning fuel for customers across the world, as well as a source of export income and jobs in the United States. The first American company to sign a significant ethane sale contract in China was American Ethane.

List of Key and Emerging Players in Ethane Market

- American Ethane

- Merck KGaA

- Air Liquide

- Reliance Industries Limited

- The Williams Companies Inc

- Targa Resources Corp

- DCP Midstream LLC

- Energy Transfer Partners

- Enterprise Products Partners LP

- Devon Energy Corporation

- Royal Dutch Shell PLCs

- Aux Sable

- Enbridge Inc

- Boardwalk Louisiana Midstream, LLC

to learn more about this report Download Market Share

recent Developments

- July 2024- ADNOC and China's Wanhua Chemical Group placed a $1.9 billion order for up to 13 large ethane and ammonia carriers to capitalize on the growing ethane market and ammonia transport sector.

- March 2024- Technip Energies and LanzaTech received a $200 billion investment from the US Department of Energy to develop sustainable ethylene production technology utilizing captured CO2 under the SECURE initiative.

Analyst Opinion

As per our analyst, the global market is poised for steady growth, driven by the petrochemical industry’s rising demand for ethylene, advancements in steam cracking technologies, and increasing international trade in ethane. While environmental concerns and regulatory pressures pose challenges, technological innovations and strategic investments in sustainable petrochemical solutions will mitigate risks. North America, particularly the U.S., will continue to lead production and exports, while Asia-Pacific, led by China and India, will be the primary demand hub. The future of the ethane market depends on balancing increasing demand with regulatory compliance, sustainability initiatives, and advancements in petrochemical processing.

Due to strong domestic demand and growing natural gas production, North America is dominant. Strategic alliances and capacity expansion are the main priorities for significant businesses like American Ethane. Ethane's vital position in ethylene manufacturing guarantees its sustained market growth in the near future despite long-term sustainability concerns about plastics, particularly with improved cleaner cracking technology.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 14.43 Billion |

| Market Size in 2025 | USD 14.88 Billion |

| Market Size in 2033 | USD 20.21 Billion |

| CAGR | 3.90% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Applications, By End Users |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Ethane Market Segments

By Applications

- Ethylene Synthesis

- Acetic Acid Synthesis

- Refrigerant

By End Users

- Packaging

- Automotive & Transportation

- Construction

- Electricals & Electronics

- Healthcare

- Power

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.