Green Methanol Market Size, Share & Trends Analysis Report By Type (Bio-methanol, E-methanol), By Production Route (Biomethane Reforming, Power to methanol, Biomass Gasification, Waste to Methanol), By End Use (Chemical, Fuel) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Green Methanol Market Overview

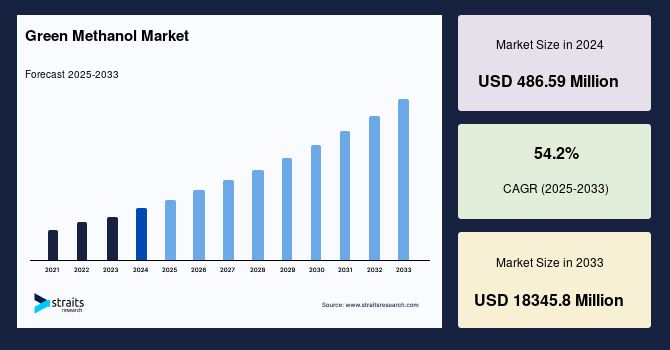

The global green methanol market size was valued at USD 486.59 million in 2024 and is projected to grow from USD 580.78 million in 2025 to USD 18345.8 million by 2033, exhibiting a CAGR of 54.2% during the forecast period (2025-2033). The primary driving force for the market globally is attributed to the surging demand for downstream products across various industries like chemical, transportation, and power generation.

Key Market Indicators

- Asia-Pacific region dominated the global green methanol market, with China leading production and consumption, accounting for over 90% of the region’s share in 2024.

- Bio-methanol dominated the green methanol industry in 2024.

- Biomethane Reforming, the production route segment, led the market in 2024.

- Based on end use, the chemical segment is the leading contributor in the global market.

Market Size & Forecast

- 2024 Market Size: USD 486.59 million

- 2033 Projected Market Size: USD 18345.8 million

- CAGR (2025-2033): 54.2%

- Largest market in 2024: North America

- Fastest-growing region: Asia Pacific

Renewable methanol is an ultra-low carbon chemical produced from sustainable biomass, often called bio-methanol, or from carbon dioxide and hydrogen produced from renewable electricity. As of February 2025, the renewable methanol announced anticipated capacity is 35.7 million tons by 2030 globally. The total projected capacity of all e-methanol projects is 19.4 million tons by 2030 globally, while the total capacity of all bio-methanol projects is 16.3 million tons globally.

Compared to conventional fuels, renewable methanol cuts carbon dioxide emissions by up to 95%, reduces nitrogen oxide emissions by up to 80%, and completely eliminates sulfur oxide and particulate matter emissions.

Overview of existing or planned facilities and technology providers for e-methanol production

|

Country |

Company |

Start-up year |

Capacity (t/y) |

Product |

Feedstock |

|

China |

Dalian Institute of Chemical Physics |

2020 |

1 000 |

e-methanol |

CO2 and H2 from water electrolysis (PV) |

|

China |

Henan Shuncheng Group/CRI |

2022 |

110 000 |

methanol (a) |

CO₂ from limekiln and H₂ from coke oven gas |

|

Sweden |

Liquid Wind |

2023 (plan for 6 facilities by 2030) |

45 000 |

e-methanol |

Upcycled industrial CO2 and H2 from water electrolysis |

|

Australia (Tasmania) |

ABEL |

2023 |

60 000 |

e-methanol |

Biogenic CO2 and H2 from water electrolysis |

|

Denmark |

Consortium of companies |

2023-2030 |

n/k |

e-methanol |

CO₂ from MSW and biomass. H₂ from water electrolysis (offshore wind). Up to 1.3 GW electrolyser capacity by 2030 |

|

Norway |

Consortium of companies/ CRI |

2024 |

100 000 |

e-methanol |

CO₂ and H₂ from water electrolysis |

|

Norway |

Swiss Liquid Future/ Thyssenkrupp |

TBD |

80 000 |

e-methanol |

CO₂ from ferrosilicon plant and H₂ from water electrolysis (hydropower) |

The European Union’s Green Deal has set ambitious targets to reduce carbon emissions by 55% by 2030 and achieve climate neutrality by 2050. These policies encourage methanol as a low-carbon fuel, especially in transport. For instance, the Methanol Institute has advocated for recognizing renewable methanol’s role in these frameworks, driving its adoption across sectors.

Different countries are introducing various technologies for the production of Green Methanol. For instance, Australia is laying emphasis on the production of green methanol with cross-country technology transfer agreements. In a recent advancement, the Hamburg-based Mabanaft received approval to build a new green methanol plant in Port Augusta, located in southern Australia, where Mabanaft will collaborate with renewable energy company Vast to build this plant, known as SM1.

- The Inflation Reduction Act (IRA) of 2022 provides tax credits such as the Clean Hydrogen Production Tax Credit (up to USD 3/kg) and the 45Q Carbon Capture Credit (USD 85/mt for stored CO2), directly supporting e-methanol and bio-methanol projects.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 486.59 Million |

| Estimated 2025 Value | USD 580.78 Million |

| Projected 2033 Value | USD 18345.8 Million |

| CAGR (2025-2033) | 54.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Methanex Corporation, OCI N.V., Carbon Clean, Nordic Green, Enerkem Inc. |

to learn more about this report Download Free Sample Report

Market Driver

The maritime sector’s shift to alternative fuels to meet International Maritime Organization (IMO) targets (50% emissions reduction by 2050) is a major driver, with methanol emerging as a scalable, low-carbon option.

- For instance, A.P. Moller-Maersk, a global shipping leader with significant U.S. operations, has ordered 36 methanol-capable containerships for delivery by 2027.

Various countries have plans to reduce emissions and adopt low-carbon fuels like green methanol. For Instance, the U.S commitment to net-zero emissions by 2050, alongside state-level mandates, is pushing industries to adopt low-carbon fuels like methanol, especially green methanol derived from renewable sources.

Market Restraint

China is one of the most prominent countries in the manufacturing of electric vehicles. The increasing trend of electric vehicles will reduce the demand for green methanol

- For Instance, in the first half of 2025, China produced 15.62 million vehicles, which is up from 12.5 percent.

Market Opportunity

Various companies are taking initiatives for the production of clean fuel. For Instance, on 25 March 2025. In the southern German city of Mannheim, the first production facility of its kind in the world uses wastewater to produce clean methanol. The plant converts biogas from the local water treatment facility with the use of green hydrogen into methanol. The German government subsidizes the facility with a small grant of USD 2.2 million. The initiatives taken by the Government of India will boost the demand for e-methanol in the future.

Government incentives, policies, and funding for research and development in methanol technology and applications to increase and tap into innovation and market expansion.Clean Fuel Production Tax Credit (Section 45Z): Supports the production of low-carbon fuels like green methanol by providing tax credits based on emissions reductions, encouraging their use in transportation and industrial applications.

Regional Insights

The North America region is one of the most dominant regions for Green Methanol. In North America, green methanol is increasingly viewed as a cleaner alternative to traditional fossil fuels, particularly in transportation and marine applications. This trend is fuelled by regulatory pressures and a shift toward decarbonization.

- In May 2024, SunGas Renewables partnered with C2X to develop and operate multiple green methanol production facilities across North America. This initiative aims to boost the supply of green methanol, aligning with the region's push for renewable energy solutions. The focus on green methanol produced from renewable sources like biomass or captured CO2 reflects rising demand for low-carbon fuels.

U.S.: Methanex is one of the largest producers of green methanol in the U.S. The company is exploring opportunities and conducting feasibility studies to use renewable electricity to produce green hydrogen and combine this with industrial or biogenic CO₂from third parties to produce e-methanol. The annual report of 2023 states that the company planned to further explore the feasibility of e-methanol, specifically at our Geismar, U.S., and Damietta, Egypt sites in 2024.

Asia Pacific Market Trends

The Asia Pacific region is one of the most dominant regions for Green Methanol. Countries like China, India are among the largest manufacturers of green methanol globally. China dominates, with companies like Yankuang Energy Group expanding green methanol production to meet needs in construction, automotive, and chemical sectors.

The region is prominent in the Automotive industry. Japan, which is the home to several major automotive manufacturers, including Toyota, Suzuki, Kawasaki, Honda, Yamaha, and Nissan, plans to develop vehicles that run on green methanol fuel. Japan’s National Energy Strategy aims to decrease reliance on gasoline from 50% to 40% by 2030 and improve energy efficiency by 30% by replacing 20% of transportation fuel with alternative options such as green methanol.

China has been advancing renewable methanol production as a pivotal strategy to enable current net-zero transitions. As of 2023, a total of ten commercial-scale green methanol production plants have been planned, with an expected annual production capacity of approximately 1.7 million tonnes by 2030, and with e-methanol accounting for about 60% of this capacity.

India: The Methanol initiatives have aligned with India, a green energy commitment that explores green methanol as a derivative. The Government of India has supported the pilot projects in mobility and shipping with an outlay of USD13.86 million up to 2025-26.

Europe Market Trends

Germany : The European Union, as part of its green deal, has imposed a ban on new sales of combustion-engine cars as of 2035. But following a last-minute campaign by Germany, the 2035 ban will exempt vehicles that run exclusively on e-fuels, a nascent technology that combines hydrogen and carbon dioxide to produce synthetic fuels. This exemption will trigger the demand for methanol for E-fuel in Germany.

UAE :The adoption of bio-methanol as an alternative fuel in the maritime sector is gaining momentum due to its ability to significantly reduce harmful emissions such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter compared to traditional marine fuels. This shift towards cleaner fuel options aligns with global efforts to lower the environmental impact of the shipping industry.

Brazil Market Trends

Brazil has undertaken initiatives for the production of methanol for the shipping sector, where a prominent example is set by Brazilian ethanol producer Inpasa and fuel distributor Vibra, which are venturing into the exploration of the production of e-methanol from ethanol by-products.

Type Insights

Bio-methanol is more dominant than e-methanol primarily due to its lower production cost and existing infrastructure compatibility, which makes it a more cost-effective and readily available green fuel option. E-methanol requires costly investments in green hydrogen and carbon capture plants, whereas bio-methanol uses abundant, accessible feedstocks like agricultural and forestry waste.

Production Route Insights

Biomethane reforming is a prominent method in the production of green methanol, particularly due to the easy availability of biogas from waste sources and its potential to be economically competitive with traditional methanol production. Biomethane from sources like landfills and wastewater treatment plants can be reformed to produce syngas, which then serves as the feedstock for bio-methanol.

End Use Insights

The chemical industry is the dominant end-use segment for green methanol, where it serves as a crucial feedstock for producing various chemicals, plastics, and solvents, with the transportation and fuel segment also being a significant and growing application.

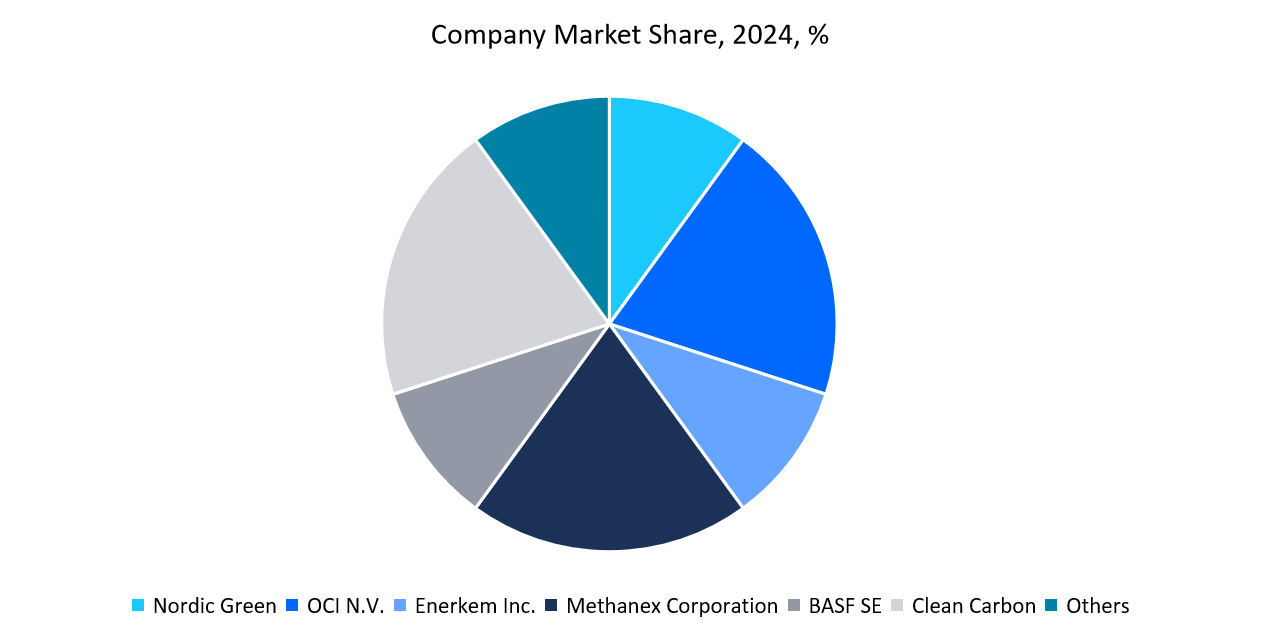

Company Market Share

The global Green Methanol market is moderately consolidated with a few players, including Methanex Corporation, OCI N.V., Clean Carbon, Enerkem Inc., and Nordic Green, trying to increase their market share by undertaking strategic initiatives, including mergers, acquisitions, new product development, and partnerships. The “Others” category includes regional manufacturers and niche players who cater to local markets or specific industries. While the market leans toward consolidation, the presence of numerous smaller producers creates opportunities for competition and innovation.

Source: Straits Research Analysis

Liquid Wind: An emerging player in the green methanol market

Liquid Wind is a leading Green Fuel facility developer, dedicated to reducing the world's dependency on fossil fuels. The company is focusing on green methanol made from green hydrogen and biogenic CO₂ we help industries capture and reuse their emissions, while providing hard-to-abate sectors like shipping and aviation the opportunity to accelerate their transition to sustainable fuels.

Recent developments by Liquid Wind Group

- On 15 February 2025, Liquid Wind, a leading developer of Green Fuel facilities, will be responsible for the development of the project starting in the spring of 2025. Once operational, the facility will produce approximately 100,000 tons of Green Methanol per year, twice as much as the previously planned eFuel facility in Örnsköldsvik.

List of Key and Emerging Players in Green Methanol Market

- Methanex Corporation

- OCI N.V.

- Carbon Clean

- Nordic Green

- Enerkem Inc.

- C1 Green Chemicals AG

- BASF SE

- Goldwind Green Energy

- Liquid Wind

- Proman

- Sarwak Petchem

Recent Developments

- May 2025: The world’s first large-scale green methanol plant has been officially inaugurated in Denmark. The Kassø Green facility in Aabenraa, near the German border, is also Europe’s second-largest green hydrogen project, using 52.5MW of Siemens Energy PEM electrolysers.

- March 2025 : Cleantech company C1 Green Chemicals AG has successfully secured USD 23.29 million in fresh capital to bring its groundbreaking green methanol catalysis technology to market. Green methanol can be used to defossilize three key industries: shipping, aviation, and carbon-based chemical production

- Jan 2025 : Sarwak Petchem Sdn Bhd has started to develop Green Methanol. Sarawak Premier Tan Sri Abang Johari Tun Openg is set to start the ceremony for the green methanol plant project at Tanjung Kidurong.

- Nov 2024: German shipowner Hapag-Lloyd has signed an offtake agreement with Goldwind Green Energy for biogenic and green hydrogen-based methanol produced in Xing'an League, China. Goldwind Green Energy's ambitious project aims to produce 500,000 tons of green methanol annually, enhancing sustainable fuel sources in the shipping industry.

Analyst Opinion

The future of green methanol looks promising as it could become a key fuel and chemical in a cleaner world, powering ships, cars, and factories with far less pollution. The production is expected to grow to over 35.7 million tons by 2030, and costs potentially dropping to USD 220-630 per ton by 2050, it is set to get cheaper and more common.

Governments and companies are pushing it hard with funding and projects, but challenges like high costs and securing enough sustainable materials could slow things down. If these hurdles are tackled, green methanol might be a big part of a zero-emission future.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 486.59 Million |

| Market Size in 2025 | USD 580.78 Million |

| Market Size in 2033 | USD 18345.8 Million |

| CAGR | 54.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Production Route, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Green Methanol Market Segments

By Type

- Bio-methanol

- E-methanol

By Production Route

- Biomethane Reforming

- Power to methanol

- Biomass Gasification

- Waste to Methanol

By End Use

- Chemical

- Fuel

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.