Industrial Valves Market Size, Share & Trends Analysis Report By Product Type (Gate Valves, Globe Valves, Butterfly Valves, Ball Valves, Check Valves, Plug Valves, Others), By Functionality (On-Off/Isolation Valves, Control Valves), By Material (Steel, Cast Iron, Alloy-Based, Others), By End-Use Industry (Oil & Gas, Power Generation, Pharmaceutical, Water & Wastewater Treatment, Chemical, Food & Beverage, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Industrial Valves Market Size

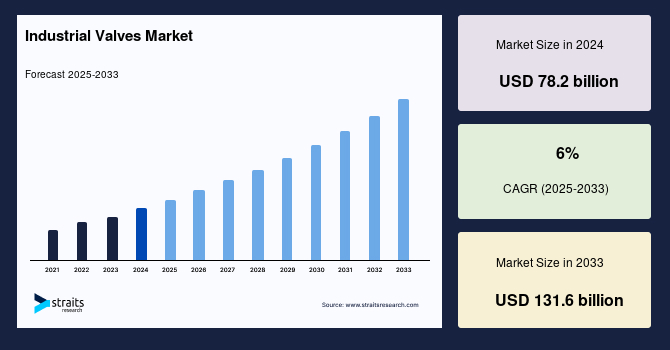

The global industrial valves market size was valued at USD 78.2 billion in 2024 and is projected to grow from USD 86.67 billion in 2025 to USD 131.6 billion by 2033, exhibiting a CAGR of 6% during the forecast period (2025-2033).

The global industrial valves market is poised for significant growth, driven by escalating demand across sectors such as oil & gas, water & wastewater treatment, power generation, and chemical processing. The modernisation of ageing infrastructure and rapid industrialisation in emerging economies propels the need for advanced valve solutions. Technological advancements, including integrating IoT and automation in valve systems, enhance operational efficiency and real-time monitoring capabilities. Furthermore, the emphasis on energy efficiency and stringent environmental regulations encourages the adoption of smart valves that offer precise control and reduced emissions. The Asia-Pacific region, particularly countries like China and India, is witnessing substantial investments in infrastructure and industrial projects, further augmenting market growth.

Latest Market Trend

Integration of Smart Technologies in Valves

A prominent trend in the industrial valves market is the integration of smart technologies, transforming traditional valves into intelligent systems capable of real-time monitoring and control. The adoption of Industrial Internet of Things (IIoT) and automation enables valves to communicate operational data, predict maintenance needs, and optimise performance. Companies invest in R&D to develop valves with embedded sensors and actuators that adapt to varying operational conditions. These smart valves facilitate predictive maintenance, reducing downtime and operational costs.

- For example, in November 2024, SPX FLOW introduced the CU4plus ASi-5 control unit, enhancing valve management with IoT capabilities, supporting up to 96 devices, and offering faster response times and improved connectivity. Similarly, Parker Hannifin launched the TFP throttle valve series with the DFplus Gen IV pilot valve, delivering 30% faster response and improved flow rates. These advancements enable real-time monitoring, predictive maintenance, and optimised industry performance.

Moreover, integrating artificial intelligence and machine learning algorithms allows for advanced data analytics, enhancing decision-making processes. The trend towards smart valves aligns with the broader movement towards Industry 4.0, emphasising automation and data exchange in manufacturing technologies. As industries prioritise efficiency and reliability, the demand for intelligent valve solutions is expected to rise, solidifying their role in modern industrial operations.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 78.2 Billion |

| Estimated 2025 Value | USD 86.67 Billion |

| Projected 2033 Value | USD 131.6 Billion |

| CAGR (2025-2033) | 6% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Emerson Electric Co., Flowserve Corporation, IMI plc, Rotork plc, KSB SE & Co. KGaA |

to learn more about this report Download Free Sample Report

Market Growth Factor

Expansion of the Oil and Gas Industry

The expansion of the oil & gas industry is a significant driver for the industrial valves market. Valves are critical components in upstream, midstream, and downstream operations, ensuring safe and efficient flow control of hydrocarbons. The resurgence of oil exploration activities, especially in regions like the Middle East, North America, and Asia-Pacific, is increasing the demand for high-performance valves.

- For instance, in August 2024, Arrow Energy announced plans to expand the Surat Gas Project in Queensland, Australia, aiming to develop 450 new gas wells to meet increasing energy demands. This expansion necessitates advanced valve solutions capable of withstanding extreme conditions and ensuring operational efficiency.

Additionally, developing unconventional oil and gas resources, such as shale gas and oil sands, requires specialised valves capable of withstanding extreme pressures and temperatures. Integrating smart valve technologies in the oil & gas sector enhances operational efficiency, safety, and environmental compliance. As global energy demand continues to rise, the oil & gas industry's growth will directly influence the expansion of the industrial valves market.

Market Restraint

High Installation and Maintenance Costs

Despite the numerous advantages of advanced industrial valves, high installation and maintenance costs significantly restrain market growth. The initial investment for smart valve systems, including sensors, actuators, and communication modules, is substantially higher than that of traditional valves. Additionally, the complexity of these systems necessitates specialised personnel for installation and maintenance, further increasing operational expenses. For small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting the adoption of advanced valve technologies.

Moreover, integrating smart valves into existing infrastructure may require substantial modifications, leading to increased downtime and associated costs. These financial barriers can deter potential users from upgrading to advanced valve systems, particularly in cost-sensitive industries. To mitigate this restraint, manufacturers focus on developing cost-effective solutions and offering flexible financing options to encourage adoption.

Market Opportunity

Infrastructure Development in Emerging Economies

Emerging economies present significant opportunities for the industrial valves market, primarily due to extensive infrastructure development projects. Countries like India, China, and Brazil invest heavily in water and wastewater treatment, power generation, and oil & gas to support their growing populations and industrial activities. These projects require various industrial valves for flow control, pressure regulation, and safety applications.

- For instance, in August 2024, India's Union Cabinet approved the development of the Palakkad Industrial Smart City in Kerala, a greenfield project spanning 1,710 acres with an estimated investment of ₹28,602 crore. This initiative, part of the Kochi-Bengaluru Industrial Corridor, focuses on sectors like chemicals, machinery, and equipment, all requiring sophisticated valve systems.

Government initiatives to improve water infrastructure and energy efficiency propel the demand for advanced valve solutions. Additionally, adopting smart city concepts in these regions is leading to the integration of intelligent valve systems for better resource management. Manufacturers have the opportunity to establish a strong presence in these markets by offering customised solutions that cater to the specific needs of emerging economies. Collaborations with local partners and investments in regional manufacturing facilities can also enhance market penetration and competitiveness.

Regional Analysis

Asia-Pacific accounted for the largest revenue share of 35.8% and is expected to witness the fastest growth over the forecast period. The region's rapid industrialisation, infrastructural development, and growing emphasis on energy efficiency are key drivers. Countries like China, India, and Japan are experiencing significant demand for advanced valves due to manufacturing, automotive, and power generation developments. For instance, in February 2024, Japan extended approximately USD 1.5 billion in loans for nine infrastructural projects in India, underscoring the region's commitment to industrial growth. Moreover, integrating digitalisation and IoT into valve systems transforms the industry, with smart valves enhancing efficiency and reducing downtime.

Chinese Market Trends

China remains one of the fastest-growing markets for industrial valves, driven by rapid industrialisation, urban infrastructure upgrades, and government initiatives like Made in China 2025 and dual carbon goals. The growth of sectors such as chemicals, metallurgy, and district heating further contributes to rising valve usage. Additionally, China's aggressive push for smart manufacturing and digitalisation is fueling the adoption of IIoT-enabled valve systems, especially in regions like Guangdong, Jiangsu, and Sichuan.

India’s industrial valves market is experiencing robust growth, fueled by rapid urbanisation, expanding industrial base, and infrastructure mega-projects like PM Gati Shakti and Smart Cities Mission. These investments drive demand across end-use sectors such as power generation, automotive, steel, and water treatment. Furthermore, the country’s expanding oil refining and petrochemical industries and the Make in India initiative encourage domestic valve manufacturing and the adoption of advanced technologies to meet rising performance and sustainability standards.

North America: Fastest-Growing Region

North America is expected to grow significantly over the forecast period, driven by industrialisation and increasing population, which drive the demand for efficient energy generation and delivery. The growth in oil & gas production, exploration, and renewable energy sources fuels the need for high-performance industrial valves. For example, the U.S. Energy Information Administration reported that crude oil production in the U.S. averaged 12.9 million barrels per day in 2023, surpassing previous records. Additionally, the surge in water and wastewater treatment projects, driven by concerns over water scarcity and infrastructure ageing, contributes to the demand for advanced valve solutions.

United States Market Trends

The U.S. industrial valves market reached USD 11.4 million in 2024 and is projected to grow at a CAGR of 3.63% through 2033. The country's robust oil & gas industry, technological advancements, and government initiatives supporting domestic manufacturing drive the market. Moreover, the push for modernisation of water and wastewater systems and adoption of smart manufacturing are accelerating the integration of intelligent valve systems across sectors like power generation, pharmaceuticals, and chemical processing.

Canada’s industrial valves market is expanding due to rising investments in oil sands, LNG terminals, and municipal water treatment infrastructure. The government’s emphasis on sustainable energy and environmental stewardship supports adopting advanced valve technologies that enhance operational efficiency and reduce emissions. Additionally, growing interest in carbon capture and storage (CCS) projects and hydrogen fuel infrastructure is expected to drive further demand for valves suitable for high-pressure, corrosive environments.

Europe: Steady Growth

Europe's industrial valves market is expected to grow at a CAGR of around 5.65% during the forecast period (2024-2030). Strict environmental regulations, prioritising energy efficiency and sustainable practices, compel industries to embrace advanced valve technologies. The increasing number of industrial projects, such as the construction of Bechtel's first nuclear power plant in Poland in April 2024, is expected to drive market growth. Moreover, Europe's diverse oil & gas industry, including exploration and production in the North Sea, contributes to the demand for industrial valves. The region's focus on renewable energy projects, such as hydro, wind, and solar power, further supports the market's steady growth.

United Kingdom's Market Trends

The UK’s industrial valves market is witnessing steady growth, supported by a surge in infrastructure renewal, energy transition projects, and technological innovation. Moreover, the UK government’s Net Zero Strategy and investments in offshore wind energy, carbon capture, and district heating systems foster demand for advanced and sustainable valve solutions. The rise of Industry 4.0 in the UK’s industrial base also prompted increased adoption of smart and automated valve systems.

Germany’s industrial valves market is driven by its advanced manufacturing sector, strong regulatory emphasis on energy efficiency, and leadership in renewable energy deployment. The country’s transition toward a low-carbon economy, supported by the “Energiewende” policy, is fueling the adoption of intelligent valves in wind, solar, and hydrogen energy projects. Furthermore, smart factory developments under Industry 4.0 are increasing the need for connected valve systems that offer predictive maintenance and remote control capabilities across process industries.

Product Type Insights

Ball valves continue to lead the industrial valves market, accounting for over 17.3% of global revenue in 2024. Their durability, low maintenance, and excellent shut-off capabilities make them indispensable across industries such as oil & gas, water treatment, and chemicals. The demand for automation and efficient flow control further propels this segment's growth. In November 2023, Flowserve Corporation introduced the Worcester Cryogenic series, a quarter-turn floating ball valve designed for cryogenic applications, enhancing safety and performance in extreme conditions. Additionally, the increasing adoption of smart valves equipped with sensors and actuators aligns with Industry 4.0 initiatives, enabling real-time monitoring and predictive maintenance.

Functionality Insights

On-Off/Isolation valves hold a significant market share due to their critical role in ensuring safety and operational efficiency. These valves are essential in applications requiring complete system shutdowns or isolations, such as in oil & gas pipelines and power plants. The growing emphasis on safety standards and the need for reliable isolation mechanisms drive demand in this segment. Advancements in valve technology, including integrating smart features, enhance their functionality. For example, Xylem introduced a single-use pump with an adjustable and integrated pressure relief valve in April 2024, minimising fluid contamination risks and maximising operator safety. Such innovations underscore the importance of On-Off/Isolation valves in modern industrial operations.

Material Insights

Steel valves are preferred for their strength, durability, and resistance to high pressures and temperatures. They are widely used in oil & gas, power generation, and chemicals. The material's ability to withstand harsh environments and its compatibility with various fluids make it a dominant choice in the market. For instance, the North American industrial valves market was valued at USD 32.10 billion in 2024 and is projected to reach USD 52.61 billion by 2032, growing at a CAGR of 6.37%. This growth is partly attributed to the demand for robust materials like steel in valve manufacturing. Moreover, the increasing focus on energy efficiency and environmental sustainability drives the adoption of steel valves with advanced coatings and designs that minimise emissions and energy losses.

End-Use Industry Insights

The oil & gas industry remains the largest end-user of industrial valves, accounting for approximately 35% of the global market share in 2024. Valves are crucial in controlling flow rates, ensuring safety, and maintaining operational efficiency in exploration, production, and refining processes. The ongoing investments in oil & gas infrastructure and the need for advanced flow control solutions fuel demand in this sector. For instance, Baker Hughes reported a 44% surge in orders for its gas technology equipment business in Q4 2024, highlighting the increasing demand for specialised valves in natural gas applications. Additionally, expanding unconventional oil and gas resources, such as shale gas and oil sands, necessitates valves capable of withstanding extreme pressures and temperatures, further driving market growth.

Company Market Share

The industrial valves market is highly competitive, with key players focusing on innovation, strategic partnerships, and geographical expansion.

Emerson Electric Co.: Emerson Electric Co. is a leading player in the industrial valves market, offering various valve solutions across multiple industries. The company's focus on innovation and technology integration has strengthened its market position.

- In May 2024, Emerson raised its profit forecast, anticipating continued demand for its measurement and analytical devices across the chemical, oil, and gas industries.The company's acquisition of AspenTech has enhanced its automation capabilities, positioning it as a leader in the market.

List of Key and Emerging Players in Industrial Valves Market

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- Rotork plc

- KSB SE & Co. KGaA

- Samson AG

- Weir Group plc

- Mankenberg GmbH

- Kirloskar Brothers Limited

- Alfa Laval AB

- PJ Valves

- Beijer Tech

- Tecnik Fluid Controls

- MOGAS Industries

to learn more about this report Download Market Share

Recent Developments

- November 2024- Samson introduced the new modular Type 251GR valve, designed to enhance efficiency in industrial applications. The valve features a modular design for flexibility, easy maintenance, and adaptability in various process control scenarios

- August 2024- Flowserve announced its agreement to acquire MOGAS Industries for USD 290 million to strengthen its position in the mining and mineral extraction sectors.

- February 2024- Beijer Tech agreed to acquire 100% of AVS Power Oy, a Finnish manufacturer of industrial valves, to enhance its product portfolio and expand its presence in the Nordic region.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 78.2 Billion |

| Market Size in 2025 | USD 86.67 Billion |

| Market Size in 2033 | USD 131.6 Billion |

| CAGR | 6% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Functionality, By Material, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Industrial Valves Market Segments

By Product Type

- Gate Valves

- Globe Valves

- Butterfly Valves

- Ball Valves

- Check Valves

- Plug Valves

- Others

By Functionality

- On-Off/Isolation Valves

- Control Valves

By Material

- Steel

- Cast Iron

- Alloy-Based

- Others

By End-Use Industry

- Oil & Gas

- Power Generation

- Pharmaceutical

- Water & Wastewater Treatment

- Chemical

- Food & Beverage

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.