South Korea Flat Glass Market Size, Share & Trends Analysis Report By Product (Clear Float, Laminated, Coated, Tempered, Insulated, Other), By Technology (Float Glass, Rolled Glass, Sheet Glass), By End-User (Construction, Automotive, Solar, Others), By Region (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) and Forecasts, 2025-2033

South Korea Flat Glass Market Size

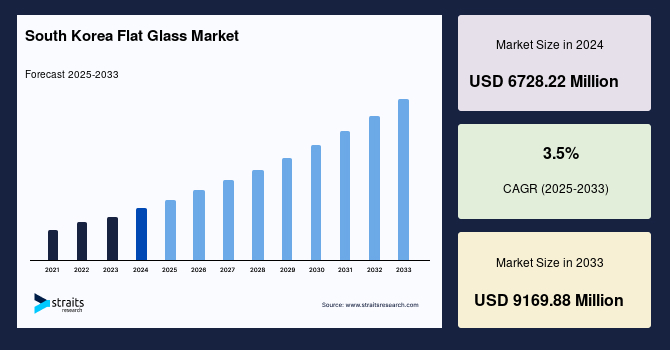

The South Korea flat glass market size was valued at USD 6728.22 million in 2024 and is projected to reach from USD 6963.71 million in 2025 to USD 9169.88 million by 2033, growing at a CAGR of 3.5% during the forecast period (2025-2033).

Rapid urbanization, advancements in green construction practices, and demand for high-performance glass across commercial and residential sectors are central to this growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 6728.22 Million |

| Estimated 2025 Value | USD 6963.71 Million |

| Projected 2033 Value | USD 9169.88 Million |

| CAGR (2025-2033) | 3.5% |

| Key Market Players | AGC Inc., Saint-Gobain, NSG Group, Guardian Industries, Schott AG |

to learn more about this report Download Free Sample Report

South Korea Flat Glass Market Growth Factors

Surge in Sustainable and Energy-Efficient Building Construction

South Korea’s commitment to reducing energy consumption and minimizing environmental impact has accelerated the adoption of flat glass, particularly in urban construction projects. Driven by government initiatives like the Green New Deal, which focuses on energy-efficient infrastructure, flat glass especially insulated and low-emissivity glass is increasingly utilized in residential and commercial buildings to reduce heat loss and energy use. According to the Ministry of Trade, Industry, and Energy (MOTIE, 2024), the country aims to decrease building energy consumption by 15% within the decade, which has led to substantial demand for insulated glass solutions, supporting this sector’s steady growth.

Market Restraining Factors

High Production and Import Costs

The flat glass market in South Korea faces challenges in managing production costs due to high energy requirements and raw material prices, compounded by the country’s dependency on imported materials like silica sand. Global fluctuations in raw material prices affect manufacturing costs, limiting the sector's competitiveness. A report from the Korean Glass Association (2024) noted that silica's cost has risen by 20% over the past year, impacting overall production costs. These price dynamics and increased regulatory standards pressure local manufacturers to maintain competitive pricing without compromising quality, which may constrain the market’s growth trajectory.

Key Market Opportunities

Growth of Smart Glass Technology Adoption

The demand for smart glass in South Korea is rising, especially in commercial buildings and public infrastructure. Smart glass, which adjusts light transmission based on environmental factors, aligns with South Korea’s push toward tech-driven, sustainable urban solutions. The Smart City initiative, led by the Ministry of Land, Infrastructure, and Transport (MOLIT, 2025), encourages using smart materials, including switchable and electrochromic glass, to enhance energy efficiency in modern buildings. Seoul, for example, has seen several government buildings install smart glass to reduce artificial lighting and cooling costs, and this trend is expected to continue as more high-tech solutions are integrated into urban planning.

Countries Insights

The market is characterized by rapid urban development, technological innovation, and a strong emphasis on sustainability. South Korea's flat glass industry benefits from advancements in construction, automotive, and renewable energy sectors, supported by government incentives and the presence of leading manufacturers.

Seoul, South Korea’s capital, leads in flat glass consumption due to its booming construction sector. The city’s high-rise buildings and urban renewal projects drive demand for low-emissivity (low-E) and laminated glass. LG Chem and KCC Corporation supply innovative glass solutions for energy-efficient structures in the city's evolving skyline. Government initiatives promoting smart cities also support the adoption of advanced glazing technologies.

Incheon, home to the Incheon Free Economic Zone, has seen significant commercial and residential construction growth. This expansion drives demand for energy-efficient and decorative glass. Guardian Glass has a strong presence here, offering products tailored to the city’s modern architectural designs. Incheon’s proximity to ports facilitates glass exports, boosting production capacities.

Busan, a major port city, contributes to the flat glass market with its growing tourism and infrastructure projects. The city’s luxury hotels and waterfront developments require high-performance glass solutions. Pilkington supplies soundproof and thermal-insulated glass to meet Busan’s demand for sustainable construction. The city’s maritime industry also drives specialized glass applications.

Daegu’s industrial development, particularly in electronics and automotive manufacturing, boosts demand for flat glass. The city’s push for green factories aligns with adopting solar control and insulated glass. Companies like AGC Inc. provide solutions catering to Daegu’s industrial and automotive glass needs, supporting the growth of electric vehicle production.

Gwangju focuses on renewable energy and eco-friendly construction, driving demand for photovoltaic and low-E glass. The city’s role in South Korea’s Green New Deal has led to partnerships with glass manufacturers for solar energy projects. KCC Corporation has successfully supplied advanced glass solutions for Gwangju’s sustainable development initiatives.

Product Insights

Insulated glass dominates the product segment and is expected to grow at a CAGR of 3.6% over the forecast period. Insulated glass has become indispensable in South Korea’s construction industry, supporting energy-efficient goals. This glass type provides excellent thermal insulation, making it ideal for office buildings and residences across South Korea’s densely populated cities. Notably, Seoul and Busan have implemented policies that favor insulated glass in new constructions, as it supports sustainability and reduces heating and cooling costs. Insulated glass manufacturers are capitalizing on these regulatory mandates, positioning this segment for continued growth.

Technology Insights

Float glass dominates the technology segment and is expected to grow at a CAGR of % during the forecast period. Float glass is the foundation of South Korea’s flat glass sector due to its cost-efficiency and versatility in processing. As a core material used in insulated and laminated glass, float glass meets the rigorous demands of South Korea’s construction and automotive sectors. With significant industrial activity, cities like Incheon and Ulsan rely on float glass for various manufacturing applications. As urban expansion continues, the demand for float glass in new construction projects is set to rise.

End-User Insights

Construction dominates the end-user and is expected to grow at a CAGR of % over the forecast period. With ongoing urbanization and redevelopment projects, there is a consistent demand for durable, energy-efficient glass in residential and commercial buildings. Major cities, including Seoul, are focused on green building initiatives, integrating flat glass to enhance energy efficiency. The South Korean government’s emphasis on green construction further encourages the use of specialized glass products, positioning this segment as a primary growth driver in the flat glass market.

List of Key and Emerging Players in South Korea Flat Glass Market

- AGC Inc.

- Saint-Gobain

- NSG Group

- Guardian Industries

- Schott AG

- Xinyi Glass Holdings

- CSG Holding Co., Ltd.

- Fuyao Glass Industry Group

- Sisecam

- Asahi India Glass Limited (AIS)

Analyst's Perspective

As per our analyst, the South Korea flat glass market is poised for rapid expansion in the coming years. This growth is primarily driven by South Korea’s commitment to sustainable urban development and the adoption of advanced glass technologies. The Green New Deal initiative underscores a national focus on reducing carbon emissions, which propels demand for energy-efficient flat glass products across residential and commercial projects.

Furthermore, the ongoing expansion of urban centers and the rising adoption of smart glass in high-tech developments reflect a shift towards energy savings and environmental sustainability. As South Korea continues its push for modernization and smart city infrastructure, the flat glass market is set to benefit from government-led projects and private-sector investments in high-performance glass materials.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 6728.22 Million |

| Market Size in 2025 | USD 6963.71 Million |

| Market Size in 2033 | USD 9169.88 Million |

| CAGR | 3.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Technology, By End-User |

to learn more about this report Download Free Sample Report

South Korea Flat Glass Market Segments

By Product

- Clear Float

- Laminated

- Coated

- Tempered

- Insulated

- Other

By Technology

- Float Glass

- Rolled Glass

- Sheet Glass

By End-User

- Construction

- Automotive

- Solar

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.