HDPE Pipes Market Size, Share & Trends Analysis Report By Type: (PE 63, PE 80, PE 100), By Diameter: (<500 mm, 500-1000 mm, 1000-2000 mm, 2000-3000 mm, >3000 mm), By Application: (Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Global Hdpe Pipes Market Size

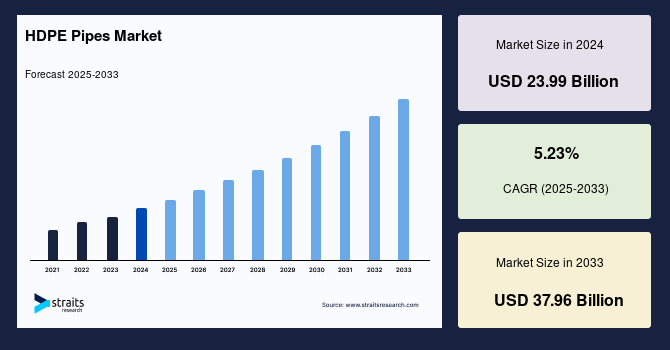

The global HDPE pipes market size was valued at USD 23.99 billion in 2024 and is estimated to grow from USD 25.24 billion in 2025 to reach USD 37.96 billion by 2033, growing at a CAGR of 5.23% during the forecast period (2025–2033).

The global market is primarily driven by the superior durability and flexibility of HDPE pipes, which offer excellent resistance to corrosion, abrasion, and chemical damage compared to traditional materials like metal or concrete. This makes them ideal for use in demanding environments such as industrial fluid transport and sewage systems.

Additionally, growing government initiatives aimed at upgrading existing infrastructure to ensure safe and reliable water distribution networks are fueling demand. Environmental advantages also play a significant role, as HDPE pipes are recyclable and have a lower carbon footprint, aligning with global sustainability goals.

Furthermore, increasing construction activities across residential, commercial, and industrial sectors boost the need for reliable piping solutions, with HDPE pipes preferred due to their lightweight nature, ease of installation, and long service life, ultimately reducing maintenance costs and downtime.

Latest Market Trends

Adoption of Smart Irrigation Systems

One of the emerging trends in the global HDPE pipes market is the growing integration of smart irrigation systems in agriculture to enhance water efficiency. As climate change and water scarcity increasingly impact agricultural productivity, farmers and governments are turning to precision irrigation methods that minimize water wastage. Smart irrigation relies on real-time data, sensors, and automated systems to optimize water delivery based on crop needs and weather conditions.

- For instance, in April 2025, the Union Cabinet approved a ₹1,600 crore sub-scheme under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) for the fiscal year 2025–26. This initiative focuses on modernizing irrigation infrastructure by integrating advanced technologies such as micro-irrigation and IoT-based water management systems. The scheme aims to deliver water directly from established sources to individual farm gates, particularly benefiting landholdings up to 1 hectare.

Such developments are driving demand for HDPE pipes, which are integral to the efficient delivery and distribution of water in smart irrigation networks.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 23.99 Billion |

| Estimated 2025 Value | USD 25.24 Billion |

| Projected 2033 Value | USD 37.96 Billion |

| CAGR (2025-2033) | 5.23% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | JM Eagle, Inc., WL Plastics, Prinsco, Inc., Uponor Corporation, Lane Enterprises, Inc. |

to learn more about this report Download Free Sample Report

Global Hdpe Pipes Market Growth Factor

Rapid Urbanization and Industrialization

Rapid urbanization and industrialization are pivotal drivers fueling the demand for HDPE pipes globally. Expanding urban populations necessitate robust infrastructure development, including water supply, sewage systems, and gas distribution networks, where HDPE pipes are preferred due to their durability and flexibility.

- For instance, China’s National New-Type Urbanization Plan focuses on transitioning its economic model from production-for-export to increased domestic consumption. The plan aims to urbanize 250 million rural Chinese by 2026, emphasizing the development of smart cities and sustainable urbanization patterns. This strategic shift reflects China’s commitment to fostering domestic economic growth through urbanization, driving large-scale infrastructure projects requiring high-performance piping solutions.

Similar urban expansion in countries like India and Brazil further boosts the market as industries grow and the need for efficient, long-lasting pipeline systems intensifies.

Market Restraint

Volatility in Raw Material Prices

The global HDPE pipes market faces a significant restraint owing to the volatility in raw material prices, primarily polyethylene, which is derived from crude oil and natural gas. Fluctuations in crude oil costs directly impact the cost of producing HDPE resin, leading to unpredictable manufacturing expenses for pipe manufacturers.

This price instability can result in higher product costs, affecting profit margins and making it challenging for manufacturers to offer competitive pricing. Additionally, sudden spikes in raw material costs may delay or reduce procurement by end-users, slowing down market growth. Such volatility also complicates long-term planning and investment for companies in the HDPE pipes industry, thereby restraining market expansion.

Market Opportunity

Expansion in Rural Water Supply and Sanitation Projects

The global push to enhance rural water access and sanitation infrastructure presents a significant opportunity for the HDPE pipes market. Governments and development organizations are increasingly investing in reliable, long-lasting piping systems to improve living standards in underserved regions. HDPE pipes, known for their corrosion resistance, durability, and cost-effectiveness, are ideal for such large-scale installations.

- For instance, in the Lao People’s Democratic Republic (Lao PDR), the World Bank's Scaling-up Water Supply, Sanitation, and Hygiene Project aims to provide access to water and sanitation in 115 villages, benefiting around 65,000 people by 2026. The project focuses on increasing hygiene awareness and improving practices, particularly in disadvantaged communities.

Similar programs across Asia, Africa, and Latin America are driving robust demand for HDPE pipes in rural infrastructure development.

Regional Analysis

The Asia Pacific region is witnessing robust growth in the HDPE pipes market due to rapid urbanization and infrastructure development across residential, industrial, and agricultural sectors. Rising demand for efficient irrigation systems and rural water supply projects is driving the installation of HDPE pipelines. The region also sees increasing investments in gas distribution and drainage systems, where the flexibility and durability of HDPE pipes offer significant advantages. Expanding construction activities, alongside supportive government initiatives for sanitation and water conservation, create substantial market opportunities for both domestic manufacturing and cross-border supply chains.

- China’s HDPE pipes industry is growing due to government-led infrastructure modernization and environmental protection initiatives. The South-to-North Water Diversion Project and rural water grid expansion heavily use HDPE pipes for their durability and flexibility. Additionally, China’s “Beautiful Countryside” initiative drives rural sewage and irrigation improvements, boosting demand. The push for eco-friendly construction and agriculture water efficiency further enhances HDPE pipe adoption across the country.

- India’s market for HDPE pipes is witnessing rapid growth driven by rural water supply missions and agricultural reforms. Under the Jal Jeevan Mission, the government has laid millions of kilometers of HDPE pipelines to ensure household tap water connections. Similarly, Pradhan Mantri Krishi Sinchayee Yojana encourages micro-irrigation using HDPE piping systems. These initiatives, coupled with increasing awareness about water conservation, make HDPE pipes vital in India’s infrastructure expansion.

North America Hdpe Pipes Market Trends

In North America, the HDPE pipes market benefits from the ongoing rehabilitation of aging water and wastewater infrastructure. Municipalities are investing in corrosion-resistant and durable piping solutions to replace traditional metal systems. The rising emphasis on sustainable construction and green building standards further accelerates HDPE adoption. Additionally, the region’s strong presence of advanced irrigation systems in agriculture and expanding natural gas distribution networks provide consistent demand. Technological innovation and regulatory focus on leak reduction and energy-efficient piping are expected to drive future growth across residential, commercial, and industrial sectors.

- The U.S. HDPE pipes industry benefits from large-scale infrastructure revitalization, including water system overhauls under the Infrastructure Investment and Jobs Act. HDPE is favored for its corrosion resistance and trenchless installation capabilities. For instance, the City of Los Angeles employs HDPE pipes to replace aging sewer and water lines, reduce leakage, and improve water delivery efficiency, especially in seismic zones prone to ground movement.

- Canada’s market is witnessing growth due to rising investments in water infrastructure upgrades and cold climate resilience. The Clean Water and Wastewater Fund (CWWF) supports municipal pipe replacement projects using HDPE pipes for their freeze-resistance and durability. For example, the City of Calgary has adopted HDPE piping in water mains to prevent winter-related failures and reduce maintenance costs across urban networks.

Europe Hdpe Pipes Market Trends

Europe’s HDPE pipes market is driven by stringent environmental regulations encouraging the utilization of recyclable and low-emission materials in infrastructure projects. The shift toward renewable energy installations, such as geothermal and solar farms, requires reliable and chemical-resistant piping solutions. Aging utility networks across several urban areas are undergoing modernization, where HDPE’s long lifecycle and low maintenance needs make it a preferred choice. Additionally, the increasing adoption of trenchless pipe-laying technology and smart water management systems is propelling market demand in both municipal and industrial applications throughout the region.

- Germany’s HDPE pipes industry is driven by rising investments in sustainable water infrastructure and green building projects. The country’s “Blue Responsibility” initiative emphasizes water efficiency and long-lasting piping solutions. For instance, HDPE pipes are extensively used in Berlin’s sewer rehabilitation projects due to their corrosion resistance and long service life. The surging focus on renewable energy and district heating networks further supports the demand for high-performance HDPE piping systems.

- The UK HDPE pipes market is experiencing growth due to increasing emphasis on modernizing aging water infrastructure. Initiatives like the AMP7 (Asset Management Plan) by Ofwat, focusing on water leakage reduction and infrastructure resilience, are boosting HDPE pipe demand. These pipes are being adopted by utilities such as Thames Water and Yorkshire Water for pipe replacement projects. HDPE's durability and leak-proof properties are critical to meeting the UK’s environmental targets.

Type Insight

PE 100 is the dominant segment in the global HDPE pipes market due to its superior mechanical properties, high tensile strength, and excellent resistance to stress cracking. This grade offers enhanced durability and longer service life, making it ideal for demanding applications such as water supply, gas distribution, and industrial piping. PE 100 pipes also support higher pressure ratings compared to PE 63 and PE 80, driving their preference among end-users. Additionally, their cost-effectiveness over time, combined with ease of installation and low maintenance, further consolidates PE 100 as the preferred choice in various infrastructure projects worldwide.

Diameter Insight

The >3000 mm diameter segment holds dominance in the HDPE pipes market owing to the growing need for large-scale infrastructure projects such as municipal water supply systems, industrial pipelines, and flood control networks. Pipes of this size are crucial for transporting large volumes of fluids efficiently over long distances. Their robustness, combined with lightweight and corrosion resistance, makes them highly suitable for high-capacity applications. Moreover, advancements in manufacturing technologies have enabled the production of these large-diameter pipes, meeting the increasing demand from urban development and industrial sectors globally.

Applications Insight

Sewage system pipes dominate the HDPE pipes market due to rising urbanization and stringent regulations on wastewater management. HDPE pipes are favored for sewage applications because of their excellent chemical resistance, flexibility, and leak-proof joints, which prevent contamination and groundwater pollution. Their durability under harsh underground conditions and ability to withstand soil movements contribute to longer service life and reduced maintenance costs. Increasing investments in sanitation infrastructure, especially in developing regions, further drive demand for HDPE sewage pipes as governments prioritize efficient and sustainable wastewater disposal solutions.

Company Market Share

Companies in the HDPE pipes market are focusing on strategic initiatives such as expanding production capacity, investing in advanced extrusion technologies, and forming partnerships with construction and infrastructure firms. Many are also emphasizing product innovation, including multilayer and UV-resistant pipes, to meet diverse application needs. Additionally, firms are strengthening their distribution networks and targeting emerging economies where urbanization and infrastructure development are accelerating demand for durable, cost-effective piping solutions.

Jm Eagle, Inc.

JM Eagle, Inc. is a leading American manufacturer of plastic pipes, headquartered in Los Angeles, California. Established in 1982 as J-M Manufacturing, the company was acquired in 2005 by Walter Wang, who later rebranded it as JM Eagle. With 22 production facilities across North America, JM Eagle produces a comprehensive range of polyvinyl chloride (PVC) and high-density polyethylene (HDPE) pipes. Their products serve various sectors, including water supply, sewage systems, irrigation, and energy distribution. Notably, JM Eagle offers a 50-year warranty on its HDPE pipes, underscoring its commitment to quality and durability.

- In October 2024, JM Eagle became a member of the Clinton Global Initiative. As part of its commitment, JM Eagle pledged to expand its philanthropic efforts to provide clean, safe drinking water to underserved communities. The company has already been instrumental in delivering clean water to over 125,000 people in Sub-Saharan Africa and 13,000 families in Senegal through its partnership with Columbia University's Earth Institute.

List of Key and Emerging Players in HDPE Pipes Market

- JM Eagle, Inc.

- WL Plastics

- Prinsco, Inc.

- Uponor Corporation

- Lane Enterprises, Inc.

- Polyplastic Group

- Mexichem SAB de CV

- China Lesso Group Holdings Ltd.

- Pipelife International GmbH

- Apollo Pipes Ltd.

to learn more about this report Download Market Share

Recent Developments

- May 2025- Infra Pipe Solutions Ltd., a leading North American HDPE pipe manufacturer, acquired a manufacturing facility in Jacksonville, Florida, for $15 million. This acquisition marks the company's sixth manufacturing site, enhancing its capacity to meet growing demand across various sectors, including water infrastructure and broadband expansion.

- November 2024- Composite Piping Technology (CPT) has commenced operations at its new manufacturing facility in Kilgore, Texas, dedicated to producing MaxDR™, the world's first large-diameter, high-pressure, fusible composite HDPE pipe. These pipes, available in diameters ranging from 12” to 24” and operating pressures up to 750 psi, are designed for applications in oil & gas, industrial, mining, and municipal sectors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 23.99 Billion |

| Market Size in 2025 | USD 25.24 Billion |

| Market Size in 2033 | USD 37.96 Billion |

| CAGR | 5.23% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Diameter, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

HDPE Pipes Market Segments

By Type

- PE 63

- PE 80

- PE 100

By Diameter

- <500 mm

- 500-1000 mm

- 1000-2000 mm

- 2000-3000 mm

- >3000 mm

By Application

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.