Integrated Passive Devices Market Size, Share & Trends Analysis Report By Component Type (Capacitive IPDs, Inductive IPDs, Resistive IPDs, Others), By Form Factor (Chip Scale Package (CSP), Laminate Package, Multi Layered Integrated Package, Others), By Application (Consumer Electronics, Automotive, Telecommunication & Networking, Industrial & Automation, Healthcare, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Integrated Passive Devices Market Overview

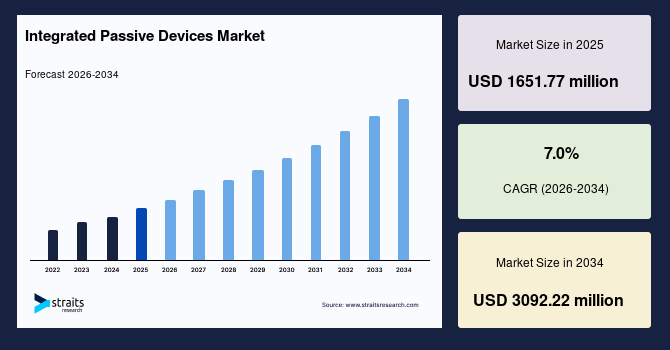

The global integrated passive devices market size is valued at USD 1651.77 million in 2025 and is estimated to reach USD 3092.22 million by 2034, growing at a CAGR of 7.0% during the forecast period. Steady growth of the market is driven by the rapid miniaturization of electronic components, rising demand for high-frequency connectivity in consumer devices, and expanding integration of passive functionalities into a single compact chip, which enhances performance, reduces power consumption, and supports the development of advanced IoT, automotive, and 5G-enabled electronics.

Key Market Trends & Insights

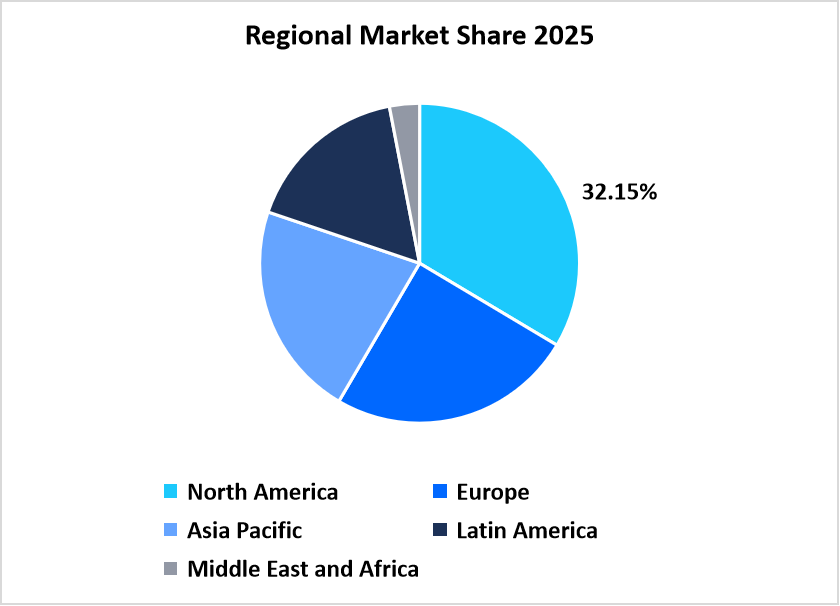

- North America dominated the market with a revenue share of 32.15% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 8.42% during the forecast period.

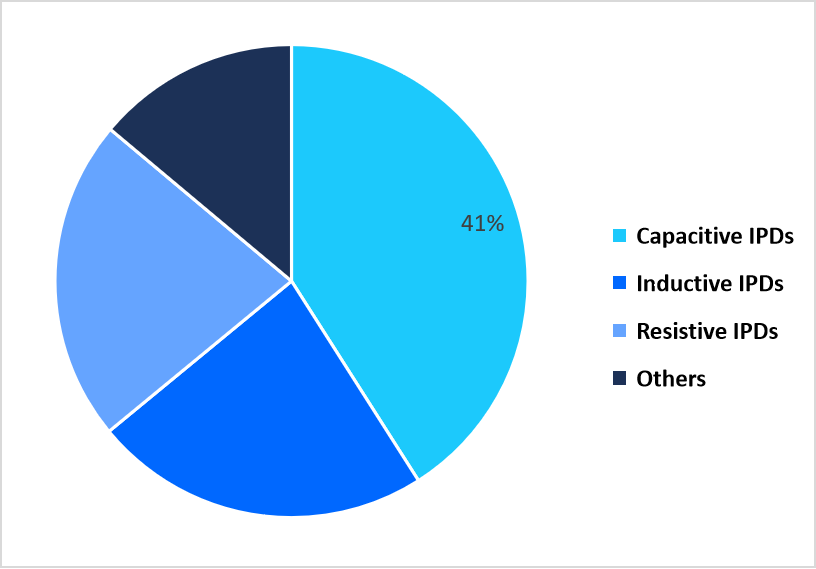

- Based on component type, the Capacitive IPDs segment held the highest market share of 41.27% in 2025.

- By form factor, the Chip Scale Package (CSP) segment is estimated to register the fastest CAGR growth of 8.95%.

- Based on application, the Consumer Electronics segment dominated the market in 2025.

- The U.S. dominates the Integrated Passive Devices market, valued at USD 421.33 million in 2024 and reaching USD 450.17 million in 2025

Table: U.S Integrated Passive Devices Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1651.77 million

- 2034 Projected Market Size: USD 3092.22 million

- CAGR (2026-2034): 7.0%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market covers an extensive list of miniaturized passive components, such as capacitors, inductors, resistors, and specialized integrated solutions designed into a single chip form factor to maximize circuit efficiency. They are fabricated through sophisticated form factor technologies like chip scale packaging (CSP), laminate-based integration, and multilayered architectures that drive performance, minimize signal loss, and enable high-frequency capabilities.

Integrated passive devices are applied in a variety of application fields, from consumer electronics and automotive systems to telecommunication and networking devices, industrial automation, and medical electronics. They are provided by a wide range of semiconductor companies, foundries, design houses, and electronic component suppliers in response to rising demand for low-profile, power-efficient, and highly reliable solutions in worldwide smart device and connected technology market.

Latest Market Trends

Increasing trend towards miniaturized and strongly integrated electronics

The electronics market is undergoing a profound shift away from legacy discrete passive devices to small system-in-package form factors, compelling high-growth adoption of integrated passive devices. Printed circuit boards in the past needed numerous external resistors, capacitors, and inductors, which increased assembly cost, powered usage, and design complexity. IPDs today integrate these components into one chip, allowing ultra-small device footprints with enhanced signal integrity and thermal efficiency.

This transition is being spurred by growing demand for smartphones, wearables, and home IoT devices where space is at a premium. Leaders in semiconductors increasingly place IPDs within RF front-end modules, high-speed interfaces, and power management units to enable greater bandwidth, improved Wi-Fi/5G connectivity, and improved battery life. Advanced packaging technologies like chip-scale packages with through-silicon vias (TSVs) have demonstrated dramatic gains in performance uniformity and yield reliability. While device makers drive more functional density, IPD integration is no longer an alternative choice, but a normal design selection.

Acceleration of 5G, IoT, and automotive electronics driving high-frequency IPDs

Global adoption of 5G networks, the growth of IoT ecosystems, and the electrification of cars are driving demand for passive components with the capability to handle high-frequency operations with minimal loss. In previous generations of the network, discrete passives had sufficient bandwidth for mid-band operations, but RF systems today demand precision-tuned filters, baluns, couplers, and decoupling networks that IPDs provide with tighter tolerance and lesser parasitics.

Automotive electronics particularly ADAS sensors, EV powertrains, and vehicle-to-everything (V2X) communication modules are becoming a high-growth opportunity for IPDs as a result of stringent reliability and thermal robustness requirements. Smart factory and Industrial IoT programs also add fuel to this movement by boosting the demand for small-form-factor, rugged sensor nodes and communication gateways. As manufacturers begin to focus on minimized signal interference and power efficiency in connected infrastructure, IPDs are becoming increasingly core components fueling the next phase of smart electronics.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1651.77 million |

| Estimated 2026 Value | USD 1771.31 million |

| Projected 2034 Value | USD 3092.22 million |

| CAGR (2026-2034) | 7.0% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Broadcom, CTS Corporation, TDK Corporation, Taiyo Yuden Co., Ltd., AVX Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Strategic government investments in semiconductor self-reliance

Governments of nations are increasingly making semiconductor independence the focal point of security and economic strategies, and this is far leading to the demand for integrated passive devices. Nations like the United States, China, South Korea, and those of the European Union have invested in massive funding programs to enhance local electronic component production and minimize dependence on foreign circuits. The U.S. CHIPS and Science Act by itself appropriates more than USD 52 billion to grow semiconductor R&D and production capacity, while the European Chips Act plans for 20% of global chip manufacturing market share in 2030 via special subsidies and industrial collaborations.

As governments encourage supply chain localization, component-level integration such as capacitors, inductors, and resistors into dense IPD formats is taking center stage to facilitate high-value chip assembly inside countries. Such policies also involve special tax regimes and grants for advanced packaging plants, which further accelerate IPD commercialization. With geopolitical tensions increasing the need for secure electronics, government-supported semiconductor growth is increasingly emerging as an effective driver of the global integrated passive devices market.

Market Restraint

Export controls and regulatory limitations on advanced semiconductor devices

A key constraint in the integrated passive devices market arises from increasing export control regulations by governments to protect national security and prevent high-value semiconductor technologies from falling into the wrong hands. Governments of leading chip-producing economies such as the U.S. Bureau of Industry and Security (BIS) and the European Commission's trade compliance regimes have implemented more stringent rules regarding cross-border transfer of high-frequency passive elements utilized in telecommunication, aerospace, and defense applications.

These control measures restrict the flow of sensitive electronic components and necessitate comprehensive compliance reporting, which reduces shipments and impedes global supply chain effectiveness. In addition, trade bans imposed as part of strategic geopolitical measures have limited technology exchange with specific countries, generating uncertainty for IPD manufacturers relying on cross-regional sources and international customer networks. As governments accelerate semiconductor export control to protect important infrastructure, such regulatory barriers persist in hampering IPD market growth through slowing down global adoption and limiting market access for important suppliers.

Market Opportunity

Expansion of national incentives for electronics manufacturing

Government initiatives towards encouraging local electronics and semiconductor manufacturing are generating huge opportunities for integrated passive devices. For instance, as part of India's Production Linked Incentive (PLI) scheme for electronics, the government has provided more than USD 2.7 billion in incentives to promote local production of high-value electronic items, including passive devices for consumer, automotive, and telecom segments.

Equally, the European Union's "Horizon Europe" program offers financial support for cutting-edge electronic component research, promoting the development and incorporation of IPDs in small, domestically produced electronics. Such schemes not only help decrease reliance on foreign components but also offer grants, tax breaks, and preferential purchases to manufacturers, creating new avenues for IPD suppliers. Through these government-sponsored initiatives, firms can increase production, consolidate domestic supply chains, and corner expanding demand in fast-expanding electronics segments like 5G communication modules, electric vehicles, and industrial automation systems.

Regional Analysis

North America led the market in 2025, commanding 32.15% market share. North America's leadership is owed to robust regional programs encouraging local electronic component production, leading-edge semiconductor research clusters, and universal usage of 5G and IoT. Regional collaborations among universities, technology parks, and independent IPD manufacturers have propagated the commercialization of integrated passive solutions for consumer electronics, automotive modules, and industrial automation. These influencing factors in aggregate spur adoption of IPDs in North America.

Development of the IPD market in the U.S. is driven by federal initiatives sponsoring next-generation communication and electronics infrastructure. For example, the National Science Foundation's Semiconductor Research Corporation programs of funding enabled several university-industry collaborations, resulting in sophisticated IPD prototypes for high-frequency applications in 2024. Moreover, U.S. manufacturers are increasingly implementing IPDs in RF modules and power management units for devices with 5G capabilities, solidifying the country's leadership position. These technology demonstrations and strategic partnerships continue to drive market adoption and confidence.

Asia Pacific Market Insights

Asia Pacific is becoming the region with the highest growth rate at a CAGR of 8.42% during 2026–2034, led by China, Taiwan, and South Korea, which are increasing domestic capacity for electronics manufacturing. Government-backed plans to build smart city infrastructure and upgrade telecommunications networks have raised the demand for small, high-reliability IPDs. The region also enjoys local sourcing of components and robust industrial clusters that enable faster design-to-production cycles, additionally driving growth.

India's IPD market is growing fast driven by government-initiated schemes for electronics manufacturing and increasing local demand for consumer and automotive electronics. For example, large-scale electronics parks under the Electronics Manufacturing Clusters (EMC) program allow startups as well as established companies to prototype and develop IPD solutions cost-effectively. Indian firms are now manufacturing multi-layered and chip-scale packaged IPDs for IoT, smart meters, and EV modules. These support infrastructure initiatives and growing local supply chains are making India a high-growth center in the Asia Pacific integrated passive devices market.

Source: Straits Research

European Market Insights

Europe is also seeing steady growth in integrated passive devices, fueled by expanding government-driven smart electronics programs, high-end manufacturing incentives, and robust adoption of 5G and auto electronics in Germany, France, and the U.K. Cluster collaboration programs between regional semiconductor clusters and electronics companies are driving R&D for IPDs for high-frequency applications at a faster pace. In addition, EU-funded initiatives for standardizing electronic components among member nations are enabling quicker implementation of IPDs in consumer, industrial, and telecom products.

Germany's IPD market expansion is driven by the nation's emphasis on Industry 4.0 and networked manufacturing systems. Top electronics giants are incorporating IPDs into robotics, automation modules, and advanced industrial sensors. The alliances among manufacturing enterprises and institutions like Fraunhofer Institutes encourage speedy prototyping and validation of high-reliability IPDs. Further, Germany's national programs for high-performance electronics drive local manufacturing of multi-layered and chip-scale packaged IPDs, allowing scalable deployment in automotive and telecommunications applications.

Latin America Market Insights

The Latin America IPD market is expanding as nations like Brazil, Mexico, and Chile are boosting domestic electronics manufacturing abilities. Spending on smart grid infrastructure, telecom network extension initiatives, and EV electronics is fueling demand for miniature, stable passive components. Regional IPD makers are collaborating with local electronics integrators to offer turnkey solutions, less dependent on foreign components and driving adoption in industrial, automotive, and telecom markets.

Brazil's IPD market is growing as government-sponsored programs facilitate advanced electronics manufacturing for automotive and renewable energy industries. Top players are manufacturing high-performance chip-scale and multi-layer IPDs optimized for EV power modules and industrial automation devices. Incentive programs like tax cuts for high-tech electronics manufacturing parks are enhancing domestic capacity, augmenting supply chain strength, and promoting wider integrated passive device adoption across the country.

Middle East and Africa Market Insights

Middle East & Africa IPD market is expanding with nations launching sophisticated electronics programs for telecom infrastructure, smart city, and energy. Local R&D is being invested in from regional hubs like South Africa, Saudi Arabia, and the UAE on integration of IPDs in IoT systems, energy meters, and communication modules. Such government-sponsored programs promote local innovation, diminish reliance on imports, and enhance dependability.

Egypt's IPD market is growing with national electronics and industrial modernization efforts. High-performance computing infrastructure, telecommunication, and industrial automation investments are fueling demand for high-reliability chip-scale and laminate IPDs. Public-private partnership-supported local electronics clusters are allowing prototyping, production, and deployment of integrated passive components to be accelerated, making Egypt a rising IPD hub in the region.

Component Type Insights

The Capacitive IPDs segment led the market with a revenue market share of 41.27% in 2025. This is fueled by the rising popularity of high-frequency and power-efficient consumer devices, including smartphones, wearables, and IoT applications, where capacitors in a monolithic chip enhance space utilization and signal stability.

The Inductive IPDs segment is expected to experience the highest growth, reflecting a forecasted CAGR of approximately 8.15% over the forecast period. Strong growth is driven by growing automotive electronics, 5G telecommunications infrastructure, and industrial automation applications, where inductors integrated within IPDs provide high-frequency filtering, energy storage, and enhanced electromagnetic compatibility.

By Component Type Market Share (%), 2025

Source: Straits Research

Form Factor Insights

The Laminate Package segment was the market leader with a revenue market share of 38.14% in 2025. This is fueled by rising use of IPDs in consumer electronics, automotive modules, and industrial automation, where laminate integration offers improved mechanical stability, better thermal performance, and better signal integrity.

The CSP segment is expected to experience the highest growth, achieving a projected CAGR of 8.95% throughout the forecast period. High growth is driven by the requirement for ultra-small, lightweight, and high-performance devices like smartphones, wearables, IoT sensors, and 5G RF modules.

Application Insights

The Consumer Electronics application is expected to grow at the highest growth rate of 8.12% due to the increasing use of smartphones, wearables, and IoT devices that demand small and energy-efficient circuit designs. With more devices being used with high-speed connectivity and multifunctional capabilities, more manufacturers are coupling capacitors, inductors, and resistors into single IPD chips, leading to an increased demand for these solutions within the consumer electronics industry.

Murata Manufacturing Co., Ltd.: An emerging market player

Murata Manufacturing Co., Ltd., the world's leading company in passive electronic components, is charting a strong course in the integrated passive devices (IPD) market by shifting from conventional component production to intelligent, integrated solutions.

- In August 2025, Murata presented its new IPD innovations as a compact, reliable, and sustainable solution for fostering the growth of data centers in the AI and 5G era. The company celebrated its transformation under the banner "Beyond Discrete – Sensing the Future," with exhibits targeting high-efficiency power modules, innovative RF switch technologies, sensing, and communication technologies that enable smarter, more sustainable systems in major sectors like mobility, digital infrastructure, and environmental applications.

Murata has become a prominent player in the international IPD market as it deploys its sensing, connectivity, and power technology expertise to create innovations that blend passive components into smart systems for next-generation digital infrastructure and mobility.

List of Key and Emerging Players in Integrated Passive Devices Market

- Broadcom

- CTS Corporation

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- AVX Corporation

- Yageo Corporation

- Vishay Intertechnology, Inc.

- KEMET Corporation

- Panasonic Corporation

- Global Communication Semiconductors, LLC.

- Johnson Electric Holdings Ltd.

- ON Semiconductor

- NXP Semiconductors

- Infineon Technologies A

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Sumida Corporation

- Nichicon Corporation

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Others

Strategic Initiatives

- August 2025: STMicroelectronics introduced nine new RF IPDs optimized for its STM32WL wireless microcontrollers, combining antenna impedance matching, balun, and harmonic filter circuitry. The new range, including models such as BALFHB-WL-01D3 through BALFLB-WL-09D3, supports frequencies ranging from 490 MHz to 915 MHz and helps designers achieve up to 30% board space savings compared to discrete designs.

- January 2025: ON Semiconductor launched IPD-enhanced front-end modules optimized for low power consumption, achieving up to 18% reduction in overall system power usage in smartphones.

- October 2024: Johanson released a new IPD-based antenna that reduces size by 15% while enhancing bandwidth, directly targeting emerging IoT device requirements.

- May 2024: Broadcom introduced a high-performance 400G PCIe Gen 5.0 Ethernet adapter, enhancing data center connectivity and supporting the growing demand for bandwidth-intensive applications.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1651.77 million |

| Market Size in 2026 | USD 1771.31 million |

| Market Size in 2034 | USD 3092.22 million |

| CAGR | 7.0% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component Type, By Form Factor, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Integrated Passive Devices Market Segments

By Component Type

- Capacitive IPDs

- Inductive IPDs

- Resistive IPDs

- Others

By Form Factor

- Chip Scale Package (CSP)

- Laminate Package

- Multi Layered Integrated Package

- Others

By Application

- Consumer Electronics

- Automotive

- Telecommunication & Networking

- Industrial & Automation

- Healthcare

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.