Lubricants Market Size, Share & Trends Analysis Report By Base Oil Type (Mineral Oil, Synthetic Lubricants, Bio-Based Lubricants), By Product Type (Automotive Oil, Others, Industrial Oil, Marine Oil, Process Oil), By Applications (Automotive, Industrial, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Lubricants Market Size

The global lubricants market size was valued at USD 147.42 billion in 2024 and is projected to reach from USD 152.57 billion in 2025 to USD 200.91 billion by 2033, growing at a CAGR of 3.5% during the forecast period (2025-2033).

The manufacturing and automotive industries are the leading consumers of lubricants worldwide, driven by the dual forces of rising industrialization and the robust growth of the automotive sector, which is characterized by increasing sales globally. This trend is anticipated to positively impact lubricant consumption in the forecast period, further bolstered by the growing aftermarket applications.

Industrial lubricants are broadly categorized into greases and liquid lubricants. Greases, the most common form of semi-solid lubricant, are composed of a base oil thickened with a soap-like material called a thickener. They are favored for their excellent adhesion, sealing properties, and resistance to water washout. Grease is particularly suitable for applications involving slow or intermittent movement, high loads, and extreme temperatures.

On the other hand, liquid lubricants, commonly known as oils, are fluid lubricants that provide exceptional lubrication properties. They are essential in applications requiring continuous lubrication, such as in circulating systems or complex machinery.

Various types of greases are utilized in industrial applications, including lithium grease, silicone grease, calcium grease, polyurea grease, synthetic grease, and PTFE grease. Among these, lithium grease is the most widely used due to its excellent mechanical stability, good temperature resistance, and water resistance. It is ideal for a variety of applications, including bearings, gears, and general lubrication.

Silicone grease, in contrast, is a non-melting, high-temperature grease renowned for its resistance to oxidation and thermal stability. It is commonly employed in high-temperature applications, electrical connectors, rubber parts, and plastic components.

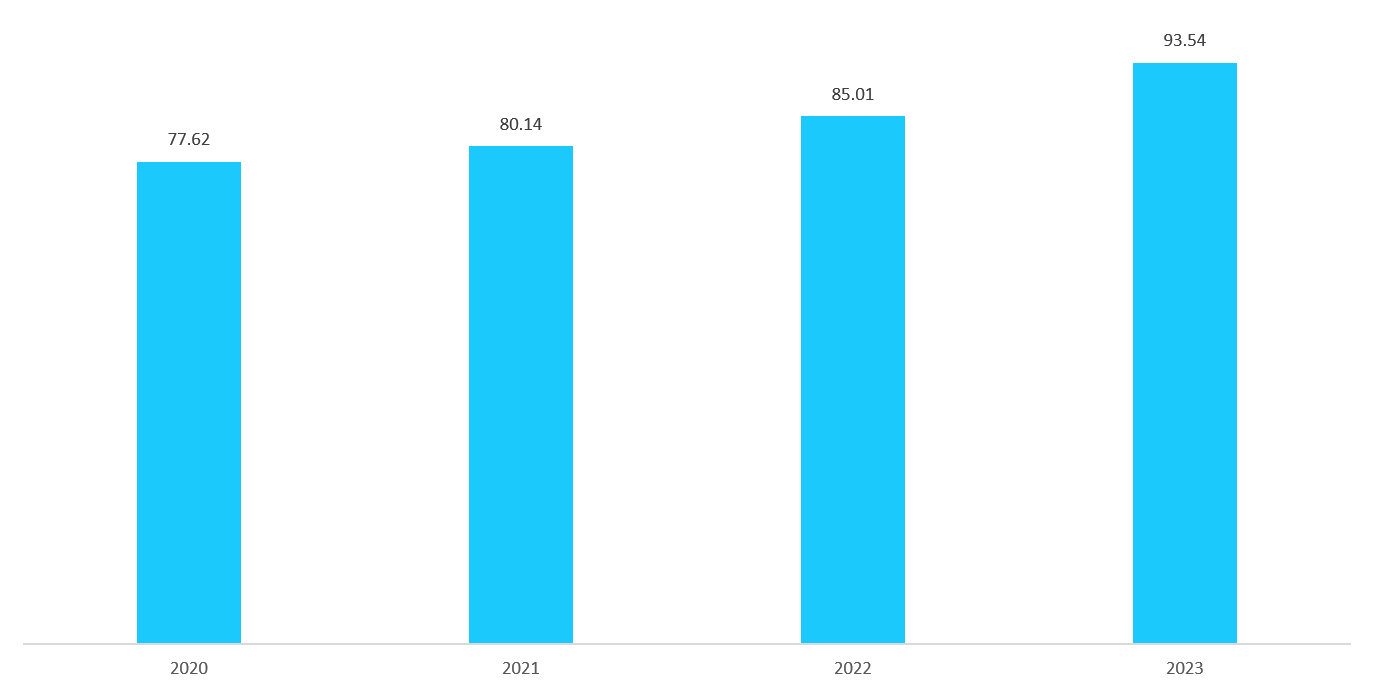

Fig: Global Production of Cars & Commercial Vehicles 2019-2023 (Billion Units)

Source: OICA

Global Lubricants Market Trends

Rising Adoption of Bio-Based Sustainable Lubricants

The global market is seeing a strong shift toward bio-based, sustainable options as governments push for eco-friendly lubricants in sensitive environments like forests, waterways, and farmland to avoid the ecological risks posed by mineral oils. Bio-lubricants now need to meet OECD biodegradability standards, supporting reduced fossil fuel dependence and circular economy goals. Many businesses are embracing these products to boost sustainability, improve brand perception, and meet CSR commitments.

The industry’s innovation is evident with new bio-based alternatives to traditional polyalphaolefins and mineral oils. Molecules like Synnova, Estolides, and Ester-PAG hybrids developed by Novvi, Biosynthetic Technologies, and VBase are gaining traction.

- For instance, Synnova, derived from renewable sources like sugarcane, is both carbon-negative and biodegradable, meeting OECD standards, making it a standout choice in bio-lubricants.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 147.42 Billion |

| Estimated 2025 Value | USD 152.57 Billion |

| Projected 2033 Value | USD 200.91 Billion |

| CAGR (2025-2033) | 3.5% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ExxonMobil Corp., Royal Dutch Shell Co., BP PLC., Total Energies, Chevron Corp. |

to learn more about this report Download Free Sample Report

Lubricants Market Growth Factors

Rapidly Growing Automotive Industry

The rapid growth of the automotive industry, fueled by rising disposable incomes and consumer demand for luxury goods, is a major driver for the lubricant market. Lubricants play a vital role in vehicles, reducing wear on parts and enhancing efficiency. The demand for automotive lubricants rises in line with increased vehicle production and sales, both in commercial and private segments.

- For example, data from the International Organization of Motor Vehicle Manufacturers (OICA) indicates a significant jump in global vehicle production, from 77.62 million units in 2020 to 93.54 million in 2023, directly boosting lubricant demand. Among these, engine oil key for reducing friction within combustion chambers remains the most widely used automotive lubricant.

Growth of the Manufacturing Industry on A Global Level

The manufacturing industry drives the demand for lubricants across several sectors. In the automotive sector, lubricants like metalworking fluids are essential in the production of parts and are widely used in aftermarket applications such as engine oils and coolants. The steel industry, too, relies on specialized lubricants, particularly metalworking fluids like neat oil and cutting oil, to facilitate machining and processing.

- For instance, in steel production, cutting oils and coolants improves precision and reduces heat in high-intensity processes, which is essential for quality and efficiency. This widespread use in manufacturing is expected to keep demand for industrial lubricants high across sectors.

Restraining Factors

Regulatory Complexity

The complex regulatory landscape for lubricants poses significant challenges for manufacturers, particularly in industries like food processing, pharmaceuticals, and manufacturing. Strict compliance is essential to maintain safety and market access, with different standards across regions and applications.

- For example, in the U.S., food-grade lubricants must adhere to FDA regulations under 21 CFR 178.3570, which restricts ingredients that may come into incidental contact with food. Internationally, ISO 21469 sets hygiene requirements for lubricants used in food, cosmetics, and pharmaceutical production, a standard adopted by several countries to ensure safety.

Additionally, the FDA requires that lubricants in pharmaceutical manufacturing do not compromise drug quality or safety, especially when in contact with containers or APIs. Navigating these varied regulations adds to production complexity and compliance costs for manufacturers.

Market Opportunities

Increasing Demand for High-Performance Lubricants in Aerospace and Defense

The aerospace and defense sectors are experiencing a surge in demand for high-performance lubricants that can withstand extreme temperatures, pressures, and challenging operating environments. These specialized lubricants enhance the durability and performance of critical equipment, which is vital for safety and efficiency. For example, jet engines and hydraulic systems in aircraft require lubricants that maintain stability under high-stress conditions, reducing wear and extending service life.

In defense, where equipment reliability is crucial, advanced lubricants help reduce maintenance costs and downtime. For instance, the U.S. military utilizes high-performance, synthetic lubricants in armored vehicles and aircraft to ensure uninterrupted operation during prolonged missions. This trend is driven by increasing defense budgets in regions like North America and Europe, alongside rising demand for space exploration initiatives. As these sectors expand, the need for reliable, high-grade lubricants creates a significant market opportunity for manufacturers specializing in aerospace and defense applications.

Regional Insights

Asia Pacific: Dominant Region with 46.79% Market Share

In the Asia-Pacific region, the market leads significantly, fueled by rapid growth in the manufacturing and automotive sectors, especially in countries like China, India, Japan, and South Korea. The automotive industry heavily relies on lubricants like engine oils, greases, and hydraulic fluids, which are widely used across Asia. Additionally, accelerated industrialization and large-scale infrastructure projects, particularly in construction and manufacturing, further amplify demand for industrial lubricants.

North America: Rapid Growth in the U.s & Canada

In North America, particularly in the U.S. and Canada, ongoing industrialization and expansion across sectors such as manufacturing, metallurgy, and food & beverages drive lubricant demand. Major industry players like ExxonMobil Corp., Royal Dutch Shell Co., BP PLC, and Total Energies dominate the market with extensive production facilities. These companies continue to expand their product offerings to cater to the diverse needs of North American industries, solidifying their strong market presence.

Countries Insights

- United States: The U.S. holds a substantial share of the regional market, supported by a mix of prominent domestic and international manufacturers that contribute to a moderately consolidated market landscape. Increasing sales of passenger and commercial vehicles in the U.S. significantly drive demand for automotive lubricants, underscoring the country’s essential role in the market.

- United Kingdom: The U.K. rose to the eighth-largest global manufacturing nation in 2023, with manufacturing output reaching USD 244.17 billion, according to the Manufacturer’s Organization UK. Motor vehicle manufacturing, which saw a 22% increase in 2023, plays a key role in driving lubricant demand as the country’s manufacturing industry continues to expand.

- Germany: As a core hub for the automotive sector, Germany benefits from a robust manufacturing landscape. In 2023, Germany produced 4.1 million cars, an 18% increase from the previous year, according to the German Association of Automotive Industry. The prominent automotive sector drives lubricant demand in both manufacturing and automotive applications.

- India: India’s manufacturing sector is a major contributor to GDP, with significant roles in infrastructure, imports, and job creation. With ambitions to become a USD 35 trillion economy, India’s manufacturing industry is expected to grow substantially, driving lubricant consumption. Government initiatives have boosted foreign direct investment in manufacturing by 55% from 2014 to 2023, reaching USD 148.97 billion.

- China: Rapid growth in sectors like manufacturing and energy characterizes China’s lubricants market, bolstered by technological investments and infrastructure development. China’s focus on sustainable industry practices further supports the expanding demand for high-performance lubricants across various applications.

lubricants Market Segmentation Analysis

By Base Oil Type

Based on the base oil type, the global market is bifurcated into mineral oil, synthetic oil, and bio-based lubricants.

In 2024, the mineral-based oil segment dominated the global market, primarily due to its cost-effectiveness and balanced performance. Derived from crude oil, mineral-based oils provide stable viscosity and good lubrication under standard operating conditions, making them suitable for general-purpose applications across industries. Their chemical composition allows for efficient lubrication at moderate temperatures and pressures, fulfilling the requirements of machinery that operates in less demanding environments.

Compared to synthetic and bio-based alternatives, mineral oils are widely preferred for their affordability and compatibility with a range of equipment. In manufacturing and automotive sectors where high-end performance isn’t essential, mineral-based lubricants provide an optimal balance of reliability and efficiency. Although there is a rising demand for synthetic lubricants, mineral oils continue to hold a strong position due to their broad application, readily available supply, and adaptability for various machinery requirements.

By Application

Based on application, the global market is divided into automotive industrial and others.

In 2024, the automotive segment held the largest share of the industrial gas market, driven by the rapid global growth of the automotive industry, especially in emerging economies. Increased disposable income has boosted consumers' purchasing power, leading to higher vehicle sales worldwide and, consequently, a rising demand for lubricants essential for vehicle efficiency and longevity. The United States, as the world’s second-largest market for vehicle sales and production, exemplifies this trend, with expanding automotive activities directly fueling lubricant consumption. This growth reinforces the automotive sector’s position as the dominant contributor to the industrial gas market.

company Market Share

Key market players are investing in strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Shell is a global leader in the petrochemical and energy industry, with a presence in 70 countries and over 90,000 employees. The company provides fuel, car services, and oils. It is also involved in the production, exploration, and refining of petroleum products.

Moreover, Shell offers lubricants for industrial and transport businesses, along with lubrication processes and services.

Recent Developments

- June 2023- Shell, the global leader in refined lubricants, introduced Shell Helix HX6 5W-30 and Shell Helix SUV 5W-30, a new line of BS-VI-compliant synthetic engine oils, in India.

List of Key and Emerging Players in Lubricants Market

- ExxonMobil Corp.

- Royal Dutch Shell Co.

- BP PLC.

- Total Energies

- Chevron Corp.

- Fuchs

- Castrol India Ltd.

- Amsoil Inc.

- JX Nippon Oil & Gas Exploration Corp.

- Philips 66 Company

- Valvoline LLC

- PetroChina Company Ltd.

- China Petrochemical Corp.

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Petrobras

- Petronas Lubricant International

- Quaker Chemical Corp.

- PetroFer Chemie

- Buhmwoo Chemical Co. Ltd.

- Zeller Gmelin Gmbh & Co. KG

- Blaser Swisslube Inc.

Recent Developments

- January 2024 - Shell U.K. completed the acquisition of MIDEL and MIVOLT, where Shell will manufacture and distribute the MIDEL and MIVOLT product lines as part of Shell’s global lubricants portfolio. The acquisition will further enable Shell to complement its differentiated position in Transformer Oils.

Analyst Opinion

As per our analysts, the global market is expanding significantly, primarily driven by rising automotive production and sales, alongside robust industrial development, especially in rapidly growing economies across the Asia-Pacific region, including India, China, Japan, and South Korea.

Industrial lubricants play a crucial role across diverse applications such as machinery, automotive, manufacturing, power generation, construction, and marine industries. These lubricants are essential in minimizing friction, reducing wear, dissipating heat, and providing corrosion protection to moving parts.

This diverse demand across sectors underscores the market's steady growth trajectory and positions it for continued expansion.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 147.42 Billion |

| Market Size in 2025 | USD 152.57 Billion |

| Market Size in 2033 | USD 200.91 Billion |

| CAGR | 3.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Base Oil Type, By Product Type, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Lubricants Market Segments

By Base Oil Type

- Mineral Oil

- Synthetic Lubricants

- Bio-Based Lubricants

By Product Type

-

Automotive Oil

- Hydraulic Oil

- Industrial Oil

- Metal Working Fluids

- Greases

- Others

- Industrial Oil

- Marine Oil

- Process Oil

By Applications

- Automotive

- Industrial

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.