Fluorochemicals Market Size, Share & Trends Analysis Report By Product Type (Fluorocarbons, Fluoropolymers, Inorganic Chemicals, Gases, Specialty Organics), By Application (Automotive Industry, Electronics Industry, Chemical Processing Industry, Pharmaceutical Industry, Construction Industry, Textile Industry, Aerospace Industry) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Fluorochemicals Market Size

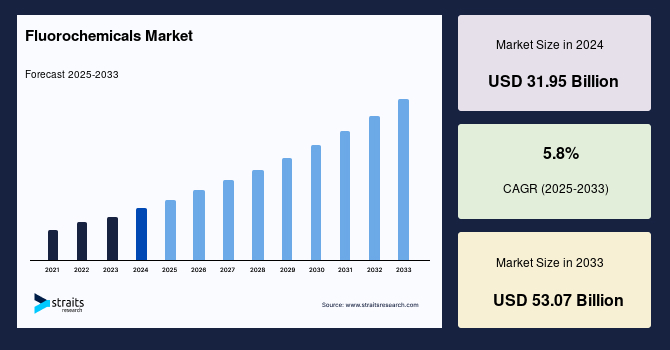

The global fluorochemicals market size was valued at USD 31.95 billion in 2024 and is projected to grow from USD 33.80 billion in 2025 to USD 53.07 billion by 2033, exhibiting a CAGR of 5.8% during the forecast period (2025-2033).

Fluorochemicals are various chemical compounds that contain fluorine. Especially an organic compound (as a fluorocarbon) in which fluorine has replaced a large proportion of the hydrogen attached to carbon. All fluorochemicals are generated from the toxic and corrosive gas hydrogen fluoride (HF) in a highly energy-intensive process. Despite stringent safety regulations, HF spills have occurred numerous times in the last decades, sometimes with fatal accidents and detrimental environmental effects.

The global fluorochemical market is experiencing growth due to its rising demand in refrigeration, electronics, pharmaceuticals, and automotive applications. The increased adoption of fluoropolymers, fluorinated gases, and specialty chemicals in high-performance applications further boosts market demand. Technological advancements and the shift toward environmentally friendly fluorochemicals, such as low-global-warming-potential (GWP) alternatives, also contribute to market expansion. However, regulatory challenges and environmental concerns regarding fluorinated compounds may impact future growth.

Latest Market Trends

Advancements in Refrigeration and Air Conditioning Systems

The rapid expansion of fluorochemicals is primarily attributed to their essential role in modern refrigeration and air-conditioning technologies. Fluorochemicals are key refrigerants facilitating energy-efficient cooling, particularly hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs). With global temperatures rising and urbanization accelerating, the demand for air conditioning and refrigeration systems is witnessing unprecedented growth. The residential sector, commercial buildings, and industrial applications such as cold chain logistics are all experiencing increased reliance on fluorochemicals.

In addition, emerging economies are seeing a surge in consumer spending on air conditioning and refrigeration appliances, further fueling market expansion. The increasing demand for energy-efficient cooling systems drives innovation in fluorochemical-based refrigerants that comply with environmental regulations.

- For instance, in March 2023, Green Power International serviced three MWM petrol engines at Gujarat Fluorochemicals Limited (GFL). These engines, which have been in operation for over 100,000 hours, highlight the integration of fluorochemicals in industrial refrigeration and energy solutions.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 31.95 Billion |

| Estimated 2025 Value | USD 33.80 Billion |

| Projected 2033 Value | USD 53.07 Billion |

| CAGR (2025-2033) | 5.8% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | 3M Company, AGC Group, Arkema group, Chukoh Chemical Industries, Ltd., Daikin Industries, Ltd. |

to learn more about this report Download Free Sample Report

fluorochemical Market Growth Factors

growth in the Automotive Industry

The automotive industry’s transition toward lightweight materials, particularly aluminum, is significantly boosting the demand for aluminum fluoride (AlF3), a key fluorochemical used in aluminum smelting. As automakers strive to enhance fuel efficiency and reduce vehicle emissions, aluminum is increasingly replacing heavier metals in car manufacturing. Additionally, the rise of electric vehicles (EVs), which require lightweight materials to extend battery range, is further fueling demand for fluorochemical-based materials.

- For example, EV car sales surged by 60% in 2022, surpassing 10 million units for the first time. The shift toward sustainable transportation is reshaping material demand, with aluminum-intensive vehicle production driving increased consumption of aluminum fluoride in automotive applications.

- According to the International Energy Agency (IEA), one in seven cars sold globally in 2022 was an EV, compared to just one in 70 vehicles in 2017. As automakers transition to cleaner energy solutions, fluorochemicals will be essential in battery cooling systems, lightweight structural materials, and insulation components in EVs.

Additionally, fluorochemicals are increasingly used in healthcare due to their high biocompatibility and chemical stability. Their application in medical implants, such as artificial joints, pacemakers, and surgical stents, transforms healthcare solutions by improving implant longevity and reducing complications from rejection or inflammation. These properties also drive innovation in fluoropolymer coatings for medical devices, ensuring enhanced durability and chemical resistance.

Restraining Factors

Regulatory Constraints

The fluorochemicals market faces increasing regulatory scrutiny due to environmental and health concerns associated with certain fluorochemicals, particularly per- and polyfluoroalkyl substances (PFAS). These persistent chemicals, known for their long-term environmental impact, are being phased out or replaced with eco-friendly alternatives. Regulatory agencies worldwide impose stringent restrictions on using high-global-warming-potential (GWP) refrigerants and fluorochemical derivatives.

- For example, the US Environmental Protection Agency (EPA) issued new PFAS regulations in April 2024, designating PFOA and PFOS as hazardous substances under CERCLA. This classification mandates stricter reporting, cleanup, and monitoring requirements, impacting the industrial use of fluorochemicals.

- Similarly, the European Union’s (EU) REACH regulations have proposed phasing out certain hydrofluorocarbons (HFCs) and perfluorinated chemicals by 2030. These changes are pushing companies toward low-GWP and biodegradable alternatives.

Market Opportunity

Emphasis on Eco-Friendly Materials Driving Sustainability Innovations

As environmental concerns grow, companies shift toward eco-friendly fluorochemicals to align with sustainability goals. The industry is actively developing low-GWP refrigerants, recyclable fluoropolymers, and alternative production processes to minimize environmental impact. This transition presents lucrative opportunities for companies investing in green fluorochemical technologies.

- For example, leading fluorochemical manufacturers like Honeywell and Daikin heavily invest in hydrofluoroolefins (HFOs), which have significantly lower global warming potential (GWP) than traditional refrigerants.

- Solvay, a global chemical giant, has developed an innovative fluoropolymer recycling process that extracts reusable fluorochemicals from end-of-life automotive and industrial components.

Moreover, with climate policies tightening and companies increasingly seeking environmentally responsible solutions, fluorochemical producers that innovate sustainable alternatives are set to gain a competitive edge. The integration of fluorochemicals in renewable energy storage, electric vehicle batteries, and advanced composite materials further underscores the market’s long-term growth potential.

Regional Insights

Asia-Pacific: Dominating Region Due to Industrial Growth and Infrastructure Development

Asia-Pacific is the dominating region in the global market, driven by intense industrialization, urbanization, and increasing investments in infrastructure. The region accounts for a significant share of fluorochemical production, with China, India, and Japan leading in manufacturing and consumption. The rising demand for air conditioning and refrigeration in tropical climates and the rapid expansion of semiconductor and electronics industries have propelled fluorochemical usage. Additionally, the growing automotive industry, particularly in China and India, has increased demand for aluminum fluoride and specialty fluoropolymers.

- For instance, China has been implementing stricter environmental regulations to phase out high-GWP fluorochemicals. India’s Bureau of Energy Efficiency (BEE) has mandated the adoption of low-emission refrigerants in HVAC systems.

- Additionally, in 2023, Dongyue Group, a major Chinese fluorochemical producer, announced a $200 million expansion in its PTFE and PVDF production lines to support the lithium-ion battery industry. Similarly, Gujarat Fluorochemicals in India has invested in high-performance fluoropolymers to meet demand from the automotive and electronics sectors.

North America: Technological Advancements and Regulatory Compliance

North America remains the fastest-growing region in the global market, driven by strong industrial demand, technological advancements, and regulatory developments. The area has a significant market share, with the U.S. leading in production and innovation. The market is fueled by applications across refrigeration, electronics, automotive, and healthcare sectors. The increasing demand for energy-efficient refrigeration and air conditioning systems is a key driver. Additionally, the automotive sector's shift towards aluminum-based components has spurred demand for aluminum fluoride.

- The U.S. Environmental Protection Agency (EPA) has enforced stricter regulations under the AIM Act, promoting the phasedown of high-GWP hydrofluorocarbons (HFCs). Major fluorochemical manufacturers like Chemours and Honeywell have accelerated their investment in next-generation refrigerants like Opteon and Solstice.

- For instance, in April 2024, Chemours expanded its Teflon fluoropolymer production facility in Texas, responding to increased demand from the semiconductor industry. Similarly, Honeywell announced a $300 million investment in producing HFO-1234yf refrigerants to support sustainable automotive cooling.

Country Analysis

- United States: The U.S. dominates the global market due to strong industrial demand and regulatory support. The EPA's phasedown of high-GWP HFCs has led to significant investments in low-GWP refrigerants. In 2024, Honeywell announced the expansion of its Solstice refrigerants production, while Chemours increased its Teflon manufacturing capacity to support semiconductor production.

- Germany: Germany's focus on Industry 4.0 has driven demand for fluorochemicals in automation, semiconductors, and EV batteries. The country has invested in sustainable refrigerants, with BASF developing next-generation fluorochemical solutions. The German government’s €1 billion subsidy for EV battery research has further boosted the demand for fluoropolymers.

- China: China is the largest producer of fluorochemicals, with a robust supply chain catering to electronics, HVAC, and automotive industries. The government’s ban on high-GWP refrigerants has increased HFOs and hydrofluoroethers (HFEs) production. In 2023, Dongyue Group expanded its fluoropolymer production, focusing on high-performance applications in batteries and coatings.

- India: India’s fluorochemical market is growing rapidly, driven by the expansion of its automotive, construction, and pharmaceutical sectors. Gujarat Fluorochemicals has been increasing its production capacity to support domestic demand. The Indian government’s PLI scheme has further incentivized local manufacturers to develop sustainable fluorochemicals.

- Japan: Japan's fluorochemicals industry is driven by electronics and precision engineering advancements. Daikin, a leader in air conditioning, has developed low-GWP refrigerants in compliance with global environmental regulations. The Japanese government has funded R&D in sustainable fluorochemical applications, particularly semiconductors and energy storage.

- South Korea: South Korea is a major player in fluorochemicals for semiconductor and display panel manufacturing. Companies like SK Innovation and LG Chem are investing in fluoropolymers for lithium-ion batteries. The government’s Green New Deal emphasizes the adoption of eco-friendly refrigerants.

- Brazil: Brazil’s fluorochemicals market is expanding due to increased refrigeration, HVAC, and aerospace demand. The country’s regulatory shift towards environmentally friendly refrigerants has led to rising investments in HFOs. In 2023, local manufacturers partnered with European firms to develop sustainable fluorochemicals.

- Australia: Australia’s market is witnessing strong growth in fluorochemicals for mining, pharmaceuticals, and refrigeration. The Australian government has implemented strict regulations on ozone-depleting substances, promoting the adoption of alternative refrigerants. Companies like Orica are investing in fluorochemical innovations for industrial applications.

Fluorochemicals Market Segmentation Analysis

By Product

Fluoropolymers have been grabbing a share of the global market. Fluoropolymers are highly sought after due to their unique properties, such as high heat resistance, chemical inertness, and low friction, making them indispensable in various industries, including automotive, electronics, and construction. The increasing demand for materials with exceptional performance characteristics and the growing emphasis on sustainability and durability in products have contributed to the dominance of fluoropolymers in the market. Industries value their versatility and reliability, driving their popularity and the fluorochemicals market growth.

By Application

The automotive sector stands out as commanding the most significant market share in this industry. This dominance can be attributed to the widespread use of fluorochemicals in critical automotive components and processes. From air conditioning systems to lubricants and protective coatings, fluorochemicals are vital in enhancing vehicle performance, durability, and efficiency. The stringent regulations pushing for energy efficiency, emissions reduction, and safety standards have fueled the demand for fluorochemicals in the automotive sector. As the automotive industry continues to evolve towards more advanced technologies and environmentally friendly practices, the reliance on fluorochemicals is expected to grow, solidifying its position as a key player in the fluorochemicals market.

Company Market Share

The global fluorochemical market is moderately fragmented and expected to expand due to increasing industrialization, demand for eco-friendly products, and technological advancements. Companies employ various strategies to improve or maintain their market share, such as product differentiation, competitive pricing, and expanding distribution channels. Some businesses focus on innovation, continually releasing new or improved products to meet evolving customer demands. Others invest in marketing and advertising to strengthen brand recognition and customer loyalty. Strategic partnerships, mergers, or acquisitions also play a role in gaining a larger share.

3M: An Emerging Player in the Fluorochemicals Market

3M's position as a leading and dominant player in the fluorochemical market because of their extensive and diverse product portfolio, encompassing fluoropolymers (like Teflon), fluorosurfactants, and specialty fluorochemicals, allows them to serve a wide range of industries, from electronics and automotive to healthcare and consumer goods. 3M is a leading producer of fluorochemicals, including Fluoropolymers, Fluorosurfactants, and Specialty Fluorochemicals. The company operates through various business segments, including consumer, healthcare, industrial, safety and transportation, and electronics and energy. Their product portfolio includes various industrial products such as adhesives, abrasives, filtration systems, and fluorochemicals. 3M has a strong global presence, with manufacturing and sales operations in numerous countries across the Americas, Asia Pacific, and EMEA regions. Their commitment to innovation, quality, and sustainability has become a trusted and recognized brand worldwide.

List of Key and Emerging Players in Fluorochemicals Market

- 3M Company

- AGC Group

- Arkema group

- Chukoh Chemical Industries, Ltd.

- Daikin Industries, Ltd.

- Derivados del Fluor, S.A.U.

- DIC Group

- Dongyue Group

- DuPont de Nemours, Inc.

- Dynax Corporation

- GMM Pfaudler

- Gujarat Fluorochemicals Limited by INOXGFL group

- Halocarbon, LLC

- HaloPolymer Kirovo-Chepetsk, LLC

- Honeywell International Inc.

- Kanto Denka Kogyo Co., Ltd.

- Maflon S.p.A. by Guarniflon S.p.A.

- Mitsui Chemicals, Inc.

to learn more about this report Download Market Share

Recent Developments

- January 2025- AGC Inc. announced plans to expand its production capacity for fluorochemical products, aiming to achieve sales exceeding 200 billion yen in the Performance Chemicals business by 2024. This decision responds to the anticipated significant growth in demand, particularly within the semiconductor industry.

- February 2025- Arkema unveiled innovations at JEC WORLD 2025, focusing on solutions that address industrial and environmental transition challenges. These include new offerings for battery recycling and other sustainable technologies.

Analyst Opinion

As per our analyst, the global fluorochemicals market, encompassing various types like fluoropolymers, fluorocarbons, and inorganic fluorochemicals, presents a dynamic landscape with diverse applications from automotive to pharmaceuticals. The market's growth is propelled by factors like the increasing demand for aluminum fluoride in the automotive industry and expanding healthcare applications. However, regulatory constraints, volatility in raw material prices, and competition from substitutes pose challenges.

Moreover, emerging industries, sustainability focus, R&D innovations, and expansion into emerging economies will support the market’s growth. The global fluorochemicals market is expected to expand due to increasing industrialization, demand for eco-friendly products, and technological advancements in applications such as refrigerants, polymers, and specialty chemicals.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 31.95 Billion |

| Market Size in 2025 | USD 33.80 Billion |

| Market Size in 2033 | USD 53.07 Billion |

| CAGR | 5.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Fluorochemicals Market Segments

By Product Type

- Fluorocarbons

- Fluoropolymers

- Inorganic Chemicals

- Gases

- Specialty Organics

By Application

- Automotive Industry

- Electronics Industry

- Chemical Processing Industry

- Pharmaceutical Industry

- Construction Industry

- Textile Industry

- Aerospace Industry

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.