Luxury Kitchen Knives Market Size, Share & Trends Analysis Report By Knife Type (Chef’s Knives, Santoku Knives, Paring Knives, Utility Knives, Bread Knives, Boning & Fillet Knives, Carving Knives, Steak Knives, Speciality Knives), By Blade Material (High-Carbon Stainless Steel, Damascus Steel, Ceramic, Carbon Steel, Titanium Alloy), By Handle Material (Wood, Micarta / G10, Stainless Steel, Polycarbonate/Composite Premium Plastics, Others), By Price Range (USD 150 – 300 (Entry Luxury), USD 300 – 600 (Mid Luxury), USD 600 – 1,000 (High Luxury), Above USD 1,000 (Ultra Luxury / Custom)), By End-User (Residential, Commercial, Collectors / Enthusiasts), By Distribution Channel (Speciality Knife Stores, Premium Department Stores, Online Direct-to-Consumer, Online Marketplaces, Culinary Equipment Retailers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Luxury Kitchen Knives Market Overview

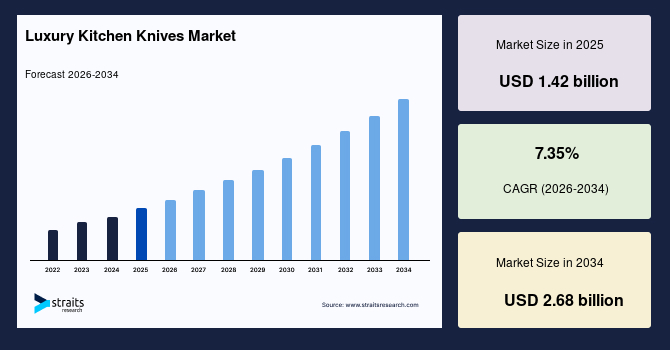

The global luxury kitchen knives market size is valued at USD 1.42 billion in 2025 and is projected to reach USD 2.68 billion by 2034, expanding at a CAGR of 7.35% during the forecast period. The growth is driven by rising interest in premium culinary tools, greater consumer focus on craftsmanship and durability, the influence of professional cooking culture, and the expanding availability of high-end knives through omnichannel retail formats.

Key Market Trends & Insights

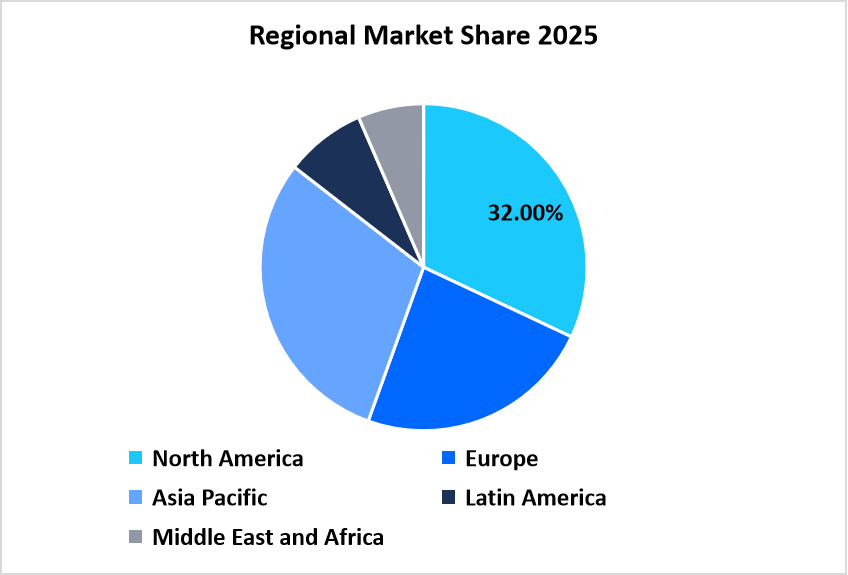

- North America dominated the market with a revenue share of 32% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 9.0% during the forecast period.

- Based on Knife Type, the chef’s knifesegment held the highest market share of 35% in 2025.

- By Blade Material, the Damascus steelsegment is estimated to register the fastest CAGR growth of 9.1%.

- Based on Handle Material, the wood category dominated the market in 2025 with a revenue share of 40%.

- Based on Price Range, the ultra-luxury and customsegment is projected to register the fastest CAGR of 8.5% during the forecast period.

- Based on End User, the Residential userssegment held the highest market share of 60% in 2025.

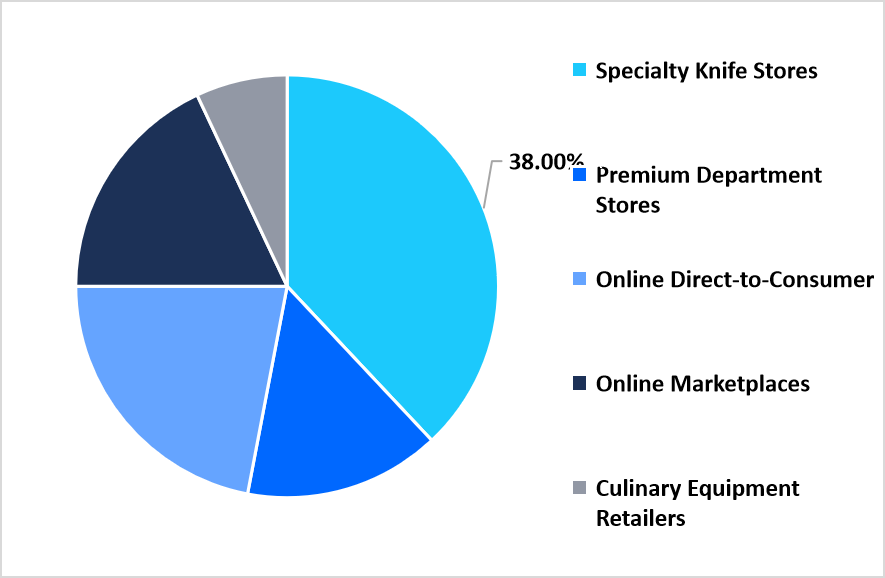

- By Distribution Channel, the Online direct-to-consumer (DTC) channelssegment is estimated to register the fastest CAGR growth of 10.3%.

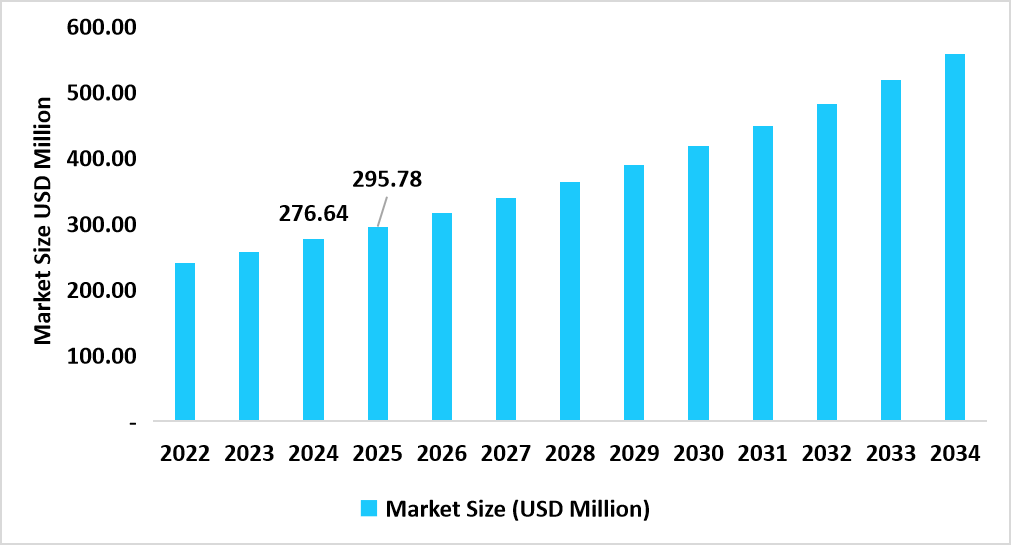

- U.S. dominates the market, valued at USD 276.64 million in 2024 and reaching USD 295.78 million in 2025.

U.S. Luxury Kitchen Knives Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 1.42 billion

- 2034 Projected Market Size: USD 2.68 billion

- CAGR (2026-2034): 7.35%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global luxury kitchen knives market encompasses premium chef’s knives, santoku knives, paring knives, utility knives, carving knives, and speciality blades made from high-performance steel, Damascus steel, carbon steel, titanium blends, and advanced composites. These products cater to both residential and professional users, offering precision, ergonomics, and long-lasting performance. The market growth is fueled by shifts in consumer preferences toward artisanal and performance-oriented kitchen tools, increased product innovation in blade engineering and handle materials, and distribution modernisation through direct-to-consumer (DTC) channels, speciality culinary stores, and curated retail partnerships.

Latest Market Trends

Rising Demand for Artisanal and Handcrafted Blades

The luxury knife segment is experiencing a strong revival of artisanal craftsmanship, driven by consumer interest in authenticity, heritage manufacturing, and high-quality build. Buyers are increasingly drawn to knives that feature traditional forging techniques, layered Damascus steel patterns, or handcrafted wooden handles. Cultural influences from Japanese knifemaking traditions continue to shape global consumer tastes. The trend is further amplified by high-quality culinary content across streaming platforms, chef-led tutorials, and cooking influencers who emphasise the importance of reliable, meticulously crafted knives. This growing preference for craftsmanship reinforces the perception of premium value, helping to elevate average selling prices across the luxury kitchen knives market.

Integration of Technological Innovation and Performance Materials

Innovation in materials and blade engineering has become a defining trend in the luxury knife industry. Consumers increasingly seek products that combine tradition with advanced metallurgy, edge retention, lightweight performance, and ergonomic precision. High-end manufacturers are incorporating cryogenic tempering, powder metallurgy steel (e.g., SG2, R2, and CPM formulations), titanium alloys, and hybrid composite handles to improve sharpness, resilience, and comfort. The blending of engineering innovation with premium design continues to draw new buyers to high-value categories, supporting sustained market expansion.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.42 billion |

| Estimated 2026 Value | USD 1.52 billion |

| Projected 2034 Value | USD 2.68 billion |

| CAGR (2026-2034) | 7.35% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | ZWILLING J.A. Henckels, WÜSTHOF, KAI / Shun, Global (GLOBAL Cutlery), MAC Knives |

to learn more about this report Download Free Sample Report

Market Drivers

Growing At-Home Culinary Culture and Professionalisation of Home Kitchens

The rise of home cooking as a hobby, creative outlet, and wellness practice continues to elevate demand for premium culinary tools. Consumers increasingly view high-end knives as essential components of a professional-style home kitchen. This shift is influenced by food media, social platforms, and widespread interest in gourmet meal preparation. Purchases are often justified by both functional performance and the perceived long-term value of durable tools. Sustained interest in high-quality cooking experiences ensures steady long-term demand for luxury knives.

Premiumization and Growing Gift Culture

Premiumization has become a significant driver of the kitchenware sector, with luxury knives increasingly positioned as status items, collectable goods, or meaningful gifts. Weddings, corporate gifting, and milestone celebrations often feature high-end culinary sets, usually enhanced by the aesthetic appeal of engraved handles or limited-edition collaborations. Several luxury brands have strengthened their gifting portfolios, enabling personalised monograms and handle inlays tailored for gift-giving. These services enhance brand visibility and create higher-margin opportunities.

Market Restraint

High Price Sensitivity and Limited Penetration in Emerging Markets

Luxury knives command high price points due to the use of specialised materials, handcrafted techniques, and import duties, making them less accessible to price-sensitive consumers. During periods of reduced discretionary spending, buyers tend to delay or forego the purchase of premium culinary tools, opting instead for lower-cost mass-market alternatives. The high upfront cost limits adoption and reduces market penetration in developing countries, where premium kitchenware remains an aspirational rather than essential purchase.

Market Opportunity

Expansion of Direct-to-Consumer (DTC) Channels and Experiential Retail

The DTC model presents substantial growth opportunities for luxury knife brands, enabling them to control pricing better and enhance the customer experience. Consumers increasingly appreciate transparent product information, behind-the-scenes manufacturing content, and direct engagement with brands. Interactive platforms, virtual knife-care tutorials, and subscription-based sharpening services enhance customer loyalty. Brands that leverage immersive sales environments and DTC ecosystems are well placed to capture new segments and deepen long-term customer relationships.

Regional Analysis

North America dominated the market in 2025, accounting for 32% market share. The region’s market is supported by high disposable incomes, a mature speciality retail network, and strong direct-to-consumer activity. Consumers value provenance, warranties, and after-sales services, which favour established premium brands and bespoke makers. Food media, celebrity chefs, and home-cooking trends encourage upgrades to high-performance knives. Speciality stores, culinary retailers, and omnichannel DTC drive discovery and repeat buying.

- The U.S. leads North America due to large affluent consumer cohorts, expansive speciality retail, and extensive online knife communities. U.S. buyers favour branded warranties, personalisation services, and premium aftercare while retailers and DTC brands invest heavily in storytelling and digital demonstrations that convert interest into purchases. Gift culture, culinary schools, and content-driven cooking trends reinforce demand for mid- and high-luxury knives.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 9.0% from 2026-2034, driven by rising disposable incomes, urban middle-class expansion, and a cultural embrace of both local and international culinary techniques. Rapid e-commerce growth and DTC brand expansion accelerate market penetration, while younger urban households trade up for quality, aesthetics, and social-media-worth items. The convergence of heritage and modern digital retail yields an elevated CAGR, making the APAC region the primary growth engine for the global luxury knife market.

- Japan remains the regional leader because of its unrivalled reputation for traditional forging, specialised steel grades, and regional smithing families. Japanese knives, such as santoku, gyuto, and petty, are valued for their edge geometry and finish, attracting collectors and professional chefs globally. Japan also drives artisanal collaborations and limited editions that appeal to collectors, reinforcing the country’s central role in both the cultural and commercial expansion of luxury kitchen knives across APAC.

Source: Straits Research

European Market Insights

Europe is a high-value market shaped by deep cutlery heritage, specialist forging centres, and consumers who associate provenance with superior quality. This cultural preference supports strong pricing for mid- and high-luxury knives. Premium department stores, speciality shops, and culinary tourism maintain brand visibility. Strict standards and familiarity with steel attributes encourage buyers to choose quality over low-cost imports. Steady economic conditions and consistent gifting habits support a moderate mid-single-digit CAGR while preserving Europe’s substantial market share.

- Germany, with its Solingen cutlery cluster and long manufacturing heritage, anchors Europe’s luxury knife demand. German consumers value functional durability, precision engineering, and locally produced goods. Retailers in Germany emphasise in-person testing and certified artistry, making the country a strategic base for premium brand positioning and an important contributor to Europe’s knife market revenues.

Latin American Market Trends

Latin America shows steady, moderate growth supported by urbanisation, a rising middle class, and modernising retail. Key markets, such as Brazil, Mexico, and Argentina, are upgrading their kitchen tools as home cooking and entertaining become more prominent. Expanding organised retail and e-commerce helps premium and mid-luxury brands reach new consumers. Price sensitivity remains higher than in developed regions, leading buyers to favour mid-luxury tiers. Overall, the region delivers low- to mid-single-digit CAGR, but offers long-term potential as retail networks continue to improve.

- Brazil leads Latin America due to its large population, active culinary culture, and growing organised retail. Urban centres show a particular appetite for premium kitchen tools among middle and upper-income consumers, while e-commerce expansion allows international and boutique brands to reach new segments. Domestic makers and importers both capitalise on the festival and gifting seasons.

The Middle East and Africa Market Trends

The Middle East and Africa (MEA) is a smaller but strategically relevant market for luxury knives. Gulf countries, such as the UAE, Saudi Arabia, and Qatar, exhibit strong per-capita spending on premium home goods and a high concentration of expatriates who purchase luxury kitchenware. In Africa, demand is nascent and primarily concentrated in urban areas, where a growing middle class is emerging. Targeted launches, regional partnerships, and duty-free retail strategies in the Gulf provide entry points for premium brands. The region posts a modest overall share with selective pockets of high growth potential.

- The UAE acts as MEA’s focal market because of high disposable incomes, significant tourist flows, and an extensive luxury retail network. Flagship stores, seasonal retail campaigns, and duty-free retail channels facilitate penetration of premium and bespoke knives. Expat communities and affluent domestic consumers show willingness to purchase luxury culinary tools, often as gifts or lifestyle statements.

Knife Type Insights

Chef’s knives dominated the market with a revenue share of 35% in 2025, as they function as versatile, everyday tools valued by both home cooks and professionals. Their appeal comes from strong performance, durability, and balanced ergonomics that replace multiple speciality blades. Premium brands highlight high-grade steels, full-tang construction, and hand-finished edges, while retailers position them as entry points into luxury collections.

Santoku knives are the fastest-growing blade type, exhibiting a CAGR of 9.0%, driven by rising interest in Japanese cooking styles and compact, efficient blade profiles. Younger and urban consumers appreciate their lighter weight and versatility for everyday prep. Marketing centred on Japanese metallurgy and precision has increased demand for layered steel and hammered-finish variants. Social media demonstrations amplify adoption, driving a strong CAGR as brands expand mid-priced santoku lines and introduce collectable, limited-edition models.

Blade Material Insights

High-carbon stainless steel dominates the market, accounting for a 45% share of the revenue. It combines corrosion resistance, hardness, and easy maintenance. It offers strong edge retention while remaining more forgiving than pure carbon steel, making it ideal for mass-premium manufacturing. Retailers and DTC brands favour it for predictable performance, fewer warranty issues, and compatibility with various finishes.

Damascus steel is experiencing rapid growth at a CAGR of 9.1% due to its visual appeal and association with artisanal craftsmanship. Layered patterns, narrative-driven designs, and limited-edition releases appeal to collectors and discerning buyers. Collaborations with bladesmiths and social-media exposure further boost interest. Although priced higher, adoption is rising in mid- and high-luxury tiers as global artisanal partnerships make supply more accessible.

Handle Material Insights

Wood holds the largest market share of 40% in 2025 because it communicates heritage, warmth, and tactile quality. Stabilised hardwoods and premium species, such as olive, walnut, and ebony, provide aesthetic richness and a natural grip valued in luxury knives. Brands emphasise wood’s traditional appeal in storytelling, making it popular for gifts and premium collections. As a result, wooden handles maintain the largest share with steady, tradition-driven growth.

Micarta and G10 are the fastest-growing handle materials at a CAGR of 9.2% thanks to their durability, moisture resistance, and modern appeal. These engineered laminates are suitable for professional kitchens and everyday use, offering low-maintenance performance. Their customizable colours and textured finishes attract younger consumers and modern design enthusiasts. Consistent quality and scalability across DTC and custom makers support a high CAGR.

Price Range Insights

The mid-luxury price band captures the largest share of 45% by balancing premium performance with accessible pricing. Buyers in this range seek refined steels, strong ergonomics, and reliable craftsmanship without entering ultra-luxury costs. Retailers and DTC brands heavily promote this tier through financing, personalisation, and bundled services. Its popularity for gifts and household upgrades, combined with manufacturing economies of scale, sustains strong revenue contribution and steady mid-single-digit growth.

The ultra-luxury and custom tier grows fastest at a CAGR of 8.6% as collectors and affluent consumers invest in bespoke pieces, historic forging methods, and limited-edition collaborations. Demand is fueled by limited-edition drops, artisanal forging methods, and personalised options such as custom handles or engravings. Influencer chefs and auction-style launches reinforce exclusivity and high margins. This segment’s prestige effects and emotional value drive premium pricing and support the highest CAGR in the market.

End-User Insights

Residential users constitute the largest share, at 60%, driven by increased at-home cooking, culinary content consumption, and a desire for long-lasting kitchen tools. Households invest across tiers, from entry-level to high-end luxury, often adding features over time. Retailers target homeowners and gift buyers through registries, in-store experiences, and lifestyle marketing. Sharpening subscriptions and accessory bundles encourages repeat purchases. Broad relevance and recurring replacement cycles make residential demand the core driver of market growth.

Collectors and enthusiasts represent the fastest-growing end-user group, exhibiting a CAGR of 9.5% in 2025. They buy knives for display, investment, and connoisseurship rather than daily cooking. Social media communities, maker showcases, and numbered-series releases fuel excitement and premium pricing. Their interest drives sales of ultra-luxury models and limited collaborations.

By Distribution Channel Market Share (%), 2025

Source: Straits Research

Distribution Channel Insights

Speciality knife stores dominate the distribution channel with a 38% share. They offer hands-on testing, expert advice, and in-person services, including sharpening and repairs. Shoppers value evaluating weight, balance, and ergonomics before making a purchase, making curated speciality assortments highly effective. Retailers build strong brand relationships and use workshops, demos, and registry programs to drive loyalty. While growth is moderate, speciality stores remain central to premium sales and high-value customer engagement.

Online direct-to-consumer (DTC) channels are growing at the fastest rate, with a CAGR of 10.3%, as brands leverage controlled storytelling, competitive pricing, and global reach. Video demos, immersive product pages, virtual try-on tools, and subscription sharpening improve conversion and loyalty. Personalisation options and limited online-only releases increase engagement. The convenience of home delivery and scalable e-commerce infrastructure support the channel’s strong CAGR and rising share in premium knife sales.

Competitive Landscape

The market is moderately fragmented, characterised by a mix of heritage leaders, specialised regional makers, and digitally native challengers. Heritage manufacturers maintain substantial pricing power through their craftsmanship, brand heritage, and established distribution channels. Mid-tier and new entrants compete by leveraging DTC models, aggressive digital marketing, and material or sustainability claims to capture younger, design- and performance-oriented buyers. Market momentum is shaped by expanding direct-to-consumer channels, targeted limited-edition drops, and service-led propositions (such as sharpening and personalisation), which together accelerate customer acquisition while preserving the premium tier’s value proposition.

Shun (KAI Corporation): A Heritage Innovator

Shun, the premium cutlery arm of Japan’s KAI Corporation, has built its reputation on Japanese metallurgy, hand-finished edges, and strong design language. The brand emerged from traditional Japanese bladecraft and has developed a global presence through a combination of heritage storytelling and distribution partnerships with speciality retailers and DTC outlets. Its model blends traditional artisan techniques with modern branding and selective limited-edition releases, reinforcing both craft credentials and aspirational pricing.

Latest News:

- In July 2025, Shun’s Kagerou 8" chef’s knife was awarded the 2025 Red Dot Award for Product Design, reinforcing its position as a design-led premium brand.

List of Key and Emerging Players in Luxury Kitchen Knives Market

- ZWILLING J.A. Henckels

- WÜSTHOF

- KAI / Shun

- Global (GLOBAL Cutlery)

- MAC Knives

- Victorinox

- Tojiro

- Masamoto

- Miyabi

- Opinel

- Dalstrong

- Messermeister

- Made In (Made In Cookware & Knives)

- Misen

- Bob Kramer (Kramer by Zwilling)

- Yaxell

- Kasumi

- Sabatier

- Cutco

- Shibata

- Kikuichi

- Dalumi

- Yoshikin

Strategic Initiatives

- September 2025 – WÜSTHOF partnered with Harrods in London for the launch of a new aesthetic for its premium Classic line: the Classic Colour collection in 'Fresh Rosemary.'

- August 2025 - Victorinox signalled potential operational adjustments to regionalise certain production or finalisation steps in response to tariff pressures; strategic localisation would protect margins and maintain competitive pricing in core export markets.

- In 2025 - GLOBAL is actively promoting and selling its 40th Anniversary Collection in 2025, alongside refreshed general collections like UKON and SAI.

- July 2025 - Opinel, known for its iconic folding knives, announced the implementation of its new Opiflex Mechanism on the Néo6 model, enhancing its popular folding line.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.42 billion |

| Market Size in 2026 | USD 1.52 billion |

| Market Size in 2034 | USD 2.68 billion |

| CAGR | 7.35% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Knife Type, By Blade Material, By Handle Material, By Price Range, By End-User, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Luxury Kitchen Knives Market Segments

By Knife Type

- Chef’s Knives

- Santoku Knives

- Paring Knives

- Utility Knives

- Bread Knives

- Boning & Fillet Knives

- Carving Knives

- Steak Knives

- Speciality Knives

By Blade Material

- High-Carbon Stainless Steel

- Damascus Steel

- Ceramic

- Carbon Steel

- Titanium Alloy

By Handle Material

- Wood

- Micarta / G10

- Stainless Steel

- Polycarbonate/Composite Premium Plastics

- Others

By Price Range

- USD 150 – 300 (Entry Luxury)

- USD 300 – 600 (Mid Luxury)

- USD 600 – 1,000 (High Luxury)

- Above USD 1,000 (Ultra Luxury / Custom)

By End-User

- Residential

- Commercial

- Collectors / Enthusiasts

By Distribution Channel

- Speciality Knife Stores

- Premium Department Stores

- Online Direct-to-Consumer

- Online Marketplaces

- Culinary Equipment Retailers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.