Japan Flat Glass Market Size, Share & Trends Analysis Report By Product (Clear Float, Laminated, Coated, Tempered, Insulated, Other), By Technology (Float Glass, Rolled Glass, Sheet Glass), By End-User (Construction, Automotive, Solar, Others), By Region (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) and Forecasts, 2025-2033

Japan Flat Glass Market Size

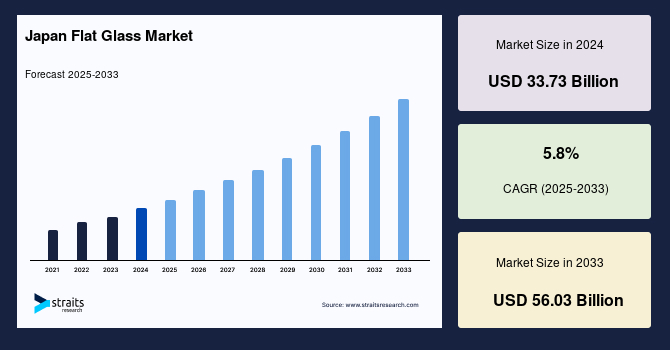

The Japan flat glass market size was valued at USD 33.73 billion in 2024 and is projected to reach from USD 35.69 billion in 2025 to USD 56.03 billion by 2033, growing at a CAGR of 5.8% during the forecast period (2025-2033).

This expansion is driven by Japan's innovative construction sector, sustainability goals, and advancements in glass technology, aligning with the demand for high-quality flat glass across residential and commercial applications.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 33.73 Billion |

| Estimated 2025 Value | USD 35.69 Billion |

| Projected 2033 Value | USD 56.03 Billion |

| CAGR (2025-2033) | 5.8% |

| Key Market Players | AGC Inc., Saint-Gobain, NSG Group, Guardian Industries, Schott AG |

to learn more about this report Download Free Sample Report

Japan Flat Glass Market Growth Factors

Growing Demand for Energy-Efficient Construction Materials

Japan’s commitment to environmental sustainability and energy efficiency has significantly boosted the construction industry's demand for flat glass products. With the 2025 target for carbon neutrality nearing, Japan’s Green Building initiative mandates that new buildings incorporate energy-efficient materials, including low-emissivity and insulated glass. According to the Ministry of the Environment (2024), building efficiency upgrades are set to reduce carbon emissions by 15% in urban areas, making flat glass an essential component in retrofitting and new constructions. High-quality insulated glass is increasingly used in Tokyo and Osaka’s corporate and commercial buildings to support Japan’s stringent energy standards, driving the flat glass market forward.

Market Restraining Factors

High Manufacturing Costs and Supply Chain Disruptions

The production of advanced flat glass in Japan incurs high costs due to expensive raw materials and the energy-intensive nature of the manufacturing process. Moreover, disruptions in global supply chains, including recent constraints on glass-grade silica imports, impact production timelines and increase material costs. A 2024 report by the Japan Glass Association noted that import costs for raw materials have risen by nearly 20%, challenging manufacturers in the flat glass sector to maintain price competitiveness while ensuring product quality. As Japan’s glass industry relies on global supply, mitigating these costs remains essential to maintaining steady market growth.

Key Market Opportunities

Rising Adoption of Smart Glass Technologies

With Japan’s focus on high-tech advancements, smart glass technology presents a promising growth opportunity. Smart glass, which allows for adaptive light transmission, is increasingly popular in Japan’s urban centers, where energy efficiency and comfort are top priorities. Supported by government incentives, smart glass is becoming standard in high-rise offices, luxury apartments, and public spaces across Tokyo, Yokohama, and Fukuoka. The Ministry of Economy, Trade, and Industry (METI) in 2025 reported that nearly 30% of new commercial projects in urban areas will incorporate smart glass by 2028, driven by Tokyo's Smart City initiative and similar projects. As companies like Nippon Sheet Glass innovate in this field, smart glass will contribute significantly to Japan's flat glass market growth.

Countries Insights

The market is characterized by diverse urban centers in Japan that demonstrate unique demands and innovative applications for flat glass products, reflecting growth across various regions.

Tokyo has led the adoption of smart and energy-efficient glass, with numerous commercial skyscrapers using advanced glazing to reduce carbon footprints. The city’s ambitious Smart City program fosters low-E and smart glass, especially in high-rise office complexes.

Osaka is known for its sizeable commercial sector and sees high demand for insulated glass in office buildings, aiming to meet energy efficiency standards. The city has incentivized green retrofitting, creating demand for advanced glass solutions in new and existing structures.

Yokohama, with growing residential development, increasingly adopts tempered and laminated glass to ensure building safety. Large residential projects near the city’s waterfront require durable materials that withstand seismic activity, further boosting flat glass usage.

Nagoya’s automotive sector drives demand for flat glass, especially tempered varieties, which are used as an industrial hub in vehicle manufacturing. Major Japanese automakers like Toyota source locally produced glass for manufacturing in and around Nagoya.

Fukuoka, a growing urban center in southern Japan, is seeing a rise in commercial buildings that utilize smart glass to optimize energy efficiency in the city’s warm climate. Government incentives for sustainable materials have spurred demand for high-performance glass.

Product Insights

Tempered glass dominates the product segment and is expected to grow at a CAGR of 6.0% over the forecast period. Known for its strength and safety benefits, tempered glass is essential for high-performance environments. The material is widely used in Japan’s high-rise buildings, where its durability helps resist earthquakes. The Japanese Construction Standard Act encourages the use of tempered glass, especially in Tokyo’s commercial skyscrapers. Additionally, its shatterproof properties make it indispensable for urban infrastructure projects, meeting the safety standards that are a priority in earthquake-prone regions like Japan.

Technology Insights

Float glass dominates the technology segment and is expected to grow at a CAGR of 5.9% during the forecast period. Float glass technology is the primary manufacturing process for Japan’s flat glass, given its efficiency and adaptability for further processing into laminated, insulated, or tempered glass. Japan's high architectural standards demand clarity and uniformity, which float glass readily provides. Major Japanese producers such as AGC Inc. rely on float glass for construction and automotive applications, making it a staple in urban building projects in Tokyo and Osaka.

End-User Insights

Construction dominates the end-user and is expected to grow at a CAGR of 5.9% over the forecast period. The construction sector is the largest consumer of flat glass in Japan, fueled by high demand for residential and commercial developments. New government regulations on sustainable building materials have increased insulated and low-E glass use in construction. Construction projects prioritize energy efficiency in cities like Fukuoka and Yokohama to align with Japan’s ambitious climate goals. The Tokyo 2025 initiative, aimed at improving the energy efficiency of city buildings, has been pivotal in driving the use of advanced glass materials in urban developments.

List of Key and Emerging Players in Japan Flat Glass Market

- AGC Inc.

- Saint-Gobain

- NSG Group

- Guardian Industries

- Schott AG

- Xinyi Glass Holdings

- CSG Holding Co., Ltd.

- Fuyao Glass Industry Group

- Sisecam

- Asahi India Glass Limited (AIS)

Analyst's Perspective

As per our analyst, the Japan flat glass market is poised for rapid expansion in the coming years. This growth is primarily driven by Japan's dedication to sustainability, stringent building codes, and technological innovation. The adoption of energy-efficient flat glass in high-rise construction reflects Japan’s commitment to carbon reduction and efficient resource use. Additionally, the focus on smart city infrastructure fosters demand for advanced glass, with Tokyo and Osaka setting benchmarks for sustainability. The country's seismic activity and urban density necessitate durable glass solutions, stimulating demand for tempered and laminated products. As Japan continues to innovate, particularly in smart glass technologies, the flat glass market is set to grow, aligned with the nation’s green building strategies and urban development goals

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 33.73 Billion |

| Market Size in 2025 | USD 35.69 Billion |

| Market Size in 2033 | USD 56.03 Billion |

| CAGR | 5.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Technology, By End-User |

to learn more about this report Download Free Sample Report

Japan Flat Glass Market Segments

By Product

- Clear Float

- Laminated

- Coated

- Tempered

- Insulated

- Other

By Technology

- Float Glass

- Rolled Glass

- Sheet Glass

By End-User

- Construction

- Automotive

- Solar

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.