Ion Exchange Resins Market Size, Share & Trends Analysis Report By Product Type (Cationic, Anionic, Others), By End Use (Power Generation Industry, Chemical & Petrochemical Industry, Pharmaceutical & Biotechnology Industry, Food & Beverage Industry, Metals & Mining Industry, Electronics & Semiconductor Industry, Others), and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Ion Exchange Resins Market Size

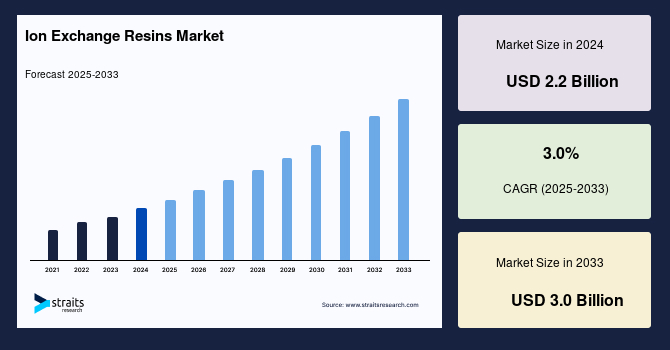

The global ion exchange resins market was valued at USD 2.2 billion in 2024 and is projected to grow from USD 2.3 billion in 2025 to USD 3.0 billion in 2033, exhibiting a CAGR of 3.0% during the forecast period (2025-2033).

Ion exchange resins are synthetic polymers that facilitate ion exchange processes, effectively removing undesirable ions from solutions and replacing them with more desirable ones. These resins are pivotal in water purification, chemical processing, pharmaceuticals, and food and beverage industries. By exchanging ions, they help in demineralization, deionization, and purification processes, ensuring the removal of contaminants like heavy metals, nitrates, and other impurities. The versatility of ion exchange resins allows their use in cationic and anionic forms, catering to a wide range of industrial and municipal applications. Their ability to regenerate and reuse further enhances their cost-effectiveness and environmental friendliness.

The global market is driven by the escalating demand for water treatment solutions across industrial, municipal, and residential sectors. Rapid urbanisation and industrialisation, especially in emerging economies, have increased water pollution, necessitating efficient purification methods. Ion exchange resins are crucial in removing contaminants, ensuring a safe and clean water supply. The pharmaceutical and food industries rely heavily on these resins for purification processes, further propelling market growth. Technological advancements have led to development more efficient and selective resins, enhancing their performance and broadening their application scope. Moreover, stringent environmental regulations and growing awareness about sustainable practices encourage industries to adopt eco-friendly purification methods, boosting the demand for ion exchange resins.

Market Trend

Rising Demand in Water Treatment Applications

The increasing global emphasis on water conservation and pollution control has significantly boosted the demand for ion exchange resins in water treatment applications. These resins are instrumental in removing hardness, heavy metals, and other contaminants from water, making it suitable for various uses. The industrial sector, in particular, has witnessed a surge in the adoption of ion exchange resins to comply with stringent wastewater discharge regulations.

- For instance, in December 2024, the New South Wales (NSW) Government in Australia announced a significant upgrade to the Cascade Water Filtration Plant in the Blue Mountains to address elevated levels of per- and polyfluoroalkyl substances (PFAS) in the drinking water. The $3.5 million project incorporates advanced technologies, including Granular Activated Carbon (GAC) and ion exchange resins, to effectively remove PFAS contaminants.

Moreover, the municipal sector employs ion exchange resins in water softening and purification processes to provide safe drinking water. The adaptability of ion exchange resins to various water treatment needs and advancements in resin technology, enhancing their efficiency and lifespan, underscore their growing significance in addressing global water challenges.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2.2 Billion |

| Estimated 2025 Value | USD 2.3 Billion |

| Projected 2033 Value | USD 3.0 Billion |

| CAGR (2025-2033) | 3.0% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ResinTech, Inc., Purolite, DuPont, Aldex Chemical Company, Ltd., IEI |

to learn more about this report Download Free Sample Report

Ion Exchange Resins Market Growth Factor

Expansion in the Pharmaceutical Industry

The pharmaceutical industry's growth has significantly driven the ion exchange resins market. These resins are extensively used in drug formulation and purification processes. They aid in separating and purifying active pharmaceutical ingredients (APIs), ensuring the removal of impurities and achieving the desired drug efficacy. Additionally, ion exchange resins are employed in controlled drug release formulations, enhancing therapeutic outcomes. The increasing demand for high-purity drugs and expanding pharmaceutical manufacturing capacities globally have amplified the need for efficient purification methods, propelling the demand for ion exchange resins.

Furthermore, the trend towards personalised medicine and complex drug formulations necessitates advanced purification techniques, where ion exchange resins play a pivotal role. The continuous research and development in resin technology to cater to specific pharmaceutical requirements further bolsters their application in this sector.

Market Restraint

Environmental Concerns and Disposal Issues

Despite their widespread use, ion exchange resins pose environmental challenges, particularly concerning their disposal after exhaustion. Spent resins, if not properly managed, can lead to secondary pollution due to the release of adsorbed contaminants. The regeneration process of resins also involves using chemicals, which can result in hazardous waste if not handled correctly. These environmental concerns have led to stringent regulations governing the disposal and regeneration of ion exchange resins, increasing operational complexities and costs for industries.

Additionally, the lack of standardised disposal methods and facilities in certain regions exacerbates the issue, potentially hindering the adoption of ion exchange resins. To address these concerns, manufacturers and end-users are exploring sustainable alternatives, such as developing biodegradable resins and implementing closed-loop regeneration systems. However, the transition to environmentally friendly practices requires significant investment and technological advancements, which may not be feasible for all stakeholders, restraining market growth.

Market Opportunity

Technological Advancements and Sustainable Innovations

The ion exchange resins market is poised to benefit from technological advancements and the growing emphasis on sustainability. Innovations in resin chemistry have led to the development of resins with higher selectivity, capacity, and stability, enhancing their performance across various applications. For instance, integrating nanotechnology has resulted in resins with improved ion exchange kinetics and regeneration efficiency. Moreover, the push towards green chemistry has spurred the creation of resins derived from renewable resources, reducing environmental impact. Companies are also investing in developing resins that require fewer chemicals for regeneration, minimising hazardous waste generation.

- For example, in April 2024, LANXESS introduced a new line of sustainable ion exchange resins produced using a solvent-free process, significantly reducing their environmental footprint.

Additionally, adopting digital technologies for real-time monitoring and optimising resin performance offers operational efficiency and predictive maintenance opportunities. These technological and sustainable innovations address environmental concerns and open new avenues for applying ion exchange resins in emerging sectors such as biopharmaceuticals and renewable energy, thereby presenting significant growth opportunities for the market.

Regional Analysis

Asia-Pacific leads the global ion exchange resins market, accounting for over 48% of the revenue share in 2024, and is anticipated to grow at a CAGR of 5.4% over the forecast period. Rapid industrialisation, particularly in China, India, South Korea, and Vietnam, has spurred substantial demand for water treatment and purification processes across manufacturing sectors. Government initiatives promoting clean water access and sustainable industrial practices further bolster the market. The region's expanding pharmaceutical, power generation, and manufacturing sectors also contribute to the heightened demand for ion exchange resins. Stringent environmental regulations have led industries to adopt advanced water treatment systems, including ion exchange resins, to meet compliance standards.

- China's rapid industrial growth and urbanisation have led to significant environmental challenges, particularly water pollution. Government initiatives to improve water quality and promote sustainable practices have driven the adoption of ion exchange resins across various industries. Under its “14th Five-Year Plan,” China invests heavily in advanced water treatment infrastructure, including rural and peri-urban areas. The electronics, chemical, and power generation sectors have also ramped up usage of ion exchange resins to comply with stricter effluent discharge standards.

- India's expanding industrial base and increasing awareness of water conservation have heightened the demand for effective purification systems. Government programs like "Make in India" and investments in infrastructure development further support the growth of the ion exchange resins market. The country faces acute water scarcity in several regions, prompting increased municipal investments in water recycling and desalination technologies, where ion exchange resins play a key role. In sectors such as textiles, petrochemicals, and food processing, companies are adopting resins to reuse process water and meet the Central Pollution Control Board’s discharge norms.

North America Market Trends

North America is a significant market for ion exchange resins, with the United States accounting for approximately 72% of the regional market share. The region's growth is driven by advanced industrial infrastructure, stringent environmental regulations, and a strong presence of major market players. In 2024, the Biden-Harris Administration announced $5.8 billion in funding for drinking water, wastewater, and stormwater infrastructure upgrades, focusing on underserved communities. This investment, part of a $50 billion allocation under the Bipartisan Infrastructure Law, aims to enhance water treatment facilities, thereby increasing the demand for ion exchange resins. Additionally, the presence of major pharmaceutical and power generation industries further cements the region's position in the market.

- The U.S. market benefits from advanced industrial sectors and proactive environmental policies. Significant investments in infrastructure and water treatment facilities, coupled with the presence of leading resin manufacturers, position the country as a key player in the global market. Major pharmaceutical industries, power generation, and food & beverages rely heavily on ion exchange resins for purification and softening processes. Additionally, the U.S. Environmental Protection Agency (EPA)’s evolving regulations on wastewater discharge and water reuse continue to push industries toward adopting advanced resin technologies for compliance and sustainability.

- Canada's emphasis on environmental conservation and sustainable practices has increased the adoption of ion exchange resins, especially in water treatment applications. The country’s vast natural resources and industrial activities necessitate efficient purification systems to mitigate environmental impacts. Canada’s stringent water quality regulations and the presence of water-stressed regions have driven municipal and industrial sectors to invest in advanced treatment technologies. Moreover, the mining and oil sands industries require highly efficient water recycling systems, where ion exchange resins are pivotal in reducing operational hazards and environmental liabilities.

Europe Market Trends

Europe maintains a robust ion exchange resins market position, driven by stringent environmental regulations and a strong emphasis on sustainable industrial practices. Countries like Germany, France, and the UK are investing in advanced water treatment technologies to meet EU directives on water quality and environmental protection. The region's focus on renewable energy and modernising existing power plants also contributes to the demand for ion exchange resins. Furthermore, Europe's pharmaceutical and food & beverage industries rely heavily on high-purity water, necessitating ion exchange resins.

- Germany's strong chemical and pharmaceutical industries rely heavily on ion exchange resins for various purification processes. The country's commitment to environmental standards ensures continuous demand for advanced treatment technologies. As one of the leaders in the EU’s Green Deal initiatives, Germany is pushing for stricter effluent regulations, which compel industries to upgrade to more efficient ion exchange systems. In addition, the country’s advanced healthcare and biotechnology sectors utilise ion exchange resins in chromatography, diagnostics, and drug production, adding further depth to resin demand beyond just water treatment applications.

- France's focus on nuclear energy and water-intensive industries underscores the importance of effective water treatment solutions. Ion exchange resins play a crucial role in ensuring the safety and efficiency of these sectors. With over 70% of France’s electricity coming from nuclear energy, maintaining ultra-pure water in reactor cooling systems is a critical application where ion exchange technology is indispensable. France’s growing pharmaceutical and cosmetic sectors also use resins for purification and formulation. National initiatives focused on reducing industrial water consumption and emissions support resin demand across industries.

Product Type Insights

Cationic resins dominate the global ion exchange resins market, accounting for over 46% of the market share in 2024. These resins are pivotal in water softening and demineralisation, effectively removing hardness-causing ions like calcium and magnesium. Their extensive application in industrial water treatment, particularly in power plants and chemical manufacturing, underscores their market leadership. Industries such as power generation and chemical manufacturing rely heavily on cation exchange resins to ensure the longevity and efficiency of their equipment. The growing demand for ultrapure water in industries such as semiconductors further propels their adoption. For instance, Mitsubishi Chemical Group announced plans in October 2024 to expand its production capacity for ion exchange resins to meet the increasing demand for ultrapure water in semiconductor manufacturing.

End Use Insights

The power generation sector is the largest end use segment for ion exchange resins, holding over 40% of the market share in 2024. These resins are integral in processes like condensate polishing and boiler feedwater treatment, ensuring the removal of impurities that can cause scaling and corrosion. Ensuring the purity of water used in boilers is crucial to prevent scaling and corrosion, which can lead to operational inefficiencies or equipment failures. As global energy demands rise, especially in developing regions, establishing new power plants will likely drive the demand for ion exchange resins in this sector. The increasing global electricity demand, coupled with the expansion of power generation capacities, especially in Asia-Pacific, drives the growth of this segment. Additionally, the shift towards nuclear power as a clean energy source necessitates using specialised nuclear-grade resins for water purification, further boosting the demand in this sector.

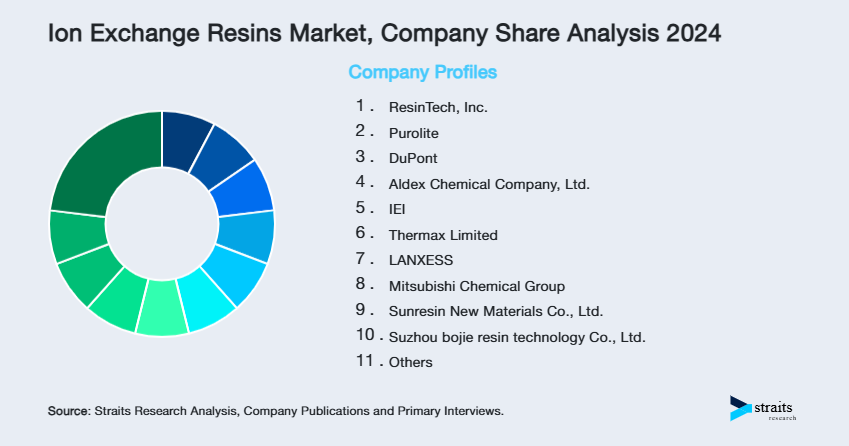

List of Key and Emerging Players in Ion Exchange Resins Market

- ResinTech, Inc.

- Purolite

- DuPont

- Aldex Chemical Company, Ltd.

- IEI

- Thermax Limited

- LANXESS

- Mitsubishi Chemical Group

- Sunresin New Materials Co., Ltd.

- Suzhou bojie resin technology Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Samyang Corporation

- Zhejiang Zhengguang Industrial Co., Ltd.

- Suqing Group

- Tosoh Corporation

- Organo Corporation

- Felite Resin Technology.

- JACOBI RESINS

- Jiangsu Linhai Resin Science and Technology Co., Ltd.

- Pure Resin Co., Ltd.

to learn more about this report Download Market Share

Recent Developments

- April 2024 - LANXESS AG launched "Lewatit S 1567 Scopeblue, a sustainable ion exchange resin designed for water-softening applications, produced using a solvent-free process to reduce environmental impact.

- February 2024 - Thermax Limited acquired TSA Process Equipments for USD 9 million, enhancing its capabilities in the process equipment space and supporting growth objectives in the ion exchange resin market.

Analyst Opinion

As per our analyst, the global ion exchange resins market is poised for sustained and dynamic growth, underpinned by a convergence of environmental, industrial, and technological factors. Increasing global awareness of water scarcity and the critical need for clean, potable water drives investments in advanced water purification systems, where ion exchange resins play a central role. Governments worldwide are tightening wastewater discharge regulations and encouraging sustainable industrial practices, making ion exchange technology an essential solution across multiple sectors.

The key growth sectors include power generation, food and beverage processing, and pharmaceuticals. In the pharmaceutical industry, ion exchange resins are increasingly utilised for controlled drug delivery, purification of active pharmaceutical ingredients (APIs), and high-efficiency separation processes. The rise of biologics and personalised medicine has further intensified demand for specialised resins capable of supporting complex drug formulations. Technological advancements, such as high-capacity, selective, and biodegradable resins, are expanding the scope of applications and improving end-user cost-efficiency.

Nonetheless, the adaptability of ion exchange resins, continuous R&D innovation and increasing global regulatory support position this market for a strong upward trajectory. Companies that can deliver high-performance, application-specific resins focusing on environmental impact will be best placed to capitalise on this evolving landscape.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2.2 Billion |

| Market Size in 2025 | USD 2.3 Billion |

| Market Size in 2033 | USD 3.0 Billion |

| CAGR | 3.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Ion Exchange Resins Market Segments

By Product Type

- Cationic

- Anionic

- Others

By End Use

- Power Generation Industry

- Chemical & Petrochemical Industry

- Pharmaceutical & Biotechnology Industry

- Food & Beverage Industry

- Metals & Mining Industry

- Electronics & Semiconductor Industry

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.