Inertial Measurement Unit (IMU) Market Size, Share & Trends Analysis Report By Product Type (IMU Modules, Gyroscopes, Magnetometers, Accelerometers, Other Product Types), By Technology (MEMS, Mechanical Gyro, Fibre-Optic Gyro, Ring Laser Gyro, Other Technologies), By Application (Aerospace & Defense, Automotive, Consumer Electronics, Marine, Healthcare, Other Applications) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Inertial Measurement Unit (IMU) Market Overview

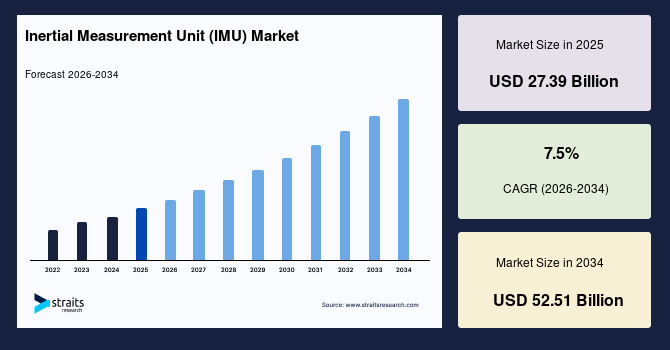

The global inertial measurement units (IMUs) market size is estimated at USD 27.39 billion in 2025 and is projected to reach USD 52.51 billion by 2034, growing at a CAGR of 7.5% during the forecast period. The major driver for the IMU industry is the growing demand for precision navigation, stabilization, and motion sensing applications in aerospace, automotive, and consumer electronics markets. Ongoing technological innovation in MEMS-based IMUs and their expanding uses in emerging industries like AR and VR are also further driving industry growth and wider industry adoption.

Key Market Trends & Insights

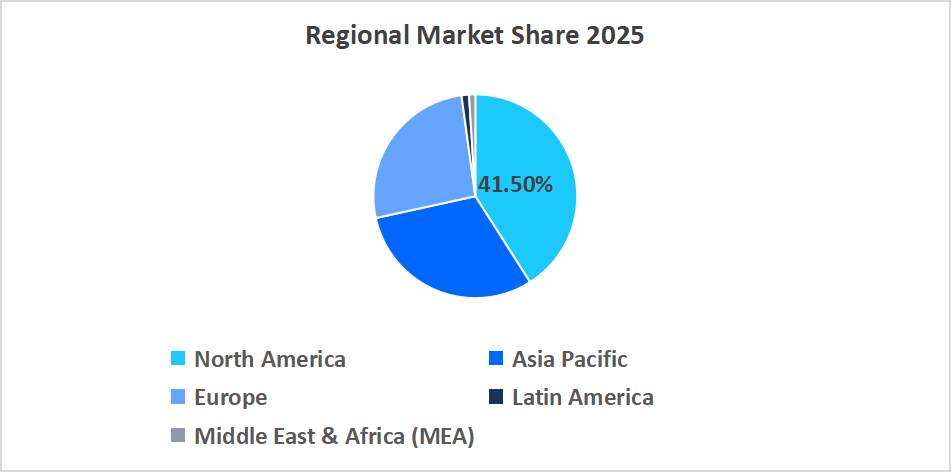

- North America held a dominant share of the market, accounting for50% of the overall market share in 2025.

- Asia Pacific region is projected to grow at the highest rate, with a CAGR of roughly 9.5% from 2026 to 2034.

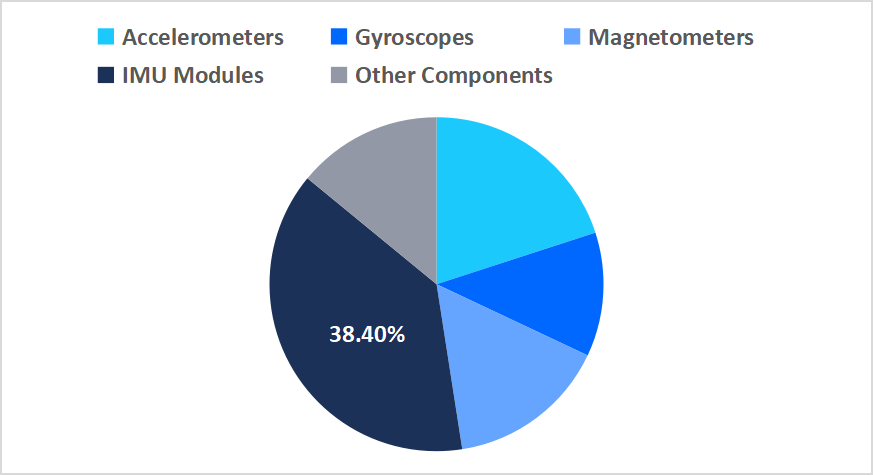

- Among product types, the IMU modules segment led the market with a revenue share of 38.40% in 2025.

- MEMS-based IMUs are expected to register a high CAGR of around 8.2%.

- By Application, the aerospace and defense is expected to increase at a steady CAGR of approximately 8.2%.

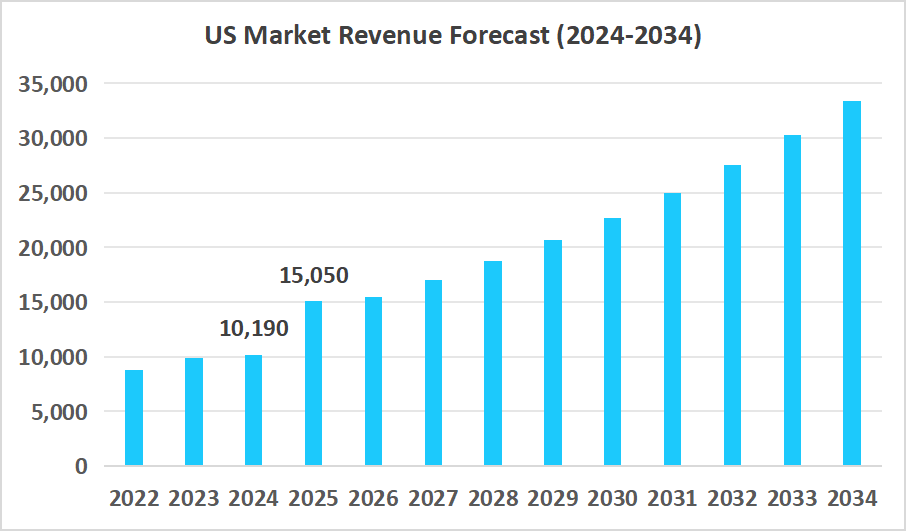

- The United States remains the biggest market for IMUs, worth about USD 10.19 billion in 2024 and expected to rise to USD 15.05 billion by 2034.

Table: U.S Inertial Measurement Unit (Imu) Market Size (USD Million)

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 39billion

- 2034 Projected Market Size: USD 51billion

- CAGR (2026–2034): 2%

- Largest Market in 2025: North America

- Fastest Growing Region: Asia Pacific

The global inertial measurement unit (IMU) market encompasses a broad range of motion sensing and navigation solutions, including gyroscopes, accelerometers, magnetometers, and sensor fusion systems. These solutions are deployed across various applications such as autonomous vehicles, advanced driver-assistance systems (ADAS), drones, industrial automation, and wearable robotics. Furthermore, IMU technologies are adopted by diverse end-use industries, including automotive, aerospace, robotics, and consumer electronics, addressing the need for precise motion tracking, navigation, and operational efficiency through comprehensive, AI-supported, and sensor-integrated systems across global markets. Encouraging government support for smart mobility initiatives and Industry 4.0, along with increased investments in AI-driven sensor fusion and predictive analytics, is further driving market growth.

Latest Market Trends

Increasing Investment in AI-Integrated and Multi-Sensor IMU Solutions

Companies of Inertial Measurement Units (IMUs) is shifting toward AI and multi-sensor IMU systems. owing to demand for smart motion sensing, predictive navigation, and autonomous decision-making in industrial robots, space, and autonomous vehicles is increasing. These systems incorporate embedded AI algorithms that leverage accelerometers, gyroscopes, and magnetometers to correct errors, alert against potential failures, and alter their trajectories as necessary. Additionally, AI-driven IMU solutions enable adaptive calibration in real time, improving system reliability and performance across dynamic environments. Growing partnerships between AI solution providers and IMU manufacturers are accelerating the development of next-generation predictive navigation technologies.

Expanding Adoption of IMU Modules in Autonomous and Aerospace Systems

With the rapid demand of IMU modules and IMU systems, as well as used to offer real-time, accurate, and consistent motion sensing for automotive, aerospace, robotics, and consumer electronics. Incorporating integration to autonomous drones, intelligent cars, industrial automation, and wearable robotics makes operations more effective, reduces navigation errors, and facilitates advanced predictive control. Technological advancements in miniaturization and energy-efficient designs are enabling broader adoption in compact and mobile platforms. Continuous improvements in sensor fusion and wireless connectivity are further enhancing the precision and reliability of IMU-enabled systems across applications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 27.39 Billion |

| Estimated 2026 Value | USD 29.47 Billion |

| Projected 2034 Value | USD 52.51 Billion |

| CAGR (2026-2034) | 7.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Analog Devices Inc., Honeywell International Inc., Bosch Sensortec GmbH, STMicroelectronics N.V., Northrop Grumman Corporation |

to learn more about this report Download Free Sample Report

Inertial Measurement Unit (IMU) Market Driver

Growing Applications of IMUs in Autonomous Cars and Advanced Driver Assistance Systems (ADAS)

The increasing pace in the development of autonomous driving technology and ADAS in the automobile sector is driving up the need for extremely accurate and reliable IMUs. The sensors offer critical measurements of acceleration, rotation, and orientation, which facilitate safe lane-keeping, adaptive cruise control, and accurate navigation in environments with poor GPS availability. Furthermore, integration with AI-powered control systems allows predictive maneuvering and collision avoidance, enhancing overall vehicle safety. Continuous improvements in sensor accuracy and miniaturization are enabling broader adoption of IMUs in passenger vehicles and commercial fleets alike.

Integration of IMUs in Electric and Hybrid Vehicles

Growing production of electric and hybrid cars is propelling the need for advanced IMUs to optimize vehicle stability, energy efficiency, and battery management. The sensors deliver accurate motion and orientation information for regenerative braking, torque vectoring, and real-time energy optimization

IMU integration helps improve vehicle handling under diverse driving conditions, ensuring a smoother and safer ride experience. The combination of IMUs with advanced vehicle control software also enables better predictive maintenance and energy management, supporting sustainable mobility goals.

Market Restraint

Skilled Workforce Shortage and Complex IMU Integration Challenges

The global Inertial Measurement Unit (IMU) market is growing slowly because there aren't enough skilled engineers and technical staff who can design, calibrate, and integrate advanced IMU systems into aerospace, automotive, industrial, and robotics applications. Deploying high-precision IMUs often requires knowledge of sensor fusion, AI-driven motion correction, and integrating systems across multiple platforms. This knowledge is hard to come by in new markets.The shortage of experienced personnel delays system deployment and increases development costs for manufacturers. Training programs and specialized courses are limited, making talent acquisition challenging for emerging IMU markets. These constraints hinder rapid adoption in regions that are increasingly investing in autonomous systems and industrial automation.

Market Opportunities

AI-Enabled IMU Investments in Smart Manufacturing and Autonomous Logistics

The global Inertial Measurement Unit (IMU) industry is increasing gradually due to the lack of skilled engineers and technical personnel who could develop, calibrate, and implement sophisticated IMU systems in aerospace, automotive, industrial, and robotics applications. High-precision IMUs are often deployed using expertise related to sensor fusion, AI-based motion correction, and system integration across platforms. Such expertise is difficult to find in emerging markets. Increasing investments in AI-enabled IMU solutions for smart factories and autonomous logistics platforms are creating new growth opportunities. Collaboration between IMU manufacturers and technology providers is helping acceleratethe adoption of advanced motion sensing systems. Additionally, government incentives for Industry 4.0 and autonomous transportation initiatives are expected to drive broader implementation of IMU-based technologies globally.

Regional Analysis

In 2025, the North American region accounted for about 41.5% of the IMU market, resulting in the largest market. Leading companies like Analog Devices, Honeywell Aerospace, and Northrop Grumman are pushing for new ideas. For example, Analog Devices' ADIS16547 tactical-grade MEMS IMU focuses on tracking motion in real time with great accuracy. Honeywell launched the SmartNav IMU-400 in March 2025. This small module provides highly accurate orientation and navigation data for drones, self-driving cars, and aerospace platforms, which helped the market grow in the region.

The U.S. is adding new technological advancements such as AI and LLM strategies, tp Invest in their research and development, and tactical MEMS modules. This will driving the growth over the forecast period. For example, the SmartNav IMU-400 from Honeywell is for drones, self-driving cars, and aerospace uses.

Asia Pacific Inertial Measurement Unit (IMU) Market Insights

The Asia Pacific region is the fastest-growing market, with a CAGR of 9.5%, thanks to the use of self-driving cars, drones, and industrial robots. TechMotion Systems, AeroNav Technologies, and STMicroelectronics work with manufacturers in the area to bring new MEMS and tactical-grade IMU solutions to market. Government programs that promote smart mobility and modernization of the military are making IMUs more popular, which is helping the market grow even more.

The IMU market in China is growing quickly, thanks in part to USD 520 million in government funding for research on advanced sensors. AeroNav Technologies and STMicroelectronics are working together with local businesses to improve production. AeroNav released the NavTrack IMU-300 series in June 2025. This series lets UAVs, regional aircraft, and self-driving cars navigate and keep an eye on their systems in real time.

Europe Inertial Measurement Unit (IMU) Market Insights

Europe held a high share in the Inertial Measurement Unit (IMU) market of 2025 due to aerospace, defense, and automotive technology advancements. Industry leaders such as Bosch Sensortec, STMicroelectronics, and Safran Electronics & Defense are leading the development of high-accuracy MEMS and tactical-grade IMUs, for example, tiny modules for drones, autonomous cars, and industrial robots. Bosch Sensortec introduced its BNO085 MEMS IMU in March 2025 to offer accurate real-time motion tracking for the commercial and defense industries.

Germany is the regional leader, fueled by high spending in aerospace and automotive R&D, adoption of autonomous vehicle technology, and government programs for precision sensor manufacturing. JVs and research institution collaborations are also increasingly establishing Germany as an integral growth hub for Europe.

Middle East & Africa Inertial Measurement Unit (IMU) Market Insights

The MEA market for IMUs is witnessing steady growth owing to expanded usage of drones, defense modernization, and industrial automation. Major players such as Teledyne Technologies, AeroNav Technologies, and STMicroelectronics are employing tactical and MEMS IMU solutions to maximize navigation and operational precision. In February 2025, Teledyne Technologies released its ADXRS645 MEMS IMU in the region, enabling precise monitoring of motion in UAVs and autonomous systems.

United Arab Emirates (UAE) leads the MEA countries, stimulated by government efforts for smart mobility, defense modernization, and the adoption of UAVs. Aerospace infrastructure investments and autonomous technology are propelling the use of advanced IMU modules in numerous industries.

Latin America Inertial Measurement Unit (IMU) Market Insights

Latin America is experiencing growth of the IMU market with moderate growth, driven by adoption in drones, autonomous vehicles, and industrial robots. Global technology OEMs are partnering with regional companies to bring MEMS and tactical IMU modules to enable precise navigation and motion sensing. In January of 2025, Honeywell Aerospace launched its SmartNav IMU-200 in Brazil to offer real-time orientation tracking and enhanced operational accuracy in UAVs and autonomous vehicles.

The region's leading country, bolstered by government investments in the modernization of defense, industrial automation, and space programs, is Brazil. Growing investments in navigation systems and smart mobility solutions are further driving the broader adoption of IMU modules.

Source: Straits Research

Product Insights

The IMU Modules segment dominated the market with a revenue share of 38.40% in 2025. This growth is driven by their critical role in providing precise motion sensing and navigation across aerospace, automotive, and industrial applications. The increasing demand for compact, high-accuracy, and integrated IMU solutions further supports the segment’s expansion.

The IMU Systems segment is anticipated to witness the fastest growth, registering a projected CAGR of around 7.8% during the forecast period. High growth is driven by rising adoption in autonomous vehicles, robotics, drones, and industrial automation, supported by advances in multi-sensor integration, AI-enabled motion correction, and real-time predictive navigation technologies.

By Product Market Share (%), 2025

Source: Straits Research

Technology Insights

The MEMS-based IMUs segment is projected to register the fastest CAGR growth of 8.2% during the forecast period. This growth is attributed to their high precision, low power consumption, and cost-effectiveness, making them ideal for drones, autonomous vehicles, and wearable electronics. These advantages have accelerated adoption across automotive, aerospace, and industrial applications, thereby supporting segment growth.

The MEMS-based IMUs segment held the largest market share of 29.4% in 2025, driven by widespread integration in compact and mobile platforms requiring accurate motion sensing and navigation. Its preference is further supported by continuous advancements in MEMS fabrication, sensor miniaturization, and multi-sensor integration, ensuring enhanced reliability and operational efficiency across end-use industries.

Grade Insights

The Tactical-Grade IMU segment dominated the market in 2025 with a market share of 32.7%, driven by increasing defense and aerospace applications requiring high precision and reliability. The segment’s adoption is further supported by advancements in ruggedization, sensor fusion, and integration with mission-critical navigation systems, thereby supporting segmental growth.

The Navigation-Grade IMU segment is projected to witness the fastest growth during the forecast period. This growth is fueled by rising adoption in autonomous vehicles, aerospace navigation systems, and industrial robotics, supported by continuous innovation in high-accuracy sensors, real-time data processing, and predictive navigation technologies, driving rapid segmental expansion.

Application Insights

The aerospace & defense segment led the market in 2025 with the highest CAGR, owing to high adoption of IMUs in UAVs, aircraft, and defense systems. The automotive ADAS & autonomy segment is expected to experience significant growth during the forecast period due to the rising demand for autonomous driving and advanced driver-assistance systems.

Competitive Landscape

There are many firms competing within the global IMU market, and hence, it becomes slightly fragmented. The firms operate in aerospace, defense, automotive, industrial robots, and consumer electronics sectors. A few of the largest firms operating in this area include Analog Devices, Honeywell Aerospace, Northrop Grumman, Bosch Sensortec, STMicroelectronics, Teledyne Technologies, and others.

Industry players are concentrating on increasing their product lines to cover demand, providing a broader spectrum of products, implementing new navigation and motion-sensing technologies, and catering to the requirements of new applications in drones, autonomous vehicles, robots, aerospace, and wearable devices.

Analog Devices Inc.: An Emerging Market Player

Analog Devices Inc., a leading global technology company, offers a range of Inertial Measurement Units (IMUs), including MEMS-based, tactical-grade, and navigation-grade motion sensors. With over 50 years in precision sensor development, its solutions are integral to aerospace, defense, autonomous vehicles, and industrial robotics.

In May 2025, Analog Devices announced that Northrop Grumman selected its ADIS16547 tactical-grade IMU for the U.S. Army’s next-generation unmanned aerial systems (UAS) and autonomous ground vehicles. This collaboration underscores Analog Devices’ commitment to providing IMU solutions that enhance real-time navigation, motion sensing, and operational efficiency across aerospace and defense platforms.

List of Key and Emerging Players in Inertial Measurement Unit (IMU) Market

- Analog Devices Inc.

- Honeywell International Inc.

- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Northrop Grumman Corporation

- Safran S.A.

- Thales S.A.

- Moog Inc.

- VectorNav Technologies LLC

- NovAtel Inc. (Hexagon AB)

- Seiko Epson Corporation

- Sensonor Technologies AS

- Kionix, Inc.

- VTI Technologies

- Panasonic Corporation

- LORD Sensing

- InterSense, Inc.

- TE Connectivity Ltd.

- Litton Industries

- Curtiss-Wright Corporation

Strategic Initiatives

- February 2025: Honeywell Aerospace entered a strategic partnership with a leading autonomous vehicle developer to integrate next-generation IMU sensors into self-driving cars, enhancing navigation accuracy in GPS-denied environments.

- March 2025: STMicroelectronics expanded its IMU production capabilities through collaboration with a semiconductor foundry, aiming to meet rising demand from robotics, drones, and aerospace sectors.

- May 2025: Analog Devices signed an alliance with a global industrial automation firm to provide AI-enabled IMU modules for predictive motion sensing and real-time monitoring in smart manufacturing facilities.

- July 2025: Bosch Mobility Solutions partnered with European aerospace companies to supply high-precision IMU systems for next-generation UAVs, improving flight stability and autonomous operational capabilities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 27.39 Billion |

| Market Size in 2026 | USD 29.47 Billion |

| Market Size in 2034 | USD 52.51 Billion |

| CAGR | 7.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Inertial Measurement Unit (IMU) Market Segments

By Product Type

- IMU Modules

- Gyroscopes

- Magnetometers

- Accelerometers

- Other Product Types

By Technology

- MEMS

- Mechanical Gyro

- Fibre-Optic Gyro

- Ring Laser Gyro

- Other Technologies

By Application

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Marine

- Healthcare

- Other Applications

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.