Gold Mining Market Size, Share & Trends Analysis Report By Mining Method (Open-Pit Mining, Underground Mining), By Ore Type (Hard Rock Deposits, Placer Deposits), By Production Scale (Large-scale Industrial Mining, Mid-tier Mining, Small-Scale and Artisanal Mining), By Application (Jewelry, Investment, Industrial Uses) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Gold Mining Market Size

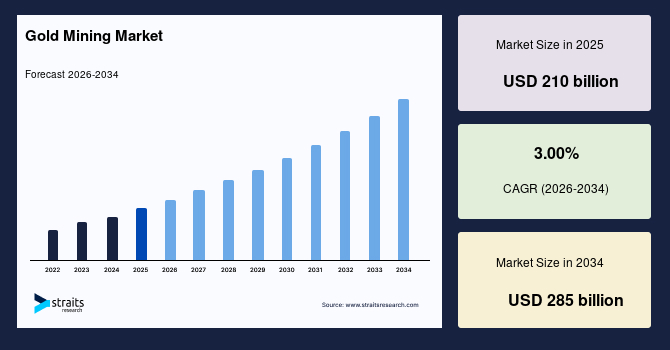

The gold mining market size was valued at USD 210 billion in 2025 and is projected to grow from USD 218 billion in 2026 to USD 285 billion by 2034, at a CAGR of 3.00% during the forecast period, as per Straits Research analysis.

Key Market Insights

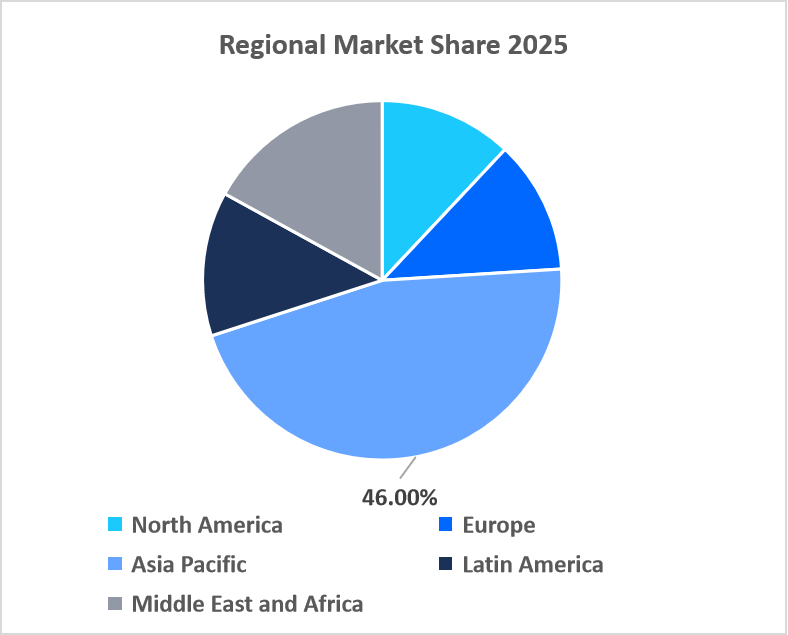

- Asia Pacific dominated the gold mining market with the largest share of 46% in 2025.

- The Middle East & Africa is expected to be the fastest-growing region in the market during the forecast period, registering a CAGR of 4.2%.

- By mining method, the underground mining segment is anticipated to register a CAGR of 3.7% during the forecast period.

- By ore type, the placer deposits segment is expected to register a CAGR of 1.8% during the forecast period.

- By production scale, the large-scale industrial mining segment dominated the gold mining market with a revenue share of 60% in 2025.

- By application, the jewelry industry segment dominated the gold mining market with a revenue share of 50% in 2025.

- The Australia gold mining market size was valued at USD 31.5 billion in 2025 and is projected to reach USD 32.4 billion in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 210 billion |

| Estimated 2026 Value | USD 218 billion |

| Projected 2034 Value | USD 285 billion |

| CAGR (2026-2034) | 3.00% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Key Market Players | Newmont Corporation, Barrick Gold Corporation, Agnico Eagle Mines Limited, AngloGold Ashanti, Gold Fields Limited |

to learn more about this report Download Free Sample Report

What are the Top 5 Gold Mining Market Trends?

Declining ore grades are increasing pressure on gold mining operations. Lower gold concentration means more material must be processed to produce each ounce. This raises energy use, equipment costs, and labor requirements. As margins tighten, mining companies are investing in automation and advanced extraction technologies to improve efficiency and maintain output.

Rising gold purchases by central banks, institutional investors, and households are strengthening overall demand. Inflation, currency volatility, and geopolitical uncertainty are supporting gold’s role as a safe-haven asset. Sustained institutional buying reduces available market supply and supports price stability. In response, mining companies are expanding reserves and securing long-term production plans.

Industry consolidation is increasing as larger mining companies acquire smaller operators. These acquisitions help improve economies of scale, diversify reserves, and lower per-ounce costs. Consolidation also supports more stable revenues during periods of price fluctuation. Companies are focusing on portfolio integration to enhance operational efficiency.

Resource depletion in mature mining regions is shifting exploration toward underdeveloped gold-rich areas in Africa, Asia Pacific, and Latin America. New projects in emerging markets are increasing capital expenditure and infrastructure investment. Mining companies are allocating higher exploration budgets to secure future production growth and reduce geographic concentration risk.

What are the Top Driving Factors in Gold Mining Market?

The strong cultural significance of gold jewelry in Asian and Middle Eastern countries drives sustained consumer demand for gold. Steady jewelry consumption supports long-term gold offtake and stabilizes output expectations. In response, gold mining companies prioritize capacity optimization, reserve expansion, and long-term supply agreements to ensure consistent production and revenue visibility.

Growing semiconductor manufacturing and clean energy transition projects raise industrial demand for gold for its superior electrical conductivity and corrosion resistance, thereby strengthening demand. To capitalize on this, gold mining companies enhance production efficiency, invest in sustainable extraction technologies, and strengthen supply partnerships with industrial manufacturers.

Currency volatility increases reliance on gold as a store of value, strengthening demand for physical gold investments. A steady retail investment demand supports downstream gold consumption and reinforces mining output requirements. In response, gold mining companies prioritize production continuity and expand reserve development to align with stable physical demand.

Inflationary pressures and financial market volatility encourage institutional and retail investors to allocate capital to gold-backed assets. This increases demand through exchange-traded funds and bullion holdings, which tightens available market supply and leads to price sensitivity. In response, mining companies optimize production planning and maintain flexible output strategies to capitalize on elevated investment demand.

What are the Restraining Factors of Gold Mining Market?

The declining discovery rate of large gold deposits pressurizes the existing reserves. As large, high-grade deposits become increasingly scarce and exploration success rates decline, mining companies face rising exploration costs, deeper ore extraction requirements, and lower yield efficiencies, which leads to constrained supply.

Changes in taxation, royalties, and ownership laws increase project cost burdens and regulatory uncertainty, leading to strained, delayed, or canceled projects, resulting in restrained investments in the gold mining market. Increased margin-based royalties and excessive windfall profits tax results in higher tax burden and strained operations for early-stage projects.

Long-project development timelines of 10–15 years from discovery to production leads to huge cost burdens, slow technological evolution, and delayed responses to volatile pricing. This exposes companies to commodity price volatility, limits the adoption of newer technologies for improved productivity, and discourages capital investments in the market.

Declining interest in mining as a primary livelihood, coupled with an aging and unevenly distributed workforce, reduces labor availability and operational efficiency. This increases staffing and training costs, which is a major restraint for companies to scale and diversify in various regions.

What are the Growth Opportunities for Players in Gold Mining Market?

Mining extraction maintains high operational costs amid depleting resources in a low-margin environment. A shift toward automation and AI-driven systems leads to higher adoption of automated drilling, hauling, and processing operations. This adoption enhances operational efficiency, reduces labor and fuel costs, improves precision in resource extraction, and ultimately increases margin per ounce.

Extractors seek more profits and environmental compliance by integrating mine sites with solar, wind, and hybrid power to reduce the dependence on grid electricity. Companies investing in gold mining require operators to disclose scope 1 & 2 emissions and align business operations with decarbonization pathways. Renewable energy integration leads to improved ESG performance, accelerates regulatory approval, and aligns with the long-term strategic imperative of low-carbon mining models, thus attracting long-term investments.

The need for higher extraction rate per ton is leading to increased adoption of newer technologies for mining. Advanced ore processing and recovery technologies help maximize extraction per ton, extend the economic life of existing mines, and stabilize margins. Technologies such as pressure oxidation (PoX) and bio-oxidation increase recovery to approximately 85-95%. Thus, use of advanced technologies for extraction opens avenues for higher extraction.

The UN Global E-waste Monitor points out that millions of tons of e-waste are generated annually, especially from circuit boards. In this scenario, urban mining encourages recycling of secondary gold sources to reduce dependency on primary extraction. This helps companies build long-term gold feedstock without complex setup, high financial risks, and stringent regulatory requirements.

Regional Analysis

The gold mining market in the Asia Pacific held the largest share of 46% in 2025. The region has strong demand for gold jewelry from China and India, high production rates from Australia and China, and established refining facilities. Government-backed exploration programs are favored by enhanced regulatory frameworks, geological surveys, and incentives to encourage mining investment. Central banks in the region are increasing gold reserves to diversify away from USD exposure. Higher investments in infrastructure and logistics projects lead to improved remote mine electrification, better rail & port routes, and integration of hybrid power systems, resulting in long-term project viability in mining regions.

Middle East & Africa Gold Mining Market Growth

The Middle East & Africa is expected to be the fastest-growing region in the gold mining market, with a CAGR of 4.2% during the forecast period. The region has unexplored gold resources and receives foreign direct investment in mining operations. The production capacity in West and Sub-Saharan Africa experiences accelerated development because of rising exploration activities, the introduction of comprehensive mining regulations, and allied infrastructure projects. Governments in this region introduced revised mining codes to attract foreign direct investments, streamline licensing, and encourage public-private participation. Investments from Gulf countries as part of economic diversification strategies away from oil reserves also drive the market.

Source: Straits Research

North America Gold Mining Market Growth

The North America market has advanced facilities, robust funding resources, and established mining laws. The US and Canada hosts some of the largest reserves globally. The region uses advanced technology for both exploration and processing and operates under clear permitting regulations that enable extended project development. The adoption of digital mining solutions, automation, and AI-driven exploration allow extraction from lower-grade and deeper ores, resulting in improved yield and profitability. Political stability and a well-established regulatory setup improve production sustainability and operational performance of mining operators in North America.

Europe Gold Mining Market Trends

The Europe market has regulated operations, which use environmentally friendly mining methods showcasing increased dedication to responsible resource extraction. Mining practices in this region involve the use of advanced geological surveying techniques, such as airborne surveys and passive seismic sensing, which comply with environmental protection laws. The adoption of sustainable mining practices, such as renewable energy integration and water recycling, attracts ESG-conscious investments, green financing, and institutional investments. Mining companies invest in modernizing plants and processing facilities to support operational scalability.

Latin America Gold Mining Market Trends

The Latin America market is expanding steadily because of its extensive mineral reserves and advantageous geological features. The region benefits from large-scale open-pit and underground mining operations throughout Andean mineral belts. Increasing focus on improving existing mine operations illustrates long-term operational stability in this market. Reformed mining codes allow incentives for tax breaks, streamlined permitting, and community engagement programs, which show enhanced policy support in this region.

What are the Key Segments in the Gold Mining Market?

|

SEGMENT |

INCLUSION |

DOMINANT SEGMENT |

CAGR OF FASTEST-GROWING SEGMENT (2026-2034) |

|---|---|---|---|

|

MINING METHOD |

|

Underground Mining |

3.7% |

|

ORE TYPE |

|

Hard Rock Deposits |

3.2% |

|

PRODUCTION SCALE |

|

Small-scale and Artisanal Mining |

3.6% |

|

APPLICATION |

|

Investment |

3.5% |

|

REGION |

|

Middle East & Africa |

4.2% |

Competitive Landscape

The gold mining market is moderately consolidated with a mix of large, mid and local companies that compete on production capabilities, asset inventory, adoption of high-tech extraction methods, exposure to geopolitical tensions, and new exploration permits. The market experiences new competition through companies using strategic mergers to broaden their resource bases, establishing joint ventures to minimize risks in expensive projects, and expanding their use of digital mine management technologies.

List of Key and Emerging Players in Gold Mining Market

- Newmont Corporation

- Barrick Gold Corporation

- Agnico Eagle Mines Limited

- AngloGold Ashanti

- Gold Fields Limited

- Kinross Gold Corporation

- Polyus

- Zijin Mining

- Harmony Gold Mining Company

- Shandong Gold Mining Co., Ltd.

- Yamana Gold

- St Barbara Limited

- IAMGOLD

- Endeavour Mining

- Sibanye-Stillwater

- Royal Gold

- Goldgroup Mining Inc.

- Ora Banda Mining

- Calibre Mining

- Lundin Gold

Latest News on Key and Emerging Players

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

| February 2026 | Goldgroup Mining Inc. | Goldgroup Mining announced an acquisition of Gold Resource Corporation to consolidate mining activities in Mexico. |

| January 2026 | Zijin Mining | Zijin Mining, via its subsidiary Zijin Gold International, announced the acquisition of Allied Gold Corp. for USD 4 billion. |

| December 2025 | Goldgroup Mining Inc. | Goldgroup Mining Inc. secured full ownership of the San Francisco gold mine through the acquisition of Molimentales del Noroeste S.A. de C.V. |

| December 2025 | St Barbara Limited | St Barbara Limited entered a strategic agreement with Lingbao Gold and Kumul Mineral Holdings for the Simberi Gold Project expansion. |

| October 2025 | IAMGOLD | IAMGOLD signed an agreement to acquire Mines D’Or Orbec Inc., leveraging a partnership with Sumitomo Metal Mining Co. Ltd. to strengthen its position in the Canadian and global markets. |

| July 2025 | Royal Gold | Royal Gold acquired Sandstorm Gold for USD 3.5 billion to strengthen its streaming and royalty portfolio and enhance long-term revenues. |

| July 2025 | AngloGold Ashanti | AngloGold Ashanti acquired Augusta Gold to strengthen its North American gold production footprint. |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 210 billion |

| Market Size in 2026 | USD 218 billion |

| Market Size in 2034 | USD 285 billion |

| CAGR | 3.00% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Mining Method, By Ore Type, By Production Scale, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Gold Mining Market Segments

By Mining Method

- Open-Pit Mining

- Underground Mining

By Ore Type

- Hard Rock Deposits

- Placer Deposits

By Production Scale

- Large-scale Industrial Mining

- Mid-tier Mining

- Small-Scale and Artisanal Mining

By Application

- Jewelry

- Investment

- Industrial Uses

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.