Indoor Positioning and Navigation Market Size, Share & Trends Analysis Report By Component (Software, Hardware, Service), By Technology (Ultra-Wideband Technology, Bluetooth Low Energy, Wi-Fi, Others), By Application (Asset & Personnel Tracking, Location-Based Analytics, Navigation & Maps, Others), By End-use (Healthcare, Retail, Manufacturing, Travel & Hospitality, Office Spaces, Public Spaces, Logistics & Warehouses, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Indoor Positioning and Navigation Market Size

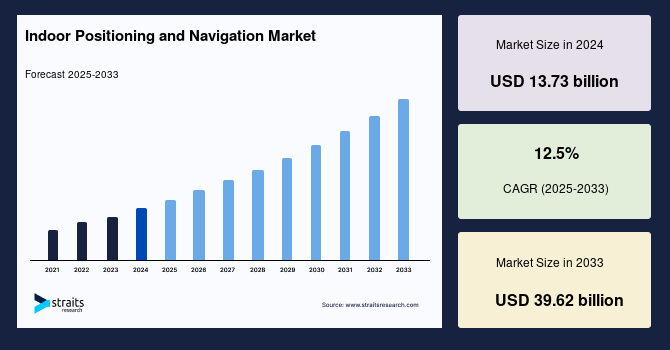

The global indoor positioning and navigation market size was valued at USD 13.73 billion in 2024 and is projected to grow from USD 15.44 billion in 2025 to USD 39.62 billion by 2033, exhibiting a CAGR of 12.5% during the forecast period (2025-2033).

The global market comprises technologies and solutions to locate and guide people or assets in indoor environments where GPS signals are weak or unavailable. These systems use Wi-Fi, Bluetooth beacons, UWB, RFID, and sensor fusion for navigation, mapping, and location analytics in facilities such as airports, shopping malls, hospitals, and warehouses.

The global indoor positioning and navigation industry growth is driven by smart building initiatives, IoT integration, and demand for enhanced customer experiences and operational efficiency. Applications span retail analytics and asset tracking to emergency response and workforce management. Continuous technological innovations improve accuracy, scalability, and real-time location services. Additionally, the surging adoption of smartphones and smart devices coupled with advanced sensors drives market growth. Business firms utilize indoor positioning technologies to offer custom services, process optimization, and rich customer behavior insights that promote performance and competitiveness. This trend thus creates substantial demand for innovative indoor positioning systems across all sectors.

Latest Market Trend

Integration of Iot and Smart Devices

The integration of Internet of Things (IoT) devices and smart technologies has significantly transformed indoor navigation systems. Smart device sensors facilitate precise indoor positioning and real-time tracking, enhancing user experiences in complex environments like airports and shopping malls. Technologies such as Wi-Fi, Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB) are increasingly combined to offer accurate and cost-effective solutions.

- For example, in February 2025, NextNav expanded its Metropolitan Beacon System (MBS) by acquiring additional spectrum licenses in the lower 900 MHz band. This move enhances their ability to provide high-precision indoor positioning services in areas where GPS signals are unreliable, supporting the integration of IoT devices in smart environments.

The proliferation of IoT-enabled devices enables businesses to collect and analyze location data, leading to improved operational efficiency and personalized services. This trend is particularly evident in sectors like retail and healthcare, where real-time location tracking enhances asset management and patient care.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 13.73 Billion |

| Estimated 2025 Value | USD 15.44 Billion |

| Projected 2033 Value | USD 39.62 Billion |

| CAGR (2025-2033) | 12.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Cisco Systems, Ekahau, Google (Alphabet Inc.), HERE Technologies, Honeywell International Inc. |

to learn more about this report Download Free Sample Report

Indoor Positioning and Navigation Market Growth Factor

Increased Demand in the Healthcare Sector

The healthcare sector is experiencing a growing demand for Indoor Positioning and Navigation systems to enhance patient care, manage medical equipment, and streamline operations. Real-Time Location Systems (RTLS) enable hospitals to track the location of patients, staff, and assets, facilitating prompt responses during emergencies and improving overall efficiency.

- For example, in August 2024, Zebra Technologies implemented Real-Time Location Systems (RTLS) in healthcare facilities to track assets, staff, and patients in real-time. This integration has led to a 20% increase in productivity and reduced patient wait times, demonstrating the operational benefits of indoor positioning systems.

In large healthcare facilities, IPS aids in navigating complex layouts, ensuring that patients and visitors can easily find their destinations. Additionally, these systems contribute to infection control by monitoring the movement of individuals and equipment, thereby enhancing safety protocols.

Market Restraint

Complexity in Integration with Existing Systems

Integrating indoor positioning solutions into existing building management or corporate systems presents significant challenges for many organizations. Legacy systems are often incompatible with modern positioning technologies, such as Bluetooth, Wi-Fi, and UWB, necessitating substantial upgrades or replacements. This integration process requires specialized technical expertise to ensure seamless operation, leading to increased implementation costs and extended timelines. Small to medium-sized enterprises may find these requirements particularly burdensome, hindering the adoption of advanced indoor location systems.

Furthermore, the need for customized solutions to align with diverse operational tools and platforms adds to the complexity. Addressing these integration challenges necessitates careful planning, adequate funding, and skilled personnel to achieve successful implementation and maximize the benefits of indoor positioning technologies.

Market Opportunity

Growth of Augmented Reality (ar) in Navigation

Augmented Reality (AR) is increasingly being integrated into indoor navigation systems to provide users with an immersive and intuitive experience. By overlaying digital information onto the physical environment, AR facilitates easier navigation through complex indoor spaces such as large airports, shopping centers, and museums. This technology enhances user engagement by providing real-time, context-aware guidance, reducing confusion, and improving overall satisfaction.

- For example, Apple Inc. has introduced AR-based indoor navigation features in its Maps app, utilizing LiDAR sensors and ARKit technology to offer immersive, turn-by-turn directions within large indoor spaces like airports and shopping malls. This development enhances user experience by overlaying digital information onto the physical environment.

As AR technology advances, its integration with indoor positioning systems is expected to become more prevalent, offering innovative solutions for navigation challenges in various sectors, including retail, healthcare, and hospitality.

Regional Insights

North America: Dominant Region with 43% Market Share

North America leads the global indoor positioning and navigation market, holding approximately 43% of the market share, primarily driven by early technology adoption, robust infrastructure, and supportive government policies. The U.S. and Canada are at the forefront of implementing indoor navigation systems across retail, healthcare, hospitality, and transportation sectors. Advanced commercial and airport infrastructures in cities like New York, Los Angeles, and Toronto increasingly rely on indoor navigation to enhance user experiences, from wayfinding to resource management.

Moreover, the region’s strong presence of major technology companies and ongoing investments in smart city initiatives further drive innovation in indoor positioning technologies. The retail sector, in particular, has embraced IPN solutions to boost customer engagement and gather valuable behavioral data through location analytics.

United States Market Trends

The U.S. is a major market for Indoor Positioning and Navigation (IPN) due to the widespread adoption of advanced technologies across sectors like retail, healthcare, transportation, and commercial real estate. The high mobile penetration and growing IoT ecosystem boost IPN growth with location-based services (LBS) applications in malls, airports, hospitals, and exhibition centers. Real-time location systems (RTLS) for staff and resource tracking in healthcare further drive market demand.

Asia-Pacific: Fastest-Growing Region with the Highest Market Cagr

Asia-Pacific is the fastest-growing global indoor positioning and navigation region and is projected to witness the highest compound annual growth rate (CAGR) over the coming years. Rapid urbanization, increasing smartphone penetration, and rising investments in public infrastructure such as airports, shopping complexes, and transportation hubs are major factors propelling growth.

Countries like China, India, Japan, and South Korea are responsible for adopting IPN technologies for smart city development, real-time location services, and digital transformation across industries. China’s aggressive push toward smart city deployment and integrating IoT solutions in public and private infrastructure catalyzes widespread IPN adoption. The healthcare and commercial real estate sectors in India invest in advanced navigation systems to enhance operational efficiency and customer experience.

Indian Industry Insights

India’s IPN market is growing with rising smartphone penetration and the expansion of retail and healthcare industries. With the growth of e-commerce, brick-and-mortar stores are adopting IPN for personalized services. In healthcare, RTLS adoption is increasing to improve asset tracking and patient management.

country Insights

- United Kingdom: The UK has effectively integrated IPN in retail, transportation, and healthcare sectors. With the rise of shopping centers, stadiums, and airports, there’s increased demand for enhanced customer experiences and operational efficiency. The healthcare sector also adopts IPN for real-time asset tracking and patient management.

- Germany: Germany, a leader in innovation, is seeing steady growth in IPN usage, especially in large enterprises and healthcare settings. With Industry 4.0 and smart infrastructure initiatives, demand for accurate indoor navigation and resource tracking continues to rise, particularly in hospitals using RTLS for clinical equipment.

- China: China is rapidly expanding its IPN market, driven by urbanization and infrastructure development in commercial and residential buildings. The government's push for smart cities and IoT technologies places China at the forefront of indoor positioning, with increasing adoption in retail, airports, and healthcare for asset tracking and location-based services.

Segmentation Analysis

By Component

The software segment dominates the global indoor positioning and navigation (IPN) market due to its critical role in enabling system interoperability, real-time analytics, and seamless integration with third-party applications. As smart infrastructure and IoT ecosystems expand across urban landscapes, indoor navigation software must evolve to integrate with cloud platforms, AI-driven analytics engines, and diverse IoT sensor networks. The rise of smart cities and connected environments demands scalable, customizable software solutions to manage complex data streams, deliver predictive insights, and enhance decision-making.

By Technology

Bluetooth Low Energy (BLE) leads the technology segment of the indoor positioning and navigation market due to its affordability, energy efficiency, and compatibility with existing consumer devices such as smartphones and tablets. BLE-based beacons offer a cost-effective alternative to more infrastructure-intensive technologies, allowing organizations to deploy indoor tracking systems without significant capital investment. The ability to support precise location detection in complex indoor settings like multi-level retail centers, convention centers, museums, and airports makes BLE attractive. BLE’s widespread adoption is also driven by its ease of maintenance, scalability, and flexibility for integration with mobile apps, customer engagement platforms, and augmented reality tools.

By Application

Asset and personnel tracking represents the largest application segment, fueled by the need for real-time visibility, efficiency, and security in business-critical environments. With the proliferation of IoT-enabled sensors, RFID tags, and smart badges, enterprises can now monitor the movement and condition of physical assets and personnel with pinpoint accuracy. This is particularly crucial in healthcare, manufacturing, logistics, and enterprise settings, where tracking ensures operational continuity, loss prevention, and compliance with safety protocols. For example, hospitals use RTLS to track the location of patients, medical equipment, and staff, ensuring quick response times and efficient workflows.

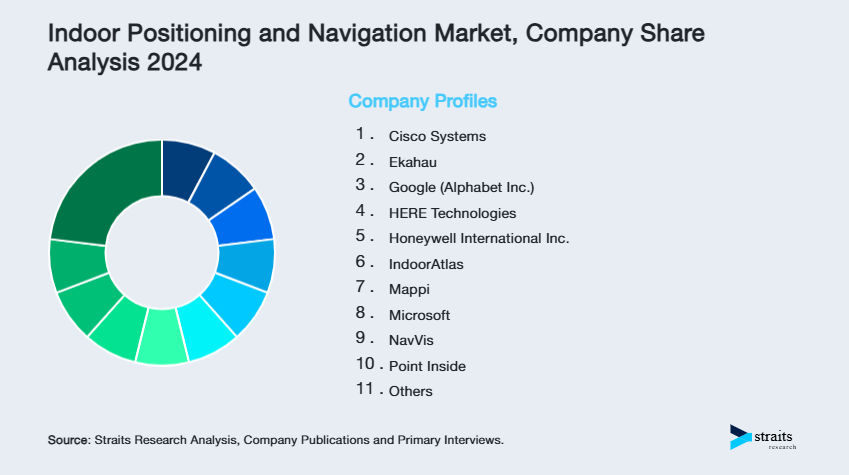

Company Market Share

The indoor Positioning and Navigation market is very competitive, with major participants from diverse industries, including enterprise-level solutions, real-time tracking systems, smartphones, and Internet of Things devices. The leading firms in the industry are Apple, Google, Honeywell, and Siemens, which offer all-inclusive solutions to various industries, such as manufacturing, transportation, healthcare, and retail. Leveraging advances in BLE, Wi-Fi, GPS, and IOT, these companies are growing and fulfilling a surging demand for asset management and seamless interior navigation across industries.

Cisco Systems, Inc.: An Emerging Player in the Indoor Positioning and Navigation Market

Cisco had the major infrastructure services and wireless solutions in this industry. With CMX technology, businesses can provide their customers with location-based services and real-time interior navigation. Especially for big commercial and industrial locations, Cisco was certainly a significant competitor for enterprises at the indoor positioning level, considering network equipment and business acquisitions in companies specialized in Wi-Fi and BLE positioning systems.

Recent developments at Cisco Systems include:

- In February 2024, Cisco System's new AP Auto find is revolutionizing large-scale wireless AP network administration through a ground-breaking capability to let users precisely find APs at the campus, building, and floor level.

List of Key and Emerging Players in Indoor Positioning and Navigation Market

- Cisco Systems

- Ekahau

- Google (Alphabet Inc.)

- HERE Technologies

- Honeywell International Inc.

- IndoorAtlas

- Mappi

- Microsoft

- NavVis

- Point Inside

- Samsung Electronics

- Siemens AG

- Ubisense

- Zebra Technologies

to learn more about this report Download Market Share

Recent Developments

- August 2024- Verizon Communications Inc. partnered with healthcare providers to deploy indoor positioning systems that enhance patient care by enabling efficient navigation within hospital facilities. These systems improve emergency response times and streamline hospital operations.

Analyst Opinion

As per our analyst, the global indoor positioning and navigation market is witnessing significant growth driven by technological advancements and increasing adoption across various sectors. Integrating IoT, smart devices, and real-time location systems (RTLS) transforms indoor navigation, particularly in retail, healthcare, and transportation. These technologies enhance user experience, optimize operational efficiency, and enable personalized services, especially in large venues like malls, airports, and hospitals. The growing demand for augmented reality (AR) in navigation further enriches user engagement by providing intuitive, real-time guidance.

The healthcare sector is also a key driver, as IPN solutions improve patient management, asset tracking, and operational flow. The rapid adoption of smartphones and IoT devices fuels the demand for more sophisticated location-based services and data analytics. As smart cities evolve, the need for efficient indoor navigation solutions will increase, ensuring sustained market growth in the coming years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 13.73 Billion |

| Market Size in 2025 | USD 15.44 Billion |

| Market Size in 2033 | USD 39.62 Billion |

| CAGR | 12.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Technology, By Application, By End-use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Indoor Positioning and Navigation Market Segments

By Component

- Software

- Hardware

- Service

By Technology

- Ultra-Wideband Technology

- Bluetooth Low Energy

- Wi-Fi

- Others

By Application

- Asset & Personnel Tracking

- Location-Based Analytics

- Navigation & Maps

- Others

By End-use

- Healthcare

- Retail

- Manufacturing

- Travel & Hospitality

- Office Spaces

- Public Spaces

- Logistics & Warehouses

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.