Australia Flat Glass Market Size, Share & Trends Analysis Report By Product (Clear Float, Laminated, Coated, Tempered, Insulated, Other), By Technology (Float Glass, Rolled Glass, Sheet Glass), By End-User (Construction, Automotive, Solar, Others), By Region (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) and Forecasts, 2025-2033

Australia Flat Glass Market Size

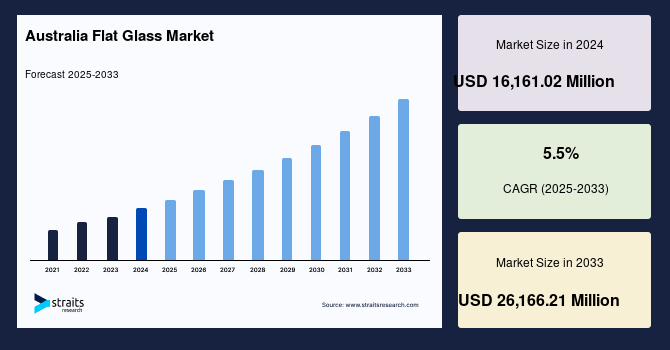

The Australia flat glass market size was valued at USD 16,161.02 million in 2024 and is projected to grow from USD 17,049.87 million in 2025 to reach USD 26,166.21 million by 2033, growing at a CAGR of 5.5% during the forecast period (2025–2033).

The market is poised for substantial growth during the forecast period, supported by advancements in construction, a rising focus on sustainability, and significant infrastructure investments.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 16,161.02 Million |

| Estimated 2025 Value | USD 17,049.87 Million |

| Projected 2033 Value | USD 26,166.21 Million |

| CAGR (2025-2033) | 5.5% |

| Key Market Players | AGC Inc., Saint-Gobain, NSG Group, Guardian Industries, Schott AG |

to learn more about this report Download Free Sample Report

Australia Flat Glass Market Growth Factor

Sustainability and Energy Efficiency Initiatives

The push for energy-efficient construction is a significant growth driver for Australia's flat glass market. National regulations like the National Construction Code (NCC) emphasize energy efficiency, promoting the adoption of double-glazed and insulated glass. Rising energy costs and consumer demand for sustainable housing have further reinforced this trend. For instance, the Australian Building Sustainability Index (BASIX) mandates using high-performance glass to reduce energy consumption in residential buildings. According to the Green Building Council of Australia (2024), 40% of new construction projects in Sydney and Melbourne adopted energy-efficient glazing, signifying a robust demand trajectory.

Market Restraint

High Production Costs and Dependence on Imports

Australia’s flat glass market faces challenges from high production costs driven by elevated energy prices and reliance on imported raw materials like silica sand. Domestic manufacturers struggle to compete with low-cost imports from Asia, creating pricing pressures. A report by the Australian Glass and Glazing Association (2024) highlighted that nearly 60% of flat glass consumed locally is imported, resulting in supply chain vulnerabilities and inconsistent pricing. Additionally, stringent environmental regulations on manufacturing processes increase operational costs, limiting the market’s potential for cost-effective scalability.

Market Opportunity

Infrastructure Expansion and Smart Cities Development

Australia's booming infrastructure sector provides a fertile ground for market growth. The Australian Infrastructure Investment Program (AIIP) allocated AUD 110 billion for large-scale projects between 2020 and 2030, creating a surge in demand for float and tempered glass. The rise of smart cities like Melbourne and Brisbane underscores the growing importance of technologically advanced materials. For example, Brisbane’s “Smart Building Initiative” integrates solar control glass to improve energy efficiency in commercial properties. According to Infrastructure Australia (2025), smart city projects will drive a 20% annual increase in demand for advanced glass technologies, opening new revenue streams for manufacturers.

Country Insights

The market is characterized by increasing demand for energy-efficient solutions, driven by green building initiatives, growing solar energy projects, and urbanization. Australia’s flat glass industry is also influenced by its focus on renewable energy and sustainable construction practices. Below is a city-specific analysis:

Sydney, Australia’s largest city, drives demand for flat glass through its booming commercial and residential construction sectors. The city’s ambitious skyscraper projects and urban renewal initiatives, such as Barangaroo, require high-performance, low-emissivity (low-E), and laminated glass. Pilkington and Guardian Glass are vital suppliers, providing energy-efficient glazing solutions to meet the city’s sustainability goals.

Melbourne is a hub for green building designs, with projects like the Melbourne Quarter and Docklands driving demand for insulated and solar control glass. The city’s emphasis on energy efficiency aligns with products from companies like AGC Glass and Viridian. Melbourne’s adoption of rooftop solar panels has also boosted demand for photovoltaic glass.

Brisbane’s growing urban development and industrial projects contribute to rising flat glass demand. The city’s hot climate has increased the need for solar control glass in residential and commercial buildings. Viridian, a leading glass manufacturer in Australia, supplies advanced glazing solutions for Brisbane’s construction sector.

Perth’s mining and energy sectors indirectly drive the flat glass market through demand for infrastructure and housing. The city’s high-end residential projects and commercial spaces utilize decorative and energy-efficient glass. Consol Glass and local manufacturers significantly cater to Perth’s growing demand for premium glazing products.

Adelaide’s flat glass market is bolstered by its renewable energy initiatives and urban expansion. Solar panel installations are prevalent, increasing demand for photovoltaic glass. Saint-Gobain and other suppliers provide insulated and low-E glass for the city’s sustainable construction projects. Adelaide’s Green Building Programme has further spurred demand for advanced glass solutions.

Product Insights

Insulated glass dominates the product segment and is expected to grow at a CAGR of 5.7% over the forecast period, driven by Australia's extreme climatic conditions and a strong focus on sustainable building practices. Residential and commercial projects in cities like Sydney and Perth increasingly utilize insulated glass to meet thermal performance standards. Innovations in glass coatings also contribute to this segment’s rising adoption.

Technology Insights

Float glass dominates the technology segment and is expected to grow at a CAGR of 5.6% during the forecast period, supported by its versatility in construction and automotive applications. Its affordability and ease of manufacturing make it a staple for projects emphasizing cost-efficiency. Cities like Melbourne and Adelaide have seen growing adoption in residential developments.

End-User Insights

Construction dominates the end-user and is expected to grow at a CAGR of 5.6% over the forecast period. Australia’s urbanization rate, at 89% in 2023, underpins the demand for glass in skyscrapers, residential complexes, and commercial buildings. High-rise developments in Sydney and Melbourne are particularly driving this growth.

List of Key and Emerging Players in Australia Flat Glass Market

- AGC Inc.

- Saint-Gobain

- NSG Group

- Guardian Industries

- Schott AG

- Xinyi Glass Holdings

- CSG Holding Co., Ltd.

- Fuyao Glass Industry Group

- Sisecam

- Asahi India Glass Limited (AIS)

Analyst's Perspective

As per our analyst, the Australia flat glass market is poised for rapid expansion in the coming years. This growth is primarily driven by Australia’s robust infrastructure development, increasing demand for energy-efficient solutions, and advancements in smart city technologies. Policies promoting sustainability and rising consumer awareness are bolstering the demand for innovative flat glass products. Additionally, local manufacturers are leveraging automation and digitalization to streamline production processes, mitigating cost challenges associated with imports. The transition toward renewable energy and solar installations further accentuates the market's growth potential, creating lucrative opportunities for glass manufacturers and technology providers.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 16,161.02 Million |

| Market Size in 2025 | USD 17,049.87 Million |

| Market Size in 2033 | USD 26,166.21 Million |

| CAGR | 5.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Technology, By End-User |

to learn more about this report Download Free Sample Report

Australia Flat Glass Market Segments

By Product

- Clear Float

- Laminated

- Coated

- Tempered

- Insulated

- Other

By Technology

- Float Glass

- Rolled Glass

- Sheet Glass

By End-User

- Construction

- Automotive

- Solar

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.