Loitering Munition Market Size, Share & Trends Analysis Report By Type (Fixed Wing Loitering Munitions, Rotary Wing Loitering Munitions, Hybrid Loitering Munitions), By Launch Mode (Man-Portable Loitering Munitions, Vehicle-Mounted Loitering Munitions, Air Launched Loitering Munitions, Naval Launched Loitering Munitions), By Application (Intelligence, Surveillance & Reconnaissance (ISR), Precision Strike, Suppression of Enemy Air Defenses (SEAD), Tactical Battlefield Support, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Loitering Munition Market Overview

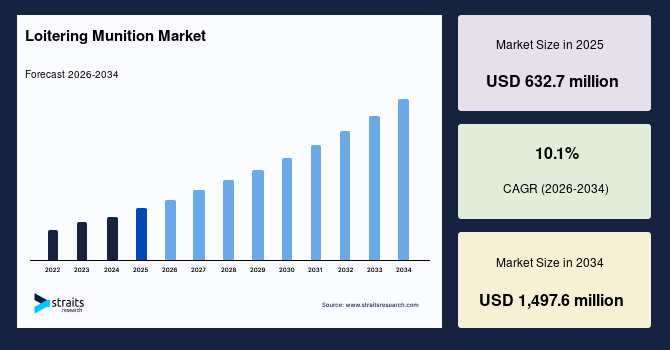

The global loitering munition market size is valued at USD 632.7 million in 2025 and is estimated to reach USD 1,497.6 million by 2034, growing at a CAGR of 10.1% during the forecast period. Consistent growth of the market is supported by the rising demand for precision-guided, cost-effective strike systems, increasing adoption of asymmetric and network-centric warfare doctrines, and growing investments in advanced defense technologies that enhance real-time surveillance, target acquisition, and rapid-response combat capabilities across modern military forces.

Key Market Trends & Insights

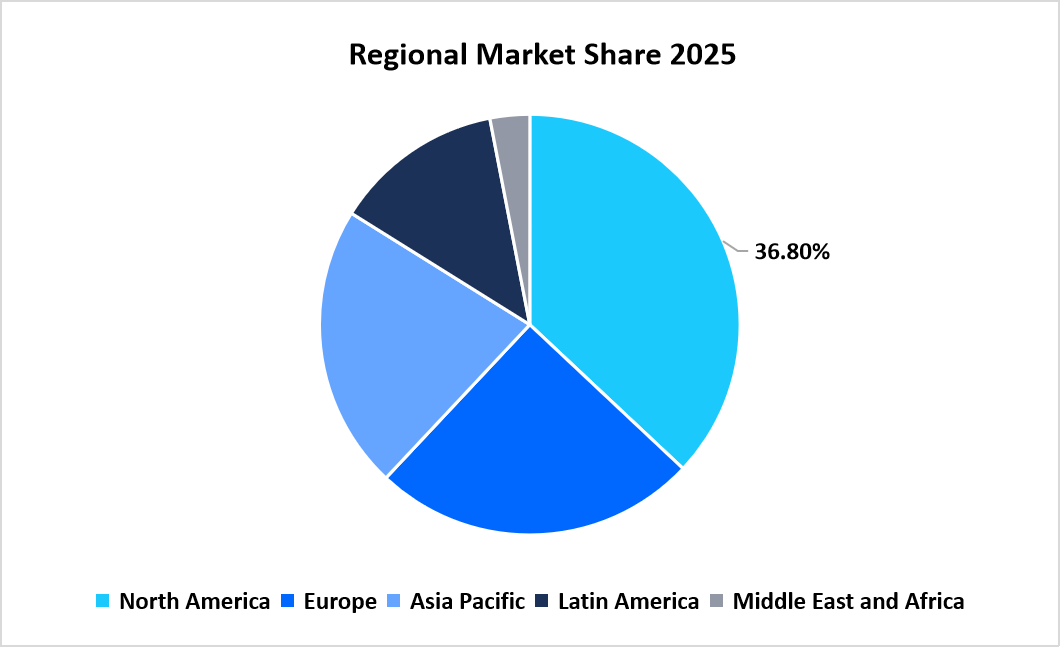

- North America dominated the market with a revenue share of 36.8% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 11.2% during the forecast period.

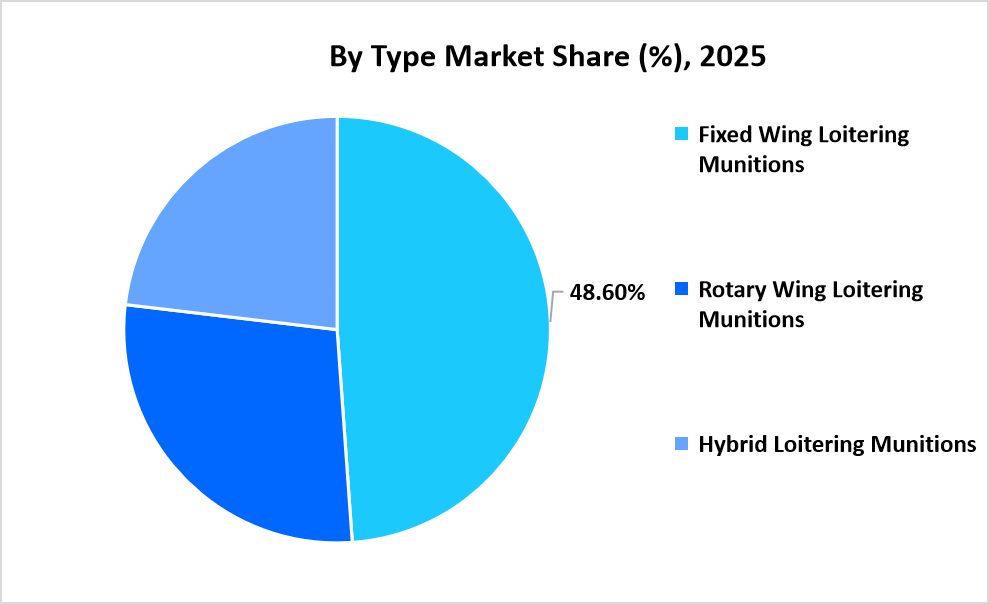

- Based on type, the Fixed Wing Loitering Munitions segment held the highest market share of 48.6% in 2025.

- By launch mode, the Man Portable Loitering Munitions segment accounted for a market share of 34.9% in 2025.

- Based on application, the Precision Strike segment is anticipated to grow at a CAGR of 10.9% during the forecast period.

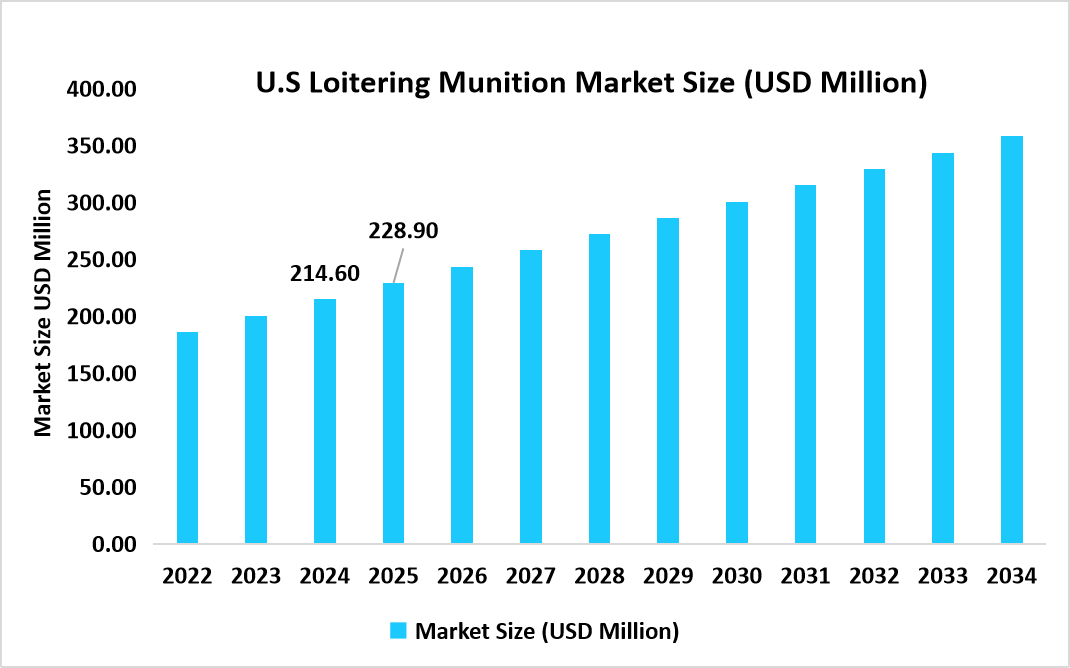

- The U.S. dominates the loitering munition market, valued at USD 214.6 million in 2024 and reaching USD 228.9 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 632.7 million

- 2034 Projected Market Size: USD 1,497.6 million

- CAGR (2026-2034): 10.1%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global loitering munition market covers a large number of precision-guided weapons with varying capabilities, including Fixed Wing Loitering Munitions, Rotary Wing Loitering Munitions, as well as Hybrid Loitering Munitions with extended loitering duration and real-time target engagement capabilities. These loitering munitions also operate using diverse means of operation, which include manual portable, vehicle-mounted, air-launched, and sea-launched platforms, offering greater flexibility in their functional usability for different warfare environments during military engagements. Additionally, loitering munitions also have functional usability in various military tasks, including intelligence, surveillance, reconnaissance, precision strikes, suppression of enemy air defenses, tactical battlefield support, and other military tasks in modern warfare.

Market Trends

Transition From Platform-Specific Strike Weapons To Multi-Mission Loitering Systems

Modern military operations have started to become less dependent on specialized strike weapons to support multi-mission loitering weapons systems. Traditional battlefield tactics used to adopt separate weapons for reconnaissance, targeting, and striking. Moreover, these tactics used to be associated with greater coordination requirements, slower response, and greater costs. However, today’s loitering weapons have started to combine intelligence, surveillance, reconnaissance, and precision striking capabilities in a single platform to support real-time targeting and instant striking. As such, military forces have started to focus on acquiring multi-mission loitering weapons capabilities that can effectively adapt to dynamic battlefield scenarios.

Rapid Adoption of Loitering Munitions In Asymmetric And Urban Warfare Environments

The increasing trend of asymmetric warfare and urban warfare has led to the adoption of loitering munitions as a preferred tactical choice. The conventional bombing attack, artillery, or mortar attack has limitations in the urban warfare environment due to the risks of collateral damage, target visibility, and operational range. Loitering munitions overpowered these limitations, providing persistent aerial presence, high accuracy, target engagement, or attack authorization by the human operator. These advantages of loitering munitions, such as lingering over the target area, detection of time-critical targets, and minimal impact on target surroundings, have led to significant success in counter-insurgency, counter-terrorism, and border security missions.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 632.7 million |

| Estimated 2026 Value | USD 696.6 million |

| Projected 2034 Value | USD 1,497.6 million |

| CAGR (2026-2034) | 10.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Israel Aerospace Industries, AeroVironment, Elbit Systems, Rheinmetall, RTX Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Acceleration Of Government-Backed Precision Warfare Procurement Programs

National defense agencies are increasingly prioritizing loitering munitions within formal procurement and modernization frameworks, making state-driven demand a critical growth driver for the market. Governments are updating force-structure doctrines to emphasize precision strike, rapid target engagement, and reduced pilot risk, directly favoring loitering munition adoption. Programs aligned with defense procurement regulations such as the U.S. National Defense Authorization Act (NDAA), Europe’s Permanent Structured Cooperation (PESCO), and Asia-Pacific military modernization roadmaps have enabled faster approvals, multi-year funding allocations, and indigenous production incentives for advanced munition systems. These policy-backed initiatives are accelerating acquisition cycles, encouraging domestic manufacturing partnerships, and expanding deployment across land, air, and naval forces.

Market Restraint

Regulatory Constraints On Autonomous And Semi-Autonomous Weapon Deployment

The most important factors that can hinder the loitering munition market are the increased regulatory scrutiny of autonomous and semi-autonomous weapons. Governments around the world have started implementing tough regulatory guidelines on matters like target engagement control, human oversight, and rules of engagement for loitering munitions. Talks in the United Nations Convention on Certain Conventional Weapons on Lethal Autonomous Weapon Systems, in addition to military export control regulations, have hindered fast-track launches of loitering munitions upon procurement. In many countries, red tape in terms of extra regulatory hurdles has to be cleared to declare its use for military purposes, especially in operations across national frontiers.

Market Opportunity

Expansion of Loitering Munitions Into Multi-Domain And Non-Traditional Mission Roles

The increasing operational requirement for responsive and versatile combat systems is presenting fresh opportunities for loitering munitions in addition to their traditional role in striking operations. There is a growing interest in the use of loitering munitions in various operational roles, including border surveillance, naval surveillance, electronic decoy employment, and rapid response operations, by military forces around the world. In various military exercises and operational trials conducted recently, loitering munitions have been proven to be effective for providing continued area surveillance, flexible engagement, and swift redeployment without depending on large attack aircraft. This widening role for loitering munitions is prompting military forces to incorporate these systems into their overall operational plans, thereby presenting fresh opportunities for growth to loitering munition suppliers.

Regional Analysis

North America led the market in 2025, accounting for a revenue share of 36.8%. This leading market share of North America can be ascribed to early adoption of precision-guided warfare systems, full integration of loitering munitions in conjunction with joint force tactics, as well as continuous employment of loitering munitions in training and operational realms. A well-established defense ecosystem, as well as a focus on interoperability, has led to rapid large-scale adoption of loitering munitions in land and aviation systems. Furthermore, regular military exercises along with rapid validation cycles have led to quicker operational acceptance, thereby contributing to market domination in the North American region.

The loitering munition market in the United States is growing due to the risingfocus on decreasing pilot risks with better battlefield situational awareness offered by unmanned strike platforms. There has also been extensive testing and employment of man-portable as well as air-launched loitering munitions in the country. Ongoing evolutionary enhancements in tactical concepts, emphasizing rapid response with time-critical targeting, will further promote acquisition programs, making the United States the single largest contributor to regional as well as worldwide market share.

Asia Pacific Loitering Munition Market Insights

The Asia Pacific market is expected to record the quickest CAGR of 11.2% in the forecast period, backed by the growing demand for security in the region, along with the rising modernization programs in the defense sector. The nations in the Asia Pacific are giving importance to loitering munitions in order to boost border security, marine security, as well as preparedness for strikes in an economical manner. The adoption of mobile strike systems suitable for varying terrains is also boosting the adoption rate in the Asia Pacific market.

The Indian loitering munition market is growing rapidly owing to the increased focus on indigenization of defense production and the resultant rise in the employment of loitering munitions in the process of border protection. The development initiatives and the successful testing of these weapons at the national level are leading to an increased level of operational confidence in loitering munitions and, therefore, promoting widespread adoption at the national level. Furthermore, the focus on scalability and integration of command structures is leading to healthy growth in the India market. The Asia-Pacific region is an important emerging market.

Source: Straits Research

Europe Market Insights

Europe is observing a steady growth in the market for loitering weapons due to increased focus on battlefield autonomy, defense cooperation across national borders, and growing use of precision strike capabilities in various defense forces across Europe. A number of countries in Europe have started focusing on developing loitering weapons to better prepare themselves for quick response and strike operations, without necessarily having to depend upon conventional forces for air support.

Loitering munition sales in Germany are increasing because of Germany's tactical transformation towards optimizing tactical strike capabilities as well as optimizing the time difference between reconnaissance and strikes. Germany is increasing investments in unmanned tactical solutions, while exploring loitering munitions for infantry forces, which is helping Germany adopt these solutions over time, making Germany an essential element for the loitering munition market in Europe.

Latin America Insights

The loitering munition market in Latin America is growing, driven by the need for budget-friendly and flexible systems to deal with border security, insurgency, and surveillance operations. Loitering munitions are gaining attention as a possible replacement for traditional strike vehicles, based on their use in hard terrain, thereby leading to a growing market in Latin America.

The Brazilian loitering munition industry is moving ahead because Brazil has been improving its emphasis on developing its situational awareness and tactical effectiveness for ground and border missions. Growing interest in unmanned strike weapon systems, which would aid in surveillance and precision engagement operations, is a factor propelling evaluations and small-scale developments in this industry. The emphasis on improving efficiency in large ground areas is putting Brazil at the forefront of loitering munition adoption in Latin America.

Middle East & Africa Market Insights

The Middle East and African loitering munitions market is growing in line with the increase in the level of security in the region. Armed forces in the region are in need of quick and accurate strike capabilities. Loitering munitions are gaining popularity in the region because of their efficiency in a contested environment and the fact that they are suitable for conventional and asymmetric warfare.

The Israeli loitering munition industry remains on the rise as a result of significant focus on real-time intelligence and rapid target engagement. Operational history, as well as continued development of the technology, has helped to reassure users that loitering munitions are essential elements in battle operations. Live battlefield operations are also ensuring that the industry grows significantly as it remains one of the most prominent in the MEA region.

Type Insights

The Fixed Wing Loitering Munitions dominated the market by holding around 48.6% of revenue share in the year 2025. This growth may be contributed by their longer endurance, extended operational ranges, and superior aerodynamic efficiency, which enable persistent surveillance and precise target engagement over wide battlefield areas.

The segment of Hybrid Loitering Munitions is expected to record the highest growth with a projected CAGR of approximately 11.6% during the forecast period. Faster growth has been observed because of increasing demand for a system that provides VTOL capability with fixed-wing endurance, enabling flexible deployment in restricted areas with extended loiter time and mission adaptability for a range of operational scenarios.

Source: Straits Research

Launch Mode Insights

Man Portable Loitering Munitions segment led the market in 2025, contributing 34.9% to the total revenue, as such munitions provide enhanced flexibility, rapid deployment, and ease of use by infantry or special operations forces.

The Air Launched Loitering Munitions segment is anticipated to register the fastest growth rate in the upcoming forecasting period. This latest development is expedited by the growing incorporation of loitering munitions with manned and unmanned aerial systems.

Application Insights

The Precision Strike segment is likely to grow the fastest at a growth rate of about 10.9% during the forecast period, due to an increasing focus on high-accuracy engagement, minimal collateral damage, and quick neutralization of time-sensitive targets. Modern military operations place a growing emphasis on precision-guided capabilities, where efficiency in missions with minimal operational risk is recognized, hence driving demand for loitering munitions that are optimized for precision strike missions and supporting accelerated growth in this application segment.

Competitive Landscape

The global market is considered to be at a moderate level of consolidation, with the presence of large defense manufacturers and specialty unmanned systems developers. Only a few players hold a major market share because of their strong technological capabilities, proven combat systems, and long-term relationships with defense forces globally.

Major companies involved in the market include Israel Aerospace Industries, AeroVironment, Elbit Systems, and others. These companies are engaging in contests for better market positioning by innovating products constantly, developing their portfolios of loitering munitions, making strategic collaborations, and long-term defense supply contracts to establish their leading positions in the changing global scenario of loitering munitions.

Granta Autonomy: An emerging market player

Granta Autonomy, a Lithuanian defense tech start-up, specializes in next-generation loitering munitions technology designed specifically to address the needs of contemporary battlefields. Granta Autonomy has been able to carve a niche through its development of loitering munitions that incorporate VTOL technology and fixed-wing loiter capabilities.

- In May 2025, Granta Autonomy unveiled its Granta X VTOL loitering munition, featuring an operational range of up to 50 km and a loitering endurance of over 60 minutes, highlighting the company’s rapid progress in developing mission-ready systems for tactical precision strike and reconnaissance roles.

Thus, Granta Autonomy firm has proved to be a significant contender in the international loitering munition market by utilising the hybrid VTOL design architecture and system size to draw immense attention from the defense forces.

List of Key and Emerging Players in Loitering Munition Market

- Israel Aerospace Industries

- AeroVironment

- Elbit Systems

- Rheinmetall

- RTX Corporation

- Northrop Grumman

- Lockheed Martin

- Thales Group

- BAE Systems

- Saab AB

- Leonardo

- UVision Air

- EDGE Group

- Baykar Technologies

- HENSOLDT

- L3Harris Technologies

- ST Engineering

- ZALA Aero

- WB Group

- Bharat Dynamics Limited

Strategic Initiatives

- November 2025: RAFAEL Advanced Defense Systems announced the introduction of the L-SPIKE 1x tactical loitering munition, designed to provide armed forces with improved precision engagement options for close-range battlefield missions, supporting broader integration of loitering systems in regional defense portfolios.

- October 2025: Mistral Inc. and UVision Inc. secured a USD 982 million multi-year IDIQ contract with the U.S. Army to deliver HERO 120 loitering munition systems, underscoring major growth and sustained procurement momentum for tactical precision strike assets.

- October 2025: AeroVironment, Inc. unveiled its next-generation Switchblade® loitering munitions suite, expanding the company’s tactical strike offerings with enhanced range and payload flexibility, reinforcing its position in global small-munition systems procurement.

- September 2025: Arquimea completed the acquisition of Perseo Techworks to strengthen its naval loitering munition capabilities and expand autonomous undersea loitering solutions, marking a major strategic expansion into integrated multi-domain unmanned systems.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 632.7 million |

| Market Size in 2026 | USD 696.6 million |

| Market Size in 2034 | USD 1,497.6 million |

| CAGR | 10.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Launch Mode, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Loitering Munition Market Segments

By Type

- Fixed Wing Loitering Munitions

- Rotary Wing Loitering Munitions

- Hybrid Loitering Munitions

By Launch Mode

- Man-Portable Loitering Munitions

- Vehicle-Mounted Loitering Munitions

- Air Launched Loitering Munitions

- Naval Launched Loitering Munitions

By Application

- Intelligence, Surveillance & Reconnaissance (ISR)

- Precision Strike

- Suppression of Enemy Air Defenses (SEAD)

- Tactical Battlefield Support

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.