In Vitro Fertilization (IVF) Market Size, Share & Trends Analysis Report By Type (Fresh Nondonor, Frozen Nondonor, Fresh Donor, Frozen Donor), By Instrument (Disposable Devices, Culture Media, Equipment), By End-User (Fertility Clinics, Hospitals) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

In Vitro Fertilization (IVF) Market Overview

The global in vitro fertilization market size is estimated at USD 28.02 billion in 2025 and is projected to reach USD 45.95 billion by 2034, growing at a CAGR of 5.69% during the forecast period. Remarkable growth of the market is propelled by the rising prevalence of infertility as well as increasing awareness and acceptance of assisted reproductive technologies. As per the data reported by the WHO, one in every six people of reproductive age worldwide (approximately 17.5% of the adult population) experienced infertility in their lifetime. Such factors enhanced the increased demand for IVF services and advanced fertility treatments, which further promoted investment and innovation in the global in vitro fertilization market.

Key Market Trends & Insights

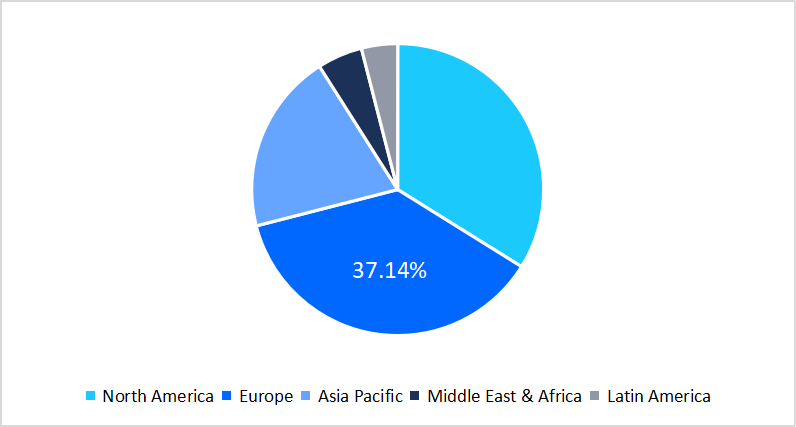

- According to Straits research, Europe held a dominant share of the global market, accounting for 37.14% share in 2025.

- According to Straits research, the Asia Pacific region is growing at the fastest pace, with a CAGR of 6.38.

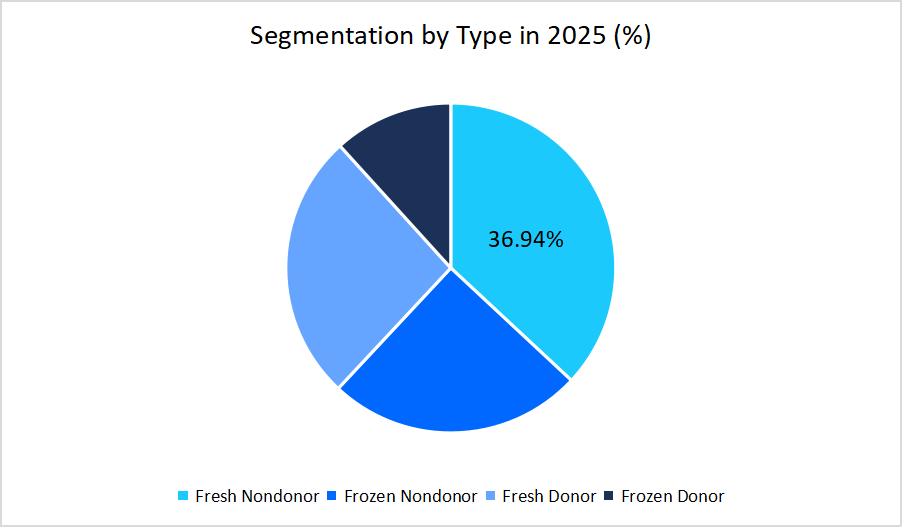

- Based on Type, the frozen non-donor segment dominated the market in 2025 with a revenue share of 36.94%.

- Based on the Instrument, the disposable devices segment is expected to register the fastest CAGR growth of 6.72%.

- Based on End User, the fertility clinics segment dominated the market in 2025.

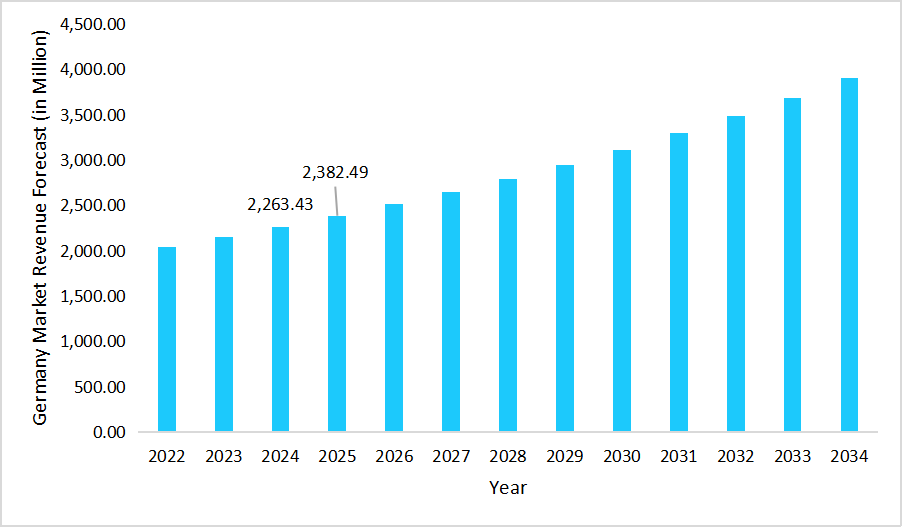

- Germany dominates the global in vitro fertilization market, valued at USD 2,263.43 million in 2024 and reaching USD 2,382.49 million in 2025.

Graph: Germany Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 28.02 billion

- 2034 Projected Market Size: USD 45.95 billion

- CAGR (2025 to 2034): 5.69%

- Dominating Region: Europe

- Fastest-Growing Region: Asia Pacific

The global in vitro fertilization (IVF) market encompasses a range of treatment types and advanced instruments, catering to individuals and couples seeking fertility solutions. Treatments include fresh nondonor, frozen nondonor, fresh donor, and frozen donor procedures, addressing infertility causes such as ovulatory disorders, male factor infertility, endometriosis, unexplained infertility, and age-related reproductive challenges. IVF procedures utilize various instruments, including disposable devices, culture media (cryopreservation, embryo culture, ovum processing, and sperm processing media), and specialized equipment such as sperm analyzer systems, imaging systems, ovum aspiration pumps, micromanipulator systems, incubators, gas analyzers, laser systems, cryosystems, sperm separation devices, IVF cabinets, anti-vibration tables, witness systems, and other supportive technologies. These procedures are administered across multiple end-users, primarily fertility clinics and hospitals, with each setting offering tailored protocols and technologies depending on patient needs and procedural complexity.

Latest Market Trends

Shift towards Advanced In Vitro Fertilization (IVF) Technologies

The shift from standard in vitro fertilization procedures with limited embryo screening to technologically advanced IVF procedures presents as a market trend. For example, in June 2025, as per the report of the American Society for Reproductive Medicine, the growing adoption of genetic screening techniques in IVF, such as preimplantation genetic testing (PGT), enabled clinics to identify genetic disorders in embryos before implantation, which resulted in higher IVF success rates and safer outcomes for offspring.

Such a shift to advanced IVF with genetic screening (PGT) boosted the market by improving success rates, enhancing safety, expanding the patient base, and enabling premium service offerings.

Integration of Artificial Intelligence into IVF

The integration of artificial intelligence in IVF has improved outcomes by enabling data-driven embryo selection, via shifting the process from traditional manual observation to predictive, AI-guided decision-making. As per the study published in the American Society for Reproductive Medicine, highlighted that AI-driven models in IVF could predict embryo viability and treatment success accurately than traditional methods.

Such factors contributed to higher success rates, enhanced efficiency, and enabled clinics to deliver efficient fertility treatments.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 28.02 Billion |

| Estimated 2026 Value | USD 29.51 Billion |

| Projected 2034 Value | USD 45.95 Billion |

| CAGR (2026-2034) | 5.69% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Thermo Fisher Scientific Inc, Vitrolife, Cook Medical LLC, CooperSurgical, Inc., FUJIFILM Irvine Scientific |

market.jpg)

to learn more about this report Download Free Sample Report

In Vitro Fertilization (IVF) Market Driver

Government Support Driving IVF Adoption

Governments are actively introducing initiatives to enhance the adoption of fertility treatments, fostering wider adoption of IVF technologies. For example, in February 2025, as per the data reported by Whitehouse.gov, President Donald Trump signed an executive order aimed at developing strategies to make IVF affordable, seeking to counter declining fertility rates.

Such policy interventions not only expanded patient access but also encouraged research, innovation, and modernization of IVF procedures.

Market Restraint

High Treatment Costs

The high financial burden of in vitro fertilization remains a barrier for market growth. According to Standford University, a single IVF cycle in the U.S. ranged from USD 15,000 to USD 20,000, and costs exceeded USD 30,000 when donor eggs were involved. Limited insurance coverage, particularly in 29 states that did not mandate private in vitro fertilization coverage, and for self-insured plans, covered 61% of the workforce, along with minimal support from public programs, such as Medicaid, hence made IVF financially inaccessible for several people, thereby slowing the overall market growth.

Market Opportunity

Expansion through Strategic Acquisitions

Leading fertility service providers are pursuing acquisitions to strengthen their presence in emerging markets, creating growth opportunities in the in vitro fertilization sector. Recently, KKR-backed IVI RMA Global announced its acquisition of ART Fertility Clinics for approximately USD 400–450 million, which marked as a major expansion into the growing in vitro fertilization market. This shift extended IVI RMA’s global footprint, which spanned over 15 countries and 190 clinical offices across the U.S., Europe, and Latin America.

Such a factor highlighted the expanding opportunities within the global in vitro fertilization market. By strengthening their presence in emerging regions, these companies not only broadened access to fertility treatments but also fostered growth and consolidation in the sector, positioning themselves to meet the rising global demand for advanced IVF solutions.

Regional Analysis

The Europe region dominated the market with a revenue share of 37.14% in 2025. The growth is attributed to factors such as advanced fertility clinics equipped with advanced technologies, highly skilled reproductive specialists, and a strong focus on research and innovation that enhance success rates and attract patients from both domestic and international markets.

The in vitro fertilization market in the UK is growing due to the increase in elective egg freezing, as reported by the HFEA. Several women have opted for oocyte cryopreservation, which drives future demand for fertility treatments and increases IVF service volumes and storage revenues. Data from HFEA highlighted the role of fertility planning and egg freezing in shaping the growth of the in vitro fertilization market.

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing region with a CAGR of 6.38% during the forecast timeframe. The growth is attributed to factors such as increasing awareness of fertility treatments supported by improved access to specialized clinics, wider availability of treatment options, and a gradual reduction in cultural stigma surrounding infertility.

The in vitro fertilization Market in China is fuelled by the strategic inclusion of assisted reproductive technologies (ART) in basic health insurance across multiple provinces, such as Shanghai expanded its coverage in June 2024, including 12 ART procedures under basic health insurance. These policies reduced the financial burden on couples seeking IVF, hence making treatments affordable.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

North America Market Insights

A factor driving the in vitro fertilization (IVF) market in North America is the increasing adoption of elective fertility preservation, particularly egg freezing among women. Rising awareness of age-related fertility decline, coupled with advances in vitrification techniques that improve egg survival and success rates, has led various women to pursue fertility preservation proactively. Companies and fertility clinics in the U.S. and Canada are offering tailored egg freezing programs, often bundled with genetic testing and counseling services, creating a specialized segment within the IVF market that caters to delayed childbearing and family planning preferences.

The in vitro fertilization market in the U.S. is widely driven by state insurance coverage for IVF treatments. These policies make fertility treatments various affordable and accessible for patients, supporting several people in pursuing advanced fertility services, which drives higher demand for IVF, hence boosting the in vitro fertilization market size and supporting steady market growth.

Middle East and Africa Market Insights

The growing demand for culturally and religiously tailored fertility treatments drives the market growth. Various clinics in the region are offering services that align with local cultural and religious practices, such as gender selection counselling, use of donor gametes in compliance with religious guidelines, and private, family-centered IVF programs. This customization enhances patient comfort and acceptance, attracting couples who might otherwise avoid assisted reproductive technologies, and creates a unique growth segment within the IVF market in these regions.

A factor driving the IVF market in South Africa is the increasing medical tourism for fertility treatments. South Africa has positioned itself as a destination for affordable, high-quality IVF services, attracting patients from neighbouring countries and even Europe. Couples from Zimbabwe and other Southern African nations often travel to private fertility clinics in Cape Town and Johannesburg to access advanced IVF procedures at lower costs compared to their home countries. This influx of international patients is boosting demand and creating a niche growth segment within the South African IVF market.

Latin America Market Insights

The rising prevalence of fertility awareness programs and government-backed reproductive health initiatives, drives the market growth. Countries such as Brazil and Mexico are increasingly implementing public campaigns to educate couples about infertility, reproductive health, and early intervention options. Fertility awareness workshops and subsidized IVF programs in public hospitals are helping to reduce social stigma around assisted reproductive technologies while increasing patient access. This focus on education and accessibility is creating a specialized growth segment within the Latin American IVF market.

A key factor driving the in vitro fertilization (IVF) market in Argentina is the expansion of private fertility clinics offering personalized IVF programs with advanced technologies. Clinics in Buenos Aires are increasingly providing services such as preimplantation genetic testing, time-lapse embryo monitoring, and customized hormone stimulation protocols. These innovations improved success rates and attracted both local and regional patients seeking high-quality, tailored fertility solutions. This focus on technological sophistication and personalized care is fueling growth in Argentina’s IVF market.

Type Insights

The frozen non-donor segment dominated the market in 2025 with a revenue share of 36.94%. The growth is attributed to the increasing preference for frozen embryo transfers due to higher success rates and flexibility in treatment timing.

The fresh donor segment is anticipated to register the fastest CAGR of 6.49% during the forecast period, due to its higher success rates compared to frozen donor procedures. Additionally, fresh donor cycles allow for better synchronization between the donor and recipient, reducing the time between egg retrieval and embryo transfer, which can improve implantation outcomes.

Source: Straits Research

Instrument Insights

The disposable devices segment is anticipated to grow at a CAGR of 6.72 % from 2026 - 2034. This growth is attributed to the rising demand for single-use medical devices in IVF procedures, which ensure sterility and minimize contamination risks.

The culture media segment dominated the market in 2025, with a revenue share of 45.22%. The market growth is due to the essential role culture media play in IVF procedures, including cryopreservation media, embryo culture media, ovum processing media, and sperm processing media. These consumables are required for each IVF cycle, ensuring the viability and development of gametes and embryos.

End-User Insights

The fertility clinics segment dominated the market in 2025. The growth is attributed to the rising patient preference for dedicated fertility services, as these centers provide specialized expertise, advanced technologies, personalized treatment plans, and comprehensive care under one roof.

The hospitals segment is anticipated to register the fastest CAGR of 6.23% during the forecast period, owing to the increasing integration of advanced fertility technologies and comprehensive reproductive services within hospital settings. Hospitals offer a wider range of specialized care, including access to experienced fertility specialists, advanced diagnostic tools, and advanced IVF laboratories, which enhance treatment outcomes and patient confidence.

Competitive Landscape

The global in vitro fertilization (IVF) market is moderately fragmented, characterized by the presence of several established players alongside numerous emerging participants. The top players are Thermo Fisher Scientific Inc., Vitrolife, Cook Medical LLC, CooperSurgical Inc, FUJIFILM Irvine Scientific and Others.

Conceivable Life Sciences: An emerging market player

Conceivable Life Sciences is an emerging player in the in vitro fertilization market, focusing on automating IVF laboratories using robotics and AI to perform critical procedures, such as intracytoplasmic sperm injection (ICSI), sperm selection, fertilization, embryo culture, and cryopreservation.

- In May 2024, Conceivable Life Sciences achieved the world’s first fully automated ICSI. The company demonstrated that its robotic AI hybrid lab could perform sperm injection procedures remotely and with clinical outcomes that rival top IVF labs.

List of Key and Emerging Players in In Vitro Fertilization (IVF) Market

- Thermo Fisher Scientific Inc

- Vitrolife

- Cook Medical LLC

- CooperSurgical, Inc.

- FUJIFILM Irvine Scientific

- Genea Pty Limited

- INVO Fertility

- Ferring

- Kitazato Corporation

- Hamilton Thorne

- IVFtech ApS

- Esco Medical

- Progyny, Inc

- Indira IVF Hospital Private Limited

- ZEISS Group

- Boston IVF

- Monash IVF Australia

- Ovation Fertility

- Shady Grove Fertility

- Group Ambroise Paré Clinic

- Others

Strategic Initiatives

- July 2025: Province launched its first-ever, publicly funded in vitro fertilization program, aimed at making it affordable as well as accessible for hopeful parents in British Columbia.

- June 2024: Senate Democrats introduced legislative protections for in vitro fertilization (IVF) patients. This move contributed to the growth by ensuring the safety and accessibility of IVF services, particularly for patients with insurance coverage issues.

- January 2024: IVI RMA announced its acquisition of the North American Operations of Eugin Group, which includes the Toronto-based TRIO and the Boston IVF fertility network. This strategic move delivered evidence-based fertility solutions while ensuring successful outcomes for a large patient population.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 28.02 Billion |

| Market Size in 2026 | USD 29.51 Billion |

| Market Size in 2034 | USD 45.95 Billion |

| CAGR | 5.69% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Instrument, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

In Vitro Fertilization (IVF) Market Segments

By Type

- Fresh Nondonor

- Frozen Nondonor

- Fresh Donor

- Frozen Donor

By Instrument

- Disposable Devices

-

Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

-

Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Others

By End-User

- Fertility Clinics

- Hospitals

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.