Graphite Market Size, Share & Trends Analysis Report By Type (Natural Graphite, Synthetic Graphite), By Application (Refractories, Battery Production, Electrodes, Foundries, Lubricants, Friction Products, Conductive Materials, Nuclear Reactors, Other Industrial Applications), By End-Use Industry (Metallurgy, Automotive, Electronics, Energy Storage, Construction, Aerospace, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Graphite Market Size

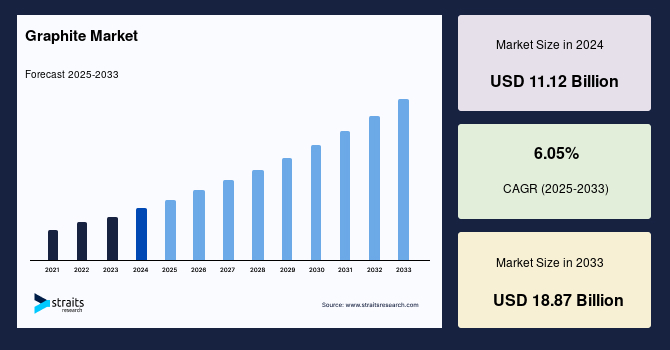

The global graphite market size was valued at USD 11.12 billion in 2024 and is estimated to grow from USD 11.79 billion in 2025 to reach USD 18.87 billion by 2033, growing at a CAGR of 6.05% during the forecast period (2025–2033).

The global market is driven by strong demand from the steel and foundry industries, where graphite electrodes are vital for electric arc furnace steelmaking due to their excellent conductivity and durability. Graphite's unique thermal and lubricating properties also make it indispensable in high-temperature industrial applications, such as refractories and brake linings.

Additionally, growing government focus on securing critical mineral supplies has positioned graphite as a strategic resource, prompting increased investments in both natural and synthetic graphite production. The electronics sector further boosts demand, as graphite materials are used extensively in thermal management solutions like heat sinks and conductive components. These factors collectively enhance graphite's market growth, supporting its expanding applications across various industries.

Current Market Trends

Technological Advancements in Graphite Processing and Purification Techniques

Technological advancements in graphite processing and purification techniques are reshaping the global market. As industries demand higher-purity graphite for applications in energy storage, semiconductors, and advanced manufacturing, innovative, eco-friendly methods are emerging to meet these needs.

- For instance, in May 2025, Australian firm EcoGraf received a second Australian patent for its HFfree® process, which purifies graphite without using toxic hydrofluoric acid. This method covers applications in battery anodes, high-purity graphite, and recycling spent battery anodes a key step toward sustainable, circular graphite manufacturing.

Such innovations not only enhance processing efficiency but also reduce environmental impact, positioning advanced purification as a critical trend. With increasing pressure to localize supply chains and meet ESG standards, companies adopting these cleaner, high-yield technologies are setting the benchmark for future graphite production globally.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 11.12 Billion |

| Estimated 2025 Value | USD 11.79 Billion |

| Projected 2033 Value | USD 18.87 Billion |

| CAGR (2025-2033) | 6.05% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Syrah Resources Limited, SGL Carbon SE, Tokai Carbon Co., Ltd., Showa Denko K.K., Imerys Graphite & Carbon |

to learn more about this report Download Free Sample Report

Graphite Market Growth Factors

Expanding Ev and Renewable Energy Markets

The expanding electric vehicle (EV) and renewable energy markets are major drivers of the global industry. As countries push for cleaner transportation and energy solutions, the demand for lithium-ion batteries where graphite is a key anode material has grown exponentially.

- According to the IEA, EV battery demand surged past 950 GWh in 2024, a 25 % year-over-year increase over 2023. In 2024 alone, total battery demand across electric vehicles and energy storage hit a record 1 TWh equivalent to what was consumed globally in a whole year just a decade ago.

On average, each EV battery incorporates 50–100 kg of graphite, making EVs a major driver of graphite consumption. This surge supports not only EV manufacturers but also renewable energy storage solutions, further boosting graphite demand globally.

Market Restraint

Environmental and Regulatory Concerns

Environmental and regulatory concerns pose significant restraints on the global graphite market. The extraction and processing of natural graphite often involve extensive mining activities, which can lead to habitat destruction, soil erosion, and water contamination. These environmental impacts have prompted stricter regulations and compliance requirements, increasing operational costs for graphite producers.

Additionally, synthetic graphite manufacturing is energy-intensive, contributing to carbon emissions and environmental pollution. Regulatory bodies in various countries are imposing more stringent environmental standards to mitigate these effects, which may limit production capacity or delay project approvals. These challenges not only affect the supply chain stability but also push companies to invest heavily in sustainable practices, impacting overall profitability.

Key Market Opportunities

Strategic Partnerships and Investments to Localize Graphite Supply Chains

Strategic partnerships and investments aimed at localizing graphite supply chains present a significant opportunity in the global graphite market. With rising demand from the electric vehicle and energy storage sectors, countries are prioritizing domestic sourcing to reduce reliance on imports, particularly from China.

- For instance, in January 2025, General Motors inked a multimillion-dollar deal with Norway's Vianode for synthetic anode-grade graphite to start shipping in 2027. Facilities will be built in North America, bypassing Asia and dramatically lowering the carbon footprint of battery components. This partnership strengthens regional supply chains for EV batteries while reducing dependency on China.

Similar collaborations can improve supply security, support local economies, and attract government incentives. As battery production scales globally, such initiatives are crucial to meeting sustainability and geopolitical goals efficiently.

Regional Analysis

Asia Pacific dominates the graphite market with rapid industrialization and expanding electric vehicle production. The region's extensive steel manufacturing base significantly drives graphite electrode consumption. Rising investments in battery manufacturing facilities to support the growing EV market accelerate demand for both natural and synthetic graphite. Increasing government support for critical minerals and advancements in processing technologies are key growth factors. Moreover, expanding electronics and renewable energy sectors further enhance the region's graphite industry potential, making it a vital hub for global graphite supply and innovation.

China Graphite Market Trends

China's market is the largest globally, dominating both natural and synthetic graphite production. The country supplies over 70% of the world's natural graphite, fueling industries like EV battery manufacturing (e.g., CATL) and steel production. However, recent environmental regulations have tightened mining practices, pushing companies to adopt cleaner technologies. China is also investing heavily in battery-grade graphite to support its expanding electric vehicle market.

India's market for graphite is rapidly growing, driven by increasing demand in steelmaking, lubricants, and lithium-ion battery production. The government's push for electric mobility and renewable energy has accelerated graphite exploration and processing projects, such as those by Graphite India Ltd. India aims to reduce reliance on imports, with domestic mining efforts in Jharkhand and Tamil Nadu expanding to meet the rising industrial and battery manufacturing needs.

Europe's Graphite Market Trends

Europe's graphite market growth is fueled by the region's transition toward clean energy and decarbonization goals. Rising adoption of electric vehicles and renewable energy storage systems is driving demand for high-purity graphite materials. The region's strong focus on environmental regulations encourages sustainable mining and processing practices. Investments in research and development are promoting advanced graphite applications, including in fuel cells and battery technologies. Additionally, initiatives to localize supply chains and reduce reliance on imports are strengthening the graphite industry ecosystem.

Germany's market is driven by its strong automotive and renewable energy sectors. The rise in electric vehicle production has increased demand for battery-grade graphite. Companies like SGL Carbon are investing in synthetic graphite and advanced materials. Germany's focus on sustainable manufacturing also boosts interest in eco-friendly graphite processing technologies, supporting its ambitions for green mobility and energy storage solutions.

The UK market for graphite is evolving with growing investments in battery manufacturing and energy storage projects. The country is promoting domestic supply chains to reduce reliance on imports, supported by initiatives like the Faraday Battery Challenge. The UK's emphasis on clean energy technologies and electric vehicles opens opportunities for graphite applications in next-gen batteries and thermal management systems, fostering innovation and local graphite processing capabilities.

North America Graphite Market Trends

The graphite market in North America is witnessing steady growth driven by increasing investments in electric vehicle manufacturing and energy storage solutions. Emphasis on developing a domestic supply chain for critical minerals is boosting exploration and production activities. The growing demand for graphite electrodes from the steel industry and the expansion of electronics manufacturing contribute to market expansion. Furthermore, supportive government policies aimed at reducing dependency on imports are encouraging innovation in synthetic graphite production and recycling technologies, fostering sustainable market development across the region.

The US market is expanding rapidly, driven by the rising demand for electric vehicles and energy storage. Companies like Graphite One and Mason Graphite are developing domestic graphite mines and processing facilities to secure supply chains. US government initiatives, such as the Inflation Reduction Act, emphasize critical mineral independence, encouraging investments in synthetic graphite production and advanced battery materials, bolstering America's position in the graphite industry.

Canada's market is growing steadily due to abundant natural graphite reserves, especially in Quebec. The country is investing in sustainable mining projects, like Nouveau Monde Graphite's Battery Anode Materials plant, aimed at supplying North America's EV industry. Canada's focus on environmentally friendly production and government support for critical minerals is attracting global interest, positioning it as a key player in reducing dependence on imported graphite.

Type Insights

Synthetic graphite holds a dominant position in the global market due to its superior purity, consistency, and performance in high-tech applications. It is widely used in lithium-ion batteries, particularly in electric vehicles and energy storage systems, owing to its controlled properties and stability. Additionally, synthetic graphite plays a critical role in the production of graphite electrodes for electric arc furnaces in steel manufacturing. Its demand is further fueled by technological advancements and the growing need for high-performance materials in electronics, aerospace, and nuclear industries. The scalability and tailored production of synthetic graphite continue to strengthen its market leadership.

Application Insights

The refractories segment accounts for a significant share of the market, driven by its essential role in high-temperature industrial processes. Graphite is a key component in refractory linings used in steel, glass, and cement manufacturing due to its excellent thermal resistance, chemical inertness, and mechanical strength. In steelmaking, it is particularly valued for lining ladles, furnaces, and crucibles, where it withstands extreme temperatures and corrosive environments. The growth of the global infrastructure and construction sectors supports increased steel production, thereby driving demand for graphite-based refractories. The segment remains vital due to graphite's unmatched performance in thermal management applications.

End-Use Industry Insights

The metallurgy segment is a major end-use area for graphite, leveraging its unique properties to enhance process efficiency and product quality. Graphite is extensively used in steelmaking as a recarburizer and in manufacturing graphite electrodes for electric arc furnaces. It also facilitates precision casting and the creation of molds in ferrous and non-ferrous metal industries. Its high thermal conductivity, chemical stability, and lubrication capability make it indispensable in smelting and refining processes. As global steel demand grows particularly from the automotive, construction, and infrastructure sectors the metallurgy segment continues to generate substantial demand for both natural and synthetic graphite products.

Company Market Share

Key companies in the graphite market are focusing on expanding production capacities, investing in advanced purification technologies, and developing synthetic graphite variants to meet rising demand. They are also forming strategic partnerships and collaborations to strengthen supply chains, particularly for battery-grade graphite. Additionally, companies are investing in research to enhance product quality and sustainability while exploring new applications in energy storage, electronics, and industrial sectors to capture emerging growth opportunities.

Northern Graphite Corporation is a Canadian mining company headquartered in Ottawa, established in 2002. It is the only graphite producer in North America, with operations at the Lac des Iles mine in Quebec the continent's sole active graphite mine. The company is advancing projects in Bissett Creek, Ontario, and Okanjande, Namibia, to meet surging demand for battery-grade graphite. Northern aims to become a leading global supplier of natural graphite for electric vehicles, fuel cells, and graphene applications.

- In May 2025, Northern Graphite reported strong demand and higher sales prices in the first quarter of 2025. The company is advancing plans to upgrade graphite from its Okanjande project in Namibia into Battery Anode Material in France, aligning with the EU's Critical Raw Materials Act.

List of Key and Emerging Players in Graphite Market

- Syrah Resources Limited

- SGL Carbon SE

- Tokai Carbon Co., Ltd.

- Showa Denko K.K.

- Imerys Graphite & Carbon

- GrafTech International Ltd.

- Northern Graphite Corporation

- Graphite India Limited

- Mason Graphite Inc.

to learn more about this report Download Market Share

Recent Developments

- June 2025- Graphite One Inc. has expanded its partnership with Lucid Motors, a leading electric vehicle manufacturer, to establish a fully domestic supply chain for advanced graphite materials. This collaboration includes a new non-binding agreement to supply Lucid and its battery cell suppliers with natural graphite, complementing a previous agreement covering synthetic anode active materials. The initiative aims to strengthen U.S. competitiveness and reduce reliance on foreign sources for critical battery materials.

- March 2025- Indian graphite electrode manufacturer HEG Ltd., part of the LNJ Bhilwara Group, is targeting project implementations worth ₹3,000 to ₹3,500 crore following the demerger of its graphite business. The company plans to raise ₹500 crore in two tranches to support expansion into green energy projects, including energy storage and lithium-ion battery initiatives. The demerger is expected to be completed by the end of 2025.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 11.12 Billion |

| Market Size in 2025 | USD 11.79 Billion |

| Market Size in 2033 | USD 18.87 Billion |

| CAGR | 6.05% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Graphite Market Segments

By Type

- Natural Graphite

- Synthetic Graphite

By Application

- Refractories

- Battery Production

- Electrodes

- Foundries

- Lubricants

- Friction Products

- Conductive Materials

- Nuclear Reactors

- Other Industrial Applications

By End-Use Industry

- Metallurgy

- Automotive

- Electronics

- Energy Storage

- Construction

- Aerospace

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.